Overview

The ZLEMA-MACD Momentum Reversal Trading System is a rule-based scalping strategy that combines Zero-Lag Exponential Moving Average (ZLEMA), Moving Average Convergence Divergence (MACD), and Exponential Moving Average (EMA) filters to capture short-term momentum shifts in the market. Designed specifically for beginners and small account traders, this strategy provides a clear visual framework for understanding basic momentum setups and applying predefined risk/reward parameters with an emphasis on clarity of execution.

The strategy leverages the zero-lag properties of ZLEMA to reduce the delay issues inherent in traditional moving averages, combines it with MACD to capture momentum shifts, and uses EMA100 as a trend filter. The system also incorporates the Relative Strength Index (RSI) for directional strength confirmation, creating a comprehensive technical analysis framework.

The strategy employs small position sizing and a low initial capital ($1000), making it more accessible to those just starting out. All logic is fully transparent, with no repainting or subjective components, providing traders with a reliable platform for learning and practice.

Strategy Principles

The core principles of the ZLEMA-MACD Momentum Reversal Trading System are based on the synergistic effect of multiple technical indicators:

Zero-Lag Exponential Moving Average (ZLEMA): The strategy first calculates ZLEMA(34), which is an optimized indicator that reduces the lag of traditional moving averages. ZLEMA eliminates some price lag by calculating

2 * EMA1 - EMA2(where EMA1 is the first EMA calculation, and EMA2 is a second smoothing of EMA1).ZLEMA-based MACD: The strategy uses ZLEMA values instead of traditional closing prices to calculate the MACD indicator with parameters 12/26/9, enhancing the indicator’s sensitivity to market momentum changes.

EMA100 Trend Filter: A 100-period exponential moving average serves as the primary trend filter, considering long signals only when price is above EMA100 and short signals only when price is below EMA100.

RSI Directional Confirmation: The strategy incorporates a 14-period RSI indicator as an additional filter, requiring RSI>50 for longs and RSI<50 for shorts, ensuring trade direction aligns with market strength.

Precise Entry Conditions:

- Long conditions: Price above EMA100 + MACD crosses above signal line + Histogram rising + MACD and signal lines not parallel + RSI>50

- Short conditions: Price below EMA100 + MACD crosses below signal line + Histogram falling + MACD and signal lines not parallel + RSI<50

Fixed Risk-Reward Ratio: The strategy implements a 2:1 risk-reward ratio with a 2% profit target and a 1% stop loss point, ensuring consistency in risk management.

Clear Exit Logic: The system closes positions on MACD reverse crossovers, histogram reversal, or RSI overbought/oversold reversals, providing multi-layered exit mechanisms.

The code implements a complete visualization framework, including trade boxes, take profit/stop loss lines, and risk-reward labels, providing traders with intuitive visual feedback.

Strategy Advantages

Through in-depth analysis of the ZLEMA-MACD Momentum Reversal Trading System code, the following significant advantages can be summarized:

Reduced Lag Effect: Using ZLEMA instead of traditional moving averages to calculate MACD significantly reduces indicator lag, making trading signals more timely and effective. The “zero-lag” property of ZLEMA mathematically counteracts some price delay, allowing the strategy to respond more quickly to market changes.

Multi-layered Filtering: The strategy integrates EMA100 trend filtering, RSI directional confirmation, MACD crossovers, and parallel line detection as multiple conditions, effectively reducing false signal risk. This multi-tiered filtering system ensures that only high-quality trading signals are executed.

Clear Visual Feedback: The system provides comprehensive visual elements including trade boxes, TP/SL lines, and risk-reward labels, helping traders intuitively understand each trade setup and expected outcome. This is particularly valuable for beginners, providing a clear learning framework.

Disciplined Risk Management: Built-in 2:1 risk-reward ratio settings (2% profit target, 1% stop loss) ensure consistency in risk control for each trade. These predefined risk parameters help traders develop good risk management habits.

Full Transparency with No Repainting: The strategy logic is completely transparent with no repainting or hidden calculations, making backtesting results more reliable. This enhances the strategy’s credibility and verifiability.

Suitable for Small Accounts: Default use of small position sizing (0.1) and low initial capital ($1000) lowers the entry barrier, making it especially suitable for beginners and small account traders.

Dynamic Exit Mechanisms: In addition to fixed TP/SL settings, the strategy includes dynamic exit conditions based on technical indicators, such as MACD reverse crossovers, histogram reversals, and RSI overbought/oversold reversals, providing flexible profit protection mechanisms.

Strategy Risks

Despite its well-designed structure, the ZLEMA-MACD Momentum Reversal Trading System has several potential risks and limitations:

Overtrading Risk: As a scalping strategy, the system may generate too many false signals in ranging or low-volatility markets, leading to overtrading and commission erosion. The solution is to add additional market volatility filters or pause trading during low volatility periods.

Limitations of Fixed Percentage TP/SL: The strategy uses fixed 2% profit and 1% stop loss settings, which may not adapt to all market environments and different volatility cycles. An optimization would be to make TP/SL points dynamic, automatically adjusting based on market volatility (such as ATR).

Trend Reversal Lag: Despite using ZLEMA to reduce lag, the system may still have some reaction delay at strong trend reversal points. It is recommended to combine shorter-period oscillators or price action analysis to enhance sensitivity to reversal points.

Sensitivity to Small Momentum Changes: The strategy may be overly sensitive to small MACD crossovers, especially in ranging markets. This can be mitigated by adding minimum threshold requirements for MACD crossovers to reduce noise trading.

Lack of Market Environment Adaptability: Strategy parameters are fixed without automatic adjustment mechanisms for different market environments. The solution is to introduce adaptive parameters that dynamically adjust based on recent market volatility and trend strength.

Single Timeframe Limitation: The strategy is based on single timeframe analysis, lacking multi-timeframe confirmation. It is recommended to add higher timeframe trend filtering to ensure trade direction aligns with larger trends.

Indicator Dependency: Over-reliance on technical indicators while lacking price action and market structure analysis. This can be enhanced by incorporating key support/resistance levels, price pattern recognition, and other methods to improve strategy comprehensiveness.

To mitigate these risks, traders should conduct thorough backtesting, paying particular attention to strategy performance across different market environments, and consider adding additional filters or adaptive parameter mechanisms.

Strategy Optimization Directions

While the ZLEMA-MACD Momentum Reversal Trading System is well-designed, there are multiple aspects that can be further optimized and improved:

Adaptive Parameter Adjustment: Change ZLEMA and MACD parameters from fixed values to adaptive values that automatically adjust based on market volatility (such as ATR). This can be implemented through the formula

adaptive length = base length * (current ATR / historical average ATR ratio), allowing the strategy to better adapt to different market environments.Multi-timeframe Analysis Integration: Add higher timeframe trend confirmation mechanisms, for example, only executing trades when the 4-hour trend aligns with the 15-minute signal direction. This can significantly improve success rates and avoid trading against major trends.

Volatility Filter: Introduce an ATR volatility filter, only considering trading signals when market volatility reaches a minimum threshold. This can avoid false signals and overtrading in low-volatility environments.

Dynamic Risk Management: Change fixed TP/SL percentages to ATR-based dynamic values, such as

stop loss = entry price - 1.5 * ATR, making risk control more aligned with current market volatility characteristics.Volume Confirmation: Integrate volume analysis, requiring increased volume when signals are generated. This can be implemented by checking if current volume is higher than recent average volume, improving signal reliability.

Market Environment Classification: Implement a market environment classification system (trend, range, high volatility, low volatility), using different parameter sets or even different strategy logic for different market states. This can be achieved by analyzing ADX, volatility, and price structure.

Price Action Analysis Integration: Add key support/resistance level identification, candlestick pattern analysis, and other price action elements, combining them with indicator signals to form a more comprehensive analytical framework.

Machine Learning Optimization: Consider using machine learning methods to automatically optimize strategy parameters or predict which market environments the strategy performs best in, achieving intelligent trading decisions.

Position Sizing Optimization: Change from fixed position sizing (0.1) to dynamic position management based on account risk percentage, such as

position size = account funds * risk percentage / (entry price - stop loss price) * entry price, implementing more scientific capital management.

Implementing these optimization directions can not only improve the strategy’s robustness and adaptability but also enable it to maintain consistent performance across different market environments. In particular, the combination of adaptive parameters and dynamic risk management can significantly enhance the strategy’s long-term survival capabilities.

Summary

The ZLEMA-MACD Momentum Reversal Trading System is a well-designed scalping framework particularly suitable for beginners and small account traders to learn and practice technical analysis trading. The strategy creates a comprehensive technical analysis system by combining ZLEMA’s low-lag properties, MACD’s momentum capture capabilities, and EMA100’s trend filtering function.

The core strengths of the strategy lie in its transparent rule system, multi-layered filtering mechanisms, and strict risk control, providing traders with a clear trading decision framework. Particularly commendable is its visualization design, including trade boxes, TP/SL lines, and risk-reward labels, which greatly enhance the trader’s learning experience.

However, the strategy also has some limitations, such as fixed parameter adaptability issues, single timeframe analysis limitations, and over-reliance on technical indicators. By implementing adaptive parameters, multi-timeframe analysis, dynamic risk management, and market environment classification, the strategy’s robustness and adaptability can be significantly enhanced.

Overall, the ZLEMA-MACD Momentum Reversal Trading System provides traders with a solid technical analysis starting point, suitable for educational purposes and as a foundation framework for more complex trading systems. For traders willing to invest time in backtesting and optimization, this strategy has the potential to develop into an efficient trading tool. Most importantly, the strategy’s clear rules and visualization framework make it an ideal choice for beginners to understand and practice technical analysis trading.

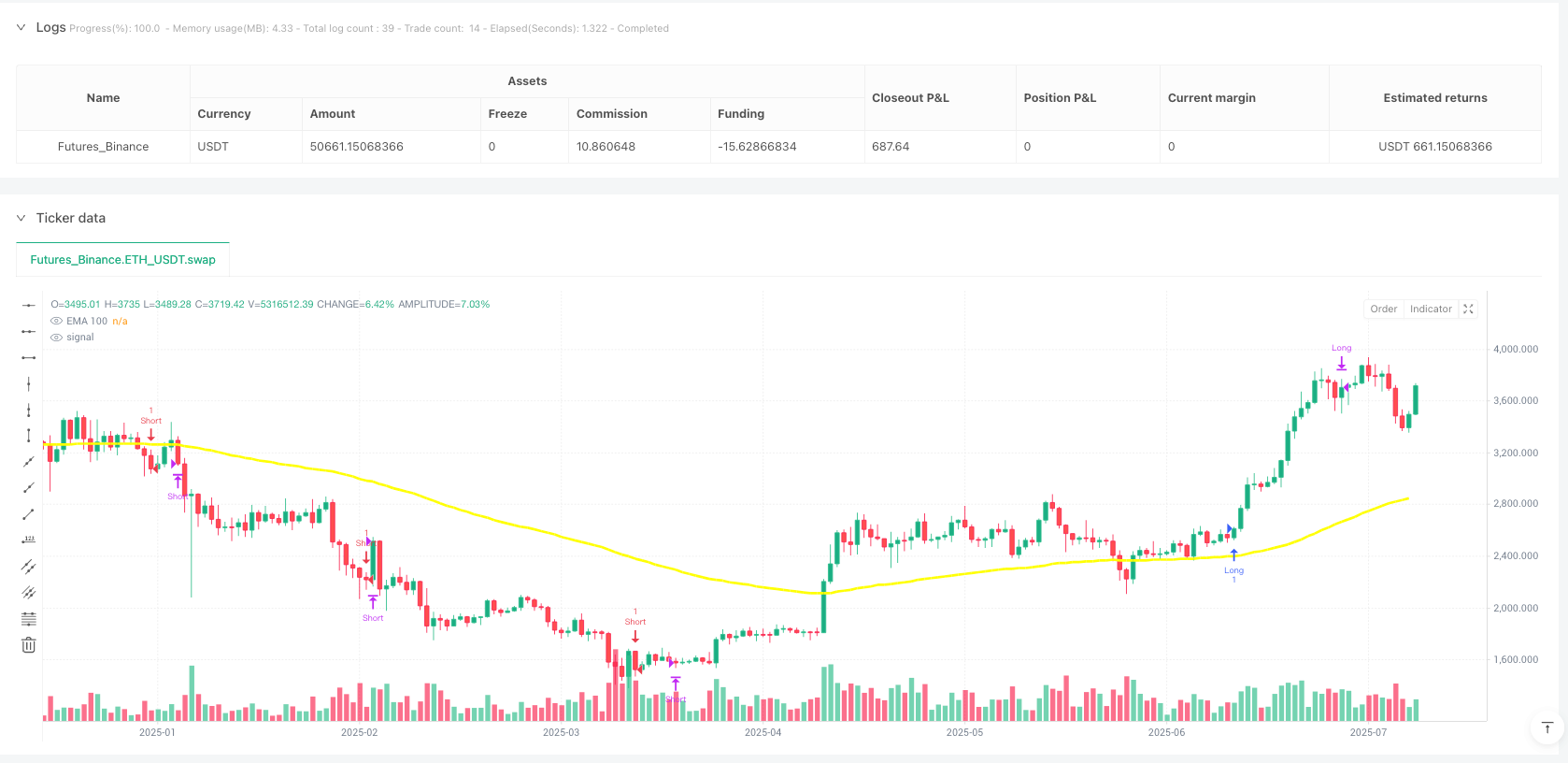

/*backtest

start: 2024-08-07 00:00:00

end: 2025-08-05 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Starter Edge Strategy", overlay=true)

// === INPUTS === //

zlemaSrc = close

zlemaLen = input.int(34, title="ZLEMA Length")

shortLen = input.int(12, title="MACD Short Length")

longLen = input.int(26, title="MACD Long Length")

signalLen = input.int(9, title="MACD Signal Smoothing")

emaLen100 = input.int(100, title="EMA 100 Length")

emaColor = input.color(color.yellow, title="EMA 100 Color")

emaWidth = input.int(3, title="EMA 100 Line Width", minval=1, maxval=5)

tpPerc = input.float(2.0, title="Take Profit % (entry based)", minval=0.1)

slPerc = input.float(1.0, title="Stop Loss % (entry based)", minval=0.1)

showVisuals = input.bool(true, title="Mostrar caja TP/SL y etiquetas")

// === EMA 100 === //

ema100 = ta.ema(close, emaLen100)

plot(ema100, title="EMA 100", color=emaColor, linewidth=emaWidth)

// === ZLEMA & MACD === //

ema1 = ta.ema(zlemaSrc, zlemaLen)

ema2 = ta.ema(ema1, zlemaLen)

zlema = 2 * ema1 - ema2

fastMA = ta.ema(zlema, shortLen)

slowMA = ta.ema(zlema, longLen)

macdLine = fastMA - slowMA

signal = ta.sma(macdLine, signalLen)

hist = macdLine - signal

// === RSI para filtros === //

rsiValue = ta.rsi(close, 14)

wasAbove70 = rsiValue[1] > 70 and rsiValue <= 70

wasBelow30 = rsiValue[1] < 30 and rsiValue >= 30

// === Condiciones === //

histFalling = hist < hist[1] and hist[1] > hist[2]

macdCrossUp = ta.crossover(macdLine, signal)

macdCrossDown = ta.crossunder(macdLine, signal)

linesParallel = math.abs(macdLine - signal) < 0.03 and math.abs(macdLine[1] - signal[1]) < 0.03

// === Variables visuales === //

var line tpLine = na

var line slLine = na

var box tradeBox = na

// === LONG === //

if (close > ema100 and macdCrossUp and not linesParallel and rsiValue > 50)

entryPrice = close

stopLoss = entryPrice * (1 - slPerc / 100)

takeProfit = entryPrice * (1 + tpPerc / 100)

strategy.entry("Long", strategy.long)

// === SHORT === //

if (close < ema100 and macdCrossDown and not linesParallel and rsiValue < 50)

entryPrice = close

stopLoss = entryPrice * (1 + slPerc / 100)

takeProfit = entryPrice * (1 - tpPerc / 100)

strategy.entry("Short", strategy.short)

// === CIERRES === //

exitLong = macdCrossDown or histFalling or wasAbove70

exitShort = macdCrossUp or histFalling or wasBelow30

if (strategy.position_size > 0 and exitLong)

strategy.close("Long", comment="Exit Long")

if (strategy.position_size < 0 and exitShort)

strategy.close("Short", comment="Exit Short")