Multi-Period Swing Breakout ATR Trailing Reversal Quantitative Trading Strategy

ATR SMA Swing High/Low BREAKOUT Trailing Stop VOLUME FILTER

Overview

The Multi-Period Swing Breakout ATR Trailing Reversal Quantitative Trading Strategy is a technically-driven trading system that focuses on identifying key moments when price breaks through historical swing highs and lows, while utilizing an automatic reversal mechanism to capture market reversal opportunities. The strategy employs the ATR indicator to dynamically set stop-loss and trailing stop levels, and optionally incorporates a volume filter to confirm the validity of breakouts. The core concept is to enter quickly after confirmed breakouts while automatically reversing positions when original trades are stopped out, capturing potential trend reversal opportunities.

Strategy Principles

The strategy operates based on several key components:

Swing High/Low Identification: The strategy uses a specified lookback period (default 20 periods) to identify swing highs and lows in price, which serve as potential breakout levels.

Breakout Confirmation Mechanism: A long signal is triggered when the closing price breaks above a swing high after previously being below it; a short signal is triggered when the closing price breaks below a swing low after previously being above it.

Volume Filter: An optional volume filtering condition requires that the volume during a breakout exceeds the average volume by a specific multiplier (default 1.5x) to ensure the strength and validity of the breakout.

ATR-Based Risk Management: The strategy uses a 14-period ATR to dynamically set stop-loss and trailing stop levels, adapting risk management to market volatility. For long trades, the stop-loss is set at the entry price minus the ATR multiplied by a user-defined multiplier, and vice versa for short trades.

Automatic Reversal Mechanism: When an existing trade is stopped out, the strategy automatically opens a new position in the opposite direction, a feature designed to capture market reversal points.

Trailing Stops: The strategy implements an ATR-based trailing stop mechanism to lock in profits and allow trends to continue. The trailing stop level is dynamically adjusted based on ATR and a user-defined multiplier.

Strategy Advantages

High Adaptability: By using the ATR indicator, the strategy can automatically adapt to the volatility characteristics of different markets, providing wider stops in highly volatile markets and tighter stops in less volatile markets.

Automatic Reversal Mechanism: When the market shifts from a trend in one direction to another, the strategy can automatically reverse positions without manual intervention, helping to capture reversal opportunities and reduce the risk of missing important turning points.

Volume Confirmation: By integrating a volume filter, the strategy can reduce false breakout signals and improve trade quality. High-volume breakouts typically indicate stronger market consensus and sustainability of the breakout.

Dynamic Risk Management: ATR-based stop-loss and trailing stop mechanisms make risk management dynamic, adapting to changing market conditions, both protecting capital and allowing profits to grow.

Clear Entry and Exit Signals: The strategy provides clear rules for entries and exits, reducing subjective decision-making and emotional influence, helping to maintain trading discipline.

Visual Chart Markings: The strategy marks various signals on the chart, including initial breakouts and reversal signals, allowing traders to visually understand market conditions and strategy decisions.

Strategy Risks

Frequent Trading in Ranging Markets: In sideways, ranging markets, prices may frequently break through swing highs and lows, leading to multiple consecutive entry, exit, and reversal trades, thereby increasing trading costs and potentially resulting in consecutive losses.

False Breakout Risk: Despite having a volume filter, the market may still produce false breakouts, especially in low-liquidity or highly manipulated market environments. These false breakouts can lead to unnecessary trades and losses.

Limitations of Fixed Parameters: The strategy uses fixed lookback periods, ATR multipliers, and volume thresholds, which may need adjustment in different market environments or timeframes. A single set of fixed parameters may not be suitable for all market conditions.

Disregard for Fundamental Factors: As a purely technical analysis strategy, the system does not consider fundamental factors or market sentiment, which may lead to undesirable trading decisions during major news events or economic data releases.

Double-Edged Sword of Reversal Mechanism: While the automatic reversal mechanism helps capture reversals, it may lead to premature counter-trend trading in strong trending markets. Trading against the dominant trend can result in consecutive losses.

Methods to mitigate these risks include: adjusting strategy parameters to suit specific market environments, setting daily or overall stop-loss limits, pausing trading before major news events, and combining other technical indicators or market environment filters to improve signal quality.

Strategy Optimization Directions

Adaptive Parameters: Transform fixed parameters (such as lookback period, ATR multiplier, and volume threshold) into adaptive parameters that dynamically adjust based on market volatility, volume characteristics, or trend strength. This will enhance the strategy’s adaptability across different market environments.

Market Environment Filter: Add a market environment recognition mechanism, such as filters based on ADX (Average Directional Index) or volatility indicators, to distinguish between trending and ranging markets. The reversal mechanism could be disabled or trading completely stopped in ranging markets to reduce false signals.

Multi-Timeframe Analysis: Integrate trend confirmation from higher timeframes, for example, only trading when the higher timeframe trend direction is consistent, which can reduce counter-trend trading and improve trade success rates.

Performance-Based Reversal Selection: Instead of automatically reversing after every stop-loss, decide whether to execute reversal trades based on market performance metrics (such as recent signal success rate or trend strength).

Partial Position Management: Implement a strategy for entering and exiting positions in parts, using only a portion of funds on the initial breakout and increasing the position as the price continues to move favorably. Similarly, partial profit-taking can be used to lock in some profits.

Time Filter: Add trading time filters to avoid known periods of low volatility or high uncertainty (such as before and after major economic data releases).

Machine Learning Optimization: Use machine learning algorithms to automatically identify optimal parameter combinations, or even predict which market environments the strategy performs better in, thereby dynamically adjusting trading decisions.

The core objective of these optimization directions is to enhance the strategy’s adaptability and robustness, reduce false signals, and adjust trading behavior according to different market environments.

Summary

The Multi-Period Swing Breakout ATR Trailing Reversal Quantitative Trading Strategy is a comprehensive trading system that combines the advantages of breakout trading, dynamic risk management, and automatic reversal mechanisms. Its strength lies in its ability to automatically adapt to market volatility, provide clear trading signals, and capture potential trend change points through its reversal mechanism.

Although the strategy considers multiple factors in its design, it still faces challenges such as frequent trading in ranging markets, false breakout risks, and limitations of fixed parameters. Performance can be further enhanced by introducing adaptive parameters, market environment filters, multi-timeframe analysis, and more sophisticated position management techniques.

For traders looking to implement this strategy, it is recommended to first backtest it under different market conditions and timeframes to find the parameter combinations that best suit specific trading instruments, and consider combining other technical analysis tools or fundamental factors as supplementary confirmation. Most importantly, any strategy requires strict money management and risk control to ensure long-term trading success.

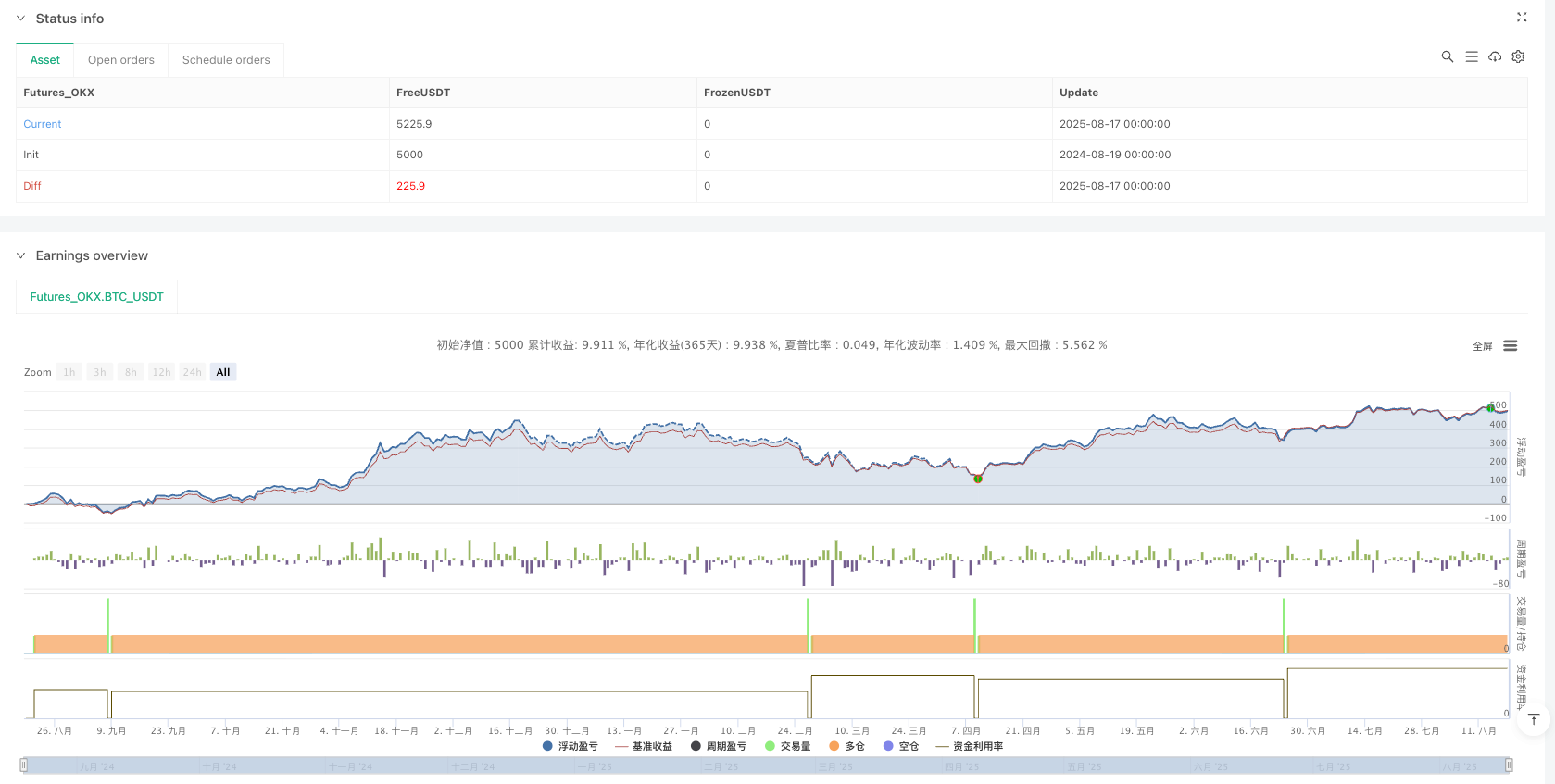

/*backtest

start: 2024-08-19 00:00:00

end: 2025-08-18 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_OKX","currency":"BTC_USDT","balance":5000}]

*/

//@version=5

strategy("Trend Breakout with Reverse Signals (Working)", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Inputs ===

length = input.int(20, "Swing Lookback")

atrMult = input.float(1.5, "Stop Loss ATR Multiplier")

trailMult = input.float(2.0, "Trailing Stop ATR Multiplier")

volumeFilter = input.bool(true, "Use Volume Filter?")

volMult = input.float(1.5, "Volume Threshold Multiplier")

// === ATR & Volume ===

atr = ta.atr(14)

avgVol = ta.sma(volume, length)

// === Swing High / Low Detection ===

swingHigh = ta.highest(high, length)

swingLow = ta.lowest(low, length)

// Plot breakout levels

plot(swingHigh, color=color.red, title="Swing High", linewidth=2)

plot(swingLow, color=color.green, title="Swing Low", linewidth=2)

// === Volume Filter ===

volOK = volumeFilter ? volume > avgVol * volMult : true

// === Confirmed Breakouts ===

longBreak = close[1] <= swingHigh[1] and close > swingHigh[1] and volOK

shortBreak = close[1] >= swingLow[1] and close < swingLow[1] and volOK

// === Trailing Stops ===

longTrail = close - atr * trailMult

shortTrail = close + atr * trailMult

// === Track positions ===

var inLong = false

var inShort = false

// === Breakout Entries ===

if longBreak and not inLong

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=close - atr*atrMult, trail_price=longTrail, trail_offset=atr*trailMult)

inLong := true

inShort := false

if shortBreak and not inShort

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=close + atr*atrMult, trail_price=shortTrail, trail_offset=atr*trailMult)

inShort := true

inLong := false

// === Reverse Signals on Exit ===

longExitSignal = inLong and strategy.position_size == 0

shortExitSignal = inShort and strategy.position_size == 0

if longExitSignal

strategy.entry("Reverse Short", strategy.short)

inLong := false

inShort := true

if shortExitSignal

strategy.entry("Reverse Long", strategy.long)

inShort := false

inLong := true

// === Plot Signals on Chart ===

plotshape(longBreak, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.large, text="BUY")

plotshape(shortBreak, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.large, text="SELL")

plotshape(longExitSignal, title="Reverse Short", location=location.abovebar, color=color.orange, style=shape.triangledown, size=size.large, text="REV SELL")

plotshape(shortExitSignal, title="Reverse Long", location=location.belowbar, color=color.blue, style=shape.triangleup, size=size.large, text="REV BUY")

// === Alerts ===

alertcondition(longBreak, title="Long Alert", message="Trend Breakout Long Signal")

alertcondition(shortBreak, title="Short Alert", message="Trend Breakout Short Signal")

alertcondition(longExitSignal, title="Reverse Short Alert", message="Exit Long → Reverse Short Signal")

alertcondition(shortExitSignal, title="Reverse Long Alert", message="Exit Short → Reverse Long Signal")