Estrategia de trading cuantitativo basada en el filtro de doble tendencia

Descripción general

Es una estrategia que utiliza un doble filtro de tendencia para realizar operaciones cuantitativas. La estrategia combina un filtro de tendencia global y un filtro de tendencia local, asegurando que las posiciones se abran solo cuando la dirección de la tendencia es correcta. Además, la estrategia establece otras condiciones de filtración, como filtros RSI, filtros de precio y filtros de pendiente, para mejorar aún más la fiabilidad de la señal de negociación.

Principio de estrategia

La lógica central de esta estrategia se basa en un filtro de doble tendencia. El filtro de tendencia global se basa en el movimiento general del mercado según el EMA de período alto, y el filtro de tendencia local se basa en el movimiento local según el EMA de período bajo. La posición se abre solo cuando ambos juzgan que la tendencia es consistente.

Concretamente, la estrategia calcula la línea EMA de BTCUSDT para determinar si el mercado general está en una tendencia ascendente o descendente, que es el filtro de tendencia global. Al mismo tiempo, la estrategia calcula la línea EMA de este contrato para determinar el movimiento del mercado local, que es el filtro de tendencia local. Cuando ambos juzgan que la tendencia es coincidente, y luego se combina con varios otros filtros auxiliares, la estrategia genera una señal de negociación y prevé la apertura de la posición en el precio de parada de pérdida.

Una vez que se determina la señal de negociación, la estrategia abre la posición inmediatamente. Al mismo tiempo, la estrategia establece el precio de parada y el precio de pérdida. La estrategia se detiene o se detiene automáticamente cuando el precio dispara un alto o una baja.

Análisis de las ventajas

Se trata de una estrategia de comercio cuantitativo estable y fiable, cuyas principales ventajas son:

El mecanismo de filtración de doble tendencia filtra la mayoría de las señales falsas, lo que hace que las señales de negociación sean más fiables y precisas.

La combinación de varios filtros auxiliares, como filtros RSI, filtros de precios, etc., mejora aún más la calidad de la señal.

El precio de parada y pérdida se calcula automáticamente, sin necesidad de monitoreo manual, lo que reduce el riesgo de transacción.

Los parámetros de la estrategia se pueden ajustar de forma personalizada para adaptarse a más variedades de transacciones y tienen una mayor adaptabilidad.

Las estrategias son claras y fáciles de entender, lo que facilita la optimización y mejora, y hay un gran espacio para la expansión.

Análisis de riesgos

A pesar de las muchas ventajas de esta estrategia, existen ciertos riesgos comerciales, que se centran principalmente en:

El filtro de doble tendencia determina el punto de entrada con poca precisión. Puede optimizarse ajustando los parámetros del filtro.

La fijación de los precios de stop loss puede ser inexacta y puede provocar un stop loss prematuro. Se pueden probar diferentes combinaciones de parámetros para encontrar la solución óptima.

La elección incorrecta de la variedad y el período de negociación puede llevar a la invalidez de la estrategia. Se recomienda ajustar y probar los parámetros para las diferentes variedades de negociación.

Existe cierto riesgo de sobreajuste. Se requiere un retroceso en un entorno de mercado más amplio para asegurar la solidez de la estrategia.

Dirección de optimización

La estrategia se puede optimizar principalmente en las siguientes direcciones:

Ajustar los parámetros del doble filtro para encontrar la combinación óptima de parámetros.

Prueba y selecciona los mejores filtros auxiliares.

Optimizar los algoritmos de stop-loss para que sean más inteligentes.

La introducción de métodos como el aprendizaje automático en la implementación de estrategias de movilización dinámica;

La estrategia se ha vuelto más estable con más variedades de transacciones y períodos más largos.

Resumir

La estrategia en su conjunto es una estrategia de comercio cuantitativa estable, precisa y fácil de optimizar. Utiliza un doble filtro de tendencia en combinación con varios filtros auxiliares para generar señales de comercio, que puede filtrar la mayor parte del ruido y hacer que la señal sea más precisa y confiable. Al mismo tiempo, la estrategia tiene una configuración de stop loss incorporada, que puede reducir el riesgo de comercio.

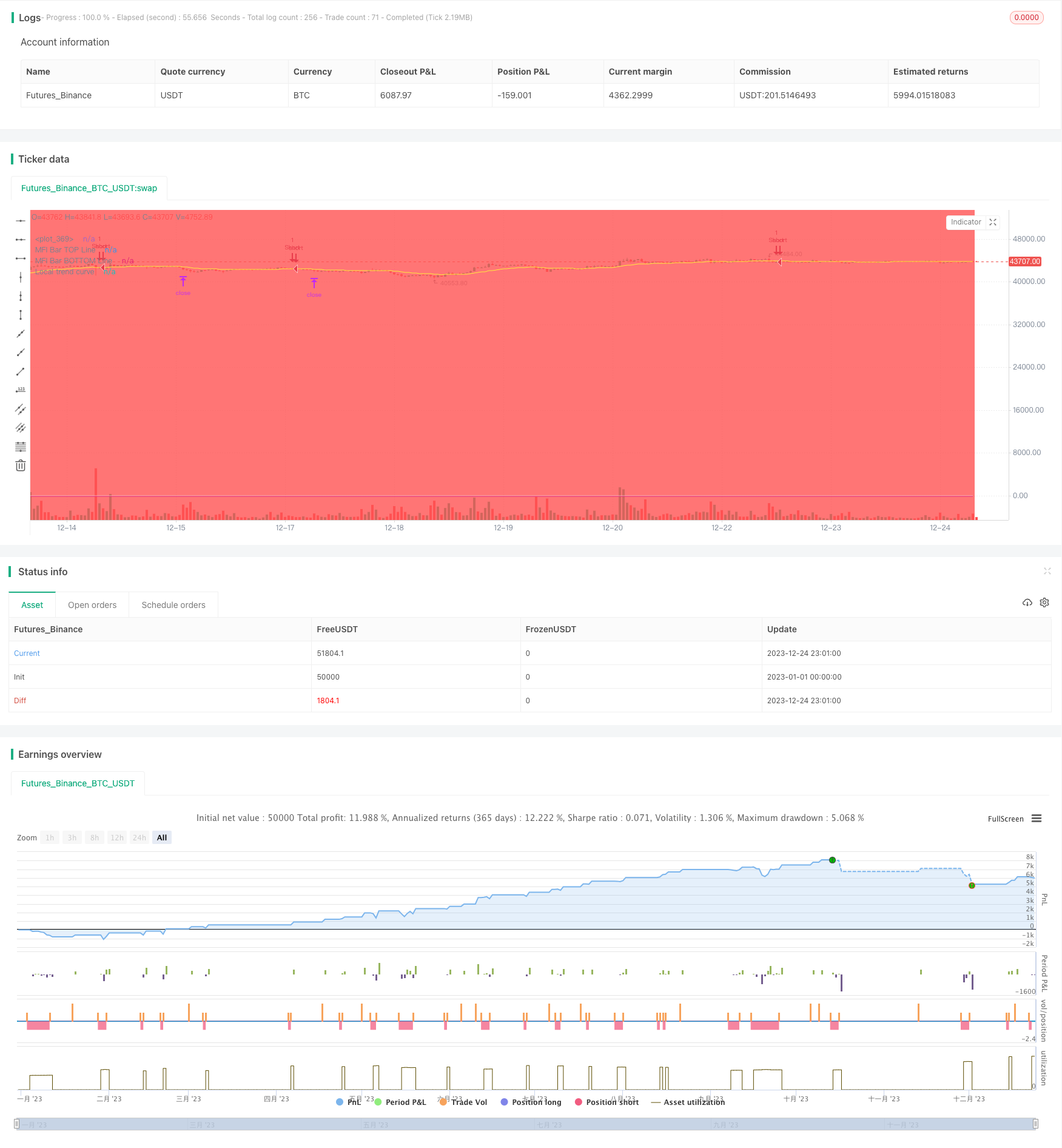

/*backtest

start: 2023-01-01 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title = 'Cipher_B', overlay=true )

// PARAMETERS {

// WaveTrend

wtShow = input(true, title = 'Show WaveTrend', type = input.bool)

wtBuyShow = input(true, title = 'Show Buy dots', type = input.bool)

wtGoldShow = input(true, title = 'Show Gold dots', type = input.bool)

wtSellShow = input(true, title = 'Show Sell dots', type = input.bool)

wtDivShow = input(true, title = 'Show Div. dots', type = input.bool)

vwapShow = input(true, title = 'Show Fast WT', type = input.bool)

wtChannelLen = input(9, title = 'WT Channel Length', type = input.integer)

wtAverageLen = input(12, title = 'WT Average Length', type = input.integer)

wtMASource = input(hlc3, title = 'WT MA Source', type = input.source)

wtMALen = input(3, title = 'WT MA Length', type = input.integer)

// WaveTrend Overbought & Oversold lines

obLevel = input(53, title = 'WT Overbought Level 1', type = input.integer)

obLevel2 = input(60, title = 'WT Overbought Level 2', type = input.integer)

obLevel3 = input(100, title = 'WT Overbought Level 3', type = input.integer)

osLevel = input(-53, title = 'WT Oversold Level 1', type = input.integer)

osLevel2 = input(-60, title = 'WT Oversold Level 2', type = input.integer)

osLevel3 = input(-75, title = 'WT Oversold Level 3', type = input.integer)

// Divergence WT

wtShowDiv = input(true, title = 'Show WT Regular Divergences', type = input.bool)

wtShowHiddenDiv = input(false, title = 'Show WT Hidden Divergences', type = input.bool)

showHiddenDiv_nl = input(true, title = 'Not apply OB/OS Limits on Hidden Divergences', type = input.bool)

wtDivOBLevel = input(45, title = 'WT Bearish Divergence min', type = input.integer)

wtDivOSLevel = input(-65, title = 'WT Bullish Divergence min', type = input.integer)

// Divergence extra range

wtDivOBLevel_addshow = input(false, title = 'Show 2nd WT Regular Divergences', type = input.bool)

wtDivOBLevel_add = input(15, title = 'WT 2nd Bearish Divergence', type = input.integer)

wtDivOSLevel_add = input(-40, title = 'WT 2nd Bullish Divergence 15 min', type = input.integer)

// RSI+MFI

rsiMFIShow = input(true, title = 'Show MFI', type = input.bool)

rsiMFIperiod = input(60,title = 'MFI Period', type = input.integer)

rsiMFIMultiplier = input(150, title = 'MFI Area multiplier', type = input.float)

rsiMFIPosY = input(2.5, title = 'MFI Area Y Pos', type = input.float)

// RSI

rsiShow = input(false, title = 'Show RSI', type = input.bool)

rsiSRC = input(close, title = 'RSI Source', type = input.source)

rsiLen = input(14, title = 'RSI Length', type = input.integer)

rsiOversold = input(30, title = 'RSI Oversold', minval = 50, maxval = 100, type = input.integer)

rsiOverbought = input(60, title = 'RSI Overbought', minval = 0, maxval = 50, type = input.integer)

// Divergence RSI

rsiShowDiv = input(false, title = 'Show RSI Regular Divergences', type = input.bool)

rsiShowHiddenDiv = input(false, title = 'Show RSI Hidden Divergences', type = input.bool)

rsiDivOBLevel = input(60, title = 'RSI Bearish Divergence min', type = input.integer)

rsiDivOSLevel = input(30, title = 'RSI Bullish Divergence min', type = input.integer)

// RSI Stochastic

stochShow = input(true, title = 'Show Stochastic RSI', type = input.bool)

stochUseLog = input(true, title=' Use Log?', type = input.bool)

stochAvg = input(false, title='Use Average of both K & D', type = input.bool)

stochSRC = input(close, title = 'Stochastic RSI Source', type = input.source)

stochLen = input(14, title = 'Stochastic RSI Length', type = input.integer)

stochRsiLen = input(14, title = 'RSI Length ', type = input.integer)

stochKSmooth = input(3, title = 'Stochastic RSI K Smooth', type = input.integer)

stochDSmooth = input(3, title = 'Stochastic RSI D Smooth', type = input.integer)

// Divergence stoch

stochShowDiv = input(false, title = 'Show Stoch Regular Divergences', type = input.bool)

stochShowHiddenDiv = input(false, title = 'Show Stoch Hidden Divergences', type = input.bool)

// Schaff Trend Cycle

tcLine = input(false, title="Show Schaff TC line", type=input.bool)

tcSRC = input(close, title = 'Schaff TC Source', type = input.source)

tclength = input(10, title="Schaff TC", type=input.integer)

tcfastLength = input(23, title="Schaff TC Fast Lenght", type=input.integer)

tcslowLength = input(50, title="Schaff TC Slow Length", type=input.integer)

tcfactor = input(0.5, title="Schaff TC Factor", type=input.float)

// Sommi Flag

sommiFlagShow = input(false, title = 'Show Sommi flag', type = input.bool)

sommiShowVwap = input(false, title = 'Show Sommi F. Wave', type = input.bool)

sommiVwapTF = input('720', title = 'Sommi F. Wave timeframe', type = input.string)

sommiVwapBearLevel = input(0, title = 'F. Wave Bear Level (less than)', type = input.integer)

sommiVwapBullLevel = input(0, title = 'F. Wave Bull Level (more than)', type = input.integer)

soomiFlagWTBearLevel = input(0, title = 'WT Bear Level (more than)', type = input.integer)

soomiFlagWTBullLevel = input(0, title = 'WT Bull Level (less than)', type = input.integer)

soomiRSIMFIBearLevel = input(0, title = 'Money flow Bear Level (less than)', type = input.integer)

soomiRSIMFIBullLevel = input(0, title = 'Money flow Bull Level (more than)', type = input.integer)

// Sommi Diamond

sommiDiamondShow = input(false, title = 'Show Sommi diamond', type = input.bool)

sommiHTCRes = input('60', title = 'HTF Candle Res. 1', type = input.string)

sommiHTCRes2 = input('240', title = 'HTF Candle Res. 2', type = input.string)

soomiDiamondWTBearLevel = input(0, title = 'WT Bear Level (More than)', type = input.integer)

soomiDiamondWTBullLevel = input(0, title = 'WT Bull Level (Less than)', type = input.integer)

// macd Colors

macdWTColorsShow = input(false, title = 'Show MACD Colors', type = input.bool)

macdWTColorsTF = input('240', title = 'MACD Colors MACD TF', type = input.string)

darkMode = input(false, title = 'Dark mode', type = input.bool)

// Colors

colorRed = #ff0000

colorPurple = #e600e6

colorGreen = #3fff00

colorOrange = #e2a400

colorYellow = #ffe500

colorWhite = #ffffff

colorPink = #ff00f0

colorBluelight = #31c0ff

colorWT1 = #90caf9

colorWT2 = #0d47a1

colorWT2_ = #131722

colormacdWT1a = #4caf58

colormacdWT1b = #af4c4c

colormacdWT1c = #7ee57e

colormacdWT1d = #ff3535

colormacdWT2a = #305630

colormacdWT2b = #310101

colormacdWT2c = #132213

colormacdWT2d = #770000

// } PARAMETERS

// FUNCTIONS {

// Divergences

f_top_fractal(src) => src[4] < src[2] and src[3] < src[2] and src[2] > src[1] and src[2] > src[0]

f_bot_fractal(src) => src[4] > src[2] and src[3] > src[2] and src[2] < src[1] and src[2] < src[0]

f_fractalize(src) => f_top_fractal(src) ? 1 : f_bot_fractal(src) ? -1 : 0

f_findDivs(src, topLimit, botLimit, useLimits) =>

fractalTop = f_fractalize(src) > 0 and (useLimits ? src[2] >= topLimit : true) ? src[2] : na

fractalBot = f_fractalize(src) < 0 and (useLimits ? src[2] <= botLimit : true) ? src[2] : na

highPrev = valuewhen(fractalTop, src[2], 0)[2]

highPrice = valuewhen(fractalTop, high[2], 0)[2]

lowPrev = valuewhen(fractalBot, src[2], 0)[2]

lowPrice = valuewhen(fractalBot, low[2], 0)[2]

bearSignal = fractalTop and high[2] > highPrice and src[2] < highPrev

bullSignal = fractalBot and low[2] < lowPrice and src[2] > lowPrev

bearDivHidden = fractalTop and high[2] < highPrice and src[2] > highPrev

bullDivHidden = fractalBot and low[2] > lowPrice and src[2] < lowPrev

[fractalTop, fractalBot, lowPrev, bearSignal, bullSignal, bearDivHidden, bullDivHidden]

// RSI+MFI

f_rsimfi(_period, _multiplier, _tf) => security(syminfo.tickerid, _tf, sma(((close - open) / (high - low)) * _multiplier, _period) - rsiMFIPosY)

// WaveTrend

f_wavetrend(src, chlen, avg, malen, tf) =>

tfsrc = security(syminfo.tickerid, tf, src)

esa = ema(tfsrc, chlen)

de = ema(abs(tfsrc - esa), chlen)

ci = (tfsrc - esa) / (0.015 * de)

wt1 = security(syminfo.tickerid, tf, ema(ci, avg))

wt2 = security(syminfo.tickerid, tf, sma(wt1, malen))

wtVwap = wt1 - wt2

wtOversold = wt2 <= osLevel

wtOverbought = wt2 >= obLevel

wtCross = cross(wt1, wt2)

wtCrossUp = wt2 - wt1 <= 0

wtCrossDown = wt2 - wt1 >= 0

wtCrosslast = cross(wt1[2], wt2[2])

wtCrossUplast = wt2[2] - wt1[2] <= 0

wtCrossDownlast = wt2[2] - wt1[2] >= 0

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCrosslast, wtCrossUplast, wtCrossDownlast, wtVwap]

// Schaff Trend Cycle

f_tc(src, length, fastLength, slowLength) =>

ema1 = ema(src, fastLength)

ema2 = ema(src, slowLength)

macdVal = ema1 - ema2

alpha = lowest(macdVal, length)

beta = highest(macdVal, length) - alpha

gamma = (macdVal - alpha) / beta * 100

gamma := beta > 0 ? gamma : nz(gamma[1])

delta = gamma

delta := na(delta[1]) ? delta : delta[1] + tcfactor * (gamma - delta[1])

epsilon = lowest(delta, length)

zeta = highest(delta, length) - epsilon

eta = (delta - epsilon) / zeta * 100

eta := zeta > 0 ? eta : nz(eta[1])

stcReturn = eta

stcReturn := na(stcReturn[1]) ? stcReturn : stcReturn[1] + tcfactor * (eta - stcReturn[1])

stcReturn

// Stochastic RSI

f_stochrsi(_src, _stochlen, _rsilen, _smoothk, _smoothd, _log, _avg) =>

src = _log ? log(_src) : _src

rsi = rsi(src, _rsilen)

kk = sma(stoch(rsi, rsi, rsi, _stochlen), _smoothk)

d1 = sma(kk, _smoothd)

avg_1 = avg(kk, d1)

k = _avg ? avg_1 : kk

[k, d1]

// MACD

f_macd(src, fastlen, slowlen, sigsmooth, tf) =>

fast_ma = security(syminfo.tickerid, tf, ema(src, fastlen))

slow_ma = security(syminfo.tickerid, tf, ema(src, slowlen))

macd = fast_ma - slow_ma,

signal = security(syminfo.tickerid, tf, sma(macd, sigsmooth))

hist = macd - signal

[macd, signal, hist]

// MACD Colors on WT

f_macdWTColors(tf) =>

hrsimfi = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, tf)

[macd, signal, hist] = f_macd(close, 28, 42, 9, macdWTColorsTF)

macdup = macd >= signal

macddown = macd <= signal

macdWT1Color = macdup ? hrsimfi > 0 ? colormacdWT1c : colormacdWT1a : macddown ? hrsimfi < 0 ? colormacdWT1d : colormacdWT1b : na

macdWT2Color = macdup ? hrsimfi < 0 ? colormacdWT2c : colormacdWT2a : macddown ? hrsimfi < 0 ? colormacdWT2d : colormacdWT2b : na

[macdWT1Color, macdWT2Color]

// Get higher timeframe candle

f_getTFCandle(_tf) =>

_open = security(heikinashi(syminfo.tickerid), _tf, open, barmerge.gaps_off, barmerge.lookahead_off)

_close = security(heikinashi(syminfo.tickerid), _tf, close, barmerge.gaps_off, barmerge.lookahead_off)

_high = security(heikinashi(syminfo.tickerid), _tf, high, barmerge.gaps_off, barmerge.lookahead_off)

_low = security(heikinashi(syminfo.tickerid), _tf, low, barmerge.gaps_off, barmerge.lookahead_off)

hl2 = (_high + _low) / 2.0

newBar = change(_open)

candleBodyDir = _close > _open

[candleBodyDir, newBar]

// Sommi flag

f_findSommiFlag(tf, wt1, wt2, rsimfi, wtCross, wtCrossUp, wtCrossDown) =>

[hwt1, hwt2, hwtOversold, hwtOverbought, hwtCross, hwtCrossUp, hwtCrossDown, hwtCrosslast, hwtCrossUplast, hwtCrossDownlast, hwtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, tf)

bearPattern = rsimfi < soomiRSIMFIBearLevel and

wt2 > soomiFlagWTBearLevel and

wtCross and

wtCrossDown and

hwtVwap < sommiVwapBearLevel

bullPattern = rsimfi > soomiRSIMFIBullLevel and

wt2 < soomiFlagWTBullLevel and

wtCross and

wtCrossUp and

hwtVwap > sommiVwapBullLevel

[bearPattern, bullPattern, hwtVwap]

f_findSommiDiamond(tf, tf2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown) =>

[candleBodyDir, newBar] = f_getTFCandle(tf)

[candleBodyDir2, newBar2] = f_getTFCandle(tf2)

bearPattern = wt2 >= soomiDiamondWTBearLevel and

wtCross and

wtCrossDown and

not candleBodyDir and

not candleBodyDir2

bullPattern = wt2 <= soomiDiamondWTBullLevel and

wtCross and

wtCrossUp and

candleBodyDir and

candleBodyDir2

[bearPattern, bullPattern]

// } FUNCTIONS

// CALCULATE INDICATORS {

// RSI

rsi = rsi(rsiSRC, rsiLen)

rsiColor = rsi <= rsiOversold ? colorGreen : rsi >= rsiOverbought ? colorRed : colorPurple

// RSI + MFI Area

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

rsiMFIColor = rsiMFI > 0 ? #3ee145 : #ff3d2e

// Calculates WaveTrend

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCross_last, wtCrossUp_last, wtCrossDown_last, wtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, timeframe.period)

// Stochastic RSI

[stochK, stochD] = f_stochrsi(stochSRC, stochLen, stochRsiLen, stochKSmooth, stochDSmooth, stochUseLog, stochAvg)

// Schaff Trend Cycle

tcVal = f_tc(tcSRC, tclength, tcfastLength, tcslowLength)

// Sommi flag

[sommiBearish, sommiBullish, hvwap] = f_findSommiFlag(sommiVwapTF, wt1, wt2, rsiMFI, wtCross, wtCrossUp, wtCrossDown)

//Sommi diamond

[sommiBearishDiamond, sommiBullishDiamond] = f_findSommiDiamond(sommiHTCRes, sommiHTCRes2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown)

// macd colors

[macdWT1Color, macdWT2Color] = f_macdWTColors(macdWTColorsTF)

// WT Divergences

[wtFractalTop, wtFractalBot, wtLow_prev, wtBearDiv, wtBullDiv, wtBearDivHidden, wtBullDivHidden] = f_findDivs(wt2, wtDivOBLevel, wtDivOSLevel, true)

[wtFractalTop_add, wtFractalBot_add, wtLow_prev_add, wtBearDiv_add, wtBullDiv_add, wtBearDivHidden_add, wtBullDivHidden_add] = f_findDivs(wt2, wtDivOBLevel_add, wtDivOSLevel_add, true)

[wtFractalTop_nl, wtFractalBot_nl, wtLow_prev_nl, wtBearDiv_nl, wtBullDiv_nl, wtBearDivHidden_nl, wtBullDivHidden_nl] = f_findDivs(wt2, 0, 0, false)

wtBearDivHidden_ = showHiddenDiv_nl ? wtBearDivHidden_nl : wtBearDivHidden

wtBullDivHidden_ = showHiddenDiv_nl ? wtBullDivHidden_nl : wtBullDivHidden

wtBearDivColor = (wtShowDiv and wtBearDiv) or (wtShowHiddenDiv and wtBearDivHidden_) ? colorRed : na

wtBullDivColor = (wtShowDiv and wtBullDiv) or (wtShowHiddenDiv and wtBullDivHidden_) ? colorGreen : na

wtBearDivColor_add = (wtShowDiv and (wtDivOBLevel_addshow and wtBearDiv_add)) or (wtShowHiddenDiv and (wtDivOBLevel_addshow and wtBearDivHidden_add)) ? #9a0202 : na

wtBullDivColor_add = (wtShowDiv and (wtDivOBLevel_addshow and wtBullDiv_add)) or (wtShowHiddenDiv and (wtDivOBLevel_addshow and wtBullDivHidden_add)) ? #1b5e20 : na

// RSI Divergences

[rsiFractalTop, rsiFractalBot, rsiLow_prev, rsiBearDiv, rsiBullDiv, rsiBearDivHidden, rsiBullDivHidden] = f_findDivs(rsi, rsiDivOBLevel, rsiDivOSLevel, true)

[rsiFractalTop_nl, rsiFractalBot_nl, rsiLow_prev_nl, rsiBearDiv_nl, rsiBullDiv_nl, rsiBearDivHidden_nl, rsiBullDivHidden_nl] = f_findDivs(rsi, 0, 0, false)

rsiBearDivHidden_ = showHiddenDiv_nl ? rsiBearDivHidden_nl : rsiBearDivHidden

rsiBullDivHidden_ = showHiddenDiv_nl ? rsiBullDivHidden_nl : rsiBullDivHidden

rsiBearDivColor = (rsiShowDiv and rsiBearDiv) or (rsiShowHiddenDiv and rsiBearDivHidden_) ? colorRed : na

rsiBullDivColor = (rsiShowDiv and rsiBullDiv) or (rsiShowHiddenDiv and rsiBullDivHidden_) ? colorGreen : na

// Stoch Divergences

[stochFractalTop, stochFractalBot, stochLow_prev, stochBearDiv, stochBullDiv, stochBearDivHidden, stochBullDivHidden] = f_findDivs(stochK, 0, 0, false)

stochBearDivColor = (stochShowDiv and stochBearDiv) or (stochShowHiddenDiv and stochBearDivHidden) ? colorRed : na

stochBullDivColor = (stochShowDiv and stochBullDiv) or (stochShowHiddenDiv and stochBullDivHidden) ? colorGreen : na

// Small Circles WT Cross

signalColor = wt2 - wt1 > 0 ? color.red : color.lime

// Buy signal.

buySignal = wtCross and wtCrossUp and wtOversold

buySignalDiv = (wtShowDiv and wtBullDiv) or

(wtShowDiv and wtBullDiv_add) or

(stochShowDiv and stochBullDiv) or

(rsiShowDiv and rsiBullDiv)

buySignalDiv_color = wtBullDiv ? colorGreen :

wtBullDiv_add ? color.new(colorGreen, 60) :

rsiShowDiv ? colorGreen : na

// Sell signal

sellSignal = wtCross and wtCrossDown and wtOverbought

sellSignalDiv = (wtShowDiv and wtBearDiv) or

(wtShowDiv and wtBearDiv_add) or

(stochShowDiv and stochBearDiv) or

(rsiShowDiv and rsiBearDiv)

sellSignalDiv_color = wtBearDiv ? colorRed :

wtBearDiv_add ? color.new(colorRed, 60) :

rsiBearDiv ? colorRed : na

// Gold Buy

lastRsi = valuewhen(wtFractalBot, rsi[2], 0)[2]

wtGoldBuy = ((wtShowDiv and wtBullDiv) or (rsiShowDiv and rsiBullDiv)) and

wtLow_prev <= osLevel3 and

wt2 > osLevel3 and

wtLow_prev - wt2 <= -5 and

lastRsi < 30

// } CALCULATE INDICATORS

// DRAW {

bgcolor(darkMode ? color.new(#000000, 80) : na)

zLine = plot(0, color = color.new(colorWhite, 50))

// MFI BAR

rsiMfiBarTopLine = plot(rsiMFIShow ? -95 : na, title = 'MFI Bar TOP Line', transp = 100)

rsiMfiBarBottomLine = plot(rsiMFIShow ? -99 : na, title = 'MFI Bar BOTTOM Line', transp = 100)

fill(rsiMfiBarTopLine, rsiMfiBarBottomLine, title = 'MFI Bar Colors', color = rsiMFIColor, transp = 75)

Global=input(title="Use Global trend?", defval=true, type=input.bool, group="Trend Settings")

regimeFilter_frame=input(title="Global trend timeframe", defval="5", options=['D','60','5'], group="Trend Settings")

regimeFilter_length=input(title="Global trend length", defval=1700, type=input.integer, group="Trend Settings")

localFilter_length=input(title="Local trend filter length", defval=20, type=input.integer, group="Trend Settings")

localFilter_frame=input(title="Local trend filter timeframe", defval="60", options=['D','60', '5'], group="Trend Settings")

Div_1=input(title="Only divergencies for long", defval=true, type=input.bool, group="Trend Settings")

Div_2=input(title="Only divergencies for short", defval=true, type=input.bool, group="Trend Settings")

sommi_diamond_on=input(title="Sommi diamond alerts", defval=false, type=input.bool, group="Trend Settings")

Cancel_all=input(title="Cancel all positions if price crosses local sma? (yellow line)", defval=false, type=input.bool, group="Trend Settings")

a_1=input(title="TP long", defval=0.95,step=0.5, type=input.float, group="TP/SL Settings")

a_1_div=input(title="TP long div", defval=0.95,step=0.5, type=input.float, group="TP/SL Settings")

a_2=input(title="TP short", defval=0.95,step=1, type=input.float, group="TP/SL Settings")

b_1=input(title="SL long", defval=5,step=0.1, type=input.float, group="TP/SL Settings")

b_2=input(title="SL short", defval=5,step=0.1, type=input.float, group="TP/SL Settings")

RSI_filter_checkbox = input(title="RSI filter ON", defval=false, type=input.bool, group="Trend Settings")

Price_filter_checkbox=input(title="Price filter ON", defval=false, type=input.bool, group="Trend Settings")

Price_filter_1_long=input(title="Long Price filter from", defval=1000, type=input.integer, group="Trend Settings")

Price_filter_2_long=input(title="Long Price filter to", defval=1200, type=input.integer, group="Trend Settings")

Price_filter_1_short=input(title="Short Price filter from", defval=1000, type=input.integer, group="Trend Settings")

Price_filter_2_short=input(title="Short Price filter to", defval=1200, type=input.integer, group="Trend Settings")

Local_filter_checkbox=input(title="Use Local trend?", defval=true, type=input.bool, group="Trend Settings")

slope_checkbox = input(title="Use Slope filter?", defval=false, type=input.bool, group="Slope Settings")

slope_number_long = input(title="Slope number long", defval=-0.3,step=0.01, type=input.float, group="Slope Settings")

slope_number_short = input(title="Slope number short", defval=0.16,step=0.01, type=input.float, group="Slope Settings")

slope_period = input(title="Slope period", defval=300, type=input.integer, group="Slope Settings")

long_on = input(title="Only long?", defval=true, type=input.bool, group="Position Settings")

short_on = input(title="Only short?", defval=true, type=input.bool, group="Position Settings")

volume_ETH_spot_checkbox = input(title="Volume filter?", defval=false, type=input.bool, group="Volume Settings")

volume_ETH_spot_number_more = input(title="Volume no more than:", defval=3700, type=input.integer, group="Volume Settings")

volume_ETH_spot_number_less = input(title="Volume no less than:", defval=600, type=input.integer, group="Volume Settings")

limit_checkbox = input(title="Shift open position?", defval=false, type=input.bool, group="Shift Settings")

limit_shift = input(title="How many % to shift?", defval=0.5,step=0.01, type=input.float, group="Shift Settings")

cancel_in = input(title="Cancel position in #bars?", defval=false, type=input.bool, group="Cancel Settings")

cancel_in_num = input(title="Number of bars", defval=96, type=input.integer, group="Cancel Settings")

//Name of ticker

_str=tostring(syminfo.ticker)

_chars = str.split(_str, "")

int _len = array.size(_chars)

int _beg = max(0, _len - 4)

string[] _substr = array.new_string(0)

if _beg < _len

_substr := array.slice(_chars, 0, _beg)

string _return = array.join(_substr, "")

//Hour sma

basis = security(syminfo.tickerid, localFilter_frame, ema(close, localFilter_length))

plot(basis, title="Local trend curve", color=color.yellow, style=plot.style_linebr)

//Trend calculation with EMA

f_sec(_market, _res, _exp) => security(_market, _res, _exp[barstate.isconfirmed ? 0 : 1])

ema = sma(close, regimeFilter_length)

emaValue = f_sec("BTC_USDT:swap", regimeFilter_frame, ema)

marketPrice = f_sec("BTC_USDT:swap", regimeFilter_frame, close)

regimeFilter = Global?(marketPrice > emaValue or marketPrice[1] > emaValue[1]):true

reverse_regime=Global?(marketPrice < emaValue or marketPrice[1] < emaValue[1]):true

bgcolor(Global?regimeFilter ? color.green : color.red:color.yellow)

//Local trend

regimeFilter_local = Local_filter_checkbox ? close > basis: true //or close[1] > basis[1]

reverse_regime_local = Local_filter_checkbox ? close < basis: true //or close[1] < basis[1]

//RSI filter

up = rma(max(change(close), 0), 14)

down = rma(-min(change(close), 0), 14)

rsi_ = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ema(rsi_,12)

//local incline

sma =security(syminfo.tickerid, '60', ema(close, 15))

slope = (sma - sma[slope_period]) / slope_period

slope_filter_long = slope_checkbox? slope > slope_number_long : true

slope_filter_short = slope_checkbox? slope < slope_number_short : true

var long_check = true

var short_check = true

if RSI_filter_checkbox

long_check:= rsiMA<40

short_check:= rsiMA>60

//

validlow = Div_1 ? buySignalDiv or wtGoldBuy : buySignal or buySignalDiv or wtGoldBuy

validhigh = Div_2 ? sellSignalDiv : sellSignal or sellSignalDiv

//check volume of ETHUSDT

volume_ETH_spot = volume

volume_ETH_spot_filter = volume_ETH_spot_checkbox? volume_ETH_spot < volume_ETH_spot_number_more and volume_ETH_spot > volume_ETH_spot_number_less : true

// Check if we have confirmation for our setup

var Price_long = true

if Price_filter_checkbox

Price_long:=close>Price_filter_1_long and close<Price_filter_2_long

var Price_short = true

if Price_filter_checkbox

Price_short:=close>Price_filter_1_short and close<Price_filter_2_short

validlong = sommi_diamond_on ? sommiBullishDiamond and strategy.position_size == 0 and barstate.isconfirmed and regimeFilter_local and regimeFilter : validlow and strategy.position_size == 0 and barstate.isconfirmed and regimeFilter_local and Price_long and long_check and slope_filter_long and volume_ETH_spot_filter

validshort = sommi_diamond_on ? sommiBearishDiamond and strategy.position_size == 0 and barstate.isconfirmed and reverse_regime_local and reverse_regime : validhigh and strategy.position_size == 0 and barstate.isconfirmed and reverse_regime_local and Price_short and short_check and slope_filter_short and volume_ETH_spot_filter

// Save trade stop & target & position size if a valid setup is detected

var tradeStopPrice = 0.0

var tradeTargetPrice = 0.0

var TP=0.0

var limit_price=0.0

//Detect valid long setups & trigger alert

if validlong

if buySignalDiv or wtGoldBuy

limit_price:=limit_checkbox? close*(1-limit_shift*0.01) : close

tradeStopPrice := limit_price*(1-b_1*0.01)

tradeTargetPrice := limit_price*(1+a_1_div*0.01)

TP:= a_1_div

else

limit_price:=limit_checkbox? close*(1-limit_shift*0.01) : close

tradeStopPrice := limit_price*(1-b_1*0.01)

tradeTargetPrice := limit_price*(1+a_1*0.01)

TP:= a_1

// if validlong

// if buySignalDiv or wtGoldBuy

// limit_price:=close

// tradeStopPrice := limit_price*(1-b_1*0.01)

// tradeTargetPrice := limit_price*(1+a_1_div*0.01)

// TP:= a_1_div

// else

// limit_price:=close

// tradeStopPrice := limit_price*(1-b_1*0.01)

// tradeTargetPrice := limit_price*(1+a_1*0.01)

// TP:= a_1

// Detect valid short setups & trigger alert

if validshort

limit_price:=limit_checkbox? close*(1+limit_shift*0.01) : close

tradeStopPrice := limit_price*(1+b_2*0.01)

tradeTargetPrice := limit_price*(1-a_2*0.01)

TP:= a_2

// if validshort

// limit_price:= close

// tradeStopPrice := limit_price*(1+b_2*0.01)

// tradeTargetPrice := limit_price*(1-a_2*0.01)

// TP:= a_2

if cancel_in and barssince(validlong) == cancel_in_num or barssince(validshort) == cancel_in_num

strategy.cancel_all()

if long_on

strategy.entry (id="Long", long=strategy.long, limit=limit_price, when=validlong, comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "buy",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "long"\n' + '}')

if short_on

strategy.entry (id="Short", long=strategy.short, limit=limit_price, when=validshort,comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "sell",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "short",\n' + ' "sl": {\n' + ' "enabled": true\n' + ' }\n' + '}')

// condition:=true

// if Cancel_all and strategy.position_size > 0 and (reverse_regime_local or reverse_regime)

// strategy.close_all(when=strategy.position_size != 0, comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "sell",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "flat"\n' + '}')

if Cancel_all and strategy.position_size > 0 and reverse_regime_local

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "sell",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if Cancel_all and strategy.position_size < 0 and regimeFilter_local

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "buy",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if cancel_in and strategy.position_size > 0 and barssince(validlong) > cancel_in_num

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "sell",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if cancel_in and strategy.position_size < 0 and barssince(validshort) > cancel_in_num

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "buy",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

// Exit trades whenever our stop or target is hit

strategy.exit(id="Long Exit", from_entry="Long", limit=tradeTargetPrice, stop=tradeStopPrice, when=strategy.position_size > 0)

strategy.exit(id="Short Exit", from_entry="Short", limit=tradeTargetPrice,stop=tradeStopPrice, when=strategy.position_size < 0)