Estrategia de cuadrícula de banda de ganancia oscilante

Descripción general

La estrategia de la red de ondas de ganancias oscilantes es una estrategia de seguimiento de tendencias que crea automáticamente una red en función de las fluctuaciones de los precios y puede ser rentable cuando los precios fluctúan.

Principio de estrategia

La idea central de esta estrategia es crear una red de bandas de precios que genere nuevas señales de transacción cuando los precios entran en diferentes bandas. Por ejemplo, si la brecha de la red se establece en \(500, entonces se generará una nueva señal de hacer más cuando el precio suba por encima de \)500.

En concreto, la estrategia consiste en moverse constantemente para crear una nueva red de precios, siguiendo los nuevos altos o bajos. En el código, definimos una variablere_gridPara almacenar el precio de la cuadrícula actual. Si el precio supera el intervalo de cuadrícula establecido, se volverá a calcular el precio de la cuadrícula siguiente.

De esta manera, cuando el precio fluctúa lo suficiente, se generan nuevas señales de negociación, que podemos aprovechar para hacer más o menos. La posición original se detiene cuando el precio comienza a moverse en la dirección opuesta más allá del intervalo de la grilla.

Análisis de las ventajas

La mayor ventaja de esta estrategia es que se puede seguir automáticamente la tendencia de los precios y obtener beneficios continuos. Siempre que los precios sigan siendo lo suficientemente fluctuantes, el tamaño de nuestras posiciones crecerá y las ganancias también.

Además, los parámetros de la grilla de configuración razonable pueden controlar el riesgo de manera efectiva. Además, la combinación de indicadores técnicos como los gráficos de la nube de Ichimoku para filtrar las señales puede mejorar la estabilidad de la estrategia.

Análisis de riesgos

El principal riesgo de esta estrategia es que el precio puede invertirse repentinamente, lo que provoca un stop loss. En este momento, las ganancias acumuladas anteriormente pueden reducirse o perder.

Para controlar este riesgo, podemos establecer líneas de stop loss, ajustar razonablemente los parámetros de la grilla, elegir variedades de operaciones con mayor tendencia, combinar varios indicadores técnicos para filtrar la señal, etc.

Dirección de optimización

La estrategia puede seguir optimizándose en los siguientes aspectos:

Optimización de parámetros de la grilla para encontrar la combinación óptima de parámetros como el espacio de la grilla, el tamaño de la posición

Aumentar o ajustar los mecanismos de suspensión de pérdidas para controlar mejor el riesgo

Prueba diferentes variedades de transacciones, selecciona las variedades con mayor volatilidad y tendencias más evidentes

Aumentar el conocimiento de los indicadores técnicos y la estabilidad estratégica

Resumir

La estrategia de la red de la franja de ganancias de la oscilación puede mantenerse rentable de manera efectiva mediante la creación de una red de precios que sigue automáticamente la tendencia. Al mismo tiempo, existe un cierto riesgo de reversión. El riesgo puede controlarse de manera efectiva y mejorar la estabilidad de la estrategia mediante la optimización de los parámetros, la configuración de stop loss y la selección de variedades.

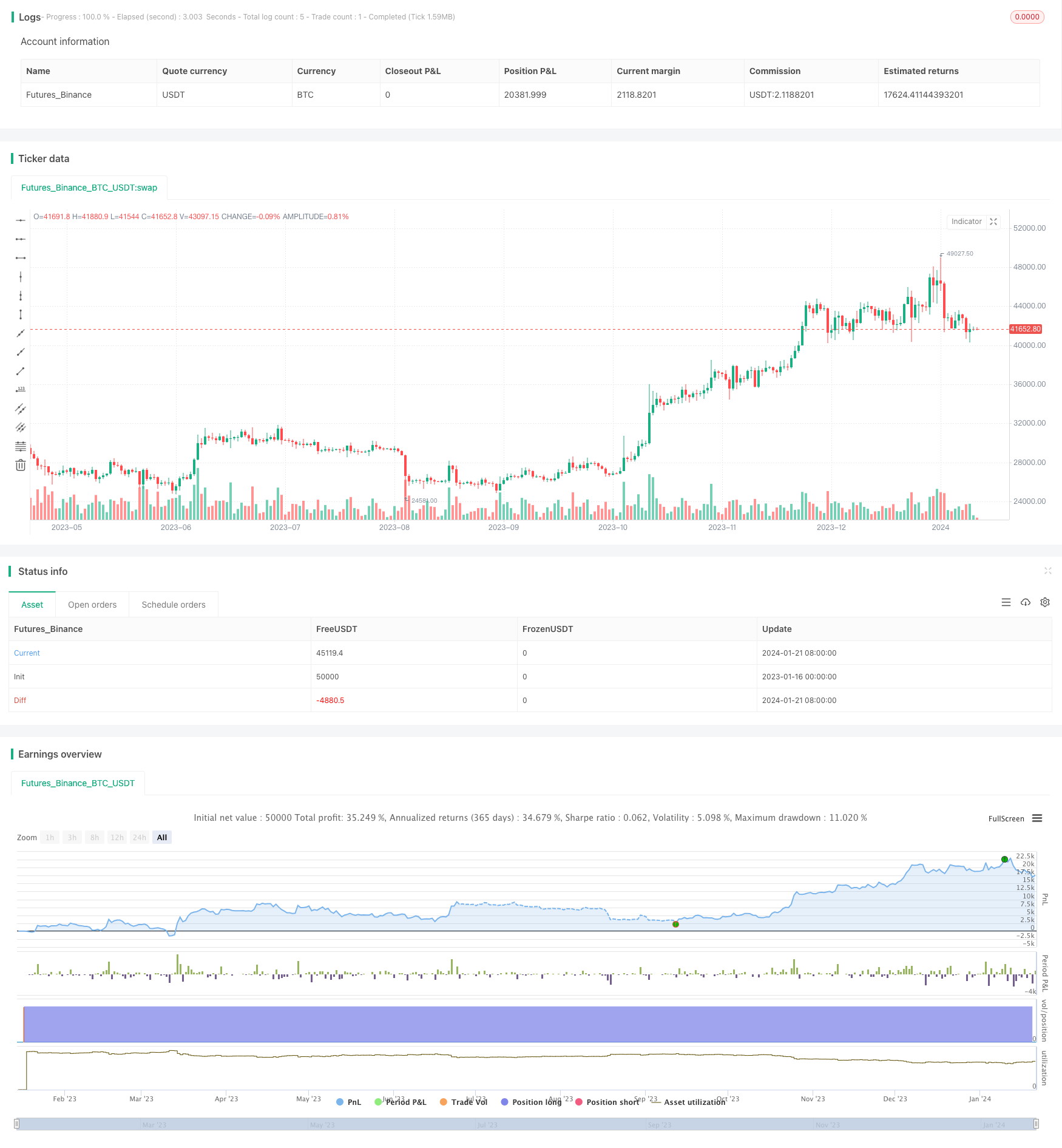

/*backtest

start: 2023-01-16 00:00:00

end: 2024-01-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ramsay09

//@version=4

strategy(title="Grid Tool",shorttitle= "Grid", overlay= true )

backtest = input(title= "Backtest (no comment-string, disable for API-trading)", type= input.bool, defval= true)

entry_type = input("Long", title= "Long/Short Entry", options= ["Long", "Short"])

X_opt = input("Grid - reentry", title="--- 1st ENTRY SIGNAL ---", options= ["---", "Grid - reentry", "Grid - counter trend", "Fractals", "Reverse fractal"])

X_opt_2 = input("---", title="--- 2nd ENTRY SIGNAL ---", options= ["---", "Grid - reentry", "Grid - counter trend", "Fractals", "Reverse fractal"])

entry_f_1 = input("---", title="Entry filter 1", options= ["---", "Bar breakout 1 filter", "Bar breakout 2 filter", "SMA filter", "MACD filter", "RSI50 filter", "Fractals filter",

"Segments filter", "Fractals 1-2-3 filter", "Reverse fractal filter", "EMA21/SMA20 filter", "TRIX filter",

"SuperTrend filter", "Parabolic SAR filter", "ADX filter", "Price X Kumo filter", "Price X Kijun filter", "Kumo flip filter",

"Price filtered Kumo flip filter", "Chikou X price filter", "Chikou X Kumo filter", "Price X Tenkan filter", "Tenkan X Kumo filter",

"Tenkan X Kijun filter"])

entry_f_2 = input("---", title="Entry filter 2", options= ["---", "Bar breakout 1 filter", "Bar breakout 2 filter", "SMA filter", "MACD filter", "RSI50 filter", "Fractals filter",

"Segments filter", "Fractals 1-2-3 filter", "Reverse fractal filter", "EMA21/SMA20 filter", "TRIX filter",

"SuperTrend filter", "Parabolic SAR filter", "ADX filter", "Price X Kumo filter", "Price X Kijun filter", "Kumo flip filter",

"Price filtered Kumo flip filter", "Chikou X price filter", "Chikou X Kumo filter", "Price X Tenkan filter", "Tenkan X Kumo filter",

"Tenkan X Kijun filter"])

exit_f_1 = input("---", title="Exit filter 1", options= ["---", "TRIX exit", "Reverse fractal exit", "SMA exit", "MACD exit",

"RSI50 exit", "Fractals exit", "SuperTrend exit", "Parabolic SAR exit", "ADX exit", "Cloud exit", "Kijun exit"])

exit_f_2 = input("---", title="Exit filter 2", options= ["---", "TRIX exit", "Reverse fractal exit", "SMA exit", "MACD exit",

"RSI50 exit", "Fractals exit", "SuperTrend exit", "Parabolic SAR exit", "ADX exit", "Cloud exit", "Kijun exit"])

//--------------------- Signal inputs -----------------------

grid_gap = input(500, type= input.float, title= "Grid gap - base currency", minval= 0, step= 10)

//--------------------- filter inputs --------------------

shared_param = input(false, title= " Shared filter and entry parameters :", type= input.bool)

sb = input(title="Segment max bars", defval= 10, minval= 0, step= 1)

fr_period = input(2, title= "Fractals period", minval= 1)

rsi_period = input(14, title= "RSI period", minval= 1)

ma_period = input(50, title= "MA period", minval= 1)

mult = input(3, type= input.float, title= "SuperTrend multiplier", minval= 1, step= 0.1)

len = input(6, type= input.integer, title= "SuperTrend length", minval= 1)

start = 0.02//input(0.02, title= "PSAR Start (Filter/Entry)", minval= 0)

inc = 0.02//input(0.02, title= "PSAR Increment (Filter/Entry)", minval= 0)

max = 0.2//input(.2, title= "PSAR Maximum (Filter/Entry)", minval= 0)

di_length_s = input(10, title= "DI length (signals)", minval= 1)

adx_smooth_s = input(10, title= "ADX smooth (signals)", minval= 1)

adx_thres_s = input(25, title= "ADX threshold (signals)", minval= 1)

trix_len_f = input(14, title= "TRIX Length", type=input.integer, minval=1)

smooth_length_f = input(6, title= "Signal Smoothing Length (TRIX)", type=input.integer, minval=1)

//--------------------- exit inputs --------------------

exit_param = input(false, title= " Exit Parameters :", type= input.bool)

trix_len_x = input(14, title= "TRIX Length", type=input.integer, minval=1)

smooth_length_x = input(6, title= "Signal Smoothing Length (TRIX)", type=input.integer, minval=1)

fr_period_x = input(2, title= "Exit fractals - period", minval= 1)

fr_past_x = input(0, title= "Exit fractals - past fractal", minval= 0)

rsi_period_x = input(14, title= "Exit RSI period", minval= 1)

ma_period_x = input(50, title= "Exit MA period", minval= 1)

mult_x = input(2, type= input.float, title= "Exit SuperTrend multiplier", minval= 1)

len_x = input(5, type= input.integer, title= "Exit SuperTrend length", minval= 1)

di_length_x = input(10, title= "Exit ADX period", minval= 1)

adx_smooth_x = input(10, title= "Exit ADX smooth", minval= 1)

adx_thres_x = input(25, title= "Exit ADX threshold", minval= 1)

//----------------------- Backtest periode --------------------------------

b_t_per_start = input(false, title= " Set backtest start or/and trend start :", type= input.bool)

start_year = input(2020, "Start year")

start_month = input(3, "Start month", minval= 1, maxval= 12)

start_day = input(13, "Start day", minval= 1, maxval= 31)

period_start = timestamp(start_year, start_month, start_day, 0, 0)

stop_year = input(2120, "Stop year")

stop_month = input(12, "Stop month", minval= 1, maxval= 12)

stop_day = input(31, "Stop day", minval= 1, maxval= 31)

period_stop = timestamp(stop_year, stop_month, stop_day, 0, 0)

backtest_period() => time >= period_start and time <= period_stop ? true : false

//-------------------- Ichimoku --------------------

TKlength = 9 //input(9, "Tenkan-sen length", minval= 1)

KJlength = 26 //input(26, "Kijun-sen length", minval= 1)

CSHSlength = 26 //input(26, "Chikouspan length/horizontal shift", minval= 1)

SBlength = 52 //input(52, "SenkouspanB length", minval= 1)

SAlength = 26 //input(26, "SenkouspanA length", minval= 1)

// calculation

TK = avg(lowest(TKlength), highest(TKlength))

KJ = avg(lowest(KJlength), highest(KJlength))

CS = close

SB = avg(lowest(SBlength), highest(SBlength))

SA = avg(TK,KJ)

kumo_high = max(SA[CSHSlength-1], SB[CSHSlength-1])

kumo_low = min(SA[CSHSlength-1], SB[CSHSlength-1])

//------------------------------------- Filters and entry signals --------------------------------------

//---------------------- Ichimoku filter ------------------------

// cross conditions for "Strong" filtered signals

var bool sasb_x = true

if crossover(SA, SB) and low > kumo_high

sasb_x := true

if crossunder(SA, SB) and high < kumo_low

sasb_x := false

var bool tkkj_x = true

if crossover(TK, KJ) and TK > kumo_high and KJ > kumo_high

tkkj_x := true

if crossunder(TK, KJ) and TK < kumo_low and KJ < kumo_low

tkkj_x := false

// Ichimoku filters

kijun_buy_f = close > KJ

kumo_buy_f = close > kumo_high

kumo_flip_buy_f = SA > SB

price_filtered_kumo_flip_buy_f = sasb_x and low > kumo_high

chikou_X_price_buy_f = CS > high[(26-1)]

chikou_X_kumo_buy_f = CS > kumo_high[26-1]

price_X_tenkan_buy_f = close > TK

tenkan_X_kumo_buy_f = TK > kumo_high

tenkan_X_kijun_buy_f = TK > KJ

kumo_filtered_tenkan_X_kijun_buy_f = tkkj_x and TK > kumo_high and KJ > kumo_high and TK > KJ

kijun_sell_f = close < KJ

kumo_sell_f = close < kumo_low

kumo_flip_sell_f = SA < SB

price_filtered_kumo_flip_sell_f = not sasb_x and high < kumo_low

chikou_X_price_sell_f = CS < low[(26-1)]

chikou_X_kumo_sell_f = CS < kumo_low[26-1]

price_X_tenkan_sell_f = close < TK

tenkan_X_kumo_sell_f = TK < kumo_low

tenkan_X_kijun_sell_f = TK < KJ

kumo_filtered_tenkan_X_kijun_sell_f = not tkkj_x and TK < kumo_low and KJ < kumo_low and TK < KJ

// Ichimoku exits

kijun_buy_x = close > KJ

kumo_buy_x = close > kumo_high

kijun_sell_x = close < KJ

kumo_sell_x = close < kumo_low

//------------------------ grid --------------------------

//up_grid = 0.

//up_grid := nz(high > up_grid[1] + grid_gap and backtest_period() ? close : up_grid[1]) // forward grid long

//dn_grid = 0.

//dn_grid := nz(low < dn_grid[1] - grid_gap and backtest_period() ? close : dn_grid[1]) // forward grid short

re_grid = 0.

re_grid := nz(high > re_grid[1] + grid_gap or low < re_grid[1] - grid_gap ? close : re_grid[1])

//grid_up_buy = up_grid > up_grid[1]

//grid_dn_sell = dn_grid < dn_grid[1]

grid_ct_buy = re_grid < re_grid[1]

grid_ct_sell = re_grid > re_grid[1]

grid_re_buy = re_grid > re_grid[1]

grid_re_sell = re_grid < re_grid[1]

//plot(re_grid,"Plot", color= color.yellow, linewidth= 2)

//---------------------- reverse fractal signal and filter --------------------------

up_bar = close[0] > open[0]

dn_bar = close[0] < open[0]

hl = low[0] > low[1]

lh = high[0] < high[1]

rev_up_fr_sell = pivothigh(high, 3, 0) and dn_bar and up_bar[1] or

pivothigh(high, 4, 1) and dn_bar and up_bar[1] or

pivothigh(high, 4, 1) and lh and up_bar and up_bar[1]

rev_dn_fr_buy = pivotlow(low, 3, 0) and up_bar and dn_bar[1] or

pivotlow(low, 4, 1) and up_bar and dn_bar[1] or

pivotlow(low, 4, 1) and hl and dn_bar and dn_bar[1]

ema_f(src, ema_len) => ema(src, ema_len) // ma function definition

sma_f(src, sma_len) => sma(src, sma_len)

ema_21 = ema_f(close, 21) // ema21/sma20 signal

sma_20 = sma_f(close, 20)

ma_cross_buy = close > ema_21 and close > sma_20 and ema_21 > sma_20

ma_cross_sell = close < ema_21 and close < sma_20 and ema_21 < sma_20

//--------------------- TRIX ------------------------

triple_ema_f = ema(ema(ema(close, trix_len_f), trix_len_f), trix_len_f)

trix_f = roc(triple_ema_f, 1)

signal_f = sma(trix_f, smooth_length_f)

triple_ema_x = ema(ema(ema(close, trix_len_x), trix_len_x), trix_len_x)

trix_x = roc(triple_ema_x, 1)

signal_x = sma(trix_x, smooth_length_x)

//filters

trix_buy_f = trix_f > signal_f

trix_sell_f = trix_f < signal_f

//exits

trix_buy_x = trix_x > signal_x

trix_sell_x = trix_x < signal_x

//----------------------- macd filter -----------------------

[macdLine_f, signalLine_f, histLine_f] = macd(close, 12, 26, 9)

//filters

macd_buy = macdLine_f > signalLine_f

macd_sell = macdLine_f < signalLine_f

//exit

macd_buy_x = macdLine_f > signalLine_f

macd_sell_x = macdLine_f < signalLine_f

//---------------------- rsi filter and entry signal------------------------

//entry

rsi_f = rsi(close, rsi_period)

rsi_f_buy = rsi_f > 50

rsi_f_sell = rsi_f < 50

//filters

rsi_f_buy_f = rsi_f > 50

rsi_f_sell_f = rsi_f < 50

//exit

rsi_f_x = rsi(close, rsi_period_x)

rsi_f_buy_x = rsi_f_x > 50

rsi_f_sell_x = rsi_f_x < 50

//---------------- Bill Williams Fractals (filter and entry signal) -----------------

up_fr = pivothigh(fr_period, fr_period)

dn_fr = pivotlow(fr_period, fr_period)

fractal_up_v = valuewhen(up_fr, high[fr_period],0)

fractal_dn_v = valuewhen(dn_fr, low[fr_period],0)

//entry signal

fr_upx = crossover(high, fractal_up_v)

fr_dnx = crossunder(low, fractal_dn_v)

//filters

fr_upx_f = high > fractal_up_v

fr_dnx_f = low < fractal_dn_v

//exit

up_fr_x = pivothigh(fr_period_x, fr_period_x)

dn_fr_x = pivotlow(fr_period_x, fr_period_x)

fractal_up_v_x = valuewhen(up_fr_x, high[fr_period_x], fr_past_x)

fractal_dn_v_x = valuewhen(dn_fr_x, low[fr_period_x], fr_past_x)

fr_upx_x = high > fractal_up_v_x

fr_dnx_x = low < fractal_dn_v_x

//higher low and higher high - lower high and lower low - entry

fractal_dn_v_1 = valuewhen(dn_fr, low[fr_period],1)

fractal_up_v_1 = valuewhen(up_fr, high[fr_period],1)

hl_hh_buy = fractal_dn_v > fractal_dn_v_1 and high > fractal_up_v // 123 signal and filter

lh_ll_sell = fractal_up_v < fractal_up_v_1 and low < fractal_dn_v

//-------------------- SuperTrend filter and entry signal ---------------------

//entry

[SuperTrend, Dir] = supertrend(mult, len)

sup_buy = close > SuperTrend

sup_sell = close < SuperTrend

//filters

sup_buy_f = close > SuperTrend

sup_sell_f = close < SuperTrend

//exit

[SuperTrend_x, Dir_x] = supertrend(mult_x, len_x)

sup_buy_x = close > SuperTrend_x

sup_sell_x = close < SuperTrend_x

//----------------- Parabolic SAR Signal (pb/ps) and filter -------------------

psar_buy = high > sar(start, inc, max)[0]

psar_sell = low < sar(start, inc, max)[0]

//filters

psar_buy_f = high > sar(start, inc, max)[0]

psar_sell_f = low < sar(start, inc, max)[0]

//-------------------------- ADX entry and filter ---------------------------

//exit

[diplus_f_x, diminus_f_X, adx_f_x] = dmi(di_length_x, adx_smooth_x)

adx_thres_f_x = adx_f_x < adx_thres_x

//adx signal 1/2 and filters

[diplus_s, diminus_s, adx_s] = dmi(di_length_s, adx_smooth_s)

adx_above_thres = adx_s > adx_thres_s

long_1 = diplus_s > diminus_s and adx_s < diplus_s and adx_s > diminus_s

short_1 = diplus_s < diminus_s and adx_s > diplus_s and adx_s < diminus_s

long_2 = diplus_s > diminus_s and adx_above_thres

short_2 = diplus_s < diminus_s and adx_above_thres

//-------------------------- SMA50 filter and entry---------------------------

//entry

sma_buy = close[2] > ema_f(close, ma_period)

sma_sell = close[2] < ema_f(close, ma_period)

//filters

sma_buy_f = close[2] > sma_f(close, ma_period)

sma_sell_f = close[2] < sma_f(close, ma_period)

//exit

sma_buy_x = close[1] > sma_f(close, ma_period_x)

sma_sell_x = close[1] < sma_f(close, ma_period_x)

//--------------------------- Segments signal ----------------------------

count1_l = 0

count2_l = 0

segment_1_stat_l = false

segment_2_stat_l = false

segment_3_stat_l = false

higher_low = low > low[1]

var line segment_low_1_l = na

var line segment_low_2_l = na

var line segment_low_3_l = na

// long segments

for i=0 to sb

count1_l := count1_l + 1

if low[1] > low[i+2] and higher_low

segment_1_stat_l := true

break

for i=count1_l to sb+count1_l

count2_l := count2_l + 1

if low[1+count1_l] > low[i+2] and segment_1_stat_l

segment_2_stat_l := true

break

for i=count2_l to sb+count2_l

if low[1+count1_l+count2_l] > low[i+2+count1_l] and segment_2_stat_l

segment_3_stat_l := true

break

// short segments

count1_s = 0

count2_s = 0

segment_1_stat_s = false

segment_2_stat_s = false

segment_3_stat_s = false

lower_high = high < high[1]

var line segment_high_1 = na

var line segment_high_2 = na

var line segment_high_3 = na

for i=0 to sb

count1_s := count1_s + 1

if high[1] < high[i+2] and lower_high

segment_1_stat_s := true

break

for i=count1_s to sb+count1_s

count2_s := count2_s + 1

if high[1+count1_s] < high[i+2] and segment_1_stat_s

segment_2_stat_s := true

break

for i=count2_s to sb+count2_s

if high[1+count1_s+count2_s] < high[i+2+count1_s] and segment_2_stat_s

segment_3_stat_s := true

break

// segments signals

seg_stat_l = segment_1_stat_l and segment_2_stat_l and segment_3_stat_l

seg_stat_s = segment_1_stat_s and segment_2_stat_s and segment_3_stat_s

//entry

segments_buy = high > high[1] and seg_stat_l[1]

segments_sell = low < low[1] and seg_stat_s[1]

//filters

segments_buy_f = high > high[1] and seg_stat_l[1]

segments_sell_f = low < low[1] and seg_stat_s[1]

//--------------------------- Entry Signal Options ---------------------------

// buy signal options 1

opt_sig_buy =

X_opt == "---" ? na :

// X_opt == "Grid - forward sig" ? grid_up_buy :

X_opt == "Grid - counter trend" ? grid_ct_buy :

X_opt == "Grid - reentry" ? grid_re_buy :

X_opt == "Fractals" ? fr_upx :

X_opt == "Reverse fractal" ? rev_dn_fr_buy : na

// sell signal options 1

opt_sig_sell =

X_opt == "---" ? na :

// X_opt == "Grid - forward sig" ? grid_dn_sell :

X_opt == "Grid - counter trend" ? grid_ct_sell :

X_opt == "Grid - reentry" ? grid_re_sell :

X_opt == "Fractals" ? fr_dnx :

X_opt == "Reverse fractal" ? rev_up_fr_sell : na

// buy signal options 2

opt_sig_buy_2 =

X_opt_2 == "---" ? na :

// X_opt_2 == "Grid - forward sig" ? grid_up_buy :

X_opt_2 == "Grid - counter trend" ? grid_ct_buy :

X_opt_2 == "Grid - reentry" ? grid_re_buy :

X_opt_2 == "Fractals" ? fr_upx :

X_opt_2 == "Reverse fractal" ? rev_dn_fr_buy : na

// sell signal options 2

opt_sig_sell_2 =

X_opt_2 == "---" ? na :

// X_opt_2 == "Grid - forward sig" ? grid_dn_sell :

X_opt_2 == "Grid - counter trend" ? grid_ct_sell :

X_opt_2 == "Grid - reentry" ? grid_re_sell :

X_opt_2 == "Fractals" ? fr_dnx :

X_opt_2 == "Reverse fractal" ? rev_up_fr_sell : na

//-------------------------- entry filter -------------------------------

//entry buy filter 1 options

entry_filter_buy_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_buy :

entry_f_1 == "RSI50 filter" ? rsi_f_buy_f :

entry_f_1 == "Fractals filter" ? fr_upx_f :

entry_f_1 == "SuperTrend filter" ? sup_buy_f :

entry_f_1 == "Parabolic SAR filter" ? psar_buy_f :

entry_f_1 == "SMA filter" ? sma_buy_f :

entry_f_1 == "ADX filter" ? adx_above_thres :

entry_f_1 == "Segments filter" ? segments_buy :

entry_f_1 == "Fractals 1-2-3 filter" ? hl_hh_buy :

entry_f_1 == "Reverse fractal filter" ? rev_dn_fr_buy :

entry_f_1 == "EMA21/SMA20 filter" ? ma_cross_buy :

entry_f_1 == "TRIX filter" ? trix_buy_f :

entry_f_1 == "Price X Kumo filter" ? kumo_buy_f :

entry_f_1 == "Price X Kijun filter" ? kijun_buy_f :

entry_f_1 == "Kumo flip filter" ? kumo_flip_buy_f :

entry_f_1 == "Price filtered Kumo flip filter" ? price_filtered_kumo_flip_buy_f :

entry_f_1 == "Chikou X price filter" ? chikou_X_price_buy_f :

entry_f_1 == "Chikou X Kumo filter" ? chikou_X_kumo_buy_f :

entry_f_1 == "Price X Tenkan filter" ? price_X_tenkan_buy_f :

entry_f_1 == "Tenkan X Kumo filter" ? tenkan_X_kumo_buy_f :

entry_f_1 == "Tenkan X Kijun filter" ? tenkan_X_kijun_buy_f : true

//entry sell filter 1 options

entry_filter_sell_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_sell :

entry_f_1 == "RSI50 filter" ? rsi_f_sell_f :

entry_f_1 == "Fractals filter" ? fr_dnx_f :

entry_f_1 == "SuperTrend filter" ? sup_sell_f :

entry_f_1 == "Parabolic SAR filter" ? psar_sell_f :

entry_f_1 == "SMA filter" ? sma_sell_f :

entry_f_1 == "ADX filter" ? adx_above_thres :

entry_f_1 == "Segments filter" ? segments_sell :

entry_f_1 == "Fractals 1-2-3 filter" ? lh_ll_sell :

entry_f_1 == "Reverse fractal filter" ? rev_up_fr_sell :

entry_f_1 == "EMA21/SMA20 filter" ? ma_cross_sell :

entry_f_1 == "TRIX filter" ? trix_sell_f :

entry_f_1 == "Price X Kumo filter" ? kumo_sell_f :

entry_f_1 == "Price X Kijun filter" ? kijun_sell_f :

entry_f_1 == "Kumo flip filter" ? kumo_flip_sell_f :

entry_f_1 == "Price filtered Kumo flip filter" ?price_filtered_kumo_flip_sell_f :

entry_f_1 == "Chikou X price filter" ? chikou_X_price_sell_f :

entry_f_1 == "Chikou X Kumo filter" ? chikou_X_kumo_sell_f :

entry_f_1 == "Price X Tenkan filter" ? price_X_tenkan_sell_f :

entry_f_1 == "Tenkan X Kumo filter" ? tenkan_X_kumo_sell_f :

entry_f_1 == "Tenkan X Kijun filter" ? tenkan_X_kijun_sell_f : true

//entry buy filter 2 options

entry_filter_buy_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_buy :

entry_f_2 == "RSI50 filter" ? rsi_f_buy_f :

entry_f_2 == "Fractals filter" ? fr_upx_f :

entry_f_2 == "SuperTrend filter" ? sup_buy_f :

entry_f_2 == "Parabolic SAR filter" ? psar_buy_f :

entry_f_2 == "SMA filter" ? sma_buy_f :

entry_f_2 == "ADX filter" ? adx_above_thres :

entry_f_2 == "Segments filter" ? segments_buy :

entry_f_2 == "Fractals 1-2-3 filter" ? hl_hh_buy :

entry_f_2 == "Reverse fractal filter" ? rev_dn_fr_buy :

entry_f_2 == "EMA21/SMA20 filter" ? ma_cross_buy :

entry_f_2 == "TRIX filter" ? trix_buy_f :

entry_f_2 == "Price X Kumo filter" ? kumo_buy_f :

entry_f_2 == "Price X Kijun filter" ? kijun_buy_f :

entry_f_2 == "Kumo flip filter" ? kumo_flip_buy_f :

entry_f_2 == "Price filtered Kumo flip filter" ? price_filtered_kumo_flip_buy_f :

entry_f_2 == "Chikou X price filter" ? chikou_X_price_buy_f :

entry_f_2 == "Chikou X Kumo filter" ? chikou_X_kumo_buy_f :

entry_f_2 == "Price X Tenkan filter" ? price_X_tenkan_buy_f :

entry_f_2 == "Tenkan X Kumo filter" ? tenkan_X_kumo_buy_f :

entry_f_2 == "Tenkan X Kijun filter" ? tenkan_X_kijun_buy_f : true

//entry sell filter 2 options

entry_filter_sell_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_sell :

entry_f_2 == "RSI50 filter" ? rsi_f_sell_f :

entry_f_2 == "Fractals filter" ? fr_dnx_f :

entry_f_2 == "SuperTrend filter" ? sup_sell_f :

entry_f_2 == "Parabolic SAR filter" ? psar_sell_f :

entry_f_2 == "SMA filter" ? sma_sell_f :

entry_f_2 == "ADX filter" ? adx_above_thres :

entry_f_2 == "Segments filter" ? segments_sell :

entry_f_2 == "Fractals 1-2-3 filter" ? lh_ll_sell :

entry_f_2 == "Reverse fractal filter" ? rev_up_fr_sell :

entry_f_2 == "EMA21/SMA20 filter" ? ma_cross_sell :

entry_f_2 == "TRIX filter" ? trix_sell_f :

entry_f_2 == "Price X Kumo filter" ? kumo_sell_f :

entry_f_2 == "Price X Kijun filter" ? kijun_sell_f :

entry_f_2 == "Kumo flip filter" ? kumo_flip_sell_f :

entry_f_2 == "Price filtered Kumo flip filter" ? price_filtered_kumo_flip_sell_f :

entry_f_2 == "Chikou X price filter" ? chikou_X_price_sell_f :

entry_f_2 == "Chikou X Kumo filter" ? chikou_X_kumo_sell_f :

entry_f_2 == "Price X Tenkan filter" ? price_X_tenkan_sell_f :

entry_f_2 == "Tenkan X Kumo filter" ? tenkan_X_kumo_sell_f :

entry_f_2 == "Tenkan X Kijun filter" ? tenkan_X_kijun_sell_f : true

//------------------------- exit filter -----------------------

//short exit buy filter 1 options

exit_filter_buy_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "TRIX exit" ? trix_buy_x :

exit_f_1 == "Reverse fractal exit" ? rev_dn_fr_buy :

exit_f_1 == "MACD exit" ? macd_buy_x :

exit_f_1 == "RSI50 exit" ? rsi_f_buy_x :

exit_f_1 == "Fractals exit" ? fr_upx_x :

exit_f_1 == "SuperTrend exit" ? sup_buy_x :

exit_f_1 == "Parabolic SAR exit" ? psar_buy :

exit_f_1 == "SMA exit" ? sma_buy_x :

exit_f_1 == "ADX exit" ? adx_thres_f_x :

exit_f_1 == "Cloud exit" ? kumo_buy_x :

exit_f_1 == "Kijun exit" ? kijun_buy_x : false

//long exit sell filter 1 options

exit_filter_sell_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "TRIX exit" ? trix_sell_x :

exit_f_1 == "Reverse fractal exit" ? rev_up_fr_sell :

exit_f_1 == "MACD exit" ? macd_sell_x :

exit_f_1 == "RSI50 exit" ? rsi_f_sell_x :

exit_f_1 == "Fractals exit" ? fr_dnx_x :

exit_f_1 == "SuperTrend exit" ? sup_sell_x :

exit_f_1 == "Parabolic SAR exit" ? psar_sell :

exit_f_1 == "SMA exit" ? sma_sell_x :

exit_f_1 == "ADX exit" ? adx_thres_f_x :

exit_f_1 == "Cloud exit" ? kumo_sell_x :

exit_f_1 == "Kijun exit" ? kijun_sell_x : false

//short exit buy filter 2 options

exit_filter_buy_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "TRIX exit" ? trix_buy_x :

exit_f_2 == "Reverse fractal exit" ? rev_dn_fr_buy :

exit_f_2 == "MACD exit" ? macd_buy_x :

exit_f_2 == "RSI50 exit" ? rsi_f_buy_x :

exit_f_2 == "Fractals exit" ? fr_upx_x :

exit_f_2 == "SuperTrend exit" ? sup_buy_x :

exit_f_2 == "Parabolic SAR exit" ? psar_buy :

exit_f_2 == "SMA exit" ? sma_buy_x :

exit_f_2 == "ADX exit" ? adx_thres_f_x :

exit_f_2 == "Cloud exit" ? kumo_buy_x :

exit_f_2 == "Kijun exit" ? kijun_buy_x : false

//long exit sell filter 2 options

exit_filter_sell_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "TRIX exit" ? trix_sell_x :

exit_f_2 == "Reverse fractal exit" ? rev_up_fr_sell :

exit_f_2 == "MACD exit" ? macd_sell_x :

exit_f_2 == "RSI50 exit" ? rsi_f_sell_x :

exit_f_2 == "Fractals exit" ? fr_dnx_x :

exit_f_2 == "SuperTrend exit" ? sup_sell_x :

exit_f_2 == "Parabolic SAR exit" ? psar_sell :

exit_f_2 == "SMA exit" ? sma_sell_x :

exit_f_2 == "ADX exit" ? adx_thres_f_x :

exit_f_2 == "Cloud exit" ? kumo_sell_x :

exit_f_2 == "Kijun exit" ? kijun_sell_x : false

//--------------------- strategy entry ---------------------

long = entry_type != "Short"

short = entry_type != "Long"

exit_long = exit_filter_sell_1 or exit_filter_sell_2

exit_short = exit_filter_buy_1 or exit_filter_buy_2

if backtest_period()

if long

strategy.entry("os_b", strategy.long, when = opt_sig_buy and entry_filter_buy_1 and entry_filter_buy_2 and not exit_long,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=buy, amount=100); }" : na)

strategy.entry("os_b", strategy.long, when = opt_sig_buy_2 and entry_filter_buy_1 and entry_filter_buy_2 and not exit_long,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=buy, amount=100); }" : na)

strategy.close("os_b", when = exit_long)

if short

strategy.entry("os_s",strategy.short, when = opt_sig_sell and entry_filter_sell_1 and entry_filter_sell_2 and not exit_short,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=sell, amount=100); }" : na)

strategy.entry("os_s",strategy.short, when = opt_sig_sell_2 and entry_filter_sell_1 and entry_filter_sell_2 and not exit_short,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=sell, amount=100); }" : na)

strategy.close("os_s", when = exit_short)

// {{strategy.order.comment}} #bot - altert message