Cloud Oscillation Breakthrough Strategy: Volume-Enhanced Trading System Based on Ichimoku Cloud and EMA

EMA Ichimoku Cloud TENKAN-SEN Kijun-Sen Senkou Span VOLUME FILTER SMA

Overview

The Cloud Oscillation Breakthrough Strategy is a comprehensive trading system that combines the Ichimoku Cloud indicator, Exponential Moving Average (EMA), and volume filters. This strategy primarily uses the Ichimoku Cloud’s bullish market structure to identify potential uptrends, while enhancing trade accuracy through volume confirmation and EMA filtering. The strategy features clear stop-loss mechanisms and EMA-based exit conditions, designed to capture strong upward price movements and exit promptly when trends weaken.

Strategy Principles

The core principle of this strategy is based on identifying market trends using the Ichimoku Cloud’s bullish alignment and price position relationships, combined with volume and moving average confirmations. Specifically:

Ichimoku Cloud Calculations:

- Tenkan-sen (Conversion Line): Average of the highest high and lowest low over a specified period (default 9)

- Kijun-sen (Base Line): Average of the highest high and lowest low over a specified period (default 26)

- Senkou Span A (Leading Span A): Average of Tenkan-sen and Kijun-sen, displaced forward by 26 periods

- Senkou Span B (Leading Span B): Average of the highest high and lowest low over a specified period (default 52), displaced forward by 26 periods

Entry Conditions:

- Price must be above both Senkou Span A and Senkou Span B (above the “cloud”)

- Current volume must be greater than the average volume over the past 10 periods

- Optional condition: Price must be above the 44-period EMA (can be enabled or disabled via parameters)

Exit Conditions:

- Primary exit signal: Price falls below the 44-period EMA

- Stop-loss condition: Price drops more than 2% below the entry price (percentage can be customized)

Risk Management:

- Each trade uses 10% of account equity

- Percentage-based stop-loss to protect capital

The key logic is that when price breaks above the cloud with volume confirmation, it typically signals the beginning of a strong uptrend; when price falls below the EMA, it may indicate weakening momentum, requiring position exit to protect profits.

Strategy Advantages

Comprehensive Signal Confirmation Mechanism: Combines multiple technical indicators (Ichimoku Cloud, EMA, and volume) to form trading signals, significantly reducing the risk of false breakouts.

Trend Following Characteristics: Identifies medium to long-term trend direction through the Ichimoku Cloud, rather than relying solely on short-term price fluctuations, helping to capture major trend movements.

Volume Confirmation: Requires volume higher than average levels, ensuring breakouts are supported by sufficient market participation, enhancing signal reliability.

Flexible Entry Filtering: Option to require price above EMA for entry, allowing traders to adjust the strategy’s aggressiveness or conservatism based on market conditions.

Clear Risk Control: Built-in stop-loss mechanism limits maximum loss per trade, protecting account capital.

Optimized Exit Mechanism: EMA-based exit strategy is more robust than simple price retracements, avoiding premature exits from strong trends.

Parameter Customizability: All key parameters are adjustable, including Ichimoku Cloud periods, EMA period, volume filter length, and stop-loss percentage, enabling the strategy to adapt to different market environments.

Strategy Risks

False Breakout Risk After Cloud Penetration: Despite volume and EMA filtering, the market may reverse after breaking above the cloud, leading to false signals. Solution: Consider adding additional confirmation indicators such as RSI or MACD divergence.

Poor Performance in Ranging Markets: The Ichimoku Cloud excels in strong trend markets but may generate too many invalid signals in sideways consolidation periods. Solution: Add market environment filters to pause trading when sideways markets are identified.

Single EMA Exit May Lag: Relying solely on EMA as an exit signal may result in slow reactions during sharp market declines. Solution: Consider adding volatility filters or more sensitive short-term moving averages as auxiliary exit conditions.

Limitations of Fixed Percentage Stop-Loss: Different markets and timeframes have different volatility characteristics, making fixed percentage stop-losses potentially inflexible. Solution: Implement ATR (Average True Range) based dynamic stop-losses to better adapt to market volatility.

Parameter Optimization Risk: Over-optimization of historical data may lead to poor strategy performance in future markets. Solution: Conduct robust parameter sensitivity testing and out-of-sample testing to ensure strategy stability.

Impact of Volume Anomalies: Abnormally large volumes may distort volume filtering conditions. Solution: Consider using volume standard deviation filters or relative volume indicators to eliminate the impact of outliers.

Strategy Optimization Directions

Dynamic Parameter Adjustment Mechanism:

- Implement a mechanism to automatically adjust Ichimoku Cloud and EMA parameters based on market volatility

- This allows the strategy to maintain optimal performance in different market environments, as fixed parameters struggle to adapt to all market states

Enhanced Market Environment Filtering:

- Add trend strength indicators (such as ADX) to identify strong and weak trend environments

- In weak trends or sideways markets, raise entry thresholds or avoid trading completely

- This will significantly reduce losing trades from false breakouts

Multi-Timeframe Analysis Integration:

- Incorporate Ichimoku Cloud status from higher timeframes as additional filtering conditions

- Only enter trades when signals from higher timeframes and trading timeframes align

- This “timeframe synchronization” approach can significantly improve signal quality

Optimized Exit Strategy:

- Implement partial profit-taking mechanisms based on profit targets, such as moving stop-loss to breakeven after reaching certain profit levels

- Consider adding dynamic exit conditions based on price action, such as price breaking short-term support levels

- This will help preserve most trend profits while responding more quickly to market reversals

Integration of Machine Learning Elements:

- Use machine learning algorithms to dynamically predict optimal Ichimoku parameter settings

- Optimize entry and exit timing based on historical pattern recognition

- This can make the strategy more adaptive and reduce the subjectivity of manual parameter setting

Enhanced Risk Management Functions:

- Implement dynamic position sizing based on account equity changes

- Automatically reduce trading size after consecutive losses and gradually increase when profits stabilize

- This “antifragile” design can protect capital and optimize long-term returns

Summary

The Cloud Oscillation Breakthrough Strategy is a well-structured trend following system that identifies trends through the Ichimoku Cloud, enhancing accuracy with volume confirmation and EMA filtering. The strategy’s main advantages lie in its comprehensive signal confirmation mechanism and clear risk control, making it excel in strong trend markets. However, the strategy may face challenges in sideways markets, and its exit mechanism has room for optimization.

By implementing the suggested optimization directions, particularly dynamic parameter adjustment, market environment filtering, and multi-timeframe analysis, the strategy can significantly enhance its adaptability and robustness. The optimized strategy will be better equipped to handle different market environments, reduce false signals, while maintaining its ability to capture major trends.

Ultimately, the Cloud Oscillation Breakthrough Strategy represents a balanced trading approach, combining multiple dimensions of technical analysis (price structure, moving averages, and volume), providing traders with a reliable framework that can be further customized according to individual risk preferences and market views.

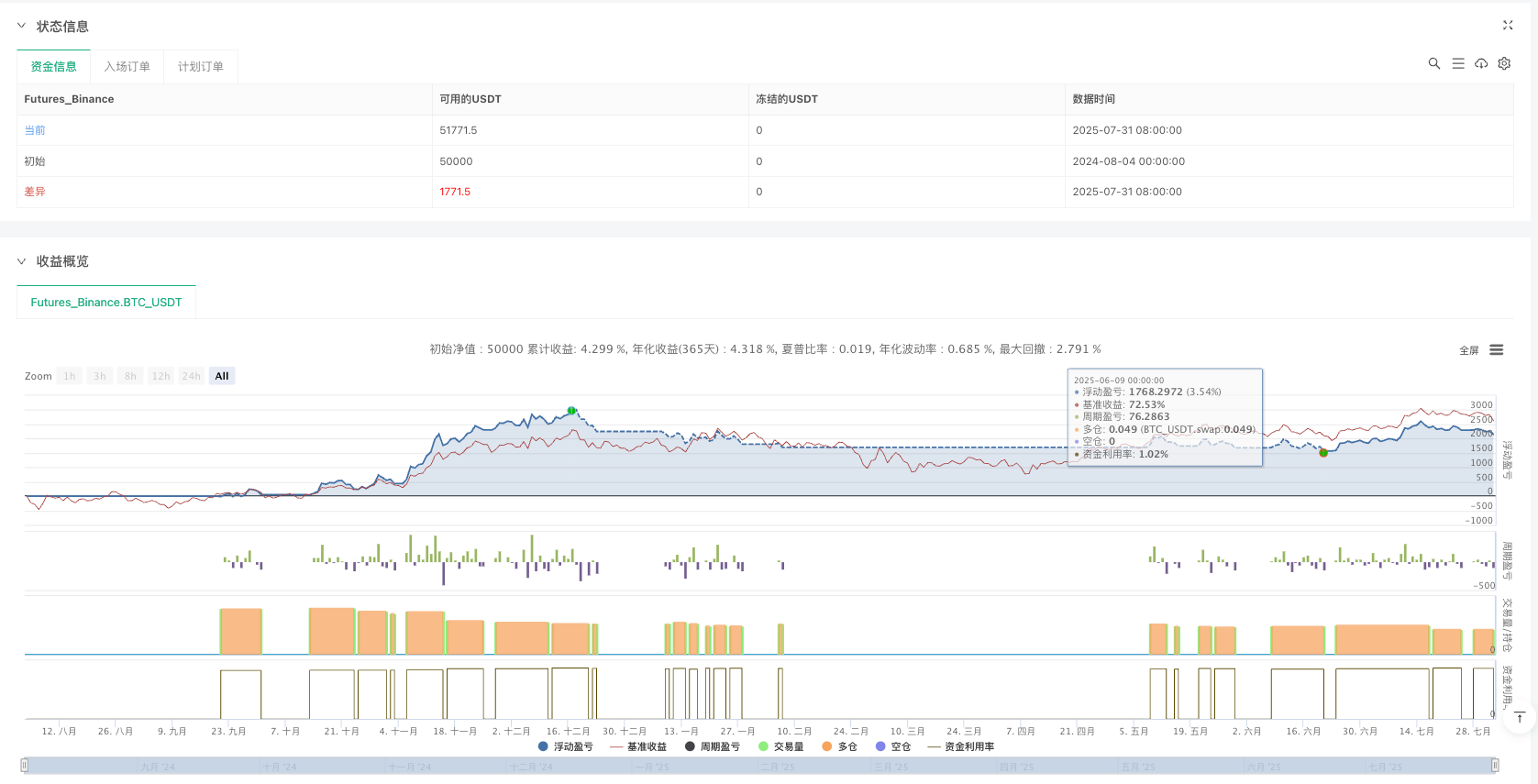

/*backtest

start: 2024-08-04 00:00:00

end: 2025-08-02 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ichimoku Cloud Buy & Custom EMA Exit [With Volume and Filters]", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === INPUTS ===

conversionPeriods = input.int(9, title="Tenkan-sen Periods")

basePeriods = input.int(26, title="Kijun-sen Periods")

displacement = input.int(26, title="Cloud Displacement")

laggingSpan = input.int(52, title="Senkou Span B Periods")

emaPeriod = input.int(44, title="EMA Length for Exit", minval=1)

avgVolLen = input.int(10, title="Average Volume Length")

useStopLoss = input.bool(true, title="Use Stop Loss for Exit")

stopLossPerc = input.float(2.0, title="Stop Loss (%)", minval=0.1, step=0.1)

requireAboveEMA = input.bool(true, title="Only Buy Above EMA?")

// === ICHIMOKU CALCULATIONS ===

tenkan = (ta.highest(high, conversionPeriods) + ta.lowest(low, conversionPeriods)) / 2

kijun = (ta.highest(high, basePeriods) + ta.lowest(low, basePeriods)) / 2

senkouA = (tenkan + kijun) / 2

senkouB = (ta.highest(high, laggingSpan) + ta.lowest(low, laggingSpan)) / 2

senkouA_now = senkouA[displacement]

senkouB_now = senkouB[displacement]

// === EMA CALC ===

emaVal = ta.ema(close, emaPeriod)

// === VOLUME CONDITION ===

avgVol = ta.sma(volume[1], avgVolLen) // Shift by 1 to exclude current bar's volume

volCondition = volume > avgVol

// === ENTRY CONDITION ===

buyCondition = close > senkouA_now and close > senkouB_now and volCondition and (not requireAboveEMA or close > emaVal)

if buyCondition

stopLevel = useStopLoss ? close * (1 - stopLossPerc / 100) : na

strategy.entry("Buy", strategy.long)

if useStopLoss

strategy.exit("Exit SL", from_entry="Buy", stop=stopLevel)

// === EXIT CONDITION ===

exitCondition = close < emaVal

if exitCondition

strategy.close("Buy")

// === PLOTS ===

plot(emaVal, color=color.yellow, linewidth=2, title="EMA")

plot(senkouA, color=color.green, title="Senkou Span A", offset=displacement)

plot(senkouB, color=color.red, title="Senkou Span B", offset=displacement)