Gold Time-Segregated Long Position Risk Management Strategy

PNL 风险管理 时间隔离 固定盈亏比 头寸控制 risk management Time Segregation Fixed Risk-Reward Position Control

Overview

The Gold Time-Segregated Long Position Risk Management Strategy is a quantitative trading system focused on risk control through fixed profit-loss ratios and time segregation mechanisms. The strategy employs simple and clear profit targets (\(20) and stop-loss limits (\)100), while introducing two time cooling mechanisms: a 12-hour cooling period after losses and a 15-minute entry delay after profits, effectively controlling risk exposure in consecutive trades. The strategy uses 10% of account equity as position size, ensuring robust fund management. Overall, this strategy provides traders with a simple and practical quantitative method under a low risk preference through strict risk management and time filtering.

Strategy Principles

The core principles of this strategy are based on strict risk control and time segregation mechanisms:

Entry Conditions: The strategy only opens long positions when three conditions are met: no current position, loss cooling period has passed, and profit delay period has passed. This ensures that trades do not frequently enter during unfavorable periods.

Exit Mechanisms: The strategy employs two clear exit conditions:

- Immediately close the position when profit reaches the preset $20

- Immediately stop loss when the loss reaches the preset $100

Time Segregation: The strategy introduces two time control mechanisms:

- 12-hour cooling period after a loss (tradeCooldown): prevents consecutive trading during unfavorable market conditions

- 15-minute entry delay after a profit (entryCooldown): avoids excessive trading in a short period

Position Management: The strategy uses a fixed percentage of account equity (10%) to determine position size, which automatically adjusts position as account size changes.

PnL Calculation: The strategy calculates real-time profit and loss of current positions based on the formula: PnL = Position Size × (Current Price - Entry Price) × Contract Size

Strategy Advantages

Analyzing this strategy code in depth, the following significant advantages can be summarized:

Simple and Clear: The strategy logic is clear, parameters are simple, easy to understand and implement, reducing the complexity of strategy operation and maintenance.

Risk Control Priority: Fixed risk-reward ratio (1:5) reflects the strategy’s emphasis on risk management. Each trade risks \(100 to gain \)20 profit. Although the risk-reward ratio is not high, it clearly defines trading boundaries.

Time Filtering Mechanism: Through two different time segregation mechanisms, it effectively avoids consecutive trading under unfavorable market conditions. Especially the 12-hour cooling period after losses can prevent emotional trading and rapid fund depletion.

Adapts to Market Fluctuations: The strategy does not rely on complex technical indicators but is based purely on price action and risk management, allowing it to maintain consistent trading rules in different market environments.

Reasonable Fund Management: Using account equity percentage (10%) to determine position size automatically adjusts trading scale as the account grows, avoiding potential fund management problems that fixed amount trading might bring.

Automated Execution: The strategy can be fully automated, reducing the impact of human intervention and emotional decision-making, improving trading discipline.

Strategy Risks

Despite having clear risk control mechanisms, this strategy still has the following potential risks:

Unfavorable Risk-Reward Ratio: The strategy’s risk-reward ratio is 5:1 (\(100 risk corresponding to \)20 profit), which is not ideal from a long-term investment perspective and requires a high win rate to achieve profitability. Solution: Adjust the risk-reward ratio or combine with other technical indicators to improve entry precision.

Single Direction Trading: The strategy only goes long without shorting, which may miss opportunities or face continuous losses during gold price downtrends. Solution: Expand the strategy logic to include short conditions, enabling bidirectional trading.

Lack of Entry Optimization: The current entry logic is too simple and does not consider market trends, volatility, or other technical indicators, which may lead to entries at non-ideal price points. Solution: Combine trend indicators, support/resistance levels, or volatility filters to optimize entry timing.

Fixed Target Limitations: Fixed profit targets and stop-loss limits do not account for changes in market volatility, potentially taking profits too early in high volatility periods or having too large stops in low volatility periods. Solution: Dynamically adjust profit and loss targets based on volatility.

Time Cooling Mechanism Risks: In strong trend markets, cooling periods may cause missing consecutive favorable opportunities. Solution: Add trend strength assessment and adjust cooling period parameters in strong trends.

Lack of Drawdown Control: The strategy has no overall account drawdown control mechanism, and consecutive losses may lead to significant fund reduction. Solution: Add maximum daily loss limits or maximum consecutive loss count limits.

Strategy Optimization Directions

Based on code analysis, this strategy can be optimized in the following directions:

Entry Condition Optimization:

- Add technical indicator filtering, such as moving averages, RSI, or MACD, to improve entry quality

- Introduce market structure analysis, such as support/resistance levels, price pattern recognition

- Reason: Current entry conditions are too simple, leading to potential entries in unfavorable market environments

Dynamic Risk Management:

- Dynamically adjust profit targets and stop-loss limits based on market volatility

- Introduce trailing stop mechanisms to capture more profits in trending markets

- Reason: Fixed profit-loss ratios cannot adapt to different market environments; dynamic adjustment can improve strategy adaptability

Bidirectional Trading Extension:

- Add short logic to enable the strategy to profit in declining markets

- Set different parameters for long and short directions to adapt to different market characteristics

- Reason: Single-direction trading limits the strategy’s profit opportunities; bidirectional trading can improve capital efficiency

Time Filtering Optimization:

- Dynamically adjust cooling periods based on market volatility or trend strength

- Add trading session filtering to avoid low liquidity or high volatility periods

- Reason: Fixed time cooling mechanisms may not be suitable for all market states; dynamic adjustment can better adapt to market changes

Position Management Improvement:

- Implement phased entry and phased profit-taking strategies

- Dynamically adjust position size based on win rate and recent trading results

- Reason: Current position management is too simple and cannot adjust risk exposure based on market conditions and trading performance

Add Overall Risk Control:

- Add daily maximum loss limits

- Implement maximum consecutive loss count control

- Set up account drawdown protection mechanisms

- Reason: Lack of overall risk control mechanisms may lead to significant account drawdowns

Summary

The Gold Time-Segregated Long Position Risk Management Strategy is a simple quantitative trading system focused on risk control through fixed profit-loss targets and time segregation mechanisms. The main advantages of this strategy are its simple operation, clear risk definition, and high degree of automation, suitable for risk-averse traders. However, its unfavorable risk-reward ratio, single-direction trading, and simple entry logic are the main drawbacks that need improvement.

By optimizing entry conditions, implementing dynamic risk management, extending to bidirectional trading, improving time filtering mechanisms, enhancing position management, and adding overall risk control, this strategy has significant room for improvement. These optimizations can significantly enhance the strategy’s robustness and long-term profitability, making it more adaptable to different market environments and trading needs.

Although the strategy has limitations in its current form, it provides a good risk management framework that can serve as a foundation for more complex trading systems. For traders willing to further develop and optimize, this strategy can evolve into a more comprehensive and effective trading system by integrating more technical analysis and risk management techniques.

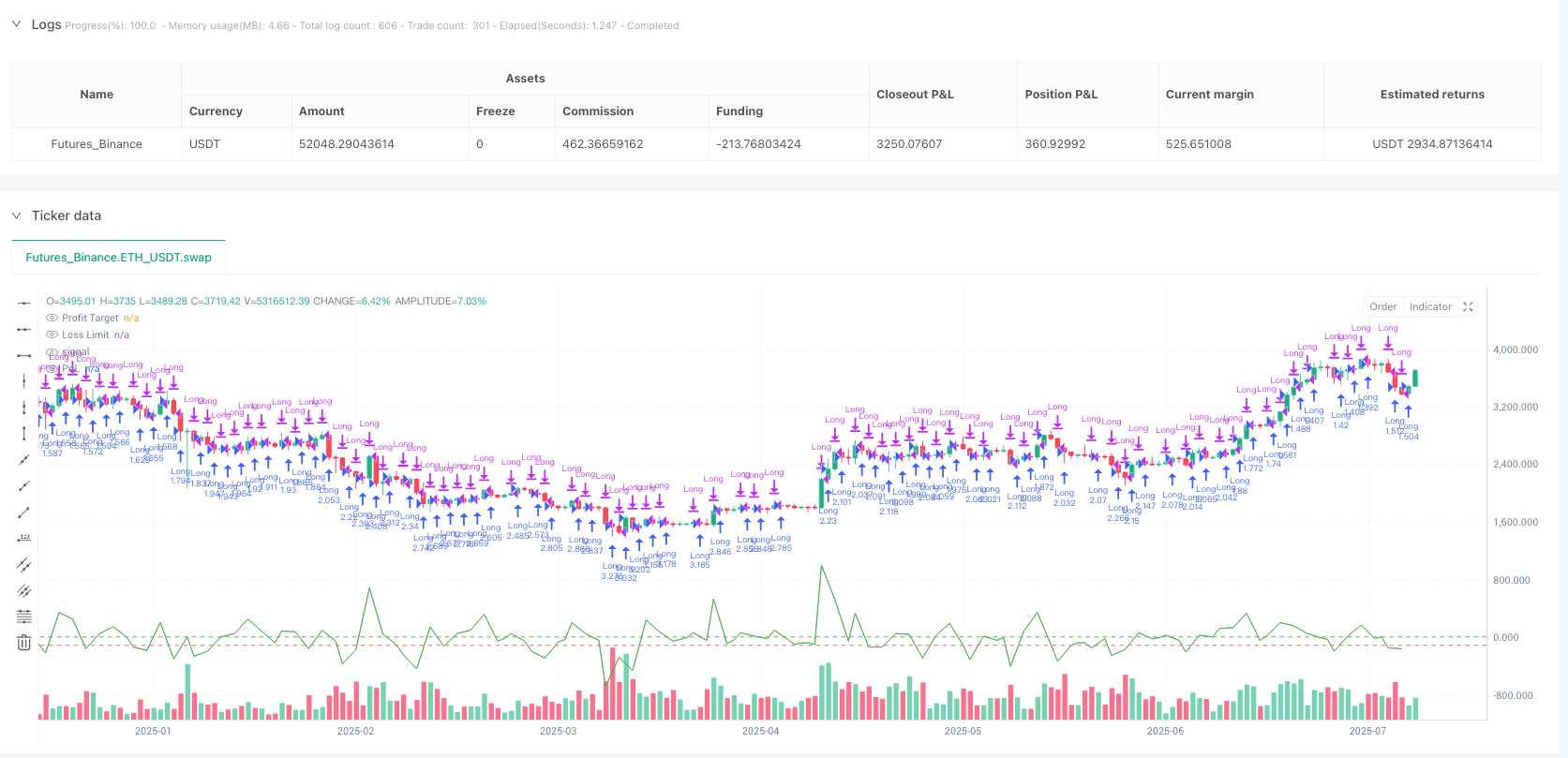

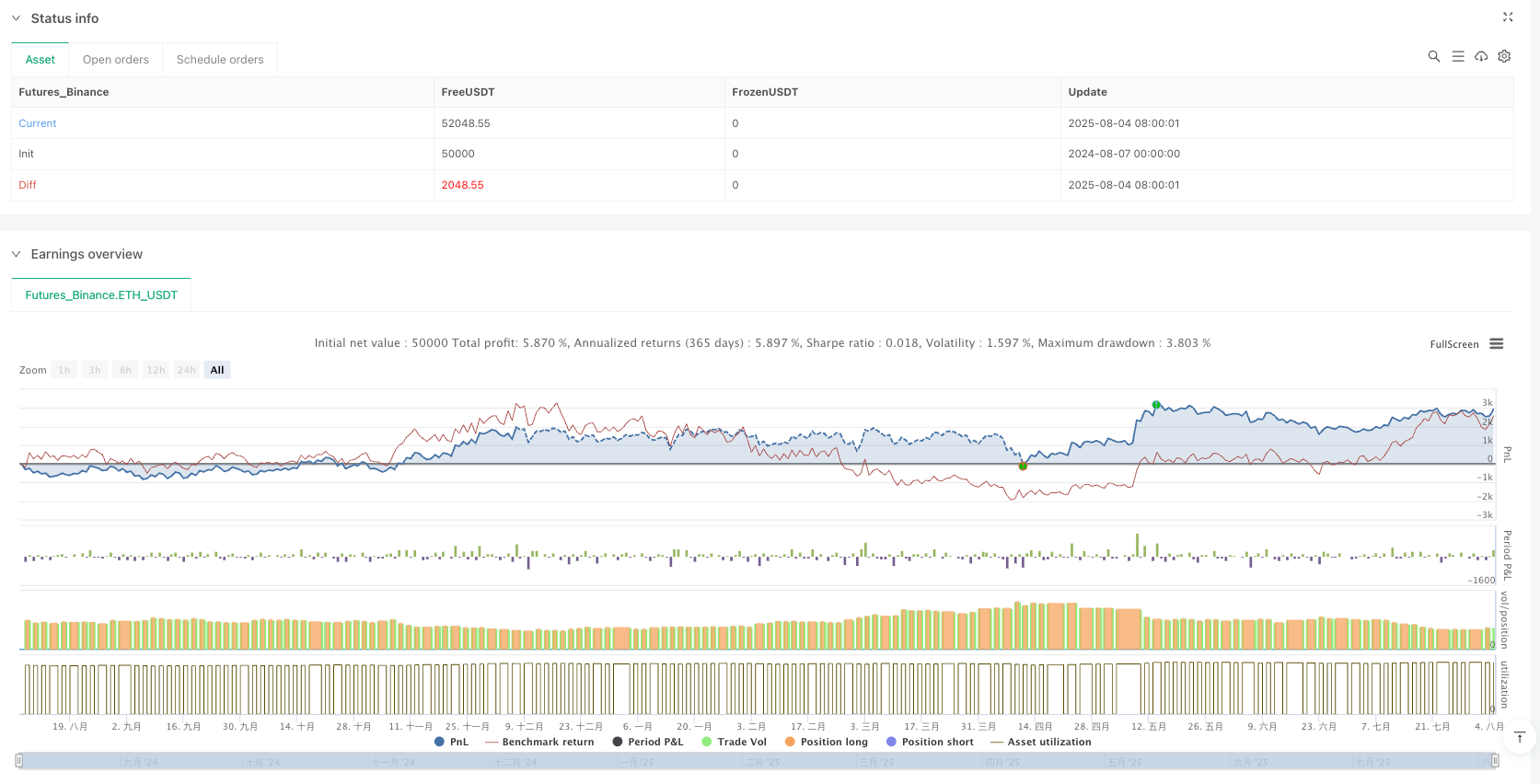

/*backtest

start: 2024-08-07 00:00:00

end: 2025-08-05 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("XAUUSD Simple $20 Profit / $100 Loss Strategy", overlay=true, margin_long=100, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Inputs

profitTarget = 20.0

lossLimit = 100.0

tradeCooldown = 12 * 60 * 60 // 12 hours in seconds

entryCooldown = 15 * 60 // 15 minutes in seconds

// Variables to track state

var float entryPrice = na

var int lastLossTime = na

var int lastProfitTime = na

// Calculate current PnL in USD

// For XAUUSD assume contract size = 1 oz, price is in USD

// PnL = (current price - entry price) * contract size * position size

// Strategy.position_avg_price gives entry price, strategy.position_size gives position size in contracts

pnl = strategy.position_size * (close - strategy.position_avg_price) * 1 // contract size = 1

// Time checks

timeNow = timenow // current time in milliseconds

// Check if cooldown from loss is active

lossCooldownActive = not na(lastLossTime) and (timeNow - lastLossTime*1000 < tradeCooldown * 1000)

// Check if cooldown from profit entry delay is active

profitCooldownActive = not na(lastProfitTime) and (timeNow - lastProfitTime*1000 < entryCooldown * 1000)

// Entry condition: no current position, no loss cooldown, no profit cooldown

canEnter = strategy.position_size == 0 and not lossCooldownActive and not profitCooldownActive

// Enter trade: for example, buy long when canEnter

if (canEnter)

strategy.entry("Long", strategy.long)

// Exit conditions

if (strategy.position_size > 0)

if (pnl >= profitTarget)

strategy.close("Long")

lastProfitTime := math.round(timeNow/1000) // record profit exit time in seconds

else if (pnl <= -lossLimit)

strategy.close("Long")

lastLossTime := math.round(timeNow/1000) // record loss exit time in seconds

// Plot some info

plot(pnl, title="PnL", color=color.new(color.green, 0))

hline(profitTarget, "Profit Target", color=color.green)

hline(-lossLimit, "Loss Limit", color=color.red)