Institutional Trend Breakout Trading System (IB-Box) with ATR Dynamic Take Profit and Stop Loss Strategy

ATR SMA RRR IB-Box INSTITUTIONAL BAR Breakout Strategy risk management

Overview

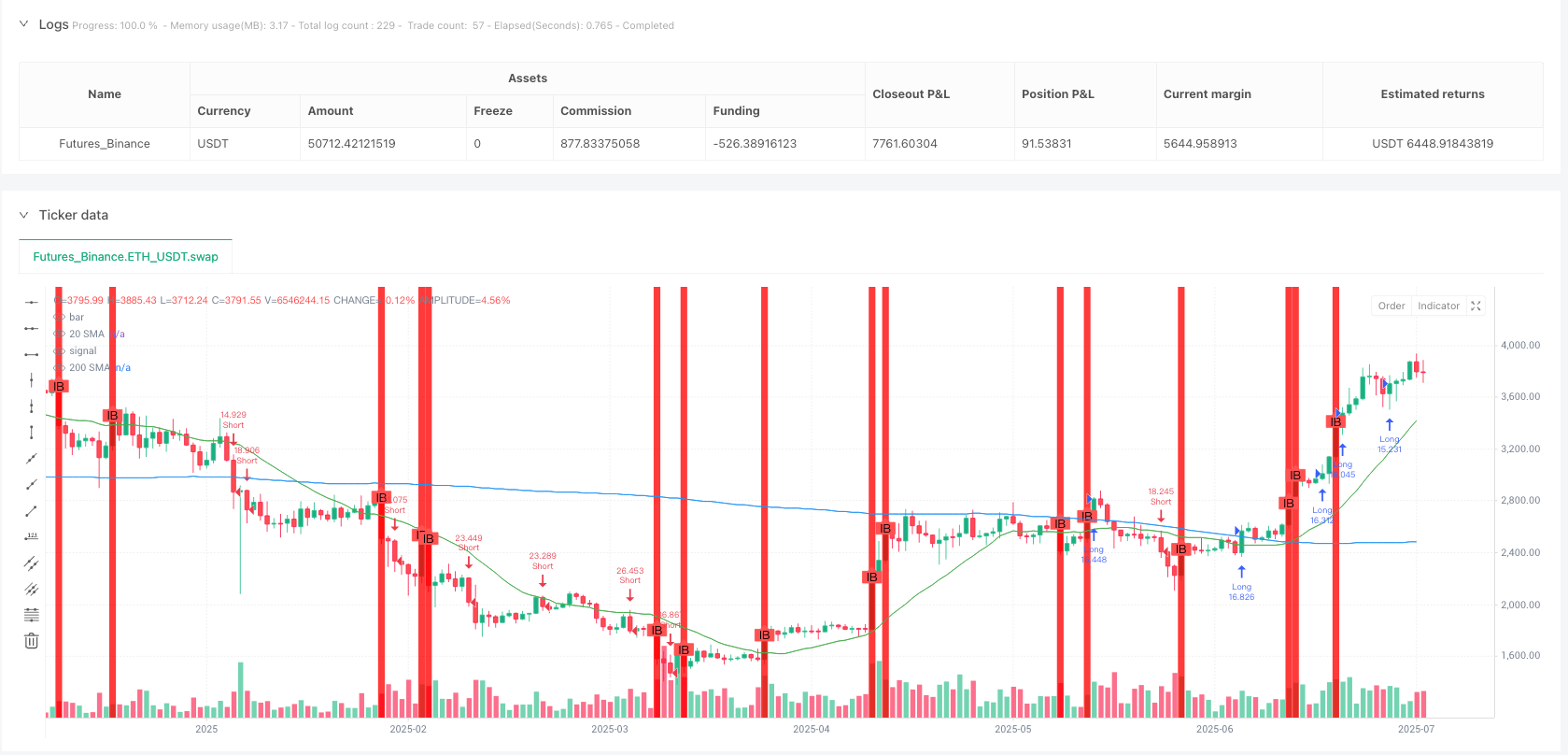

The Institutional Trend Breakout Trading System (IB-Box) is a quantitative trading strategy based on identifying and breaking out of Institutional Bars. The strategy first identifies price bars with institutional characteristics, which typically represent market activity with large capital participation. The strategy builds a “Treasure Box” around these institutional bars and goes long when the price breaks above the box’s upper boundary and short when it breaks below the lower boundary. The strategy also incorporates a moving average system for trend confirmation and uses the ATR indicator for dynamic risk management, including stop-loss and take-profit settings. The Risk-Reward Ratio (RRR) is set at 1:2, ensuring that the potential return on each trade is twice the potential risk.

Strategy Principle

The core of this strategy is to identify and utilize “Institutional Bars,” which are special price bars with the following characteristics: 1. Body ratio greater than 0.7, indicating that the distance between the closing price and opening price accounts for more than 70% of the entire bar range 2. Bar range greater than 1.5 times the 20-period average bar range, indicating abnormal volatility

Once an institutional bar is identified, the strategy creates a “Treasure Box” around it that lasts for 10 bars, with the upper boundary at the institutional bar’s high and the lower boundary at its low. Then, trades are executed according to the following conditions:

Long Entry Conditions: - Price closes above the box’s upper boundary - Price is above both the 20 and 200-period Simple Moving Averages - Current bar is bullish (closing price higher than opening price)

Short Entry Conditions: - Price closes below the box’s lower boundary - Price is below both the 20 and 200-period Simple Moving Averages - Current bar is bearish (closing price lower than opening price)

For risk management, the strategy uses the 14-period ATR value to set dynamic stop-loss and take-profit levels: - Long stop-loss: Current closing price minus ATR - Long take-profit: Current closing price plus ATR multiplied by the risk-reward ratio (default is 2) - Short stop-loss: Current closing price plus ATR - Short take-profit: Current closing price minus ATR multiplied by the risk-reward ratio (default is 2)

Strategy Advantages

Trading Logic Based on Institutional Behavior: By identifying institutional bars, the strategy can capture market trends driven by large capital, improving trading reliability.

Trend Confirmation Mechanism: By combining 20 and 200-period SMAs, the strategy ensures trading only in the established trend direction, avoiding counter-trend operations and increasing win rates.

Dynamic Risk Management: Using ATR to set stop-loss and take-profit levels automatically adjusts risk parameters based on market volatility, adapting to different market environments.

Fixed Risk-Reward Ratio: The default 2:1 risk-reward ratio ensures that the potential return on each trade is twice the potential risk, conducive to long-term profitability.

Visualization of Trading Signals: The strategy graphically displays institutional bars and treasure boxes, allowing traders to intuitively understand market structure and potential trading opportunities.

Flexible Timeframe Adaptability: The strategy is applicable to multiple timeframes (2-minute, 3-minute, 5-minute, and 15-minute), providing flexible trading options.

Clear Entry and Exit Rules: The strategy provides clear entry conditions and preset exit points, reducing subjective judgment during the trading process.

Strategy Risks

False Breakout Risk: Prices may quickly retrace after breaking through the “Treasure Box” boundary, triggering stop-losses. To mitigate this risk, consider adding confirmation mechanisms, such as waiting for close confirmation or adding additional filtering conditions.

Large Gap Risk: Markets may experience large gaps after major news releases, causing stop-losses to not execute as expected. It is recommended to reduce position size or pause trading before important data or event releases.

Trend Reversal Risk: Using SMAs for trend confirmation may cause missed trading opportunities at the beginning of trend reversals. Consider adding more sensitive trend indicators as supplements.

Parameter Overoptimization: Excessive optimization of ATR length and risk-reward ratio may lead to overfitting. It is recommended to test parameter robustness across multiple markets and timeframes.

Liquidity Risk: In low liquidity markets, it may be difficult to execute trades at expected prices. It is recommended to primarily trade in markets and time periods with adequate liquidity.

Systemic Risk: The strategy may not perform well during abnormal market volatility. It is recommended to set daily maximum loss limits and overall position management rules.

Strategy Optimization Directions

Optimize Institutional Bar Identification Parameters: The current strategy uses fixed 0.7 body ratio and 1.5 volatility threshold to identify institutional bars. Consider making these parameters adjustable or automatically adjusting them based on different market characteristics to improve the accuracy of institutional bar identification.

Enhance Trend Confirmation Mechanism: In addition to simple moving averages, consider adding trend strength indicators, such as ADX or MACD, to avoid trading in weak trend or consolidation markets.

Optimize Treasure Box Duration: Currently fixed at 10 bars, consider dynamically adjusting this parameter based on market volatility or timeframe, or setting it as a user-defined input parameter.

Add Volume Filtering: Incorporate volume confirmation in institutional bar identification, requiring abnormal bars to be accompanied by abnormal trading volume, which may further improve signal quality.

Implement Partial Take-Profit Mechanism: Consider moving stop-loss to breakeven or partially closing positions after reaching certain profit levels, to lock in partial profits while allowing remaining positions to continue profiting.

Add Market State Filtering: Implement automatic identification of market states (trending/consolidating), and apply this strategy only in trending markets to avoid frequent false breakouts in consolidating markets.

Optimize Entry Timing: Consider entering on pullbacks after breakouts rather than directly at breakout points, which may increase win rates but sacrifice some potential profits.

Add Time Filtering: Avoid trading near market opening and closing times, which typically have higher volatility and unclear direction.

Summary

The Institutional Trend Breakout Trading System (IB-Box) is a comprehensive trading strategy that combines institutional behavior analysis, trend confirmation, and dynamic risk management. By identifying price bars with institutional characteristics and establishing “Treasure Boxes” around them, the strategy aims to capture sustainable breakout trends. The core advantage of the strategy lies in its focus on institutional activity, combined with trend filtering and strict risk control, forming a complete trading system.

Although the strategy provides clear entry and exit rules, traders still need to be aware of risks from false breakouts, trend reversals, and special market conditions. There is significant room for improvement by optimizing institutional bar identification parameters, enhancing trend confirmation mechanisms, dynamically adjusting Treasure Box duration, and adding additional filtering conditions.

Ultimately, the success of this strategy depends on accurate identification of institutional behavior characteristics and correct judgment of market trends, while strictly implementing preset risk management rules. For investors seeking to trade based on institutional activity and technical breakouts, this is a strategy framework worth considering.

/*backtest

start: 2024-08-01 00:00:00

end: 2025-07-30 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Wx2 Treasure Box – V2", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS ===

atrLength = input.int(14, title="ATR Length")

rrRatio = input.float(2.0, title="Risk-Reward Ratio (TP = RRR × SL)", minval=0.5, step=0.1)

boxColor = input.color(color.new(color.orange, 80), title="Institutional Bar Box Color")

instBarColor = input.color(color.red, title="Institutional Bar Highlight")

// === MOVING AVERAGES ===

sma20 = ta.sma(close, 20)

sma200 = ta.sma(close, 200)

plot(sma20, color=color.green, title="20 SMA")

plot(sma200, color=color.blue, title="200 SMA")

// === INSTITUTIONAL BAR LOGIC ===

bodySize = math.abs(close - open)

rangeBar = high - low

bodyRatio = bodySize / rangeBar

instBar = bodyRatio > 0.7 and rangeBar > ta.sma(rangeBar, 20) * 1.5

isBullish = close > open

isBearish = close < open

plotshape(instBar, title="Institutional Bar", location=location.abovebar, color=color.red, style=shape.labelup, text="IB")

// === MARK BOX AROUND INSTITUTIONAL BAR ===

var float ibHigh = na

var float ibLow = na

var int ibTime = na

if instBar

ibHigh := high

ibLow := low

ibTime := bar_index

// Plot Rectangle for IB

inRange = bar_index <= ibTime + 10 and not na(ibHigh) and not na(ibLow)

var box ibBox = na

if instBar

if not na(ibBox)

box.delete(ibBox)

// === ENTRY CONDITIONS ===

priceAboveMAs = close > sma20 and close > sma200

priceBelowMAs = close < sma20 and close < sma200

longEntry = not na(ibHigh) and close > ibHigh and bar_index > ibTime and priceAboveMAs and isBullish

shortEntry = not na(ibLow) and close < ibLow and bar_index > ibTime and priceBelowMAs and isBearish

// === SL and TP ===

atr = ta.atr(atrLength)

longSL = close - atr

shortSL = close + atr

longTP = close + atr * rrRatio

shortTP = close - atr * rrRatio

// === EXECUTE TRADES ===

if longEntry

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL Long", from_entry="Long", limit=longTP, stop=longSL)

label.new(bar_index, high, text="Buy", style=label.style_label_up, color=color.green, textcolor=color.white)

alert("Long Entry Triggered", alert.freq_once_per_bar)

if shortEntry

strategy.entry("Short", strategy.short)

strategy.exit("TP/SL Short", from_entry="Short", limit=shortTP, stop=shortSL)

label.new(bar_index, low, text="Sell", style=label.style_label_down, color=color.red, textcolor=color.white)

alert("Short Entry Triggered", alert.freq_once_per_bar)

// === Highlight Institutional Bar Background ===

bgcolor(instBar ? color.new(instBarColor, 85) : na)