Strategy Overview

The EMA Crossover with Volume and Stacked Take Profit & Trailing Stop Loss Strategy is a trend-following trading system that combines technical indicators with volume-price relationships. This strategy is based on crossover signals between fast and slow Exponential Moving Averages (EMAs) as entry conditions, coupled with volume confirmation to enhance signal quality. The exit mechanism employs a triple-protection design, including two fixed take-profit levels based on ATR multiples and a trailing stop-loss mechanism, dividing the position into three parts to capture profits in stages while protecting capital. This strategy design provides a flexible and comprehensive risk management solution while remaining simple and intuitive.

Strategy Principles

The core logic of this strategy revolves around several key components:

Entry Signal Generation:

- Uses two Exponential Moving Averages (EMAs) with different periods (default 21 and 55) to identify trend direction and potential turning points

- Generates a long signal when the fast EMA (21-period) crosses above the slow EMA (55-period)

- Generates a short signal when the fast EMA crosses below the slow EMA

Volume Confirmation:

- Calculates a 20-period Simple Moving Average (SMA) of volume as a baseline

- Confirms trade signals only when current volume exceeds the average volume by a specific multiplier (default 1.2)

- This filtering condition ensures trades are executed only when market activity increases, enhancing signal reliability

Risk Management and Exit Mechanisms:

- Uses Average True Range (ATR) to dynamically adjust take-profit and stop-loss levels, allowing the strategy to adapt to different market volatilities

- Divides the position into three parts (33%, 33%, 34%) to implement a layered take-profit and trailing stop-loss strategy

- Sets the first take-profit target at 1.5 times ATR, applied to 33% of the position

- Sets the second take-profit target at 2.5 times ATR, applied to 33% of the position

- Applies a trailing stop-loss mechanism to the remaining 34% of the position, with a stop distance of 1.5 times ATR, activated when the price moves 1.5 times ATR

This multi-tiered exit strategy ensures partial profit capture in small favorable moves while allowing for maximum profit potential with the remaining position during strong trend moves. Meanwhile, the trailing stop-loss mechanism provides dynamic protection for the last portion of the position, effectively preventing profit givebacks.

Strategy Advantages

Simple Yet Effective Design:

- Strategy based on widely used technical indicators (EMA), easy to understand and implement

- No complex calculations or difficult-to-understand logic, suitable for traders of all levels including beginners

Volume-Price Integration Improves Signal Quality:

- Effectively filters out potential false breakouts with low volume by requiring volume confirmation

- Volume threshold designed to be dynamically calculated (based on recent average volume), allowing the strategy to adapt to different market environments and timeframes

Comprehensive Risk Management:

- Stacked take-profit design balances the need to lock in profits and follow trends

- Dynamic stop-loss and take-profit settings based on ATR, ensuring the strategy maintains consistent risk-reward ratios across different volatility environments

- Trailing stop-loss mechanism effectively protects realized profits, especially during trend reversals

High Adaptability:

- Strategy parameters can be adjusted for different trading instruments and timeframes

- Code mentions the strategy performs well across multiple trading instruments, demonstrating its robustness and versatility

Integrated Capital Management:

- Strategy uses a percentage of account equity (10%) by default for position sizing, avoiding excessive risk that fixed lot sizes might introduce

Strategy Risks

Poor Performance in Ranging Markets:

- As a trend-following strategy, it may generate multiple false signals in sideways, choppy markets, leading to consecutive small losses

- Solution: Add additional market environment filters such as ADX or volatility indicators to trade only in clear trending environments

Parameter Sensitivity:

- The choice of EMA periods, volume multiplier, and ATR multiples significantly impacts strategy performance

- Different market environments may require different parameter settings, and excessive optimization may lead to overfitting risk

- Solution: Conduct extensive backtesting analysis to find parameter combinations that perform consistently across various market conditions

Slippage Risk in Rapid Reversals:

- In extreme market conditions, prices may quickly jump past stop levels, resulting in actual execution prices worse than expected

- Solution: Consider setting maximum slippage limits or trading on higher timeframes to reduce such risks

Fixed Take-Profit Proportions:

- The current strategy divides positions into fixed proportions (33%/33%/34%) for take-profits, which may not be optimal for all market conditions

- Solution: Consider dynamically adjusting batch proportions based on market volatility or trend strength

Volume Fluctuations:

- Some markets may have seasonal or temporal volume patterns that a simple 20-period average may not capture adequately

- Solution: Implement more sophisticated volume normalization techniques or use different volume thresholds for different time periods

Strategy Optimization Directions

Introduce Trend Strength Filters:

- Integrate trend strength indicators such as Average Directional Index (ADX) to open positions only in clearly trending markets

- This will significantly reduce the number of false signals in ranging markets and improve overall win rate

- Implementation: Add

adx = ta.adx(14)calculation and includeand adx > 25condition in entry criteria

Optimize Volume Analysis:

- Consider using Relative Volume Index (RVI) or Volume Weighted Moving Average (VWMA) instead of simple volume thresholds

- This can more precisely capture volume anomalies and reduce misjudgments based on pure volume

- Implementation: Calculate volume standard deviation and use deviation rather than simple multipliers to judge volume breakouts

Dynamic Adjustment of Take-Profit Levels:

- Dynamically adjust take-profit multiples based on market volatility or trend strength, setting farther take-profit targets in strong trends

- Implementation: Can incorporate ADX readings to dynamically adjust tp1Mult and tp2Mult parameters

Optimize Entry Timing:

- Add price momentum confirmation, such as RSI or MACD, as additional filtering conditions for EMA crossover signals

- This can reduce potential false signals that may occur at the beginning of trend reversals

- Implementation: Add

rsi = ta.rsi(close, 14)and include directional conditions in entry criteria

Add Time Filters:

- Implement trading session filters to avoid low liquidity or high volatility periods

- Some trading instruments perform better during specific time periods, and setting targeted trading times can improve overall performance

- Implementation: Use Pine Script’s

timefunction to check if the current trading time is within the ideal period

Implement Dynamic Position Sizing:

- Dynamically adjust position size based on the system’s recent performance, market volatility, or other risk metrics

- This will allow the strategy to increase risk exposure in favorable market conditions and automatically reduce risk in unfavorable conditions

- Implementation: Adjust the default_qty_value parameter based on changes in consecutive win/loss counts or ATR values relative to historical levels

Summary

The EMA Crossover with Volume and Stacked Take Profit & Trailing Stop Loss Strategy is an elegantly designed and comprehensive trading system that combines classical technical analysis methods with modern risk management techniques. The core strengths of this strategy lie in its simplicity and adaptability, providing entry signals through EMA crossovers combined with volume confirmation, and implementing comprehensive risk control through stacked take-profits and trailing stop-losses.

While the strategy performs well across multiple trading instruments, there are still potential risks and optimization opportunities. By introducing trend strength filters, optimizing volume analysis, dynamically adjusting take-profit levels, refining entry timing, and implementing dynamic position sizing, the strategy’s robustness and profitability can be further enhanced.

Ultimately, this strategy demonstrates how to build a quantitative trading system that is both accessible to beginners and valuable for practical trading while maintaining simplicity and intuitive design through carefully designed risk management and signal confirmation mechanisms. As noted in the code comments, “Simple does it!” - sometimes the most effective strategies don’t require complex indicator combinations but rather reasonable logical structure and comprehensive risk control design.

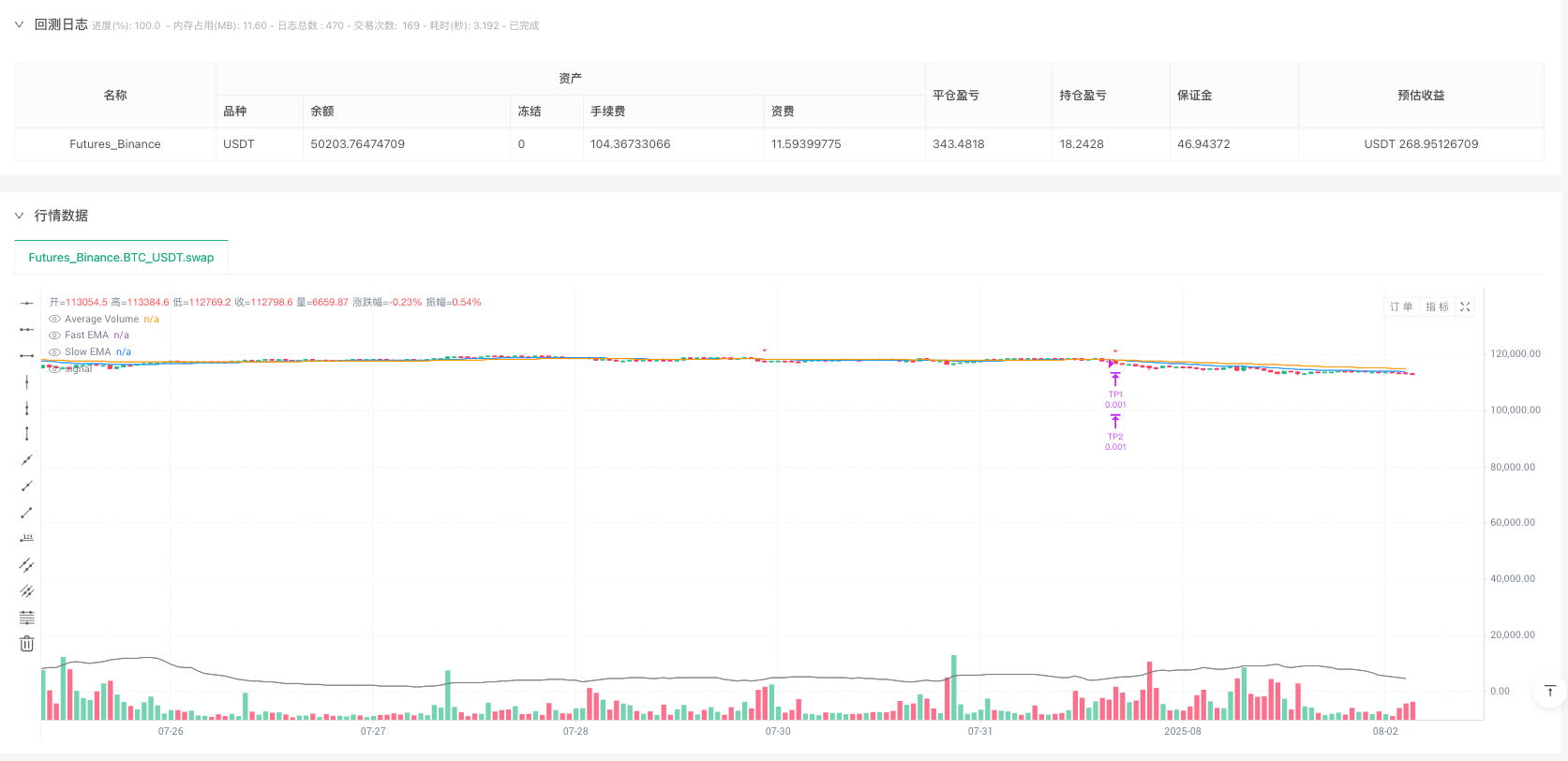

/*backtest

start: 2025-01-01 00:00:00

end: 2025-08-03 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("EMA Crossover with Volume + Stacked TP & Trailing SL", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// 📊 Inputs

fastLen = input.int(21, title="Fast EMA")

slowLen = input.int(55, title="Slow EMA")

volMultiplier = input.float(1.2, title="Volume Threshold Multiplier")

atrLen = input.int(14, title="ATR Length")

tp1Mult = input.float(1.5, title="TP1 ATR Multiplier")

tp2Mult = input.float(2.5, title="TP2 ATR Multiplier")

trailOffsetMult = input.float(1.5, title="Trailing SL Offset (ATR)")

trailTriggerMult = input.float(1.5, title="Trailing SL Activation (ATR)")

// 📈 Indicators

fastEMA = ta.ema(close, fastLen)

slowEMA = ta.ema(close, slowLen)

plot(fastEMA, color=color.blue, title="Fast EMA")

plot(slowEMA, color=color.orange, title="Slow EMA")

atr = ta.atr(atrLen)

avgVolume = ta.sma(volume, 20)

volumeCondition = volume > avgVolume * volMultiplier

plot(avgVolume, color=color.gray, title="Average Volume")

// 🚀 Entry Conditions

longCondition = ta.crossover(fastEMA, slowEMA) and volumeCondition

shortCondition = ta.crossunder(fastEMA, slowEMA) and volumeCondition

// 📌 Entry

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// 🎯 Take Profit Targets

tp1 = atr * tp1Mult

tp2 = atr * tp2Mult

// 🛡️ Trailing Stop Setup

trailOffset = atr * trailOffsetMult

trailTrigger = atr * trailTriggerMult

// 📤 Exit Logic for Long

if (strategy.position_size > 0)

strategy.exit("TP1", from_entry="Long", profit=tp1, qty_percent=33)

strategy.exit("TP2", from_entry="Long", profit=tp2, qty_percent=33)

strategy.exit("Trail", from_entry="Long", trail_offset=trailOffset, trail_price=trailTrigger, qty_percent=34)

// 📤 Exit Logic for Short

if (strategy.position_size < 0)

strategy.exit("TP1", from_entry="Short", profit=tp1, qty_percent=33)

strategy.exit("TP2", from_entry="Short", profit=tp2, qty_percent=33)

strategy.exit("Trail", from_entry="Short", trail_offset=trailOffset, trail_price=trailTrigger, qty_percent=34)

// 🧠 Visual Debug

plotshape(longCondition, location=location.belowbar, color=color.green, style=shape.triangleup, title="Long Signal")

plotshape(shortCondition, location=location.abovebar, color=color.red, style=shape.triangledown, title="Short Signal")