🎯 What’s This Strategy Really Doing?

You know what? There’s a group of “smart money” in the market that loves setting traps at key levels! This strategy works like an experienced hunter, specifically identifying these traps and trading in reverse. Simply put, when price deliberately “fakes out” important support/resistance levels and quickly snaps back, we follow the big money’s rhythm!

📊 Triple Filter System Revealed

Key point! This strategy uses three layers of protection:

🔸 Trend Filter: 200-period EMA acts like an experienced driver, telling you whether you’re on an uphill or downhill road

🔸 Key Level Identification: Automatically finds those “strategically important” support and resistance zones

🔸 Liquidity Sweep Detection: Catches the deliberate “fake moves” created by big money

It’s like fishing - you need to know where the fish are, what bait to use, and when to reel in!

🎪 The Magic of Liquidity Sweeps

Imagine this: you’re queuing for bubble tea when someone suddenly shouts “Free drinks!” Everyone rushes over, only to find it’s fake, but smart people have already cut to the front of the line.

Markets work the same way! Price first “pretends” to break below support (sweeping stop losses), then quickly recovers - that’s the perfect entry moment. The strategy sets a 0.6x ATR buffer to ensure it’s truly a “sweep” and not a real breakout.

⚡ Risk Control: The Golden 1:2 Ratio

Pitfall Guide: Many traders are like driving without seatbelts - this strategy enforces a mandatory 1:2 risk-reward ratio!

- Stop loss set 0.5x ATR below key levels

- Take profit is 2x the stop loss distance

- Even with just 40% win rate, you’ll profit long-term!

🚀 Practical Application Tips

This strategy works best on 15-minute gold charts. Why? Because gold markets have good liquidity, obvious fake breakout patterns, and the 15-minute timeframe filters out excessive noise.

Remember: don’t be greedy! The strategy finds you good positions - leave the rest to the market and time!

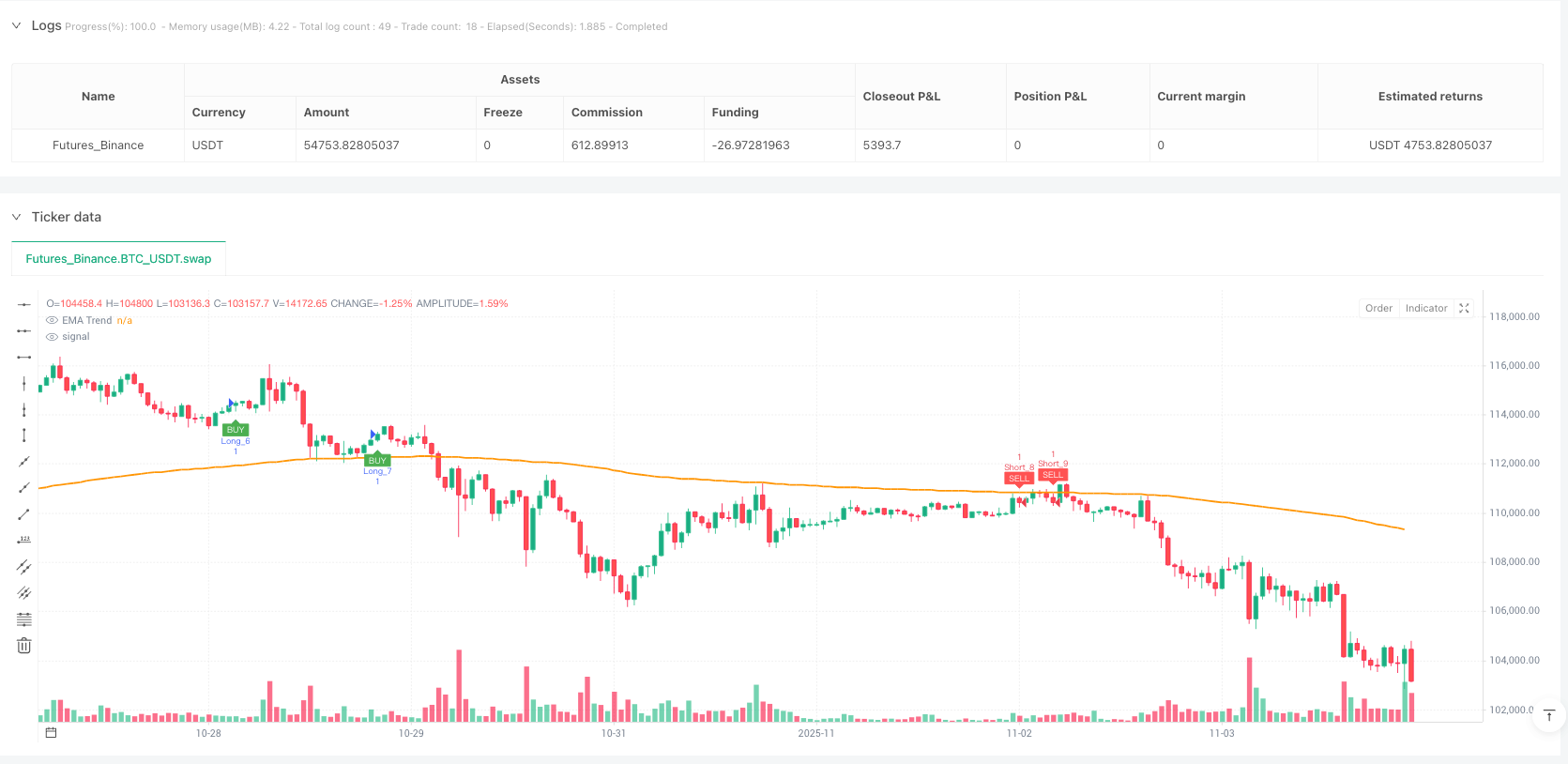

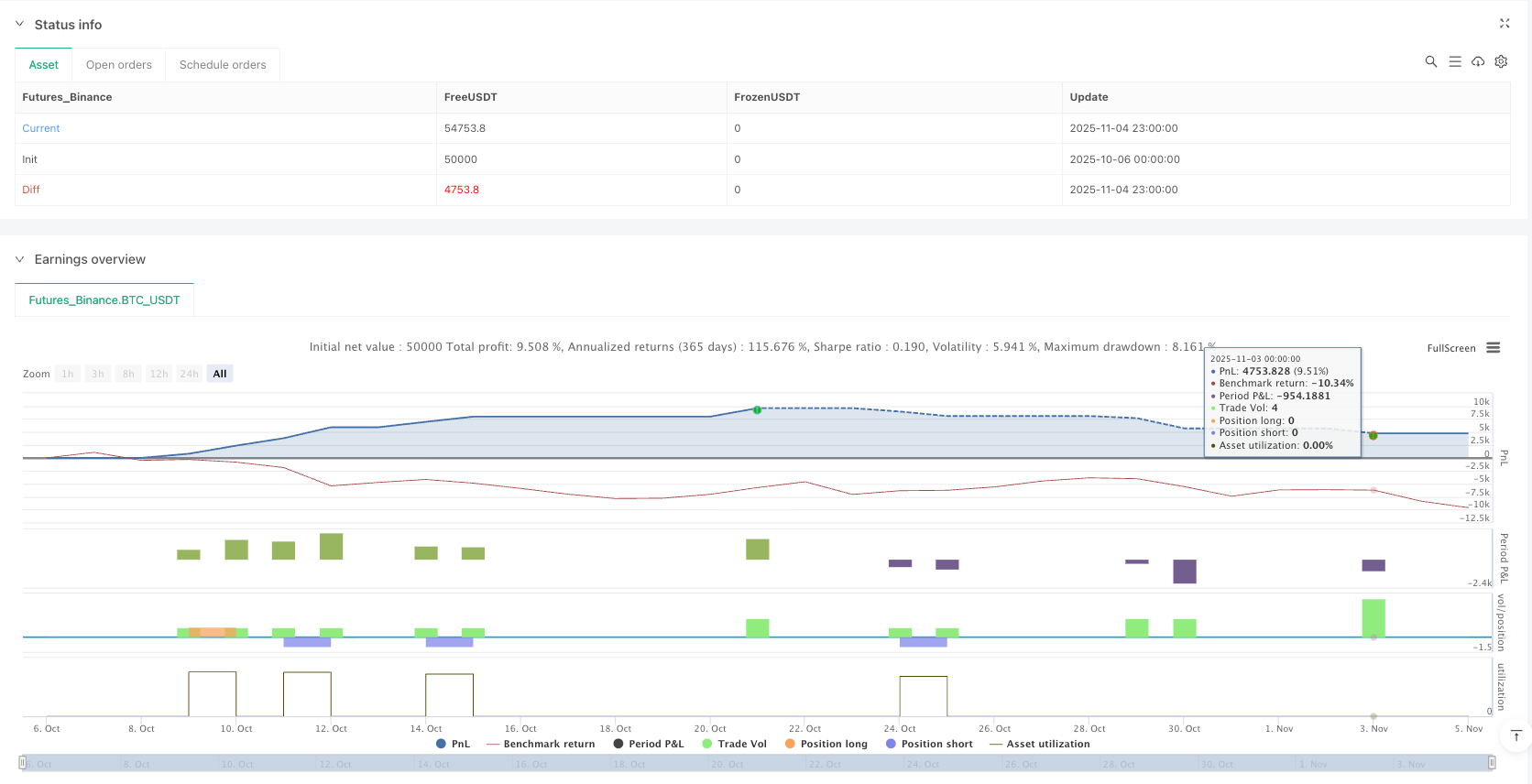

/*backtest

start: 2025-10-06 00:00:00

end: 2025-11-05 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Gold 15m: Trend + S/R + Liquidity Sweep (RR 1:2)", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1, commission_type=strategy.commission.percent, commission_value=0.0)

// ---------------------- INPUTS ----------------------

symbol_input = input.string(title="Symbol (for reference only)", defval="XAUUSD")

tf_note = input.timeframe(title="Intended timeframe", defval="15")

ema_len = input.int(200, "Trend EMA length", minval=50)

pivot_left = input.int(5, "Pivot left bars", minval=1)

pivot_right = input.int(5, "Pivot right bars", minval=1)

sweep_atr_mult = input.float(0.6, "Liquidity sweep buffer (ATR ×)", step=0.1)

sl_atr_mult = input.float(0.5, "SL buffer beyond pivot (ATR ×)", step=0.1)

min_sweep_bars = input.int(1, "Max bars between sweep and reclaim", minval=1)

use_only_trend = input.bool(true, "Only trade with trend (EMA filter)")

rr = input.float(2.0, "Reward/Risk (TP = RR × Risk)", minval=1.0, step=0.1)

enable_long = input.bool(true, "Enable Longs")

enable_short = input.bool(true, "Enable Shorts")

show_zones = input.bool(true, "Plot pivots / zones")

// ---------------------- INDICATORS ----------------------

ema_trend = ta.ema(close, ema_len)

atr = ta.atr(14)

// ---------------------- PIVOT S/R DETECTION ----------------------

// Using builtin pivots: returns price of pivot when formed, else na

ph = ta.pivothigh(high, pivot_left, pivot_right)

pl = ta.pivotlow(low, pivot_left, pivot_right)

// We'll track last confirmed pivot prices and bar index

var float lastPivotHigh = na

var int lastPivotHighBar = na

var float lastPivotLow = na

var int lastPivotLowBar = na

if not na(ph)

lastPivotHigh := ph

lastPivotHighBar := bar_index - pivot_right

if not na(pl)

lastPivotLow := pl

lastPivotLowBar := bar_index - pivot_right

// ---------------------- LIQUIDITY SWEEP DETECTION ----------------------

// For a bullish liquidity sweep (buy):

// 1) Price makes a new low wick below lastPivotLow - (atr * sweep_atr_mult) (sweep candle)

// 2) Within `min_sweep_bars` the price reclaims: close > lastPivotLow => bullish signal

var int sweepLowBar = na

var int sweepHighBar = na

// detect sweep down (wick pierce)

isSweepDown = false

if not na(lastPivotLow)

// a candle with low sufficiently below pivot

isSweepDown := low < (lastPivotLow - atr * sweep_atr_mult)

// detect sweep up (wick pierce)

isSweepUp = false

if not na(lastPivotHigh)

isSweepUp := high > (lastPivotHigh + atr * sweep_atr_mult)

// record bar of sweep

if isSweepDown

sweepLowBar := bar_index

if isSweepUp

sweepHighBar := bar_index

// check reclaim after sweep: close back above pivot (buy reclaim) or close back below pivot (sell reclaim)

// ensure reclaim happens within `min_sweep_bars` bars after sweep

bullReclaim = false

bearReclaim = false

if not na(lastPivotLow) and not na(sweepLowBar)

if (bar_index - sweepLowBar) <= min_sweep_bars and close > lastPivotLow

bullReclaim := true

if not na(lastPivotHigh) and not na(sweepHighBar)

if (bar_index - sweepHighBar) <= min_sweep_bars and close < lastPivotHigh

bearReclaim := true

// ---------------------- TREND FILTER ----------------------

in_uptrend = close > ema_trend

in_downtrend = close < ema_trend

// final entry conditions

longCondition = enable_long and bullReclaim and (not use_only_trend or in_uptrend)

shortCondition = enable_short and bearReclaim and (not use_only_trend or in_downtrend)

// Note: variable name required by Pine, we set from input

use_only_trend := use_only_trend // no-op to fix linter if needed

// ---------------------- ORDER EXECUTION & SL/TP CALC ----------------------

var int tradeId = 0

// For buy: SL = lastPivotLow - (atr * sl_atr_mult)

// risk = entry - SL

// TP = entry + rr * risk

if longCondition

// compute SL and TP

sl_price = lastPivotLow - atr * sl_atr_mult

entry_price = close

risk_amt = entry_price - sl_price

tp_price = entry_price + (risk_amt * rr)

// safety: only place trade if positive distances

if risk_amt > 0 and tp_price > entry_price

tradeId += 1

// send entry and exit with stop & limit

strategy.entry("Long_"+str.tostring(tradeId), strategy.long)

strategy.exit("ExitLong_"+str.tostring(tradeId), from_entry="Long_"+str.tostring(tradeId), stop=sl_price, limit=tp_price)

// For sell: SL = lastPivotHigh + (atr * sl_atr_mult)

// risk = SL - entry

// TP = entry - rr * risk

if shortCondition

sl_price_s = lastPivotHigh + atr * sl_atr_mult

entry_price_s = close

risk_amt_s = sl_price_s - entry_price_s

tp_price_s = entry_price_s - (risk_amt_s * rr)

if risk_amt_s > 0 and tp_price_s < entry_price_s

tradeId += 1

strategy.entry("Short_"+str.tostring(tradeId), strategy.short)

strategy.exit("ExitShort_"+str.tostring(tradeId), from_entry="Short_"+str.tostring(tradeId), stop=sl_price_s, limit=tp_price_s)

// ---------------------- PLOTTING ----------------------

// EMA (trend)

plot(ema_trend, title="EMA Trend", linewidth=2)

// arrows and markers for entries

plotshape(longCondition, title="Buy Signal", location=location.belowbar, style=shape.labelup, text="BUY", textcolor=color.white, size=size.tiny, color=color.green)

plotshape(shortCondition, title="Sell Signal", location=location.abovebar, style=shape.labeldown, text="SELL", textcolor=color.white, size=size.tiny, color=color.red)

// plot last SL/TP lines for last trade (visual reference)

// find last open position and plot currently active SL/TP if any

if strategy.position_size > 0

last_sl = strategy.position_avg_price - (strategy.position_avg_price - (lastPivotLow - atr * sl_atr_mult))

// instead use exit order price from last exit? Simpler: plot SL/TP computed earlier if long

// This may plot approximate lines; TradingView native order lines will also display.

// We skip redundant plotting to avoid confusion.