4

Seguir

1283

Seguidores

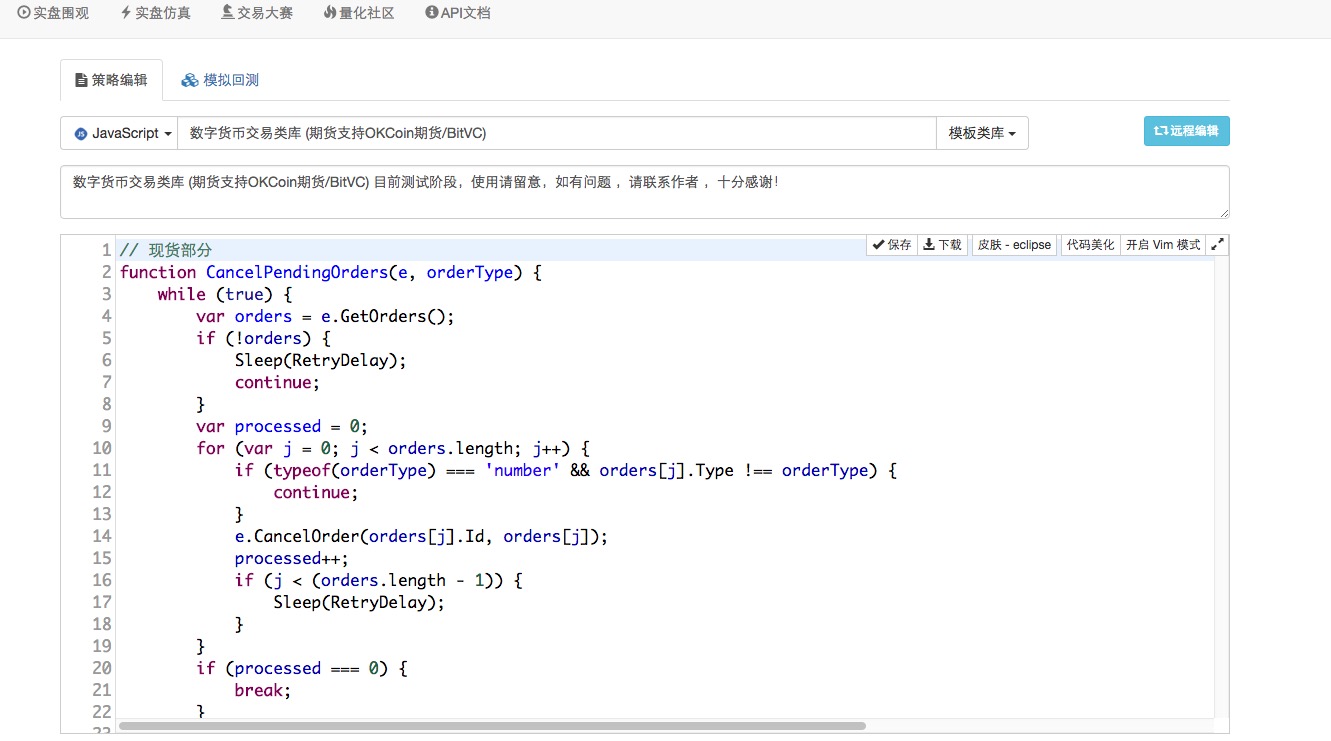

3.2 Plantilla: Biblioteca de comercio de divisas digitales (soporte integrado para futuros y spot de OKCoin y futuros de BitVC)

Creado el: 2017-01-04 19:00:10,

Actualizado el:

2017-10-11 10:27:01

19

19

5355

5355

3.2 Plantilla: Biblioteca de comercio de divisas digitales (soporte integrado para futuros y spot de OKCoin y futuros de BitVC)

En el capítulo 3.1 se muestra una plantilla de negociación en efectivo, lo que simplifica considerablemente la composición de una estrategia en efectivo. Sin embargo, el procesamiento de operaciones en futuros es muy diferente al de las operaciones en efectivo, por lo que la función de negociación en futuros se ha integrado en la base de la plantilla en efectivo y ahora está disponible.

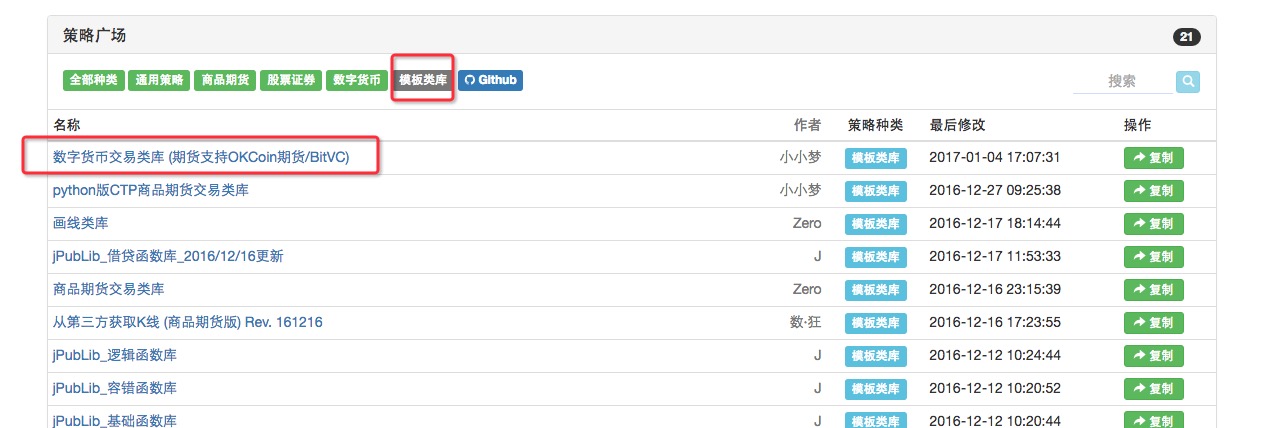

El sitio web de Twitter de la campaña, que ya ha sido publicado en Strategy Square, dice:

- ### En la actualidad:

En cuanto al efectivo, es el mismo que en el caso de las monedas digitales.

- ### El plazo:

parámetro:

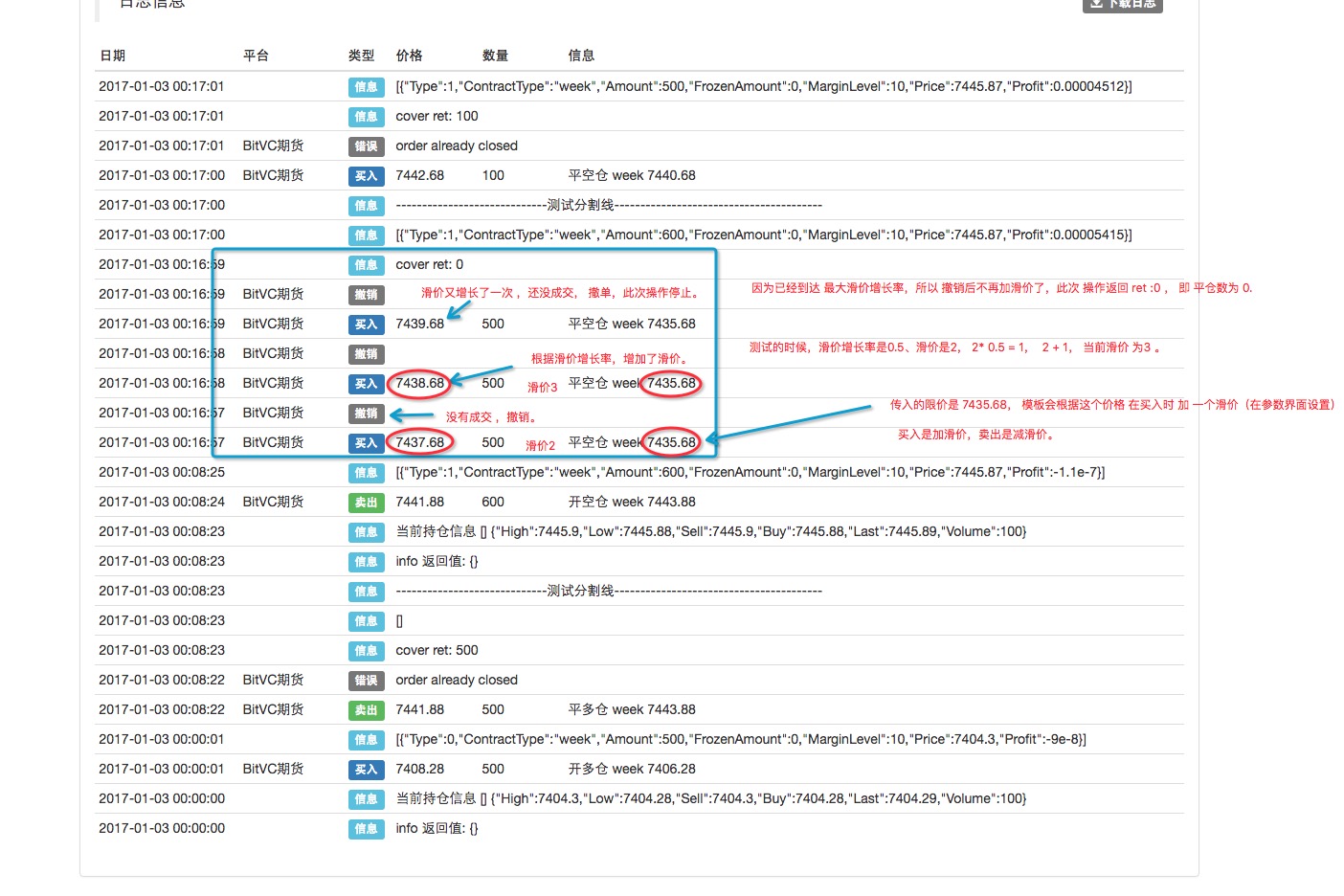

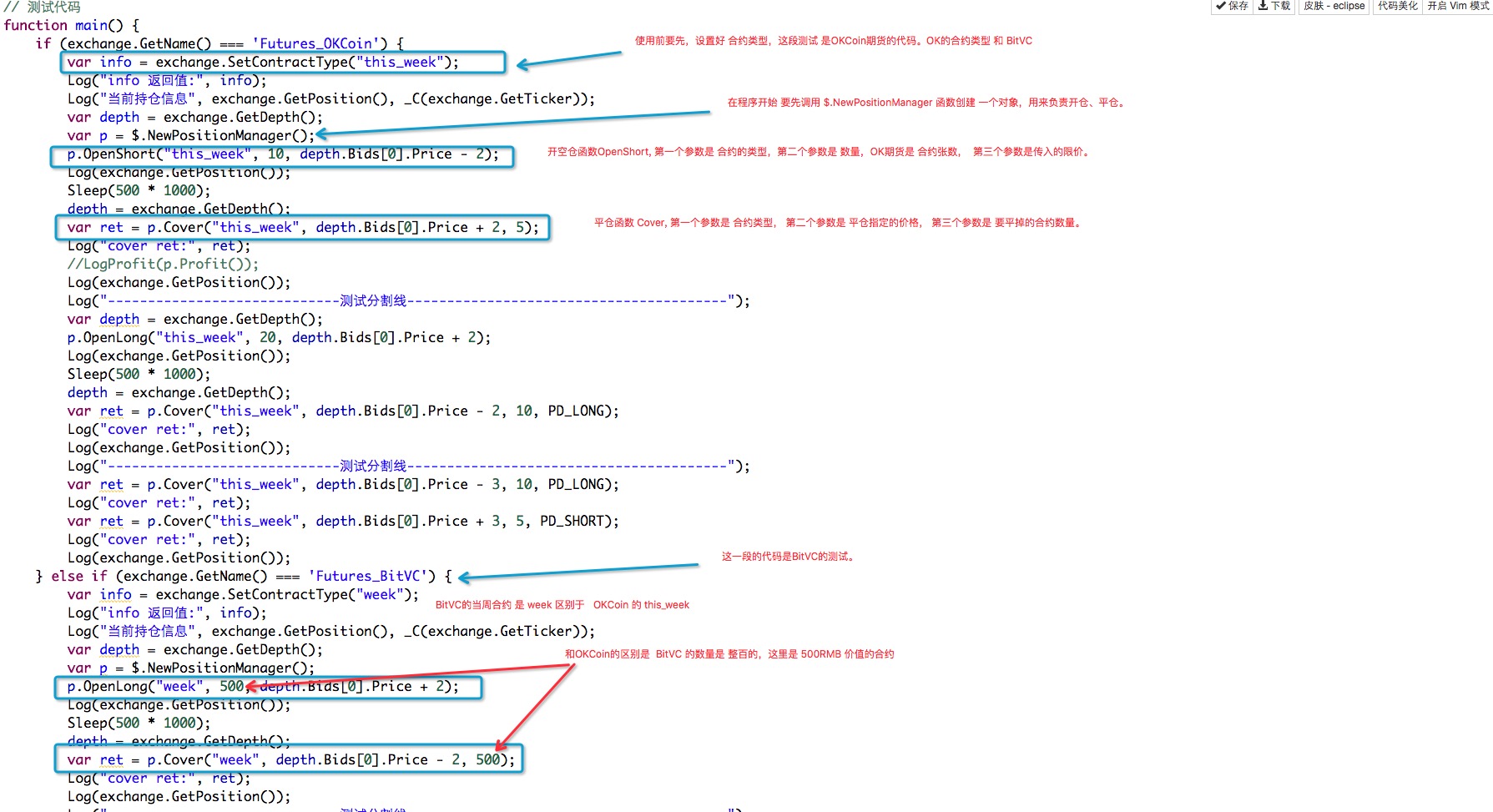

El código de prueba de la estrategia:

function main() {

if (exchange.GetName() === 'Futures_OKCoin') {

var info = exchange.SetContractType("this_week");

Log("info 返回值:", info);

Log("当前持仓信息", exchange.GetPosition(), _C(exchange.GetTicker));

var depth = exchange.GetDepth();

var p = $.NewPositionManager();

p.OpenShort("this_week", 10, depth.Bids[0].Price - 2);

Log(exchange.GetPosition());

Sleep(500 * 1000);

depth = exchange.GetDepth();

var ret = p.Cover("this_week", depth.Bids[0].Price + 2, 5);

Log("cover ret:", ret);

//LogProfit(p.Profit());

Log(exchange.GetPosition());

Log("-----------------------------测试分割线----------------------------------------");

var depth = exchange.GetDepth();

p.OpenLong("this_week", 20, depth.Bids[0].Price + 2);

Log(exchange.GetPosition());

Sleep(500 * 1000);

depth = exchange.GetDepth();

var ret = p.Cover("this_week", depth.Bids[0].Price - 2, 10, PD_LONG);

Log("cover ret:", ret);

Log(exchange.GetPosition());

Log("-----------------------------测试分割线----------------------------------------");

var ret = p.Cover("this_week", depth.Bids[0].Price - 3, 10, PD_LONG);

Log("cover ret:", ret);

var ret = p.Cover("this_week", depth.Bids[0].Price + 3, 5, PD_SHORT);

Log("cover ret:", ret);

Log(exchange.GetPosition());

} else if (exchange.GetName() === 'Futures_BitVC') {

var info = exchange.SetContractType("week");

Log("info 返回值:", info);

Log("当前持仓信息", exchange.GetPosition(), _C(exchange.GetTicker));

var depth = exchange.GetDepth();

var p = $.NewPositionManager();

p.OpenLong("week", 500, depth.Bids[0].Price + 2);

Log(exchange.GetPosition());

Sleep(500 * 1000);

depth = exchange.GetDepth();

var ret = p.Cover("week", depth.Bids[0].Price - 2, 500);

Log("cover ret:", ret);

Log(exchange.GetPosition());

Log("-----------------------------测试分割线----------------------------------------");

var info = exchange.SetContractType("week");

Log("info 返回值:", info);

Log("当前持仓信息", exchange.GetPosition(), _C(exchange.GetTicker));

var depth = exchange.GetDepth();

p.OpenShort("week", 600, depth.Bids[0].Price - 2);

Log(exchange.GetPosition());

Sleep(500 * 1000);

depth = exchange.GetDepth();

var ret = p.Cover("week", depth.Bids[0].Price - 2, 500, PD_SHORT);

Log("cover ret:", ret);

Log(exchange.GetPosition());

Log("-----------------------------测试分割线----------------------------------------");

var ret = p.Cover("week", depth.Bids[0].Price + 3, 100, PD_SHORT);

Log("cover ret:", ret);

//p.Cover("week", depth.Asks[0].Price - 3, 300, PD_LONG);

Log(exchange.GetPosition());

} else if(exchange.GetName() === 'huobi' || exchange.GetName() === 'OKCoin'){

Log($.GetAccount());

Log($.Buy(0.5));

Log($.Sell(0.5));

exchange.Buy(1000, 3);

$.CancelPendingOrders(exchanges[0]);

Log($.Cross(30, 7));

Log($.Cross([1,2,3,2.8,3.5], [3,1.9,2,5,0.6]));

}

}

Utilizado por:

Código de prueba en la estrategia (selecciona la plantilla de referencia)

Estrategias de prueba:

function main(){

var p = $.NewPositionManager();

var i = 0;

exchanges[0].SetContractType("this_week");

var isFirst = true;

var ret = null;

while(true){

var depth = _C(exchanges[0].GetDepth);

var positions = _C(exchanges[0].GetPosition);

var len = positions.length;

if(isFirst === true && i % 3 === 0 && len === 0){

ret = p.OpenLong("this_week", 1 + (i % 3) + (i % 2), depth.Asks[0].Price);

isFirst = false;

}else if(isFirst === false){

ret = p.OpenShort("this_week", 1 + (i % 3) + (i % 2), depth.Bids[0].Price);

isFirst = true;

}else{

for(var j = 0 ; j < len; j++){

if(positions[j].Type === PD_LONG){

ret = p.Cover("this_week", depth.Bids[0].Price - 2, positions[j].Amount, PD_LONG);

}else if(positions[j].Type === PD_SHORT){

ret = p.Cover("this_week", depth.Asks[0].Price + 2, positions[j].Amount, PD_SHORT);

}

Log("ret:", ret);

}

}

Log("ret", ret, "---------------------#FF0000");

i++;

Sleep(1000 * 60 * 15);

}

}

Si tienes alguna pregunta, BUG, no dudes en contactar con el autor, ¡muchas gracias!