Estrategia de tendencia a corto plazo basada en la toma de decisiones con indicadores multidimensionales

Descripción general

La estrategia combina indicadores técnicos de tres dimensiones diferentes, el soporte de la resistencia, el sistema de línea media y el indicador de sobreventa y sobreventa, para determinar la dirección de la tendencia a corto plazo en función de sus señales combinadas, con el fin de obtener una mayor probabilidad de éxito.

Principio de estrategia

El código primero calcula los puntos de soporte y resistencia del precio, incluyendo el eje de oscilación estándar y los puntos de soporte y resistencia de Fibonacci, y los traza en un gráfico. Cuando el precio rompe estos puntos clave, se considera una señal de tendencia importante.

Luego se calculan las medias móviles ponderadas VWAP y la media, para juzgar sus señales de cruz dorada y cruz muerta. Esto es un juicio de tendencia a medio y largo plazo.

Finalmente, se calcula el indicador Stochastic RSI para determinar si su señal de cruzamiento dorado y la horca muerta pertenecen al indicador de sobrecompra y sobreventa.

La combinación de estas tres dimensiones de los indicadores, si el soporte de la resistencia, la línea media VWAP y el RSI estocástico emiten señales de compra al mismo tiempo, se abre una oferta; si los tres emiten señales de venta al mismo tiempo, se abre una oferta en blanco.

Análisis de las ventajas

La mayor ventaja de esta estrategia es que combina indicadores de tres dimensiones diferentes, lo que hace que el juicio sea más completo y preciso, con una mayor probabilidad de ganar. Primero, apoya el punto de resistencia para juzgar la tendencia general; luego, el VWAP para juzgar la tendencia de la línea media y larga; y finalmente, el RSI estocástico para juzgar la situación de sobreventa y sobreventa.

Además, la estrategia incluye la función de bloqueo, que puede bloquear una cierta proporción de ganancias, lo que es útil para la administración de fondos.

Análisis de riesgos

El principal riesgo de esta estrategia reside en que la toma de decisiones en exceso depende de la sincronización de las señales de los indicadores, lo que puede conducir a errores de decisión si algunos indicadores emiten señales erróneas. Por ejemplo, el RSI estocástico emite una señal de sobrecompra, pero el VWAP y el juicio de resistencia de soporte siguen siendo optimistas, en este momento es posible que se pierda el punto de compra y no se ingrese.

Además, la configuración incorrecta de los parámetros del indicador también puede causar errores en el juicio de la señal, lo que requiere una prueba repetida para encontrar el parámetro óptimo.

Además, a corto plazo, los mercados de valores suelen sufrir eventos de ‘black swans’ que provocan la invalidez de los indicadores. Para evitar este riesgo, se puede incorporar una estrategia de stop loss para evitar pérdidas individuales excesivas.

Dirección de optimización

La estrategia puede seguir optimizándose en los siguientes aspectos:

Añadir más señales de indicadores, como el índice de volumen de negocios, para determinar la fortaleza de la tendencia y mejorar la precisión de la decisión.

Se añaden modelos de aprendizaje automático para entrenar indicadores multidimensionales y buscar automáticamente las mejores estrategias de negociación.

Optimización de acuerdo con los parámetros de las diferentes variedades, con parámetros de adaptación.

Aumentar las estrategias de stop loss y controlar mejor el riesgo en función del tamaño de las posiciones de control de retiro.

Optimización de la combinación, búsqueda de variedades de baja relevancia para la combinación y reducción de la retirada de la combinación.

Resumir

La estrategia en general es muy adecuada para el comercio de tendencias a corto plazo. Utiliza indicadores multidimensionales para tomar decisiones, puede filtrar una gran cantidad de ruido y tiene una alta tasa de éxito. Sin embargo, debe tenerse en cuenta el riesgo de que los indicadores envíen señales erróneas.

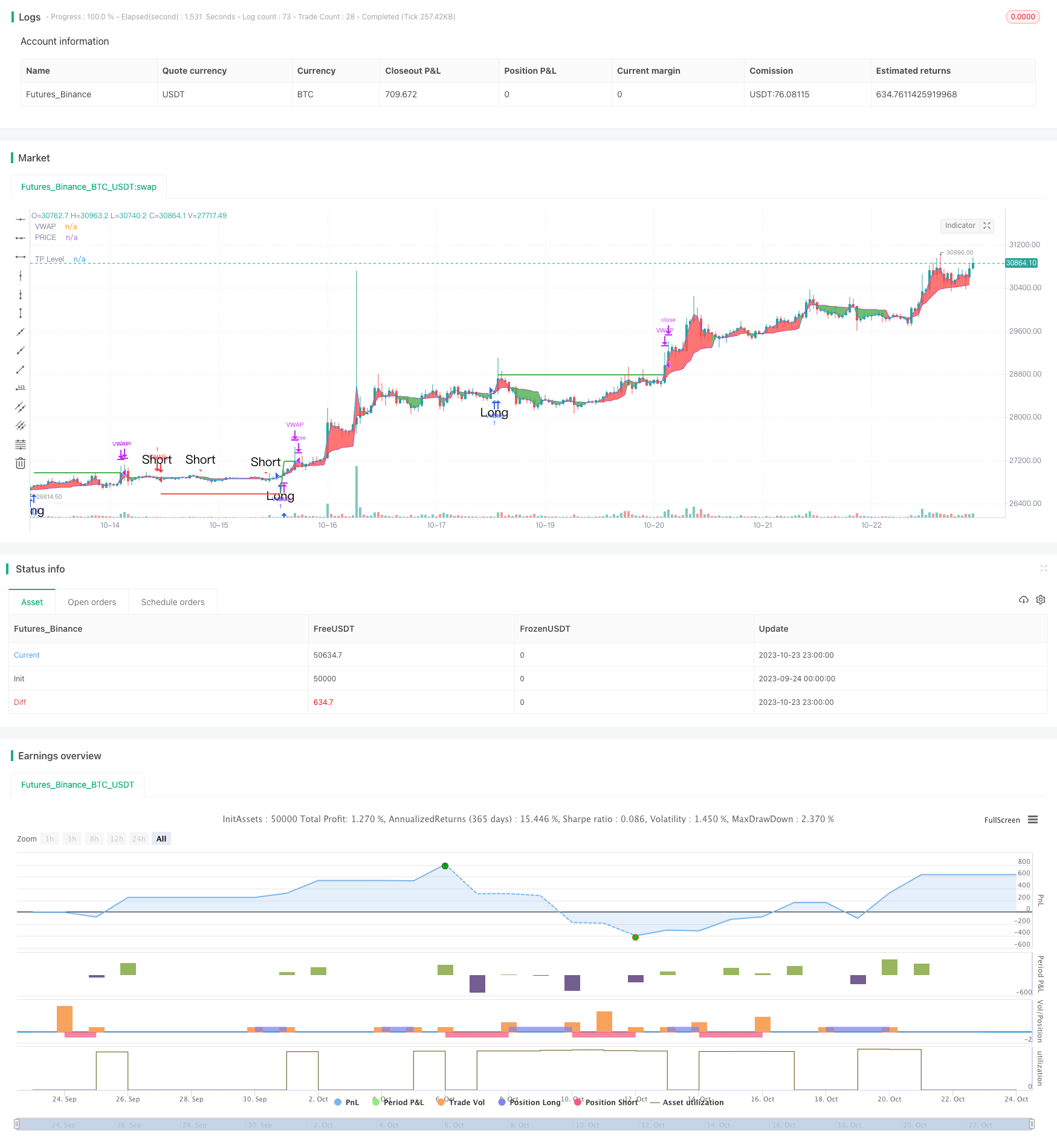

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// EmperorBTC's VWAP Indicator & Strategy

// v2.1

//

// coded by Bogdan Vaida

// This indicator was created after EmperorBTC's conditions on Twitter.

// Good timeframes for it: 30', 15', 5'

// To convert from strategy to study switch the commented lines in the beginning

// and at the end of the script and vice versa.

// What this indicator does is to check if:

// o Pivot Point was crossed

// o Stoch-RSI and VWAP were crossed in current or previous candle

// o Candle (or previous candle) close is in the trend direction

// If all these are true then it will go long or short based on direction.

// FUTURE IDEAS:

// - Volume Expansion

// - Candle Stick patterns

//@version=4

// 🔥Uncomment the line below for the indicator and comment the strategy lines

// study(title="EmperorBTC's VWAP Indicator", shorttitle="EMP-VWAP", overlay=true)

// 🔥 Uncomment the line below for the strategy and comment the above line

strategy(title="EmperorBTC's VWAP Strategy", shorttitle="EMP-VWAP", overlay=true, pyramiding=1)

plotAveragePriceCrossedPivotPoint = input(false, title="Plot Close Price Crossing Pivot Points?", group="Pivot Points")

plotPivotPoints = input(false, title="Plot Pivot Points?", group="Pivot Points")

pivotPointsType = input(title="Pivot Points type", defval="Fibonacci", options=["Fibonacci", "Traditional"], group="Pivot Points")

pivotPointCircleWidth = input(2, title="Width of Pivot Point circles", minval=1, group="Pivot Points")

plotVWAP = input(true, title="Plot VWAP?", group="VWAP")

plotAvgPrice = input(true, title="Plot Average Price?", group="VWAP")

plotVWAPCrossPrice = input(false, title="Plot Price Crossing VWAP?", group="VWAP")

reso = input(title="Period", type=input.resolution, defval="D", group="VWAP")

cumulativePeriod = input(14, "VWAP Cumulative Period", group="VWAP")

plotStochRSICross = input(false, title="Plot StochRSI Cross?", group="StochRSI")

smoothK = input(3, "K", minval=1, group="StochRSI", inline="K&D")

smoothD = input(3, "D", minval=1, group="StochRSI", inline="K&D")

lengthRSI = input(14, "RSI Length", minval=1, group="Stochastic-RSI", inline="length")

lengthStoch = input(14, "Stochastic Length", minval=1, group="Stochastic-RSI", inline="length")

rsiSrc = input(close, title="RSI Source", group="Stochastic-RSI")

plotLong = input(true, title="Plot Long Opportunity?", group="Strategy only")

plotShort = input(true, title="Plot Short Opportunity?", group="Strategy only")

tradingDirection = input(title="Strategy trading Direction: ", defval="L&S", options=["L&S", "L", "S"], group="Strategy only")

takeProfit = input(1.0, title='Take Profit %', group="Strategy only") / 100

plotTP = input(true, title="Plot Take Profit?", group="Strategy only")

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31, group="Backtesting range", inline="Start Date")

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12, group="Backtesting range", inline="Start Date")

startYear = input(title="Start Year", type=input.integer,

defval=2017, minval=1800, maxval=2100, group="Backtesting range", inline="Start Date")

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31, group="Backtesting range", inline="End Date")

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12, group="Backtesting range", inline="End Date")

endYear = input(title="End Year", type=input.integer,

defval=2050, minval=1800, maxval=2100, group="Backtesting range", inline="End Date")

// PivotPoint code (PVTvX by DGT has some nice code on PP)

candleHigh = security(syminfo.tickerid,"D", high[1], lookahead=barmerge.lookahead_on)

candleLow = security(syminfo.tickerid,"D", low[1], lookahead=barmerge.lookahead_on)

candleClose = security(syminfo.tickerid,"D", close[1], lookahead=barmerge.lookahead_on)

pivotPoint = (candleHigh+candleLow+candleClose) / 3

float resistance1 = na

float resistance2 = na

float resistance3 = na

float support1 = na

float support2 = na

float support3 = na

if pivotPointsType == "Fibonacci"

resistance1 := pivotPoint + 0.382 * (candleHigh - candleLow)

resistance2 := pivotPoint + 0.618 * (candleHigh - candleLow)

resistance3 := pivotPoint + (candleHigh - candleLow)

support1 := pivotPoint - 0.382 * (candleHigh - candleLow)

support2 := pivotPoint - 0.618 * (candleHigh - candleLow)

support3 := pivotPoint - (candleHigh - candleLow)

else if pivotPointsType == "Traditional"

resistance1 := 2 * pivotPoint - candleLow

resistance2 := pivotPoint + (candleHigh - candleLow)

resistance3 := candleHigh + 2 * (pivotPoint - candleLow)

support1 := 2 * pivotPoint - candleHigh

support2 := pivotPoint - (candleHigh - candleLow)

support3 := candleLow - 2 * (candleHigh - pivotPoint)

plot(series = plotPivotPoints ? support1 : na, color=#ff0000, title="S1", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? support2 : na, color=#800000, title="S2", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? support3 : na, color=#330000, title="S3", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? pivotPoint : na, color=#FFA500, title="PP", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? resistance1 : na, color=#00FF00, title="R1", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? resistance2 : na, color=#008000, title="R2", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? resistance3 : na, color=#003300, title="R3", style = plot.style_circles, linewidth = pivotPointCircleWidth)

pivotPointCrossedUp = ((low < support3) and (close > support3)) or ((low < support2) and (close > support2)) or ((low < support1) and (close > support1)) or ((low < pivotPoint) and (close > pivotPoint))

pivotPointCrossedDown = ((high > support3) and (close < support3)) or ((high > support2) and (close < support2)) or ((high > support1) and (close < support1)) or ((high > pivotPoint) and (close < pivotPoint))

plotPPColor = pivotPointCrossedUp ? color.green :

pivotPointCrossedDown ? color.red :

na

plotshape(series = plotAveragePriceCrossedPivotPoint ? (pivotPointCrossedUp or pivotPointCrossedDown) : na, title="PP Cross", style = shape.triangleup, location=location.belowbar, color=plotPPColor, text="PP", size=size.small)

// VWAP (taken from the TV code)

// There are five steps in calculating VWAP:

//

// 1. Calculate the Typical Price for the period. [(High + Low + Close)/3)]

// 2. Multiply the Typical Price by the period Volume (Typical Price x Volume)

// 3. Create a Cumulative Total of Typical Price. Cumulative(Typical Price x Volume)

// 4. Create a Cumulative Total of Volume. Cumulative(Volume)

// 5. Divide the Cumulative Totals.

//

// VWAP = Cumulative(Typical Price x Volume) / Cumulative(Volume)

// Emperor's Edition

t = time(reso)

debut = na(t[1]) or t > t[1]

addsource = ohlc4 * volume

addvol = volume

addsource := debut ? addsource : addsource + addsource[1]

addvol := debut ? addvol : addvol + addvol[1]

vwapValue = addsource / addvol

pVWAP = plot(series = plotVWAP ? vwapValue : na, color=color.purple, title="VWAP")

pAvgPrice = plot(series = plotAvgPrice ? ohlc4 : na, color=color.blue, title="PRICE")

fill(pVWAP, pAvgPrice, color = ohlc4 > vwapValue ? color.red : color.green, title="VWAP PRICE FILL")

vwapCrossUp = (low < vwapValue) and (vwapValue < high) and (close > open) // added green candle check

vwapCrossDown = (high > vwapValue) and (vwapValue > low) and (close < open) // added red candle check

plotVWAPColor = vwapCrossUp ? color.green :

vwapCrossDown ? color.red :

na

plotshape(series = plotVWAPCrossPrice ? (vwapCrossUp or vwapCrossDown) : na, title="VWAP Cross Price", style=shape.triangleup, location=location.belowbar, color=plotVWAPColor, text="VWAP", size=size.small)

// Stochastic RSI

rsi1 = rsi(rsiSrc, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

sRsiCrossUp = k[1] < d[1] and k > d

sRsiCrossDown = k[1] > d[1] and k < d

plotColor = sRsiCrossUp ? color.green :

sRsiCrossDown ? color.red :

na

plotshape(series = plotStochRSICross ? (sRsiCrossUp or sRsiCrossDown) : na, title="StochRSI Cross Up", style=shape.triangleup, location=location.belowbar, color=plotColor, text="StochRSI", size=size.small)

// Long Trades

sRsiCrossedUp = sRsiCrossUp or sRsiCrossUp[1]

vwapCrossedUp = vwapCrossUp or vwapCrossUp[1]

// longCond1 = (sRsiCross and vwapCross) or (sRsiCross[1] and vwapCross) or (sRsiCross and vwapCross[1])

longCond1 = (sRsiCrossedUp[1] and vwapCrossedUp[1])

longCond2 = pivotPointCrossedUp[1]

longCond3 = (close[1] > open[1]) and (close > open) // check this

longCond = longCond1 and longCond2 and longCond3

plotshape(series = plotLong ? longCond : na, title="Long", style=shape.triangleup, location=location.belowbar, color=color.green, text="Long", size=size.normal)

// Short Trades

sRsiCrossedDown = sRsiCrossDown or sRsiCrossDown[1]

vwapCrossedDown = vwapCrossDown or vwapCrossDown[1]

shortCond1 = (sRsiCrossedDown[1] and vwapCrossedDown[1])

shortCond2 = pivotPointCrossedDown[1]

shortCond3 = (close[1] < open[1]) and (close < open)

shortCond = shortCond1 and shortCond2 and shortCond3

plotshape(series = plotShort ? shortCond : na, title="Short", style=shape.triangledown, location=location.abovebar, color=color.red, text="Short", size=size.normal)

// alertcondition(condition=longCond, title="Long", message="Going long")

// alertcondition(condition=shortCond, title="Short", message="Going short")

// 🔥 Uncomment the lines below for the strategy and revert for the study

takeProfitLong = strategy.position_avg_price * (1 + takeProfit)

takeProfitShort = strategy.position_avg_price * (1 - takeProfit)

exitTp = ((strategy.position_size > 0) and (close > takeProfitLong)) or ((strategy.position_size < 0) and (close < takeProfitShort))

strategy.risk.allow_entry_in(tradingDirection == "L" ? strategy.direction.long : tradingDirection == "S" ? strategy.direction.short : strategy.direction.all)

plot(series = (plotTP and strategy.position_size > 0) ? takeProfitLong : na, title="TP Level",color=color.green, style=plot.style_linebr, linewidth=2)

plot(series = (plotTP and strategy.position_size < 0) ? takeProfitShort : na, title="TP Level",color=color.red, style=plot.style_linebr, linewidth=2)

inDateRange = (time >= timestamp(syminfo.timezone, startYear,

startMonth, startDate, 0, 0)) and (time < timestamp(syminfo.timezone, endYear, endMonth, endDate, 0, 0))

strategy.entry("VWAP", strategy.long, comment="Long", when=longCond and inDateRange)

strategy.entry("VWAP", strategy.short, comment="Short", when=shortCond and inDateRange)

strategy.close(id="VWAP", when=exitTp)

if (not inDateRange)

strategy.close_all()