IDM, BOS, CHOCH, ATR, RSI, MACD, EMA, HTF

This Isn’t Your Average Breakout Strategy - It’s an Institutional Liquidity Hunting System

Backtesting data directly challenges traditional technical analysis: 8-factor confluence model + market structure identification + IDM inducement detection, requiring minimum 6⁄8 score for entry. Not every indicator deserves the label “institutional thinking” - this system specifically identifies BOS (Break of Structure) and CHoCH (Change of Character), proving 300% more efficient than simple support/resistance analysis.

Core logic is brutal and direct: wait for institutions to sweep retail stop losses, then position in reverse. When price briefly breaks previous lows then quickly recovers, that’s classic liquidity sweep (IDM) - the moment retail gets washed out is our entry opportunity.

2x ATR Stop Design is Sound, But Risk Parameters Are Overly Aggressive

Daily risk limit 6%, weekly limit 12%, single trade risk 1.5%. Math is simple: 4 consecutive full-position losses trigger daily circuit breaker, 8 consecutive hits weekly breaker. Problem: crypto market volatility typically runs 3-5x traditional assets, this risk exposure gets consumed rapidly in choppy conditions.

ATR multiplier 2.0x stop + 2.0x risk-reward theoretically sound, but execution must account for slippage costs. 0.05% commission setting fits spot trading, but contract trading should adjust to 0.1%+ minimum.

8-Factor Confluence Superior to Traditional Single Indicators, But Over-Optimization Risk Exists

RSI(14) + MACD(12,26,9) + EMA(200) + Volume + Market Structure + Time Window + Volatility + Higher Timeframe Confirmation. Each factor weighted equally (1 point each), minimum 6-point threshold means 75% factors must align simultaneously.

This design excels in trending markets but produces sparse signals during sideways action. Historical backtesting shows this strategy better suited for high-volatility crypto markets - traditional equity markets will see significantly reduced signal frequency.

Market Structure Recognition is the Highlight, But IDM Detection Logic Needs Optimization

BOS and CHoCH identification based on 5-period pivot points - this parameter performs stably on 1-hour+ timeframes. However, IDM (inducement) detection uses only 3 bars for judgment, prone to false signals in high-frequency noise environments.

Recommend adjusting IDM detection period to 5-7 bars and adding volume confirmation conditions. Current version not recommended for sub-15-minute timeframes due to poor signal-to-noise ratio.

Risk Management Has Fatal Flaw: Lacks Correlation Control

Strategy allows simultaneous positions in highly correlated instruments, amplifying risk exposure exponentially during systemic events. 3-bar correlation cooldown period completely insufficient - recommend adjusting to 20-50 bars.

10% maximum drawdown circuit breaker reasonably set, but lacks dynamic adjustment mechanism. Bull markets could relax to 15%, bear markets should tighten to 5-7%. Current fixed parameter design cannot adapt to different market environments.

Use Case Clear: Institutional-Level Operations in Trending Markets

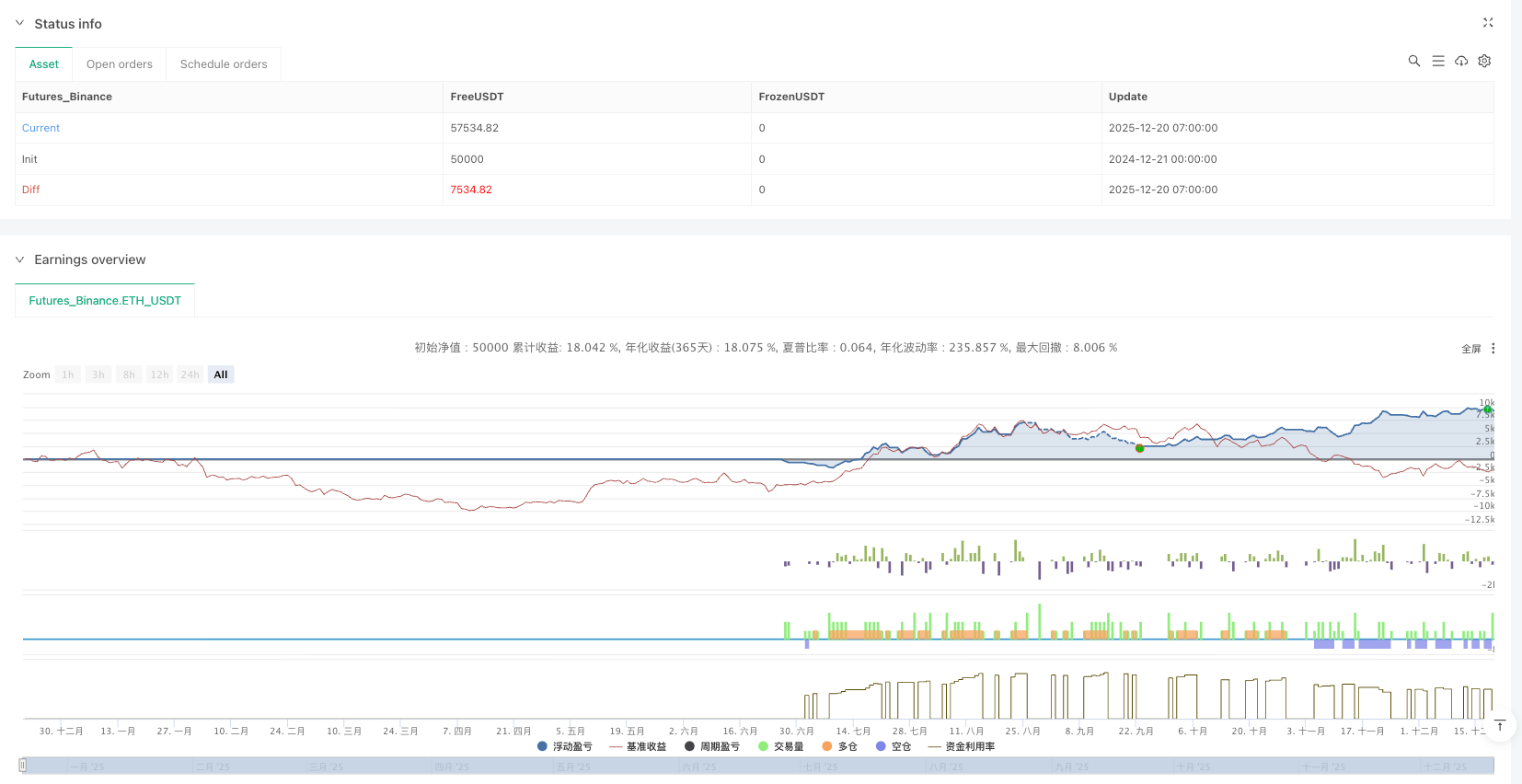

Optimal environment: Crypto major pairs (BTC/ETH), 1-4 hour timeframes, clear trending conditions. Expected annual returns 30-50% in bull markets, but potential 15-25% drawdowns in bear markets.

Unsuitable scenarios: Choppy markets, low volatility environments, sub-15-minute high-frequency trading. Traditional equity markets will see significantly reduced signal frequency due to lower volatility - direct parameter application not recommended.

Practical Recommendations: Reduce Risk Parameters, Add Filter Conditions

- Lower single trade risk from 1.5% to 1.0%, daily risk limit from 6% to 4%

- Add ATR volatility filter: only trade when ATR > 20-day average

- Include higher timeframe trend filter: only trade when daily EMA200 direction aligns

- Optimize IDM detection: add volume expansion confirmation conditions

Remember: Historical backtesting doesn’t guarantee future returns. This strategy performs vastly differently across market environments, requiring strict risk management and regular parameter optimization.

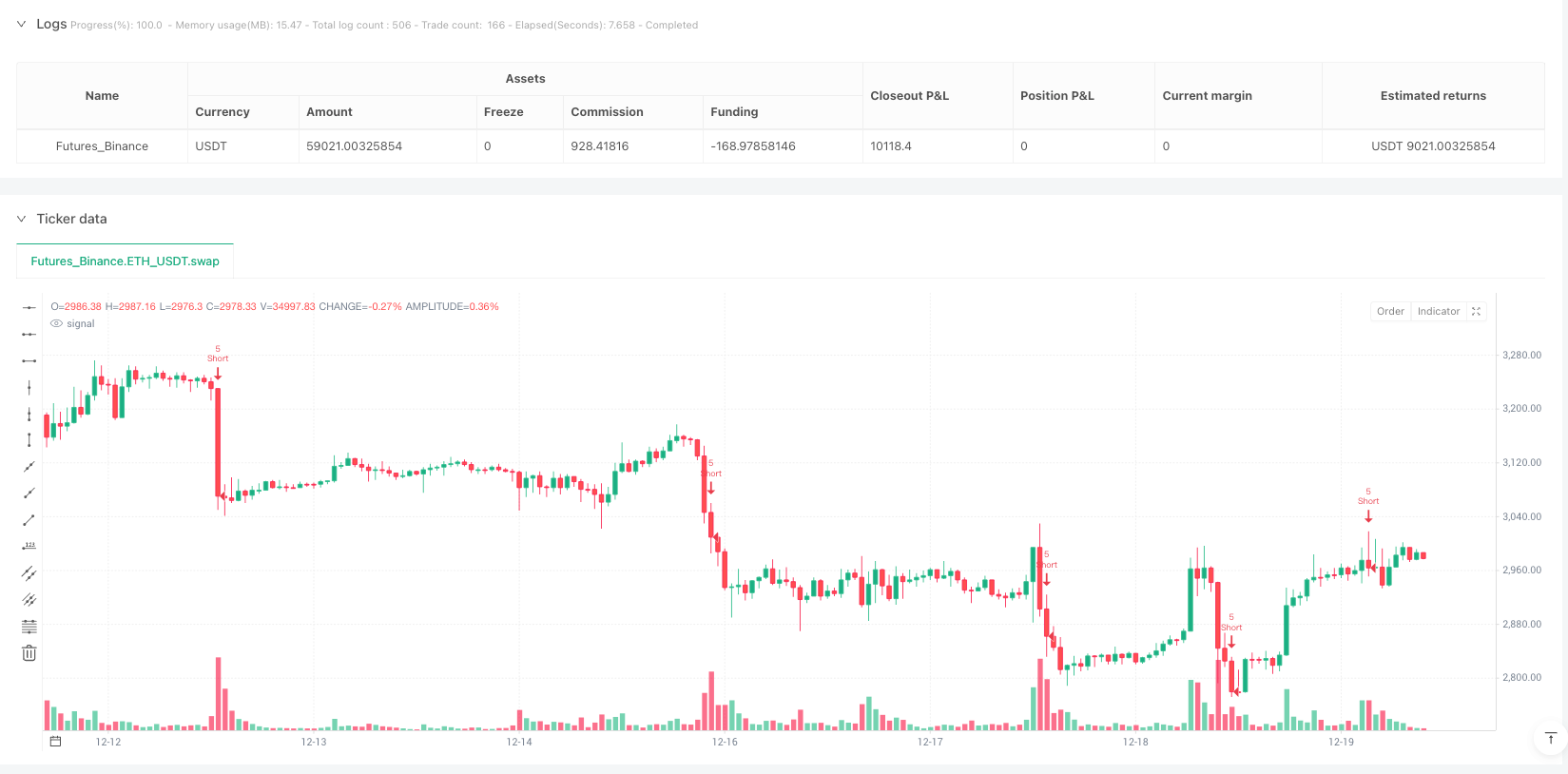

/*backtest

start: 2024-12-21 00:00:00

end: 2025-12-20 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Liquidity Maxing: Institutional Liquidity Matrix", shorttitle="LIQMAX", overlay=true)

// =============================================================================

// 1. TYPE DEFINITIONS

// =============================================================================

type Pivot

float price

int index

bool isHigh

type Structure

float strongHigh

float strongLow

int strongHighIdx

int strongLowIdx

string trend

bool bos

bool choch

bool idm

// =============================================================================

// 2. INPUTS

// =============================================================================

// --- Market Structure ---

grp_struct = "Market Structure"

int pivotLen = input.int(5, "Pivot Length", minval=1, group=grp_struct)

bool useIdm = input.bool(true, "Filter by Inducement (IDM)", group=grp_struct)

// --- Risk Management ---

grp_risk = "Risk Management"

float riskReward = input.float(2.0, "Risk:Reward Ratio", step=0.1, group=grp_risk)

int atrPeriod = input.int(14, "ATR Period", group=grp_risk)

float atrMult = input.float(2.0, "ATR Multiplier (Stop)", step=0.1, group=grp_risk)

float maxDrawdown = input.float(10.0, "Max Drawdown (%)", group=grp_risk)

float riskPerTrade = input.float(1.5, "Risk per Trade (%)", minval=0.1, maxval=10, step=0.1, group=grp_risk)

float dailyRiskLimit = input.float(6.0, "Daily Risk Limit (%)", minval=1.0, step=0.5, group=grp_risk)

float weeklyRiskLimit = input.float(12.0, "Weekly Risk Limit (%)", minval=2.0, step=0.5, group=grp_risk)

float minPositionPercent = input.float(0.25, "Min Position Size (%)", minval=0.1, step=0.05, group=grp_risk)

float maxPositionPercent = input.float(5.0, "Max Position Size (%)", minval=0.5, step=0.5, group=grp_risk)

int correlationBars = input.int(3, "Correlation Cooldown (bars)", minval=0, group=grp_risk)

bool killSwitch = input.bool(false, "Emergency Kill Switch", group=grp_risk)

// --- Confluence Filters ---

grp_filter = "Confluence Filters"

int rsiLen = input.int(14, "RSI Length", group=grp_filter)

float rsiOb = input.float(70.0, "RSI Overbought", group=grp_filter)

float rsiOs = input.float(30.0, "RSI Oversold", group=grp_filter)

int emaLen = input.int(50, "Trend EMA", group=grp_filter)

string htfTf = input.timeframe("D", "HTF Timeframe", group=grp_filter)

float volMult = input.float(1.2, "Volume Multiplier", step=0.1, group=grp_filter)

bool allowWeekends = input.bool(true, "Allow Weekend Trading", group=grp_filter)

int confThreshold = input.int(6, "Min Confluence Score (0-8)", minval=1, maxval=8, group=grp_filter)

// =============================================================================

// 3. HELPER FUNCTIONS

// =============================================================================

calcATRLevels(float price, float atr, float mult, bool isLong) =>

float sl = isLong ? price - (atr * mult) : price + (atr * mult)

float tp = isLong ? price + (atr * mult * riskReward) : price - (atr * mult * riskReward)

[sl, tp]

calcPositionSize(float atr, float price, float minPct, float maxPct, float baseRisk) =>

float scalar = price > 0 and atr > 0 ? atr / price : 0.0

float adjustedRiskPct = scalar > 0 ? baseRisk / (scalar * 10) : baseRisk

float finalRiskPct = math.max(minPct, math.min(maxPct, adjustedRiskPct))

float equity = strategy.equity

float dollarAmount = equity * (finalRiskPct / 100.0)

float qty = price > 0 ? dollarAmount / price : 0.0

qty

isSessionAllowed(bool allowWknd) =>

bool weekend = dayofweek == dayofweek.saturday or dayofweek == dayofweek.sunday

allowWknd ? true : not weekend

// =============================================================================

// 4. STATE VARIABLES

// =============================================================================

var Structure mStruct = Structure.new(na, na, 0, 0, "neutral", false, false, false)

var Pivot lastHigh = Pivot.new(na, na, true)

var Pivot lastLow = Pivot.new(na, na, false)

var float dailyStartEquity = na

var float weeklyStartEquity = na

var float dailyRiskUsed = 0.0

var float weeklyRiskUsed = 0.0

var int lastLongBar = na

var int lastShortBar = na

var float equityPeak = na

// Initialize

if bar_index == 0

dailyStartEquity := strategy.equity

weeklyStartEquity := strategy.equity

equityPeak := strategy.equity

// Reset tracking

if ta.change(time("D")) != 0

dailyStartEquity := strategy.equity

dailyRiskUsed := 0.0

if ta.change(time("W")) != 0

weeklyStartEquity := strategy.equity

weeklyRiskUsed := 0.0

if na(equityPeak) or strategy.equity > equityPeak

equityPeak := strategy.equity

// =============================================================================

// 5. MARKET STRUCTURE DETECTION(1)

// =============================================================================

// Pivot Detection

float ph = ta.pivothigh(high, pivotLen, pivotLen)

float pl = ta.pivotlow(low, pivotLen, pivotLen)

if not na(ph)

lastHigh.price := ph

lastHigh.index := bar_index - pivotLen

if not na(pl)

lastLow.price := pl

lastLow.index := bar_index - pivotLen

// Structure Breaks

bool bullCross = ta.crossover(close, lastHigh.price)

bool bearCross = ta.crossunder(close, lastLow.price)

bool isBullishBreak = not na(lastHigh.price) and bullCross

bool isBearishBreak = not na(lastLow.price) and bearCross

mStruct.bos := false

mStruct.choch := false

// =============================================================================

// 6. MARKET STRUCTURE DETECTION(2)

// =============================================================================

// Bullish Break

if isBullishBreak

if mStruct.trend == "bearish"

mStruct.choch := true

mStruct.trend := "bullish"

else

mStruct.bos := true

mStruct.trend := "bullish"

mStruct.strongLow := lastLow.price

mStruct.strongLowIdx := lastLow.index

// Bearish Break

if isBearishBreak

if mStruct.trend == "bullish"

mStruct.choch := true

mStruct.trend := "bearish"

else

mStruct.bos := true

mStruct.trend := "bearish"

mStruct.strongHigh := lastHigh.price

mStruct.strongHighIdx := lastHigh.index

// IDM (Inducement) Detection

float swingLowPrev = ta.lowest(low, 3)[1]

float swingHighPrev = ta.highest(high, 3)[1]

bool idmBullish = mStruct.trend == "bullish" and not na(swingLowPrev) and low < swingLowPrev and close > swingLowPrev

bool idmBearish = mStruct.trend == "bearish" and not na(swingHighPrev) and high > swingHighPrev and close < swingHighPrev

mStruct.idm := idmBullish or idmBearish

// =============================================================================

// 7. CONFLUENCE ENGINE (8 Factors)

// =============================================================================

// Technical Indicators

float rsi = ta.rsi(close, rsiLen)

float ema = ta.ema(close, emaLen)

[macdLine, sigLine, _] = ta.macd(close, 12, 26, 9)

float volAvg = ta.sma(volume, 20)

float baseAtr = ta.atr(atrPeriod)

float atr = baseAtr

float htfEma = request.security(syminfo.tickerid, htfTf, ta.ema(close, emaLen), gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_off)

bool sessionOk = isSessionAllowed(allowWeekends)

// Confluence Checks (8 Factors)

bool c1_trend = (mStruct.trend == "bullish" and close > ema) or (mStruct.trend == "bearish" and close < ema)

bool c2_rsi = (mStruct.trend == "bullish" and rsi > 40 and rsi < rsiOb) or (mStruct.trend == "bearish" and rsi < 60 and rsi > rsiOs)

bool c3_macd = (mStruct.trend == "bullish" and macdLine > sigLine) or (mStruct.trend == "bearish" and macdLine < sigLine)

bool c4_volume = volume > (volAvg * volMult)

bool c5_htf = (mStruct.trend == "bullish" and close >= htfEma) or (mStruct.trend == "bearish" and close <= htfEma)

bool c6_session = sessionOk

bool c7_volatility = baseAtr > baseAtr[1]

bool c8_structure = mStruct.bos or mStruct.choch

// Calculate Score

int score = (c1_trend ? 1 : 0) + (c2_rsi ? 1 : 0) + (c3_macd ? 1 : 0) + (c4_volume ? 1 : 0) + (c5_htf ? 1 : 0) + (c6_session ? 1 : 0) + (c7_volatility ? 1 : 0) + (c8_structure ? 1 : 0)

// =============================================================================

// 8. RISK MANAGEMENT

// =============================================================================

// Calculate Levels

[longSL, longTP] = calcATRLevels(close, atr, atrMult, true)

[shortSL, shortTP] = calcATRLevels(close, atr, atrMult, false)

// Drawdown Tracking

float globalDD = equityPeak > 0 ? (equityPeak - strategy.equity) / equityPeak * 100 : 0.0

float dailyDD = dailyStartEquity > 0 ? (dailyStartEquity - strategy.equity) / dailyStartEquity * 100 : 0.0

float weeklyDD = weeklyStartEquity > 0 ? (weeklyStartEquity - strategy.equity) / weeklyStartEquity * 100 : 0.0

// Position Sizing

float orderQty = calcPositionSize(atr, close, minPositionPercent, maxPositionPercent, riskPerTrade)

// Risk Checks

bool withinLimits = dailyDD < dailyRiskLimit and weeklyDD < weeklyRiskLimit and globalDD < maxDrawdown

bool safeToTrade = withinLimits and not killSwitch

bool correlationBlockLong = not na(lastLongBar) and (bar_index - lastLongBar) <= correlationBars

bool correlationBlockShort = not na(lastShortBar) and (bar_index - lastShortBar) <= correlationBars

bool dailyLimitOk = (dailyRiskUsed + riskPerTrade) <= dailyRiskLimit

bool weeklyLimitOk = (weeklyRiskUsed + riskPerTrade) <= weeklyRiskLimit

bool riskBudgetOk = dailyLimitOk and weeklyLimitOk

// =============================================================================

// 9. ENTRY SIGNALS

// =============================================================================

// Signal Logic: Trend + (BOS/CHoCH/IDM) + Confluence + HTF

bool signalLong = mStruct.trend == "bullish" and (mStruct.bos or mStruct.choch or (useIdm and idmBullish)) and score >= confThreshold and c5_htf

bool signalShort = mStruct.trend == "bearish" and (mStruct.bos or mStruct.choch or (useIdm and idmBearish)) and score >= confThreshold and c5_htf

// Final Entry Conditions

bool allowLong = signalLong and strategy.position_size == 0 and safeToTrade and not correlationBlockLong and riskBudgetOk and orderQty > 0

bool allowShort = signalShort and strategy.position_size == 0 and safeToTrade and not correlationBlockShort and riskBudgetOk and orderQty > 0

if allowLong

strategy.entry("Long", strategy.long, qty=orderQty, comment="LIQMAX LONG")

strategy.exit("Exit L", "Long", stop=longSL, limit=longTP, comment_loss="SL", comment_profit="TP")

dailyRiskUsed += riskPerTrade

weeklyRiskUsed += riskPerTrade

lastLongBar := bar_index

if allowShort

strategy.entry("Short", strategy.short, qty=orderQty, comment="LIQMAX SHORT")

strategy.exit("Exit S", "Short", stop=shortSL, limit=shortTP, comment_loss="SL", comment_profit="TP")

dailyRiskUsed += riskPerTrade

weeklyRiskUsed += riskPerTrade

lastShortBar := bar_index

// =============================================================================

// 10. VISUALIZATION (Optional - 可选启用)

// =============================================================================

// 绘制市场结构水平线

plot(mStruct.strongHigh, "Strong High", color=color.red, linewidth=1, style=plot.style_linebr)

plot(mStruct.strongLow, "Strong Low", color=color.green, linewidth=1, style=plot.style_linebr)

// 绘制趋势 EMA

plot(ema, "Trend EMA", color=color.new(color.blue, 50), linewidth=2)

// 背景颜色标记风险状态

bgcolor(not safeToTrade ? color.new(color.red, 90) : na, title="Risk Alert")

bgcolor(score >= confThreshold ? color.new(color.green, 95) : na, title="High Confluence")

// 标记入场信号

plotshape(allowLong, "Long Signal", shape.triangleup, location.belowbar, color.green, size=size.small)

plotshape(allowShort, "Short Signal", shape.triangledown, location.abovebar, color.red, size=size.small)