Estrategia de media móvil suavizada estocástica de momentum

Descripción general

La estrategia combina el promedio móvil indexado (EMA) con el indicador aleatorio (oscilador estocástico) para seguir y continuar la tendencia, y tiene algunas características geniales. He diseñado esta estrategia específicamente para el comercio de monedas alternativas, pero también se aplica a Bitcoin en sí y a algunos pares de divisas.

Principio de estrategia

La estrategia tiene 4 requisitos para abrir una señal de negociación. Los siguientes son los requisitos para abrir una señal de negociación múltiple:

- El EMA rápido es más alto que el EMA lento

- La línea K aleatoria está en zona de sobreventa

- La línea K aleatoria sube a través de la línea D aleatoria

- El cierre del precio entre el EMA lento y el EMA rápido

Una vez que todas las condiciones son verdaderas, se abre la posición cuando se abre la siguiente línea K.

Análisis de las ventajas

La estrategia combina las ventajas de los EMA y los indicadores aleatorios para capturar de manera efectiva el inicio y la continuación de la tendencia y es adecuada para operaciones de línea media y larga. La estrategia también ofrece una variedad de parámetros personalizables que el usuario puede ajustar según su propio estilo de negociación y características del mercado.

En concreto, las ventajas de la estrategia son:

- EMA cruza la dirección de la tendencia, aumentando la estabilidad y la fiabilidad de la señal

- Indicadores aleatorios para determinar si hay sobreventa o sobrecompra y buscar oportunidades de reversión

- Combinación de dos indicadores, seguimiento de tendencias y contratación en contra

- ATR calcula automáticamente la distancia de parada, la parada se ajusta a la volatilidad del mercado

- Ratio de riesgo-beneficio personalizable para satisfacer las necesidades de los diferentes usuarios

- Ofrece una variedad de configuraciones de parámetros que el usuario puede ajustar según el mercado

Análisis de riesgos

El principal riesgo de esta estrategia proviene de:

- Las señales que se forman en EMA cruzados pueden presentar falsas rupturas, lo que genera una señal errónea

- Los indicadores aleatorios son por sí mismos retrasados y pueden perder el mejor momento para que los precios se inviertan

- Una sola estrategia no puede adaptarse completamente a un entorno de mercado cambiante

Para reducir los riesgos mencionados, se pueden tomar las siguientes medidas:

- Ajuste adecuado de los parámetros del ciclo EMA para evitar la generación de demasiadas falsas señales

- Asegurar la fiabilidad de las señales de negociación con más indicadores para determinar tendencias y soportes

- Establecer estrategias claras de gestión de fondos y controlar el riesgo de cada transacción

- Utilizando estrategias combinadas, las diferentes estrategias pueden verificar las señales entre sí y mejorar la estabilidad.

Dirección de optimización

La estrategia puede ser mejorada en los siguientes aspectos:

- Aumentar el módulo de ajuste de la posición basada en la volatilidad. Reducir la posición adecuadamente cuando la volatilidad del mercado se agrava; cuando la volatilidad se debilita, puede aumentar la posición.

- Aumentar el juicio de las tendencias a gran escala, evitando operaciones de contraste. Por ejemplo, la dirección de la tendencia en combinación con la línea K diaria o semanal.

- Se añade un modelo de aprendizaje automático para determinar las señales de compra y venta. Se puede entrenar un modelo de clasificación en base a datos históricos para ayudar a generar señales de transacción.

- Optimizar el módulo de estrategias de gestión de fondos para que el Stop Loss y el tamaño de posición sean más inteligentes.

Resumir

Esta estrategia integra las ventajas de seguir la tendencia y invertir el comercio, que considera el entorno del mercado a gran escala, y el comportamiento de los precios actuales, es una estrategia eficaz que vale la pena seguir a largo plazo. Mediante la optimización continua de la configuración de los parámetros, el aumento de la tendencia de los módulos de juicio, etc., el rendimiento de la estrategia también tiene mucho espacio para mejorar, vale la pena invertir más energía en el desarrollo.

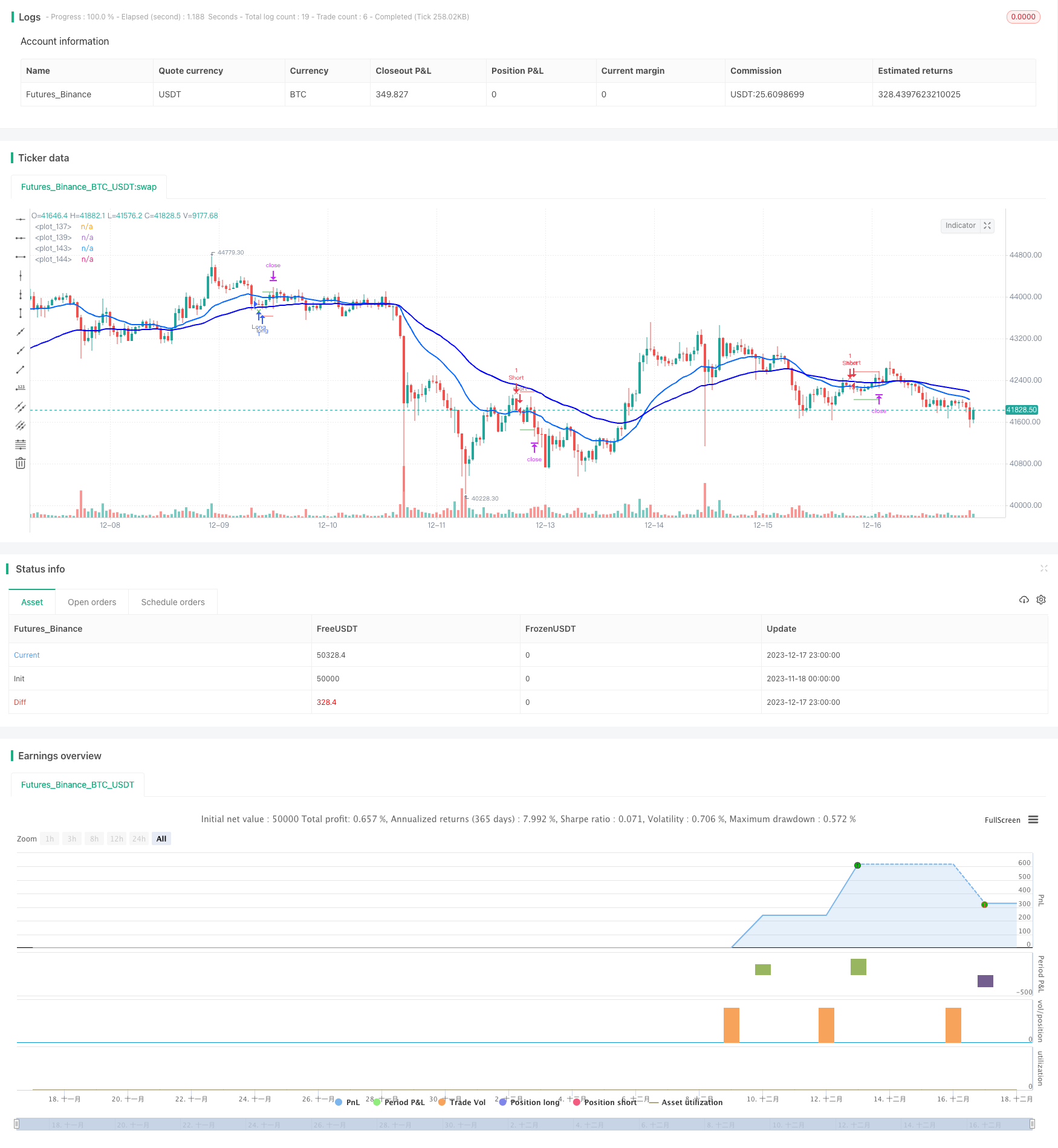

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LucasVivien

// Since this Strategy may have its stop loss hit within the opening candle, consider turning on 'Recalculate : After Order is filled' in the strategy settings, in the "Properties" tabs

//@version=5

strategy("Stochastic Moving Average", shorttitle="Stoch. EMA", overlay=true, default_qty_type= strategy.cash, initial_capital=10000, default_qty_value=100)

//==============================================================================

//============================== USER INPUT ================================

//==============================================================================

var g_tradeSetup = " Trade Setup"

activateLongs = input.bool (title="Long Trades" , defval=true , inline="A1", group=g_tradeSetup, tooltip="")

activateShorts = input.bool (title="Short Trades" , defval=true , inline="A1", group=g_tradeSetup, tooltip="")

rr = input.float(title="Risk : Reward" , defval=1 , minval=0, maxval=100 , step=0.1, inline="" , group=g_tradeSetup, tooltip="")

RiskEquity = input.bool (title="Risk = % Equity ", defval=false , inline="A2", group=g_tradeSetup, tooltip="Set stop loss size as a percentage of 'Initial Capital' -> Strategy Parameter -> Properties tab (Low liquidity markets will affect will prevent to get an exact amount du to gaps)")

riskPrctEqui = input.float(title="" , defval=1 , minval=0, maxval=100 , step=0.1, inline="A2", group=g_tradeSetup, tooltip="")

RiskUSD = input.bool (title="Risk = $ Amount " , defval=false , inline="A3", group=g_tradeSetup, tooltip="Set stop loss size as a fixed Base currency amount (Low liquidity markets will affect will prevent to get an exact amount du to gaps)")

riskUSD = input.float(title="" , defval=1000, minval=0, maxval=1000000000, step=100, inline="A3", group=g_tradeSetup, tooltip="")

var g_stopLoss = " Stop Loss"

atrMult = input.float(title="ATR Multiplier", defval=1 , minval=0, maxval=100 , step=0.1, tooltip="", inline="", group=g_stopLoss)

atrLen = input.int (title="ATR Lookback" , defval=14, minval=0, maxval=1000, step=1 , tooltip="", inline="", group=g_stopLoss)

var g_stochastic = " Stochastic"

Klen = input.int (title="K%" , defval=14, minval=0, maxval=1000, step=1, inline="S2", group=g_stochastic, tooltip="")

Dlen = input.int (title=" D%" , defval=3 , minval=0, maxval=1000, step=1, inline="S2", group=g_stochastic, tooltip="")

OBstochLvl = input.int (title="OB" , defval=80, minval=0, maxval=100 , step=1, inline="S1", group=g_stochastic, tooltip="")

OSstochLvl = input.int (title=" OS" , defval=20, minval=0, maxval=100 , step=1, inline="S1", group=g_stochastic, tooltip="")

OBOSlookback = input.int (title="Stoch. OB/OS lookback", defval=0 , minval=0, maxval=100 , step=1, inline="" , group=g_stochastic, tooltip="This option allow to look 'x' bars back for a value of the Stochastic K line to be overbought or oversold when detecting an entry signal (if 0, looks only at current bar. if 1, looks at current and previous and so on)")

OBOSlookbackAll = input.bool (title="All must be OB/OS" , defval=false , inline="" , group=g_stochastic, tooltip="If turned on, all bars within the Stochastic K line lookback period must be overbought or oversold to return a true signal")

entryColor = input.color(title=" " , defval=#00ffff , inline="S3", group=g_stochastic, tooltip="")

baseColor = input.color(title=" " , defval=#333333 , inline="S3", group=g_stochastic, tooltip="Will trun to designated color when stochastic gets to opposite extrem zone of current trend / Number = transparency")

transp = input.int (title=" " , defval=50, minval=0, maxval=100, step=10, inline="S3", group=g_stochastic, tooltip="")

var g_ema = " Exp. Moving Average"

ema1len = input.int (title="Fast EMA ", defval=21, minval=0, maxval=1000, step=1, inline="E1", group=g_ema, tooltip="")

ema2len = input.int (title="Slow EMA ", defval=50, minval=0, maxval=1000, step=1, inline="E2", group=g_ema, tooltip="")

ema1col = input.color(title=" " , defval=#0066ff , inline="E1", group=g_ema, tooltip="")

ema2col = input.color(title=" " , defval=#0000ff , inline="E2", group=g_ema, tooltip="")

var g_referenceMarket =" Reference Market"

refMfilter = input.bool (title="Reference Market Filter", defval=false , inline="", group=g_referenceMarket)

market = input (title="Market" , defval="BTC_USDT:swap", inline="", group=g_referenceMarket)

res = input.timeframe(title="Timeframe" , defval="30" , inline="", group=g_referenceMarket)

len = input.int (title="EMA Length" , defval=50 , inline="", group=g_referenceMarket)

//==============================================================================

//========================== FILTERS & SIGNALS =============================

//==============================================================================

//------------------------------ Stochastic --------------------------------

K = ta.stoch(close, high, low, Klen)

D = ta.sma(K, Dlen)

stochBullCross = ta.crossover(K, D)

stochBearCross = ta.crossover(D, K)

OSstoch = false

OBstoch = false

for i = 0 to OBOSlookback

if K[i] < OSstochLvl

OSstoch := true

else

if OBOSlookbackAll

OSstoch := false

for i = 0 to OBOSlookback

if K[i] > OBstochLvl

OBstoch := true

else

if OBOSlookbackAll

OBstoch := false

//---------------------------- Moving Averages -----------------------------

ema1 = ta.ema(close, ema1len)

ema2 = ta.ema(close, ema2len)

emaBull = ema1 > ema2

emaBear = ema1 < ema2

//---------------------------- Price source --------------------------------

bullRetraceZone = (close < ema1 and close >= ema2)

bearRetraceZone = (close > ema1 and close <= ema2)

//--------------------------- Reference market -----------------------------

ema = ta.ema(close, len)

emaHTF = request.security(market, res, ema [barstate.isconfirmed ? 0 : 1])

closeHTF = request.security(market, res, close[barstate.isconfirmed ? 0 : 1])

bullRefMarket = (closeHTF > emaHTF or closeHTF[1] > emaHTF[1])

bearRefMarket = (closeHTF < emaHTF or closeHTF[1] < emaHTF[1])

//-------------------------- SIGNAL VALIDATION -----------------------------

validLong = stochBullCross and OSstoch and emaBull and bullRetraceZone

and activateLongs and (refMfilter ? bullRefMarket : true) and strategy.position_size == 0

validShort = stochBearCross and OBstoch and emaBear and bearRetraceZone

and activateShorts and (refMfilter ? bearRefMarket : true) and strategy.position_size == 0

//==============================================================================

//=========================== STOPS & TARGETS ==============================

//==============================================================================

SLdist = ta.atr(atrLen) * atrMult

longSL = close - SLdist

longSLDist = close - longSL

longTP = close + (longSLDist * rr)

shortSL = close + SLdist

shortSLDist = shortSL - close

shortTP = close - (shortSLDist * rr)

var SLsaved = 0.0

var TPsaved = 0.0

if validLong or validShort

SLsaved := validLong ? longSL : validShort ? shortSL : na

TPsaved := validLong ? longTP : validShort ? shortTP : na

//==============================================================================

//========================== STRATEGY COMMANDS =============================

//==============================================================================

if validLong

strategy.entry("Long", strategy.long,

qty = RiskEquity ? ((riskPrctEqui/100)*strategy.equity)/longSLDist : RiskUSD ? riskUSD/longSLDist : na)

if validShort

strategy.entry("Short", strategy.short,

qty = RiskEquity ? ((riskPrctEqui/100)*strategy.equity)/shortSLDist : RiskUSD ? riskUSD/shortSLDist : na)

strategy.exit(id="Long Exit" , from_entry="Long" , limit=TPsaved, stop=SLsaved, when=strategy.position_size > 0)

strategy.exit(id="Short Exit", from_entry="Short", limit=TPsaved, stop=SLsaved, when=strategy.position_size < 0)

//==============================================================================

//============================= CHART PLOTS ================================

//==============================================================================

//---------------------------- Stops & Targets -----------------------------

plot(strategy.position_size != 0 or (strategy.position_size[1] != 0 and strategy.position_size == 0) ? SLsaved : na,

color=color.red , style=plot.style_linebr)

plot(strategy.position_size != 0 or (strategy.position_size[1] != 0 and strategy.position_size == 0) ? TPsaved : na,

color=color.green, style=plot.style_linebr)

//--------------------------------- EMAs -----------------------------------

l1 = plot(ema1, color=#0066ff, linewidth=2)

l2 = plot(ema2, color=#0000ff, linewidth=2)

//-------------------------- Stochastic gradient ---------------------------

// fill(l1, l2, color.new(color.from_gradient(K, OSstochLvl, OBstochLvl,

// emaBull ? entryColor : emaBear ? baseColor : na,

// emaBull ? baseColor : emaBear ? entryColor : na), transp))

//---------------------------- Trading Signals -----------------------------

plotshape(validLong, color=color.green, location=location.belowbar, style=shape.xcross, size=size.small)

plotshape(validShort, color=color.red , location=location.abovebar, style=shape.xcross, size=size.small)

//---------------------------- Reference Market ----------------------------

bgcolor(bullRefMarket and refMfilter ? color.new(color.green,90) : na)

bgcolor(bearRefMarket and refMfilter ? color.new(color.red ,90) : na)