🎯 How Powerful Is This Strategy?

You know what? This “Bollinger Bandit” strategy is like a market sniper! 📈 It’s not the type that shoots randomly, but specifically targets “boundary violators” at Bollinger Band edges. When price acts like a naughty kid running outside the “safe zone” of Bollinger Bands, this strategy immediately strikes to catch the rebound opportunity!

💡 Core Logic Is Super Simple

Key point! The essence of this strategy is “contrarian thinking”: - Price breaks below lower band = Oversold, prepare to go long! 🚀 - Price breaks above upper band = Overbought, prepare to go short! 📉 Like a spring - the harder you compress it, the stronger it bounces back. Bollinger Bands are the visualization tool for this “spring,” with 20-day MA as the center axis and upper/lower bands as extreme positions.

🎪 The Magic of Scaled Take Profit

What’s the most brilliant design here? Scaled take profit! Unlike traditional “one-size-fits-all” strategies, this one works like a smart merchant: - When TP1 hits, secure 50% profit first (3 points) 💰 - Hold remaining 50% for TP2 (5 points) 🎯 - If market doesn’t cooperate, 5-point stop loss provides protection 🛡️

It’s like selling spot - sell half to break even, keep the rest for better prices!

🔧 Practical Configuration Tips

Pitfall guide incoming! 📋 - Period Selection: 20-day is classic, but adjust based on trading instrument - Multiplier Setting: 1.0 standard deviation suits most cases, try 1.5-2.0 for high-volatility instruments - SL/TP Levels: 3/5/5 configuration is conservative, try 5/8/10 for more aggressive approach

Remember: This strategy works best in ranging markets, be careful of “false breakouts” in trending conditions!

🚀 Why Choose This Strategy?

If you’re the type of trader who prefers “steady wins,” this strategy is tailor-made for you! It won’t make you rich overnight, but helps you profit steadily from market fluctuations. Like running a restaurant - not aiming for daily packed crowds, but ensuring steady customer flow every day!

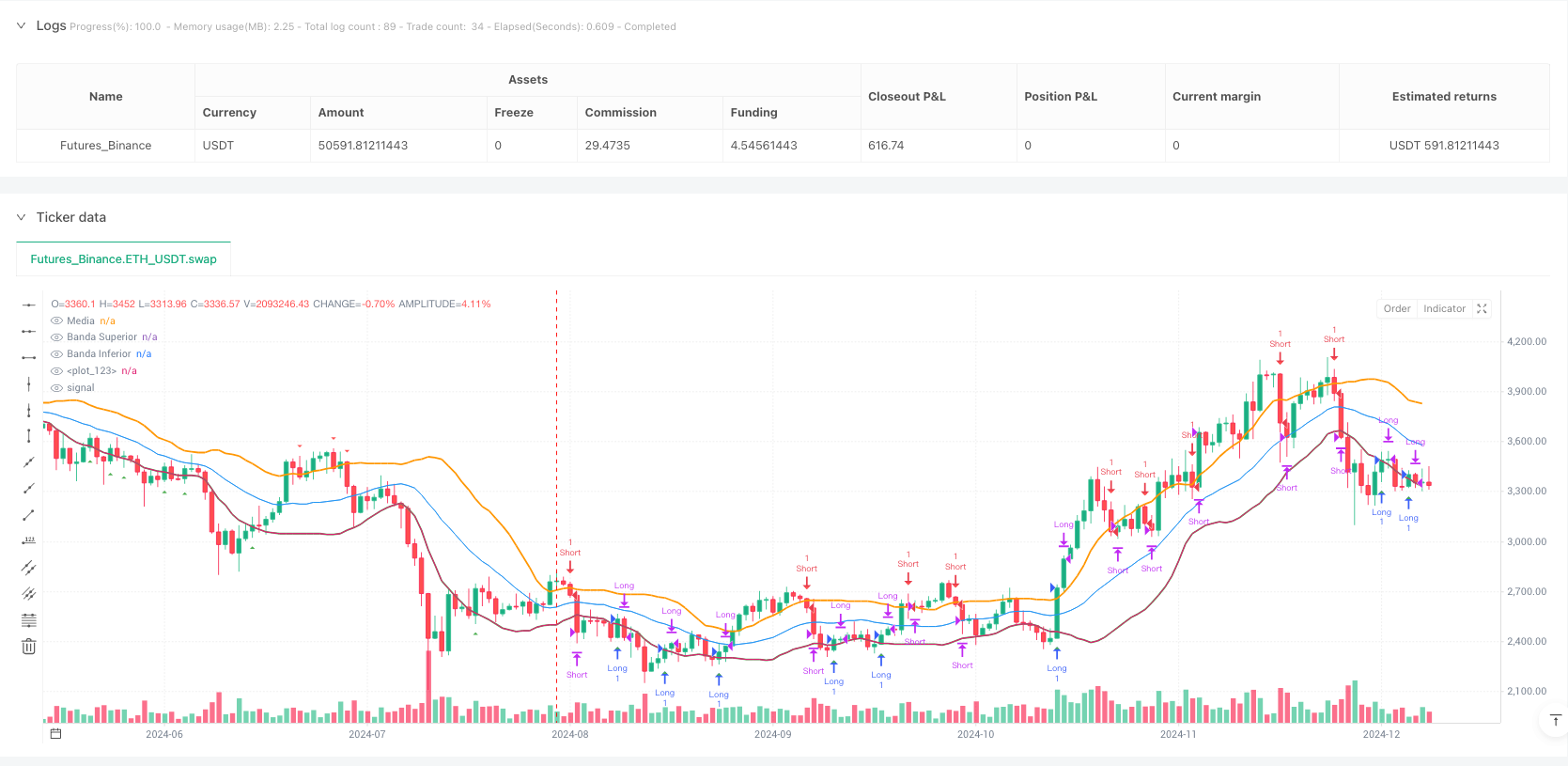

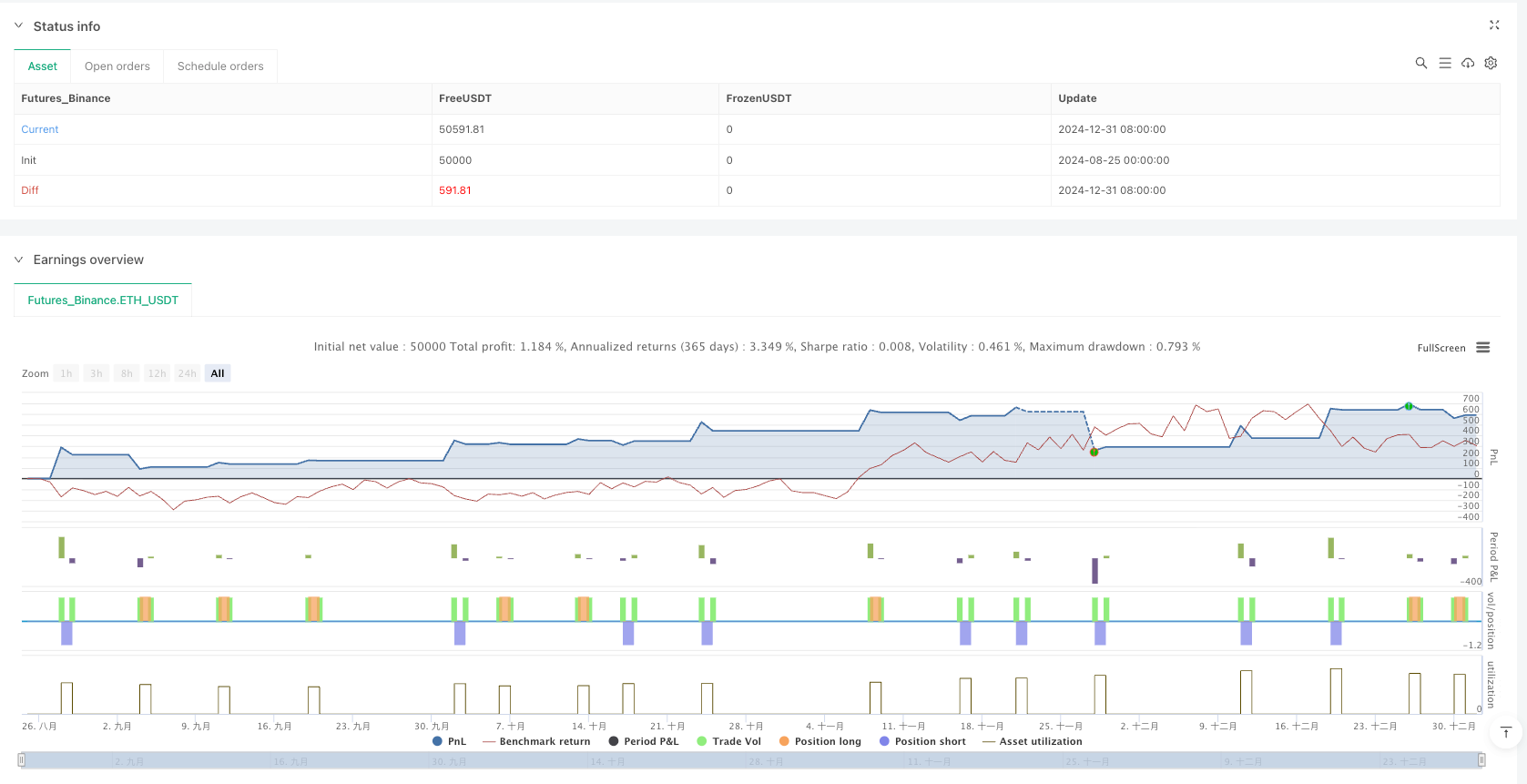

/*backtest

start: 2024-08-25 00:00:00

end: 2025-01-01 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Bollinger Bandit + TP Escalonado", overlay=true)

// Configuración básica

length = input.int(20, "Periodo", minval=1)

mult = input.float(1.0, "Multiplicador", minval=0.1, maxval=3.0)

source = input(close, "Fuente")

// Opción para cierre en media

close_on_ma = input.bool(true, "Cierre en Media Móvil")

// SL/TP CONFIGURABLE CON NIVELES FIJOS

use_sltp = input.bool(true, "Usar SL/TP Personalizado", group="Gestión de Riesgo")

sl_points = input.int(5, "Puntos para SL", minval=1, group="Gestión de Riesgo")

tp1_points = input.int(3, "Puntos para TP1", minval=1, group="Gestión de Riesgo")

tp2_points = input.int(5, "Puntos para TP2", minval=1, group="Gestión de Riesgo")

// MOSTRAR TEXTO DE PRECIO

show_price_text = input.bool(true, "Mostrar Precio SL/TP", group="Visualización")

// Cálculo de las Bandas de Bollinger

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

// Detección de cruces

longCondition = ta.crossover(close, lower)

shortCondition = ta.crossunder(close, upper)

// Cálculo de SL/TP con niveles FIJOS EXACTOS - CORREGIDO

var float last_sl_price = na

var float last_tp1_price = na

var float last_tp2_price = na

var int last_entry_bar = 0

var float last_entry_price = na

var bool last_is_long = false

if longCondition or shortCondition

last_entry_price := close

last_is_long := longCondition

if longCondition

// COMPRA: SL = entrada - 5 puntos, TP1 = entrada + 3 puntos, TP2 = entrada + 5 puntos

last_sl_price := last_entry_price - sl_points

last_tp1_price := last_entry_price + tp1_points

last_tp2_price := last_entry_price + tp2_points

else

// VENTA: SL = entrada + 5 puntos, TP1 = entrada - 3 puntos, TP2 = entrada - 5 puntos

last_sl_price := last_entry_price + sl_points

last_tp1_price := last_entry_price - tp1_points

last_tp2_price := last_entry_price - tp2_points

last_entry_bar := bar_index

// Entradas

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// DETECCIÓN DE CIERRES CON TEXTO PERSONALIZADO

var bool long_closed_by_sl = false

var bool long_closed_by_tp1 = false

var bool long_closed_by_tp2 = false

var bool short_closed_by_sl = false

var bool short_closed_by_tp1 = false

var bool short_closed_by_tp2 = false

// Para posiciones LARGAS

if (use_sltp and strategy.position_size > 0)

if low <= last_sl_price

strategy.close("Long", comment="LongSL")

long_closed_by_sl := true

else if high >= last_tp1_price and not long_closed_by_tp1

strategy.close("Long", qty_percent=50, comment="LongTP1")

long_closed_by_tp1 := true

else if high >= last_tp2_price and not long_closed_by_tp2

strategy.close("Long", comment="LongTP2")

long_closed_by_tp2 := true

else if (strategy.position_size > 0)

if (ta.crossunder(close, upper))

strategy.close("Long", comment="STOP")

if (close_on_ma and ta.crossunder(close, basis))

strategy.close("Long", comment="STOPMedia")

// Para posiciones CORTAS

if (use_sltp and strategy.position_size < 0)

if high >= last_sl_price

strategy.close("Short", comment="ShortSL")

short_closed_by_sl := true

else if low <= last_tp1_price and not short_closed_by_tp1

strategy.close("Short", qty_percent=50, comment="ShortTP1")

short_closed_by_tp1 := true

else if low <= last_tp2_price and not short_closed_by_tp2

strategy.close("Short", comment="ShortTP2")

short_closed_by_tp2 := true

else if (strategy.position_size < 0)

if (ta.crossover(close, lower))

strategy.close("Short", comment="STOP")

if (close_on_ma and ta.crossover(close, basis))

strategy.close("Short", comment="STOPMedia")

// Reset flags cuando no hay posición

if strategy.position_size == 0

long_closed_by_sl := false

long_closed_by_tp1 := false

long_closed_by_tp2 := false

short_closed_by_sl := false

short_closed_by_tp1 := false

short_closed_by_tp2 := false

// Visualización (manteniendo tus colores y estilo)

plot(basis, "Media", color=color.blue, linewidth=1)

plot(upper, "Banda Superior", color=color.orange, linewidth=2)

plot(lower, "Banda Inferior", color=color.green, linewidth=2)

// Señales de entrada

plotshape(longCondition, "↑ Compra", shape.triangleup, location.belowbar, color=color.green, size=size.tiny)

plotshape(shortCondition, "↓ Venta", shape.triangledown, location.abovebar, color=color.red, size=size.tiny)

// Relleno entre bandas (manteniendo tu estilo)

bgcolor = color.new(color.yellow,80)

fill(plot(upper), plot(lower), bgcolor)