Overview

The Dual EMA Crossover with Momentum Confirmation Day Trading Strategy is a short-term trading system based on fast and slow Exponential Moving Average (EMA) crossover signals combined with Relative Strength Index (RSI) filtering. Designed specifically for intraday trading, this strategy generates buy signals when the fast EMA crosses above the slow EMA and sell signals when the fast EMA crosses below the slow EMA, but only executes trades when the RSI confirms favorable momentum direction to avoid false signals in choppy markets. The strategy incorporates configurable stop-loss and take-profit mechanisms, set at 1% by default, helping traders quickly limit losses and secure profits within the trading day. The system clearly marks buy and sell signals on the chart and notifies traders of trading opportunities through real-time alerts. This approach provides short-term traders with a disciplined, mechanical method for capturing intraday trends with momentum confirmation and essential risk control measures. It is fully customizable to suit different intraday trading instruments, timeframes, and risk preferences.

Strategy Principles

The core principles of this strategy combine a dual EMA crossover system with momentum confirmation mechanisms while implementing strict risk management measures. Specifically:

Dual EMA Crossover Signal Generation: The strategy uses an 8-period fast EMA and a 21-period slow EMA. A buy signal is generated when the fast EMA crosses above the slow EMA; a sell signal is generated when the fast EMA crosses below the slow EMA. This mechanism is based on trend-following principles, with the fast EMA being more sensitive to price changes and capable of capturing trend shifts earlier.

RSI Momentum Confirmation: To reduce false signals, the strategy incorporates a 14-period RSI indicator as a filter. Buy signals are only executed when the RSI is below 70 (not overbought); sell signals are only executed when the RSI is above 30 (not oversold). This design effectively avoids unfavorable trades during extreme market conditions.

Risk Management Mechanism: Each trade is set with a 1% stop-loss and a 1% take-profit level. This means that regardless of market movements, the maximum loss is limited to 1% of the entry price, while profits are automatically secured when the price moves 1% in the favorable direction. This mechanism ensures disciplined fund management and predictable trading outcomes.

Entry Logic and Avoidance of Duplicate Trades: The code includes condition checks to ensure that no duplicate trades are entered in the same direction when positions already exist. New buy signals are only executed when there is no current long position or when holding a short position; similarly, new sell signals are only executed when there is no short position or when holding a long position.

Visualization and Alert System: The strategy plots fast and slow EMA curves on the chart, displays buy and sell signals with distinctive markers, and sets up a real-time alert system so traders can respond promptly to trading opportunities.

Strategy Advantages

Enhanced Signal Quality: By combining EMA crossovers with RSI confirmation, the strategy significantly reduces false signals, only trading when trend and momentum align, improving win rates and trade quality.

Built-in Risk Control: Each trade automatically sets stop-loss and take-profit levels, limiting risk to a predictable range, avoiding excessive losses due to emotional decision-making, and ensuring profits are secured when the market moves favorably.

High Customizability: The strategy allows adjustment of EMA periods, RSI parameters, and risk management settings, which can be optimized for different trading instruments, market environments, and personal risk preferences.

Mechanical Trading Rules: Clear entry and exit conditions eliminate subjective judgment, providing a repeatable trading system that helps cultivate trading discipline.

Real-time Visual Feedback and Alerts: The strategy visually displays trading signals on the chart and sets up an alert system, ensuring traders don’t miss important trading opportunities, particularly suitable for fast-paced intraday trading environments.

Integrated Fund Management: The strategy defaults to using 10% of account equity for trading, a proportional allocation method that contributes to long-term capital growth and risk diversification.

Strategy Risks

Poor Performance in Choppy Markets: Despite RSI filtering, in choppy markets without clear trends, the dual EMA crossover strategy may still generate multiple false signals, leading to consecutive small losses that erode account capital.

Limitations of Fixed Stop-Loss: The fixed 1% stop-loss may be too tight in high-volatility markets or timeframes, easily triggered by market noise, while in low-volatility environments, it might be too loose.

Excessive Trading Frequency: The 8 and 21 period EMA parameter settings are relatively sensitive and may generate multiple trading signals in a short time, increasing transaction costs and potentially leading to overtrading.

Lack of Market Environment Adaptability: The strategy has no built-in mechanism to identify overall market environments (such as trend strength or volatility conditions) and will still generate signals in market conditions unsuitable for EMA crossover strategies.

Gap Risk: Intraday trading strategies face price gap risks, especially overnight gaps that may render stop-losses ineffective, resulting in actual losses exceeding the preset 1% limit.

Solutions: - Add a trend strength filter, such as the ADX indicator, to trade only when trends are clear - Implement dynamic stop-losses that automatically adjust based on market volatility - Add market environment recognition mechanisms to pause trading during unfavorable conditions - Consider using time filters to avoid high-volatility market opening and closing periods - Optimize EMA parameters, using longer periods to reduce false signals

Strategy Optimization Directions

Dynamic Parameter Adaptation: Change fixed EMA periods and RSI thresholds to dynamic parameters that automatically adjust based on market volatility. For example, use longer EMA periods in high-volatility markets to reduce noise and shorter periods in low-volatility markets to improve response speed. This approach recognizes that different market environments require different parameter settings for optimal performance.

Add Trend Strength Filter: Introduce Average Directional Index (ADX) as an additional filtering condition, executing trades only when ADX is above a specific threshold (indicating a strong trend). This will effectively reduce losing trades in trendless markets, as EMA crossover strategies perform best in strong trend environments.

Implement Dynamic Stop-Loss and Take-Profit: Replace fixed percentage settings with dynamic stop-loss/take-profit based on Average True Range (ATR), matching risk management with current market volatility. In more volatile markets, stop-loss points automatically widen, while in less volatile markets they tighten, better adapting to different market conditions.

Add Trading Session Filters: Restrict trading to specific time periods, avoiding high-volatility and low-liquidity periods around market opening and closing. This optimization is based on the principle that different intraday periods have different characteristics; selectively trading during the most effective periods can improve overall performance.

Integrate Volume Confirmation: Add volume analysis as an additional condition for trade confirmation, executing signals only when volume supports the price movement direction. This improvement is based on the principle that price movements should be confirmed by volume, helping to distinguish between real trend changes and temporary price fluctuations.

Drawdown Control Mechanism: Implement dynamic position sizing based on historical performance, automatically reducing position size or pausing trading after consecutive losses or reaching preset drawdown limits, until market conditions improve. This mechanism helps protect capital and avoid excessive losses during unfavorable market conditions.

Multi-Timeframe Confirmation: Check higher timeframe trend direction before executing trades, only trading when the current timeframe signal aligns with the higher timeframe trend. This approach is based on the principle of trading with the trend, improving success rates by ensuring trade direction aligns with the larger trend.

Summary

The Dual EMA Crossover with Momentum Confirmation Day Trading Strategy provides a structured, disciplined approach to capturing short-term market trends while implementing strict risk controls. By combining fast and slow EMA crossover signals with RSI momentum confirmation, the strategy can identify potential favorable trading opportunities while reducing false signals. The built-in stop-loss and take-profit mechanisms ensure controllable risk for each trade, while customizable parameters provide flexibility to adapt to different market conditions.

However, like all trading strategies, this system has limitations, particularly in choppy markets where it may generate consecutive small losses, and fixed stop-loss and take-profit settings may not be suitable for all market environments. To further enhance strategy performance, it is recommended to implement dynamic parameter adaptation, trend strength filtering, dynamic risk management, and multi-timeframe confirmation.

Overall, this strategy provides intraday traders with a solid starting point, combining the fundamental elements of technical analysis, momentum confirmation, and risk management. Through continuous optimization and adaptation, it can develop into a powerful trading system suitable for different market environments and personal trading goals. The core advantages of the strategy lie in its clear rules, built-in risk control, and high customizability, making it a valuable component in a short-term trader’s toolkit.

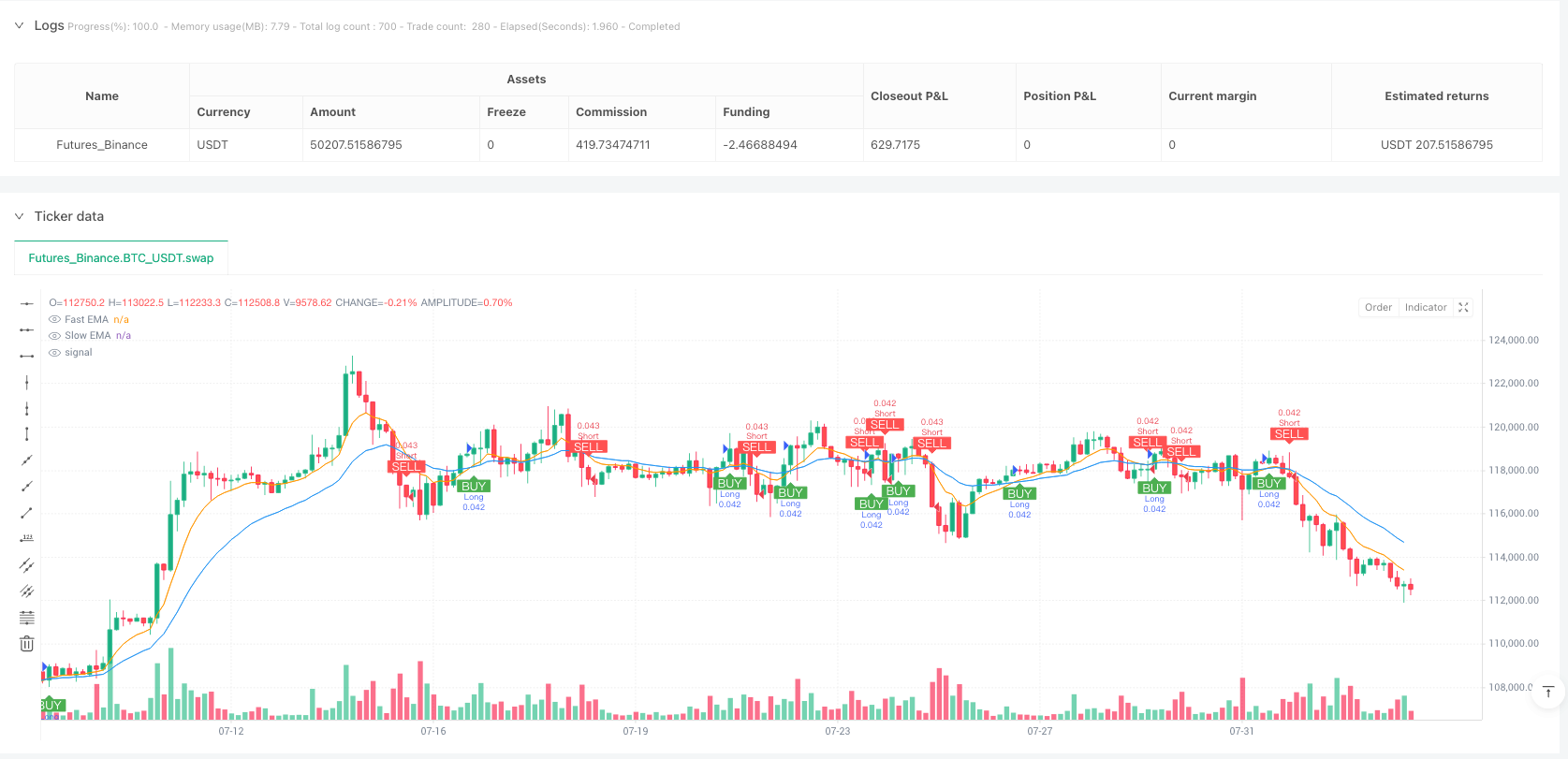

/*backtest

start: 2024-08-05 00:00:00

end: 2025-08-03 08:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Day Trading Strategy (With Risk Management)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Inputs for EMAs

fastEMA = input.int(8, "Fast EMA")

slowEMA = input.int(21, "Slow EMA")

// Input for RSI filter

rsiLength = input.int(14, "RSI Length")

rsiOverbought = input.int(70, "RSI Overbought")

rsiOversold = input.int(30, "RSI Oversold")

// Calculate EMAs

emaFast = ta.ema(close, fastEMA)

emaSlow = ta.ema(close, slowEMA)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Buy and Sell signals based on EMA crossover and RSI filter

buySignal = ta.crossover(emaFast, emaSlow) and rsi < rsiOverbought

sellSignal = ta.crossunder(emaFast, emaSlow) and rsi > rsiOversold

// Plot EMAs

plot(emaFast, color=color.orange, title="Fast EMA")

plot(emaSlow, color=color.blue, title="Slow EMA")

// Plot Buy and Sell signals on chart

plotshape(buySignal, title="Buy Signal", location=location.belowbar, style=shape.labelup, text="BUY", size=size.small, color=color.green, textcolor=color.white)

plotshape(sellSignal, title="Sell Signal", location=location.abovebar, style=shape.labeldown, text="SELL", size=size.small, color=color.red, textcolor=color.white)

// Strategy entries with check to avoid multiple entries without exit

if (buySignal and strategy.position_size <= 0)

strategy.entry("Long", strategy.long)

strategy.exit("LongExit", "Long", stop=close * 0.99, limit=close * 1.01)

if (sellSignal and strategy.position_size >= 0)

strategy.entry("Short", strategy.short)

strategy.exit("ShortExit", "Short", stop=close * 1.01, limit=close * 0.99)

// Alerts for buy and sell signals

alertcondition(buySignal, title="Buy Alert", message="BUY Signal Triggered!")

alertcondition(sellSignal, title="Sell Alert", message="SELL Signal Triggered!")