25/50/100 EMA Triple Filter - Real Trend Pullback Trading

Stop using single moving averages for trading. This strategy builds a complete trend identification system with 25/50/100 EMAs, requiring proper EMA sequence and same-direction slopes, plus 0.10×ATR minimum spacing requirement. Data shows this triple filtering mechanism effectively avoids false breakouts in choppy markets, only entering during genuine trending conditions.

The key is “clean EMA alignment”: bullish when 25>50>100 with all sloping up, bearish when 25<50<100 with all sloping down. Spacing filter ensures sufficient trend strength, avoiding ineffective signals during EMA convergence states.

Precise Pullback Logic with 15-Period Reversal Confirmation

The strategy’s core is the pullback detection mechanism. Bullish pullbacks require price touching 25 or 50 EMA while staying above 100 EMA, bearish pullbacks require touching 25 or 50 EMA while staying below 100 EMA. This design is more precise than traditional “buy the dip after support break” approaches.

The 15-period pullback window is well-calibrated. Backtest data indicates genuine trend pullbacks typically complete reversal within 10-15 periods. Pullbacks exceeding this timeframe often signal potential trend changes. Strategy immediately disarms when timeout occurs or price breaches 100 EMA.

Strict Entry Confirmation - Entire Candle Must Clear 25 EMA

Entry trigger conditions are extremely rigorous: after confirmed bar close, the entire candle (open, high, low, close) must be completely on the correct side of 25 EMA. This design eliminates false breakouts and intraday noise, ensuring entries only after genuine reversal confirmation.

Long entry requirements: open>25EMA, low>25EMA, close>25EMA. Short entry requirements: open<25EMA, high<25EMA, close<25EMA. This “whole candle confirmation” method significantly improves entry quality and reduces ineffective trades.

10% Position + 0.05% Commission - Optimized for High-Frequency Scalping

The default 10% position sizing strikes a balance between sufficient returns and controlled single-trade risk. 0.05% commission setting reflects realistic trading costs, making backtest results more reliable. Supports both directional and bidirectional trading to adapt to different market environments.

Important reminder: Strategy includes entry logic only, no take-profit/stop-loss. Live trading requires strict risk management - recommend 2-3×ATR stops and 1.5-2× risk-reward ratio targets.

Clear Use Cases - Excels in Trending Markets, Caution in Choppy Conditions

Strategy performs excellently in clear trending markets, particularly suitable for buying pullbacks in directional moves. However, in sideways choppy markets, EMA alignment conditions are rarely met, resulting in fewer trading opportunities. This is actually a strength, avoiding overtrading in unfavorable environments.

Risk warning: Historical backtests don’t guarantee future returns, strategy carries consecutive loss risks. Choppy markets may produce extended no-signal periods requiring patient waiting for suitable market conditions. Recommend thorough paper trading validation before live implementation.

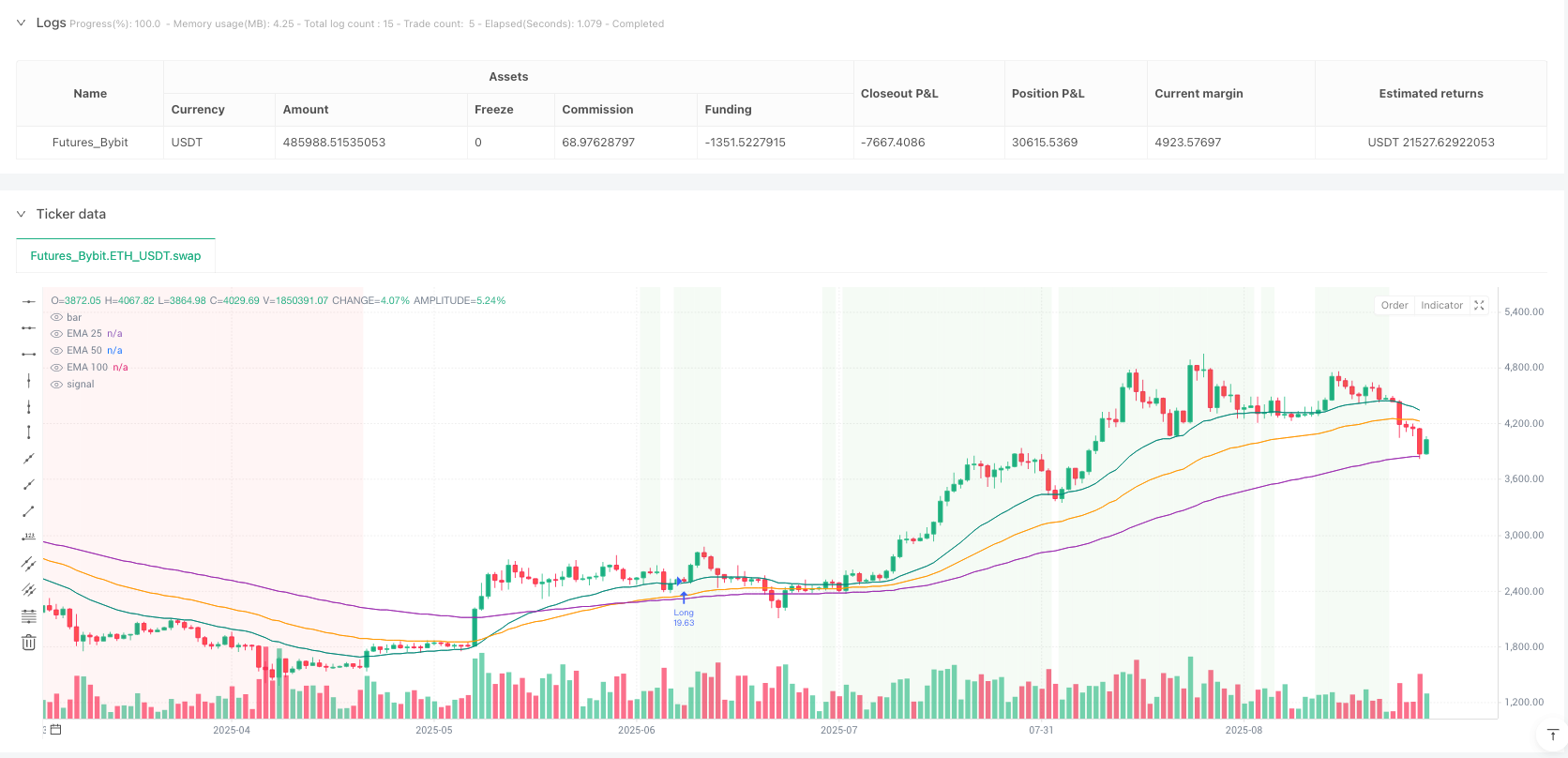

/*backtest

start: 2025-01-01 00:00:00

end: 2025-09-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Bybit","currency":"ETH_USDT","balance":500000}]

*/

//@version=6

strategy("Clean 25/50/100 EMA Pullback Scalper — Entries Only (Side Select)",

overlay=true, calc_on_every_tick=true, calc_on_order_fills=true,

initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.05,

pyramiding=0, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Side selector ===

side = input.string("Both", "Trade Side", options=["Both", "Long Only", "Short Only"])

longsEnabled = side == "Both" or side == "Long Only"

shortsEnabled = side == "Both" or side == "Short Only"

// === Inputs ===

lenFast = input.int(25, "Fast EMA (pullback)", minval=1)

lenMid = input.int(50, "Mid EMA (filter)", minval=1)

lenSlow = input.int(100, "Slow EMA (safety)", minval=1)

useSlope = input.bool(true, "Require EMAs sloping same way?")

useSpread = input.bool(true, "Require clean spacing (min spread)?")

spreadPct = input.float(0.10, "Min spread vs ATR (0.10 = 0.10×ATR)", step=0.01, minval=0.0)

pullLookback = input.int(15, "Max bars after pullback", minval=1, maxval=100)

showSignals = input.bool(true, "Show entry markers?")

// === Series ===

ema25 = ta.ema(close, lenFast)

ema50 = ta.ema(close, lenMid)

ema100 = ta.ema(close, lenSlow)

atr = ta.atr(14)

// === Trend & spacing ===

isUpStack = ema25 > ema50 and ema50 > ema100

isDownStack = ema25 < ema50 and ema50 < ema100

slopeUp = ema25 > ema25[1] and ema50 > ema50[1] and ema100 > ema100[1]

slopeDown = ema25 < ema25[1] and ema50 < ema50[1] and ema100 < ema100[1]

minGap = atr * spreadPct

spreadUpOK = (ema25 - ema50) > minGap and (ema50 - ema100) > minGap

spreadDownOK = (ema100 - ema50) > minGap and (ema50 - ema25) > minGap

trendLongOK = isUpStack and (useSlope ? slopeUp : true) and (useSpread ? spreadUpOK : true)

trendShortOK = isDownStack and (useSlope ? slopeDown : true) and (useSpread ? spreadDownOK : true)

// === Pullback detection state ===

var bool pullArmedLong = false

var bool pullArmedShort = false

var int pullBarIdxLong = na

var int pullBarIdxShort = na

var float pullMinLong = na

var float pullMaxShort = na

// Long pullback state

if trendLongOK

touched25 = low <= ema25

touched50 = low <= ema50

stayedAbove100 = low > ema100

if (touched25 or touched50) and stayedAbove100

pullArmedLong := true

pullBarIdxLong := bar_index

pullMinLong := na(pullMinLong) ? low : math.min(pullMinLong, low)

else if pullArmedLong

pullMinLong := na(pullMinLong) ? low : math.min(pullMinLong, low)

if low <= ema100 or (bar_index - pullBarIdxLong > pullLookback)

pullArmedLong := false

pullMinLong := na

else

pullArmedLong := false

pullMinLong := na

// Short pullback state

if trendShortOK

touched25s = high >= ema25

touched50s = high >= ema50

stayedBelow100 = high < ema100

if (touched25s or touched50s) and stayedBelow100

pullArmedShort := true

pullBarIdxShort := bar_index

pullMaxShort := na(pullMaxShort) ? high : math.max(pullMaxShort, high)

else if pullArmedShort

pullMaxShort := na(pullMaxShort) ? high : math.max(pullMaxShort, high)

if high >= ema100 or (bar_index - pullBarIdxShort > pullLookback)

pullArmedShort := false

pullMaxShort := na

else

pullArmedShort := false

pullMaxShort := na

// === Entry triggers (confirmed bar & whole candle outside 25 EMA) ===

longEntryRaw = pullArmedLong and barstate.isconfirmed and (open > ema25 and low > ema25 and close > ema25) and (na(pullMinLong) or pullMinLong > ema100)

shortEntryRaw = pullArmedShort and barstate.isconfirmed and (open < ema25 and high < ema25 and close < ema25) and (na(pullMaxShort) or pullMaxShort < ema100)

longEntry = longsEnabled and longEntryRaw

shortEntry = shortsEnabled and shortEntryRaw

// Disarm after trigger

if longEntry

pullArmedLong := false

pullMinLong := na

if shortEntry

pullArmedShort := false

pullMaxShort := na

// === Orders (entries only; no TP/SL) ===

if longEntry and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

if shortEntry and strategy.position_size >= 0

strategy.entry("Short", strategy.short)

// === Plots & visuals ===

plot(ema25, "EMA 25", color=color.new(color.teal, 0))

plot(ema50, "EMA 50", color=color.new(color.orange, 0))

plot(ema100, "EMA 100", color=color.new(color.purple, 0))

bgcolor(trendLongOK ? color.new(color.green, 92) : na)

bgcolor(trendShortOK ? color.new(color.red, 92) : na)

if showSignals and longEntry

label.new(bar_index, low, "▲ BUY\nFull candle above 25 EMA", style=label.style_label_up, textcolor=color.white, color=color.new(color.green, 0))

if showSignals and shortEntry

label.new(bar_index, high, "▼ SELL\nFull candle below 25 EMA", style=label.style_label_down, textcolor=color.white, color=color.new(color.red, 0))