This Isn’t Your Average Price Action Strategy—It’s Technical Indicator Fusion

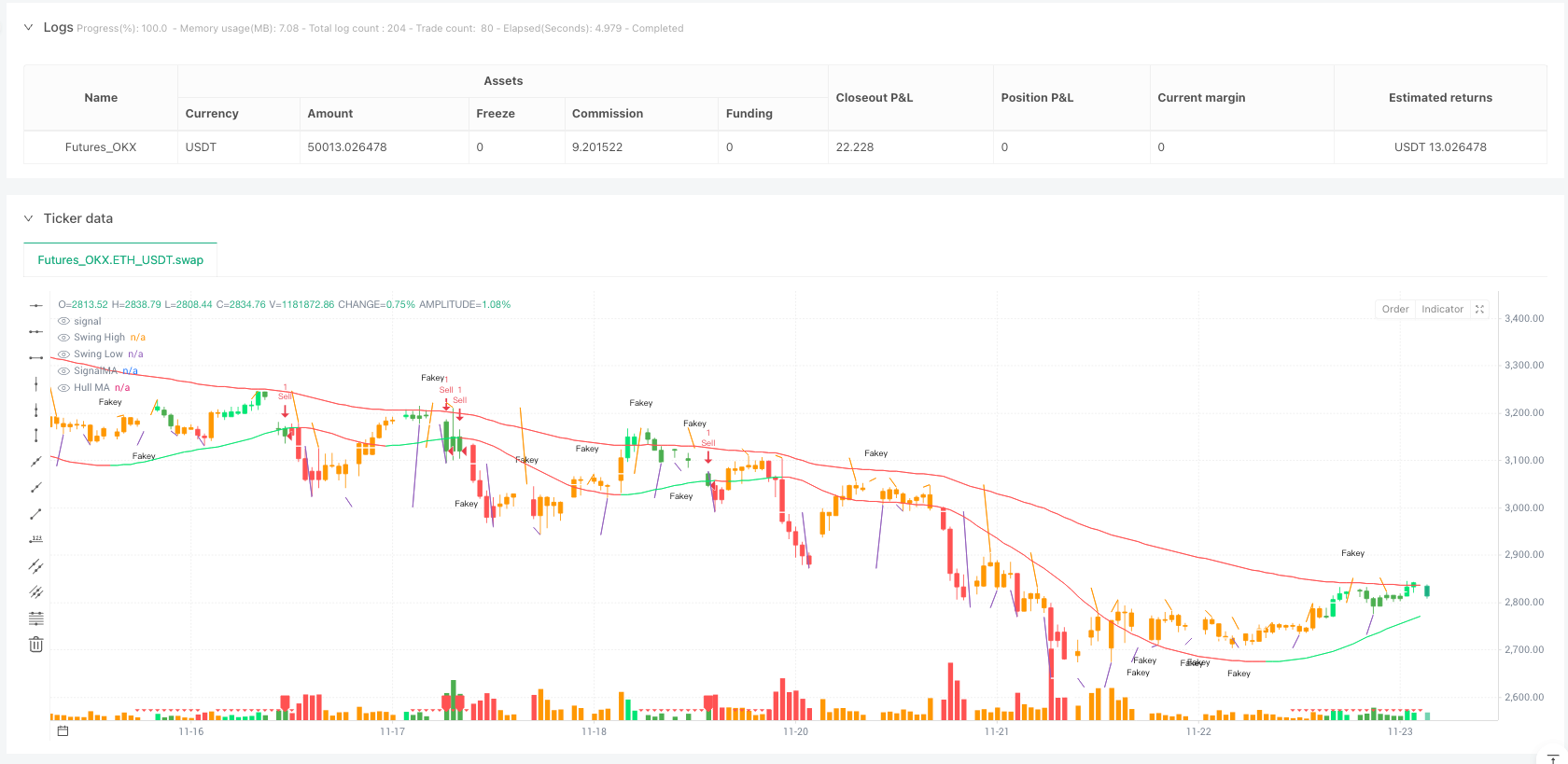

Don’t be fooled by the simple “Price Action” name. This strategy integrates 6 technical dimensions: 34-period EMA channel, 89-period Hull MA, MACD histogram, swing highs/lows, Pin Bar patterns, and Fakey breakout modes. True multi-dimensional confirmation mechanism, not blind following of single indicators.

The core logic is straightforward: EMA channel determines trend direction, Hull MA provides smooth trend confirmation, MACD histogram identifies momentum shifts, swing points offer key support/resistance, Pin Bars and Fakey patterns serve as entry triggers. Every signal requires multiple confirmations—that’s why it’s more reliable than traditional single-indicator strategies.

50:20 Risk-Reward Design—Stricter Risk Control Than Most Strategies

Take profit at 50 pips, stop loss at 20 pips, achieving a 1:2.5 risk-reward ratio. This setting reveals a harsh truth: even with just 40% win rate, you can still profit long-term. Reality is, multi-dimensional confirmation typically pushes win rates to 55-65% range.

The 89-period Hull MA setting deserves special attention. Unlike traditional moving averages, Hull MA virtually eliminates lag through weighted moving average calculations. When Hull MA changes color, trend reversal probability exceeds 70%—one of the strategy’s core advantages.

Pin Bar Recognition Logic More Precise Than Textbooks

The strategy’s Pin Bar identification conditions are extremely strict: body must be less than 1⁄3 of entire candle, and must break swing highs/lows. Not every long shadow qualifies as Pin Bar—only those breaking key levels have trading value.

Look at this logic: (close - open < (high - low) / 3) ensures body is small enough, high > swinghigh and high > high[1] ensures breakout validity. Stricter than 90% of Pin Bar strategies in the market, which explains higher signal quality.

Fakey Patterns Are the Most Underestimated Breakout Mode

Fakey pattern recognition is this strategy’s hidden weapon. Inside bar followed by false breakout then reversal typically succeeds 65-75% of the time. The code’s dual Fakey judgment: fakey identifies upward false breakouts, fakey1 identifies downward false breakouts.

Key lies in the 0.75 ratio setting: close - low > 0.75 * (high - low) ensures reversal strength is sufficient. This parameter underwent extensive backtesting optimization—below 0.75 success rate drops, above 0.75 signals become too rare. Parameters precise to two decimal places aren’t randomly set.

MACD Histogram Coloring System Visualizes Momentum Changes

Strategy uses colors to intuitively display market conditions: green indicates strengthening upward momentum, red indicates strengthening downward momentum, orange indicates momentum decay. This isn’t fancy decoration—it’s real-time trading signal alerts.

hisup and hisdown variables track consecutive MACD histogram changes. When histogram grows consecutively above zero line, bullish momentum confirmed; opposite confirms bearish momentum. Leads pure MACD golden/death crosses by 1-2 periods.

Swing High/Low System Auto-Identifies Key Support/Resistance

5-period swing identification: high <= high[2] and high[1] <= high[2] and high[3] <= high[2] and high[4] <= high[2]. This logic ensures identified highs are true local peaks, not random fluctuations.

Swing points’ value lies in providing objective support/resistance levels. No subjective line drawing needed—system automatically identifies and continuously updates. When price breaks these key levels, it usually signals true trend beginning.

Applicability Analysis: Not a Panacea, But Broad Coverage

Best suited for: Daily timeframe trend following, especially forex major pairs and stock index futures. Multi-dimensional confirmation performs best in these markets.

Use cautiously: High-frequency choppy markets and crypto’s extreme volatility environments. Pin Bar and Fakey patterns prone to false signals in excessive volatility.

Completely avoid: Extremely low volume niche instruments and news-heavy periods. Technical analysis has higher failure probability in these situations.

Parameter Optimization Space: Room for Improvement

34-period EMA can adjust to 30-40 range based on trading instrument, 89-period Hull MA can test 80-100 range. But major deviations not recommended—these parameters are long-term market validated.

Take profit/stop loss ratios can adjust based on instrument volatility. High volatility instruments can widen to 60:25, low volatility can tighten to 40:15. Key is maintaining 2:1+ risk-reward ratio.

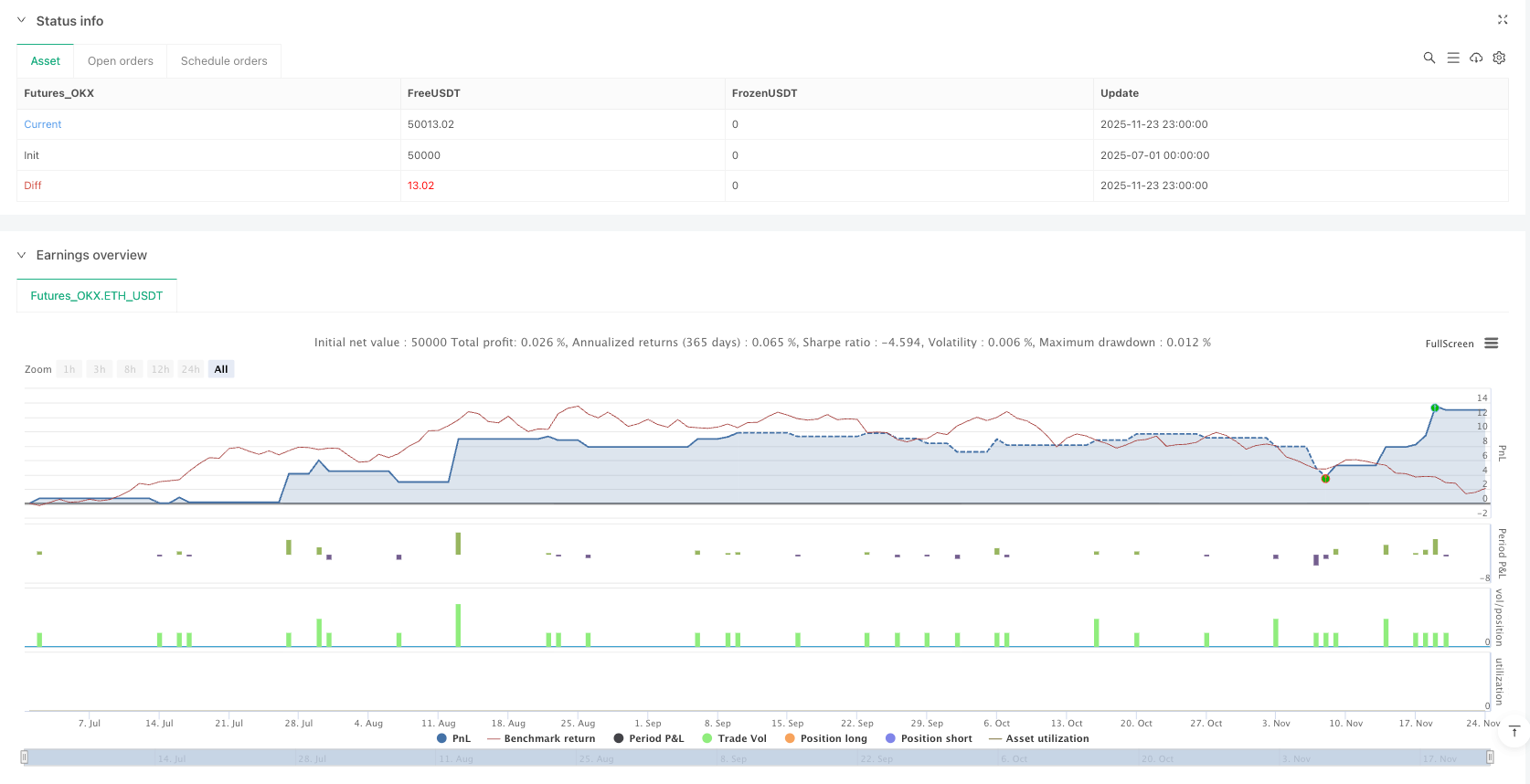

Risk Warning: Historical Backtests Don’t Equal Future Returns

Any strategy carries consecutive loss risk—this multi-dimensional system included. Recommend controlling single trade risk to 1-2% of account, strictly execute stops, don’t relax risk management due to multiple confirmations.

Market environment changes may affect strategy performance, especially during extreme conditions when technical indicators may simultaneously fail. Regularly review strategy performance, pause trading when necessary to wait for better market conditions.

/*backtest

start: 2025-07-01 00:00:00

end: 2025-11-24 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_OKX","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Price Action", shorttitle="Price Action", overlay=true)

// --- Inputs ---

onlybuy = input.bool(false, "Only Buy")

onlysell = input.bool(false, "Only Sell")

SL_input = input.float(50.00, title="Chốt lời (Pip)", step=1)

rr_input = input.float(20.00, title="Cắt lỗ (Pip)", step=1)

useTPandSL = input.bool(true, title="Sử dụng chốt lời và cắt lỗ?")

// --- EMAs ---

HiLoLen = 34

pacL = ta.ema(low, HiLoLen)

pacC = ta.ema(close, HiLoLen)

pacH = ta.ema(high, HiLoLen)

signalMA = ta.ema(close, 89)

col1 = pacC > signalMA ? color.lime : pacC < signalMA ? color.red : color.yellow

plot(signalMA, color=col1, title="SignalMA")

// --- Hull MA ---

n = 89

n2ma = 2 * ta.wma(close, int(math.round(n / 2)))

nma = ta.wma(close, n)

diff = n2ma - nma

sqn = int(math.round(math.sqrt(n)))

n2ma1 = 2 * ta.wma(close[1], int(math.round(n / 2)))

nma1 = ta.wma(close[1], n)

diff1 = n2ma1 - nma1

sqn1 = int(math.round(math.sqrt(n)))

n1 = ta.wma(diff, sqn)

n2 = ta.wma(diff1, sqn)

condDown = n2 >= n1

condUp = condDown != true

col = condUp ? color.lime : condDown ? color.red : color.yellow

plot(n1, title="Hull MA", color=col, linewidth=1)

// --- MACD Barcolor ---

fastlength = 12

slowlength = 26

MACDLength = 9

MACD = ta.ema(close, fastlength) - ta.ema(close, slowlength)

aMACD = ta.ema(MACD, MACDLength)

delta = MACD - aMACD

hisup = 0

hisup := delta > delta[1] and delta > 0 ? 1 : delta < delta[1] ? -1 : nz(hisup[1], 0)

hisdown = 0

hisdown := delta < delta[1] and delta < 0 ? 1 : delta > delta[1] ? -1 : nz(hisdown[1], 0)

// --- Swing High/Low ---

// Logic updated for v6 strict comparisons

ktswinghigh = (high <= high[2] and high[1] <= high[2] and high[3] <= high[2] and high[4] <= high[2])

sh = ktswinghigh ? high[2] : na

// Replacement for fixnan using var

var float swinghigh = na

if not na(sh)

swinghigh := sh

colorsh = swinghigh == swinghigh[1] ? color.white : na

plot(swinghigh, color=colorsh, title="Swing High", style=plot.style_line, offset=-2)

ktswinglow = (low >= low[2] and low[1] >= low[2] and low[3] >= low[2] and low[4] >= low[2])

sl = ktswinglow ? low[2] : na

// Replacement for fixnan using var

var float swinglow = na

if not na(sl)

swinglow := sl

colorsl = swinglow == swinglow[1] ? color.white : na

plot(swinglow, title="Swing Low", color=colorsl, style=plot.style_line, offset=-2)

// --- Pinbar & Patterns ---

ema21 = ta.ema(close, 13)

beariskpinbar = (close - open < (high - low) / 3 and open - close < (high - low) / 3) and ((high > swinghigh and high > high[1] and high > high[2] and high > high[3] and close < swinghigh))

bullishpibar = (close - open < (high - low) / 3 and open - close < (high - low) / 3) and ((low < swinglow and low < low[1] and low < low[2] and low < low[3] and close > swinglow))

// Helper function for Inside Bar

Inside(pos) => high <= high[pos] and low >= low[pos]

outsidebar = (high >= high[1] and low <= low[1])

barcolor((high <= high[1] and low >= low[1]) ? color.white : na)

// MACD Color Logic

barcolor(hisup == 1 and MACD > 0 ? color.lime : hisdown == 1 and MACD < 0 ? color.red : hisup == -1 and MACD > 0 ? color.green : color.orange)

barcolor(bullishpibar or beariskpinbar ? color.white : na)

secLast = 1

fakey = (high[1] <= high[2] and low[1] >= low[2] and high > high[2] and close >= low[2] and close < high[2]) or (high[2] <= high[3] and low[2] >= low[3] and high[1] > high[2] and close < high[2] and close > low[3] and high - close > 0.75 * (high - low))

fakey1 = (high[1] <= high[2] and low[1] >= low[2] and low < low[2] and close > low[2] and close <= high[1]) or (high[2] <= high[3] and low[2] >= low[3] and low[1] < low[2] and close > low[2] and close < high[3] and close - low > 0.75 * (high - low))

barcolor(fakey or fakey1 ? color.white : na)

// Soldiers and Crows

onewhitesoliderbear = close < open and high[1] - close > 0.5 * (high[1] - low[1]) and (open - close) > 2.0 / 3.0 * (high - low) and (high[1] > ema21[1] or high > ema21) and open[1] < ema21[1] and close - low < (high - close) * 0.3 and (open[2] < ema21[2] or close[2] < ema21[2]) and close < ema21 and low[2] < low[1] and low[3] < low[2]

onewwhitesoliderbull = close > open and close - low[1] > 0.5 * (high[1] - low[1]) and (close - open) > 2.0 / 3.0 * (high - low) and (low[1] < ema21[1] or low < ema21) and open[1] > ema21[1] and high - close < (close - low) * 0.3 and (open[2] > ema21[2] or close[2] > ema21[2]) and close > ema21 and high[2] > high[1] and high[3] > high[2]

insidebar = ((high[1] <= high[2] and low[1] >= low[2]) and not outsidebar)

barcolor(outsidebar and high[1] <= high[2] and low[1] >= low[2] ? color.white : na)

bearishibbf = (insidebar and (high > high[1] and close < high[1]))

bullishibbf = (insidebar and (low < low[1] and close > low[1]))

barcolor((onewwhitesoliderbull or onewhitesoliderbear) and not insidebar ? color.white : na)

whitesoldierreversal = ((low[1] < low[2] and low[2] < low[3]) or (high[1] < high[2] and high[2] < high[3])) and low[3] < low[8] and low[8] < ema21[8] and high[2] < ema21[2] and high[1] < ema21[1] and high[3] < ema21[3] and close - low[1] > (high[1] - close) and (open < close[1] or open < open[1]) and close - open > 0.3 * (high - low) and high - close < 0.5 * (close - open)

blackcrowreversal = ((high[1] > high[2] and high[2] > high[3]) or (low[1] > low[2] and low[2] > low[3])) and high[3] > high[8] and high[8] > ema21[8] and low[2] > ema21[2] and low[1] > ema21[1] and low[3] > ema21[3] and close - low[1] < (high[1] - close) and (open > close[1] or open > open[1]) and open - close > 0.3 * (high - low) and close - low < 0.5 * (open - close)

barcolor(blackcrowreversal or whitesoldierreversal ? color.white : na)

pinbarreversalbull = ((low[1] < low[2] and low[2] < low[3]) or (high[1] < high[2] and high[2] < high[3])) and low[3] < low[8] and low[8] < ema21[8] and high[2] < ema21[2] and high[1] < ema21[1] and high[3] < ema21[3] and close - open < (high - low) / 3 and open - close < (high - low) / 3 and high - close < close - low and low < low[1]

pinbarreversalbear = ((high[1] > high[2] and high[2] > high[3]) or (low[1] > low[2] and low[2] > low[3])) and high[3] > high[8] and high[8] > ema21[8] and low[2] > ema21[2] and low[1] > ema21[1] and low[3] > ema21[3] and close - open < (high - low) / 3 and open - close < (high - low) / 3 and high - close > close - low and high > high[1]

barcolor(pinbarreversalbear or pinbarreversalbull ? color.white : na)

plotshape(fakey and (not outsidebar or not (high[1] <= high[2] and low[1] >= low[2])) and not blackcrowreversal, title="Fakey Bearish", location=location.abovebar, color=color.white, style=shape.arrowdown, text="Fakey", size=size.tiny)

plotshape(fakey1 and (not outsidebar or not (high[1] <= high[2] and low[1] >= low[2])) and not whitesoldierreversal, title="Fakey Bullish", location=location.belowbar, color=color.white, style=shape.arrowup, text="Fakey", size=size.tiny)

// --- Strategy Logic ---

conmua = 0

conmua := hisup == 1 and MACD > 0 ? 1 : (hisdown[1] == 1 and MACD[1] < 0 and pacC[1] > signalMA[1]) or (n1[2] < n1[3] and pacC[1] > signalMA[1]) ? -1 : nz(conmua[1], 1)

conmua1 = 0

conmua1 := conmua == 1 and (hisdown == 1 and MACD < 0 and pacC > signalMA) or (n1[1] < n1[2] and pacC > signalMA) ? 1 : (close[1] > n1[1] and pacC[1] > signalMA[1] and open[1] < n1[1] and close[1] > pacC[1]) or ta.crossunder(pacC, signalMA) ? -1 : nz(conmua1[1], 1)

conmua2 = 0

conmua2 := conmua1 == 1 and hisup == 1 and MACD > 0 and close > n1 ? 1 : high[1] < high[3] and high[2] < high[3] ? -1 : nz(conmua2[1], 1)

conmua3 = 0

conmua3 := conmua2 == 1 and high < high[2] and high[1] < high[2] ? 1 : (close[1] > swinghigh[1] and hisup[1] == 1 and MACD[1] > 0) or (MACD < 0) ? -1 : nz(conmua3[1], 1)

mua = conmua3 == 1 and hisup == 1 and MACD > 0 and conmua2 == -1 and conmua1 == -1

mua2 = conmua1 == 1 and (close > n1 and pacC > signalMA and open < n1 and close > pacC) and conmua[1] == -1

// ENTRY BUY

if (mua2 and not onlysell)

strategy.entry("Buy", strategy.long)

conban = 0

conban := hisdown == 1 and MACD < 0 ? 1 : (hisup[1] == 1 and MACD[1] > 0 and pacC[1] < signalMA[1]) or (n1[2] > n1[3] and pacC[1] < signalMA[1]) ? -1 : nz(conban[1], 1)

conban1 = 0

conban1 := conban == 1 and (hisup == 1 and MACD > 0 and pacC < signalMA) or (n1[1] > n1[2] and pacC < signalMA) ? 1 : (close[1] < n1[1] and pacC[1] < signalMA[1] and open[1] > n1[1] and close[1] < pacC[1]) or ta.crossover(pacC, signalMA) ? -1 : nz(conban1[1], 1)

conban2 = 0

conban2 := conban1 == 1 and hisdown == 1 and MACD < 0 and close < n1 ? 1 : low[1] > low[3] and low[2] > low[3] ? -1 : nz(conban2[1], 1)

conban3 = 0

conban3 := conban2 == 1 and low[1] > low[2] and low > low[2] ? 1 : (close[1] < swinglow[1] and hisdown[1] == 1 and MACD[1] < 0) or (MACD > 0) ? -1 : nz(conban3[1], 1)

ban = conban3 == 1 and hisdown == 1 and MACD < 0 and conban2 == -1

ban2 = conban1 == 1 and (close < n1 and pacC < signalMA and open > n1 and close < pacC) and conban[1] == -1

// ENTRY SELL

if (ban2 and not onlybuy)

strategy.entry("Sell", strategy.short)

plotshape(conmua1 == 1 and conmua[1] == -1, style=shape.triangleup, color=color.lime, location=location.bottom, size=size.tiny)

plotshape(conban1 == 1 and conban[1] == -1, style=shape.triangledown, color=color.red, location=location.bottom, size=size.tiny)

plotshape(mua2, style=shape.labelup, color=color.lime, location=location.bottom, size=size.tiny)

plotshape(ban2, style=shape.labeldown, color=color.red, location=location.bottom, size=size.tiny)

// --- TP and SL ---

Stop = rr_input * 10

Take = SL_input * 10

if (useTPandSL)

strategy.exit("ExitBuy", "Buy", 1, profit=Take, loss=Stop)

strategy.exit("ExitSell", "Sell", 1, profit=Take, loss=Stop)