🎯 What’s This Amazing Strategy?

You know what? This strategy is like installing an “emotion detector” for the market! 📡 It uses a two-pole smoothing oscillator to sense the market’s “moods” - when the market gets too excited (overbought) or too depressed (oversold), it sends out trading signals. Key point! This isn’t your ordinary oscillator, but a premium version with “double beauty filter” processing that effectively filters out market noise, helping you see the real trend direction.

💡 How It Works - The Big Reveal

Imagine this strategy as a super-sensitive “market thermometer” 🌡️. First, it calculates how much prices deviate from the 25-period moving average, then standardizes this (like converting people of different heights to standard height ratios). Next comes the crucial “double smoothing” process, like applying two beauty filters to a photo consecutively, making signals clearer and more reliable. When the oscillator breaks through set thresholds, the strategy strikes decisively!

⚡ This Strategy’s Superpowers

Pitfall guide incoming! The most powerful feature is its “reverse signal exit” mechanism - as smart as hitting the brakes immediately when seeing a red light while driving! 🚦 When opposite signals appear, the strategy closes positions immediately without stubbornly holding on. Plus there’s 5-period fixed stop-loss protection, like adding an “airbag” to your capital. Most thoughtfully, it comes with complete trading statistics, keeping you informed of strategy performance at all times!

🚨 Risk Warnings Are Essential

Key point! While this strategy is excellent, it’s not omnipotent. In strong trending markets, the oscillator might get “lost,” like using city navigation on a highway - not quite suitable. Fixed threshold settings might not adapt well to different market environments, requiring flexible adjustments based on actual conditions. Remember, any strategy needs good risk management - don’t put all your eggs in one basket!

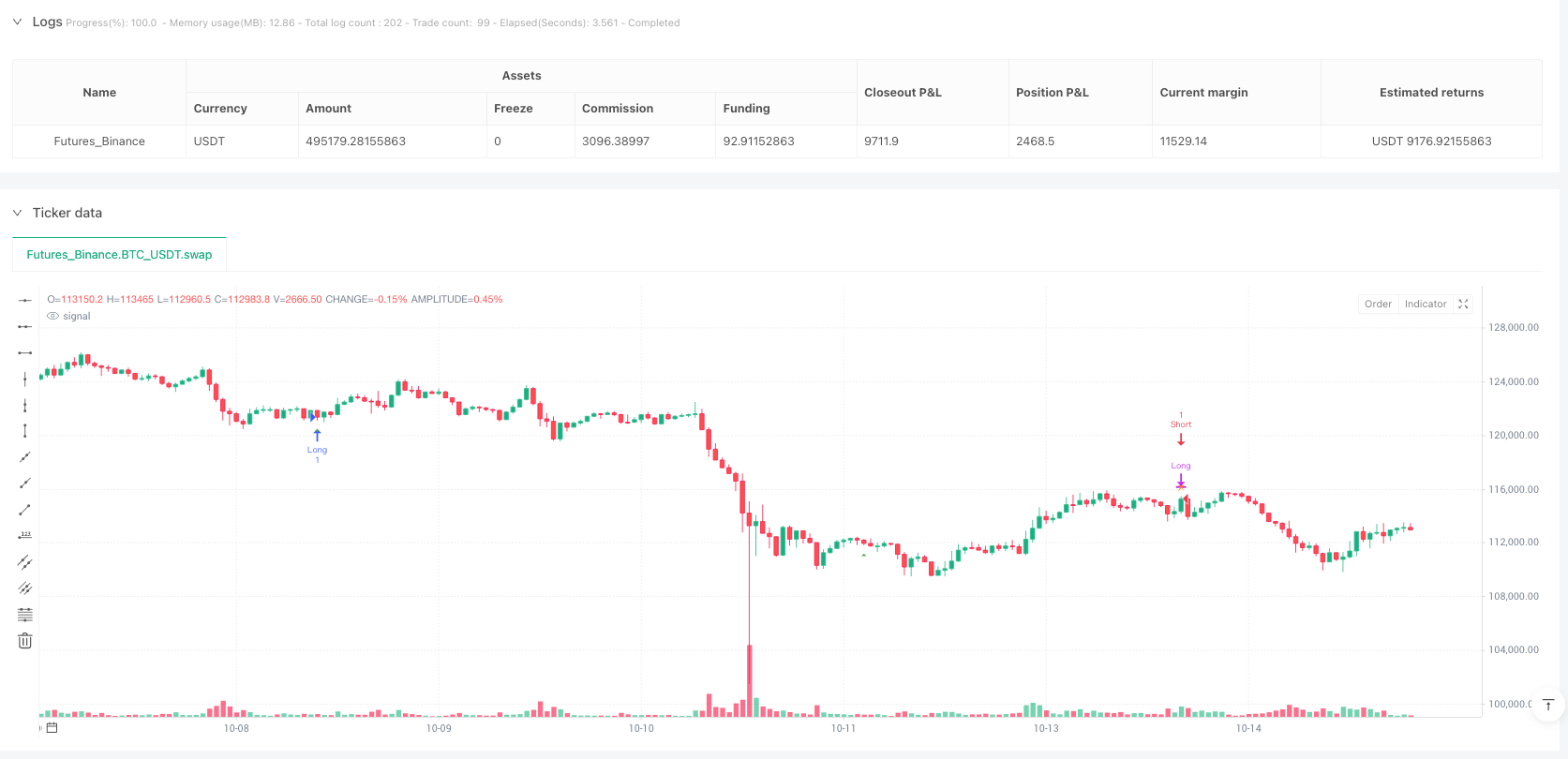

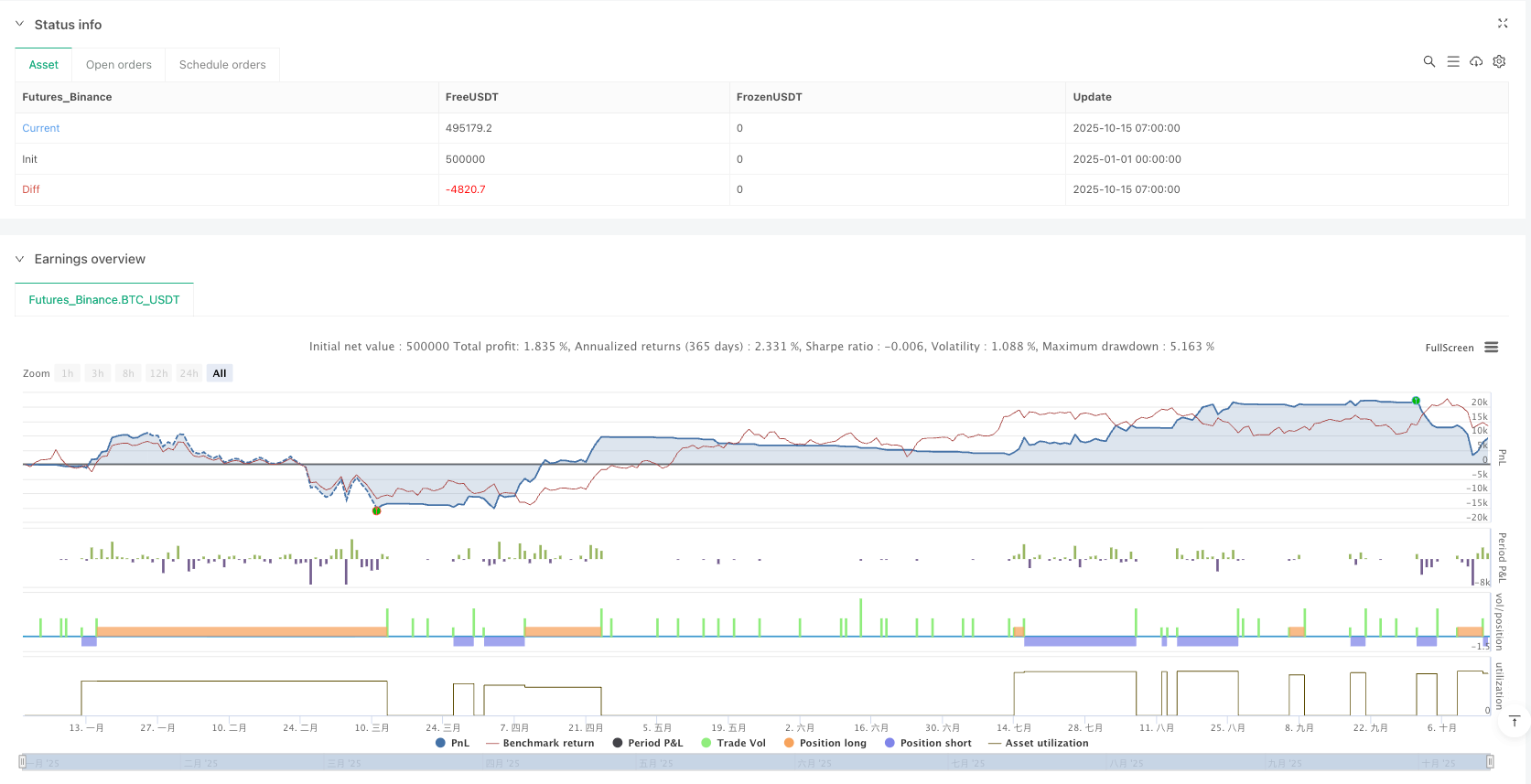

/*backtest

start: 2025-01-01 00:00:00

end: 2025-10-15 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":500000}]

*/

//@version=6

strategy("Two-Pole Threshold Entries + Opposite-Signal & Stop Exits + Stats",

overlay=true,

max_labels_count=500)

// === Inputs ===

length = input.int(20, minval=1, title="Filter Length")

buyTrig = input.float(-0.8, title="Buy Threshold (osc ↑)")

sellTrig = input.float( 0.8, title="Sell Threshold (osc ↓)")

stopLossPts = input.int(10, minval=1, title="Stop Loss (pts)")

// === Two-Pole Oscillator ===

sma25 = ta.sma(close, 25)

dev = (close - sma25) - ta.sma(close - sma25, 25)

norm = dev / ta.stdev(close - sma25, 25)

alpha = 2.0 / (length + 1)

var float s1 = na

var float s2 = na

s1 := na(s1) ? norm : (1 - alpha) * s1 + alpha * norm

s2 := na(s2) ? s1 : (1 - alpha) * s2 + alpha * s1

osc = s2

prevOsc = osc[4]

// === Trigger Cross Signals ===

isLongSig = ta.crossover(osc, buyTrig) and barstate.isconfirmed

isShortSig = ta.crossunder(osc, sellTrig) and barstate.isconfirmed

// === State & Stats Vars ===

var int tradeDir = 0 // 1=long, -1=short, 0=flat

var float entryPrice = na

var int entryBar = na

var int buyTotal = 0

var int buyFailed = 0

var float sumMoveB = 0.0

var int cntMoveB = 0

var float sumPLptsB = 0.0

var int sellTotal = 0

var int sellFailed = 0

var float sumMoveS = 0.0

var int cntMoveS = 0

var float sumPLptsS = 0.0

// === Exit Marker Flags ===

var bool longStopHit = false

var bool shortStopHit = false

var bool longSigExit = false

var bool shortSigExit = false

longStopHit := false

shortStopHit := false

longSigExit := false

shortSigExit := false

// === 1) Opposite-Signal Exit ===

if tradeDir == 1 and isShortSig

float ptsL = close - entryPrice

sumMoveB += ptsL

sumPLptsB += ptsL

cntMoveB += 1

strategy.close("Long")

longSigExit := true

tradeDir := 0

if tradeDir == -1 and isLongSig

float ptsS = entryPrice - close

sumMoveS += ptsS

sumPLptsS += ptsS

cntMoveS += 1

strategy.close("Short")

shortSigExit := true

tradeDir := 0

// === 2) 5-Bar, Bar-Close 10-pt Stop Exit ===

inWindow = (tradeDir != 0) and (bar_index <= entryBar + 5)

longStopPrice = entryPrice - stopLossPts

shortStopPrice = entryPrice + stopLossPts

if tradeDir == 1 and inWindow and close <= longStopPrice

buyFailed += 1

sumPLptsB -= stopLossPts

strategy.close("Long")

longStopHit := true

tradeDir := 0

if tradeDir == -1 and inWindow and close >= shortStopPrice

sellFailed += 1

sumPLptsS -= stopLossPts

strategy.close("Short")

shortStopHit := true

tradeDir := 0

// === 3) New Entries (only when flat) ===

if tradeDir == 0 and isLongSig

buyTotal += 1

entryPrice := close

entryBar := bar_index

strategy.entry("Long", strategy.long)

tradeDir := 1

if tradeDir == 0 and isShortSig

sellTotal += 1

entryPrice := close

entryBar := bar_index

strategy.entry("Short", strategy.short)

tradeDir := -1

// === Stats Computation ===

float avgMoveB = cntMoveB > 0 ? sumMoveB / cntMoveB : na

float successPctB = buyTotal > 0 ? (buyTotal - buyFailed) / buyTotal * 100 : na

float pnlUSD_B = sumPLptsB * 50.0

float avgMoveS = cntMoveS > 0 ? sumMoveS / cntMoveS : na

float successPctS = sellTotal > 0 ? (sellTotal - sellFailed) / sellTotal * 100 : na

float pnlUSD_S = sumPLptsS * 50.0

string tf = timeframe.period

// === On-Chart Markers ===

plotshape(isLongSig, title="Long Entry", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

plotshape(isShortSig, title="Short Entry", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

plotshape(longSigExit, title="Exit on Sell Sig", style=shape.xcross, location=location.abovebar, color=color.orange, size=size.tiny)

plotshape(shortSigExit, title="Exit on Buy Sig", style=shape.xcross, location=location.belowbar, color=color.orange, size=size.tiny)

plotshape(longStopHit, title="Stop Exit Long", style=shape.xcross, location=location.abovebar, color=color.purple, size=size.tiny)

plotshape(shortStopHit, title="Stop Exit Short", style=shape.xcross, location=location.belowbar, color=color.purple, size=size.tiny)