Estrategia de seguimiento de tendencias de medias móviles múltiples

Descripción general

La estrategia utiliza varios tipos diferentes de medias móviles para analizar el movimiento de los precios desde varios ángulos y formar una señal de calificación integral para decidir la dirección de la apertura de la posición. La estrategia tiene las ventajas de getParameter: 1) múltiples medias móviles forman un sistema de calificación que mejora la precisión de los juicios; 2) los parámetros del sistema de calificación se pueden ajustar de manera flexible para adaptarse a diferentes variedades; 3) se pueden configurar las condiciones de calificación de entrada y controlar el riesgo.

Principio de estrategia

La estrategia utiliza un total de 17 tipos diferentes de promedios móviles, que incluyen SMA, EMA, ALMA, SMMA, LSMA, VWMA, DEMA, HMA, KAMA, TEMA, ZLEMA, TRIMA, T3 y otros.

Para cada tipo de promedio móvil, juzgar su relación con el precio de cierre, si el promedio móvil es inferior al precio de cierre, se le da una calificación de 1 punto, si es superior al precio de cierre, se le da una calificación de -1 punto. Si no se puede juzgar, no se le da un punto.

La suma de las calificaciones de todos los promedios móviles, dividida por el número de promedios móviles que se pueden calificar, obtiene una calificación integral.

Compara la calificación integral con la devaluación de la calificación de entrada para decidir la dirección de la posición. Si la calificación integral alcanza la devaluación de más, haga más; Si alcanza la devaluación de menos, haga menos.

El uso de promedios móviles de diferentes períodos permite determinar tendencias a corto y largo plazo. El uso de diferentes tipos de promedios móviles puede proporcionar una referencia más rica en indicadores técnicos y permitir el juicio desde múltiples ángulos.

Ventajas estratégicas

- Varias medias móviles para una mayor precisión

En comparación con una o varias medias móviles, la estrategia utiliza 17 diferentes medias móviles para calificar, lo que permite juzgar la dirección de las tendencias del mercado desde más perspectivas y reducir los juicios inexactos derivados de la desviación de un indicador. La participación de varios indicadores en la calificación puede mejorar la fiabilidad de los resultados finales.

- Los parámetros del sistema de calificación se pueden configurar para adaptarse a diferentes variedades

El número de ciclos de promedio móvil y el umbral de calificación en el sistema de calificación se pueden configurar a través de parámetros, lo que permite que la estrategia se adapte de manera flexible a las características de las diferentes variedades de operaciones, lo que facilita la optimización.

- Condiciones de calificación de ingreso configurables para controlar el riesgo

Las estrategias permiten configurar un umbral de calificación de entrada de más de un hueco. Se emite una señal cuando la calificación integral alcanza el umbral, lo que evita la apertura errónea de posiciones en momentos de incertidumbre en el mercado. La configuración razonable del umbral de entrada ayuda a reducir el número de operaciones innecesarias y a controlar el riesgo.

Riesgos y soluciones

- Una sola variedad puede no funcionar

La configuración de los parámetros de esta estrategia está diseñada para el mercado general y puede no ser muy adecuada para una variedad en particular. La solución es optimizar los parámetros individualmente para diferentes variedades.

- El error es mayor en mercados de caos múltiple.

Cuando el mercado está en un estado de caos, la estrategia es propensa a generar señales erróneas. La solución es aumentar la desvalorización de la calificación de entrada y reducir el número de operaciones en este tipo de mercado.

- El funcionamiento a largo plazo puede requerir la optimización periódica de los parámetros

El entorno del mercado cambia constantemente, y las configuraciones de parámetros fijos pueden causar variaciones en la eficacia de la estrategia. Se recomienda volver a probar los parámetros optimizados cada cierto tiempo para garantizar la eficacia de la estrategia.

Dirección de optimización

La inclusión de otros indicadores de participación en la calificación, como el índice de volatilidad, el índice de volumen de transacciones, etc., proporciona una base de juicio de más dimensiones.

Optimización de los parámetros de prueba para las diferentes variedades y mejora de la adaptabilidad de las estrategias.

Establezca un período de retrospectiva más largo, como seis meses, un año, y observe el tiempo de permanencia del efecto de los parámetros.

Estudiar el efecto real de diferentes medias móviles en diferentes períodos, seleccionando la combinación preferida.

Prueba métodos de aprendizaje automático para optimizar los parámetros.

Resumir

La estrategia tiene la ventaja de que los parámetros se pueden configurar y se pueden adaptar de manera flexible a diferentes variedades, y también se puede controlar la actitud de riesgo de la estrategia mediante el ajuste de los parámetros. Además, el sistema de calificación se puede optimizar y perfeccionar continuamente para mejorar el rendimiento de la estrategia. En general, la estrategia utiliza la eficacia de varios indicadores técnicos para formar una mayor capacidad de seguimiento de tendencias.

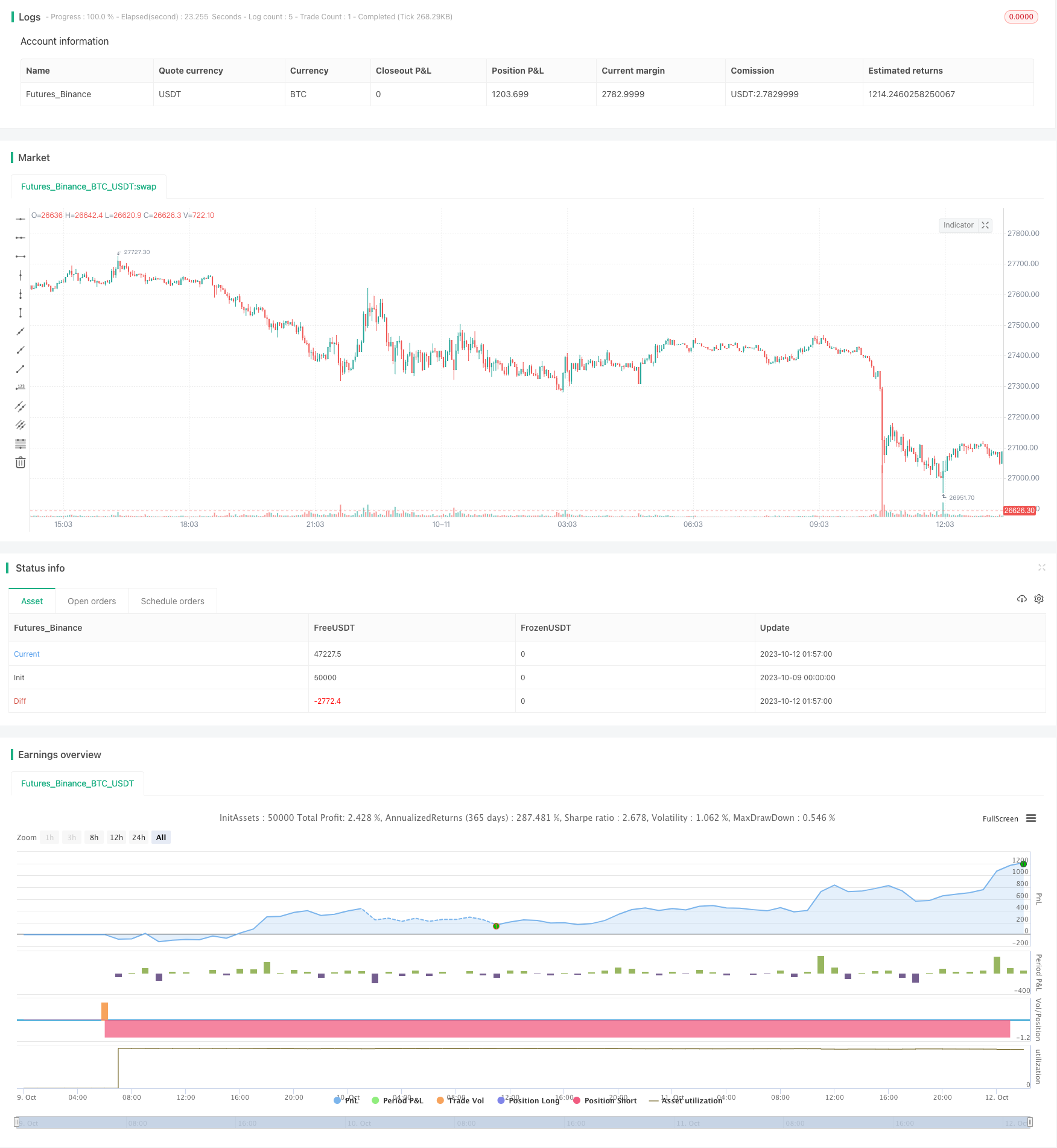

/*backtest

start: 2023-10-09 00:00:00

end: 2023-10-12 02:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=5

strategy(title='Ultra Moving Average Rating Trend Strategy', overlay=true) //, pyramiding=1,initial_capital = 1000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.03)

// //

//==========DEMA

getDEMA(src, len) =>

dema = 2 * ta.ema(src, len) - ta.ema(ta.ema(src, len), len)

dema

//==========HMA

getHULLMA(src, len) =>

hullma = ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

hullma

//==========KAMA

getKAMA(src, len, k1, k2) =>

change = math.abs(ta.change(src, len))

volatility = math.sum(math.abs(ta.change(src)), len)

efficiency_ratio = volatility != 0 ? change / volatility : 0

kama = 0.0

fast = 2 / (k1 + 1)

slow = 2 / (k2 + 1)

smooth_const = math.pow(efficiency_ratio * (fast - slow) + slow, 2)

kama := nz(kama[1]) + smooth_const * (src - nz(kama[1]))

kama

//==========TEMA

getTEMA(src, len) =>

e = ta.ema(src, len)

tema = 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

tema

//==========ZLEMA

getZLEMA(src, len) =>

zlemalag_1 = (len - 1) / 2

zlemadata_1 = src + src - src[zlemalag_1]

zlema = ta.ema(zlemadata_1, len)

zlema

//==========FRAMA

getFRAMA(src, len) =>

Price = src

N = len

if N % 2 != 0

N += 1

N

N1 = 0.0

N2 = 0.0

N3 = 0.0

HH = 0.0

LL = 0.0

Dimen = 0.0

alpha = 0.0

Filt = 0.0

N3 := (ta.highest(N) - ta.lowest(N)) / N

HH := ta.highest(N / 2 - 1)

LL := ta.lowest(N / 2 - 1)

N1 := (HH - LL) / (N / 2)

HH := high[N / 2]

LL := low[N / 2]

for i = N / 2 to N - 1 by 1

if high[i] > HH

HH := high[i]

HH

if low[i] < LL

LL := low[i]

LL

N2 := (HH - LL) / (N / 2)

if N1 > 0 and N2 > 0 and N3 > 0

Dimen := (math.log(N1 + N2) - math.log(N3)) / math.log(2)

Dimen

alpha := math.exp(-4.6 * (Dimen - 1))

if alpha < .01

alpha := .01

alpha

if alpha > 1

alpha := 1

alpha

Filt := alpha * Price + (1 - alpha) * nz(Filt[1], 1)

if bar_index < N + 1

Filt := Price

Filt

Filt

//==========VIDYA

getVIDYA(src, len) =>

mom = ta.change(src)

upSum = math.sum(math.max(mom, 0), len)

downSum = math.sum(-math.min(mom, 0), len)

out = (upSum - downSum) / (upSum + downSum)

cmo = math.abs(out)

alpha = 2 / (len + 1)

vidya = 0.0

vidya := src * alpha * cmo + nz(vidya[1]) * (1 - alpha * cmo)

vidya

//==========JMA

getJMA(src, len, power, phase) =>

phase_ratio = phase < -100 ? 0.5 : phase > 100 ? 2.5 : phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, power)

MA1 = 0.0

Det0 = 0.0

MA2 = 0.0

Det1 = 0.0

JMA = 0.0

MA1 := (1 - alpha) * src + alpha * nz(MA1[1])

Det0 := (src - MA1) * (1 - beta) + beta * nz(Det0[1])

MA2 := MA1 + phase_ratio * Det0

Det1 := (MA2 - nz(JMA[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(Det1[1])

JMA := nz(JMA[1]) + Det1

JMA

//==========T3

getT3(src, len, vFactor) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

ema4 = ta.ema(ema3, len)

ema5 = ta.ema(ema4, len)

ema6 = ta.ema(ema5, len)

c1 = -1 * math.pow(vFactor, 3)

c2 = 3 * math.pow(vFactor, 2) + 3 * math.pow(vFactor, 3)

c3 = -6 * math.pow(vFactor, 2) - 3 * vFactor - 3 * math.pow(vFactor, 3)

c4 = 1 + 3 * vFactor + math.pow(vFactor, 3) + 3 * math.pow(vFactor, 2)

T3 = c1 * ema6 + c2 * ema5 + c3 * ema4 + c4 * ema3

T3

//==========TRIMA

getTRIMA(src, len) =>

N = len + 1

Nm = math.round(N / 2)

TRIMA = ta.sma(ta.sma(src, Nm), Nm)

TRIMA

//-------------- FUNCTIONS

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : up > down and up > 0 ? up : 0

minusDM = na(down) ? na : down > up and down > 0 ? down : 0

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / truerange)

minus = fixnan(100 * ta.rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

adx

src = close

res = input.timeframe("", title="Indicator Timeframe")

// Ichimoku Cloud

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

ichimoku_cloud() =>

conversionLine = donchian(9)

baseLine = donchian(26)

leadLine1 = math.avg(conversionLine, baseLine)

leadLine2 = donchian(52)

[conversionLine, baseLine, leadLine1, leadLine2]

calcRatingMA(ma, src) => na(ma) or na(src) ? na : (ma == src ? 0 : ( ma < src ? 1 : -1 ))

calcRating(buy, sell) => buy ? 1 : ( sell ? -1 : 0 )

calcRatingAll() =>

//============== MA =================

SMA10 = ta.sma(close, 10)

SMA20 = ta.sma(close, 20)

SMA30 = ta.sma(close, 30)

SMA50 = ta.sma(close, 50)

SMA100 = ta.sma(close, 100)

SMA200 = ta.sma(close, 200)

EMA10 = ta.ema(close, 10)

EMA20 = ta.ema(close, 20)

EMA30 = ta.ema(close, 30)

EMA50 = ta.ema(close, 50)

EMA100 = ta.ema(close, 100)

EMA200 = ta.ema(close, 200)

ALMA10 = ta.alma(close, 10, 0.85, 6)

ALMA20 = ta.alma(close, 20, 0.85, 6)

ALMA50 = ta.alma(close, 50, 0.85, 6)

ALMA100 = ta.alma(close, 100, 0.85, 6)

ALMA200 = ta.alma(close, 200, 0.85, 6)

SMMA10 = ta.rma(close, 10)

SMMA20 = ta.rma(close, 20)

SMMA50 = ta.rma(close, 50)

SMMA100 = ta.rma(close, 100)

SMMA200 = ta.rma(close, 200)

LSMA10 = ta.linreg(close, 10, 0)

LSMA20 = ta.linreg(close, 20, 0)

LSMA50 = ta.linreg(close, 50, 0)

LSMA100 = ta.linreg(close, 100, 0)

LSMA200 = ta.linreg(close, 200, 0)

VWMA10 = ta.vwma(close, 10)

VWMA20 = ta.vwma(close, 20)

VWMA50 = ta.vwma(close, 50)

VWMA100 = ta.vwma(close, 100)

VWMA200 = ta.vwma(close, 200)

DEMA10 = getDEMA(close, 10)

DEMA20 = getDEMA(close, 20)

DEMA50 = getDEMA(close, 50)

DEMA100 =getDEMA(close, 100)

DEMA200 = getDEMA(close, 200)

HMA10 = ta.hma(close, 10)

HMA20 = ta.hma(close, 20)

HMA50 = ta.hma(close, 50)

HMA100 = ta.hma(close, 100)

HMA200 = ta.hma(close, 200)

KAMA10 = getKAMA(close, 10, 2, 30)

KAMA20 = getKAMA(close, 20, 2, 30)

KAMA50 = getKAMA(close, 50, 2, 30)

KAMA100 = getKAMA(close, 100, 2, 30)

KAMA200 = getKAMA(close, 200 , 2, 30)

FRAMA10 = getFRAMA(close, 10)

FRAMA20 = getFRAMA(close, 20)

FRAMA50 = getFRAMA(close, 50)

FRAMA100 =getFRAMA(close, 100)

FRAMA200 = getFRAMA(close, 200)

VIDMA10 = getVIDYA(close, 10)

VIDMA20 = getVIDYA(close, 20)

VIDMA50 = getVIDYA(close, 50)

VIDMA100 =getVIDYA(close, 100)

VIDMA200 = getVIDYA(close, 200)

JMA10 = getJMA(close, 10, 2, 50)

JMA20 = getJMA(close, 20, 2, 50)

JMA50 = getJMA(close, 50, 2, 50)

JMA100 =getJMA(close, 100, 2, 50)

JMA200 = getJMA(close, 200, 2, 50)

TEMA10 = getTEMA(close, 10)

TEMA20 = getTEMA(close, 20)

TEMA50 = getTEMA(close, 50)

TEMA100 =getTEMA(close, 100)

TEMA200 = getTEMA(close, 200)

ZLEMA10 = getZLEMA(close, 10)

ZLEMA20 = getZLEMA(close, 20)

ZLEMA50 = getZLEMA(close, 50)

ZLEMA100 =getZLEMA(close, 100)

ZLEMA200 = getZLEMA(close, 200)

TRIMA10 = getTRIMA(close, 10)

TRIMA20 = getTRIMA(close, 20)

TRIMA50 = getTRIMA(close, 50)

TRIMA100 =getTRIMA(close, 100)

TRIMA200 = getTRIMA(close, 200)

T3MA10 = getT3(close, 10, 0.7)

T3MA20 = getT3(close, 20, 0.7)

T3MA50 = getT3(close, 50, 0.7)

T3MA100 =getT3(close, 100, 0.7)

T3MA200 = getT3(close, 200, 0.7)

[IC_CLine, IC_BLine, IC_Lead1, IC_Lead2] = ichimoku_cloud()

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

PriceAvg = ta.ema(close, 50)

DownTrend = close < PriceAvg

UpTrend = close > PriceAvg

// calculate trading recommendation based on SMA/EMA

float ratingMA = 0

float ratingMAC = 0

float ratingSMA10 = na

if not na(SMA10)

ratingSMA10 := calcRatingMA(SMA10, close)

ratingMA := ratingMA + ratingSMA10

ratingMAC := ratingMAC + 1

float ratingSMA20 = na

if not na(SMA20)

ratingSMA20 := calcRatingMA(SMA20, close)

ratingMA := ratingMA + ratingSMA20

ratingMAC := ratingMAC + 1

float ratingSMA30 = na

if not na(SMA30)

ratingSMA30 := calcRatingMA(SMA30, close)

ratingMA := ratingMA + ratingSMA30

ratingMAC := ratingMAC + 1

float ratingSMA50 = na

if not na(SMA50)

ratingSMA50 := calcRatingMA(SMA50, close)

ratingMA := ratingMA + ratingSMA50

ratingMAC := ratingMAC + 1

float ratingSMA100 = na

if not na(SMA100)

ratingSMA100 := calcRatingMA(SMA100, close)

ratingMA := ratingMA + ratingSMA100

ratingMAC := ratingMAC + 1

float ratingSMA200 = na

if not na(SMA200)

ratingSMA200 := calcRatingMA(SMA200, close)

ratingMA := ratingMA + ratingSMA200

ratingMAC := ratingMAC + 1

float ratingEMA10 = na

if not na(EMA10)

ratingEMA10 := calcRatingMA(EMA10, close)

ratingMA := ratingMA + ratingEMA10

ratingMAC := ratingMAC + 1

float ratingEMA20 = na

if not na(EMA20)

ratingEMA20 := calcRatingMA(EMA20, close)

ratingMA := ratingMA + ratingEMA20

ratingMAC := ratingMAC + 1

float ratingEMA30 = na

if not na(EMA30)

ratingEMA30 := calcRatingMA(EMA30, close)

ratingMA := ratingMA + ratingEMA30

ratingMAC := ratingMAC + 1

float ratingEMA50 = na

if not na(EMA50)

ratingEMA50 := calcRatingMA(EMA50, close)

ratingMA := ratingMA + ratingEMA50

ratingMAC := ratingMAC + 1

float ratingEMA100 = na

if not na(EMA100)

ratingEMA100 := calcRatingMA(EMA100, close)

ratingMA := ratingMA + ratingEMA100

ratingMAC := ratingMAC + 1

float ratingEMA200 = na

if not na(EMA200)

ratingEMA200 := calcRatingMA(EMA200, close)

ratingMA := ratingMA + ratingEMA200

ratingMAC := ratingMAC + 1

///////////////////////////

float ratingALMA10 = na

if not na(ALMA10)

ratingALMA10 := calcRatingMA(ALMA10, close)

ratingMA := ratingMA + ratingALMA10

ratingMAC := ratingMAC + 1

float ratingALMA20 = na

if not na(ALMA20)

ratingALMA20 := calcRatingMA(ALMA20, close)

ratingMA := ratingMA + ratingALMA20

ratingMAC := ratingMAC + 1

float ratingALMA50 = na

if not na(ALMA50)

ratingALMA50 := calcRatingMA(ALMA50, close)

ratingMA := ratingMA + ratingALMA50

ratingMAC := ratingMAC + 1

float ratingALMA100 = na

if not na(ALMA100)

ratingALMA100 := calcRatingMA(ALMA100, close)

ratingMA := ratingMA + ratingALMA100

ratingMAC := ratingMAC + 1

float ratingALMA200 = na

if not na(ALMA200)

ratingALMA200 := calcRatingMA(ALMA200, close)

ratingMA := ratingMA + ratingALMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingSMMA10 = na

if not na(SMMA10)

ratingSMMA10 := calcRatingMA(SMMA10, close)

ratingMA := ratingMA + ratingSMMA10

ratingMAC := ratingMAC + 1

float ratingSMMA20 = na

if not na(SMMA20)

ratingSMMA20 := calcRatingMA(SMMA20, close)

ratingMA := ratingMA + ratingSMMA20

ratingMAC := ratingMAC + 1

float ratingSMMA50 = na

if not na(SMMA50)

ratingSMMA50 := calcRatingMA(SMMA50, close)

ratingMA := ratingMA + ratingSMMA50

ratingMAC := ratingMAC + 1

float ratingSMMA100 = na

if not na(SMMA100)

ratingSMMA100 := calcRatingMA(SMMA100, close)

ratingMA := ratingMA + ratingSMMA100

ratingMAC := ratingMAC + 1

float ratingSMMA200 = na

if not na(SMMA200)

ratingSMMA200 := calcRatingMA(SMMA200, close)

ratingMA := ratingMA + ratingSMMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingLSMA10 = na

if not na(LSMA10)

ratingLSMA10 := calcRatingMA(LSMA10, close)

ratingMA := ratingMA + ratingLSMA10

ratingMAC := ratingMAC + 1

float ratingLSMA20 = na

if not na(LSMA20)

ratingLSMA20 := calcRatingMA(LSMA20, close)

ratingMA := ratingMA + ratingLSMA20

ratingMAC := ratingMAC + 1

float ratingLSMA50 = na

if not na(LSMA50)

ratingLSMA50 := calcRatingMA(LSMA50, close)

ratingMA := ratingMA + ratingLSMA50

ratingMAC := ratingMAC + 1

float ratingLSMA100 = na

if not na(LSMA100)

ratingLSMA100 := calcRatingMA(LSMA100, close)

ratingMA := ratingMA + ratingLSMA100

ratingMAC := ratingMAC + 1

float ratingLSMA200 = na

if not na(LSMA200)

ratingLSMA200 := calcRatingMA(LSMA200, close)

ratingMA := ratingMA + ratingLSMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingVWMA10 = na

if not na(VWMA10)

ratingVWMA10 := calcRatingMA(VWMA10, close)

ratingMA := ratingMA + ratingVWMA10

ratingMAC := ratingMAC + 1

float ratingVWMA20 = na

if not na(VWMA20)

ratingVWMA20 := calcRatingMA(VWMA20, close)

ratingMA := ratingMA + ratingVWMA20

ratingMAC := ratingMAC + 1

float ratingVWMA50 = na

if not na(VWMA50)

ratingVWMA50 := calcRatingMA(VWMA50, close)

ratingMA := ratingMA + ratingVWMA50

ratingMAC := ratingMAC + 1

float ratingVWMA100 = na

if not na(VWMA100)

ratingVWMA100 := calcRatingMA(VWMA100, close)

ratingMA := ratingMA + ratingVWMA100

ratingMAC := ratingMAC + 1

float ratingVWMA200 = na

if not na(VWMA200)

ratingVWMA200 := calcRatingMA(VWMA200, close)

ratingMA := ratingMA + ratingVWMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingDEMA10 = na

if not na(DEMA10)

ratingDEMA10 := calcRatingMA(DEMA10, close)

ratingMA := ratingMA + ratingDEMA10

ratingMAC := ratingMAC + 1

float ratingDEMA20 = na

if not na(DEMA20)

ratingDEMA20 := calcRatingMA(DEMA20, close)

ratingMA := ratingMA + ratingDEMA20

ratingMAC := ratingMAC + 1

float ratingDEMA50 = na

if not na(DEMA50)

ratingDEMA50 := calcRatingMA(DEMA50, close)

ratingMA := ratingMA + ratingDEMA50

ratingMAC := ratingMAC + 1

float ratingDEMA100 = na

if not na(DEMA100)

ratingDEMA100 := calcRatingMA(DEMA100, close)

ratingMA := ratingMA + ratingDEMA100

ratingMAC := ratingMAC + 1

float ratingDEMA200 = na

if not na(DEMA200)

ratingDEMA200 := calcRatingMA(DEMA200, close)

ratingMA := ratingMA + ratingDEMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

float ratingHMA10 = na

if not na(HMA10)

ratingHMA10 := calcRatingMA(HMA10, close)

ratingMA := ratingMA + ratingHMA10

ratingMAC := ratingMAC + 1

float ratingHMA20 = na

if not na(HMA20)

ratingHMA20 := calcRatingMA(HMA20, close)

ratingMA := ratingMA + ratingHMA20

ratingMAC := ratingMAC + 1

float ratingHMA50 = na

if not na(HMA50)

ratingHMA50 := calcRatingMA(HMA50, close)

ratingMA := ratingMA + ratingHMA50

ratingMAC := ratingMAC + 1

float ratingHMA100 = na

if not na(HMA100)

ratingHMA100 := calcRatingMA(HMA100, close)

ratingMA := ratingMA + ratingHMA100

ratingMAC := ratingMAC + 1

float ratingHMA200 = na

if not na(HMA200)

ratingHMA200 := calcRatingMA(HMA200, close)

ratingMA := ratingMA + ratingHMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingKAMA10 = na

if not na(KAMA10)

ratingKAMA10 := calcRatingMA(KAMA10, close)

ratingMA := ratingMA + ratingKAMA10

ratingMAC := ratingMAC + 1

float ratingKAMA20 = na

if not na(KAMA20)

ratingKAMA20 := calcRatingMA(KAMA20, close)

ratingMA := ratingMA + ratingKAMA20

ratingMAC := ratingMAC + 1

float ratingKAMA50 = na

if not na(KAMA50)

ratingKAMA50 := calcRatingMA(KAMA50, close)

ratingMA := ratingMA + ratingKAMA50

ratingMAC := ratingMAC + 1

float ratingKAMA100 = na

if not na(KAMA100)

ratingKAMA100 := calcRatingMA(KAMA100, close)

ratingMA := ratingMA + ratingKAMA100

ratingMAC := ratingMAC + 1

float ratingKAMA200 = na

if not na(KAMA200)

ratingKAMA200 := calcRatingMA(KAMA200, close)

ratingMA := ratingMA + ratingKAMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingFRAMA10 = na

if not na(FRAMA10)

ratingFRAMA10 := calcRatingMA(FRAMA10, close)

ratingMA := ratingMA + ratingFRAMA10

ratingMAC := ratingMAC + 1

float ratingFRAMA20 = na

if not na(FRAMA20)

ratingFRAMA20 := calcRatingMA(FRAMA20, close)

ratingMA := ratingMA + ratingFRAMA20

ratingMAC := ratingMAC + 1

float ratingFRAMA50 = na

if not na(FRAMA50)

ratingFRAMA50 := calcRatingMA(FRAMA50, close)

ratingMA := ratingMA + ratingFRAMA50

ratingMAC := ratingMAC + 1

float ratingFRAMA100 = na

if not na(FRAMA100)

ratingFRAMA100 := calcRatingMA(FRAMA100, close)

ratingMA := ratingMA + ratingFRAMA100

ratingMAC := ratingMAC + 1

float ratingFRAMA200 = na

if not na(FRAMA200)

ratingFRAMA200 := calcRatingMA(FRAMA200, close)

ratingMA := ratingMA + ratingFRAMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingVIDMA10 = na

if not na(VIDMA10)

ratingVIDMA10 := calcRatingMA(VIDMA10, close)

ratingMA := ratingMA + ratingVIDMA10

ratingMAC := ratingMAC + 1

float ratingVIDMA20 = na

if not na(VIDMA20)

ratingVIDMA20 := calcRatingMA(VIDMA20, close)

ratingMA := ratingMA + ratingVIDMA20

ratingMAC := ratingMAC + 1

float ratingVIDMA50 = na

if not na(VIDMA50)

ratingVIDMA50 := calcRatingMA(VIDMA50, close)

ratingMA := ratingMA + ratingVIDMA50

ratingMAC := ratingMAC + 1

float ratingVIDMA100 = na

if not na(VIDMA100)

ratingVIDMA100 := calcRatingMA(VIDMA100, close)

ratingMA := ratingMA + ratingVIDMA100

ratingMAC := ratingMAC + 1

float ratingVIDMA200 = na

if not na(VIDMA200)

ratingVIDMA200 := calcRatingMA(VIDMA200, close)

ratingMA := ratingMA + ratingVIDMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

float ratingJMA10 = na

if not na(JMA10)

ratingJMA10 := calcRatingMA(JMA10, close)

ratingMA := ratingMA + ratingJMA10

ratingMAC := ratingMAC + 1

float ratingJMA20 = na

if not na(JMA20)

ratingJMA20 := calcRatingMA(JMA20, close)

ratingMA := ratingMA + ratingJMA20

ratingMAC := ratingMAC + 1

float ratingJMA50 = na

if not na(JMA50)

ratingJMA50 := calcRatingMA(JMA50, close)

ratingMA := ratingMA + ratingJMA50

ratingMAC := ratingMAC + 1

float ratingJMA100 = na

if not na(JMA100)

ratingJMA100 := calcRatingMA(JMA100, close)

ratingMA := ratingMA + ratingJMA100

ratingMAC := ratingMAC + 1

float ratingJMA200 = na

if not na(JMA200)

ratingJMA200 := calcRatingMA(JMA200, close)

ratingMA := ratingMA + ratingJMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingTEMA10 = na

if not na(TEMA10)

ratingTEMA10 := calcRatingMA(TEMA10, close)

ratingMA := ratingMA + ratingTEMA10

ratingMAC := ratingMAC + 1

float ratingTEMA20 = na

if not na(TEMA20)

ratingTEMA20 := calcRatingMA(TEMA20, close)

ratingMA := ratingMA + ratingTEMA20

ratingMAC := ratingMAC + 1

float ratingTEMA50 = na

if not na(TEMA50)

ratingTEMA50 := calcRatingMA(TEMA50, close)

ratingMA := ratingMA + ratingTEMA50

ratingMAC := ratingMAC + 1

float ratingTEMA100 = na

if not na(TEMA100)

ratingTEMA100 := calcRatingMA(TEMA100, close)

ratingMA := ratingMA + ratingTEMA100

ratingMAC := ratingMAC + 1

float ratingTEMA200 = na

if not na(TEMA200)

ratingTEMA200 := calcRatingMA(TEMA200, close)

ratingMA := ratingMA + ratingTEMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

float ratingZLEMA10 = na

if not na(ZLEMA10)

ratingZLEMA10 := calcRatingMA(ZLEMA10, close)

ratingMA := ratingMA + ratingZLEMA10

ratingMAC := ratingMAC + 1

float ratingZLEMA20 = na

if not na(ZLEMA20)

ratingZLEMA20 := calcRatingMA(ZLEMA20, close)

ratingMA := ratingMA + ratingZLEMA20

ratingMAC := ratingMAC + 1

float ratingZLEMA50 = na

if not na(ZLEMA50)

ratingZLEMA50 := calcRatingMA(ZLEMA50, close)

ratingMA := ratingMA + ratingZLEMA50

ratingMAC := ratingMAC + 1

float ratingZLEMA100 = na

if not na(ZLEMA100)

ratingZLEMA100 := calcRatingMA(ZLEMA100, close)

ratingMA := ratingMA + ratingZLEMA100

ratingMAC := ratingMAC + 1

float ratingZLEMA200 = na

if not na(ZLEMA200)

ratingZLEMA200 := calcRatingMA(ZLEMA200, close)

ratingMA := ratingMA + ratingZLEMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingTRIMA10 = na

if not na(TRIMA10)

ratingTRIMA10 := calcRatingMA(TRIMA10, close)

ratingMA := ratingMA + ratingTRIMA10

ratingMAC := ratingMAC + 1

float ratingTRIMA20 = na

if not na(TRIMA20)

ratingTRIMA20 := calcRatingMA(TRIMA20, close)

ratingMA := ratingMA + ratingTRIMA20

ratingMAC := ratingMAC + 1

float ratingTRIMA50 = na

if not na(TRIMA50)

ratingTRIMA50 := calcRatingMA(TRIMA50, close)

ratingMA := ratingMA + ratingTRIMA50

ratingMAC := ratingMAC + 1

float ratingTRIMA100 = na

if not na(TRIMA100)

ratingTRIMA100 := calcRatingMA(TRIMA100, close)

ratingMA := ratingMA + ratingTRIMA100

ratingMAC := ratingMAC + 1

float ratingTRIMA200 = na

if not na(TRIMA200)

ratingTRIMA200 := calcRatingMA(TRIMA200, close)

ratingMA := ratingMA + ratingTRIMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

float ratingT3MA10 = na

if not na(T3MA10)

ratingT3MA10 := calcRatingMA(T3MA10, close)

ratingMA := ratingMA + ratingT3MA10

ratingMAC := ratingMAC + 1

float ratingT3MA20 = na

if not na(T3MA20)

ratingT3MA20 := calcRatingMA(T3MA20, close)

ratingMA := ratingMA + ratingT3MA20

ratingMAC := ratingMAC + 1

float ratingT3MA50 = na

if not na(T3MA50)

ratingT3MA50 := calcRatingMA(T3MA50, close)

ratingMA := ratingMA + ratingT3MA50

ratingMAC := ratingMAC + 1

float ratingT3MA100 = na

if not na(T3MA100)

ratingT3MA100 := calcRatingMA(T3MA100, close)

ratingMA := ratingMA + ratingT3MA100

ratingMAC := ratingMAC + 1

float ratingT3MA200 = na

if not na(T3MA200)

ratingT3MA200 := calcRatingMA(T3MA200, close)

ratingMA := ratingMA + ratingT3MA200

ratingMAC := ratingMAC + 1

//////////////////////////////////////////

float ratingIC = na

if not (na(IC_Lead1) or na(IC_Lead2) or na(close) or na(close[1]) or na(IC_BLine) or na(IC_CLine))

ratingIC := calcRating(

IC_Lead1 > IC_Lead2 and close > IC_Lead1 and close < IC_BLine and close[1] < IC_CLine and close > IC_CLine,

IC_Lead2 > IC_Lead1 and close < IC_Lead2 and close > IC_BLine and close[1] > IC_CLine and close < IC_CLine)

if not na(ratingIC)

ratingMA := ratingMA + ratingIC

ratingMAC := ratingMAC + 1

ratingMA := ratingMAC > 0 ? ratingMA / ratingMAC : na

float ratingTotal = 0

float ratingTotalC = 0

if not na(ratingMA)

ratingTotal := ratingTotal + ratingMA

ratingTotalC := ratingTotalC + 1

ratingTotal := ratingTotalC > 0 ? ratingTotal / ratingTotalC : na

[ratingTotal, ratingMA]

getSignal2(ratingTotal, ratingMA) =>

float _res = ratingTotal

_res := ratingMA

[ratingTotal, ratingMA] = request.security(syminfo.tickerid, res, calcRatingAll())

tradeSignal = getSignal2(ratingTotal, ratingMA)

rating_entry = input.float(0.95, title='Rating for long', group="Entry Rating %", step=0.05)

rating_exit = input.float(0.75, title='Rating for short', group="Entry Rating %", step=0.05) * -1

long = tradeSignal >= rating_entry

short = tradeSignal <= rating_exit

strategy.entry("long",strategy.long,when=long)

strategy.entry('short',strategy.short,when=short)