🎯 What’s This Amazing Strategy?

You know what? This strategy is like a super calm “bubble detective”! 📊 When the market goes crazy pumping like it’s on steroids, it doesn’t chase the hype. Instead, it patiently waits for the bubble to burst. It’s like watching someone flexing on social media - you know they’re probably going broke soon 😏

🔍 Core Strategy Logic Revealed

Key Point Alert! This strategy has two brilliant entry modes: 1. Bubble Cooldown Mode: When RSI hits 70+ or volume explodes 1.5x, it marks the “bubble period” and patiently waits for RSI to drop below 60 before considering shorts 2. New High Trap Mode: When price hits a 20-period new high without bubble signals, it shorts immediately

It’s like waiting for the right bus - you don’t jump on every one, you wait for the right one! 🚌

💡 How Smart Is The Risk Control?

Pitfall Prevention Guide! The coolest feature is its “early warning system”: - If you’re already short and suddenly detect another pump, immediately close and run! - 2% take profit, 6% stop loss, 1:3 risk-reward ratio with sweet mathematical expectation 📈 - Special “no-short zones” to avoid dangerous periods

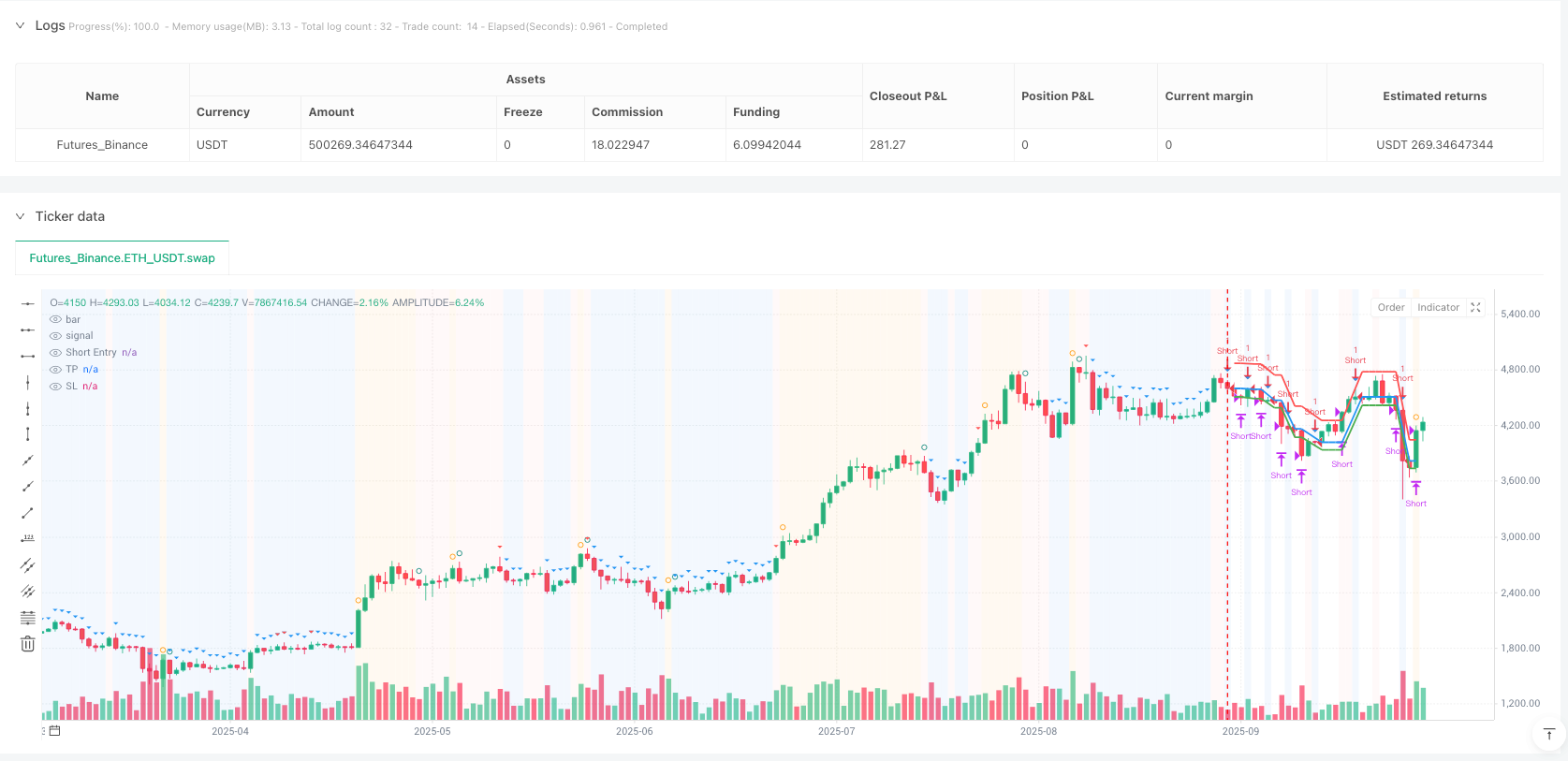

🎨 Visual Interface Is Super User-Friendly

This strategy’s charts look better than iPhone interface! - Orange background = Pump in progress, danger zone ⚠️ - Blue background = Post-pump short zone, opportunity knocks 💙 - Red background = No-short zone, stay put - Various icons marking key levels, crystal clear visualization

🚀 Perfect For What Kind of Trader?

If you’re this type of trader, this strategy is tailor-made for you: - Rational types who hate chasing pumps and dumps - Value investors who believe “what goes up fast, comes down fast” - Smart money who stays calm when others get greedy

Remember: Markets never lack opportunities, they lack the wisdom to wait patiently for good ones! ✨

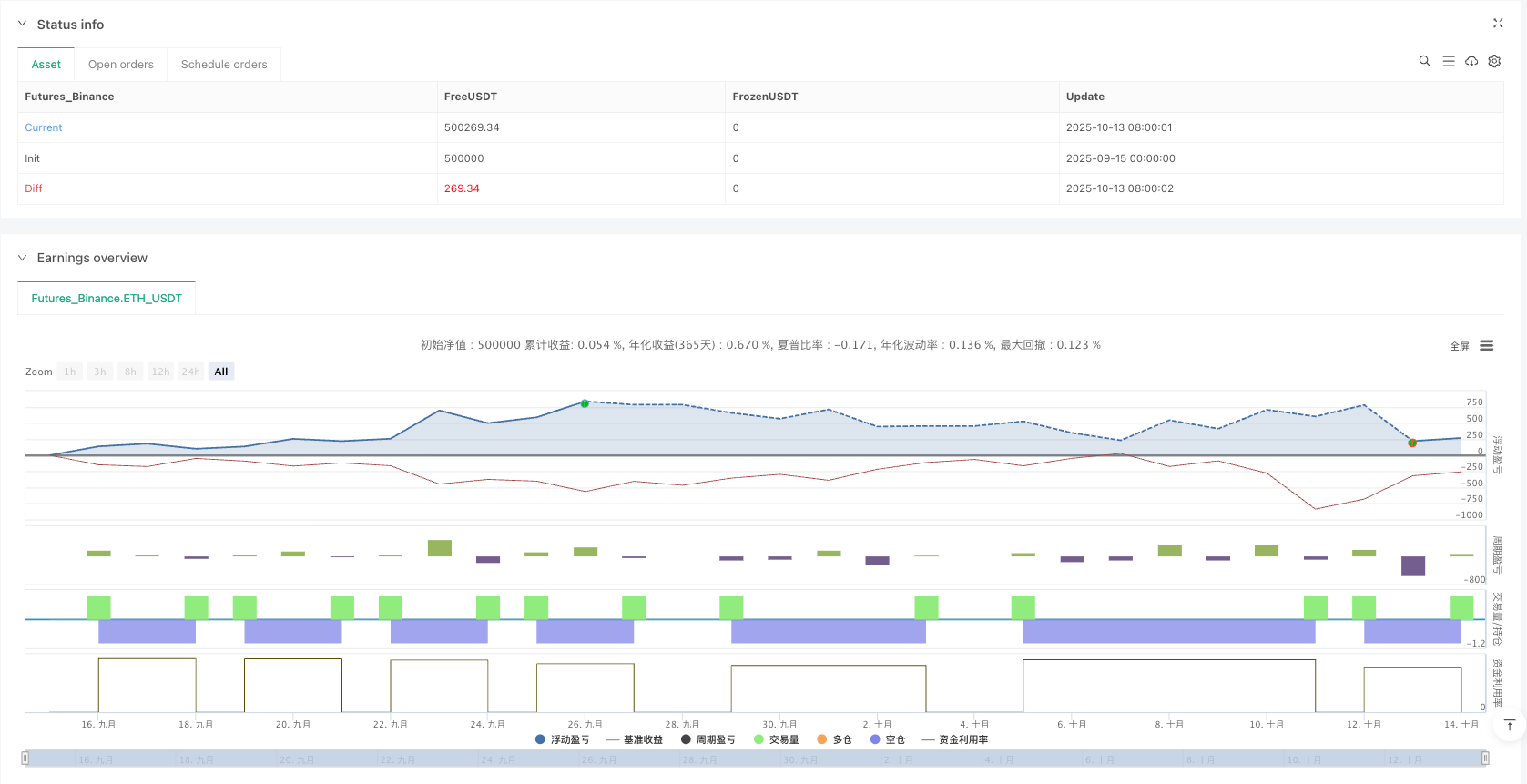

/*backtest

start: 2025-09-15 00:00:00

end: 2025-10-14 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("Pump-Smart Shorting Strategy", overlay=true)

// Inputs

lookbackPeriod = input.int(20, "Lookback Period for New High", minval=5)

minProfitPerc = input.float(0.02, "Take Profit %", minval=0.001)

stopLossPerc = input.float(0.06, "Stop Loss %", minval=0.001)

hedgeTokens = input.int(1, "Hedge Tokens")

// Pump detection inputs

rsiPeriod = input.int(14, "RSI Period")

rsiHigh = input.float(70, "Pump RSI ≥")

rsiCool = input.float(60, "Pump cool-off RSI ≤")

volMult = input.float(1.5, "Volume Pump Multiplier")

pctUp = input.float(0.05, "1-bar Up % for Pump")

barsWait = input.int(0, "Bars to wait after pump ends", minval=0, maxval=10)

// Tech

rsi = ta.rsi(close, rsiPeriod)

avgVol = ta.sma(volume, 20)

oneBarUp = (close - close[1]) / close[1]

// Pump on if any strong up-move pattern

pumpOn = (rsi >= rsiHigh) or (volume > avgVol * volMult and oneBarUp > pctUp)

// Track pump state with var and transitions

var bool wasPump = false

pumpStart = not wasPump and pumpOn

pumpEnd = wasPump and not pumpOn

// Update state each bar

wasPump := pumpOn

// Count bars since pump ended

var int barsSincePumpEnd = 10000

barsSincePumpEnd := pumpEnd ? 0 : math.min(10000, barsSincePumpEnd + 1)

// Define "pump ended and cooled" condition

cooled = (rsi <= rsiCool) and (oneBarUp <= pctUp/2 or volume <= avgVol * (volMult * 0.8))

// Immediate short signal when pump finishes and cooled (with optional wait)

shortAfterPump = (barsSincePumpEnd >= barsWait) and cooled and not pumpOn and strategy.position_size == 0

// Also allow shorts on fresh new highs when not pumping (optional, keep for more entries)

isNewHigh = high > ta.highest(high, lookbackPeriod)[1]

shortOnPeak = isNewHigh and not pumpOn and strategy.position_size == 0

// Define conditions where we DON'T short (for red background)

noShortZone = pumpOn or (isNewHigh and pumpOn) or (barsSincePumpEnd < barsWait) or not cooled

// Preemptive close if pump turns on while short

var float shortEntry = na

inShort = strategy.position_size < 0 and not na(shortEntry)

if inShort and pumpOn

strategy.close("Short")

shortEntry := na

// Entry rules: short either right after pump ends OR on new high when not pumping

if (shortAfterPump or shortOnPeak) and strategy.position_size == 0

strategy.entry("Short", strategy.short, qty=hedgeTokens)

shortEntry := na

// Track entry price

if strategy.position_size < 0 and na(shortEntry)

shortEntry := strategy.position_avg_price

if strategy.position_size == 0

shortEntry := na

inShort := strategy.position_size < 0 and not na(shortEntry)

// TP/SL

tp = shortEntry * (1 - minProfitPerc)

sl = shortEntry * (1 + stopLossPerc)

exitTP = inShort and close <= tp

exitSL = inShort and close >= sl

if exitTP

strategy.close("Short")

if exitSL

strategy.close("Short")

// Visuals - REMOVED TEXT FROM ARROWS

plotshape(pumpStart, style=shape.circle, color=color.orange, location=location.abovebar, size=size.tiny)

plotshape(pumpEnd, style=shape.circle, color=color.teal, location=location.abovebar, size=size.tiny)

plotshape(shortAfterPump, style=shape.triangledown, color=color.blue, location=location.abovebar, size=size.small)

plotshape(shortOnPeak, style=shape.triangledown, color=color.red, location=location.abovebar, size=size.tiny)

plot(inShort ? shortEntry : na, color=color.blue, linewidth=2, title="Short Entry")

plot(inShort ? tp : na, color=color.green, linewidth=2, title="TP")

plot(inShort ? sl : na, color=color.red, linewidth=2, title="SL")

// Background colors - ADDED RED NO-SHORT ZONES

bgcolor(pumpOn ? color.new(color.orange, 92) : na, title="Pump Zone")

bgcolor(shortAfterPump ? color.new(color.blue, 92) : na, title="Post-Pump Short Zone")

bgcolor(noShortZone and not pumpOn ? color.new(color.red, 95) : na, title="No Short Zone")