Estrategia de trading con triple media móvil

Descripción general

La estrategia es una estrategia de negociación de seguimiento de tendencias basada en tres medias móviles. Se trata de una estrategia típica de seguimiento de tendencias, que utiliza tres medias móviles de diferentes períodos para tomar decisiones en el mercado de divisas.

Principio de estrategia

La estrategia utiliza 3 promedios móviles: MA1, MA2 y MA3. Los 3 promedios móviles tienen un ciclo establecido por el usuario, generalmente MA1 < MA2 < MA3, por ejemplo, MA1 es de 50 ciclos, MA2 es de 100 ciclos y MA3 es de 200 ciclos.

La estrategia utiliza el MA1 como la principal línea de referencia para la toma de decisiones comerciales. Cuando el corto ciclo MA1 atraviesa el largo ciclo MA2 o MA3, haga más; cuando el MA1 atraviesa el MA2 o MA3, haga un vacío.

La estrategia puede optar por negociar solo cruces de MA1 y MA2, o solo cruces de MA1 y MA3, o negociar ambos cruces al mismo tiempo.

Cuando aparezca una señal de cruce, abra una posición utilizando el precio de mercado. El stop loss se establece como un porcentaje cerrado, por ejemplo, el stop loss del 30% y el stop loss del 15%.

En cuanto a la optimización de la estrategia, se puede ajustar el parámetro de ciclo de la línea MA, ajustar el porcentaje de stop loss, agregar otros indicadores de filtración de señales, etc.

Análisis de las ventajas

El uso de múltiples grupos de medias móviles para la toma de decisiones puede filtrar eficazmente las brechas falsas.

Utilizando una combinación de MA de diferentes períodos, se puede ajustar dinámicamente la posición en la tendencia para lograr el seguimiento de la tendencia.

Opciones de negociación flexibles: negociar solo con la Cruz de Oro, negociar solo con la Cruz de la Muerte o ambas.

El mecanismo de suspensión de pérdidas puede controlar eficazmente las pérdidas individuales.

Análisis de riesgos

En la actualidad, el gobierno de la República Democrática del Congo (RDC) está en proceso de crear un sistema de supervisión de los precios de los bienes y servicios.

Si el ciclo de MA no está configurado correctamente, puede haber operaciones frecuentes, lo que reduce la probabilidad de ganar.

Si no se detiene a tiempo después del fracaso de la brecha, puede haber grandes pérdidas.

Si el Stop Loss es demasiado flexible, la pérdida individual puede ser excesiva.

Dirección de optimización

Optimizar los parámetros de MA para encontrar la combinación óptima de parámetros.

Añadir otros indicadores para filtrar y optimizar el tiempo de entrada. Por ejemplo, MACD, KDJ, etc.

Optimización de los puntos de parada y pérdida para optimizar el riesgo-beneficio de la estrategia.

Aumentar la administración de posiciones, por ejemplo, abrir posiciones de cantidad fija o administración de fondos.

Aumentar el punto de deslizamiento de la línea de stop loss y optimizar la estrategia de stop loss para la ruptura.

Resumir

Esta estrategia en su conjunto es una estrategia de seguimiento de tendencias típica, juzgada por el cruce de múltiples grupos de MA, y pertenece a una estrategia de seguimiento de tendencias relativamente estable. Se puede mejorar aún más mediante la optimización de parámetros, filtrado de indicadores, administración de posiciones, etc. Pero la idea central es simple y clara, adecuada para que los principiantes aprendan y practiquen.

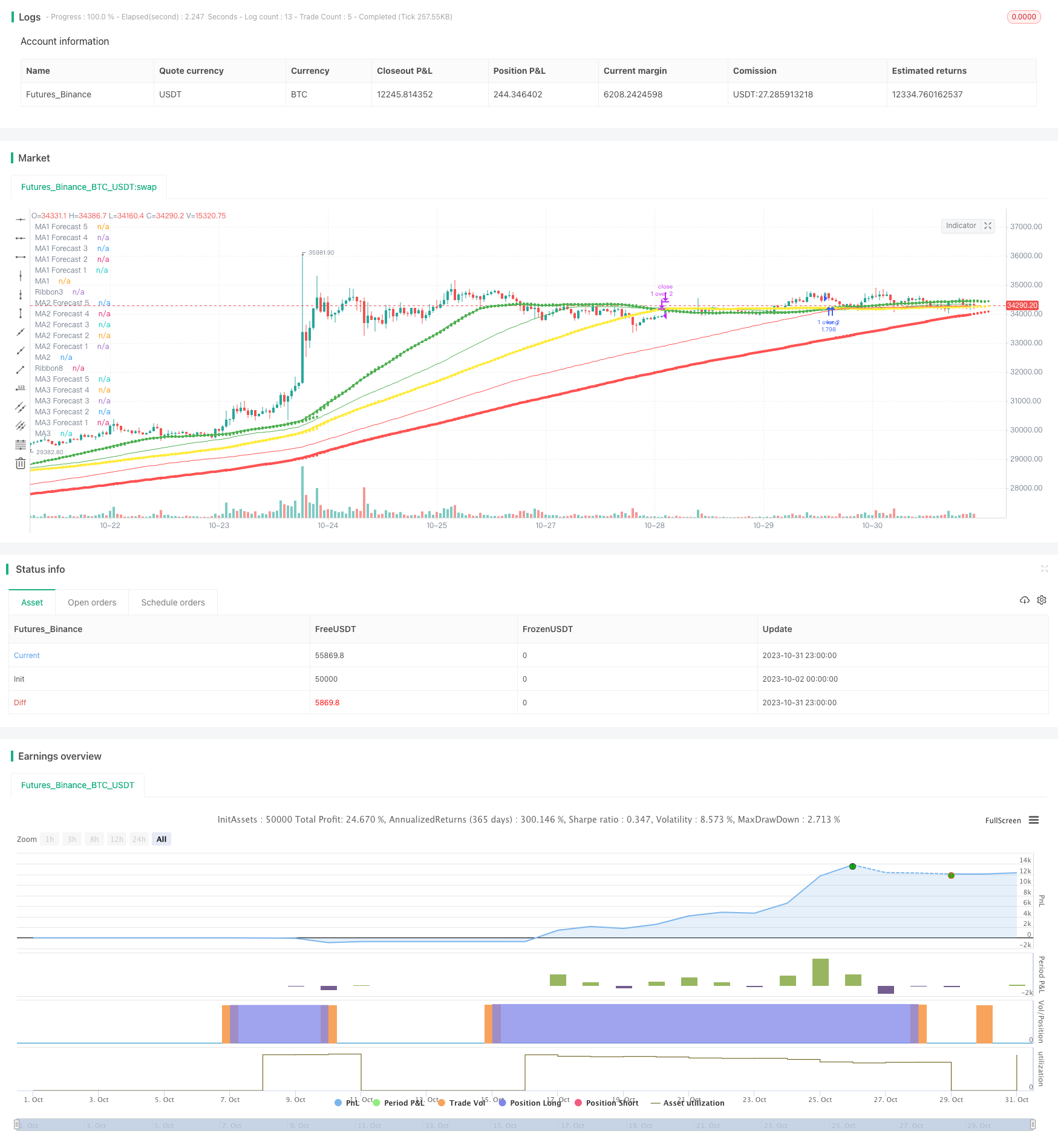

/*backtest

start: 2023-10-02 00:00:00

end: 2023-11-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// Pine Script v4

// @author BigBitsIO

// Script Library: https://www.tradingview.com/u/BigBitsIO/#published-scripts

//

// study(title, shorttitle, overlay, format, precision)

// https://www.tradingview.com/pine-script-reference/#fun_strategy

strategy(shorttitle = "TManyMA Strategy - STA - Stops", title="Triple Many Moving Averages", overlay=true, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// MA#Period is a variable used to store the indicator lookback period. In this case, from the input.

// input - https://www.tradingview.com/pine-script-docs/en/v4/annotations/Script_inputs.html

MA1Period = input(50, title="MA1 Period", minval=1, step=1)

MA1Type = input(title="MA1 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA1Source = input(title="MA1 Source", type=input.source, defval=close)

MA1Resolution = input(title="MA1 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA1Visible = input(title="MA1 Visible", type=input.bool, defval=true) // Will automatically hide crossBovers containing this MA

MA2Period = input(100, title="MA2 Period", minval=1, step=1)

MA2Type = input(title="MA2 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA2Source = input(title="MA2 Source", type=input.source, defval=close)

MA2Resolution = input(title="MA2 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA2Visible = input(title="MA2 Visible", type=input.bool, defval=true) // Will automatically hide crossovers containing this MA

MA3Period = input(200, title="MA3 Period", minval=1, step=1)

MA3Type = input(title="MA3 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA3Source = input(title="MA3 Source", type=input.source, defval=close)

MA3Resolution = input(title="MA3 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA3Visible = input(title="MA3 Visible", type=input.bool, defval=true) // Will automatically hide crossovers containing this MA

ShowCrosses = input(title="Show Crosses", type=input.bool, defval=false)

ForecastBias = input(title="Forecast Bias", defval="Neutral", options=["Neutral", "Bullish", "Bearish"])

ForecastBiasPeriod = input(14, title="Forecast Bias Period")

ForecastBiasMagnitude = input(1, title="Forecast Bias Magnitude", minval=0.25, maxval=20, step=0.25)

ShowForecasts = input(title="Show Forecasts", type=input.bool, defval=true)

ShowRibbons = input(title="Show Ribbons", type=input.bool, defval=true)

TradeMA12Crosses = input(title="Trade MA 1-2 Crosses", type=input.bool, defval=true)

TradeMA13Crosses = input(title="Trade MA 1-3 Crosses", type=input.bool, defval=true)

TradeMA23Crosses = input(title="Trade MA 2-3 Crosses", type=input.bool, defval=true)

TakeProfitPercent = input(30, title="Take Profit Percent", minval=0.01, step=0.5)

StopLossPercent = input(15, title="Stop Loss Percent", minval=0.01, step=0.5)

// MA# is a variable used to store the actual moving average value.

// if statements - https://www.tradingview.com/pine-script-reference/#op_if

// MA functions - https://www.tradingview.com/pine-script-reference/ (must search for appropriate MA)

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

ma(MAType, MASource, MAPeriod) =>

if MAType == "SMA"

sma(MASource, MAPeriod)

else

if MAType == "EMA"

ema(MASource, MAPeriod)

else

if MAType == "WMA"

wma(MASource, MAPeriod)

else

if MAType == "RMA"

rma(MASource, MAPeriod)

else

if MAType == "HMA"

wma(2*wma(MASource, MAPeriod/2)-wma(MASource, MAPeriod), round(sqrt(MAPeriod)))

else

if MAType == "DEMA"

e = ema(MASource, MAPeriod)

2 * e - ema(e, MAPeriod)

else

if MAType == "TEMA"

e = ema(MASource, MAPeriod)

3 * (e - ema(e, MAPeriod)) + ema(ema(e, MAPeriod), MAPeriod)

else

if MAType == "VWMA"

vwma(MASource, MAPeriod)

res(MAResolution) =>

if MAResolution == "00 Current"

timeframe.period

else

if MAResolution == "01 1m"

"1"

else

if MAResolution == "02 3m"

"3"

else

if MAResolution == "03 5m"

"5"

else

if MAResolution == "04 15m"

"15"

else

if MAResolution == "05 30m"

"30"

else

if MAResolution == "06 45m"

"45"

else

if MAResolution == "07 1h"

"60"

else

if MAResolution == "08 2h"

"120"

else

if MAResolution == "09 3h"

"180"

else

if MAResolution == "10 4h"

"240"

else

if MAResolution == "11 1D"

"1D"

else

if MAResolution == "12 1W"

"1W"

else

if MAResolution == "13 1M"

"1M"

// https://www.tradingview.com/pine-script-reference/#fun_request.security

MA1 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period))

MA2 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period))

MA3 = request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period))

// Plotting crossover/unders for all combinations of crosses

// Crossovers no longer detected in label code, they need to be re-used for strategy - crosses and visibility must be set

MA12Crossover = MA1Visible and MA2Visible and crossover(MA1, MA2)

MA12Crossunder = MA1Visible and MA2Visible and crossunder(MA1, MA2)

MA13Crossover = MA1Visible and MA3Visible and crossover(MA1, MA3)

MA13Crossunder = MA1Visible and MA3Visible and crossunder(MA1, MA3)

MA23Crossover = MA2Visible and MA3Visible and crossover(MA2, MA3)

MA23Crossunder = MA2Visible and MA3Visible and crossunder(MA2, MA3)

// https://www.tradingview.com/pine-script-reference/v4/#fun_label%7Bdot%7Dnew

if ShowCrosses and MA12Crossunder

lun1 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed under '+tostring(MA2Period)+' '+MA2Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun1, MA1)

if ShowCrosses and MA12Crossover

lup1 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed over '+tostring(MA2Period)+' '+MA2Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup1, MA1)

if ShowCrosses and MA13Crossunder

lun2 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed under '+tostring(MA3Period)+' '+MA3Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun2, MA1)

if ShowCrosses and MA13Crossover

lup2 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed over '+tostring(MA3Period)+' '+MA3Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup2, MA1)

if ShowCrosses and MA23Crossunder

lun3 = label.new(bar_index, na, tostring(MA2Period)+' '+MA2Type+' crossed under '+tostring(MA3Period)+' '+MA3Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun3, MA2)

if ShowCrosses and MA23Crossover

lup3 = label.new(bar_index, na, tostring(MA2Period)+' '+MA2Type+' crossed over '+tostring(MA3Period)+' '+MA3Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup3, MA2)

// plot - This will draw the information on the chart

// plot - https://www.tradingview.com/pine-script-docs/en/v4/annotations/plot_annotation.html

plot(MA1Visible ? MA1 : na, color=color.green, linewidth=2, title="MA1")

plot(MA2Visible ? MA2 : na, color=color.yellow, linewidth=3, title="MA2")

plot(MA3Visible ? MA3 : na, color=color.red, linewidth=4, title="MA3")

// Forecasting - forcasted prices are calculated using our MAType and MASource for the MAPeriod - the last X candles.

// it essentially replaces the oldest X candles, with the selected source * X candles

// Bias - We'll add an "adjustment" for each additional candle being forecasted based on ATR of the previous X candles

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

bias(Bias, BiasPeriod) =>

if Bias == "Neutral"

0

else

if Bias == "Bullish"

(atr(BiasPeriod) * ForecastBiasMagnitude)

else

if Bias == "Bearish"

((atr(BiasPeriod) * ForecastBiasMagnitude) * -1) // multiplying by -1 to make it a negative, bearish bias

// Note - Can not show forecasts on different resolutions at the moment, x-axis is an issue

Bias = bias(ForecastBias, ForecastBiasPeriod) // 14 is default atr period

MA1Forecast1 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 1)) * (MA1Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA1Period

MA1Forecast2 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 2)) * (MA1Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA1Period

MA1Forecast3 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 3)) * (MA1Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA1Period

MA1Forecast4 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 4)) * (MA1Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA1Period

MA1Forecast5 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 5)) * (MA1Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA1Period

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast1 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 1", offset=1, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast2 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 2", offset=2, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast3 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 3", offset=3, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast4 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 4", offset=4, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast5 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 5", offset=5, show_last=1)

MA2Forecast1 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 1)) * (MA2Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA2Period

MA2Forecast2 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 2)) * (MA2Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA2Period

MA2Forecast3 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 3)) * (MA2Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA2Period

MA2Forecast4 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 4)) * (MA2Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA2Period

MA2Forecast5 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 5)) * (MA2Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA2Period

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast1 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 1", offset=1, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast2 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 2", offset=2, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast3 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 3", offset=3, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast4 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 4", offset=4, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast5 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 5", offset=5, show_last=1)

MA3Forecast1 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 1)) * (MA3Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA3Period

MA3Forecast2 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 2)) * (MA3Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA3Period

MA3Forecast3 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 3)) * (MA3Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA3Period

MA3Forecast4 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 4)) * (MA3Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA3Period

MA3Forecast5 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 5)) * (MA3Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA3Period

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast1 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 1", offset=1, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast2 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 2", offset=2, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast3 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 3", offset=3, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast4 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 4", offset=4, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast5 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 5", offset=5, show_last=1)

// Ribbon related code

// For Ribbons to work - they must use the same MAType, MAResolution and MASource. This is to ensure the ribbons are fair between one to the other.

// Ribbons also will usually look better if MA1Period < MA2Period and MA2Period < MA3Period

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

// This function is used to calculate the period to be used on a ribbon based on existing MAs

rperiod(P1, P2, Step, Ribbons) =>

((abs(P1 - P2)) / (Ribbons + 1) * Step) + min(P1, P2)

// divide by +1 so that 5 lines can show. Divide by 5 and one line shows up on another MA

// MA1-MA2

Ribbon1 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 1, 5)))

Ribbon2 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 2, 5)))

Ribbon3 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 3, 5)))

Ribbon4 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 4, 5)))

Ribbon5 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 5, 5)))

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon1 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon1", transp=90)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon2 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon2", transp=85)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon3 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon3", transp=80)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon4 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon4", transp=75)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon5 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon5", transp=70)

// MA2-MA3

Ribbon6 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 1, 5)))

Ribbon7 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 2, 5)))

Ribbon8 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 3, 5)))

Ribbon9 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 4, 5)))

Ribbon10 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 5, 5)))

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon6 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon6", transp=70)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon7 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon7", transp=75)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon8 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon8", transp=80)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon9 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon9", transp=85)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon10 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon10", transp=90)

// Strategy Specific

ProfitTarget = (close * (TakeProfitPercent / 100)) / syminfo.mintick

LossTarget = (close * (StopLossPercent / 100)) / syminfo.mintick

if MA12Crossover and TradeMA12Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("1 over 2", true) // buy by market

strategy.exit("profit or loss", "1 over 2", profit = ProfitTarget, loss = LossTarget)

if MA12Crossunder and TradeMA12Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("1 over 2") // sell by market

if MA13Crossover and TradeMA13Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("1 over 3", true) // buy by market

strategy.exit("profit or loss", "1 over 3", profit = ProfitTarget, loss = LossTarget)

if MA13Crossunder and TradeMA13Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("1 over 3") // sell by market

if MA23Crossover and TradeMA23Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("2 over 3", true) // buy by market

strategy.exit("profit or loss", "2 over 3", profit = ProfitTarget, loss = LossTarget)

if MA23Crossunder and TradeMA23Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("2 over 3") // sell by market