Overview

The Williams %R Forced Flip Strategy with ATR Trend Filter is a quantitative trading system specifically designed to identify key market turning points. The core of this strategy utilizes the Williams %R oscillator’s signals in overbought (-21) and oversold (-79) regions, combined with an Average True Range (ATR) trend filter to enhance trading signal quality. This combined approach is particularly suitable for short timeframe trading (30 minutes and below), especially in currency pairs, by implementing forced position flips at market extremes to automatically switch between long and short positions.

Strategy Principles

This strategy is built on two key technical indicators: Williams %R and ATR.

Williams %R Indicator Application:

- Uses a 60-period Williams %R indicator to measure market overbought and oversold conditions

- Sets -79 as the oversold level (buy trigger)

- Sets -21 as the overbought level (sell trigger)

- Indicator values range from -100 to 0, with levels below -79 considered oversold and above -21 considered overbought

ATR Trend Filter:

- Employs a 5-period ATR to measure market volatility and trend strength

- Rising ATR (current ATR value greater than previous period) is viewed as an uptrend confirmation signal

- Falling ATR (current ATR value less than previous period) is viewed as a downtrend confirmation signal

Forced Flip Logic:

- When Williams %R crosses above the -79 level and ATR is rising, a buy signal is generated

- When Williams %R crosses below the -21 level and ATR is falling, a sell signal is generated

- When a buy signal triggers, the system automatically closes all short positions and opens a long position

- When a sell signal triggers, the system automatically closes all long positions and opens a short position

The core implementation uses the ta.crossover and ta.crossunder functions to detect indicator crossings of key levels, while using ATR direction as an additional confirmation condition. The system is designed to operate with 100% equity allocation, without stop-loss or take-profit levels, relying entirely on reverse signals to exit positions.

Strategy Advantages

Clear and Objective Signals:

- Based on clear mathematical calculations and preset parameters, eliminating subjective judgment interference

- Trading rules are simple and straightforward, easy to understand and execute

- Williams %R extreme zones provide high-probability reversal opportunities

Dual Indicator Confirmation:

- Combines Williams %R and ATR indicators to form a cross-validation mechanism

- ATR trend filter effectively reduces false signals common to oscillator indicators

- Improves signal quality and reduces the possibility of erroneous trades

Efficiency of the Forced Flip Mechanism:

- Automatically implements long-short switching without manual intervention

- Able to promptly capture market sentiment changes and turning points

- Maximizes utilization of bidirectional market volatility, not limited to single-direction trading

Suitable for Short-Term Oscillating Markets:

- Particularly suitable for trading in 30-minute and shorter timeframes

- Performs excellently in high-frequency volatile markets such as currency pairs

- Capable of frequently capturing short-term profit opportunities in oscillating markets

High Capital Utilization Efficiency:

- Strategy designed for full position operation, with 100% capital utilization

- Through the forced flip mechanism, capital is always working

- Reduces the opportunity cost of idle capital

Strategy Risks

Lack of Stop-Loss Mechanism:

- Strategy does not set traditional stop-loss levels, relying on reverse signals to close positions

- May face significant drawdowns during strong unidirectional market trends

- Strongly recommended to add stop-loss mechanisms for risk control in practical applications

Signal Lag:

- Williams %R as an oscillator indicator has a certain degree of lag

- The 60-period parameter setting makes signal response relatively delayed

- May not be able to adjust positions timely when markets change direction rapidly

Overtrading Risk:

- May frequently generate trading signals in highly volatile markets

- Accumulated transaction fees from overtrading can significantly impact net returns

- May cause consecutive losses in markets with increased oscillation but no clear direction

Parameter Sensitivity:

- Strategy performance is highly dependent on Williams %R and ATR parameter settings

- Parameter optimization may lead to overfitting historical data

- Different markets and timeframes may require different parameter settings

Insufficient ATR Filtering:

- Using only ATR direction as a filter may not be sufficient to identify true trends

- May generate false signals in markets with sudden volatility changes

- A 5-period ATR may be too short-term to capture longer-term trend changes

Strategy Optimization Directions

Add Stop-Loss and Take-Profit Mechanisms:

- Add dynamic stop-loss levels based on ATR multiples

- Design take-profit mechanisms based on risk-reward ratios

- Implement partial position closing strategies instead of full position flips

Enhance Trend Filtering System:

- Integrate other trend identification indicators (such as moving averages, MACD, etc.)

- Add multi-timeframe analysis to confirm more reliable trends

- Consider adding trend strength assessment to reduce counter-trend trading in strong trends

Optimize Parameter Adaptive Mechanism:

- Develop an adaptive parameter adjustment system based on market volatility

- Use different Williams %R extreme levels for different market conditions

- Implement dynamic adjustment of ATR periods to adapt to different market environments

Add Signal Confirmation Mechanisms:

- Introduce volume confirmation signals

- Add candlestick pattern recognition as auxiliary confirmation

- Consider incorporating support and resistance level analysis to improve accuracy

Position Management Optimization:

- Implement dynamic position size adjustment based on volatility

- Develop graduated position building and reduction strategies to replace full position operations

- Add capital risk management modules to limit maximum loss per trade

Summary

The Williams %R Forced Flip Strategy with ATR Trend Filter is an elegantly designed quantitative trading system focused on capturing reversal opportunities in market extreme areas. By combining Williams %R overbought/oversold judgments with ATR trend confirmation, the strategy creates an efficient trading mechanism particularly suited for short timeframe oscillating market trading.

Although the strategy is conceptually clean and straightforward in execution, its lack of built-in risk management mechanisms is a notable deficiency. In practical applications, traders are strongly advised to add appropriate stop-loss strategies and consider optimizing the trend filtering system and parameter settings to adapt to different market environments.

The true value of this strategy lies in its sensitivity to market extreme conditions and its automated position flipping mechanism, making it a powerful tool in a short-term trader’s toolkit. Through the suggested optimization directions, this basic strategy can be further developed into a more comprehensive and robust trading system that not only captures market turning points but also effectively manages risk and adapts to various market conditions.

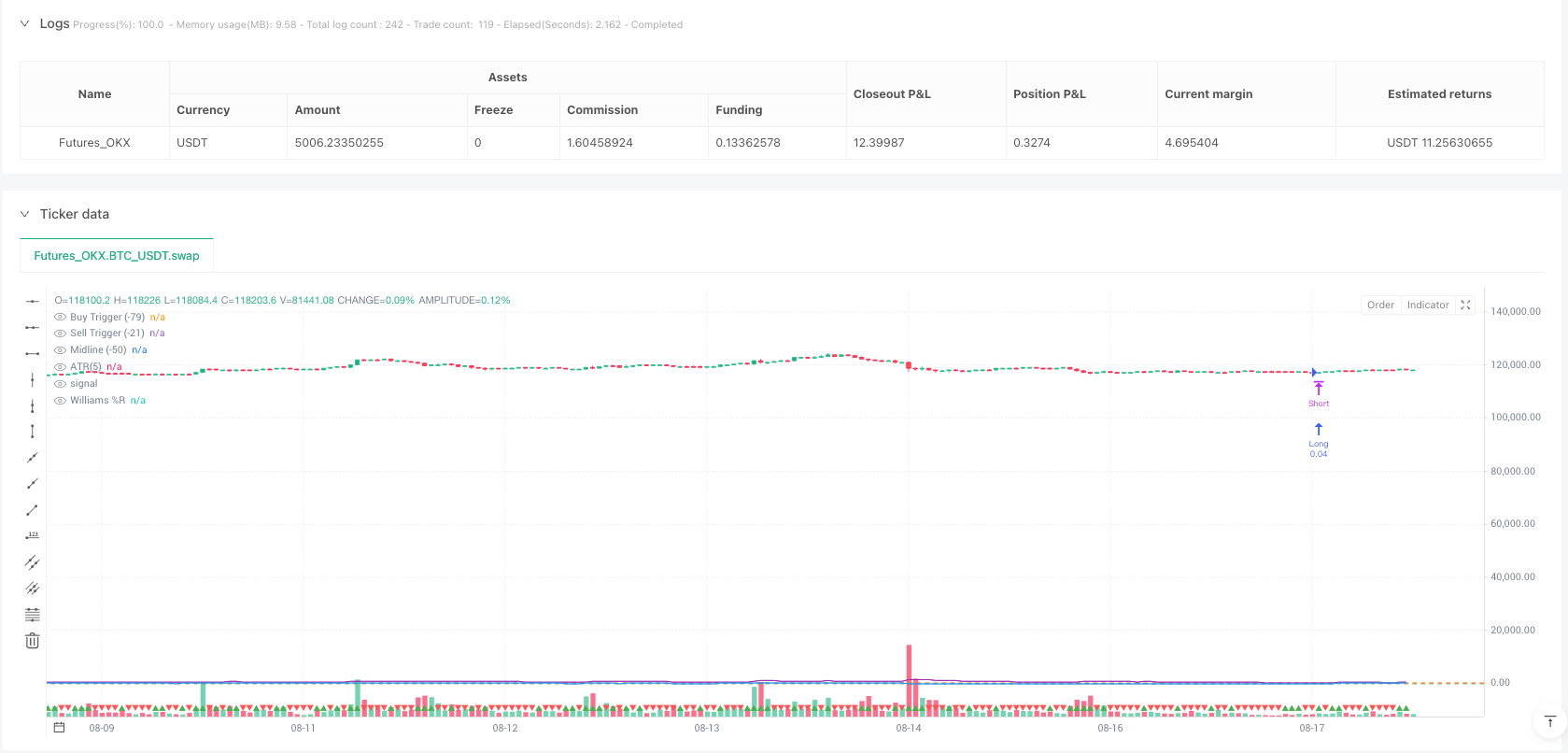

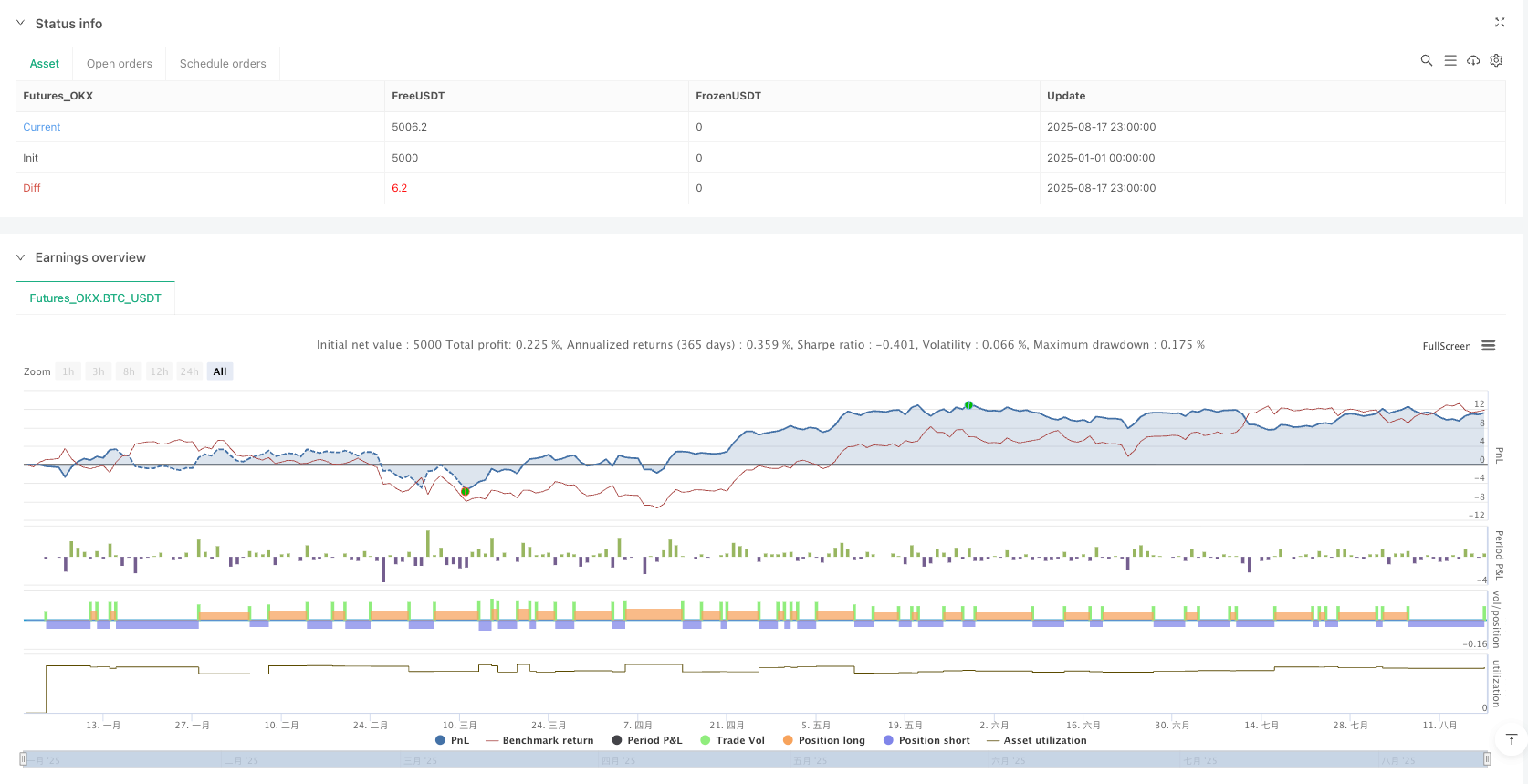

/*backtest

start: 2025-01-01 00:00:00

end: 2025-08-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_OKX","currency":"BTC_USDT","balance":5000}]

*/

//@version=5

strategy("Williams %R Forced Flip Strategy (-79/-21) + ATR(5) Trend Filter [No SL/TP]", overlay=true, pyramiding=0, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Inputs

len = input.int(60, "Williams %R Length", minval=1)

buyLvl = input.float(-79.0, "Buy Level", minval=-100, maxval=0, step=0.1)

sellLvl= input.float(-21.0, "Sell Level", minval=-100, maxval=0, step=0.1)

atrLen = input.int(5, "ATR Length", minval=1)

// Indicators

wr = ta.wpr(len) // Williams %R (-100..0)

atr = ta.atr(atrLen) // ATR(5)

atrUp = atr > atr[1] // rising ATR

atrDown = atr < atr[1] // falling ATR

// Entry signals

longSignal = ta.crossover(wr, buyLvl) and atrUp // cross above -79 + ATR rising

shortSignal = ta.crossunder(wr, sellLvl) and atrDown // cross below -21 + ATR falling

// --- Forced Flip Logic ---

// If long signal → close shorts and go long

if (longSignal)

strategy.close("Short")

strategy.entry("Long", strategy.long)

// If short signal → close longs and go short

if (shortSignal)

strategy.close("Long")

strategy.entry("Short", strategy.short)

// --- Plots ---

// Williams %R

plot(wr, title="Williams %R", color=color.blue)

hline(buyLvl, "Buy Trigger (-79)", color=color.green)

hline(sellLvl, "Sell Trigger (-21)", color=color.red)

hline(-50, "Midline (-50)", color=color.orange)

// ATR + slope markers

plot(atr, title="ATR(5)", color=color.purple)

plotchar(atrUp, title="ATR Rising", char="▲", location=location.bottom, color=color.green, size=size.tiny)

plotchar(atrDown, title="ATR Falling", char="▼", location=location.bottom, color=color.red, size=size.tiny)