Ajustar la estrategia de compra y caída

Descripción general

La estrategia combina el indicador RSI y la línea de medianía del precio para buscar oportunidades de venta por encima de la línea de medianía. A medida que el precio de la acción cae aún más, la estrategia aumenta la posición por etapas por ciento, según lo previsto, para alcanzar el objetivo del costo promedio de la posición.

Principio de estrategia

Cuando el indicador RSI esté por debajo de la línea de venta por encima de 29 y el precio de cierre esté por debajo de la línea media, haga una primera orden de apertura adicional.

Cuando el precio de las acciones alcanza el 2% de la primera caída, aumenta la posición; cuando la caída alcanza el 3%, aumenta la posición por tercera vez, y así sucesivamente hasta un máximo de 8 posiciones. Esto logra el efecto de construir posiciones en lotes.

Cada vez que se abre una posición, se registra el precio de apertura en ese momento. Estos puntos de precio son los precios de referencia para la entrada. Y se trazan estas líneas de precio en el gráfico.

Después de abrir una posición, se calcula el precio promedio de la posición. El 3% del precio promedio es el precio de cierre de cada posición, el 4% es el precio de cierre de la posición en general.

Cuando el precio sube más que el precio de parada de una posición, se elige la posición para cerrar.

El método de cálculo de la parada progresiva: cada vez que se cancela una posición, se deducirá la ganancia obtenida por esa posición en el precio de parada general. Esto puede hacer que la línea de parada se mueva lentamente hacia abajo y solo se cancelará completamente cuando las ganancias de todas las posiciones sean suficientes para compensar la mayor pérdida.

Cuando el precio dispara la línea de parada progresiva, seleccione la posición llena.

Análisis de las ventajas

El indicador RSI puede determinar con mayor precisión las zonas de venta excesiva, lo que ayuda a aprovechar las oportunidades de reversión.

Se pueden incrementar los costos de mantenimiento de una posición en el punto más bajo en una serie de incrementos.

La suspensión progresiva reduce el riesgo de pérdidas y permite una salida progresiva. Incluso si se producen pérdidas, se pueden controlar hasta cierto punto.

Se pueden configurar las tasas de stop loss y las tasas de alza de posición para ajustar el riesgo de la estrategia en función del mercado.

En el gráfico se muestran las líneas de referencia de apertura y de cierre de la posición.

Análisis de riesgos

En situaciones de crisis, se pueden disparar varias veces las posiciones abiertas y las paradas, y las operaciones a menudo causan pérdidas de puntos de deslizamiento. Se puede relajar adecuadamente el parámetro RSI y reducir el número de operaciones.

El número y la proporción incorrectamente establecidos pueden conducir a exceso de operaciones y deben configurarse con precaución según la situación de los fondos.

Si el mercado continúa bajando, puede enfrentarse a un riesgo de agujero sin fondo. Se debe prever un límite máximo en el número de adiciones, y el último nivel de adiciones es conservador.

Si la proporción de frenado es demasiado pequeña, puede provocar un frenado prematuro. Se debe establecer la proporción de frenado adecuada según los datos de retroalimentación histórica.

Dirección de optimización

Se pueden introducir indicadores como MACD para filtrar las señales RSI y reducir las operaciones no válidas.

El ATR se puede configurar para evitar grandes pérdidas en situaciones extremas.

Se pueden optimizar parámetros como el número de incrementos, la proporción y la proporción de suspensión para que las estrategias se adapten mejor a las diferentes variedades.

Se puede ajustar la proporción de frenado de forma inteligente en función de la tasa de fluctuación, con una relajación adecuada cuando la fluctuación es grande.

Resumir

La estrategia aprovecha al máximo el indicador RSI para determinar zonas de sobreventa, para realizar operaciones de reversión en combinación con la línea de equilibrio de los precios. Al mismo tiempo, utiliza un mecanismo de alza inteligente y parada progresiva, para lograr una estrategia de multitarea eficiente bajo la premisa de controlar el riesgo.

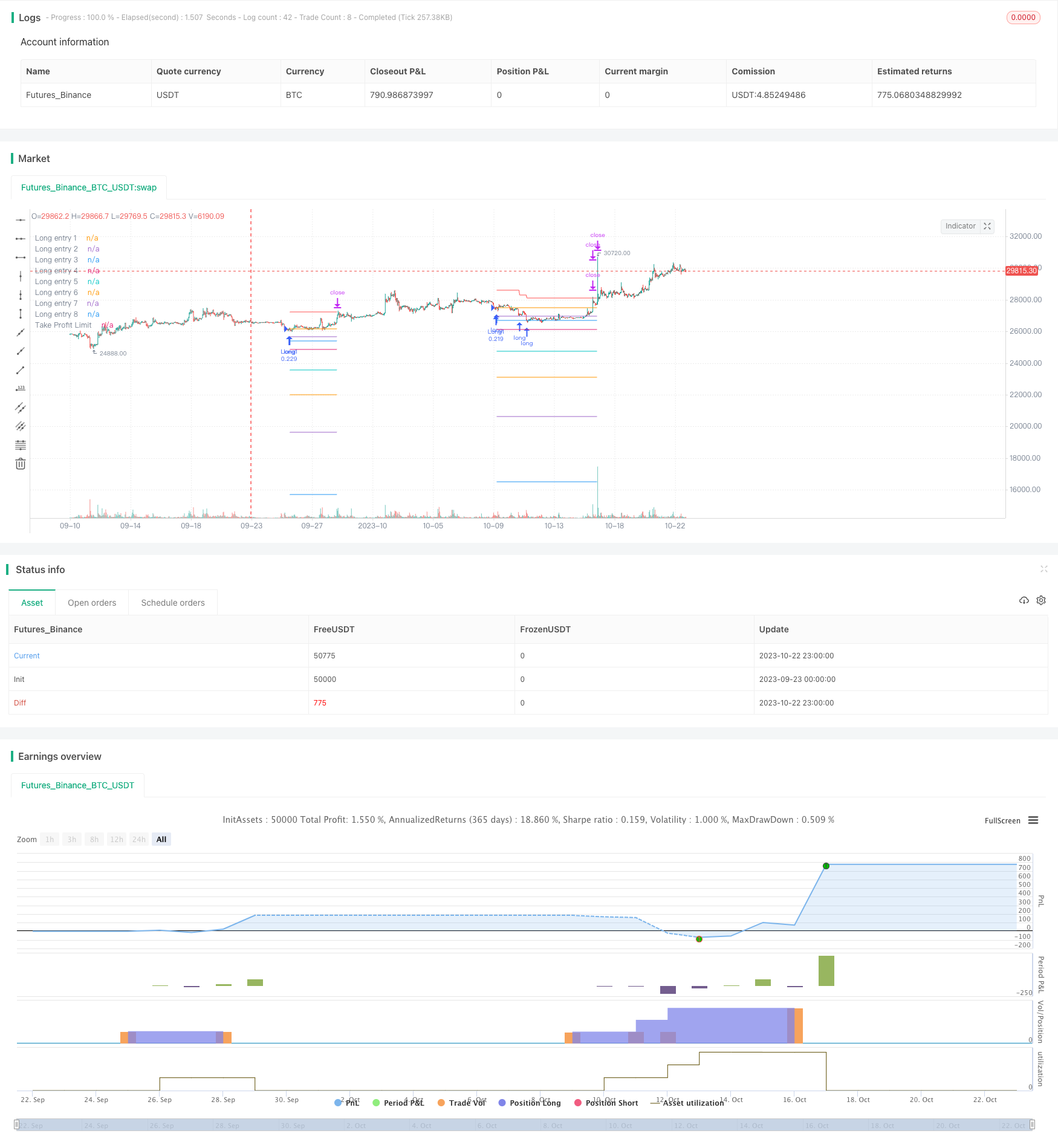

/*backtest

start: 2023-09-23 00:00:00

end: 2023-10-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

// © A3Sh

// RSI Strategy that buys the dips, uses Price Averaging and Pyramiding.

// When the price drops below specified percentages of the price (8 PA layers), new entries are openend to average the price of the assets.

// Open entries are closed by a specified take profit.

// Entries can be reopened, after closing and consequently crossing a PA layer again.

// This strategy is based on the RSI+PA+DCA strategy I created earlier. The difference is the way the Take Profit is calculated.

// Instead of directly connecting the take profit limit to the decreasing average price level with an X percent above the average price,

// the take profit is calculated for a part on the decreasing average price and for another part on the deduction

// of the profits of the individual closed positions.

// The Take Profit Limit drop less significant then the average price level and the full position only completely exits

// when enough individual closed positions made up for the losses.

// This makes it less risky and more conservative and great for a long term trading strategy

// RSI code is adapted from the build in Relative Strength Index indicator

// MA Filter and RSI concept adapted from the Optimized RSI Buy the Dips strategy, by Coinrule

// https://www.tradingview.com/script/Pm1WAtyI-Optimized-RSI-Strategy-Buy-The-Dips-by-Coinrule/

// Pyramiding entries code adapted from Pyramiding Entries on Early Trends startegy, by Coinrule

// Pyramiding entries code adapted from Pyramiding Entries on Early Trends startegy, by Coinrule

// https://www.tradingview.com/script/7NNJ0sXB-Pyramiding-Entries-On-Early-Trends-by-Coinrule/

// Plot entry layers code adapted from HOWTO Plot Entry Price by vitvlkv

// https://www.tradingview.com/script/bHTnipgY-HOWTO-Plot-Entry-Price/

strategy(title='RSI+PA+PTP', pyramiding=16, overlay=true, initial_capital=400, default_qty_type=strategy.percent_of_equity, default_qty_value=15, commission_type=strategy.commission.percent, commission_value=0.075, close_entries_rule='FIFO')

port = input.float(12, group = "Risk", title='Portfolio % Used To Open The 8 Positions', step=0.1, minval=0.1, maxval=100)

q = strategy.equity / 100 * port / open

// Long position PA entry layers. Percentage from the entry price of the the first long

ps2 = input.float(2, group = "Long Position Entry Layers", title='2nd Long Entry %', step=0.1)

ps3 = input.float(3, group = "Long Position Entry Layers", title='3rd Long Entry %', step=0.1)

ps4 = input.float(5, group = "Long Position Entry Layers", title='4th Long Entry %', step=0.1)

ps5 = input.float(10, group = "Long Position Entry Layers", title='5th Long Entry %', step=0.1)

ps6 = input.float(16, group = "Long Position Entry Layers", title='6th Long Entry %', step=0.1)

ps7 = input.float(25, group = "Long Position Entry Layers" ,title='7th Long Entry %', step=0.1)

ps8 = input.float(40, group = "Long Position Entry Layers", title='8th Long Entry %', step=0.1)

// Calculate Moving Averages

plotMA = input.bool(group = "Moving Average Filter", title='Plot Moving Average', defval=false)

movingaverage_signal = ta.sma(close, input(100, group = "Moving Average Filter", title='MA Length'))

plot (plotMA ? movingaverage_signal : na, color = color.new (color.green, 0))

// RSI inputs and calculations

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

overSold = input.int(29, title="Oversold, Trigger to Enter First Position", group = "RSI Settings")

// Long trigger (co)

co = ta.crossover(rsi, overSold) and close < movingaverage_signal

// Store values to create and plot the different PA layers

long1 = ta.valuewhen(co, close, 0)

long2 = ta.valuewhen(co, close - close / 100 * ps2, 0)

long3 = ta.valuewhen(co, close - close / 100 * ps3, 0)

long4 = ta.valuewhen(co, close - close / 100 * ps4, 0)

long5 = ta.valuewhen(co, close - close / 100 * ps5, 0)

long6 = ta.valuewhen(co, close - close / 100 * ps6, 0)

long7 = ta.valuewhen(co, close - close / 100 * ps7, 0)

long8 = ta.valuewhen(co, close - close / 100 * ps8, 0)

eps1 = 0.00

eps1 := na(eps1[1]) ? na : eps1[1]

eps2 = 0.00

eps2 := na(eps2[1]) ? na : eps2[1]

eps3 = 0.00

eps3 := na(eps3[1]) ? na : eps3[1]

eps4 = 0.00

eps4 := na(eps4[1]) ? na : eps4[1]

eps5 = 0.00

eps5 := na(eps5[1]) ? na : eps5[1]

eps6 = 0.00

eps6 := na(eps6[1]) ? na : eps6[1]

eps7 = 0.00

eps7 := na(eps7[1]) ? na : eps7[1]

eps8 = 0.00

eps8 := na(eps8[1]) ? na : eps8[1]

plot(strategy.position_size > 0 ? eps1 : na, title='Long entry 1', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps2 : na, title='Long entry 2', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps3 : na, title='Long entry 3', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps4 : na, title='Long entry 4', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps5 : na, title='Long entry 5', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps6 : na, title='Long entry 6', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps7 : na, title='Long entry 7', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps8 : na, title='Long entry 8', style=plot.style_linebr)

// Take Profit Settings

ProfitTarget_Percent = input.float(3.0, group = "Take Profit Settings", title='Take Profit % (Per Position)')

ProfitTarget_Percent_All = input.float(4.0, group = "Take Profit Settings", title='Take Profit % (Exit All, Progressive Take Profit Limit')

TakeProfitProgression = input.float(12, group = "Take Profit Settings", title='Take Profit Progression', tooltip = 'Progression is defined by the position size. By default 12% of the start equity (portfolio) is used to open a position, see Risk. This same % percentage is used to calculate the profit amount that will be deducted from the Take Profit Limit.')

entryOn = input.bool (true, group = "Take Profit Settings", title='New entries affect Take Profit limit', tooltip = 'This option changes the behaviour of the Progressive Take Profit. When switchted on, the difference between the former and current original Take Profit is deducted from the Progressive Take Profit. When switchted off, the Progressive Take Profit is only affected by the profit deduction or each closed position.')

avPricePlot = input.bool (false, group = "Take Profit Settings", title='Plot Average Price (FIFO)')

// Original Take Profit Limit

tpLimit = strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All)

// Create variables to calculate the Take Profit Limit Progresssion

var endVal = 0.0

var startVal = 0.0

// The value at the the start of the loop is the value of the end of the previous loop

startVal := endVal

// Set variable to the original Take Profit Limit when the first position opens.

if strategy.position_size > 0 and strategy.position_size[1] ==0

endVal := tpLimit

// Everytime a specific position opens, the difference of the previous (original) Take Profit price and the current (original) Take Profit price will be deducted from the Progressive Take Profit Limit

// This feature can be toggled on and off in the settings panel. By default it is toggled on.

entryAmount = 0.0

for i = 1 to strategy.opentrades

entryAmount := i

if entryOn and strategy.position_size > 0 and strategy.opentrades[1] == (entryAmount) and strategy.opentrades == (entryAmount + 1)

endVal := startVal - (tpLimit[1] - tpLimit)

// Everytime a specific position closes, the amount of profit from that specific position will be deducted from the Progressive Take Profit Limit.

exitAmount = 0.0

for id = 1 to strategy.opentrades

exitAmount := id

if strategy.opentrades[1] ==(exitAmount + 1) and strategy.opentrades == (exitAmount)

endVal := startVal - (TakeProfitProgression / 100 * strategy.opentrades.entry_price (id - 1) / 100 * ProfitTarget_Percent )

// The Final Take Profit Price

tpn = (strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All)) - (strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All) - endVal)

plot (strategy.position_size > 0 ? tpn : na, title = "Take Profit Limit", color=color.new(color.red, 0), style = plot.style_linebr, linewidth = 1)

// Plot position average price as reference

plot (avPricePlot ? strategy.position_avg_price : na, title= "Average price", color = color.new(color.white, 0), style = plot.style_linebr, linewidth = 1)

// When to trigger the Take Profit per position or the Progressive Take Profit

tpl1 = close < tpn ? eps1 + close * (ProfitTarget_Percent / 100) : tpn

tpl2 = close < tpn ? eps2 + close * (ProfitTarget_Percent / 100) : tpn

tpl3 = close < tpn ? eps3 + close * (ProfitTarget_Percent / 100) : tpn

tpl4 = close < tpn ? eps4 + close * (ProfitTarget_Percent / 100) : tpn

tpl5 = close < tpn ? eps5 + close * (ProfitTarget_Percent / 100) : tpn

tpl6 = close < tpn ? eps6 + close * (ProfitTarget_Percent / 100) : tpn

tpl7 = close < tpn ? eps7 + close * (ProfitTarget_Percent / 100) : tpn

tpl8 = close < tpn ? eps8 + close * (ProfitTarget_Percent / 100) : tpn

// Submit Entry Orders

if co and strategy.opentrades == 0

eps1 := long1

eps2 := long2

eps3 := long3

eps4 := long4

eps5 := long5

eps6 := long6

eps7 := long7

eps8 := long8

strategy.entry('Long1', strategy.long, q)

if strategy.opentrades == 1

strategy.entry('Long2', strategy.long, q, limit=eps2)

if strategy.opentrades == 2

strategy.entry('Long3', strategy.long, q, limit=eps3)

if strategy.opentrades == 3

strategy.entry('Long4', strategy.long, q, limit=eps4)

if strategy.opentrades == 4

strategy.entry('Long5', strategy.long, q, limit=eps5)

if strategy.opentrades == 5

strategy.entry('Long6', strategy.long, q, limit=eps6)

if strategy.opentrades == 6

strategy.entry('Long7', strategy.long, q, limit=eps7)

if strategy.opentrades == 7

strategy.entry('Long8', strategy.long, q, limit=eps8)

// Submit Exit orders

if strategy.position_size > 0

strategy.exit(id='Exit 1', from_entry='Long1', limit=tpl1)

strategy.exit(id='Exit 2', from_entry='Long2', limit=tpl2)

strategy.exit(id='Exit 3', from_entry='Long3', limit=tpl3)

strategy.exit(id='Exit 4', from_entry='Long4', limit=tpl4)

strategy.exit(id='Exit 5', from_entry='Long5', limit=tpl5)

strategy.exit(id='Exit 6', from_entry='Long6', limit=tpl6)

strategy.exit(id='Exit 7', from_entry='Long7', limit=tpl7)

strategy.exit(id='Exit 8', from_entry='Long8', limit=tpl8)

// Make sure that all open limit orders are canceled after exiting all the positions

longClose = strategy.position_size[1] > 0 and strategy.position_size == 0 ? 1 : 0

if longClose

strategy.cancel_all()