Overview

The Multi-Smoothed Momentum Crossover Quantitative Strategy is a momentum-driven crossover system designed specifically for short-term traders. The core of this strategy utilizes the crossover relationship between a smoothed moving average filter and a fast signal line to capture short-term momentum shifts in the market. The strategy constructs a custom signal line called the “Scalping Line,” which is calculated from the difference between a double-smoothed moving average and a shorter-period signal line. When this signal line crosses above or below the zero line, the strategy triggers trading signals, providing a clear rules-based framework for both long and short entries.

Strategy Principles

The core logic of this strategy is built on several key computational components:

Main Trend Filter: The strategy first calculates a double-smoothed moving average (default period of 100). This double smoothing process effectively reduces price noise and provides a more robust foundational framework for short-term trading signals.

Percentage Filter: To avoid false signals, the strategy introduces a customizable percentage filter parameter. This filter adjusts the system’s “sensitivity” to price deviations from the moving average, helping to filter out insignificant price fluctuations.

Signal Line Calculation: Uses a shorter-period simple moving average (default 7) to provide faster responsiveness to recent price action.

Scalping Line (SLI) Calculation: The core signal line is defined as the difference between the fast signal line and the smoothed moving average. When the SLI crosses the zero point, it indicates a potential momentum shift:

- SLI > 0: Momentum bias is bullish

- SLI < 0: Momentum bias is bearish

Trade Direction Control: The strategy can be configured for long-only, short-only, or bidirectional trading to suit different trading styles.

Signal Flip Option: By default, long signals are triggered when the SLI crosses below the zero line, and short signals when it crosses above. However, this configuration can be flipped, allowing for alternative interpretations of momentum signals based on different market conditions.

Time Window Filtering: For intraday traders, a time filter can be enabled to restrict signals to specific trading sessions (e.g., 9 AM to 4 PM), which is particularly useful for trading assets with strong intraday volatility.

Strategy Advantages

After deep analysis of the code, the following significant advantages of this strategy can be summarized:

Clear Signal System: The strategy uses zero-line crossovers as the primary signal, providing traders with clear and intuitive entry points, reducing ambiguity in interpretation.

High Customizability: From moving average periods, filter percentages to signal direction and time filtering, the strategy offers multiple adjustable parameters, allowing traders to optimize according to their market and style.

Strong Adaptability: Through the percentage filter and adjustable smoothing parameters, the strategy can adapt to different market volatility conditions, maintaining effectiveness in both high and low volatility environments.

Clear Visual Feedback: The strategy provides intuitive visual indications, including zero-line reference, histogram filling, and signal markers, enabling traders to easily identify potential trading opportunities.

Multi-Market Applicability: The strategy logic is simple yet effective and can be applied to various markets including stocks, forex, cryptocurrencies, and futures, particularly suitable for markets with sufficient intraday volatility.

Flexible Timeframe Adaptability: While primarily designed for short-term trading on 1-minute to 15-minute charts, the strategy can also adapt to higher timeframes for swing trading by adjusting parameters.

Strategy Risks

Despite its many advantages, the strategy also presents some potential risks:

Lack of Built-in Risk Management: The strategy primarily focuses on entry signals without built-in position management, stop-loss, and take-profit rules. Traders need to overlay these rules based on their risk management style.

Parameter Sensitivity: Strategy performance is highly dependent on parameter settings, and inappropriate parameters may lead to overtrading or missed opportunities. Parameter optimization is necessary for specific market conditions.

False Signal Risk: In oscillating markets or low volatility environments, the strategy may produce more false signals, leading to unnecessary trades and potential losses.

Latency Issues: Despite using a shorter-period signal line, moving averages inherently have some latency and may underreact at rapid market turning points.

Single Indicator Dependence: The strategy relies solely on the Scalping Line indicator for decision-making, lacking support from other confirmation indicators, which may increase the risk of erroneous signals.

Methods to address these risks include: - Overlaying strict risk management rules, including appropriate position sizing, stop losses, and profit targets - Conducting thorough backtesting and forward testing to find optimal parameter combinations - Considering adding auxiliary indicators as confirmation tools - Limiting the use of the strategy under specific market conditions

Strategy Optimization Directions

Based on an in-depth analysis of the code, the strategy has several potential optimization directions:

Risk Management Integration: Directly integrate stop-loss and take-profit logic into the strategy, with stop-loss positions based on ATR (Average True Range) or fixed percentages, while setting risk-reward ratios to determine profit targets.

Multiple Timeframe Analysis: Introduce higher timeframe trend confirmation, trading only in the direction of the main trend, which can significantly reduce the risk of counter-trend trading.

Volatility Adaptation: Add dynamic parameter adjustments based on ATR or similar indicators, allowing the strategy to automatically adjust signal sensitivity according to current market volatility.

Additional Filters: Integrate volume, relative strength, or other momentum indicators as confirmation tools, trading only when multiple indicators align, thereby improving signal quality.

Machine Learning Optimization: Use machine learning techniques to dynamically select the best parameter combinations, automatically adjusting strategy parameters based on different market conditions.

Entry Optimization: Consider more complex signal patterns beyond zero-line crossovers, such as extreme value reversals, divergence/convergence patterns, to improve entry precision.

These optimizations can enhance the strategy’s robustness, reduce false signals, and improve overall performance across various market conditions. Particularly, the integration of risk management is crucial for capital protection and achieving long-term profitability.

Summary

The Multi-Smoothed Momentum Crossover Quantitative Strategy offers a precise, flexible approach to short-term trading, particularly suitable for intraday and short-term traders. By combining double-smoothed moving averages, adaptive filtering, and flexible signal options, it helps traders identify short-term momentum shifts with clarity and confidence.

The core strength of the strategy lies in its simplicity and adaptability, making it a powerful tool in the short-term trader’s toolkit. However, to achieve optimal results, traders should consider adding appropriate risk management rules, conducting thorough backtesting, and adjusting parameters according to specific market conditions.

With the optimization suggestions mentioned above, particularly integrating risk management and multi-indicator confirmation, the strategy has the potential to become a more comprehensive and robust trading system that not only identifies potential trading opportunities but also protects capital and achieves sustained success across various market environments.

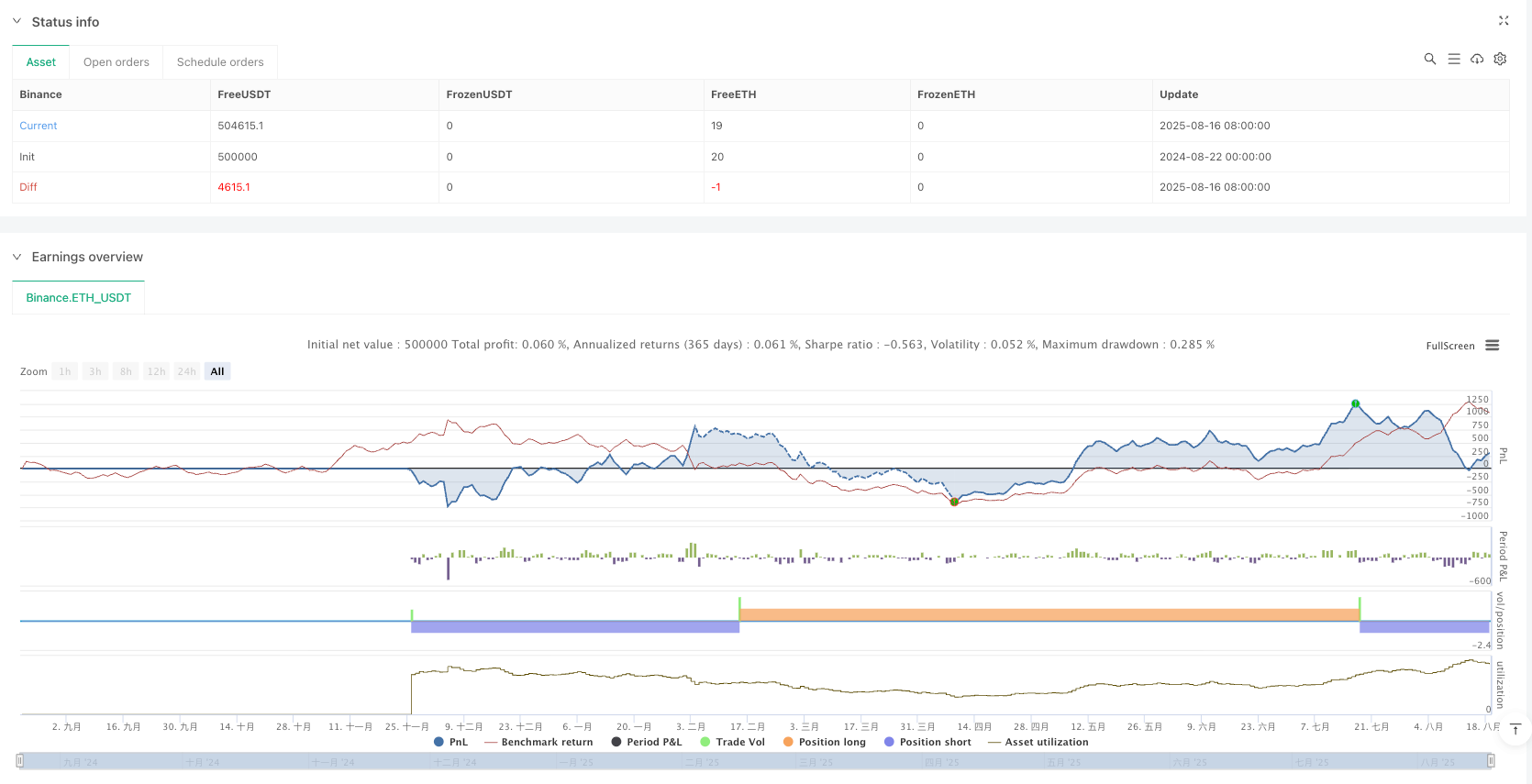

/*backtest

start: 2024-08-22 00:00:00

end: 2025-08-19 08:00:00

period: 3d

basePeriod: 3d

exchanges: [{"eid":"Binance","currency":"ETH_USDT","balance":500000}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nirnaykhatri - Strategy Version (Based on Scalping Line Indicatory By KivancOzbilgic)

//@version=6

strategy("Scalping Line Strategy", overlay=false)

// ═══════════════════════════════════════════════════════════════════════════════

// 📊 INPUT PARAMETERS

// ═══════════════════════════════════════════════════════════════════════════════

// === Core Indicator Settings ===

src = input.source(close, title="Source", group="📈 Core Settings")

percent = input.float(1.0, "Percent Filter", step=0.1, minval=0, group="📈 Core Settings", tooltip="Percentage threshold for signal filtering")

mainperiod = input.int(100, "Main Period", minval=1, group="📈 Core Settings", tooltip="Main moving average period")

signalperiod = input.int(7, "Signal Period", minval=1, group="📈 Core Settings", tooltip="Signal line moving average period")

// === Strategy Configuration ===

tradeDirection = input.string("Both", "Trade Direction", options=["Long Only", "Short Only", "Both"], group="🎯 Strategy Settings")

flipSignals = input.bool(false, "Flip Entry Signals", group="🎯 Strategy Settings", tooltip="When enabled: Long on cross above zero, Short on cross below zero. When disabled: Long on cross below zero, Short on cross above zero")

enableLongs = tradeDirection == "Long Only" or tradeDirection == "Both"

enableShorts = tradeDirection == "Short Only" or tradeDirection == "Both"

// === Signal Filtering ===

enableTimeFilter = input.bool(false, "Enable Time Filter", group="🕒 Signal Filters")

startHour = input.int(9, "Start Hour", minval=0, maxval=23, group="🕒 Signal Filters")

endHour = input.int(16, "End Hour", minval=0, maxval=23, group="🕒 Signal Filters")

// ═══════════════════════════════════════════════════════════════════════════════

// 🔧 CORE CALCULATIONS (Original Indicator Logic)

// ═══════════════════════════════════════════════════════════════════════════════

// Calculate the main moving average with double smoothing

MA = ta.sma(ta.sma(src, math.ceil(mainperiod / 2)), math.floor(mainperiod / 2) + 1)

// Apply percentage-based signal smoothing

ssMA = MA > close + MA * percent / 100 ? MA : MA < close - MA * percent / 100 ? MA : close

// Calculate signal line

signalline = ta.sma(close, signalperiod)

// Calculate the Scalping Line Indicator (core signal)

ScalpLine = signalline - ssMA

// ═══════════════════════════════════════════════════════════════════════════════

// 📈 ORIGINAL INDICATOR VISUALS (Preserved)

// ═══════════════════════════════════════════════════════════════════════════════

// Plot the original indicator

k1 = plot(ScalpLine, "SLI", color.maroon, 2)

k2 = plot(0, "", color=color.gray)

// Original color logic and fill

color1 = ScalpLine >= 0 ? color.green : color.red

fill(k1, k2, color=color.new(color1, 80))

// ═══════════════════════════════════════════════════════════════════════════════

// 🎯 TRADING LOGIC & SIGNAL GENERATION

// ═══════════════════════════════════════════════════════════════════════════════

// Time filter logic

inTimeWindow = not enableTimeFilter or (hour >= startHour and hour <= endHour)

// Signal generation with crossover detection

longSignal = (flipSignals ? ta.crossover(ScalpLine, 0) : ta.crossunder(ScalpLine, 0)) and enableLongs and inTimeWindow

shortSignal = (flipSignals ? ta.crossunder(ScalpLine, 0) : ta.crossover(ScalpLine, 0)) and enableShorts and inTimeWindow

// ═══════════════════════════════════════════════════════════════════════════════

// 🚀 STRATEGY EXECUTION (Following BB-Strategy Pattern)

// ═══════════════════════════════════════════════════════════════════════════════

// Simple strategy entries following BB-Strategy pattern

if (longSignal)

strategy.entry("Long", strategy.long, comment="Long Entry")

else

strategy.cancel(id="Long")

if (shortSignal)

strategy.entry("Short", strategy.short, comment="Short Entry")

else

strategy.cancel(id="Short")

// ═══════════════════════════════════════════════════════════════════════════════

// 🎨 VISUAL INDICATORS (Simple and Clean)

// ═══════════════════════════════════════════════════════════════════════════════

// Plot entry signals

plotshape(longSignal, title="Long Entry", style=shape.triangleup, location=location.belowbar, color=color.lime, size=size.small)

plotshape(shortSignal, title="Short Entry", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Zero line for reference

hline(0, title="Zero Line", color=color.gray, linestyle=hline.style_solid)