Halving Cycle Strategy: Historical Data Shows Average Returns Exceeding 1000%

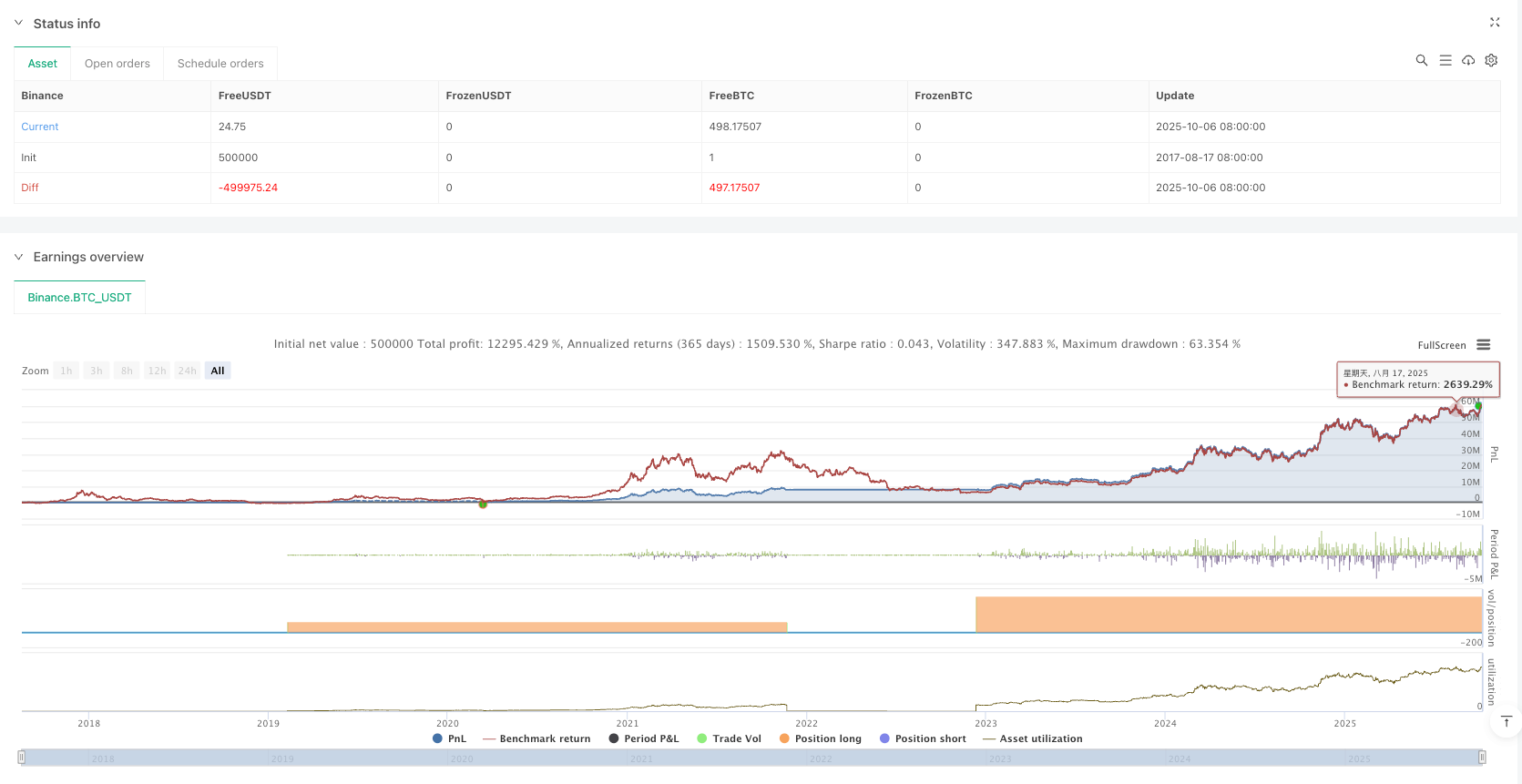

This isn’t another technical analysis strategy, but a long-term investment framework based on Bitcoin’s 4-year halving cycles. Backtesting data reveals: strict execution at halving timepoints can yield over 2000% returns per cycle. But don’t get excited yet - this strategy demands iron discipline and massive risk tolerance.

Core logic is brutally simple: buy at halving, take profits 40-80 weeks later, restart DCA after 135 weeks. Sounds easy, requires steel willpower to execute.

Three-Phase Framework: More Precise Timing Than Traditional DCA

Phase 1: Halving Entry Period (0-40 weeks) Enter immediately after halving events - this is the strategy’s core entry point. Historical data shows the 40 weeks post-halving represent optimal accumulation periods, when markets haven’t fully priced in supply reduction impacts.

Phase 2: Profit-Taking Window (40-80 weeks) Weeks 40-80 post-halving historically mark Bitcoin’s explosive price discovery periods. 2016 halving delivered 3000%+ gains by week 78, 2020 halving showed similar patterns. This timing isn’t speculation - it’s mathematical derivation from supply-demand fundamentals.

Phase 3: Bear Market DCA Period (135+ weeks) Week 135 post-halving typically enters deep bear territory, triggering DCA activation. This timing beats blind dollar-cost averaging by avoiding inefficient capital deployment during bull market peaks.

Risk Management: Not a Guaranteed Win, Requires Strict Discipline

Primary Risk: Execution Failure Strategy’s biggest enemy isn’t market volatility - it’s human nature. Halving entries require contrarian positioning during pessimistic periods, profit-taking demands composure during euphoria. Historical evidence shows 90% of participants fail complete execution.

Capital Management Requirements Recommend maximum 20% portfolio allocation per cycle, as individual cycles may face 80%+ drawdowns. 2018 bear market crashed from \(20k to \)3.2k - even “correct” timing involves massive unrealized losses.

Market Evolution Risk Strategy relies on 3 complete historical cycles, but Bitcoin markets are maturing rapidly. Institutional inflows, ETF approvals, and regulatory clarity may disrupt traditional cycle patterns. Past performance doesn’t guarantee future returns - this isn’t legal boilerplate.

Parameter Settings: Mathematical Models, Not Subjective Guesswork

40-Week Profit Start: Calculated from historical post-halving supply-demand equilibrium points. Earlier exits risk missing primary uptrends, later exits risk peak exposure.

80-Week Profit End: Historical data identifies week 80 post-halving as high-probability peak zones. Must initiate position reduction here - don’t chase final rally segments.

135-Week DCA Activation: Statistical optimization for bear market bottom zones, offering optimal risk-adjusted entry timing for accumulation phases.

Implementation Guide: Built for Long-Term Capital, Not Short-Term Trading

This strategy suits capital with 5+ year investment horizons, unsuitable for emergency funds or low risk tolerance profiles. Individual cycles require enduring 2-3 years of unrealized losses with massive psychological pressure.

Strategy edge isn’t short-term price prediction - it’s capturing long-term supply cycle dynamics. Bitcoin halving represents deterministic events, but price reaction timing and magnitude remain uncertain variables.

Critical Warning: This constitutes high-risk investment strategy with potential total capital loss. Historical backtesting doesn’t guarantee future performance. Thoroughly assess personal risk tolerance before implementation.

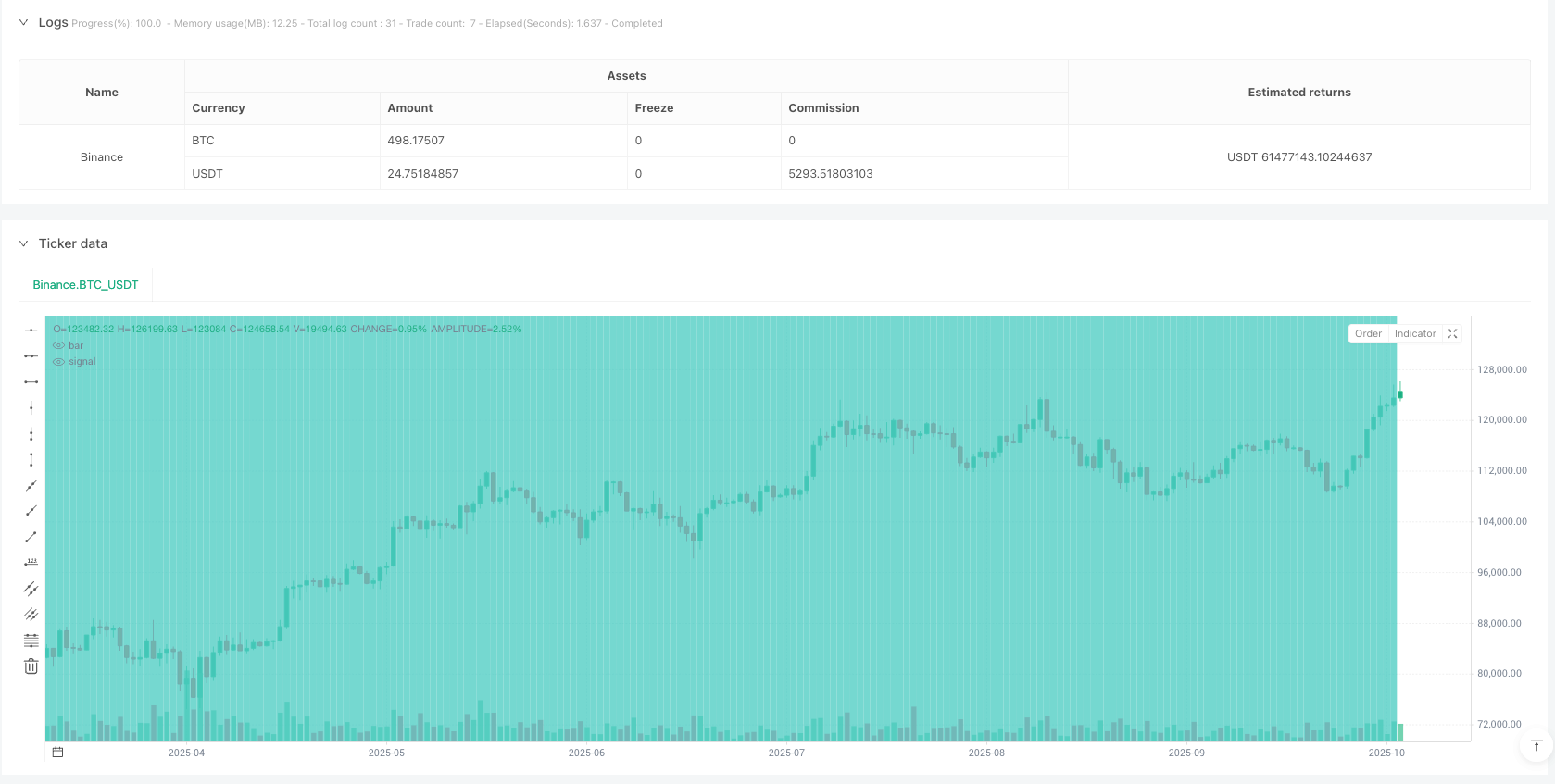

/*backtest

start: 2017-08-17 08:00:00

end: 2025-10-07 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT","balance":500000}]

*/

//@version=6

strategy(title='Bitcoin Halving Cycle Profit - Backtesting', shorttitle='BTC Halv', overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.1)

// ════════════════════════════════════════════════════════════════════════════════════════════════

// CONFIGURATION & INPUTS

// ════════════════════════════════════════════════════════════════════════════════════════════════

// Backtesting Settings

enableBacktesting = input.bool(true, "Enable Backtesting", group="Backtesting Settings")

enableShortTrades = input.bool(true, "Enable Short Trades", group="Backtesting Settings")

positionSize = input.float(100, "Position Size (%)", minval=10, maxval=100, group="Backtesting Settings")

slippage = input.float(0.05, "Slippage (%)", minval=0, maxval=1, group="Backtesting Settings")

// Main Settings

showHalvingLines = input.bool(true, "Show Halving Lines", group="Display Options")

showProfitZones = input.bool(true, "Show Profit Zones", group="Display Options")

showBackgroundGradient = input.bool(true, "Show Background Gradient", group="Display Options")

showLabels = input.bool(true, "Show Labels", group="Display Options")

showDCAZone = input.bool(true, "Show DCA Zone", group="Display Options")

showInfoTable = input.bool(true, "Show Info Table", group="Display Options")

showTradeSignals = input.bool(true, "Show Trade Signals", group="Display Options")

// Table Settings

tablePosition = input.string("Top Right", "Table Position", options=["Top Left", "Top Right", "Bottom Left", "Bottom Right"], group="Table Settings")

tableSize = input.string("Normal", "Table Size", options=["Small", "Normal", "Large"], group="Table Settings")

tableTransparency = input.int(10, "Table Transparency", minval=0, maxval=50, group="Table Settings")

// Professional Dark Theme Color Scheme

colorHalving = input.color(color.new(#ff6b35, 0), "Halving Line Color", group="Colors")

colorProfitStart = input.color(color.new(#4ecdc4, 0), "Profit Start Color", group="Colors")

colorProfitEnd = input.color(color.new(#ff6b6b, 0), "Profit End Color", group="Colors")

colorDCA = input.color(color.new(#ffd93d, 0), "DCA Color", group="Colors")

colorBackground = input.color(color.new(#4ecdc4, 92), "Background Color", group="Colors")

// Timing Settings

profitStartWeeks = input.int(40, "Profit Start (Weeks)", minval=1, group="Timing")

profitEndWeeks = input.int(80, "Profit End (Weeks)", minval=1, group="Timing")

dcaStartWeeks = input.int(135, "DCA Start (Weeks)", minval=1, group="Timing")

// ════════════════════════════════════════════════════════════════════════════════════════════════

// HELPER FUNCTIONS

// ════════════════════════════════════════════════════════════════════════════════════════════════

// Get table position

getTablePosition() =>

switch tablePosition

"Top Left" => position.top_left

"Top Right" => position.top_right

"Bottom Left" => position.bottom_left

"Bottom Right" => position.bottom_right

=> position.top_right

// Get table text size

getTableTextSize() =>

switch tableSize

"Small" => size.tiny

"Normal" => size.small

"Large" => size.normal

=> size.small

// Get table header text size

getTableHeaderSize() =>

switch tableSize

"Small" => size.small

"Normal" => size.normal

"Large" => size.large

=> size.normal

// Calculate weeks from halving date

weeksFromHalving(halvingTimestamp) =>

(time - halvingTimestamp) / (7 * 24 * 60 * 60 * 1000)

// Check if current time is within profit zone

inProfitZone(halvingTimestamp) =>

weeks = weeksFromHalving(halvingTimestamp)

weeks >= profitStartWeeks and weeks <= profitEndWeeks

// Check if current time is within DCA zone

inDCAZone(halvingTimestamp) =>

weeks = weeksFromHalving(halvingTimestamp)

weeks >= dcaStartWeeks

// ════════════════════════════════════════════════════════════════════════════════════════════════

// HALVING DATES & DATA

// ════════════════════════════════════════════════════════════════════════════════════════════════

// Historical halving dates

halving1 = timestamp(2012, 11, 28)

halving2 = timestamp(2016, 7, 9)

halving3 = timestamp(2020, 5, 11)

halving4 = timestamp(2024, 4, 19)

// Store halving data

type HalvingData

float timestamp

string label

string emoji

color lineColor

halvings = array.new<HalvingData>()

array.push(halvings, HalvingData.new(halving1, "1st Halving\n2012", "⛏️", colorHalving))

array.push(halvings, HalvingData.new(halving2, "2nd Halving\n2016", "⛏️⛏️", colorHalving))

array.push(halvings, HalvingData.new(halving3, "3rd Halving\n2020", "⛏️⛏️⛏️", colorHalving))

array.push(halvings, HalvingData.new(halving4, "4th Halving\n2024", "⛏️⛏️⛏️⛏️", colorHalving))

// Get current cycle status

getCurrentCycleStatus() =>

var string result = "⏳ Pre-Halving Phase"

for i = array.size(halvings) - 1 to 0 by 1

halvingData = array.get(halvings, i)

if time >= halvingData.timestamp

weeks = weeksFromHalving(halvingData.timestamp)

if weeks <= profitStartWeeks

result := "🔶 Accumulation Phase"

break

else if weeks <= profitEndWeeks

result := "🟢 Profit Taking Phase"

break

else if weeks <= dcaStartWeeks

result := "⚠️ Bear Market Phase"

break

else

result := "🟡 DCA Phase"

break

result

// Get weeks until next phase

getWeeksUntilNextPhase() =>

var float result = na

for i = array.size(halvings) - 1 to 0 by 1

halvingData = array.get(halvings, i)

if time >= halvingData.timestamp

weeks = weeksFromHalving(halvingData.timestamp)

if weeks <= profitStartWeeks

result := profitStartWeeks - weeks

break

else if weeks <= profitEndWeeks

result := profitEndWeeks - weeks

break

else if weeks <= dcaStartWeeks

result := dcaStartWeeks - weeks

break

else

result := na

break

result

// Get next phase date

getNextPhaseDate() =>

var float result = na

for i = array.size(halvings) - 1 to 0 by 1

halvingData = array.get(halvings, i)

if time >= halvingData.timestamp

weeks = weeksFromHalving(halvingData.timestamp)

if weeks <= profitStartWeeks

result := halvingData.timestamp + (profitStartWeeks * 7 * 24 * 60 * 60 * 1000)

break

else if weeks <= profitEndWeeks

result := halvingData.timestamp + (profitEndWeeks * 7 * 24 * 60 * 60 * 1000)

break

else if weeks <= dcaStartWeeks

result := halvingData.timestamp + (dcaStartWeeks * 7 * 24 * 60 * 60 * 1000)

break

else

result := na

break

result

// Get current phase name

getCurrentPhaseName() =>

var string result = "Pre-Halving"

for i = array.size(halvings) - 1 to 0 by 1

halvingData = array.get(halvings, i)

if time >= halvingData.timestamp

weeks = weeksFromHalving(halvingData.timestamp)

if weeks <= profitStartWeeks

result := "Accumulation"

break

else if weeks <= profitEndWeeks

result := "Profit Taking"

break

else if weeks <= dcaStartWeeks

result := "Bear Market"

break

else

result := "DCA"

break

result

// Get next phase name

getNextPhaseName() =>

var string result = "Accumulation"

for i = array.size(halvings) - 1 to 0 by 1

halvingData = array.get(halvings, i)

if time >= halvingData.timestamp

weeks = weeksFromHalving(halvingData.timestamp)

if weeks <= profitStartWeeks

result := "Profit Taking"

break

else if weeks <= profitEndWeeks

result := "Bear Market"

break

else if weeks <= dcaStartWeeks

result := "DCA"

break

else

result := "Next Halving"

break

result

// Get phase countdown variables

getPhaseCountdown() =>

var float currentHalvingTimestamp = na

var float profitStartWeeksLeft = na

var float profitEndWeeksLeft = na

var float dcaStartWeeksLeft = na

var string profitStartDateText = "N/A"

var string profitEndDateText = "N/A"

var string dcaStartDateText = "N/A"

var string nextPhaseName = "N/A"

var string nextPhaseDateText = "N/A"

for i = array.size(halvings) - 1 to 0 by 1

halvingData = array.get(halvings, i)

if time >= halvingData.timestamp

currentHalvingTimestamp := halvingData.timestamp

weeks = weeksFromHalving(halvingData.timestamp)

// Calculate countdowns

profitStartWeeksLeft := profitStartWeeks - weeks

profitEndWeeksLeft := profitEndWeeks - weeks

dcaStartWeeksLeft := dcaStartWeeks - weeks

// Calculate dates

profitStartDate = halvingData.timestamp + (profitStartWeeks * 7 * 24 * 60 * 60 * 1000)

profitEndDate = halvingData.timestamp + (profitEndWeeks * 7 * 24 * 60 * 60 * 1000)

dcaStartDate = halvingData.timestamp + (dcaStartWeeks * 7 * 24 * 60 * 60 * 1000)

profitStartDateText := str.format("{0,date,yyyy-MM-dd}", profitStartDate)

profitEndDateText := str.format("{0,date,yyyy-MM-dd}", profitEndDate)

dcaStartDateText := str.format("{0,date,yyyy-MM-dd}", dcaStartDate)

// Get next phase

if weeks <= profitStartWeeks

nextPhaseName := "Profit Taking"

nextPhaseDateText := profitStartDateText

break

else if weeks <= profitEndWeeks

nextPhaseName := "Bear Market"

nextPhaseDateText := profitEndDateText

break

else if weeks <= dcaStartWeeks

nextPhaseName := "DCA"

nextPhaseDateText := dcaStartDateText

break

else

nextPhaseName := "Next Halving"

nextPhaseDateText := "N/A"

break

[profitStartWeeksLeft, profitEndWeeksLeft, dcaStartWeeksLeft, profitStartDateText, profitEndDateText, dcaStartDateText, nextPhaseName, nextPhaseDateText]

// ════════════════════════════════════════════════════════════════════════════════════════════════

// BACKTESTING LOGIC

// ════════════════════════════════════════════════════════════════════════════════════════════════

// Variables for tracking signals

var bool longSignal = false

var bool shortSignal = false

var bool buyAtHalving = false

var bool buyAtDCA = false

var bool sellAtProfitEnd = false

var bool shortAtProfitEnd = false

var bool coverAtDCA = false

// Reset signals

longSignal := false

shortSignal := false

buyAtHalving := false

buyAtDCA := false

sellAtProfitEnd := false

shortAtProfitEnd := false

coverAtDCA := false

// Check for buy signals (Halving and DCA zones)

for i = 0 to array.size(halvings) - 1

halvingData = array.get(halvings, i)

weeks = weeksFromHalving(halvingData.timestamp)

// Buy at halving (within 1 week of halving)

if math.abs(weeks) < 1 and weeks >= 0

buyAtHalving := true

longSignal := true

// Buy at DCA start

if math.abs(weeks - dcaStartWeeks) < 0.5

buyAtDCA := true

longSignal := true

// Sell at profit end

if math.abs(weeks - profitEndWeeks) < 0.5

sellAtProfitEnd := true

if enableShortTrades

shortAtProfitEnd := true

shortSignal := true

// Cover short at DCA (same time as long entry)

if math.abs(weeks - dcaStartWeeks) < 0.5 and enableShortTrades

coverAtDCA := true

// Execute trades

if enableBacktesting

// Long entries

if longSignal and (buyAtHalving or buyAtDCA)

strategy.close("SHORT", comment="Cover Short")

strategy.entry("LONG", strategy.long, qty=positionSize/100 * strategy.equity/close, comment=buyAtHalving ? "Buy at Halving" : "Buy at DCA")

// Long exit and short entry

if sellAtProfitEnd and strategy.position_size > 0

strategy.close("LONG", comment="Sell at Profit End")

if enableShortTrades and shortAtProfitEnd

strategy.entry("SHORT", strategy.short, qty=positionSize/100 * strategy.equity/close, comment="Short at Profit End")

// Short cover (already handled above with long entry)

// ════════════════════════════════════════════════════════════════════════════════════════════════

// VISUAL ELEMENTS

// ════════════════════════════════════════════════════════════════════════════════════════════════

// Trade signals visualization

if showTradeSignals

if longSignal and buyAtHalving

label.new(bar_index, low, "🟢 BUY\nHALVING", style=label.style_label_up, color=color.new(color.green, 0), textcolor=color.white, size=size.normal)

if longSignal and buyAtDCA

label.new(bar_index, low, "🟢 BUY\nDCA", style=label.style_label_up, color=color.new(color.green, 0), textcolor=color.white, size=size.normal)

if sellAtProfitEnd

label.new(bar_index, high, "🔴 SELL\nPROFIT END", style=label.style_label_down, color=color.new(color.red, 0), textcolor=color.white, size=size.normal)

if shortAtProfitEnd and enableShortTrades

label.new(bar_index, high, "🔴 SHORT\nPROFIT END", style=label.style_label_down, color=color.new(color.orange, 0), textcolor=color.white, size=size.normal)

// Background gradient for profit zones

var bool showBgGradient = false

if showBackgroundGradient

for i = 0 to array.size(halvings) - 1

halvingData = array.get(halvings, i)

if inProfitZone(halvingData.timestamp)

showBgGradient := true

break

else

showBgGradient := false

bgcolor(showBackgroundGradient and showBgGradient ? colorBackground : na)

// ════════════════════════════════════════════════════════════════════════════════════════════════

// PROFESSIONAL DARK THEME TABLE - ALWAYS VISIBLE

// ════════════════════════════════════════════════════════════════════════════════════════════════

// Get position variables

var string currentPosition = "FLAT"

var color positionColor = color.new(#cccccc, 0)

var string positionEmoji = "⚪"

// Update position variables

currentPosition := strategy.position_size > 0 ? "LONG" : strategy.position_size < 0 ? "SHORT" : "FLAT"

positionColor := strategy.position_size > 0 ? color.new(#00ff88, 0) : strategy.position_size < 0 ? color.new(#ff4444, 0) : color.new(#cccccc, 0)

positionEmoji := strategy.position_size > 0 ? "🟢" : strategy.position_size < 0 ? "🔴" : "⚪"

// Get phase countdown data

[profitStartWeeksLeft, profitEndWeeksLeft, dcaStartWeeksLeft, profitStartDateText, profitEndDateText, dcaStartDateText, nextPhaseName, nextPhaseDateText] = getPhaseCountdown()

// ════════════════════════════════════════════════════════════════════════════════════════════════

// ALERTS

// ════════════════════════════════════════════════════════════════════════════════════════════════

// Enhanced alerts with trade signals

for i = 0 to array.size(halvings) - 1

halvingData = array.get(halvings, i)

weeks = weeksFromHalving(halvingData.timestamp)

if math.abs(weeks) < 0.1 and weeks >= 0

alert("🟢 Bitcoin Halving Cycle: BUY SIGNAL at halving event!", alert.freq_once_per_bar)

if math.abs(weeks - profitEndWeeks) < 0.1

alert("🔴 Bitcoin Halving Cycle: SELL SIGNAL - Last call for profit taking! (" + str.tostring(profitEndWeeks) + " weeks post-halving)", alert.freq_once_per_bar)

if math.abs(weeks - dcaStartWeeks) < 0.1

alert("🟡 Bitcoin Halving Cycle: BUY SIGNAL - DCA accumulation phase has begun! (" + str.tostring(dcaStartWeeks) + " weeks post-halving)", alert.freq_once_per_bar)