Estrategia de ruptura de fluctuación de volumen de compra/venta dinámica

Fecha de creación:

2023-12-26 11:15:31

Última modificación:

2023-12-26 11:15:31

Copiar:

0

Número de Visitas:

686

1

Seguir

1664

Seguidores

Descripción general

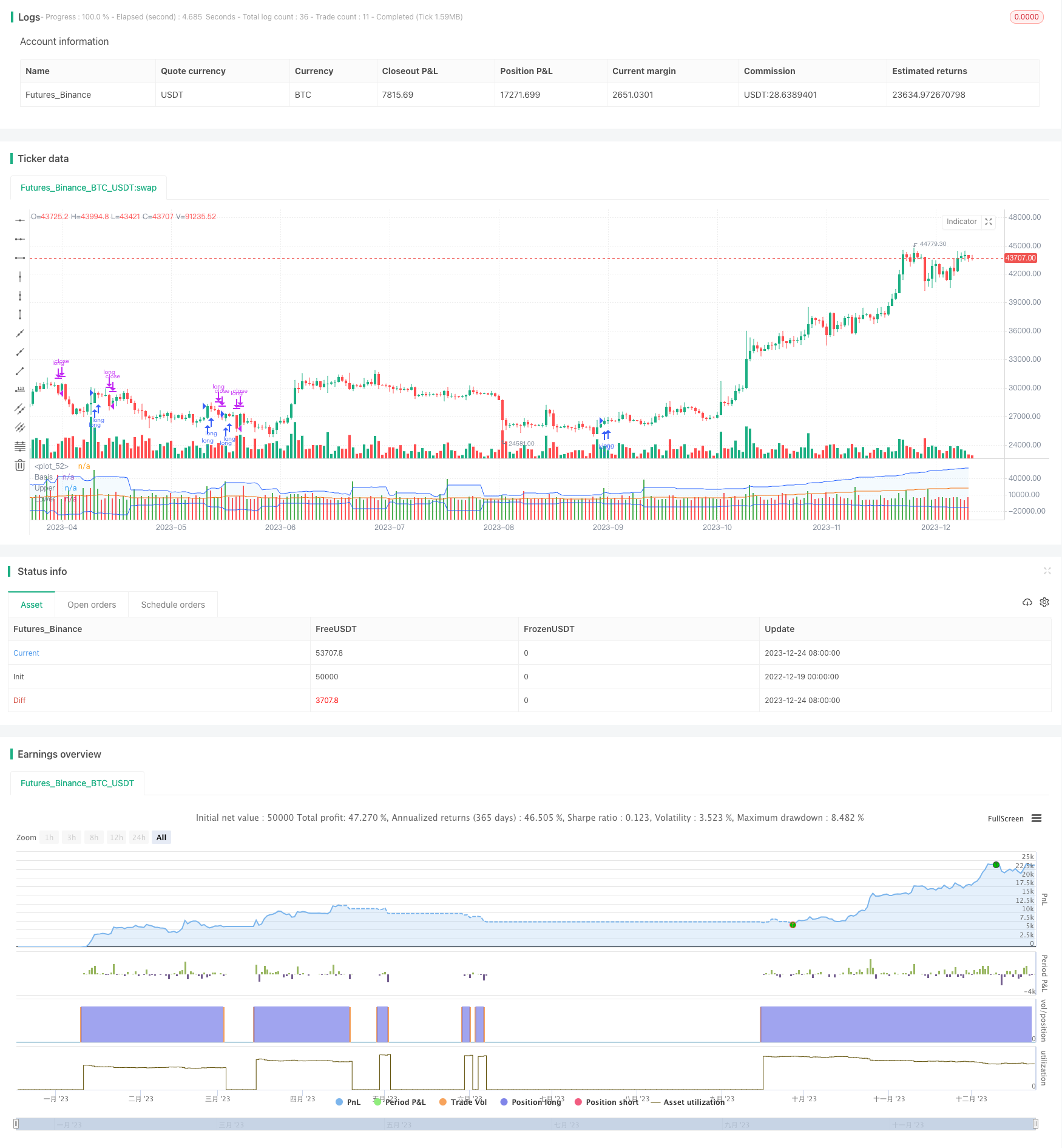

Esta estrategia permite el seguimiento de tendencias de alta probabilidad a través de un análisis de la volatilidad de los volúmenes de compra y venta en períodos de tiempo personalizados, en combinación con un filtro de VWAP de circunferencia y una banda de browning. Al mismo tiempo, se introduce un mecanismo de stop loss dinámico que permite controlar eficazmente el riesgo unilateral.

Principio de estrategia

- Calcula el indicador de volumen de compra y venta en un período de tiempo personalizado

- BV: Cantidad comprada, cantidad generada por la compra de puntos bajos

- SV: Ventas, el volumen generado por las ventas más altas

- Tratamiento de las ventas

- Utilizando 20 ciclos de EMA para suavizar

- Separación positiva y negativa de la cantidad de compra y venta tratada

- La dirección de los indicadores

- Un indicador mayor a 0 es positivo y menor a 0 es negativo.

- El proyecto de ley de la ciudad de Nueva York, que incluye el VWAP y el juicio de Brin, es una violación de la ley.

- El precio está por encima del VWAP y el indicador está mirando hacia arriba como una señal de aumento

- El precio está por debajo del VWAP y el indicador ha bajado como señal de corto plazo

- Dinámica paralización de pérdidas

- Porcentaje de pérdidas de parada por ATR por día

Ventajas estratégicas

- El volumen de compra y venta refleja el verdadero dinamismo del mercado y capta la energía potencial de la tendencia

- La línea de circunferencia VWAP determina la dirección de la tendencia del gran ciclo, la banda de Bryn determina la señal de ruptura

- El ATR dinámico establece el stop loss para bloquear al máximo las ganancias y evitar el exceso de ajuste

Riesgo estratégico

- Los datos de las ventas y compras son erróneos y pueden conducir a errores de juicio.

- Un solo indicador puede generar señales erróneas

- El parámetro de la banda de Brin está mal configurado y reduce la brecha efectiva

Dirección de optimización de la estrategia

- Optimización del índice de volumen de compra y venta en períodos de tiempo múltiples

- Filtrado de indicadores auxiliares como el aumento del volumen de operaciones

- Ajuste dinámico del Parámetro de la Banda de Brin para mejorar la eficiencia de la brecha

Resumir

Esta estrategia aprovecha la predicción de la cantidad de compra y venta, junto con la generación de señales de alta probabilidad con VWAP y Brin, para controlar el riesgo de manera efectiva a través de un stop loss dinámico. Es una estrategia de comercio cuantitativa eficiente y estable.

Código Fuente de la Estrategia

/*backtest

start: 2022-12-19 00:00:00

end: 2023-12-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © original author ceyhun

//@ exlux99 update

//@version=5

strategy('Buying Selling Volume Strategy', format=format.volume, precision=0, overlay=false)

weekly_vwap = request.security(syminfo.tickerid, "W", ta.vwap(hlc3))

vi = false

customTimeframe = input.timeframe("60", group="Entry Settings")

allow_long = input.bool(true, group="Entry Settings")

allow_short = input.bool(false, group="Entry Settings")

xVolume = request.security(syminfo.tickerid, customTimeframe, volume)

xHigh = request.security(syminfo.tickerid, customTimeframe, high)

xLow = request.security(syminfo.tickerid, customTimeframe, low)

xClose = request.security(syminfo.tickerid, customTimeframe, close)

BV = xHigh == xLow ? 0 : xVolume * (xClose - xLow) / (xHigh - xLow)

SV = xHigh == xLow ? 0 : xVolume * (xHigh - xClose) / (xHigh - xLow)

vol = xVolume > 0 ? xVolume : 1

TP = BV + SV

BPV = BV / TP * vol

SPV = SV / TP * vol

TPV = BPV + SPV

tavol20 = request.security(syminfo.tickerid, customTimeframe, ta.ema(vol, 20))

tabv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(BV, 20))

tasv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(SV, 20))

VN = vol / tavol20

BPN = BV / tabv20 * VN * 100

SPN = SV / tasv20 * VN * 100

TPN = BPN + SPN

xbvp = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPV))

xbpn = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPN))

xspv = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPV))

xspn = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPN))

BPc1 = BPV > SPV ? BPV : xbvp

BPc2 = BPN > SPN ? BPN : xbpn

SPc1 = SPV > BPV ? SPV : xspv

SPc2 = SPN > BPN ? SPN : xspn

BPcon = vi ? BPc2 : BPc1

SPcon = vi ? SPc2 : SPc1

minus = BPcon + SPcon

plot(minus, color = BPcon > SPcon ? color.green : color.red , style=plot.style_columns)

length = input.int(20, minval=1, group="Volatility Settings")

src = minus//input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev", group="Volatility Settings")

xtasma = request.security(syminfo.tickerid, customTimeframe, ta.sma(src, length))

xstdev = request.security(syminfo.tickerid, customTimeframe, ta.stdev(src, length))

basis = xtasma

dev = mult * xstdev

upper = basis + dev

lower = basis - dev

plot(basis, "Basis", color=#FF6D00, offset = 0)

p1 = plot(upper, "Upper", color=#2962FF, offset = 0)

p2 = plot(lower, "Lower", color=#2962FF, offset = 0)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// Original a

longOriginal = minus > upper and BPcon > SPcon and close > weekly_vwap

shortOriginal = minus > upper and BPcon < SPcon and close< weekly_vwap

high_daily = request.security(syminfo.tickerid, "D", high)

low_daily = request.security(syminfo.tickerid, "D", low)

close_daily = request.security(syminfo.tickerid, "D", close)

true_range = math.max(high_daily - low_daily, math.abs(high_daily - close_daily[1]), math.abs(low_daily - close_daily[1]))

atr_range = ta.sma(true_range*100/request.security(syminfo.tickerid, "D", close), 14)

ProfitTarget_Percent_long = input.float(100.0, title='TP Multiplier for Long entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_long = close + (close * (atr_range * ProfitTarget_Percent_long))/100

LossTarget_Percent_long = input.float(1.0, title='SL Multiplier for Long entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_long = close - (close * (atr_range * LossTarget_Percent_long ))/100

ProfitTarget_Percent_short = input.float(100.0, title='TP Multiplier for Short entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_short = close - (close * (atr_range*ProfitTarget_Percent_short))/100

LossTarget_Percent_short = input.float(5.0, title='SL Multiplier for Short entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_short = close + (close * (atr_range*LossTarget_Percent_short))/100

var longOpened_original = false

var int timeOfBuyLong = na

var float tpLong_long_original = na

var float slLong_long_original = na

long_entryx = longOriginal

longEntry_original = long_entryx and not longOpened_original

if longEntry_original

longOpened_original := true

tpLong_long_original := Profit_Ticks_long

slLong_long_original := Loss_Ticks_long

timeOfBuyLong := time

//lowest_low_var_sl := lowest_low

tpLong_trigger = longOpened_original[1] and ((close > tpLong_long_original) or (high > tpLong_long_original)) //or high > lowest_low_var_tp

slLong_Trigger = longOpened_original[1] and ((close < slLong_long_original) or (low < slLong_long_original)) //or low < lowest_low_var_sl

longExitSignal_original = shortOriginal or tpLong_trigger or slLong_Trigger

if(longExitSignal_original)

longOpened_original := false

tpLong_long_original := na

slLong_long_original := na

if(allow_long)

strategy.entry("long", strategy.long, when=longOriginal)

strategy.close("long", when= longExitSignal_original) //or shortNew

if(allow_short)

strategy.entry("short", strategy.short, when=shortOriginal )

strategy.close("short", when= longOriginal) //or shortNew