Overview

This strategy is a price action trading system that combines the Relative Strength Index (RSI) with Order Blocks. Its core concept is to capture potential price reversal points by confirming overbought or oversold conditions through RSI when price revisits specific order block zones. The strategy integrates technical indicators with price structure analysis, providing a systematic approach to identify high-probability trading opportunities.

Strategy Principles

The strategy operates based on two key components: Order Block identification and RSI confirmation.

Order Block Identification: - Bullish Order Block: Formed when price action shows a pattern of a bearish close followed by a bullish candle that breaks the previous high. This indicates a potential support zone. - Bearish Order Block: Formed when price action shows a pattern of a bullish close followed by a bearish candle that breaks the previous low. This indicates a potential resistance zone.

Tap Detection with RSI Confirmation: - Bull Tap: A long entry is triggered when price revisits the bullish order block zone (within the defined high-low range), and RSI is below the buy level (default 40), indicating an oversold condition. - Bear Tap: A short entry is triggered when price revisits the bearish order block zone (within the defined high-low range), and RSI is above the sell level (default 60), indicating an overbought condition.

The strategy is implemented in PineScript, with core logic including dynamic detection of order blocks, state management, and visual display. The system also incorporates a cooldown period (minimum 5 candles) to prevent overtrading.

Strategy Advantages

- Precise Entry Point Identification: By combining price structure (Order Blocks) and momentum indicators (RSI), the strategy can more accurately identify potential reversal points.

- Visually Clear Trading Zones: The strategy visualizes order block zones as rectangular boxes, green for bullish areas and red for bearish areas, allowing traders to intuitively track relevant price zones.

- Flexible Parameter Adjustment: RSI buy and sell levels can be adjusted according to different market conditions and trading preferences, with default values set at 40 and 60.

- Systematic Trading Approach: Provides clear entry rules, reducing subjective judgment and helping maintain trading discipline.

- Filtering Low-Quality Signals: Through RSI filters and cooldown period settings, the risk of false signals and overtrading is reduced.

- Moderate Win Rate: Under default settings, backtesting shows approximately a 55% win rate, which is quite robust for a price action strategy.

Strategy Risks

- False Breakout Risk: Price may briefly touch the order block zone and then continue its original trend, leading to false signals. The solution is to add additional confirmation indicators or adjust RSI thresholds.

- Parameter Sensitivity: RSI buy and sell level settings significantly impact strategy performance. Thresholds that are too high or too low may result in missed opportunities or excessive false signals. It is recommended to determine the most suitable parameters for specific markets through backtesting.

- Adaptability to Different Market Environments: In strong trending markets, reversal strategies may not be as effective as in range-bound markets. Traders should adjust the use of the strategy based on current market conditions.

- Money Management Risk: Although the strategy defaults to using 10% of account equity for trading, this may lead to larger drawdowns in more volatile markets. It is advisable to adjust position sizes according to personal risk tolerance.

- Over-reliance on Visual Confirmation: While visual markers help identify trading zones, over-reliance on chart indications may cause traders to miss other important market information.

Strategy Optimization Directions

- Add Trend Filters: Incorporating longer-period trend indicators, such as moving averages or MACD, to ensure trading only in the direction of the main trend can improve win rates.

- Dynamic Adjustment of RSI Thresholds: Automatically adjust RSI buy and sell levels based on market volatility, using more extreme RSI values in high-volatility markets and more neutral values in low-volatility markets.

- Optimize Order Block Identification: Consider volume characteristics of order blocks; those formed with high volume may have stronger support or resistance effects.

- Add Stop-Loss and Take-Profit Targets: Set dynamic stop-loss and take-profit targets based on ATR (Average True Range) or key price levels to optimize risk-reward ratios.

- Time Filters: Avoiding important economic data releases or periods of low market liquidity can reduce risks brought by abnormal volatility.

- Multi-Timeframe Analysis: Integrating order block information from higher timeframes and prioritizing signals that overlap with higher timeframe order blocks can improve trade quality.

- Sentiment Indicator Integration: Consider adding market sentiment indicators, such as VIX or volume indicators, to better assess current market conditions.

Summary

The RSI and Order Block Tap Reversal Strategy provides a systematic approach to identifying potential market reversal points by combining technical indicators with price structure analysis. The core strength of the strategy lies in its integration of momentum indicators (RSI) with price action theory (Order Blocks), creating a visually clear trading system with well-defined rules.

While the strategy performs well in oscillating markets, there remains some risk of false breakouts and parameter sensitivity issues. Through the addition of trend filters, dynamic parameter adjustments, and optimization of order block identification, the strategy’s performance can be further enhanced.

For traders seeking a combination of price action and technical indicators, this strategy provides a solid foundation framework that can be further customized and optimized according to personal trading styles and market conditions. Successful implementation of the strategy depends not only on technical settings but also on good money management and trading psychology.

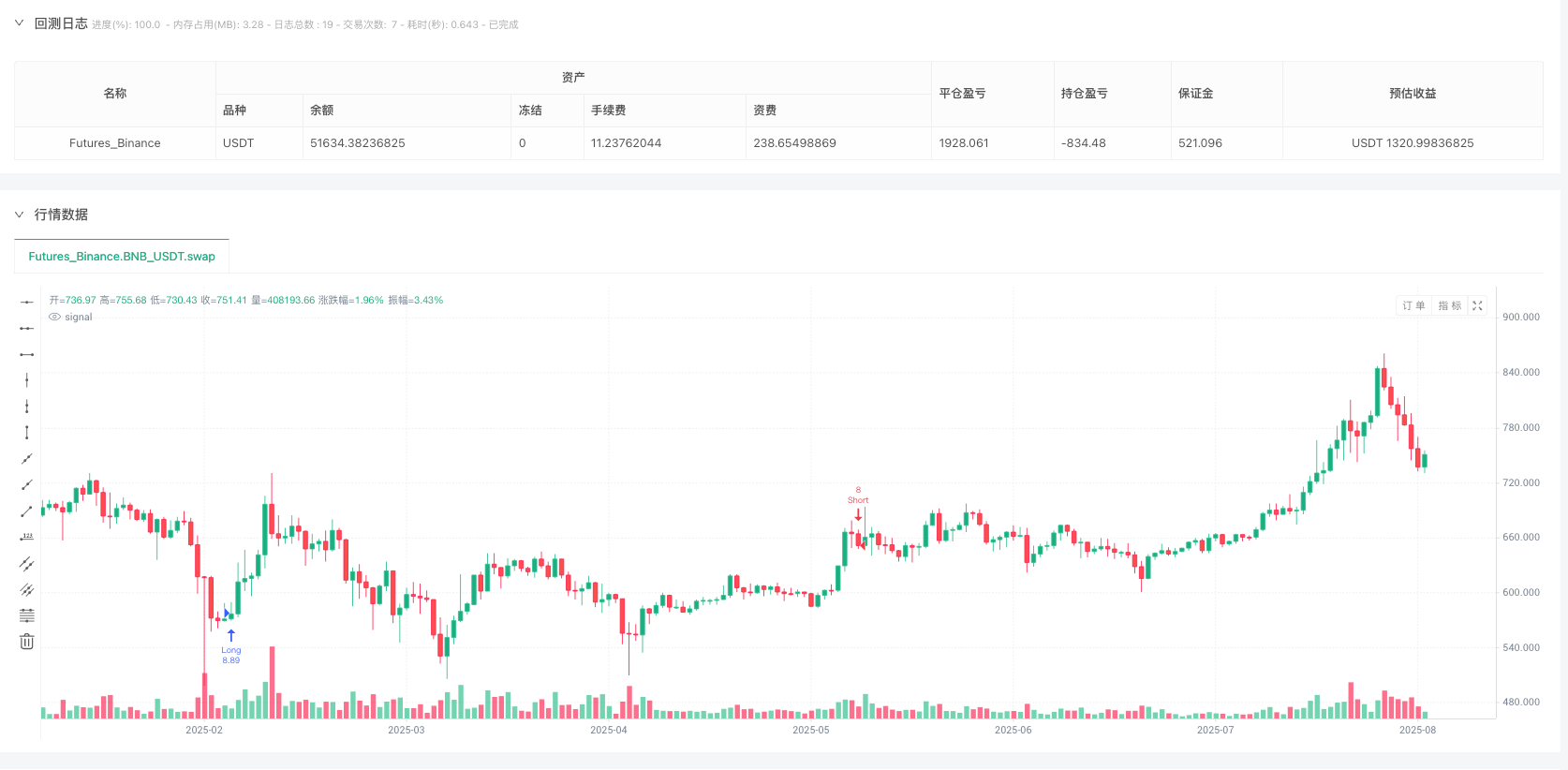

/*backtest

start: 2024-08-06 00:00:00

end: 2025-08-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BNB_USDT"}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Gerritnotsnailo

//@version=5

strategy("✅ RSI + Order Block Tap (met tekstlabels)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === RSI instellingen ===

rsi = ta.rsi(close, 14)

rsiBuyLevel = input.int(40, title="RSI Buy onder")

rsiSellLevel = input.int(60, title="RSI Sell boven")

// === Order Block Detectie ===

bullOB = close[2] < open[2] and close[1] > open[1] and close[1] > close[2]

bearOB = close[2] > open[2] and close[1] < open[1] and close[1] < close[2]

// === Opslaan OB-zones ===

var float bullOB_low = na

var float bullOB_high = na

var bool bullOB_active = false

var float bearOB_low = na

var float bearOB_high = na

var bool bearOB_active = false

if bullOB

bullOB_low := low[2]

bullOB_high := high[2]

bullOB_active := true

if bearOB

bearOB_low := low[2]

bearOB_high := high[2]

bearOB_active := true

// === Tap detectie met RSI-filter ===

bullTap = bullOB_active and close <= bullOB_high and close >= bullOB_low and rsi < rsiBuyLevel

bearTap = bearOB_active and close <= bearOB_high and close >= bearOB_low and rsi > rsiSellLevel

// === Entries

if bullTap

strategy.entry("Long", strategy.long)

bullOB_active := false

label.new(bar_index, low, "LONG", style=label.style_label_up, color=color.green, textcolor=color.white)

if bearTap

strategy.entry("Short", strategy.short)

bearOB_active := false

label.new(bar_index, high, "SHORT", style=label.style_label_down, color=color.red, textcolor=color.white)