#### Overview

The ATR Dynamic Channel Breakout Trend Following Strategy is a quantitative trading system developed based on Gann theory and technical analysis principles. This strategy captures breakthrough market movements by constructing dynamic price channels combined with trend filtering mechanisms. The strategy employs moving averages as price benchmarks and utilizes the Average True Range (ATR) indicator to dynamically adjust channel width, forming upper and lower boundary lines. Buy signals are triggered when prices break above the upper channel boundary while meeting trend conditions, achieving stable investment returns through strict risk control mechanisms.

This strategy focuses exclusively on long-side trading, particularly suitable for highly volatile financial market environments. Through the organic combination of multiple technical indicators, the strategy effectively identifies market trend reversal points while maintaining high win rates and controlling trading risks. The core advantage of the strategy lies in its dynamic adjustment capability, automatically optimizing trading parameters based on market volatility changes to provide more precise trading signals.

Strategy Principles

The core principle of this strategy is built upon the integration of Gann channel theory and modern quantitative analysis techniques. First, the strategy uses Simple Moving Average (SMA) to calculate the price baseline over a specified period, representing the medium-term price trend of the market. Through a 100-period moving average, the strategy smooths short-term price fluctuations to obtain a more stable trend reference.

The construction of dynamic channels is the core technical component of the strategy. The strategy employs a 14-period Average True Range (ATR) indicator to measure market volatility, then multiplies the ATR value by a preset multiplier to form the channel width. The upper channel boundary equals the baseline plus ATR multiples, while the lower channel boundary equals the baseline minus ATR multiples. This dynamic adjustment mechanism enables the channel to adapt to market volatility changes, expanding channel width during high volatility periods and contracting during low volatility periods.

The trend filtering mechanism is an important component of the strategy. Using a 200-period long-term moving average as the trend judgment benchmark ensures trading signals align with the major trend direction. The strategy only considers buy operations when prices are above the long-term moving average, significantly improving the reliability of trading signals.

The entry logic is rigorous and clear. When prices break above the upper channel boundary from below while simultaneously meeting the condition of prices being above the 200-period moving average, the strategy triggers a buy signal. This dual confirmation mechanism effectively filters false breakout signals and improves trading success rates.

The exit mechanism employs dynamic stop-loss and take-profit design. The stop-loss is set at the entry price minus 1.5 times the ATR value, while take-profit is set at the entry price plus 3 times the ATR value. This ATR-based dynamic adjustment method can reasonably set risk-reward ratios based on market volatility, typically maintaining a 1:2 risk-reward ratio.

Strategy Advantages

Dynamic adaptability is one of the greatest advantages of this strategy. Through the application of the ATR indicator, the strategy automatically adapts to volatility changes under different market environments. During high volatility periods, channel width automatically expands, reducing false signals caused by noise; during low volatility periods, channels contract, improving signal sensitivity. This adaptive mechanism enables the strategy to maintain good performance under various market conditions.

Trend consistency is an important guarantee for strategy stability. Through trend filtering with the 200-period moving average, the strategy ensures all trades align with the major trend direction, significantly reducing the risk of counter-trend trading. This trend-following characteristic enables the strategy to capture major price movements in the market while avoiding frequent losses in ranging markets.

The risk control mechanism is comprehensive and scientific. The strategy employs an ATR-based dynamic stop-loss system that automatically adjusts stop-loss distances based on market volatility. This method avoids the problems of fixed stops being either too conservative or too aggressive, providing appropriate risk buffer space for each trade. Meanwhile, the 3x ATR take-profit setting ensures a good risk-reward ratio.

Signal quality is high and easy to execute. The strategy’s entry conditions are clear, with upper channel boundary breakouts combined with trend confirmation, significantly reducing the impact of subjective judgment. Clear trading rules make the strategy easy to automate, reducing the interference of human emotions on trading decisions.

Parameter optimization space is abundant. The strategy provides multiple adjustable parameters, including moving average periods, ATR periods, channel multipliers, etc., offering rich optimization space for different market environments and trading styles. Traders can adjust these parameters based on historical backtesting results and market characteristics to achieve better strategy performance.

Strategy Risks

False breakout risk is one of the main risks faced by the strategy. Although the strategy reduces the probability of false breakouts through trend filtering, markets may still experience situations where prices briefly spike higher then retreat. Such false breakouts may cause the strategy to enter at wrong timing, subsequently facing stop-loss exits. It is recommended to mitigate such risks by adding additional confirmation indicators or adjusting the time window for breakout confirmation.

Single-sided trading limitations restrict the strategy’s profit opportunities. The strategy only executes long trades and cannot profit through short selling in declining trend markets. While this design simplifies trading logic, it also means the strategy may remain on the sidelines for extended periods in bear market environments, missing profit opportunities from bidirectional trading. Consider developing a corresponding short version to compensate for this deficiency.

Parameter sensitivity may affect strategy stability. The selection of key parameters such as ATR multipliers and moving average periods significantly impacts strategy performance. Inappropriate parameter settings may lead to signals being too frequent or too sparse, affecting overall trading effectiveness. It is recommended to determine the most suitable parameter combinations through thorough historical backtesting and parameter optimization.

Market environment dependency is an important factor for the strategy to consider. This strategy performs well in trending markets but may face frequent stop-losses and lower win rates in sideways ranging markets. Traders need to adjust strategy parameters or pause strategy operation based on changing market environments.

Liquidity risk may be amplified under certain market conditions. The strategy’s technical breakout-based trading logic may create resonance effects with other traders’ strategies, forming concentrated trading volume at breakout levels. Under such circumstances, actual execution prices may deviate from expectations, affecting the strategy’s actual performance.

Strategy Optimization Directions

The introduction of multi-timeframe analysis can significantly improve strategy signal quality. It is recommended to add higher timeframe trend confirmation on the existing foundation, such as using daily chart trend status to guide hourly chart trading decisions. This multi-timeframe coordination can further improve the accuracy of trading signals and reduce trading opportunities against major trends.

The addition of volume confirmation mechanisms can enhance the reliability of breakout signals. Truly effective price breakouts are usually accompanied by volume expansion, while false breakouts often lack volume support. By adding volume threshold or volume change rate requirements to breakout conditions, lower quality breakout signals can be effectively filtered.

The implementation of dynamic position management systems can improve capital utilization efficiency. The current strategy uses fixed proportion position allocation; it is recommended to dynamically adjust position sizes based on market volatility, signal strength, and other factors. Appropriately increase positions when signals have high certainty and reduce positions when uncertainty is high, achieving better risk-adjusted returns.

Refinement of take-profit strategies can capture more profits. The current fixed take-profit mechanism may exit too early, missing profits from trend continuation. It is recommended to implement partial take-profit or trailing take-profit mechanisms, retaining some positions to continue participating in trends after reaching initial take-profit targets, while adjusting stop-loss levels above breakeven.

Development of market condition identification modules can improve strategy adaptability. Judge whether the current market is in a trending or ranging state through technical indicator combinations and adjust strategy parameters accordingly. Use wider channel settings in trending markets to reduce noise interference, and use narrower channel settings in ranging markets to improve signal sensitivity.

Further improvement of risk control mechanisms includes maximum drawdown control and consecutive loss protection. Automatically reduce positions or pause trading when the strategy experiences drawdowns exceeding preset thresholds to protect capital safety. Meanwhile, trigger strategy review mechanisms when consecutive losses reach a certain number to avoid excessive losses in unfavorable market environments.

Summary

The ATR Dynamic Channel Breakout Trend Following Strategy represents the organic combination of modern quantitative trading technology with classic technical analysis theory. Through innovations in multiple technical aspects including dynamic channel construction, trend filtering confirmation, and scientific risk control, the strategy provides traders with a structured, systematic trading solution. Its core value lies in quantifying market volatility into actionable trading signals while ensuring signal quality through multiple confirmation mechanisms.

The design philosophy of this strategy embodies the core concept of quantitative trading: “let profits run, keep losses limited.” Through the ATR dynamic adjustment mechanism, the strategy can automatically optimize parameter settings in different market environments, demonstrating good adaptability and stability. The trend-following characteristic enables the strategy to participate in major price movements in the market and achieve considerable investment returns.

Although the strategy has some inherent risks and limitations, its market performance can be further enhanced through continuous optimization improvements and risk management refinements. The strategy provides quantitative trading practitioners with a solid foundational framework, upon which personalized adjustments and optimizations can be made based on individual trading styles and market characteristics.

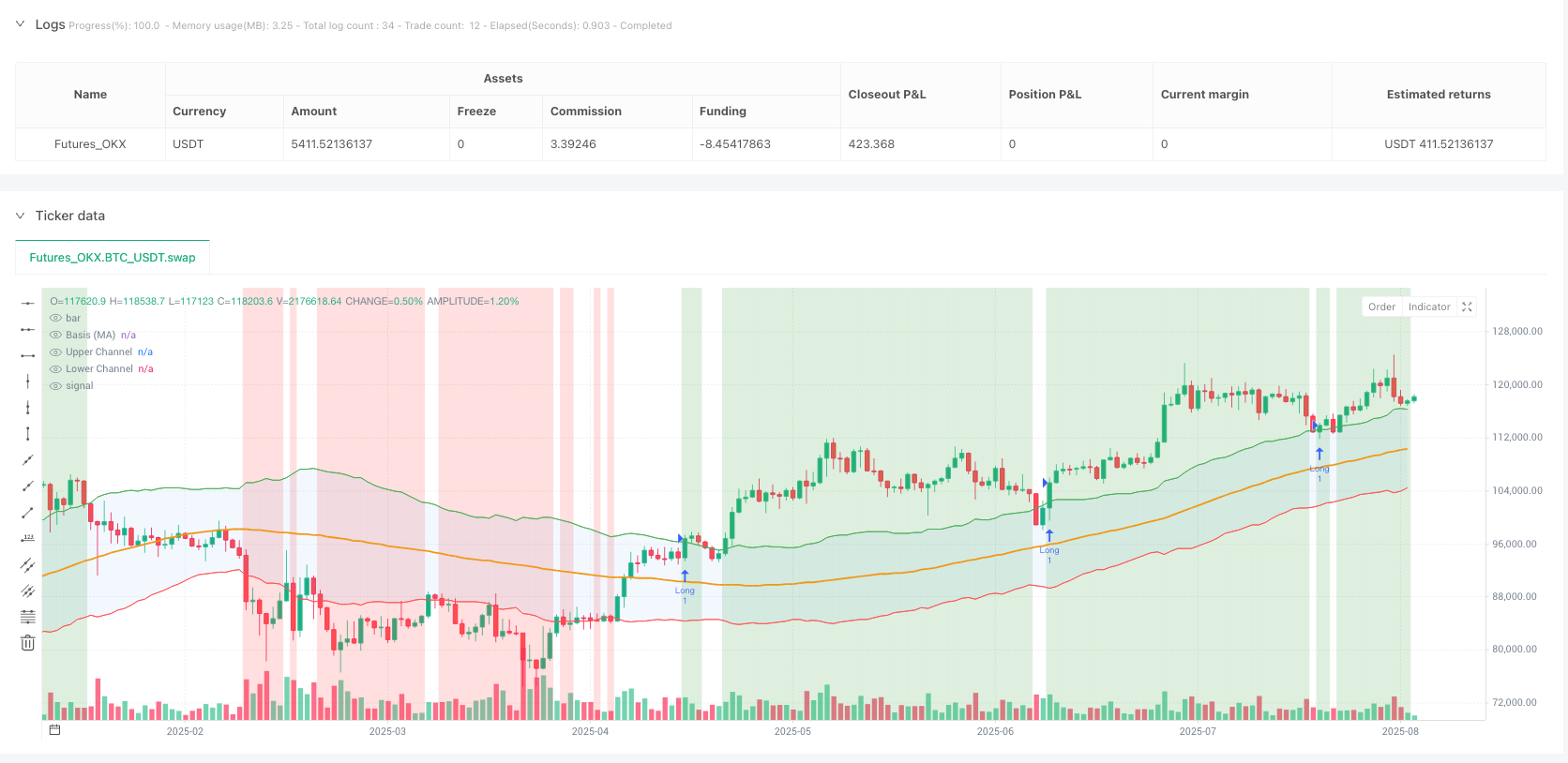

/*backtest

start: 2024-08-19 00:00:00

end: 2025-08-18 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_OKX","currency":"BTC_USDT","balance":5000}]

*/

//@version=6

strategy("Crypto Gann Channel Strategy (Long Bias, fixed)", overlay=true,

default_qty_type=strategy.percent_of_equity, default_qty_value=10,

initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.1)

// === Inputs ===

maLength = input.int(100, "Baseline MA Length")

atrLength = input.int(14, "ATR Length")

multiplier = input.float(2.0, "ATR Multiplier", step=0.1)

stopATR = input.float(1.5, "Stop Loss ATR", step=0.1)

takeATR = input.float(3.0, "Take Profit ATR", step=0.1)

trendMA = input.int(200, "Trend Filter MA")

shadeTransp = input.int(75, "Zone Shade Transparency (0–100)", minval=0, maxval=100)

// === Channel Calculation ===

basis = ta.sma(close, maLength)

atr = ta.atr(atrLength)

upper = basis + atr * multiplier

lower = basis - atr * multiplier

// === Trend Filter ===

trend = ta.sma(close, trendMA)

// === Plot Gann Channel ===

pBasis = plot(basis, "Basis (MA)", color=color.orange, linewidth=2)

pUpper = plot(upper, "Upper Channel", color=color.green)

pLower = plot(lower, "Lower Channel", color=color.red)

fill(pUpper, pLower, color=color.new(color.blue, 92), title="Channel Fill")

// === Buy / Sell Zones Shading ===

buyZone = close > upper

sellZone = close < lower

bgcolor(buyZone ? color.new(color.green, shadeTransp) : na, title="Buy Zone Shading")

bgcolor(sellZone ? color.new(color.red, shadeTransp) : na, title="Sell Zone Shading")

// === Entry Logic (Long-only, crypto bias) ===

longCond = ta.crossover(close, upper) and close > trend

if longCond

strategy.entry("Long", strategy.long)

// === Bracket Exit (updates each bar while in position) ===

if strategy.position_size > 0

longStop = strategy.position_avg_price - stopATR * atr

longLimit = strategy.position_avg_price + takeATR * atr

// keep it on one line to avoid parser issues

strategy.exit("Exit Long", "Long", stop=longStop, limit=longLimit)