🎯 How Powerful Is This Strategy Really?

You know what? 90% of traders are chasing pumps and dumps, but real pros are hunting for “price vacuum zones”! This Advanced FVG Strategy Pro+ is the ultimate weapon for capturing these mysterious gaps 🚀

FVG (Fair Value Gap) is simply the “blank area” left when price jumps, like stepping over a puddle while walking - you’ll eventually have to come back and “fill the gap.” This strategy ambushes at the perfect timing, waiting by the “puddle edge” for fish to bite!

💡 Spotlight! Three Core Black Technologies

1. Multi-Timeframe Analysis 📊 No more single timeframe limitations! The strategy can execute on 5-minute charts while using 1-hour FVG signals. It’s like using a telescope for distant mountains and a magnifying glass for details - comprehensive vision!

2. IIR Trend Filter 🌊

This isn’t your ordinary moving average! Using engineering-grade IIR low-pass filters for precise trend direction identification. Imagine equipping your trading with “trend radar,” only striking when the wind is favorable!

3. Smart Risk Management 🛡️ Supports both percentage and fixed amount risk modes, plus anti-blowup protection mechanisms. Like driving with both seatbelts and airbags for double protection, keeping your account safer!

🎪 Real Trading Scenarios

Perfect for these situations:

- Finding breakout opportunities in ranging markets ⚡

- Pullback entry points in trending markets 📈

- Precision sniping near key support/resistance levels 🎯

Pitfall Guide: - Pause before major news events - Be cautious with low-liquidity altcoins - Remember to adjust risk parameters based on market volatility

🚀 Why Choose This Strategy?

Traditional strategies either have too few signals (missing opportunities) or too many signals (getting trapped by false breakouts). This strategy achieves “quality over quantity” precision strikes through multiple filtering mechanisms!

The most thoughtful feature is that all parameters are customizable, like a sound engineer mixing audio - you can “tune” the perfect trading rhythm for different market environments 🎵

Remember: A good strategy doesn’t make you trade every day, but helps you strike when you’re most confident! That’s the charm of the FVG strategy ✨

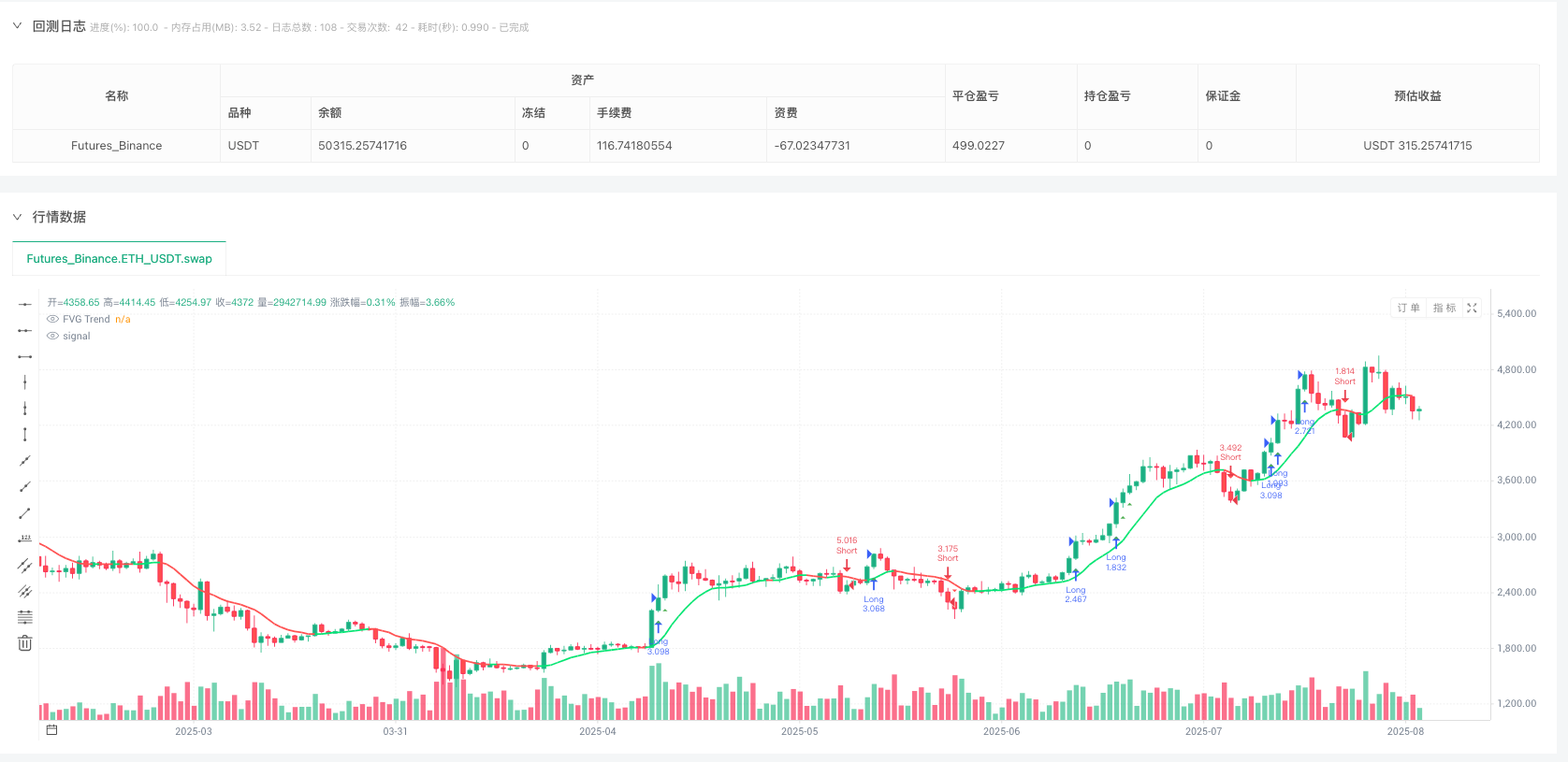

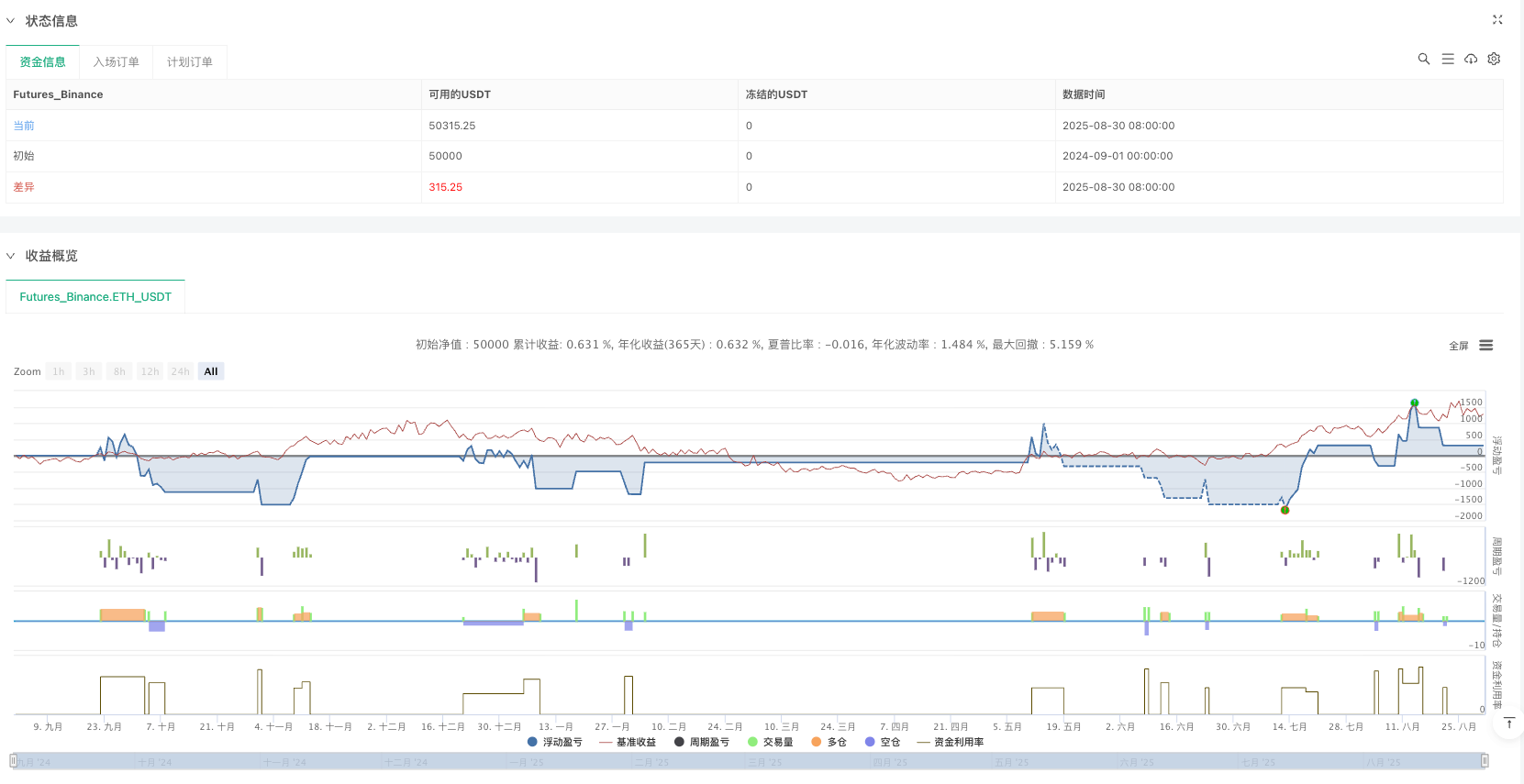

/*backtest

start: 2024-09-01 00:00:00

end: 2025-08-31 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Advanced FVG Strategy Pro+ (v6)", overlay=true,

initial_capital=10000,

default_qty_type=strategy.fixed,

default_qty_value=1,

commission_type=strategy.commission.percent,

commission_value=0.05,

calc_on_every_tick=true,

process_orders_on_close=true)

// ---------------- Inputs ----------------

fvg_tf = input.timeframe("", "FVG Timeframe (MTF)")

bodySens = input.float(1.0, "FVG Body Sensitivity", step=0.1, minval=0.0)

mitigate_mid = input.bool(true, "Mitigation on Midpoint")

rr_ratio = input.float(2.0, "Risk/Reward Ratio", step=0.1)

risk_mode = input.string("Percent", "Risk Mode", options=["Percent","Fixed $"])

risk_perc = input.float(1.0, "Risk % (of Equity)", minval=0.1, maxval=10.0)

risk_fixed = input.float(100.0, "Fixed $ Risk", minval=1.0)

useTrend = input.bool(true, "Filter with FVG Trend")

rp = input.float(10.0, "Trend Filter Ripple (dB)", minval=0.1, step=0.1)

fc = input.float(0.1, "Trend Filter Cutoff (0..0.5)", minval=0.01, maxval=0.5, step=0.01)

extendLength = input.int(10, "Extend Boxes (bars)", minval=0)

// ---------------- MTF candles ----------------

c1 = fvg_tf == "" ? close : request.security(syminfo.tickerid, fvg_tf, close, lookahead = barmerge.lookahead_on)

o1 = fvg_tf == "" ? open : request.security(syminfo.tickerid, fvg_tf, open, lookahead = barmerge.lookahead_on)

h1 = fvg_tf == "" ? high : request.security(syminfo.tickerid, fvg_tf, high, lookahead = barmerge.lookahead_on)

l1 = fvg_tf == "" ? low : request.security(syminfo.tickerid, fvg_tf, low, lookahead = barmerge.lookahead_on)

h2 = fvg_tf == "" ? high[2] : request.security(syminfo.tickerid, fvg_tf, high[2], lookahead = barmerge.lookahead_on)

l2 = fvg_tf == "" ? low[2] : request.security(syminfo.tickerid, fvg_tf, low[2], lookahead = barmerge.lookahead_on)

// ---------------- FVG detection ----------------

float wick = math.abs(c1 - o1)

float avg_body = ta.sma(wick, 50)

bool bullFVG = (l1 > h2) and (c1 > h2) and (wick >= avg_body * bodySens)

bool bearFVG = (h1 < l2) and (c1 < l2) and (wick >= avg_body * bodySens)

// ---------------- Trend Filter (IIR low-pass) ----------------

float src = (h1 + l1) / 2.0

float epsilon = math.sqrt(math.pow(10.0, rp/10.0) - 1.0)

float d = math.sqrt(1.0 + epsilon * epsilon)

float c = 1.0 / math.tan(math.pi * fc)

float norm = 1.0 / (1.0 + d * c + c * c)

float b0 = norm

float b1 = 2.0 * norm

float b2 = norm

float a1 = 2.0 * norm * (1.0 - c * c)

float a2 = norm * (1.0 - d * c + c * c)

var float trend = na

var float trend1 = na

var float trend2 = na

trend := bar_index < 2 ? src : (b0 * src + b1 * src[1] + b2 * src[2] - a1 * nz(trend1) - a2 * nz(trend2))

trend2 := trend1

trend1 := trend

bool trendUp = trend > nz(trend[1])

bool trendDown = trend < nz(trend[1])

// ---------------- Strategy Conditions ----------------

bool longCond = bullFVG and (not useTrend or trendUp)

bool shortCond = bearFVG and (not useTrend or trendDown)

// stop loss / take profit (based on MTF gap edges)

float longSL = l1

float shortSL = h1

float longRisk = close - longSL

float shortRisk = shortSL - close

float longTP = close + (close - longSL) * rr_ratio

float shortTP = close - (shortSL - close) * rr_ratio

// ---------------- Position sizing ----------------

float equity = strategy.equity

float riskCash = risk_mode == "Percent" ? (equity * risk_perc / 100.0) : risk_fixed

float longQty = (longRisk > 0.0) ? (riskCash / longRisk) : na

float shortQty = (shortRisk > 0.0) ? (riskCash / shortRisk) : na

// safety cap: avoid ridiculously large position sizes (simple protective cap)

float maxQty = math.max(1.0, (equity / math.max(1e-8, close)) * 0.25) // cap ~25% equity worth of base asset

if not na(longQty)

longQty := math.min(longQty, maxQty)

if not na(shortQty)

shortQty := math.min(shortQty, maxQty)

// small extra guard (do not trade if qty becomes extremely small or NaN)

bool canLong = longCond and not na(longQty) and (longQty > 0.0)

bool canShort = shortCond and not na(shortQty) and (shortQty > 0.0)

// ---------------- Orders ----------------

if canLong

strategy.entry("Long", strategy.long, qty = longQty)

strategy.exit("Long TP/SL", "Long", stop = longSL, limit = longTP)

if canShort

strategy.entry("Short", strategy.short, qty = shortQty)

strategy.exit("Short TP/SL", "Short", stop = shortSL, limit = shortTP)

// ---------------- Visuals ----------------

plotshape(longCond, title="Bull FVG", color=color.new(color.green, 0), style=shape.triangleup, location=location.belowbar, size=size.small)

plotshape(shortCond, title="Bear FVG", color=color.new(color.red, 0), style=shape.triangledown, location=location.abovebar, size=size.small)

plot(useTrend ? trend : na, title="FVG Trend", color=trendUp ? color.lime : trendDown ? color.red : color.gray, linewidth=2)