🎯 Strategy Core Highlights: Triple-Insurance Trend Breakout Master

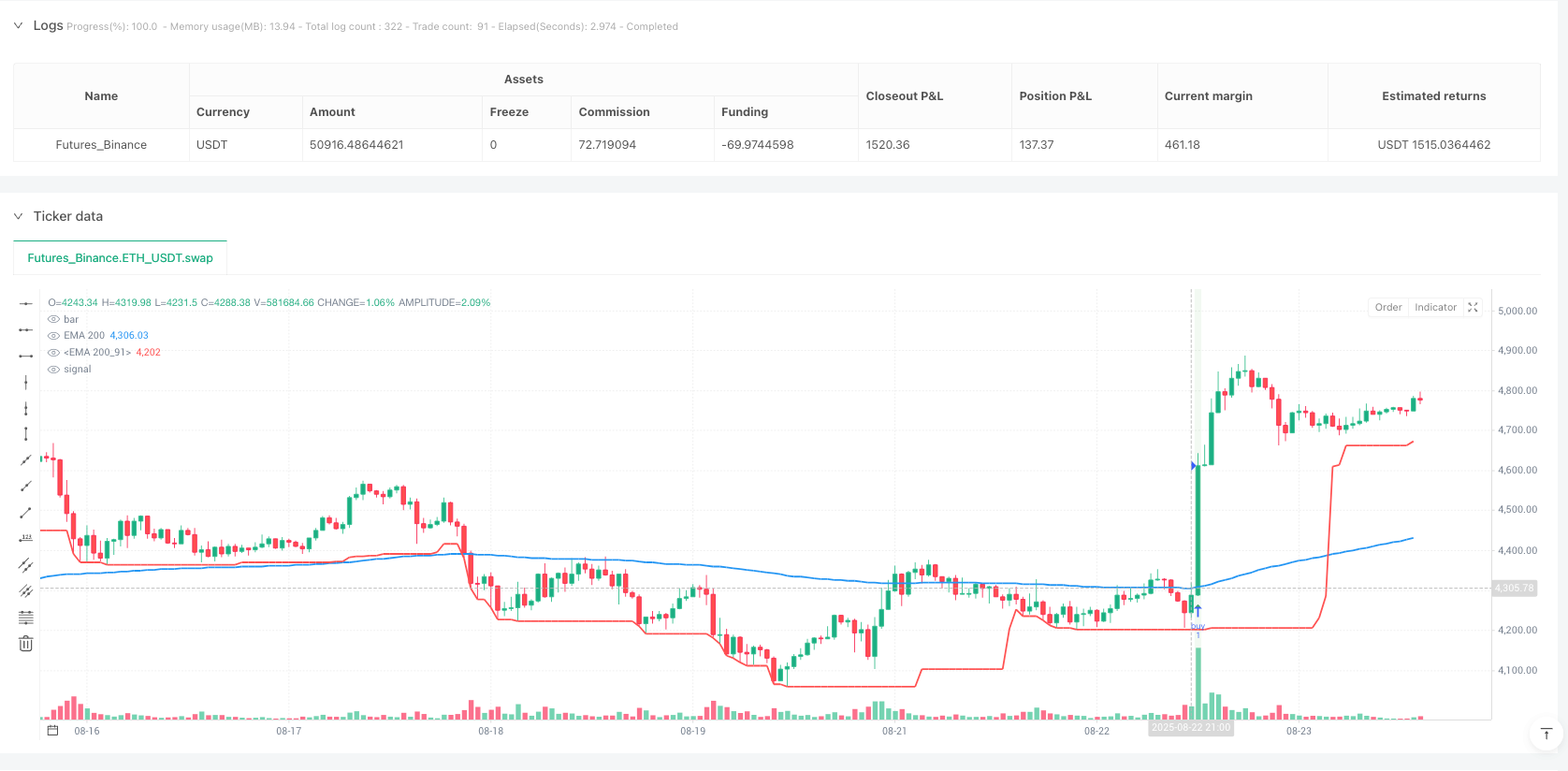

You know what? This strategy is like installing triple insurance for your trading! 📊 First, it uses EMA200 to determine the major trend direction, then confirms breakout authenticity with volume, and finally protects profits with dynamic ATR stops. Simply put, it’s the perfect combo of “identify direction + confirm signal + protect capital”!

Key point! This isn’t some rigid mechanical trading system, but an intelligent strategy that can “read the room.” When price breaks above EMA200, it also checks if volume is sufficient (default 1.5x average) to avoid false breakout traps.

🛡️ Dynamic Stop Mechanism: The “Stair-Climbing” Guardian Angel

Here comes the most exciting part! This strategy’s stop loss isn’t a rigid fixed value, but a dynamic protector that “climbs stairs.” 💪

Super Simple Logic: - Entry: Stop set 2x ATR below entry price - During position: Stop adjusts upward following 20-period lowest low - Exit: Close position when price breaks below dynamic stop

It’s like climbing stairs with a safety rope - every floor up, you raise the rope one level, never going backward! This protects profits while giving trends enough room to develop.

📈 Volume Confirmation: Core Weapon of the Pitfall Avoidance Guide

Pitfall avoidance guide incoming! 💡 The biggest problem with many breakout strategies is false breakouts, like the “boy who cried wolf” story. This strategy solves this pain point through volume confirmation:

Volume must exceed 1.5x the 20-day average to qualify as a valid breakout. Imagine if only a few people are spreading news, it might be fake; but if the whole city is talking about it, it’s worth attention!

This design helps you filter out those “bluffing” false breakouts, capturing only genuine trend opportunities backed by real capital flow.

🎪 Practical Application: What Problems Does This Strategy Solve

Suitable For: - Investors wanting to follow medium-long term trends 📈 - Cautious traders afraid of false breakout traps - Rational traders seeking systematic stop protection

Core Problems Solved: 1. Direction Confusion: EMA200 helps identify major trends 2. False Breakout Troubles: Volume confirmation filters noise 3. Stop Loss Dilemma: Dynamic ATR stops are both protective and flexible 4. Emotional Trading: Fully automated execution, goodbye human weaknesses

Remember, this strategy’s greatest value isn’t making you rich overnight, but helping you profit steadily in trending markets while maximizing capital protection. It’s like equipping your trading with GPS navigation + airbags + collision avoidance system! 🚗

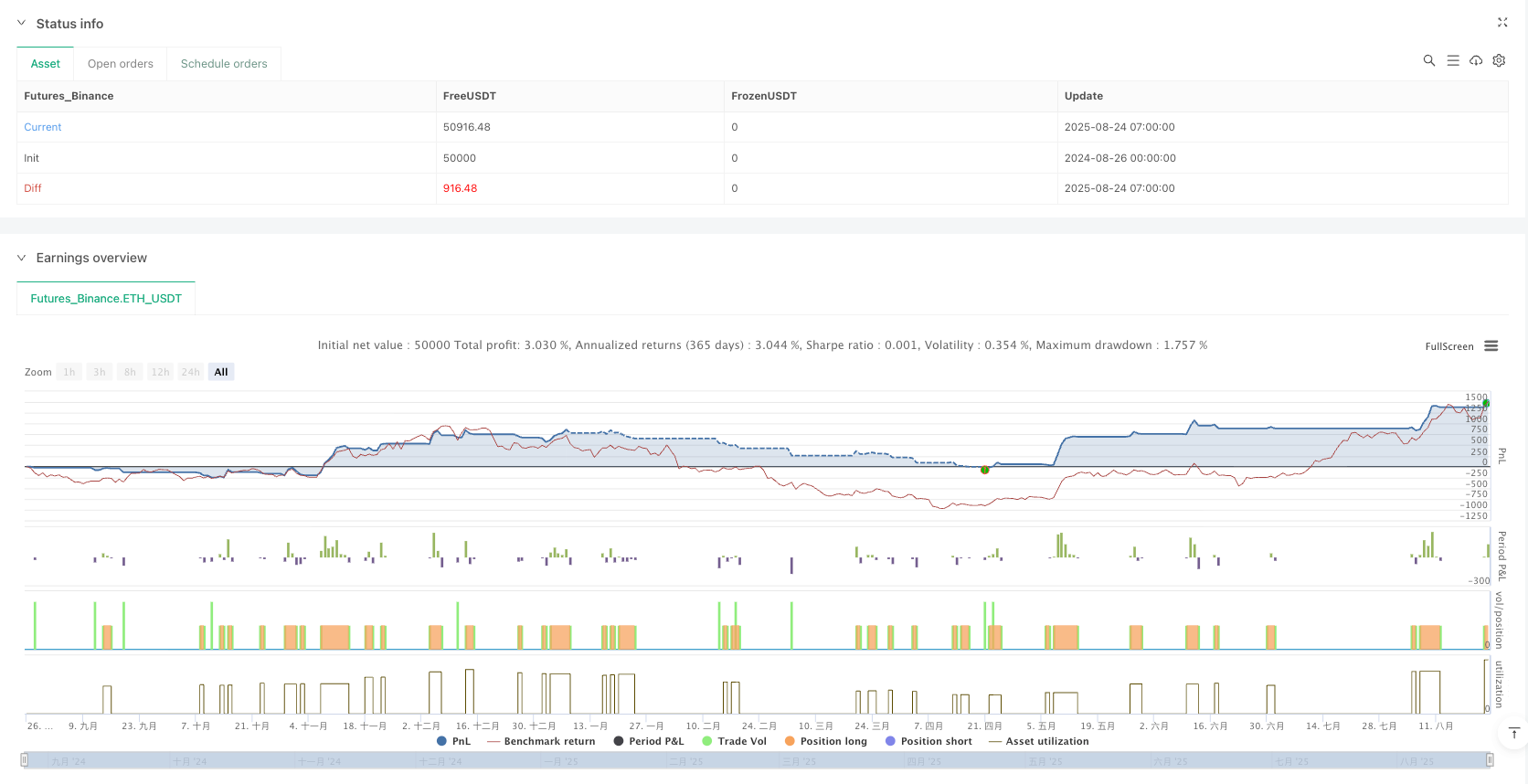

/*backtest

start: 2024-08-26 00:00:00

end: 2025-08-24 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("EMA Break + Stop ATR", overlay = true)

// =============================================================================

// STRATEGY PARAMETERS

// =============================================================================

// User inputs for strategy customization

shortPeriod = input.int(20, title = "Stop Period", minval = 1, maxval = 100, tooltip = "Period for lowest low calculation")

atrPeriod = 1 // ATR period always set to 1

initialStopLoss = 0.0 // Initial stop loss always set to 0 (auto based on ATR)

// Confirmation indicator settings

useVolumeConfirmation = input.bool(true, title = "Use Volume Confirmation", tooltip = "Require volume above average for breakout confirmation")

volumeMultiplier = input.float(1.5, title = "Volume Multiplier", minval = 1.0, maxval = 5.0, step = 0.1, tooltip = "Volume must be this times above average")

// Strategy variables

var float STOP_LOSS = 0.0 // Dynamic stop loss value

var float TRAILING_STOP = na // Trailing stop based on lowest low

// =============================================================================

// TECHNICAL INDICATORS

// =============================================================================

// Calculate True Range and its Simple Moving Average

trueRange = ta.tr(true)

smaTrueRange = ta.sma(trueRange, atrPeriod)

// Calculate 200-period Exponential Moving Average

ema200 = ta.ema(close, 200)

// Calculate lowest low over the short period

lowestLow = ta.lowest(input(low), shortPeriod)

// Calculate potential stop loss level (always available)

potentialStopLoss = close - 2 * smaTrueRange

// Volume confirmation for breakout validation

volumeSMA = ta.sma(volume, 20) // 20-period average volume

isVolumeConfirmed = not useVolumeConfirmation or volume > volumeSMA * volumeMultiplier

// =============================================================================

// STOP LOSS MANAGEMENT

// =============================================================================

// Update trailing stop based on lowest low (always, not just when in position)

if na(TRAILING_STOP) or lowestLow > TRAILING_STOP

TRAILING_STOP := lowestLow

// Update stop loss if we have an open position and new lowest low is higher

if (strategy.position_size > 0) and (STOP_LOSS < lowestLow)

strategy.cancel("buy_stop")

STOP_LOSS := lowestLow

// Soft stop loss - exit only when close is below stop level

if (strategy.position_size > 0) and (close < STOP_LOSS)

strategy.close("buy", comment = "Soft Stop Loss")

alert("Position closed: Soft Stop Loss triggered at " + str.tostring(close), alert.freq_once_per_bar)

// =============================================================================

// ENTRY CONDITIONS

// =============================================================================

// Enhanced entry signal with volume confirmation to avoid false breakouts

isEntrySignal = ta.crossover(close, ema200) and (strategy.position_size == 0) and isVolumeConfirmed

if isEntrySignal

// Cancel any pending orders

strategy.cancel("buy")

strategy.cancel("sell")

// Enter long at market on crossover

strategy.entry("buy", strategy.long)

// Set initial stop loss (2 * ATR below close, or use custom value if specified)

if initialStopLoss > 0

STOP_LOSS := initialStopLoss

else

STOP_LOSS := close - 2 * smaTrueRange

// Alert for position opened

alert("Position opened: Long entry at " + str.tostring(close) + " with stop loss at " + str.tostring(STOP_LOSS), alert.freq_once_per_bar)

// =============================================================================

// PLOTTING

// =============================================================================

// Plot EMA 200

plot(ema200, color = color.blue, title = "EMA 200", linewidth = 2)

// Plot Stop Loss

plot(strategy.position_size > 0 ? STOP_LOSS : lowestLow, color = color.red, title = "Stop Loss", linewidth = 2)

// Plot confirmation signals

plotshape(isEntrySignal, title="Confirmed Breakout", location=location.belowbar,

color=color.green, style=shape.triangleup, size=size.normal)

// Plot volume confirmation (only if enabled)

bgcolor(useVolumeConfirmation and isVolumeConfirmed and ta.crossover(close, ema200) ? color.new(color.green, 90) : na, title="Volume Confirmed")