Adaptive Opening Range Breakout Momentum Strategy with Risk-Optimized Position Sizing

ORB SPY R-multiple POSITION SIZING risk management BREAKOUT momentum INTRADAY

Overview

The Adaptive Opening Range Breakout Momentum Strategy is an intraday trading system focused on capturing breakouts from the first 15-minute candle formation after market open. Based on the Opening Range Breakout (ORB) principle, this strategy incorporates precise risk management and position sizing methods, making it particularly effective on high-liquidity assets like SPY. The core concept is to identify the initial momentum direction after market open and follow this direction while maintaining strict risk control. The strategy allows both long and short positions and provides flexible profit-taking methods, including targets based on risk multiples (R-multiples) or closing positions at the end of the trading day. The system also features a daily trade limit function to help avoid overtrading and concentration risk.

Strategy Principles

The core principle of this strategy is to leverage the directional momentum formed by the first 15-minute candle after market open. The specific implementation logic is as follows:

- Precisely locate the market opening time (through setting specific hour and minute parameters)

- Identify and record the open, high, low, and close prices of the first 15-minute candle after market open

- Determine the direction of this candle:

- If the closing price is higher than the opening price (green candle) and longs are allowed, go long at candle close

- If the closing price is lower than the opening price (red candle) and shorts are allowed, go short at candle close

- Set risk management parameters:

- For long trades, the stop loss is placed at the reference candle’s low point

- For short trades, the stop loss is placed at the reference candle’s high point

- The risk amount ® is calculated as the absolute difference between entry price and stop loss price

- Calculate the precise position size based on account size and risk percentage per trade:

- Position = Account Size × Risk Percentage ÷ Risk Amount

- Set profit-taking strategy:

- If “10R” mode is selected, the profit target is the entry price plus (for longs) or minus (for shorts) 10 times the risk amount

- If “EoDOnly” mode is selected, positions are only closed at the end of the trading day

- Implement a one-trade-per-day limit (if this option is enabled)

- Force close all open positions at the set end time of the trading day

This strategy does not rely on traditional technical indicators but is purely based on price action and time structure, which reduces overfitting risk and keeps the strategy concept simple and effective.

Strategy Advantages

After in-depth code analysis, this strategy demonstrates the following significant advantages:

Clear Entry Signals: The strategy provides clear, unambiguous entry signals based on the direction of the first 15-minute candle after market open, avoiding subjective judgment.

Precise Risk Control: Each trade has a predefined stop loss location, ensuring that risk amounts can be precisely quantified. The strategy automatically calculates ideal position size based on account size and preset risk percentage, achieving mathematical optimization of risk.

Directional Flexibility: The strategy supports both long and short trades, making it adaptable to different market environments, whether in uptrends or downtrends.

Adaptive Position Sizing: Position size is dynamically adjusted according to the actual risk of each trade, meaning it automatically reduces positions in high-volatility environments and increases positions in low-volatility environments, achieving risk balance.

Time Efficiency: The strategy focuses on the first period after market open, which typically offers higher volatility and directional opportunities, helping to efficiently utilize trading time.

Overtrading Protection: The “one trade per day” option effectively prevents overtrading, a common problem faced by many intraday traders.

Forced Closing Mechanism: The forced position closing function at the end of the trading day eliminates overnight risk, avoiding the impact of adverse events that may occur after market close.

Simple Logical Structure: The strategy does not rely on complex indicator combinations but is based on simple and clear price action principles, reducing the risk of strategy failure and overfitting.

Customizability: The strategy provides multiple adjustable parameters, including risk percentage, profit-taking mode, and trading direction preferences, allowing traders to make personalized adjustments based on individual risk tolerance and market views.

Strategy Risks

Despite its well-designed nature, this strategy still has the following potential risks and challenges:

Gap Risk: If the market opens with a large gap, the strategy may enter at an unfavorable price, causing the stop loss position to be too distant, thereby increasing the risk amount per trade or reducing the number of shares that can be traded. The solution is to add gap size filtering conditions, avoiding trades when the gap exceeds a specific threshold.

False Breakout Risk: The direction of the first 15-minute candle after market open may be a false signal, with prices quickly reversing, triggering stop losses. Consider adding confirmation mechanisms, such as requiring price breakouts to reach a minimum threshold before executing trades.

Liquidity Risk: Applying this strategy to non-highly liquid assets may lead to increased slippage, especially in fast markets. The strategy should be limited to highly liquid assets like SPY and avoid trading in excessively volatile market environments.

Limitations of Fixed R-Multiples: The fixed 10R profit target may be too aggressive or conservative, depending on market conditions. Consider dynamically adjusting the R-multiple based on market volatility or expected daily range.

Time Zone Dependency: The strategy uses a specific time zone (Europe/Stockholm) to determine trading times, which may lead to inaccurate entries if time zone settings are incorrect. Consider adding time zone verification mechanisms or using relative time calculations.

Single Timeframe Dependency: The strategy is based solely on the 15-minute timeframe, lacking multi-timeframe confirmation. Consider adding higher timeframe trend filters to ensure that the trading direction aligns with the larger trend.

Lack of Market Environment Adaptability: The strategy does not distinguish between high-volatility and low-volatility environments, which may lead to excessively small stop ranges and overly large positions on low-volatility days. Consider adding volatility filters to avoid trading in extremely low-volatility environments.

Reliance on Precise Opening Times: If the opening time parameters are set incorrectly, the entire strategy may fail. Consider adding automatic detection mechanisms for opening times to reduce human error.

Strategy Optimization Directions

Based on code analysis, here are several key optimization directions for this strategy:

Add Volatility Filters: Calculate the intraday Average True Range (ATR) and avoid trading when the day’s ATR is below a certain percentage of historical ATR. This can prevent trading in abnormally low-volatility environments, which typically produce poor-quality signals.

Integrate Multi-Timeframe Analysis: Add confirmation of trend direction from higher timeframes (such as 1-hour or daily) and only trade when the 15-minute signal is consistent with the higher timeframe trend direction. This can significantly improve signal quality, as trend-following trades are generally more effective.

Dynamically Adjust R-Multiples: Automatically adjust the R-multiple for profit targets based on market volatility. For example, use higher R-multiples (such as 12-15R) in high-volatility environments and more conservative targets (such as 6-8R) in low-volatility environments. This adaptive approach can better match market conditions.

Add Partial Profit-Taking Mechanisms: Implement a staged profit-taking strategy, such as closing 50% of the position at 5R and keeping the remaining position with a trailing stop or holding until the 10R target. This approach can lock in partial profits while retaining the potential for significant gains.

Integrate Volume Confirmation: Analyze the trading volume of the first 15-minute candle after market open and only execute trades when the volume is significantly higher than the average level at the same time in previous days. High volume typically indicates more reliable breakouts and can reduce false breakout risk.

Optimize Daily Trading Windows: Currently, the strategy only trades during a specific period after market open. Consider adding midday or pre-close trading windows to leverage the volatility characteristics of these periods. Research shows that the US stock market typically has different volatility characteristics at open, midday, and pre-close, allowing for targeted strategy design.

Add Market State Filters: Judge the overall market state by analyzing the previous trading day’s closing price relative to moving averages or indicators such as the VIX index level, and adjust strategy parameters or whether to trade based on different market states.

Enhance Position Sizing Algorithms: On the basis of the basic risk percentage model, consider adding the Kelly formula or optimal f-value method to optimize position size to maximize long-term capital growth rate. This approach can dynamically adjust position size based on the strategy’s historical win rate and profit/loss ratio.

The above optimization directions aim to improve the strategy’s robustness and adaptability while maintaining the simplicity of its core logic. Before implementing these optimizations, it is recommended to conduct rigorous backtesting on historical data to ensure that the optimizations indeed bring statistically significant improvements.

Summary

The Adaptive Opening Range Breakout Momentum Strategy is a carefully designed intraday trading system that combines clear entry logic, precise risk management, and flexible profit-taking mechanisms. The strategy’s core is to capture the directional momentum shown by the first 15-minute candle after market open and optimize trade execution through strict risk control and position management.

The main advantages of this strategy lie in its clear and straightforward trading logic, adaptive position calculation methods, and strict risk control framework. At the same time, by limiting the number of daily trades and setting fixed trading end times, the strategy effectively controls overtrading risk and overnight risk.

However, the strategy also faces challenges such as false breakouts, gap risk, and market environment adaptability. In response to these challenges, we have proposed several optimization suggestions, including adding volatility filters, integrating multi-timeframe analysis, dynamically adjusting profit targets, and improving position management algorithms. These optimization directions aim to enhance the strategy’s robustness and adaptability, maintaining its effectiveness across different market environments.

Overall, this strategy represents a balanced, systematic trading approach that is particularly suitable for intraday traders to apply in highly liquid markets. By following clearly defined rules and continuously optimizing key parameters, traders can establish a trading system that both effectively manages risk and captures short-term market opportunities.

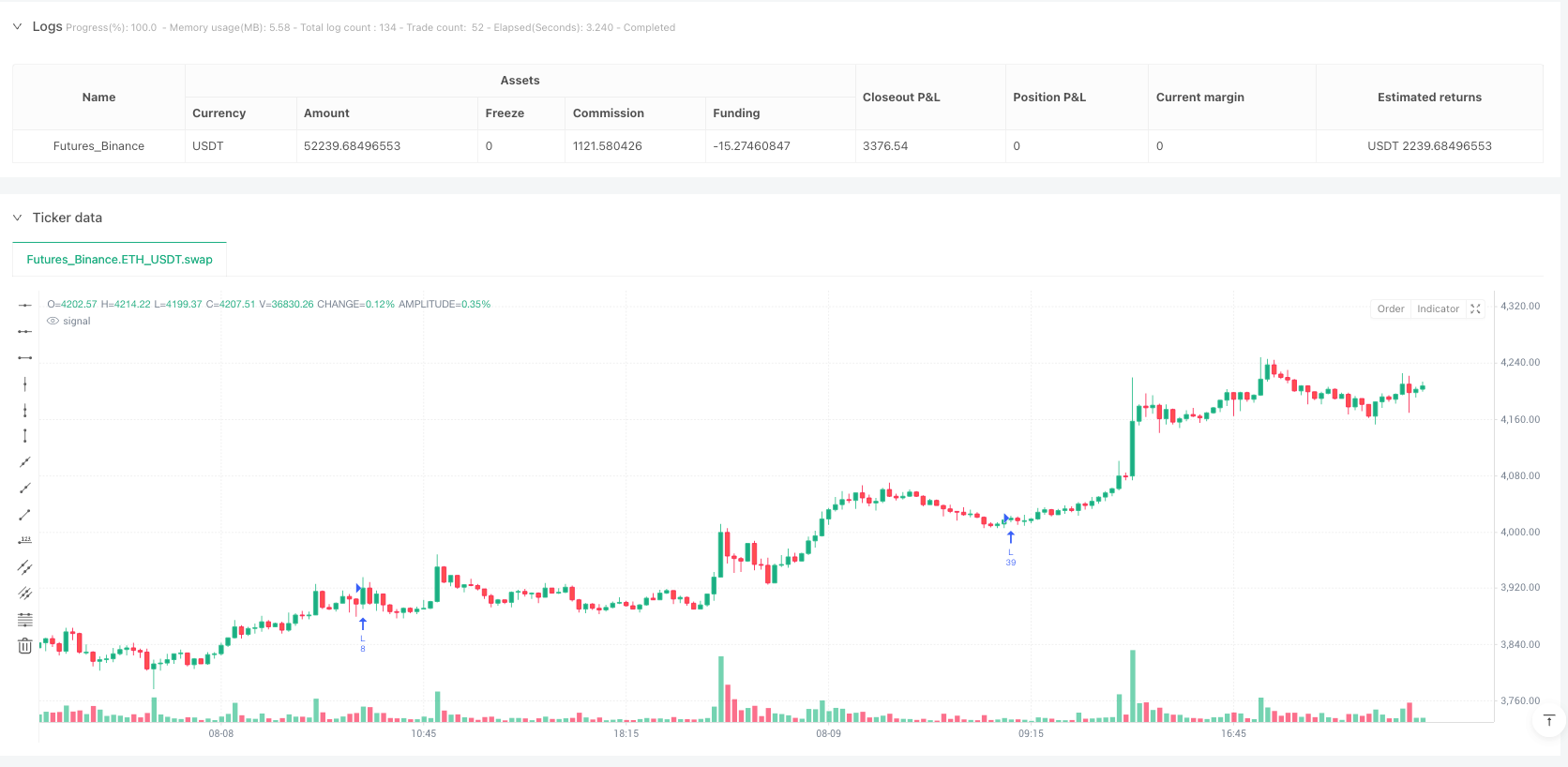

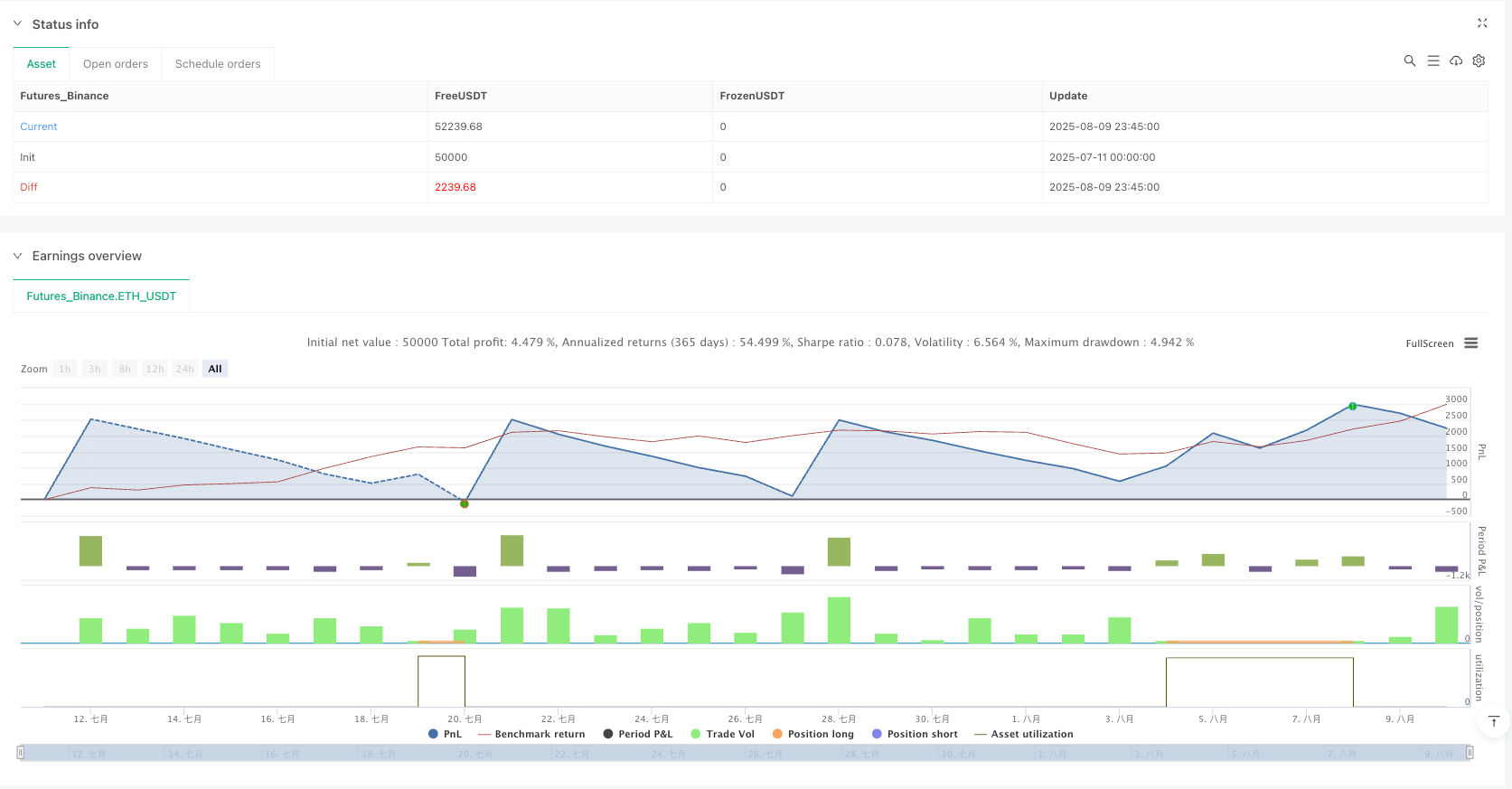

/*backtest

start: 2025-07-11 00:00:00

end: 2025-08-10 00:00:00

period: 15m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("ORB 15m – SE First 15min Breakout (Long/Short)",

overlay=true, initial_capital=25000, pyramiding=0,

calc_on_every_tick=false, process_orders_on_close=true)

// ===== Inputs =====

accountSize = input.float(25000, "Account Size", minval=1)

riskPct = input.float(1.0, "Risk per Trade (%)", minval=0.01, step=0.1)

oneTradePerDay = input.bool(true, "Limit to 1 Trade per Day?")

useLongs = input.bool(true, "Allow Longs?")

useShorts = input.bool(true, "Allow Shorts?")

tpMode = input.string("10R","Take Profit Mode", options=["10R","EoDOnly"])

R_multiple = input.float(10.0, "TP = R multiple (if 10R)", minval=0.1, step=0.5)

sessEndHourSE = input.int(22, "Session End Hour (Europe/Stockholm)", minval=0, maxval=23)

sessEndMinSE = input.int(0, "Session End Minute", minval=0, maxval=59)

sessionOpenHour = input.int(15, "Session Open Hour (Europe/Stockholm)", minval=0, maxval=23)

sessionOpenMin = input.int(30, "Session Open Minute", minval=0, maxval=59)

// ===== Detect first 15-min candle after open =====

isSessionOpen = hour(time, "Europe/Stockholm") == sessionOpenHour and minute(time, "Europe/Stockholm") == sessionOpenMin

is15m = timeframe.isintraday and timeframe.multiplier == 15

plotchar(not is15m, title="Timeframe Warning", char="X", location=location.top, color=color.red, size=size.tiny)

// Reference candle vars

var int refBarIndex = na

var float refOpen = na

var float refHigh = na

var float refLow = na

var float refClose = na

if barstate.isnew and isSessionOpen

refBarIndex := bar_index

refOpen := open

refHigh := high

refLow := low

refClose := close

if bar_index == refBarIndex

refHigh := math.max(refHigh, high)

refLow := math.min(refLow, low)

refClose := close

// Direction

refIsGreen = not na(refOpen) and not na(refClose) and (refClose > refOpen)

refIsRed = not na(refOpen) and not na(refClose) and (refClose < refOpen)

// One trade per day

var int lastTradeYmd = 0

todayYmd = year * 10000 + month * 100 + dayofmonth

tradedToday = (lastTradeYmd == todayYmd)

// Trade vars

var float entry = na

var float stopPrice = na

var float r = na

var float tp = na

var int qty = 0

// Entry at close of first 15-min candle

isRefBarClose = barstate.isconfirmed and (bar_index == refBarIndex)

if isRefBarClose and not tradedToday and strategy.position_size == 0

entry := close

// Long

if refIsGreen and useLongs

stopPrice := refLow

r := math.abs(entry - stopPrice)

qty := r > 0 ? int(math.floor((accountSize * (riskPct * 0.01)) / r)) : 1

qty := qty < 1 ? 1 : qty

strategy.entry("L", strategy.long, qty=qty)

if tpMode == "10R"

tp := entry + (R_multiple * r)

strategy.exit("L-Exit", from_entry="L", stop=stopPrice, limit=tp)

else

strategy.exit("L-Exit", from_entry="L", stop=stopPrice)

lastTradeYmd := todayYmd

// Short

if refIsRed and useShorts

stopPrice := refHigh

r := math.abs(entry - stopPrice)

qty := r > 0 ? int(math.floor((accountSize * (riskPct * 0.01)) / r)) : 1

qty := qty < 1 ? 1 : qty

strategy.entry("S", strategy.short, qty=qty)

if tpMode == "10R"

tp := entry - (R_multiple * r)

strategy.exit("S-Exit", from_entry="S", stop=stopPrice, limit=tp)

else

strategy.exit("S-Exit", from_entry="S", stop=stopPrice)

lastTradeYmd := todayYmd

// Flatten at session end

sessEndTsSE = timestamp("Europe/Stockholm", year, month, dayofmonth, sessEndHourSE, sessEndMinSE)

if time_close == sessEndTsSE and strategy.position_size != 0

strategy.close_all()