Estrategia de ruptura de la desviación estándar de las bandas de Bollinger

Fecha de creación:

2023-11-21 17:14:04

Última modificación:

2023-11-21 17:14:04

Copiar:

0

Número de Visitas:

883

1

Seguir

1664

Seguidores

Descripción general

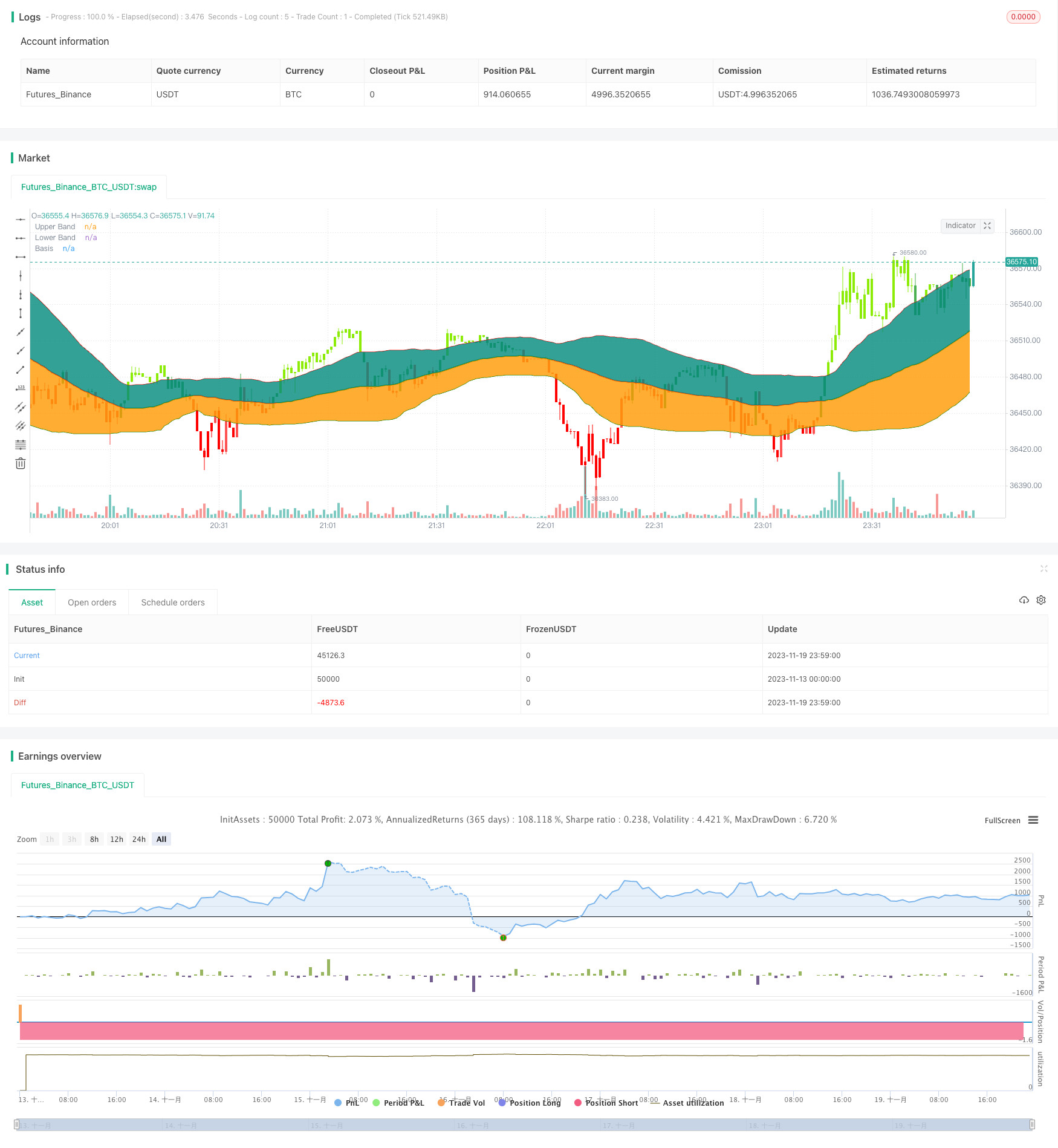

La estrategia se basa en el clásico indicador de bandas de Bollinger, que hace más cuando el cierre de precios se rompe en la vía ascendente, y hace menos cuando el cierre de precios se rompe en la vía descendente, y pertenece a la estrategia de seguimiento de tendencias.

Principio de estrategia

- La línea de referencia es la media móvil simple de 55 días.

- Los trenes superiores y inferiores están separados por una diferencia de un estándar por debajo de la línea de referencia.

- Cuando el precio se cierra, se produce una señal de multiplicación.

- Se produce una señal de corto plazo cuando el cierre del precio se rompe en la vía descendente.

- El uso de la diferencia estándar en lugar de la clásica de dos veces la diferencia estándar reduce el riesgo.

Análisis de las ventajas

- El uso de valores estándar en lugar de valores fijos reduce el riesgo.

- Las medias móviles de 55 días reflejan mejor la tendencia a mediano plazo.

- El cierre del año pasado fue un gran avance.

- Es fácil determinar la dirección de la tendencia mediante el análisis de múltiples períodos de tiempo.

Análisis de riesgos

- Es fácil generar ganancias inesperadas.

- Se deben tener en cuenta las consecuencias de los honorarios.

- La señal de ruptura puede ser falsa.

- Puede haber un punto de desliz de pérdidas.

Se puede reducir el riesgo mediante la configuración de stop loss, la consideración de las comisiones de transacción o la adición de filtros de indicadores.

Dirección de optimización

- Optimización de los parámetros de la línea de referencia para encontrar la mejor línea media.

- Los criterios de optimización son muy pequeños, para encontrar los parámetros óptimos.

- Indicadores de valor agregado y otros criterios auxiliares.

- Añadido el mecanismo de suspensión de pérdidas.

Resumir

La lógica general de la estrategia es clara, se ajusta el riesgo a través del ancho de banda de la diferencia estándar, se evita la brecha de cierre de la brecha falsa. Sin embargo, se debe tener en cuenta la prevención de pérdidas por choque, que se puede optimizar mediante el stop loss, el aumento de filtros, etc.

Código Fuente de la Estrategia

/*backtest

start: 2023-11-13 00:00:00

end: 2023-11-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//┌───── •••• ─────┐//

// TradeChartist //

//└───── •••• ─────┘//

//Bollinger Bands is a classic indicator that uses a simple moving average of 20 periods along with upper and lower bands that are 2 standard deviations away from the basis line.

//These bands help visualize price volatility and trend based on where the price is in relation to the bands.

//This Bollinger Bands filter plots a long signal when price closes above the upper band and plots a short signal when price closes below the lower band.

//It doesn't take into account any other parameters such as Volume/RSI/fundamentals etc, so user must use discretion based on confirmations from another indicator or based on fundamentals.

//This filter's default is 55 SMA and 1 standard deviation, but can be changed based on asset type

//It is definitely worth reading the 22 rules of Bollinger Bands written by John Bollinger.

strategy(shorttitle="BB Breakout Strategy", title="Bollinger Bands Filter", overlay=true,

pyramiding=1, currency=currency.NONE ,

initial_capital = 10000, default_qty_type = strategy.percent_of_equity,

default_qty_value=100, calc_on_every_tick= true, process_orders_on_close=false)

src = input(close, title = "Source")

length = input(55, minval=1, title = "SMA length")// 20 for classis Bollinger Bands SMA line (basis)

mult = input(1., minval=0.236, maxval=2, title="Standard Deviation")//2 for Classic Bollinger Bands //Maxval = 2 as higher the deviation, higher the risk

basis = sma(src, length)

dev = mult * stdev(src,length)

CC = input(true, "Color Bars")

upper = basis + dev

lower = basis - dev

//Conditions for Long and Short - Extra filter condition can be used such as RSI or CCI etc.

short = src<lower// and rsi(close,14)<40

long = src>upper// and rsi(close,14)>60

L1 = barssince(long)

S1 = barssince(short)

longSignal = L1<S1 and not (L1<S1)[1]

shortSignal = S1<L1 and not (S1<L1)[1]

//Plots and Fills

////Long/Short shapes with text

// plotshape(S1<L1 and not (S1<L1)[1]?close:na, text = "sᴇʟʟ", textcolor=#ff0100, color=#ff0100, style=shape.triangledown, size=size.small, location=location.abovebar, transp=0, title = "SELL", editable = true)

// plotshape(L1<S1 and not (L1<S1)[1]?close:na, text = "ʙᴜʏ", textcolor = #008000, color=#008000, style=shape.triangleup, size=size.small, location=location.belowbar, transp=0, title = "BUY", editable = true)

// plotshape(shortSignal?close:na, color=#ff0100, style=shape.triangledown, size=size.small, location=location.abovebar, transp=0, title = "Short Signal", editable = true)

// plotshape(longSignal?close:na, color=#008000, style=shape.triangleup, size=size.small, location=location.belowbar, transp=0, title = "Long Signal", editable = true)

p1 = plot(upper, color=#ff0000, display=display.all, transp=75, title = "Upper Band")

p2 = plot(lower, color=#008000, display=display.all, transp=75, title = "Lower Band")

p = plot(basis, color=L1<S1?#008000:S1<L1?#ff0000:na, linewidth=2, editable=false, title="Basis")

fill(p,p1, color=color.teal, transp=85, title = "Top Fill") //fill for basis-upper

fill(p,p2, color=color.orange, transp=85, title = "Bottom Fill")//fill for basis-lower

//Barcolor

bcol = src>upper?color.new(#8ceb07,0):

src<lower?color.new(#ff0000,0):

src>basis?color.green:

src<basis?color.red:na

barcolor(CC?bcol:na, editable=false, title = "Color Bars")

// //Alerts ---- // Use 'Once per bar close'

// alertcondition(condition=longSignal, title="Long - BB Filter", message='BB Filter Long @ {{close}}') // Use 'Once per bar close'

// alertcondition(condition=shortSignal, title="Short - BB Filter", message='BB Filter Short @ {{close}}') // Use 'Once per bar close'

Notestart1 = input(true, "╔═══ Time Range to BackTest ═══╗")

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input(defval=2018, title="From Year", minval=2015)

ToMonth = input(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input(defval=9999, title="To Year", minval=2010)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => // create function "within window of time"

time >= start and time <= finish ? true : false

if(window())

strategy.entry("Long", long=true, when = longSignal)

// strategy.close("Long", when = (short and S3==0), comment = "Close Long")

if(window())

strategy.entry("Short", long=false, when = shortSignal)

// strategy.close("Short", when = (long and L3==0), comment = "Close Short")