Overview

This strategy is a comprehensive trend-following trading system that combines multiple Exponential Moving Averages (EMAs) with the Relative Strength Index (RSI). The strategy utilizes three different period EMAs (20, 50, 200) to determine market trend direction and employs the RSI indicator as an additional filter to avoid entering the market in overbought or oversold conditions. This approach blends trend-following and momentum reversal concepts, providing traders with a complete system that can both capture trends and avoid false signals.

Strategy Principles

The core logic of this strategy is based on the following key components:

Trend Identification: Using EMA200 as a long-term trend indicator. When price is above EMA200, it’s considered an uptrend; when price is below EMA200, it’s considered a downtrend.

Entry Signals: Generated through the crossover of EMA20 and EMA50. Specifically:

- Long signal: When EMA20 crosses above EMA50 and price is above EMA200

- Short signal: When EMA20 crosses below EMA50 and price is below EMA200

Additional Confirmation: The strategy offers optional entry confirmation conditions:

- Requiring closing price to be above/below both EMA20 and EMA50

- RSI filter: Long requires RSI not exceeding 70, Short requires RSI not below 30

Risk Management: The strategy provides two stop-loss methods:

- ATR-based stops: Using an ATR multiplier to calculate dynamic stop-loss levels

- Swing-based stops: Using the lowest/highest points of the previous N candles

Profit Management: Utilizing a risk-reward ratio (R-multiple) to set profit targets, defaulting to 2R

Position Sizing: Based on a fixed percentage risk model of account equity, ensuring consistent risk exposure for each trade

Exit Mechanisms: In addition to stop-loss and profit targets, an option to exit on opposite EMA crossover signals

Strategy Advantages

A deep analysis of the strategy’s code implementation reveals several significant advantages:

Multi-level Trend Confirmation: Through three different period EMAs, the strategy effectively identifies and confirms market trends, reducing false signals. The long-term EMA(200) determines the major trend, while the short-term EMA(20⁄50) crossovers capture entry opportunities within the trend.

Filtering False Breakouts: The RSI filter effectively prevents entries in overbought or oversold market conditions, significantly reducing erroneous trades when the market is about to reverse.

Flexible Risk Management: The strategy offers two stop-loss methods (ATR and Swing points), allowing traders to choose the most appropriate risk control mechanism for different market environments.

Dynamic Position Sizing: The percentage risk calculation based on account equity ensures consistent risk exposure under varying market volatility conditions, a key feature of professional trading systems.

Multiple Exit Mechanisms: The strategy includes not only stop-loss and profit targets but also an option to exit on trend reversal signals, providing more comprehensive risk control.

Transparent Parameterized Design: All key parameters can be adjusted through the input interface, allowing traders to customize the strategy according to their risk preferences and trading style.

Strategy Risks

Despite its comprehensive design, the strategy still has some potential risks and limitations:

Parameter Sensitivity: The strategy heavily depends on the choice of EMA and RSI parameters. Inappropriate parameter settings may lead to overtrading or missing important trading opportunities. The solution is to optimize parameters through historical backtesting to find the best combination for specific markets.

Trend Transition Delay: An inherent disadvantage of using moving averages as trend indicators is their lag, which may produce significant drawdowns during the early stages of trend reversals. Consider adding more sensitive trend indicators as supplements.

Limitations of RSI Filtering: While the RSI filter helps avoid overbought/oversold markets, in strong trending markets, RSI may remain in extreme territories for extended periods, causing missed favorable trading opportunities. The solution is to adjust RSI thresholds for different market environments.

Fixed Ratio Profit Target Limitations: Using a fixed risk-reward ratio (R-multiple) to set profit targets may not adapt to all market conditions. When market volatility changes, dynamic adjustment of the risk-reward ratio may be necessary.

Trading Cost Impact: Although the strategy considers a 0.05% commission, in high-frequency trading environments, slippage and other trading costs may significantly impact strategy performance. More realistic trading cost models should be included in backtesting.

Strategy Optimization Directions

Based on a deep analysis of the strategy, here are several possible optimization directions:

Dynamic Parameter Adjustment: Consider automatically adjusting EMA periods and RSI thresholds based on market volatility. For example, use longer EMA periods in high-volatility markets and shorter periods in low-volatility markets. This can be implemented by incorporating ATR or historical volatility indicators.

Multi-timeframe Analysis: Add confirmation of trends in higher timeframes, for instance, only entering when the daily trend direction aligns with the current trading timeframe. This helps reduce the risk of counter-trend trading.

Improved Profit Management: Consider implementing a partial profit-taking strategy, such as closing part of the position at 1R and letting the remainder run to capture larger trends. This approach balances the need to lock in profits and trail trends.

Adding Volume Analysis: Incorporate volume filters in trade signal confirmation, only entering when volume supports price movement. This helps confirm the strength and reliability of trends.

Machine Learning Optimization: Use machine learning algorithms to automatically identify different market environments and select the optimal strategy parameter combinations for each environment. This can significantly improve the strategy’s adaptability across different market conditions.

Consider Market Seasonality and Time Factors: In some markets, specific time periods or seasons may be more suitable for this type of trend-following strategy. Analyzing historical data to identify optimal trading periods can further enhance strategy performance.

Summary

The Multi-Exponential Moving Average with RSI Trend Filter Trading Strategy is a comprehensively designed trend-following system that combines several key elements of technical analysis: trend identification, momentum confirmation, risk management, and position control. By using three different period EMAs to determine trends and combining an RSI filter to avoid trades in overbought/oversold areas, the strategy provides a balanced approach to capturing market trends while controlling risk.

The main advantages of the strategy lie in its multi-level trend confirmation mechanism and comprehensive risk management system, including dynamic stop-losses, risk-based position sizing, and multiple exit mechanisms. However, it also faces inherent challenges such as parameter sensitivity and moving average lag.

Through further optimization, such as dynamic parameter adjustment, multi-timeframe analysis, and improved profit management strategies, traders can enhance the system’s adaptability and profitability. Overall, this is a well-structured strategy framework that can serve as a solid foundation for trend-following trading systems, suitable for medium to long-term traders.

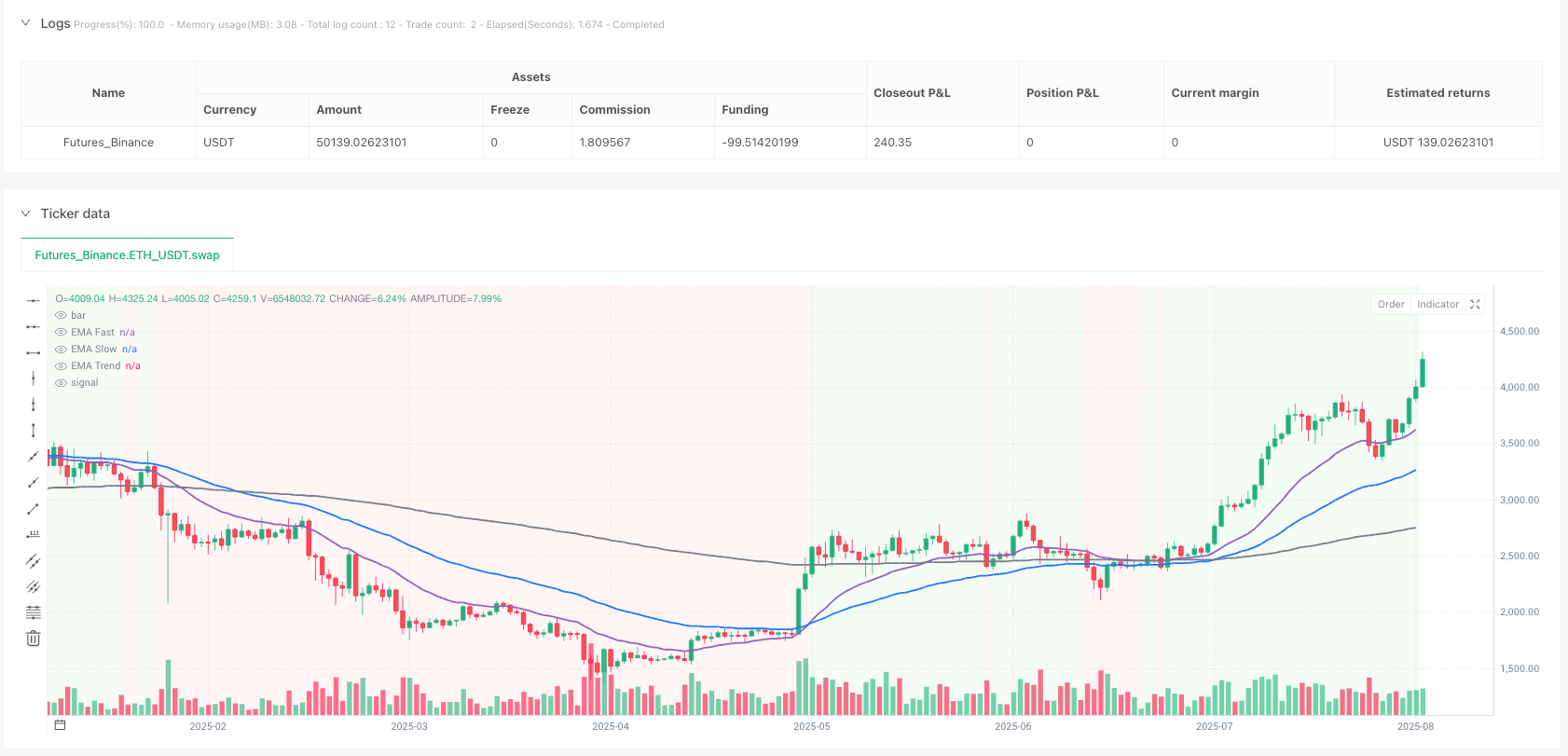

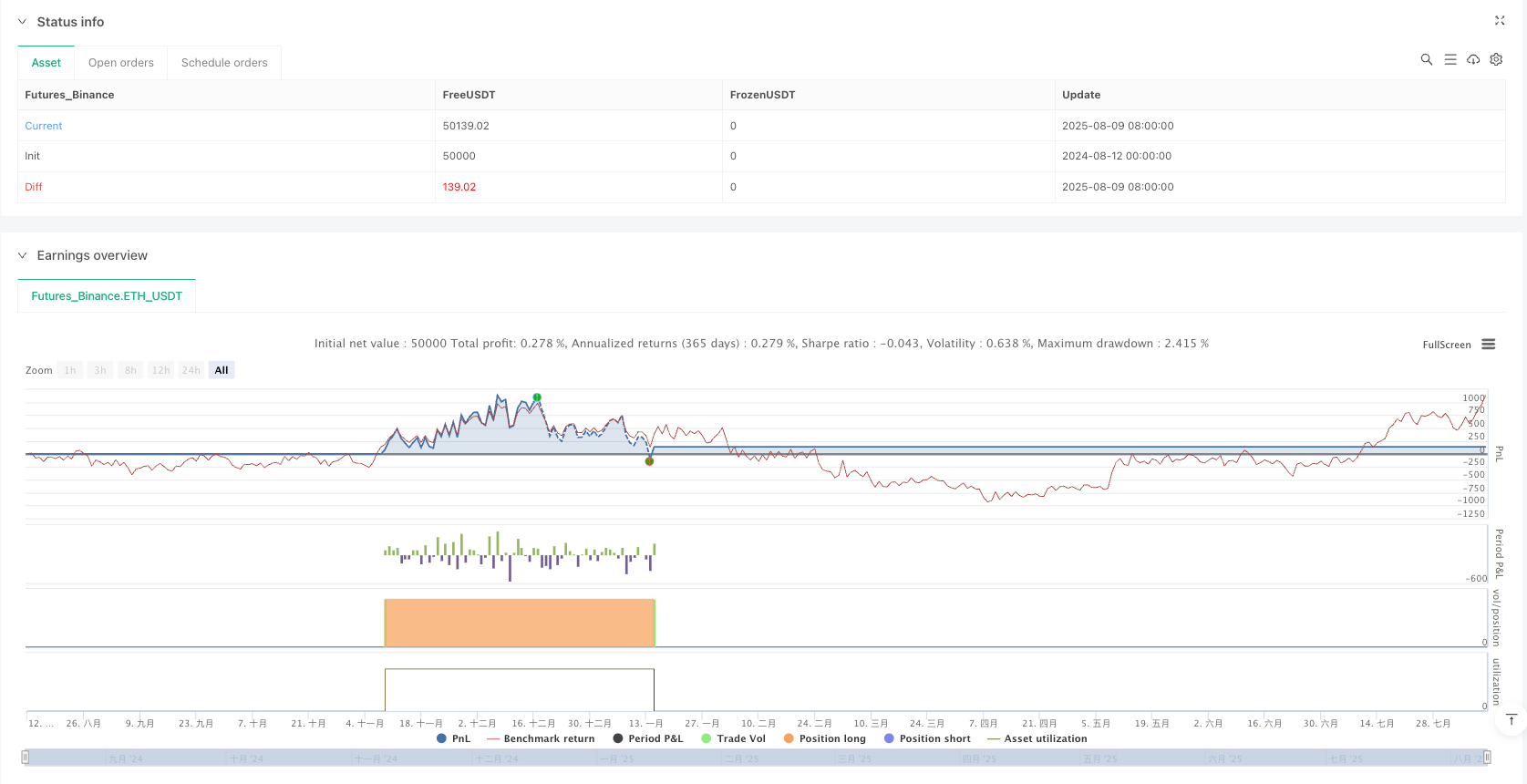

/*backtest

start: 2024-08-12 00:00:00

end: 2025-08-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("EMA20/50/200 + RSI Swing (Trend Filter)", overlay=true, initial_capital=100000, pyramiding=0,

commission_type=strategy.commission.percent, commission_value=0.05)

// ==== Inputs ====

lenFast = input.int(20, "EMA Fast", minval=1)

lenSlow = input.int(50, "EMA Slow", minval=1)

lenTrend = input.int(200, "EMA Trend", minval=1)

useLong = input.bool(true, "Enable Longs")

useShort = input.bool(false, "Enable Shorts")

// RSI filter

rsiLen = input.int(14, "RSI Length", minval=1)

useRsi = input.bool(true, "Use RSI Filter")

rsiMaxLong = input.float(70.0, "Max RSI for Long", step=0.1)

rsiMinShort = input.float(30.0, "Min RSI for Short", step=0.1)

// Entry confirmation: require close above/below fast & slow EMA

requireCloseConfirm = input.bool(true, "Require close above/below EMA20 & EMA50 for entry")

// Risk Management

riskType = input.string("ATR", "Stop Basis", options=["ATR","Swing"])

atrLen = input.int(14, "ATR Length", minval=1)

atrMult = input.float(2.0, "ATR Multiplier", step=0.1)

swingLen = input.int(5, "Swing Lookback (bars)", minval=1)

useTP = input.bool(true, "Use Take-Profit (R multiple)")

rr = input.float(2.0, "Reward/Risk (TP in R)", step=0.1, minval=0.1)

posSizePct = input.float(10, "Position Size % of Equity", step=0.5, minval=0.1, maxval=100)

exitOnOpposite = input.bool(true, "Exit on opposite EMA cross")

// ==== Indicators ====

emaFast = ta.ema(close, lenFast)

emaSlow = ta.ema(close, lenSlow)

emaTrend = ta.ema(close, lenTrend)

rsi = ta.rsi(close, rsiLen)

// ==== Conditions ====

trendUp = close > emaTrend

trendDown = close < emaTrend

crossUp = ta.crossover(emaFast, emaSlow)

crossDown = ta.crossunder(emaFast, emaSlow)

confirmLong = not requireCloseConfirm or (close > emaFast and close > emaSlow)

confirmShort = not requireCloseConfirm or (close < emaFast and close < emaSlow)

rsiOKLong = not useRsi or (rsi <= rsiMaxLong)

rsiOKShort = not useRsi or (rsi >= rsiMinShort)

longSignal = useLong and trendUp and crossUp and confirmLong and rsiOKLong

shortSignal = useShort and trendDown and crossDown and confirmShort and rsiOKShort

// ==== Stops & Take Profit helpers ====

getLongStop() =>

float stop = na

if riskType == "ATR"

stop := close - ta.atr(atrLen) * atrMult

else

stop := ta.lowest(low, swingLen)

stop

getShortStop() =>

float stop = na

if riskType == "ATR"

stop := close + ta.atr(atrLen) * atrMult

else

stop := ta.highest(high, swingLen)

stop

// ==== Position sizing ====

capital = strategy.equity

qtyPercent = posSizePct * 0.01

// ==== Entries & Exits ====

if (longSignal)

longStop = getLongStop()

riskPerShare = math.max(close - longStop, syminfo.mintick)

qty = math.floor((capital * qtyPercent) / riskPerShare)

strategy.entry("Long", strategy.long, qty)

tp = useTP ? close + riskPerShare * rr : na

strategy.exit("Long-Exit", "Long", stop=longStop, limit=tp)

if (shortSignal)

shortStop = getShortStop()

riskPerShare = math.max(shortStop - close, syminfo.mintick)

qty = math.floor((capital * qtyPercent) / riskPerShare)

strategy.entry("Short", strategy.short, qty)

tp = useTP ? close - riskPerShare * rr : na

strategy.exit("Short-Exit", "Short", stop=shortStop, limit=tp)

// Optional exit on opposite cross

if exitOnOpposite

if strategy.position_size > 0 and crossDown

strategy.close("Long", comment="Opposite cross")

if strategy.position_size < 0 and crossUp

strategy.close("Short", comment="Opposite cross")

// ==== Visuals ====

plot(emaFast, title="EMA Fast", linewidth=2)

plot(emaSlow, title="EMA Slow", linewidth=2)

plot(emaTrend, title="EMA Trend", color=color.new(color.gray, 0), linewidth=2)

// markers utan text-param

plotshape(longSignal, title="Long Signal", style=shape.triangleup, location=location.belowbar, color=color.new(color.lime, 0), size=size.tiny)

plotshape(shortSignal, title="Short Signal", style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny)

bgcolor(trendUp ? color.new(color.green, 92) : trendDown ? color.new(color.red, 92) : na)

// ==== Alerts ====

alertcondition(longSignal, title="Long Signal", message="EMA20 crossed above EMA50 with price > EMA200 and RSI filter OK")

alertcondition(shortSignal, title="Short Signal", message="EMA20 crossed below EMA50 with price < EMA200 and RSI filter OK")

// ==== Notes panel ====

var label note = na

if barstate.islast

label.delete(note)

msg = "EMA20/50/200 + RSI Swing\n" +

"Long: TrendUp & CrossUp & (ConfirmClose=" + str.tostring(requireCloseConfirm) + ") & (RSI<=" + str.tostring(rsiMaxLong) + ")\n" +

"Short: TrendDown & CrossDown & (ConfirmClose=" + str.tostring(requireCloseConfirm) + ") & (RSI>=" + str.tostring(rsiMinShort) + ")\n" +

"Stops: " + riskType + (riskType=="ATR" ? " (" + str.tostring(atrLen) + ", x" + str.tostring(atrMult) + ")" : " (swing len=" + str.tostring(swingLen) + ")") +

(useTP ? " | TP=" + str.tostring(rr) + "R" : " | TP: off")

note := label.new(bar_index, high, msg, style=label.style_label_upper_left, textcolor=color.white, color=color.new(color.black, 20))