Estrategia de swing trading con Fibonacci adaptativa y multimarco temporal

Descripción general

Una estrategia de seguimiento de la tendencia que combina la línea media de adaptación, el indicador Stochastic RSI y las zonas de retracción de Fibonacci. La estrategia utiliza varios indicadores para analizar el movimiento de los mercados a diferentes niveles y ajustar dinámicamente las posiciones.

Principio de estrategia

La estrategia de negociación de la franja de Fibonacci para el marco de tiempo múltiple se integra con los siguientes indicadores y mecanismos técnicos:

Líneas medias adaptadas ((SMA y WMA): calcula las medias móviles adaptadas de los precios en diferentes períodos (minutos, horas, días, etc.). Determina la dirección de la tendencia según el estado de vacío de la línea media.

Stochastic RSI: Calcula el valor estocástico del indicador RSI para determinar si el RSI está sobrecomprando o sobrevendido. Combina la fuerza y la tendencia del análisis de la forma de la curva RSI.

Zonas de retracción de Fibonacci: Mapear las zonas de retracción de Fibonacci en función de los últimos Swing High y Swing Low, y configurar puntos de compra y venta opcionales. Estas zonas tienen características de reversión y corrección de tendencias potenciales.

Administración de posiciones: ajuste dinámico de las posiciones de acuerdo con las fuertes y débiles señales del RSI de Stoch y la línea de avance de adaptación.

La estrategia primero determina la dirección de la tendencia y establece un punto de compra y venta de opciones cuando el precio de las acciones entra en la zona de retracción de Fibonacci. Cuando la línea de medias de adaptación y el RSI de Stoch emiten una señal de entrada, ejecute una orden cerca del punto de compra y venta de opciones. El stop loss se establece fuera de la zona de retracción para controlar el riesgo.

Análisis de las ventajas

Las estrategias de negociación de segmentos de Fibonacci que se adaptan a múltiples marcos de tiempo tienen las siguientes ventajas:

Análisis de múltiples marcos de tiempo: evalúa simultáneamente varios niveles de periodicidad (minutos, horas, líneas de día) y juzga tendencias de manera más integral.

Gestión de posiciones dinámica: ajustar posiciones según las circunstancias y controlar el riesgo.

Zona de retroceso de posición precisa: la zona de Fibonacci puede usarse para capturar una reversión corta en la tendencia.

Detención estricta: evita pérdidas masivas de acuerdo con la configuración de la zona de retirada.

Filtración de señales: solo ejecutar operaciones cerca de puntos de venta y compra alternativos para evitar falsas rupturas.

Optimización de los parámetros: muchos parámetros de entrada se pueden ajustar según el mercado para optimizar el rendimiento de la estrategia.

Análisis de riesgos

El principal riesgo de esta estrategia es:

Riesgo de fallo de la zona de retirada: los precios no alcanzan la zona de Fibonacci o fallo de la zona, no se puede construir un almacén. Se puede mitigar ampliando el alcance de la zona y aumentando el número de zonas.

Riesgo de seguimiento de pérdidas: la configuración estática de pérdidas, que puede ser golpeada de antemano. Se puede optimizar mediante pérdidas mecánicas, áreas de pérdidas de reserva, etc.

Riesgo de fallas de señales: la línea media de adaptación, el RSI de Stoch ocasionalmente produce falsas señales que producen transacciones innecesarias. Se pueden filtrar adecuadamente las señales para reducir la probabilidad de falsas brechas.

Riesgo de ser demasiado complejo: el uso de una combinación de varios parámetros y indicadores técnicos aumenta la complejidad de la estrategia. La optimización y la prueba son más difíciles.

Dirección de optimización

La estrategia de negociación de bandas de Fibonacci adaptada a múltiples marcos de tiempo puede optimizarse aún más en las siguientes dimensiones:

Prueba más acciones y variedades de divisas para evaluar la solidez de la estrategia. Ajusta los parámetros según los diferentes mercados.

Aumentar el mecanismo de filtración de señales, reducir la probabilidad de falsas señales y mejorar el índice de ruido.

Prueba y compara la eficacia de los parámetros en diferentes tipos de medias móviles.

Intentar cambiar los paros fijos por paros de seguimiento o paradas de reserva para ver cómo la estrategia mejora.

Intentar señales de breakout o mecanismos de seguimiento de tendencias, diseñar formas de obtener ganancias en la línea larga.

Resumir

La estrategia de trading de segmentos de Fibonacci se adapta a múltiples marcos de tiempo. Utiliza una variedad de herramientas de análisis para identificar tendencias y desplegar posiciones precisas en períodos de retroceso. El estricto mecanismo de control de pérdidas y riesgos ayuda a optimizar las ganancias en grandes tendencias.

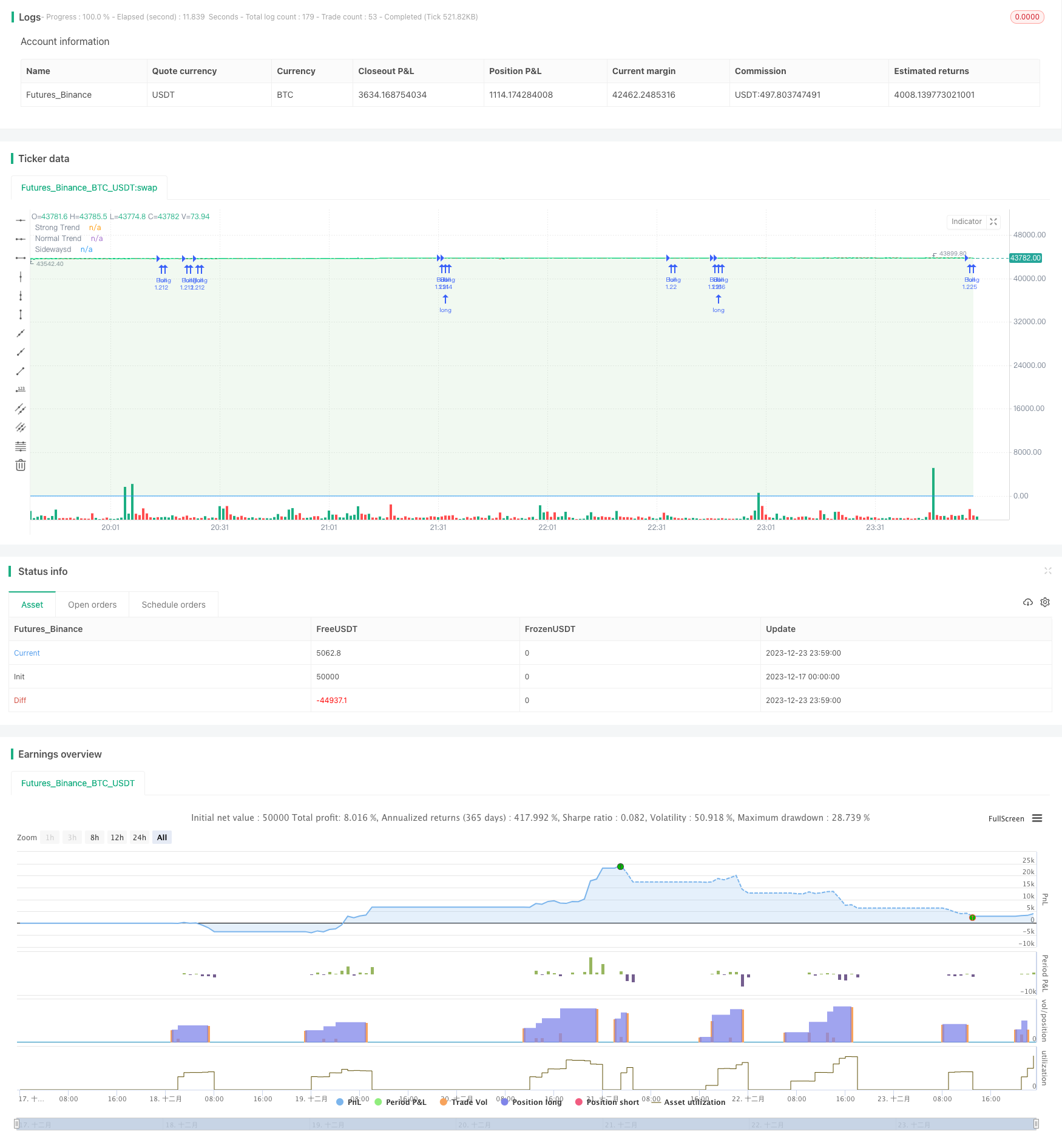

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-24 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © imal_max

//@version=5

strategy(title="Auto Fib Golden Pocket Band - Autofib Moving Average", shorttitle="Auto Fib Golden Pocket Band", overlay=true, pyramiding=15, process_orders_on_close=true, calc_on_every_tick=true, initial_capital=10000, currency = currency.USD, default_qty_value=100, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, commission_value=0.05, slippage=2)

//indicator("Auto Fib Golden Pocket Band - Autofib Moving Average", overlay=true, shorttitle="Auto Fib Golden Pocket Band", timeframe""")

// Fibs

// auto fib ranges

// fib band Strong Trend

enable_StrongBand_Bull = input.bool(title='enable Upper Bullish Band . . . Fib Level', defval=true, group='══════ Strong Trend Levels ══════', inline="0")

select_StrongBand_Fib_Bull = input.float(0.236, title=" ", options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Strong Trend Levels ══════', inline="0")

enable_StrongBand_Bear = input.bool(title='enable Lower Bearish Band . . . Fib Level', defval=false, group='══════ Strong Trend Levels ══════', inline="1")

select_StrongBand_Fib_Bear = input.float(0.382, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Strong Trend Levels ══════', inline="1")

StrongBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=400, group='══════ Strong Trend Levels ══════', inline="2")

StrongBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=120, group='══════ Strong Trend Levels ══════', inline="2")

// fib middle Band regular Trend

enable_MiddleBand_Bull = input.bool(title='enable Middle Bullish Band . . . Fib Level', defval=true, group='══════ Regular Trend Levels ══════', inline="0")

select_MiddleBand_Fib_Bull = input.float(0.618, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.6, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Regular Trend Levels ══════', inline="0")

enable_MiddleBand_Bear = input.bool(title='enable Middle Bearish Band . . . Fib Level', defval=true, group='══════ Regular Trend Levels ══════', inline="1")

select_MiddleBand_Fib_Bear = input.float(0.382, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Regular Trend Levels ══════', inline="1")

MiddleBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=900, group='══════ Regular Trend Levels ══════', inline="2")

MiddleBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=400, group='══════ Regular Trend Levels ══════', inline="2")

// fib Sideways Band

enable_SidewaysBand_Bull = input.bool(title='enable Lower Bullish Band . . . Fib Level', defval=true, group='══════ Sideways Trend Levels ══════', inline="0")

select_SidewaysBand_Fib_Bull = input.float(0.6, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.6, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Sideways Trend Levels ══════', inline="0")

enable_SidewaysBand_Bear = input.bool(title='enable Upper Bearish Band . . . Fib Level', defval=true, group='══════ Sideways Trend Levels ══════', inline="1")

select_SidewaysBand_Fib_Bear = input.float(0.5, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Sideways Trend Levels ══════', inline="1")

SidewaysBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=4000, group='══════ Sideways Trend Levels ══════', inline="2")

SidewaysBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=150, group='══════ Sideways Trend Levels ══════', inline="2")

// Strong Band

isBelow_StrongBand_Bull = true

isBelow_StrongBand_Bear = true

StrongBand_Price_of_Low = float(na)

StrongBand_Price_of_High = float(na)

StrongBand_Bear_Fib_Price = float(na)

StrongBand_Bull_Fib_Price = float(na)

/// Middle Band

isBelow_MiddleBand_Bull = true

isBelow_MiddleBand_Bear = true

MiddleBand_Price_of_Low = float(na)

MiddleBand_Price_of_High = float(na)

MiddleBand_Bear_Fib_Price = float(na)

MiddleBand_Bull_Fib_Price = float(na)

// Sideways Band

isBelow_SidewaysBand_Bull = true

isBelow_SidewaysBand_Bear = true

SidewaysBand_Price_of_Low = float(na)

SidewaysBand_Price_of_High = float(na)

SidewaysBand_Bear_Fib_Price = float(na)

SidewaysBand_Bull_Fib_Price = float(na)

// get Fib Levels

if enable_StrongBand_Bull

StrongBand_Price_of_High := ta.highest(high, StrongBand_Lookback)

StrongBand_Price_of_Low := ta.lowest(low, StrongBand_Lookback)

StrongBand_Bull_Fib_Price := (StrongBand_Price_of_High - StrongBand_Price_of_Low) * (1 - select_StrongBand_Fib_Bull) + StrongBand_Price_of_Low //+ fibbullHighDivi

isBelow_StrongBand_Bull := StrongBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_StrongBand_Bull

if enable_StrongBand_Bear

StrongBand_Price_of_High := ta.highest(high, StrongBand_Lookback)

StrongBand_Price_of_Low := ta.lowest(low, StrongBand_Lookback)

StrongBand_Bear_Fib_Price := (StrongBand_Price_of_High - StrongBand_Price_of_Low) * (1 - select_StrongBand_Fib_Bear) + StrongBand_Price_of_Low// + fibbullLowhDivi

isBelow_StrongBand_Bear := StrongBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_StrongBand_Bear

if enable_MiddleBand_Bull

MiddleBand_Price_of_High := ta.highest(high, MiddleBand_Lookback)

MiddleBand_Price_of_Low := ta.lowest(low, MiddleBand_Lookback)

MiddleBand_Bull_Fib_Price := (MiddleBand_Price_of_High - MiddleBand_Price_of_Low) * (1 - select_MiddleBand_Fib_Bull) + MiddleBand_Price_of_Low //+ fibbullHighDivi

isBelow_MiddleBand_Bull := MiddleBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_MiddleBand_Bull

if enable_MiddleBand_Bear

MiddleBand_Price_of_High := ta.highest(high, MiddleBand_Lookback)

MiddleBand_Price_of_Low := ta.lowest(low, MiddleBand_Lookback)

MiddleBand_Bear_Fib_Price := (MiddleBand_Price_of_High - MiddleBand_Price_of_Low) * (1 - select_MiddleBand_Fib_Bear) + MiddleBand_Price_of_Low// + fibbullLowhDivi

isBelow_MiddleBand_Bear := MiddleBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_MiddleBand_Bear

if enable_SidewaysBand_Bull

SidewaysBand_Price_of_High := ta.highest(high, SidewaysBand_Lookback)

SidewaysBand_Price_of_Low := ta.lowest(low, SidewaysBand_Lookback)

SidewaysBand_Bull_Fib_Price := (SidewaysBand_Price_of_High - SidewaysBand_Price_of_Low) * (1 - select_SidewaysBand_Fib_Bull) + SidewaysBand_Price_of_Low //+ fibbullHighDivi

isBelow_SidewaysBand_Bull := SidewaysBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_SidewaysBand_Bull

if enable_SidewaysBand_Bear

SidewaysBand_Price_of_High := ta.highest(high, SidewaysBand_Lookback)

SidewaysBand_Price_of_Low := ta.lowest(low, SidewaysBand_Lookback)

SidewaysBand_Bear_Fib_Price := (SidewaysBand_Price_of_High - SidewaysBand_Price_of_Low) * (1 - select_SidewaysBand_Fib_Bear) + SidewaysBand_Price_of_Low// + fibbullLowhDivi

isBelow_SidewaysBand_Bear := SidewaysBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_SidewaysBand_Bear

// Fib EMAs

// fib ema Strong Trend

StrongBand_current_Trend_EMA = float(na)

StrongBand_Bull_EMA = ta.ema(StrongBand_Bull_Fib_Price, StrongBand_EmaLen)

StrongBand_Bear_EMA = ta.ema(StrongBand_Bear_Fib_Price, StrongBand_EmaLen)

StrongBand_Ema_in_Uptrend = ta.change(StrongBand_Bull_EMA) > 0 or ta.change(StrongBand_Bear_EMA) > 0

StrongBand_Ema_Sideways = ta.change(StrongBand_Bull_EMA) == 0 or ta.change(StrongBand_Bear_EMA) == 0

StrongBand_Ema_in_Downtrend = ta.change(StrongBand_Bull_EMA) < 0 or ta.change(StrongBand_Bear_EMA) < 0

if StrongBand_Ema_in_Uptrend or StrongBand_Ema_Sideways

StrongBand_current_Trend_EMA := StrongBand_Bull_EMA

if StrongBand_Ema_in_Downtrend

StrongBand_current_Trend_EMA := StrongBand_Bear_EMA

// fib ema Normal Trend

MiddleBand_current_Trend_EMA = float(na)

MiddleBand_Bull_EMA = ta.ema(MiddleBand_Bull_Fib_Price, MiddleBand_EmaLen)

MiddleBand_Bear_EMA = ta.ema(MiddleBand_Bear_Fib_Price, MiddleBand_EmaLen)

MiddleBand_Ema_in_Uptrend = ta.change(MiddleBand_Bull_EMA) > 0 or ta.change(MiddleBand_Bear_EMA) > 0

MiddleBand_Ema_Sideways = ta.change(MiddleBand_Bull_EMA) == 0 or ta.change(MiddleBand_Bear_EMA) == 0

MiddleBand_Ema_in_Downtrend = ta.change(MiddleBand_Bull_EMA) < 0 or ta.change(MiddleBand_Bear_EMA) < 0

if MiddleBand_Ema_in_Uptrend or MiddleBand_Ema_Sideways

MiddleBand_current_Trend_EMA := MiddleBand_Bull_EMA

if MiddleBand_Ema_in_Downtrend

MiddleBand_current_Trend_EMA := MiddleBand_Bear_EMA

// fib ema Sideways Trend

SidewaysBand_current_Trend_EMA = float(na)

SidewaysBand_Bull_EMA = ta.ema(SidewaysBand_Bull_Fib_Price, SidewaysBand_EmaLen)

SidewaysBand_Bear_EMA = ta.ema(SidewaysBand_Bear_Fib_Price, SidewaysBand_EmaLen)

SidewaysBand_Ema_in_Uptrend = ta.change(SidewaysBand_Bull_EMA) > 0 or ta.change(SidewaysBand_Bear_EMA) > 0

SidewaysBand_Ema_Sideways = ta.change(SidewaysBand_Bull_EMA) == 0 or ta.change(SidewaysBand_Bear_EMA) == 0

SidewaysBand_Ema_in_Downtrend = ta.change(SidewaysBand_Bull_EMA) < 0 or ta.change(SidewaysBand_Bear_EMA) < 0

if SidewaysBand_Ema_in_Uptrend or SidewaysBand_Ema_Sideways

SidewaysBand_current_Trend_EMA := SidewaysBand_Bull_EMA

if SidewaysBand_Ema_in_Downtrend

SidewaysBand_current_Trend_EMA := SidewaysBand_Bear_EMA

// trend states and colors

all_Fib_Emas_Trending = StrongBand_Ema_in_Uptrend and MiddleBand_Ema_in_Uptrend and SidewaysBand_Ema_in_Uptrend

all_Fib_Emas_Downtrend = MiddleBand_Ema_in_Downtrend and StrongBand_Ema_in_Downtrend and SidewaysBand_Ema_in_Downtrend

all_Fib_Emas_Sideways = MiddleBand_Ema_Sideways and StrongBand_Ema_Sideways and SidewaysBand_Ema_Sideways

all_Fib_Emas_Trend_or_Sideways = (MiddleBand_Ema_Sideways or StrongBand_Ema_Sideways or SidewaysBand_Ema_Sideways) or (StrongBand_Ema_in_Uptrend or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend) and not (MiddleBand_Ema_in_Downtrend or StrongBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend)

allFibsUpAndDownTrend = (MiddleBand_Ema_in_Downtrend or StrongBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend) and (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways or StrongBand_Ema_Sideways or StrongBand_Ema_in_Uptrend or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend)

Middle_and_Sideways_Emas_Trending = MiddleBand_Ema_in_Uptrend and SidewaysBand_Ema_in_Uptrend

Middle_and_Sideways_Fib_Emas_Downtrend = MiddleBand_Ema_in_Downtrend and SidewaysBand_Ema_in_Downtrend

Middle_and_Sideways_Fib_Emas_Sideways = MiddleBand_Ema_Sideways and SidewaysBand_Ema_Sideways

Middle_and_Sideways_Fib_Emas_Trend_or_Sideways = (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways) or (MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend) and not (MiddleBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend)

Middle_and_Sideways_UpAndDownTrend = (MiddleBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend) and (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend)

UpperBand_Ema_Color = all_Fib_Emas_Trend_or_Sideways ? color.lime : all_Fib_Emas_Downtrend ? color.red : allFibsUpAndDownTrend ? color.white : na

MiddleBand_Ema_Color = Middle_and_Sideways_Fib_Emas_Trend_or_Sideways ? color.lime : Middle_and_Sideways_Fib_Emas_Downtrend ? color.red : Middle_and_Sideways_UpAndDownTrend ? color.white : na

SidewaysBand_Ema_Color = SidewaysBand_Ema_in_Uptrend ? color.lime : SidewaysBand_Ema_in_Downtrend ? color.red : (SidewaysBand_Ema_in_Downtrend and (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend)) ? color.white : na

plotStrong_Ema = plot(StrongBand_current_Trend_EMA, color=UpperBand_Ema_Color, title="Strong Trend")

plotMiddle_Ema = plot(MiddleBand_current_Trend_EMA, color=MiddleBand_Ema_Color, title="Normal Trend")

plotSideways_Ema = plot(SidewaysBand_current_Trend_EMA, color=SidewaysBand_Ema_Color, title="Sidewaysd")

Strong_Middle_fillcolor = color.new(color.green, 90)

if all_Fib_Emas_Trend_or_Sideways

Strong_Middle_fillcolor := color.new(color.green, 90)

if all_Fib_Emas_Downtrend

Strong_Middle_fillcolor := color.new(color.red, 90)

if allFibsUpAndDownTrend

Strong_Middle_fillcolor := color.new(color.white, 90)

Middle_Sideways_fillcolor = color.new(color.green, 90)

if Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

Middle_Sideways_fillcolor := color.new(color.green, 90)

if Middle_and_Sideways_Fib_Emas_Downtrend

Middle_Sideways_fillcolor := color.new(color.red, 90)

if Middle_and_Sideways_UpAndDownTrend

Middle_Sideways_fillcolor := color.new(color.white, 90)

fill(plotStrong_Ema, plotMiddle_Ema, color=Strong_Middle_fillcolor, title="fib band background")

fill(plotMiddle_Ema, plotSideways_Ema, color=Middle_Sideways_fillcolor, title="fib band background")

// buy condition

StrongBand_Price_was_below_Bull_level = ta.lowest(low, 1) < StrongBand_current_Trend_EMA

StrongBand_Price_is_above_Bull_level = close > StrongBand_current_Trend_EMA

StronBand_Price_Average_above_Bull_Level = ta.ema(low, 10) > StrongBand_current_Trend_EMA

StrongBand_Low_isnt_toLow = (ta.lowest(StrongBand_current_Trend_EMA, 15) - ta.lowest(low, 15)) < close * 0.005

StronBand_Trend_isnt_fresh = ta.barssince(StrongBand_Ema_in_Downtrend) > 50 or na(ta.barssince(StrongBand_Ema_in_Downtrend))

MiddleBand_Price_was_below_Bull_level = ta.lowest(low, 1) < MiddleBand_current_Trend_EMA

MiddleBand_Price_is_above_Bull_level = close > MiddleBand_current_Trend_EMA

MiddleBand_Price_Average_above_Bull_Level = ta.ema(close, 20) > MiddleBand_current_Trend_EMA

MiddleBand_Low_isnt_toLow = (ta.lowest(MiddleBand_current_Trend_EMA, 10) - ta.lowest(low, 10)) < close * 0.0065

MiddleBand_Trend_isnt_fresh = ta.barssince(MiddleBand_Ema_in_Downtrend) > 50 or na(ta.barssince(MiddleBand_Ema_in_Downtrend))

SidewaysBand_Price_was_below_Bull_level = ta.lowest(low, 1) < SidewaysBand_current_Trend_EMA

SidewaysBand_Price_is_above_Bull_level = close > SidewaysBand_current_Trend_EMA

SidewaysBand_Price_Average_above_Bull_Level = ta.ema(low, 80) > SidewaysBand_current_Trend_EMA

SidewaysBand_Low_isnt_toLow = (ta.lowest(SidewaysBand_current_Trend_EMA, 150) - ta.lowest(low, 150)) < close * 0.0065

SidewaysBand_Trend_isnt_fresh = ta.barssince(SidewaysBand_Ema_in_Downtrend) > 50 or na(ta.barssince(SidewaysBand_Ema_in_Downtrend))

StrongBand_Buy_Alert = StronBand_Trend_isnt_fresh and StrongBand_Low_isnt_toLow and StronBand_Price_Average_above_Bull_Level and StrongBand_Price_was_below_Bull_level and StrongBand_Price_is_above_Bull_level and all_Fib_Emas_Trend_or_Sideways

MiddleBand_Buy_Alert = MiddleBand_Trend_isnt_fresh and MiddleBand_Low_isnt_toLow and MiddleBand_Price_Average_above_Bull_Level and MiddleBand_Price_was_below_Bull_level and MiddleBand_Price_is_above_Bull_level and Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

SidewaysBand_Buy_Alert = SidewaysBand_Trend_isnt_fresh and SidewaysBand_Low_isnt_toLow and SidewaysBand_Price_Average_above_Bull_Level and SidewaysBand_Price_was_below_Bull_level and SidewaysBand_Price_is_above_Bull_level and (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend and ( not SidewaysBand_Ema_in_Downtrend))

// Sell condition

StrongBand_Price_was_above_Bear_level = ta.highest(high, 1) > StrongBand_current_Trend_EMA

StrongBand_Price_is_below_Bear_level = close < StrongBand_current_Trend_EMA

StronBand_Price_Average_below_Bear_Level = ta.sma(high, 10) < StrongBand_current_Trend_EMA

StrongBand_High_isnt_to_High = (ta.highest(high, 15) - ta.highest(StrongBand_current_Trend_EMA, 15)) < close * 0.005

StrongBand_Bear_Trend_isnt_fresh = ta.barssince(StrongBand_Ema_in_Uptrend) > 50

MiddleBand_Price_was_above_Bear_level = ta.highest(high, 1) > MiddleBand_current_Trend_EMA

MiddleBand_Price_is_below_Bear_level = close < MiddleBand_current_Trend_EMA

MiddleBand_Price_Average_below_Bear_Level = ta.sma(high, 9) < MiddleBand_current_Trend_EMA

MiddleBand_High_isnt_to_High = (ta.highest(high, 10) - ta.highest(MiddleBand_current_Trend_EMA, 10)) < close * 0.0065

MiddleBand_Bear_Trend_isnt_fresh = ta.barssince(MiddleBand_Ema_in_Uptrend) > 50

SidewaysBand_Price_was_above_Bear_level = ta.highest(high, 1) > SidewaysBand_current_Trend_EMA

SidewaysBand_Price_is_below_Bear_level = close < SidewaysBand_current_Trend_EMA

SidewaysBand_Price_Average_below_Bear_Level = ta.sma(high, 20) < SidewaysBand_current_Trend_EMA

SidewaysBand_High_isnt_to_High = (ta.highest(high, 20) - ta.highest(SidewaysBand_current_Trend_EMA, 15)) < close * 0.0065

SidewaysBand_Bear_Trend_isnt_fresh = ta.barssince(SidewaysBand_Ema_in_Uptrend) > 50

StrongBand_Sell_Alert = StronBand_Price_Average_below_Bear_Level and StrongBand_High_isnt_to_High and StrongBand_Bear_Trend_isnt_fresh and StrongBand_Price_was_above_Bear_level and StrongBand_Price_is_below_Bear_level and all_Fib_Emas_Downtrend and not all_Fib_Emas_Trend_or_Sideways

MiddleBand_Sell_Alert = MiddleBand_Price_Average_below_Bear_Level and MiddleBand_High_isnt_to_High and MiddleBand_Bear_Trend_isnt_fresh and MiddleBand_Price_was_above_Bear_level and MiddleBand_Price_is_below_Bear_level and Middle_and_Sideways_Fib_Emas_Downtrend and not Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

SidewaysBand_Sell_Alert = SidewaysBand_Price_Average_below_Bear_Level and SidewaysBand_High_isnt_to_High and SidewaysBand_Bear_Trend_isnt_fresh and SidewaysBand_Price_was_above_Bear_level and SidewaysBand_Price_is_below_Bear_level and SidewaysBand_Ema_in_Downtrend and not (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend and ( not SidewaysBand_Ema_in_Downtrend))

// Backtester

////////////////// Stop Loss

// Stop loss

enableSL = input.bool(true, title='enable Stop Loss', group='══════════ Stop Loss Settings ══════════')

whichSL = input.string(defval='low/high as SL', title='SL based on static % or based on the low/high', options=['low/high as SL', 'static % as SL'], group='══════════ Stop Loss Settings ══════════')

whichOffset = input.string(defval='% as offset', title='choose offset from the low/high', options=['$ as offset', '% as offset'], group='Stop Loss at the low/high')

lowPBuffer = input.float(1.4, title='SL Offset from the Low/high in %', group='Stop Loss at the low/high') / 100

lowDBuffer = input.float(100, title='SL Offset from the Low/high in $', group='Stop Loss at the low/high')

SlLowLookback = input.int(title='SL lookback for Low/high', defval=5, minval=1, maxval=50, group='Stop Loss at the low/high')

longSlLow = float(na)

shortSlLow = float(na)

if whichOffset == "% as offset" and whichSL == "low/high as SL" and enableSL

longSlLow := ta.lowest(low, SlLowLookback) * (1 - lowPBuffer)

shortSlLow := ta.highest(high, SlLowLookback) * (1 + lowPBuffer)

if whichOffset == "$ as offset" and whichSL == "low/high as SL" and enableSL

longSlLow := ta.lowest(low, SlLowLookback) - lowDBuffer

shortSlLow := ta.highest(high, SlLowLookback) + lowDBuffer

//plot(shortSlLow, title="stoploss", color=color.new(#00bcd4, 0))

// long settings - 🔥 uncomment the 6 lines below to disable the alerts and enable the backtester

longStopLoss = input.float(0.5, title='Long Stop Loss in %', group='static % Stop Loss', inline='Input 1') / 100

// short settings - 🔥 uncomment the 6 lines below to disable the alerts and enable the backtester

shortStopLoss = input.float(0.5, title='Short Stop Loss in %', group='static % Stop Loss', inline='Input 1') / 100

/////// Take profit

longTakeProfit1 = input.float(4, title='Long Take Profit in %', group='Take Profit', inline='Input 1') / 100

/////// Take profit

shortTakeProfit1 = input.float(1.6, title='Short Take Profit in %', group='Take Profit', inline='Input 1') / 100

////////////////// SL TP END

/////////////////// alerts

selectalertFreq = input.string(defval='once per bar close', title='Alert Options', options=['once per bar', 'once per bar close', 'all'], group='═══════════ alert settings ═══════════')

BuyAlertMessage = input.string(defval="Bullish Divergence detected, put your SL @", title='Buy Alert Message', group='═══════════ alert settings ═══════════')

enableSlMessage = input.bool(true, title='enable Stop Loss Value at the end of "buy Alert message"', group='═══════════ alert settings ═══════════')

AfterSLMessage = input.string(defval="", title='Buy Alert message after SL Value', group='═══════════ alert settings ═══════════')

////////////////// Backtester

// 🔥 uncomment the all lines below for the backtester and revert for alerts

shortTrading = enable_MiddleBand_Bear or enable_StrongBand_Bear or enable_SidewaysBand_Bear

longTrading = enable_StrongBand_Bull or enable_MiddleBand_Bull or enable_SidewaysBand_Bull

longTP1 = strategy.position_size > 0 ? strategy.position_avg_price * (1 + longTakeProfit1) : strategy.position_size < 0 ? strategy.position_avg_price * (1 - longTakeProfit1) : na

longSL = strategy.position_size > 0 ? strategy.position_avg_price * (1 - longStopLoss) : strategy.position_size < 0 ? strategy.position_avg_price * (1 + longStopLoss) : na

shortTP = strategy.position_size > 0 ? strategy.position_avg_price * (1 + shortTakeProfit1) : strategy.position_size < 0 ? strategy.position_avg_price * (1 - shortTakeProfit1) : na

shortSL = strategy.position_size > 0 ? strategy.position_avg_price * (1 - shortStopLoss) : strategy.position_size < 0 ? strategy.position_avg_price * (1 + shortStopLoss) : na

strategy.risk.allow_entry_in(longTrading == true and shortTrading == true ? strategy.direction.all : longTrading == true ? strategy.direction.long : shortTrading == true ? strategy.direction.short : na)

strategy.entry('Bull', strategy.long, comment='Upper Band Long', when=StrongBand_Buy_Alert)

strategy.entry('Bull', strategy.long, comment='Lower Band Long', when=MiddleBand_Buy_Alert)

strategy.entry('Bull', strategy.long, comment='Lower Band Long', when=SidewaysBand_Buy_Alert)

strategy.entry('Bear', strategy.short, comment='Upper Band Short', when=StrongBand_Sell_Alert)

strategy.entry('Bear', strategy.short, comment='Lower Band Short', when=MiddleBand_Sell_Alert)

strategy.entry('Bear', strategy.short, comment='Lower Band Short', when=SidewaysBand_Sell_Alert)

// check which SL to use

if enableSL and whichSL == 'static % as SL'

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1, stop=longSL)

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP, stop=shortSL)

// get bars since last entry for the SL at low to work

barsSinceLastEntry()=>

strategy.opentrades > 0 ? (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades-1)) : na

if enableSL and whichSL == 'low/high as SL' and ta.barssince(StrongBand_Buy_Alert or MiddleBand_Buy_Alert or SidewaysBand_Buy_Alert) < 2 and barsSinceLastEntry() < 2

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1, stop=longSlLow)

if enableSL and whichSL == 'low/high as SL' and ta.barssince(StrongBand_Sell_Alert or MiddleBand_Sell_Alert or SidewaysBand_Sell_Alert) < 2 and barsSinceLastEntry() < 2

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP, stop=shortSlLow)

if not enableSL

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1)

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP)