🔮 What Magic is This Strategy Really Playing?

You know what? The market is actually like a giant geometric playground! This strategy simplifies complex price movements into three adorable shapes: 💎 diamonds represent reversal signals, 🔺 triangles represent trend continuation, and ⭕ circles represent choppy filters. It’s like putting “geometric glasses” on the market to instantly see the true intentions of price action!

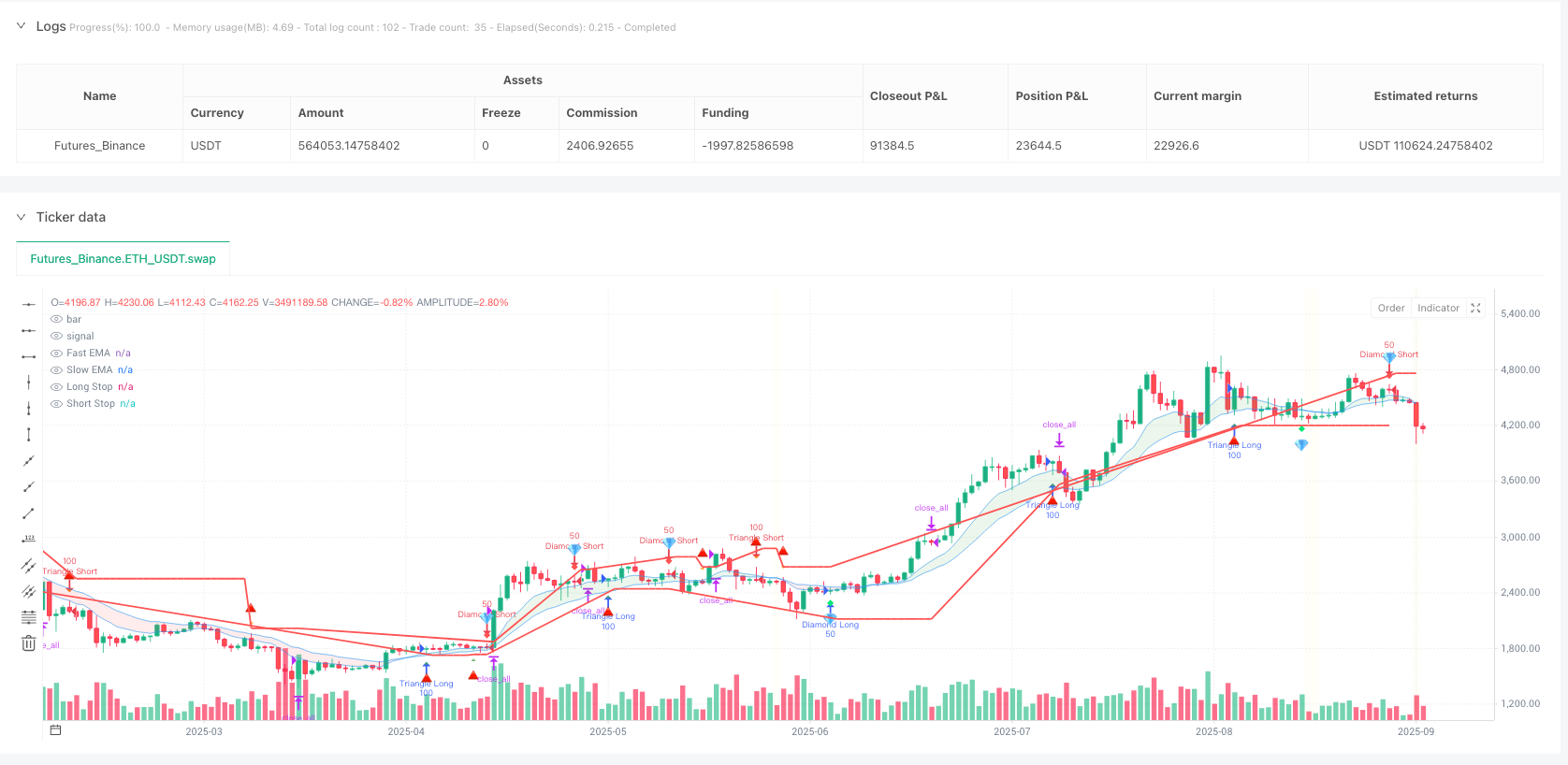

The core logic is super simple: fast and slow EMAs form a cloud to determine the major trend, then based on price position relative to the cloud, different breakouts of highs and lows get different “labels.” Breakouts below the cloud are diamond reversal signals, breakouts above the cloud are triangle continuation signals, and those signals with insufficient EMA separation get marked as “noise” by circles and filtered out.

📊 Key Points! Three Signal Systems Explained

Diamond Signals💎: Specialized in catching reversal opportunities! Triggered when price shows higher lows below the EMA cloud, or lower highs above the cloud. It’s as obvious as finding gems in valleys or seeing warning lights on mountain peaks.

Triangle Signals🔺: Reliable assistants for trend continuation! Activated when price shows higher lows above the cloud, or lower highs below the cloud. Imagine surfing with the wave direction - naturally higher success rates.

Circle Filters⭕: Such a thoughtful design! When EMA separation is below the set threshold, all signals get marked as “choppy noise.” It’s like installing an “anti-shake function” for the strategy, avoiding frequent entries during sideways markets.

🎯 Risk Management: Simple but Effective

Stop loss logic uses previous key levels: long stops at previous lows, short stops at previous highs. The advantage is clear technical basis, avoiding random stops that get hit by “false breakouts.”

RSI exit mechanism is also smart: long positions close when RSI drops from above 70, short positions close when RSI bounces from below 30. This locks in profits while avoiding continued holding in extreme overbought/oversold zones.

🚀 Practical Application: Who is This Strategy For?

Best Scenarios: Medium to short-term trend following and reversal trading, especially excellent performance in moderately volatile market environments. The strategy automatically adjusts position sizes: 50% position for reversal signals as exploration, 100% position for continuation signals as follow-through.

Pitfall Guide: Never blindly use in extremely choppy markets! Although there’s circle filtering, signals become scarce during prolonged sideways action. Also, this strategy relies more on technical analysis - major fundamental news might make geometric shapes “ineffective.”

Remember, the best strategy isn’t the most complex one, but the one that best fits your trading style! 🎪

/*backtest

start: 2024-09-26 00:00:00

end: 2025-09-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("💎🔺⚫ Diamond-Triangle-Circle Strategy", overlay=true)

// === INPUTS ===

ema_fast = input.int(10, "Fast EMA Length")

ema_slow = input.int(20, "Slow EMA Length")

min_ema_separation = input.float(0.1, "Min EMA Separation %", minval=0.01, maxval=1.0)

rsi_length = input.int(14, "RSI Length")

rsi_exit_level = input.int(70, "RSI Exit Level")

// === CALCULATIONS ===

ema_fast_val = ta.ema(close, ema_fast)

ema_slow_val = ta.ema(close, ema_slow)

rsi = ta.rsi(close, rsi_length)

// EMA Cloud and separation

cloud_bull = ema_fast_val > ema_slow_val

ema_separation_pct = math.abs(ema_fast_val - ema_slow_val) / close * 100

chop_filter = ema_separation_pct >= min_ema_separation

// Price position relative to cloud

price_above_cloud = close > math.max(ema_fast_val, ema_slow_val)

price_below_cloud = close < math.min(ema_fast_val, ema_slow_val)

// === HIGHER LOW DETECTION ===

lowPoint = ta.lowest(low, 3)

prevLowPoint = ta.lowest(low[3], 3)

isHigherLow = low == lowPoint and low > prevLowPoint

higherLowConfirmed = isHigherLow and close > open

// === LOWER HIGH DETECTION ===

highPoint = ta.highest(high, 3)

prevHighPoint = ta.highest(high[3], 3)

isLowerHigh = high == highPoint and high < prevHighPoint

lowerHighConfirmed = isLowerHigh and close < open

// === SIGNAL CLASSIFICATION ===

// Diamond Signal - Reversal (below cloud)

diamondBullish = higherLowConfirmed and price_below_cloud and chop_filter

diamondBearish = lowerHighConfirmed and price_above_cloud and chop_filter

// Triangle Signal - Continuation (above cloud)

triangleBullish = higherLowConfirmed and price_above_cloud and chop_filter

triangleBearish = lowerHighConfirmed and price_below_cloud and chop_filter

// Circle Signal - Chop (filtered out - display only)

chopBullish = higherLowConfirmed and not chop_filter

chopBearish = lowerHighConfirmed and not chop_filter

// === RSI EXIT LOGIC ===

rsi_was_above_70 = rsi[1] >= rsi_exit_level and rsi < rsi[1]

rsi_was_below_30 = rsi[1] <= (100 - rsi_exit_level) and rsi > rsi[1]

// === STOP LOSS LOGIC ===

var float long_stop = na

var float short_stop = na

if diamondBullish or triangleBullish

long_stop := prevLowPoint

if diamondBearish or triangleBearish

short_stop := prevHighPoint

// === STRATEGY EXECUTION ===

// Long Entries

if diamondBullish

strategy.entry("Diamond Long", strategy.long, qty=50, comment="💎 Reversal")

if triangleBullish

strategy.entry("Triangle Long", strategy.long, qty=100, comment="🔺 Continuation")

// Short Entries

if diamondBearish

strategy.entry("Diamond Short", strategy.short, qty=50, comment="💎 Reversal")

if triangleBearish

strategy.entry("Triangle Short", strategy.short, qty=100, comment="🔺 Continuation")

// === EXITS ===

// Long Exits

if strategy.position_size > 0

if close <= long_stop

strategy.close_all(comment="Stop Loss")

else if rsi_was_above_70

strategy.close_all(comment="RSI Exit")

// Short Exits

if strategy.position_size < 0

if close >= short_stop

strategy.close_all(comment="Stop Loss")

else if rsi_was_below_30

strategy.close_all(comment="RSI Exit")

// === VISUAL ELEMENTS ===

// EMA Cloud

ema1 = plot(ema_fast_val, "Fast EMA", color.new(color.blue, 60), linewidth=1)

ema2 = plot(ema_slow_val, "Slow EMA", color.new(color.blue, 60), linewidth=1)

fill(ema1, ema2, color=cloud_bull ? color.new(color.green, 85) : color.new(color.red, 85), title="EMA Cloud")

// Signal Shapes

plotshape(diamondBullish, "Diamond Long", shape.diamond, location.belowbar,

color.new(color.lime, 0), size=size.small, text="💎")

plotshape(diamondBearish, "Diamond Short", shape.diamond, location.abovebar,

color.new(color.red, 0), size=size.small, text="💎")

plotshape(triangleBullish, "Triangle Long", shape.triangleup, location.belowbar,

color.new(color.green, 20), size=size.small, text="🔺")

plotshape(triangleBearish, "Triangle Short", shape.triangledown, location.abovebar,

color.new(color.orange, 20), size=size.small, text="🔺")

plotshape(chopBullish, "Chop Long", shape.circle, location.belowbar,

color.new(color.gray, 50), size=size.tiny, text="⚫")

plotshape(chopBearish, "Chop Short", shape.circle, location.abovebar,

color.new(color.gray, 50), size=size.tiny, text="⚫")

// Stop Loss Lines

plot(strategy.position_size > 0 ? long_stop : na, "Long Stop", color.red, linewidth=2)

plot(strategy.position_size < 0 ? short_stop : na, "Short Stop", color.red, linewidth=2)

// Background coloring for market conditions

bgcolor(not chop_filter ? color.new(color.yellow, 95) : na, title="Chop Zone")

// === ALERTS ===

alertcondition(diamondBullish, title="Diamond Long Signal", message="💎 REVERSAL LONG - {{ticker}} at {{close}}")

alertcondition(diamondBearish, title="Diamond Short Signal", message="💎 REVERSAL SHORT - {{ticker}} at {{close}}")

alertcondition(triangleBullish, title="Triangle Long Signal", message="🔺 CONTINUATION LONG - {{ticker}} at {{close}}")

alertcondition(triangleBearish, title="Triangle Short Signal", message="🔺 CONTINUATION SHORT - {{ticker}} at {{close}}")

alertcondition(strategy.position_size == 0 and strategy.position_size[1] != 0, title="Position Closed", message="💰 POSITION CLOSED - {{ticker}} at {{close}}")