🔱 What is the Pitchfork Strategy? Precise as Poseidon’s Trident!

Did you know? This strategy works like the ancient Greek sea god Poseidon’s trident - a powerful trading weapon built from three key points! 📈 It identifies three important market turning points (pivot points) and draws a “trident-shaped” channel to help you capture golden breakout opportunities.

Imagine setting up a simple tent at the beach with three sticks 🏕️ - one main support pole and two others forming the tent boundaries. When the wind (price) breaks through the tent boundaries, that’s our signal to act!

📊 Core Strategy Logic: Three Points Define Everything

Key Point! The essence of this strategy lies in: - 🎯 Smart Pivot Detection: Automatically finds market highs and lows, ensuring they alternate (no consecutive highs or lows) - 📐 Pitchfork Construction: Uses three points to draw median line, upper line, and lower line, forming a price channel - 💥 Breakout Signals: Go long when price breaks above upper line, go short when it breaks below lower line - 🛡️ Risk Control: Stop loss at median line, take profit at 1:1 ratio

It’s like observing crowd flow at a busy subway station 🚇, watching three key nodes to predict which direction the crowd will surge!

🎪 Entry Timing: Catching the Breakout Moment

Pitfall Guide: Not every breakout is worth chasing!

Long Conditions: - Price breaks above pitchfork upper line ⬆️ - Overall trend is upward (positive median line slope) - Like joining a fast-moving bubble tea queue when it suddenly accelerates!

Short Conditions: - Price breaks below pitchfork lower line ⬇️ - Overall trend is downward (negative median line slope) - Like following the crowd toward exits when a concert ends

💰 Risk Management: Only Risk 1% Per Trade

The most thoughtful aspect of this strategy is its built-in scientific money management! 🧮

- Risk Control: Only risk 1% of account capital per trade

- Stop Loss Placement: Set at pitchfork median line, giving price room to breathe

- Profit Target: 1:1 risk-reward ratio, steady without being greedy

- Position Sizing: Automatically adjusts trade size based on stop distance

It’s like riding a roller coaster at an amusement park 🎢 - you must fasten your safety belt (stop loss), but still leave room for excitement!

🌟 Strategy Advantages: Why Is It So Popular?

- High Objectivity: Purely based on price action, unaffected by emotions

- Great Adaptability: Works on any timeframe, from minutes to weekly charts

- Controllable Risk: Built-in money management prevents major losses from single mistakes

- Simple Operation: Clear signals that even beginners can quickly master

Remember, trading is like learning to ride a bicycle 🚴♀️ - you might fall at first, but once you find balance, you can ride freely! This pitchfork strategy serves as your “training wheels,” helping you maintain balance while navigating the markets.

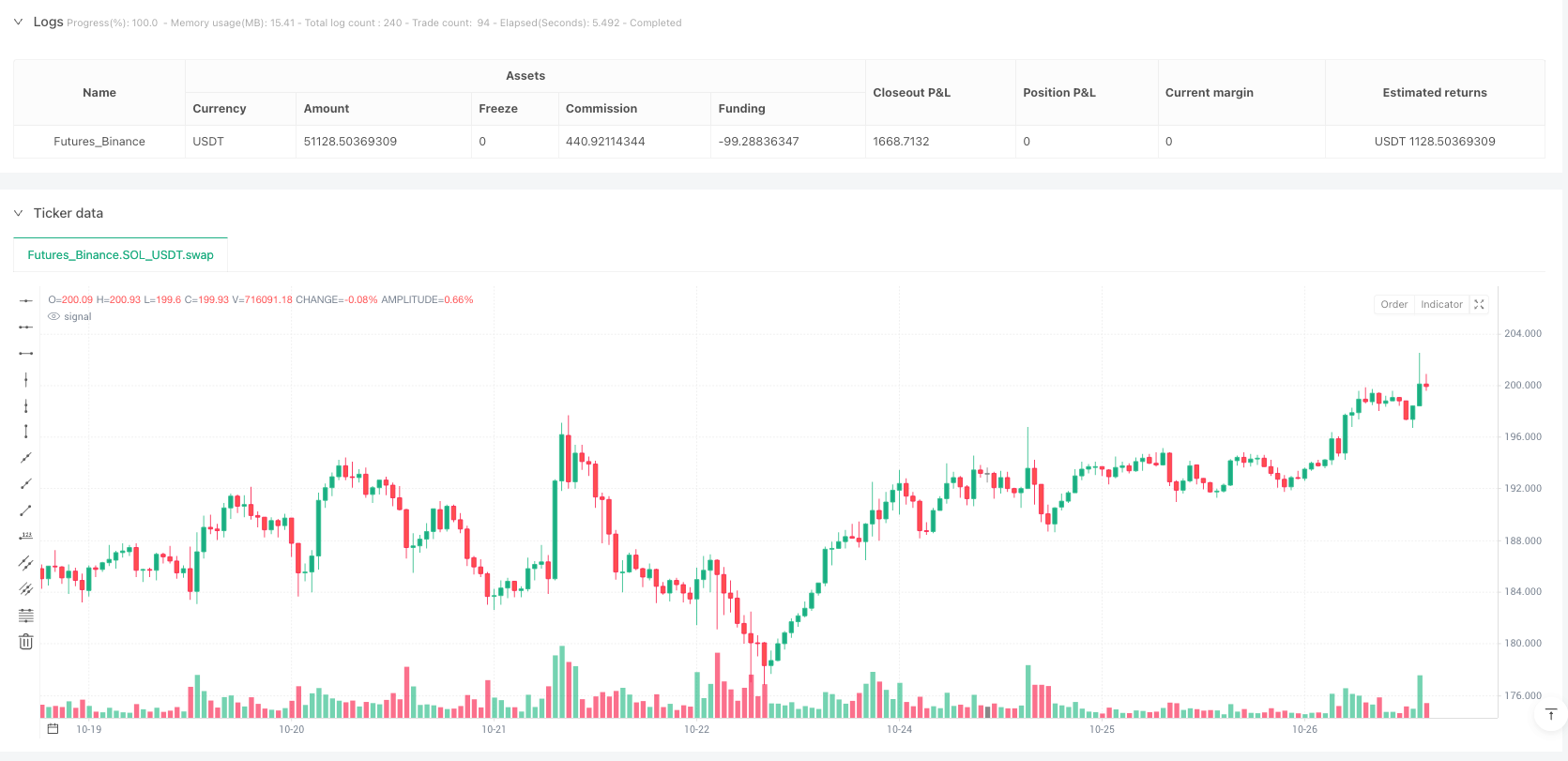

/*backtest

start: 2024-10-29 00:00:00

end: 2025-10-27 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Pitchfork Trading Friends",

overlay=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=100) // We will calculate size manually

// === 1. INPUTS ===

leftBars = input.int(10, "Pivot Left Bars", minval=1)

rightBars = input.int(10, "Pivot Right Bars", minval=1)

riskPercent = input.float(1.0, "Risk Per Trade %", minval=0.1, step=0.1)

// === 2. PIVOT DETECTION & STORAGE ===

// Find pivot points

float ph = ta.pivothigh(high, leftBars, rightBars)

float pl = ta.pivotlow(low, leftBars, rightBars)

// Store the last 3 pivots (P1, P2, P3)

var float p1_price = na

var int p1_bar = na

var float p2_price = na

var int p2_bar = na

var float p3_price = na

var int p3_bar = na

var int lastPivotType = 0 // 0=none, 1=high, -1=low

// Update pivots when a new one is found, ensuring they alternate

if not na(ph) and lastPivotType != 1

p1_price := p2_price

p1_bar := p2_bar

p2_price := p3_price

p2_bar := p3_bar

p3_price := ph

p3_bar := bar_index[rightBars]

lastPivotType := 1

if not na(pl) and lastPivotType != -1

p1_price := p2_price

p1_bar := p2_bar

p2_price := p3_price

p2_bar := p3_bar

p3_price := pl

p3_bar := bar_index[rightBars]

lastPivotType := -1

// === 3. PITCHFORK CALCULATION & DRAWING ===

// We need 3 valid points to draw

bool has3Pivots = not na(p1_bar) and not na(p2_bar) and not na(p3_bar)

// Declare lines

var line medianLine = na

var line upperLine = na

var line lowerLine = na

// Declare line prices for strategy logic

var float ml_price = na

var float ul_price = na

var float ll_price = na

if (has3Pivots)

// P1, P2, P3 coordinates

p1_y = p1_price

p1_x = p1_bar

p2_y = p2_price

p2_x = p2_bar

p3_y = p3_price

p3_x = p3_bar

// Calculate midpoint of P2-P3

mid_y = (p2_y + p3_y) / 2.0

mid_x = (p2_x + p3_x) / 2.0

// Calculate Median Line (ML) slope

float ml_slope = (mid_y - p1_y) / (mid_x - p1_x)

// Calculate price on current bar for each line

// y = m*(x - x_n) + y_n

ml_price := ml_slope * (bar_index - p1_x) + p1_y

// Identify which pivot is high (P2 or P3)

float highPivot_y = p2_y > p3_y ? p2_y : p3_y

int highPivot_x = p2_y > p3_y ? p2_x : p3_x

float lowPivot_y = p2_y < p3_y ? p2_y : p3_y

int lowPivot_x = p2_y < p3_y ? p2_x : p3_x

// Upper/Lower line prices

ul_price := ml_slope * (bar_index - highPivot_x) + highPivot_y

ll_price := ml_slope * (bar_index - lowPivot_x) + lowPivot_y

// === 4. STRATEGY LOGIC ===

// Define trend by pitchfork slope

bool trendUp = ml_slope > 0

bool trendDown = ml_slope < 0

// Entry Conditions

bool longEntry = ta.crossover(close, ul_price) // Breakout

bool shortEntry = ta.crossunder(close, ll_price) // Breakdown

// Risk Calculation

float capital = strategy.equity

float riskAmount = (capital * riskPercent) / 100

// --- LONG TRADE ---

if (longEntry and trendUp)

float sl_price = ml_price // SL at median line

float stop_loss_pips = close - sl_price

float tp_price = close + stop_loss_pips // 1:1 TP

// Calculate position size

float positionSize = riskAmount / (stop_loss_pips * syminfo.pointvalue)

if (positionSize > 0)

strategy.entry("Long", strategy.long, qty=positionSize)

strategy.exit("SL/TP Long", from_entry="Long", stop=sl_price, limit=tp_price)

// --- SHORT TRADE ---

if (shortEntry and trendDown)

float sl_price = ml_price // SL at median line

float stop_loss_pips = sl_price - close

float tp_price = close - stop_loss_pips // 1:1 TP

// Calculate position size

float positionSize = riskAmount / (stop_loss_pips * syminfo.pointvalue)

if (positionSize > 0)

strategy.entry("Short", strategy.short, qty=positionSize)

strategy.exit("SL/TP Short", from_entry="Short", stop=sl_price, limit=tp_price)