Estrategia de banda de media móvil suavizada

Descripción general

Esta estrategia es una estrategia típica de seguimiento de tendencias, ya que construye bandas de precios suaves utilizando promedios móviles suaves y integra varios promedios móviles suaves para lograr la función de filtrar tendencias en tiempo real.

Principio de estrategia

- La construcción de bandas de precios suaves permite un seguimiento suave de los cambios de precios mediante el uso de promedios móviles suaves.

- La estrategia admite la entrada de varios tipos diferentes de promedios móviles como tipos de cálculo de promedios móviles suaves, como EMA, SMMA, KAMA, etc.

- El soporte de estas medias móviles se superpone de 1 a 5 veces para obtener bandas de precios más suaves.

- También se apoya el uso de bandas de Brin entre los precios y las medias móviles para capturar mejor los cambios en los precios.

- Al activar el filtro de media móvil adicional, se pueden filtrar mejor las oscilaciones y identificar la dirección de la tendencia. El filtro también admite varios tipos de media móvil.

- Combinado con indicadores de identificación de formas, permite la identificación automática de las señales de compra y venta.

La estrategia capta la tendencia de los precios mediante la construcción de bandas de precios suaves y la integración de filtros de medias móviles para confirmar la dirección de la tendencia, y es una estrategia típica de seguimiento de tendencias. Al ajustar los parámetros, se puede adaptar con flexibilidad a diferentes tipos de entornos de mercado en diferentes períodos.

Ventajas estratégicas

- La construcción de bandas de precios permite un seguimiento más fluido de las tendencias de los cambios en los precios, lo que reduce la probabilidad de perder oportunidades.

- Soporta varios tipos de promedios móviles, que permiten seleccionar los promedios móviles adecuados para diferentes períodos y variedades, lo que mejora la adaptabilidad de las estrategias.

- La superposición de 1 a 5 suavizaciones puede mejorar significativamente la capacidad de rastrear los cambios en los precios y capturar con mayor precisión los puntos de cambio de tendencia.

- El filtro de media móvil puede reducir eficazmente las señales no válidas y aumentar la tasa de éxito.

- Al ajustar la longitud de las medias móviles, se puede adaptar a diferentes períodos de tiempo, e incluso se puede verificar en múltiples marcos de tiempo, lo que mejora aún más la eficacia de la estrategia.

- La pantalla de vidrio oscurecido permite una visión clara e intuitiva de las bandas de precios.

Riesgo estratégico

- El seguimiento de las tendencias a largo plazo es fuerte, pero el seguimiento y la reacción a las fluctuaciones a corto plazo son deficientes y son propensos a generar más señales de invalidez en situaciones de crisis.

- En un cambio rápido de precios con una caída violenta, las medias móviles lisas tienen un cierto atraso y pueden perder el mejor momento de entrada.

- Las medias móviles superpuestas pueden suavizar demasiado los cambios de precio, lo que hace que los puntos de compra y venta no se reconozcan correctamente.

- Si se activa la media móvil de la configuración incorrecta de la longitud de los parámetros, puede causar una gran cantidad de falsas señales.

La solución:

- Reducir adecuadamente la longitud de las medias móviles para acelerar la respuesta a los cambios en los precios.

- Ajuste el número de superposiciones para reducir la posibilidad de un deslizamiento excesivo.

- Optimización y prueba de combinaciones de medias móviles para seleccionar los mejores parámetros.

- En combinación con otros indicadores, la verificación de múltiples marcos de tiempo reduce la tasa de falsedad.

Dirección de optimización de la estrategia

- Prueba de combinaciones de tipos de promedios móviles optimizados y selecciona los mejores parámetros.

- Las pruebas optimizan los parámetros de longitud de las medias móviles para adaptarse a una variedad y un período de tiempo más amplios.

- Prueba diferentes niveles de superposición para encontrar el punto de equilibrio óptimo.

- Intentar agregar el cinturón de Bryn como indicador auxiliar.

- Prueba diferentes medias móviles adicionales como filtros.

- Verificación de marcos de tiempo múltiples en combinación con otros indicadores.

Resumir

Esta estrategia es una estrategia típica de seguimiento de tendencias, que sigue continuamente la tendencia de los precios mediante la construcción de bandas de medias móviles suaves, combinadas con filtros auxiliares para evitar señales ineficaces. La ventaja de la estrategia reside en la construcción de bandas de precios suaves, que pueden capturar mejor el giro de la tendencia de los precios.

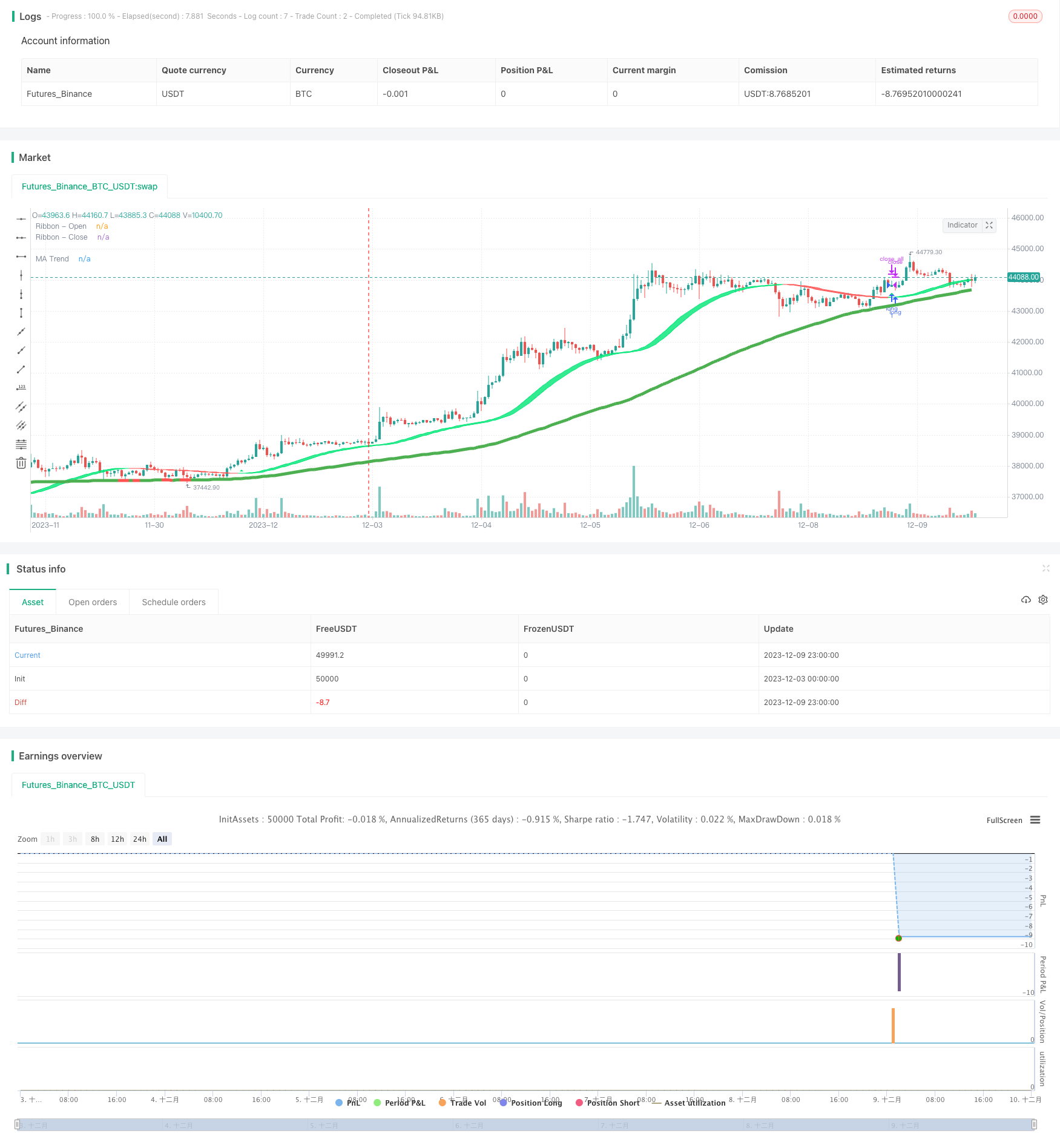

/*backtest

start: 2023-12-03 00:00:00

end: 2023-12-10 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Copyright (c) 2007-present Jurik Research and Consulting. All rights reserved.

// Copyright (c) 2018-present, Alex Orekhov (everget)

// Thanks to everget for code for more advanced moving averages

// Smooth Moving Average Ribbon [STRATEGY] @PuppyTherapy script may be freely distributed under the MIT license.

strategy( title="Smooth Moving Average Ribbon [STRATEGY] @PuppyTherapy", overlay=true )

// ---- CONSTANTS ----

lsmaOffset = 1

almaOffset = 0.85

almaSigma = 6

phase = 2

power = 2

// ---- GLOBAL FUNCTIONS ----

kama(src, len)=>

xvnoise = abs(src - src[1])

nfastend = 0.666

nslowend = 0.0645

nsignal = abs(src - src[len])

nnoise = sum(xvnoise, len)

nefratio = iff(nnoise != 0, nsignal / nnoise, 0)

nsmooth = pow(nefratio * (nfastend - nslowend) + nslowend, 2)

nAMA = 0.0

nAMA := nz(nAMA[1]) + nsmooth * (src - nz(nAMA[1]))

t3(src, len)=>

xe1_1 = ema(src, len)

xe2_1 = ema(xe1_1, len)

xe3_1 = ema(xe2_1, len)

xe4_1 = ema(xe3_1, len)

xe5_1 = ema(xe4_1, len)

xe6_1 = ema(xe5_1, len)

b_1 = 0.7

c1_1 = -b_1*b_1*b_1

c2_1 = 3*b_1*b_1+3*b_1*b_1*b_1

c3_1 = -6*b_1*b_1-3*b_1-3*b_1*b_1*b_1

c4_1 = 1+3*b_1+b_1*b_1*b_1+3*b_1*b_1

nT3Average_1 = c1_1 * xe6_1 + c2_1 * xe5_1 + c3_1 * xe4_1 + c4_1 * xe3_1

// The general form of the weights of the (2m + 1)-term Henderson Weighted Moving Average

getWeight(m, j) =>

numerator = 315 * (pow(m + 1, 2) - pow(j, 2)) * (pow(m + 2, 2) - pow(j, 2)) * (pow(m + 3, 2) - pow(j, 2)) * (3 * pow(m + 2, 2) - 11 * pow(j, 2) - 16)

denominator = 8 * (m + 2) * (pow(m + 2, 2) - 1) * (4 * pow(m + 2, 2) - 1) * (4 * pow(m + 2, 2) - 9) * (4 * pow(m + 2, 2) - 25)

denominator != 0

? numerator / denominator

: 0

hwma(src, termsNumber) =>

sum = 0.0

weightSum = 0.0

termMult = (termsNumber - 1) / 2

for i = 0 to termsNumber - 1

weight = getWeight(termMult, i - termMult)

sum := sum + nz(src[i]) * weight

weightSum := weightSum + weight

sum / weightSum

get_jurik(length, phase, power, src)=>

phaseRatio = phase < -100 ? 0.5 : phase > 100 ? 2.5 : phase / 100 + 1.5

beta = 0.45 * (length - 1) / (0.45 * (length - 1) + 2)

alpha = pow(beta, power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * pow(1 - alpha, 2) + pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

variant(src, type, len ) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = 2 * v2 - ema(v2, len) // Double Exponential

v4 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v5 = wma(src, len) // Weighted

v6 = vwma(src, len) // Volume Weighted

v7 = na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len // Smoothed

v8 = wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) // Hull

v9 = linreg(src, len, lsmaOffset) // Least Squares

v10 = alma(src, len, almaOffset, almaSigma) // Arnaud Legoux

v11 = kama(src, len) // KAMA

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v13 = t3(src, len) // T3

v14 = ema1+(ema1-ema2) // Zero Lag Exponential

v15 = hwma(src, len) // Henderson Moving average thanks to @everget

ahma = 0.0

ahma := nz(ahma[1]) + (src - (nz(ahma[1]) + nz(ahma[len])) / 2) / len //Ahrens Moving Average

v16 = ahma

v17 = get_jurik( len, phase, power, src)

type=="EMA"?v2 : type=="DEMA"?v3 : type=="TEMA"?v4 : type=="WMA"?v5 : type=="VWMA"?v6 :

type=="SMMA"?v7 : type=="Hull"?v8 : type=="LSMA"?v9 : type=="ALMA"?v10 : type=="KAMA"?v11 :

type=="T3"?v13 : type=="ZEMA"?v14 : type=="HWMA"?v15 : type=="AHMA"?v16 : type=="JURIK"?v17 : v1

smoothMA(o, h, l, c, maLoop, type, len) =>

ma_o = 0.0

ma_h = 0.0

ma_l = 0.0

ma_c = 0.0

if maLoop == 1

ma_o := variant(o, type, len)

ma_h := variant(h, type, len)

ma_l := variant(l, type, len)

ma_c := variant(c, type, len)

if maLoop == 2

ma_o := variant(variant(o ,type, len),type, len)

ma_h := variant(variant(h ,type, len),type, len)

ma_l := variant(variant(l ,type, len),type, len)

ma_c := variant(variant(c ,type, len),type, len)

if maLoop == 3

ma_o := variant(variant(variant(o ,type, len),type, len),type, len)

ma_h := variant(variant(variant(h ,type, len),type, len),type, len)

ma_l := variant(variant(variant(l ,type, len),type, len),type, len)

ma_c := variant(variant(variant(c ,type, len),type, len),type, len)

if maLoop == 4

ma_o := variant(variant(variant(variant(o ,type, len),type, len),type, len),type, len)

ma_h := variant(variant(variant(variant(h ,type, len),type, len),type, len),type, len)

ma_l := variant(variant(variant(variant(l ,type, len),type, len),type, len),type, len)

ma_c := variant(variant(variant(variant(c ,type, len),type, len),type, len),type, len)

if maLoop == 5

ma_o := variant(variant(variant(variant(variant(o ,type, len),type, len),type, len),type, len),type, len)

ma_h := variant(variant(variant(variant(variant(h ,type, len),type, len),type, len),type, len),type, len)

ma_l := variant(variant(variant(variant(variant(l ,type, len),type, len),type, len),type, len),type, len)

ma_c := variant(variant(variant(variant(variant(c ,type, len),type, len),type, len),type, len),type, len)

[ma_o, ma_h, ma_l, ma_c]

smoothHA( o, h, l, c ) =>

hao = 0.0

hac = ( o + h + l + c ) / 4

hao := na(hao[1])?(o + c / 2 ):(hao[1] + hac[1])/2

hah = max(h, max(hao, hac))

hal = min(l, min(hao, hac))

[hao, hah, hal, hac]

// ---- Main Ribbon ----

haSmooth = input(true, title=" Use HA as source ? " )

length = input(11, title=" MA1 Length", minval=1, maxval=1000)

maLoop = input(3, title=" Nr. of MA1 Smoothings ", minval=1, maxval=5)

type = input("EMA", title="MA Type", options=["SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "Hull", "LSMA", "ALMA", "KAMA", "ZEMA", "HWMA", "AHMA", "JURIK", "T3"])

haSmooth2 = input(true, title=" Use HA as source ? " )

// ---- Trend ----

ma_use = input(true, title=" ----- Use MA Filter ( For Lower Timeframe Swings / Scalps ) ? ----- " )

ma_source = input(defval = close, title = "MA - Source", type = input.source)

ma_length = input(100,title="MA - Length", minval=1 )

ma_type = input("SMA", title="MA - Type", options=["SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "Hull", "LSMA", "ALMA", "KAMA", "ZEMA", "HWMA", "AHMA", "JURIK", "T3"])

ma_useHA = input(defval = false, title = "Use HA Candles as Source ?")

ma_rsl = input(true, title = "Use Rising / Falling Logic ?" )

// ---- BODY SCRIPT ----

[ ha_open, ha_high, ha_low, ha_close ] = smoothHA(open, high, low, close)

_open_ma = haSmooth ? ha_open : open

_high_ma = haSmooth ? ha_high : high

_low_ma = haSmooth ? ha_low : low

_close_ma = haSmooth ? ha_close : close

[ _open, _high, _low, _close ] = smoothMA( _open_ma, _high_ma, _low_ma, _close_ma, maLoop, type, length)

[ ha_open2, ha_high2, ha_low2, ha_close2 ] = smoothHA(_open, _high, _low, _close)

_open_ma2 = haSmooth2 ? ha_open2 : _open

_high_ma2 = haSmooth2 ? ha_high2 : _high

_low_ma2 = haSmooth2 ? ha_low2 : _low

_close_ma2 = haSmooth2 ? ha_close2 : _close

ribbonColor = _close_ma2 > _open_ma2 ? color.lime : color.red

p_open = plot(_open_ma2, title="Ribbon - Open", color=ribbonColor, transp=70)

p_close = plot(_close_ma2, title="Ribbon - Close", color=ribbonColor, transp=70)

fill(p_open, p_close, color = ribbonColor, transp = 40 )

// ----- FILTER

ma = 0.0

if ma_use == true

ma := variant( ma_useHA ? ha_close : ma_source, ma_type, ma_length )

maFilterShort = ma_use ? ma_rsl ? falling(ma,1) : ma_useHA ? ha_close : close < ma : true

maFilterLong = ma_use ? ma_rsl ? rising(ma,1) : ma_useHA ? ha_close : close > ma : true

colorTrend = rising(ma,1) ? color.green : color.red

plot( ma_use ? ma : na, title="MA Trend", color=colorTrend, transp=80, transp=70, linewidth = 5)

long = crossover(_close_ma2, _open_ma2 ) and maFilterLong

short = crossunder(_close_ma2, _open_ma2 ) and maFilterShort

closeAll = cross(_close_ma2, _open_ma2 )

plotshape( short , title="Short", color=color.red, transp=80, style=shape.triangledown, location=location.abovebar, size=size.small)

plotshape( long , title="Long", color=color.lime, transp=80, style=shape.triangleup, location=location.belowbar, size=size.small)

//* Backtesting Period Selector | Component *//

//* Source: https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

if testPeriod() and long

strategy.entry( "long", strategy.long )

if testPeriod() and short

strategy.entry( "short", strategy.short )

if closeAll

strategy.close_all( when = closeAll )