Overview

The Multi-layered Momentum and Fair Value Gap Reversion Quantitative Strategy is a disciplined short-term mean-reversion trading system that cleverly combines RSI momentum filtering, dual EMA channels, and Fair Value Gap (FVG) detection to precisely identify short-term market reversal points. Designed for volatile markets, this strategy balances trading opportunities and risk through precise entry points and ATR-based take profit management. The core logic is to seek potential reversals when price shows short-term over-extension, momentum indicators display extreme values, and structural price gaps exist.

Strategy Principles

The strategy uses a multi-layered approach of technical indicators to confirm trading signals:

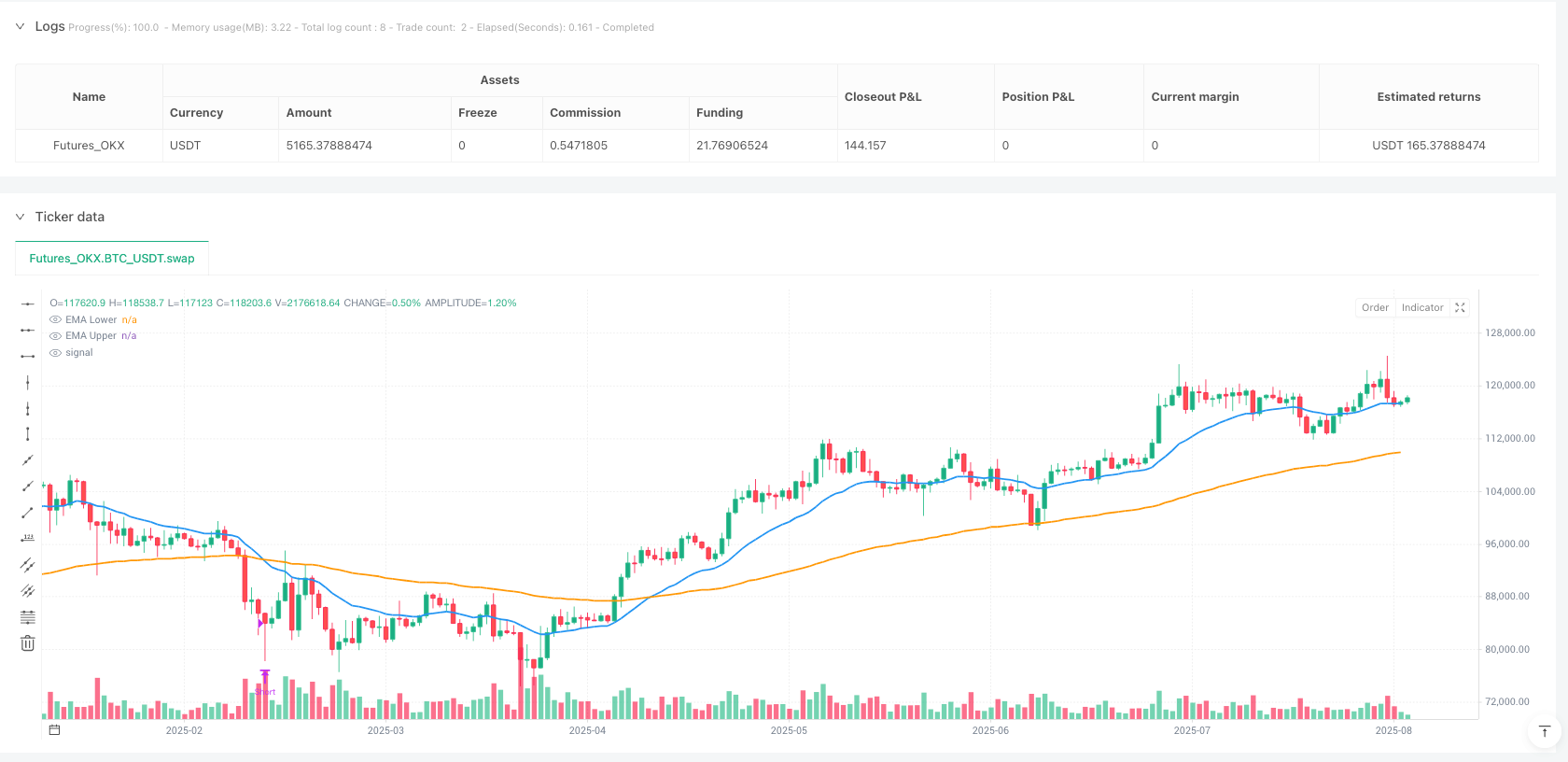

Dual EMA Channel System:

- Fast 20-period EMA and slow 100-period EMA form a reference channel for price action

- Long entry conditions require price below both EMAs, indicating potential undervaluation

- Short entry conditions require price above both EMAs, indicating potential overvaluation

- This dual EMA filtering mechanism avoids erroneous counter-trend signals that might occur when using just a single EMA

Fair Value Gap (FVG) Detection:

- The strategy uses a 12-bar lookback period to detect significant gaps in price structure

- Bullish FVGs form when earlier lows sit above current highs, suggesting downward over-extension

- Bearish FVGs form when earlier highs sit below current lows, suggesting upward over-extension

- FVG signals align with candle direction (bullish = close > open, bearish = close < open), avoiding random gaps

RSI Momentum Filter:

- Uses 14-period RSI with extreme thresholds (80 overbought/20 oversold)

- Long signals require RSI < 20, indicating oversold conditions

- Short signals require RSI > 80, indicating overbought conditions

- This ensures entry points are not only technically valid but also backed by momentum extremes

ATR-Based Take Profit Management:

- Uses 14-period ATR calculation with a default multiplier of 4

- At entry, a fixed target is set = Entry Price ± (ATR × 4)

- Take profit targets automatically adjust with market volatility: narrower in calm markets, wider in volatile conditions

Strategy Advantages

Multi-layered Confirmation Mechanism: The strategy requires price outside the EMA channel, RSI at extreme values, and FVG structure to trigger trades, significantly improving signal quality through this triple confirmation approach.

Adaptability to Volatility: The ATR-based take profit mechanism automatically adjusts targets according to current market volatility conditions, maintaining adaptability across different market environments.

Clear Visual Signals: The strategy provides clear visual markers on the chart, including entry signals and take profit completion markers, making it easy for traders to monitor and manage trades.

High Selectivity: Through strict filtering conditions, the strategy filters out over 90% of market noise, focusing only on high-quality short-term reversal opportunities and reducing ineffective trades.

Mean Reversion Principle: The strategy is based on the market theory that prices will eventually revert to the mean, entering at extreme conditions to increase the probability of success.

Disciplined Trading Framework: Through fixed entry conditions and ATR-based take profits, the strategy provides a non-discretionary, disciplined trading framework.

Strategy Risks

Low-Frequency Trading Risk: Due to multiple filtering conditions, the strategy may generate fewer trading signals during certain periods, leading to lower capital utilization efficiency. The solution is to apply the strategy across multiple markets or multiple timeframes.

False Breakout Risk: In highly volatile markets, price may temporarily trigger entry conditions and then immediately move in the opposite direction. The solution is to consider adding confirmation periods or implementing stop-loss mechanisms.

Parameter Sensitivity: Strategy performance highly depends on parameter settings such as RSI thresholds, EMA periods, and ATR multipliers. The solution is to backtest and optimize for different markets and periods to find the most suitable parameter combinations.

Poor Performance in Trending Markets: As a mean-reversion strategy, it may frequently trigger false signals in strong trending markets. The solution is to add trend filters or pause strategy use in clearly trending markets.

Money Management Risk: The default 25% capital allocation may lead to significant account fluctuations during consecutive losses. The solution is to adjust position size according to personal risk tolerance or implement more conservative money management strategies.

Strategy Optimization Directions

Add Stop-Loss Mechanism: The current strategy only has ATR-based take profits without explicit stop-loss settings. It is recommended to add time-based or price-based stop-losses to limit maximum loss per trade, especially in strong trending markets.

Integrate Trend Filters: Consider adding longer-period trend indicators (such as 200 EMA direction or ADX values) to only trade in favorable trend environments, avoiding counter-trend trading. This is because mean-reversion strategies usually perform better at reversal points in the direction of the trend.

Optimize Entry Timing: Consider adding additional price action confirmations, such as close price breakouts, candlestick patterns, or volume confirmations to improve entry precision. This can reduce false signals and increase the success rate of individual trades.

Dynamic Parameter Adjustment: Automatically adjust RSI thresholds and ATR multipliers based on market volatility conditions to maintain optimal performance across different market environments. This is because fixed parameters may perform differently under varying volatility conditions.

Multi-Timeframe Analysis: Incorporate higher timeframe market structure and support/resistance levels, only trading signals triggered near key price levels to improve win rates. This combines micro short-term signals with macro market structures.

Improved Money Management: Implement volatility-based position sizing, reducing positions during high volatility periods and increasing them during low volatility periods to balance risk-reward ratios.

Conclusion

The Multi-layered Momentum and Fair Value Gap Reversion Quantitative Strategy is a carefully designed short-term mean-reversion trading system that effectively identifies high-probability market reversal points through a triple filtering mechanism of RSI momentum, EMA channels, and FVG structures. Its ATR-based adaptive take profit design allows the strategy to maintain stable performance across different volatility environments.

The main advantages of the strategy lie in its high selectivity and discipline, filtering out high-quality trading opportunities through strict multi-layered confirmation mechanisms while avoiding the interference of subjective judgments. However, the strategy also faces risks such as low-frequency trading, false breakouts, and poor performance in trending markets.

By adding stop-loss mechanisms, integrating trend filters, optimizing entry timing, implementing dynamic parameter adjustments, and improving money management, this strategy can further enhance its robustness and adaptability. Overall, this is a clearly structured, logically rigorous quantitative trading strategy suitable for traders seeking short-term market reversal opportunities.

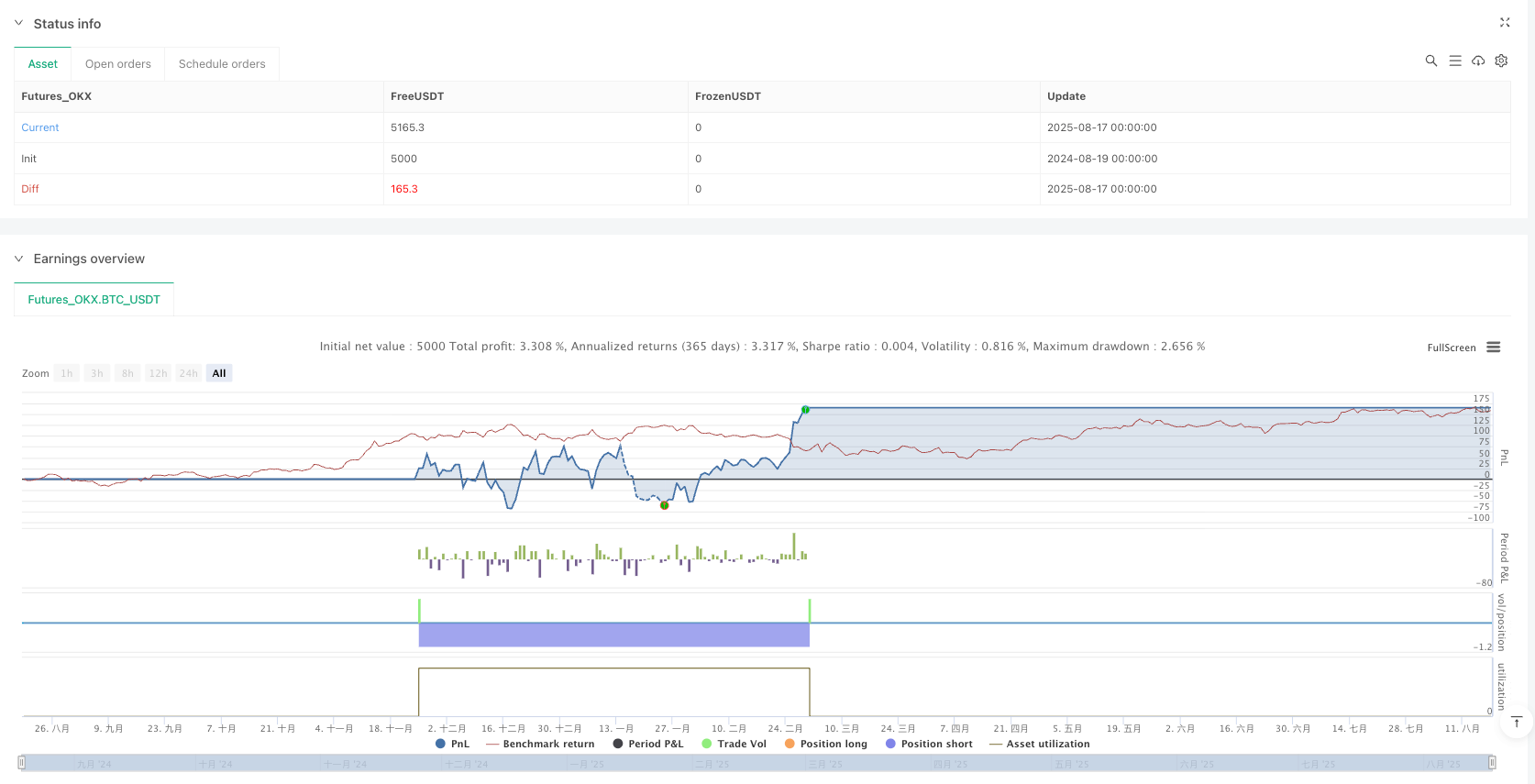

/*backtest

start: 2024-08-19 00:00:00

end: 2025-08-18 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_OKX","currency":"BTC_USDT","balance":5000}]

*/

//@version=5

strategy("The Barking Rat Lite", overlay=true)

/// === INPUTS === ///

rsiLength = input.int(14, "RSI Length")

rsiOverbought = input.int(80, "RSI Overbought")

rsiOversold = input.int(20, "RSI Oversold")

atrLength = input.int(14, "ATR Length")

atrMultiplier = input.float(4, "ATR TP Multiplier")

emaLengthLower = input.int(20, "EMA Lower")

emaLengthUpper = input.int(100, "EMA Upper")

// === RSI FILTER ===

rsi = ta.rsi(close, rsiLength)

rsi_long_ok = rsi < rsiOversold

rsi_short_ok = rsi > rsiOverbought

// === ATR FOR TP ===

atr = ta.atr(atrLength)

// === EMA BAND ===

emaLower = ta.ema(close, emaLengthLower)

emaUpper = ta.ema(close, emaLengthUpper)

// === PLOT EMA LINES ===

plot(emaLower, color=color.blue, title="EMA Lower", linewidth=2)

plot(emaUpper, color=color.orange, title="EMA Upper", linewidth=2)

// === FVG DETECTION ===

fvg_up = high[12] < low

fvg_down = low[12] > high

// === WICK REJECTION SIGNALS ===

valid_bullish_fvg = fvg_down

valid_bearish_fvg = fvg_up

bullish_signal = valid_bullish_fvg and close > open and rsi_long_ok

bearish_signal = valid_bearish_fvg and close < open and rsi_short_ok

// === TRADE STATE VARIABLES ===

var inTrade = false

var isLong = false

var isShort = false

var float longTP = na

var float shortTP = na

// === ENTRY LOGIC WITH LABELS & LINES ===

if bullish_signal and close < emaLower and close < emaUpper

float labelY = low * 0.98

strategy.entry("Long", strategy.long)

inTrade := true

isLong := true

isShort := false

longTP := close + atr * atrMultiplier // fixed TP at entry

if bearish_signal and close > emaUpper and close > emaLower

float labelY = high * 1.02

strategy.entry("Short", strategy.short)

inTrade := true

isShort := true

isLong := false

shortTP := close - atr * atrMultiplier // fixed TP at entry

// === EXIT LOGIC: ATR-BASED TP ===

if inTrade and isLong and close >= longTP

strategy.close("Long")

inTrade := false

isLong := false

longTP := na

if inTrade and isShort and close <= shortTP

strategy.close("Short")

inTrade := false

isShort := false

shortTP := na