Estrategia de inversión de tendencia con combinación de múltiples indicadores

Descripción general

Se trata de una estrategia que utiliza varios indicadores para combinar y identificar los puntos de reversión de la tendencia de los precios. La idea básica es que un solo indicador es difícil de identificar perfectamente el punto de inflexión de la tendencia, por lo que elegir varios indicadores con una función similar para combinar, cuando varios indicadores emiten señales simultáneas, podemos determinar la probabilidad relativa de que se produzca una reversión de la tendencia y, por lo tanto, realizar operaciones comerciales.

Principio de estrategia

La estrategia selecciona cinco indicadores diferentes para su uso en combinación, que tienen la función de determinar la tendencia de los precios. Los cinco indicadores son:

- Coral Trend Indicator: combinaciones de medias móviles lisas de índices de triple o más para determinar la tendencia de los precios

- SSL Channel: el canal y la tendencia de precios en combinación con el promedio móvil

- El RSI de Heikin Ashi: Tendencia de la combinación de índices de cambio y líneas medias diarias

- MACD DEMA: tendencia de las medias móviles binarias y la combinación de MACD

- El WaveTrend Oscillator: tendencias basadas en el canal de precios

La lógica de trading de la estrategia es que se puede elegir arbitrariamente uno o más indicadores de los 5 indicadores mencionados anteriormente para combinarlos. Cuando varios indicadores seleccionados emiten señales de compra / venta al mismo tiempo, abrimos una posición de plus / short en la barra correspondiente.

Por ejemplo, si elegimos 2 indicadores: Coral Trend y SSL Channel. Entonces solo hacemos más si ambos emiten señales de compra al mismo tiempo; solo hacemos nada si ambos emiten señales de venta al mismo tiempo.

La verificación de la combinación de varios indicadores puede mejorar considerablemente la fiabilidad de las señales de negociación y evitar la confusión de un solo indicador.

Ventajas estratégicas

- El uso de una combinación de indicadores puede identificar situaciones de alta probabilidad de reversión de tendencias y mejorar la ganancia de las operaciones.

- Cada indicador utiliza un método de cálculo diferente para que la señal sea más completa y precisa.

- Se puede elegir entre 1 y 5 indicadores para combinarlos, con flexibilidad

- Proporciona una configuración de parámetros detallada para cada indicador, que se puede optimizar para diferentes mercados

- Ofrece parámetros de la ventana de retrospectiva para ajustar la sensibilidad de identificación de puntos de venta

Riesgos estratégicos y soluciones

El riesgo de que un solo indicador sea engañoso

- Solución: Verificación combinada de varios indicadores

La configuración incorrecta de los parámetros puede causar demasiada sensibilidad o demasiada lentitud

- Solución: Parámetros de optimización de pruebas repetidas según diferentes ciclos y variedades

Hay un cierto retraso entre los indicadores

- Solución: Configurar una ventana de tiempo de retroceso adecuada

Dirección de optimización de la estrategia

- Prueba más tipos de indicadores de tendencia, amplía el grupo de indicadores y enriquece la combinación

- Aumentar el algoritmo de aprendizaje automático para identificar la mejor combinación de indicadores

- Aumentar los parámetros para adaptarse a los módulos de optimización, lo que permite que los parámetros se ajusten dinámicamente

- Reversión de las tendencias de identificación en combinación con indicadores emocionales y fundamentales

- Desarrollo de modelos de gestión de riesgos cuantitativos para controlar el riesgo de las transacciones

Resumir

La estrategia en su conjunto ha logrado una estrategia de inversión de tendencias más fiable. Su idea, que utiliza una combinación de varios indicadores de verificación, tiene una gran adaptabilidad universal y una excelente extensibilidad. Si se optimiza aún más, junto con tecnologías como el aprendizaje automático y la optimización dinámica de parámetros, el efecto puede mejorar aún más y merece un estudio y una aplicación más profundos.

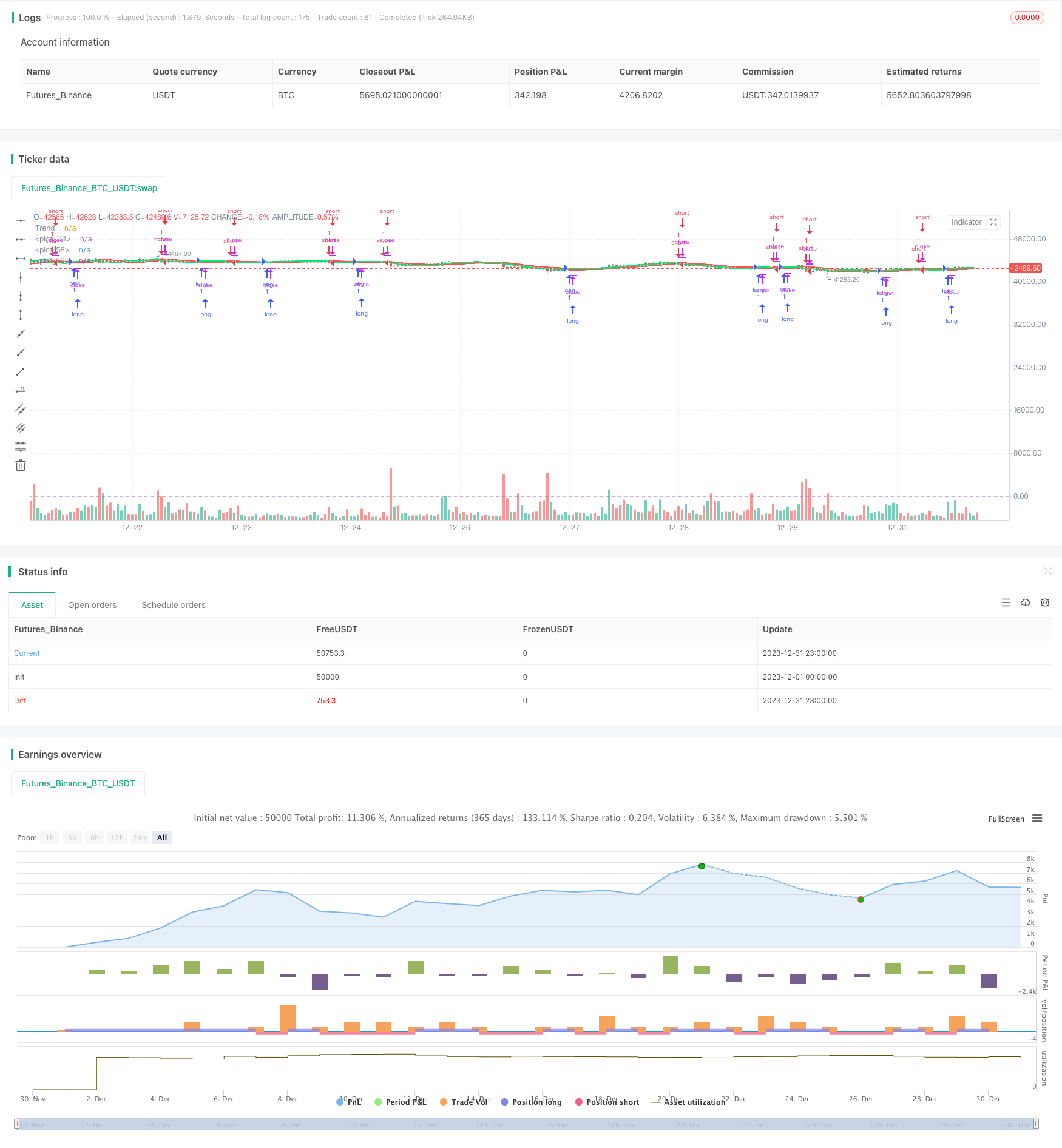

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@author=iori86

//Any trade decisions you make are entirely your own responsibility//

strategy('GT 5.1 Strategy', 'GT 5.1 Strategy •', true, default_qty_type=strategy.cash)

string GROUP_6="STRATEGY OPTIONS"

dec1 = input(true,"HARSI", group=GROUP_6)

harsi_back = input.int(6, 'Lookback HARSI', group=GROUP_6, minval=1, maxval=32)

dec2 = input(true,"SSL", group=GROUP_6)

ssl_back = input.int(1, 'Lookback SSL', group=GROUP_6, minval=0, maxval=4)

dec3 = input(true,"CORAL", group=GROUP_6)

coral_back = input.int(4, 'Lookback CORAL', group=GROUP_6, minval=1, maxval=10)

dec4 = input(false,"MACD DEMA", group=GROUP_6)

macd_back =input.int(0, 'Lookback MACD DEMA', group=GROUP_6, minval=0, maxval=10)

dec5 = input(false,"WAVE TREND", group=GROUP_6)

wave_back=input.int(0, 'Lookback WAVE', group=GROUP_6, minval=0, maxval=10)

//================================================================HARSI============================================================================//

string GROUP_1 = 'Config » HARSI'

i_lenHARSI = input.int(14, 'Length', group=GROUP_1, minval=1)

i_smoothing = input.int(7, 'Open Smoothing', group=GROUP_1, minval=1, maxval=100)

f_zrsi(_source, _length) => ta.rsi(_source, _length) - 50

f_zstoch(_source, _length, _smooth, _scale) =>

float _zstoch = ta.stoch(_source, _source, _source, _length) - 50

float _smoothed = ta.sma(_zstoch, _smooth)

float _scaled = (_smoothed / 100 )* _scale

f_rsi(_source, _length, _mode) =>

float _zrsi = f_zrsi(_source, _length)

var float _smoothed = na

_smoothed := na(_smoothed[1]) ? _zrsi : (_smoothed[1] + _zrsi) / 2

_mode ? _smoothed : _zrsi

f_rsiHeikinAshi(_length) =>

float _closeRSI = f_zrsi(close, _length)

float _openRSI = nz(_closeRSI[1], _closeRSI)

float _highRSI_raw = f_zrsi(high, _length)

float _lowRSI_raw = f_zrsi(low, _length)

float _highRSI = math.max(_highRSI_raw, _lowRSI_raw)

float _lowRSI = math.min(_highRSI_raw, _lowRSI_raw)

float _close = (_openRSI + _highRSI + _lowRSI + _closeRSI) / 4

var float _open = na

_open := na(_open[i_smoothing]) ? (_openRSI + _closeRSI) / 2 : ((_open[1] * i_smoothing) + _close[1]) / (i_smoothing + 1)

float _high = math.max(_highRSI, math.max(_open, _close))

float _low = math.min(_lowRSI, math.min(_open, _close))

[_open, _high, _low, _close]

[O, H, L, C] = f_rsiHeikinAshi(i_lenHARSI)

//=======================================================================SSL=======================================================================//

string GROUP_2 = 'Config » SSL Channel'

int len = input.int(10, 'Period', group=GROUP_2)

float smaHigh = ta.sma(high, len)

float smaLow = ta.sma(low, len)

float Hlv = na

Hlv := close > smaHigh ? 1 : close < smaLow ? -1 : Hlv[1]

float sslDown = Hlv < 0 ? smaHigh : smaLow

float sslUp = Hlv < 0 ? smaLow : smaHigh

plot(sslDown, linewidth=2, color=color.new(color.red, 0))

plot(sslUp, linewidth=2, color=color.new(color.lime, 0))

//=======================================================================CORAL=======================================================================//

string GROUP_3 = 'Config » Coral Trend Candles'

src = close

sm = input.float(9, 'Smoothing Period', group=GROUP_3, minval=1)

cd = input.float(0.4, 'Constant D', group=GROUP_3, minval=0.1)

float di = (sm) / 2.0 + 1.0

float c1 = 2 / (di + 1.0)

float c2 = 1 - c1

float c3 = 3.0 * (cd * cd + cd * cd * cd)

float c4 = -3.0 * (2.0 * cd * cd + cd + cd * cd * cd)

float c5 = 3.0 * cd + 1.0 + cd * cd * cd + 3.0 * cd * cd

var float i1 = na

var float i2 = na

var float i3 = na

var float i4 = na

var float i5 = na

var float i6 = na

i1 := c1 * src + c2 * nz(i1[1])

i2 := c1 * i1 + c2 * nz(i2[1])

i3 := c1 * i2 + c2 * nz(i3[1])

i4 := c1 * i3 + c2 * nz(i4[1])

i5 := c1 * i4 + c2 * nz(i5[1])

i6 := c1 * i5 + c2 * nz(i6[1])

var float bfr = na

bfr := -cd * cd * cd * i6 + c3 * i5 + c4 * i4 + c5 * i3

color bfrC = bfr > nz(bfr[1]) ? color.green : bfr < nz(bfr[1]) ? color.red : color.blue

plot(bfr, title='Trend', linewidth=3, style=plot.style_circles, color=bfrC)

//=======================================================================MACD DEMA=======================================================================//

string GROUP_4 = 'Config » MACD DEMA'

sma = input(12,title='DEMA Short', group=GROUP_4)

lma = input(26,title='DEMA Long', group=GROUP_4)

tsp = input(9,title='Signal', group=GROUP_4)

//dolignes = input(true,title="Lines", group=GROUP_4)

MMEslowa = ta.ema(close,lma)

MMEslowb = ta.ema(MMEslowa,lma)

DEMAslow = ((2 * MMEslowa) - MMEslowb )

MMEfasta = ta.ema(close,sma)

MMEfastb = ta.ema(MMEfasta,sma)

DEMAfast = ((2 * MMEfasta) - MMEfastb)

LigneMACDZeroLag = (DEMAfast - DEMAslow)

MMEsignala = ta.ema(LigneMACDZeroLag, tsp)

MMEsignalb = ta.ema(MMEsignala, tsp)

Lignesignal = ((2 * MMEsignala) - MMEsignalb )

MACDZeroLag = (LigneMACDZeroLag - Lignesignal)

swap1 = MACDZeroLag>0?color.green:color.red

//plot(MACDZeroLag,'Histo',color=swap1,histbase=0)

//p1 = plot(dolignes?LigneMACDZeroLag:na,"LigneMACD",color.blue)

//p2 = plot(dolignes?Lignesignal:na,"Signal",color.red)

//fill(p1, p2, color.blue)

hline(0)

//=======================================================================WAVE TREND=======================================================================//

string GROUP_5 = 'Config » WAVE TREND'

n1 = input(10, "Channel Length", group=GROUP_5)

n2 = input(21, "Average Length", group=GROUP_5)

//obLevel1 = input(60, "Over Bought Level 1", group=GROUP_5)

//obLevel2 = input(53, "Over Bought Level 2", group=GROUP_5)

//osLevel1 = input(-60, "Over Sold Level 1", group=GROUP_5)

//osLevel2 = input(-53, "Over Sold Level 2", group=GROUP_5)

ap = hlc3

esa = ta.ema(ap, n1)

d = ta.ema(math.abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ta.ema(ci, n2)

wt1 = tci

wt2 = ta.sma(wt1,4)

//plot(0,"a" ,color.gray)

//plot(obLevel1,"a", color.red)

//plot(osLevel1,"a", color.green)

//plot(obLevel2,"a", color.red)

//plot(osLevel2,"a", color.green)

//plot(wt1,"a", color.green)

//plot(wt2,"a", color.red)

//plot(wt1-wt2,"a",color.blue, 1)

//=======================================================================CONDITIONS=======================================================================//

bool checker_1 = false // HARSI BUY

bool checker_11 = false // HARSI lookback BUY

bool checker_2 = false // HARSI SELL

bool checker_21 = false // HARSI lookback SELL

bool checker_3 = false // SSL AL

bool checker_31 = false // SSL lookback 0 dan büyükse al

bool checker_4 = false // SSL SAT

bool checker_41 = false // SSL lookback 0 dan büyükse sat

bool checker_5 = false // CORAL AL

bool checker_51 = false // CORAL lookback 1 den büyükse al

bool checker_6 = false // CORAL SAT

bool checker_61 = false // CORAL lookback 1 den büyükse sat

bool checker_7 = false // MACD AL

bool checker_71 = false // MACD lookback 0 dan büyükse al

bool checker_8 = false // MACD SAT

bool checker_81 = false // MACD lookback 0 dan büyükse sat

bool checker_9 = false // WAVE AL

bool checker_91 = false // WAVE lookback 0 dan büyükse al

bool checker_10 = false // WAVE SAT

bool checker_101 = false // WAVE lookback 0 dan büyükse sat

//=======================================================================HARSI=======================================================================//

if harsi_back==1

if ( C > O and C[1] < O[1] and C > C[1])

checker_1 := true

//HARSI SELL

if (C < O and C[1] > O[1] )

checker_2 := true

// HARSI BUY

if harsi_back>1

int say_1=0

while harsi_back>say_1 and checker_11 == false

if ( C[say_1] > O[say_1] and C[say_1+1] < O[say_1+1] and C[say_1] > C[say_1+1])

checker_11 := true

say_1:=say_1+1

int say_2=0

while harsi_back>say_2 and checker_21 == false

if (C[say_2] < O[say_2] and C[say_2+1] > O[say_2+1])

checker_21 := true

say_2:=say_2+1

//=======================================================================SSL=======================================================================//

if ssl_back==0

if (ta.crossover(sslUp, sslDown))

checker_3 := true

if (ta.crossover(sslDown, sslUp))

checker_4 := true

if ssl_back>0

int say_3=0

while ssl_back>=say_3 and checker_31==false

if (sslUp[say_3]>sslDown[say_3] and sslUp[say_3+1]<sslDown[say_3+1] )

checker_31 := true

say_3:=say_3+1

int say_4=0

while ssl_back>=say_4 and checker_41==false

if (sslUp[say_4]<sslDown[say_4] and sslUp[say_4+1]>sslDown[say_4+1])

checker_41 := true

say_4:=say_4+1

//======================================================================CORAL=======================================================================//

if coral_back==1

if(bfrC == color.green and bfrC[1] == color.red)

checker_5 := true

if(bfrC == color.red and bfrC[1] == color.green)

checker_6 := true

if coral_back>1

int say_5=0

while coral_back>say_5 and checker_51 == false

if(bfrC[say_5] == color.green and bfrC[say_5+1] == color.red)

checker_51 := true

say_5 := say_5+1

int say_6=0

while coral_back>say_6 and checker_61 == false

if(bfrC[say_6] == color.red and bfrC[say_6+1] == color.green)

checker_61 := true

say_6 := say_6+1

//=======================================================================MACD=======================================================================//

if macd_back==0

if ta.crossover(LigneMACDZeroLag,Lignesignal)

checker_7 := true

if ta.crossover(Lignesignal,LigneMACDZeroLag)

checker_8 := true

if macd_back>0

int say_7=0

while macd_back>=say_7 and checker_71==false

if ta.crossover(LigneMACDZeroLag[say_7],Lignesignal[say_7])

checker_71 := true

say_7:=say_7+1

int say_8=0

while macd_back>=say_8 and checker_81==false

if ta.crossover(Lignesignal[say_8],LigneMACDZeroLag[say_8])

checker_81 := true

say_8:=say_8+1

//=======================================================================WAVE TREND=======================================================================//

if wave_back ==0

if ta.crossover(wt1,wt2)

checker_9 := true

if ta.crossover(wt2,wt1)

checker_10 :=true

if wave_back>0

int say_9 =0

while wave_back>=say_9 and checker_91==false

if (ta.crossover(wt1[say_9],wt2[say_9]))

checker_91 := true

say_9:=say_9+1

int say_10=0

while wave_back>=say_10 and checker_101==false

if (ta.crossover(wt2[say_10],wt1[say_10]))

checker_101 := true

say_10:=say_10+1

//=======================================================================BUY=======================================================================//

var buy = false

var sell = true

//=======================================================================TEK SEÇENEK=======================================================================//

if buy == false and sell==true

//dec1

if dec1 == true and dec2==false and dec3== false and dec4==false and dec5==false

if checker_1 or checker_11

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec2

if dec2 == true and dec1==false and dec3== false and dec4==false and dec5==false

if checker_3 or checker_31

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up,textcolor= color.white, size=size.small, text="SSL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec3

if dec3 == true and dec2==false and dec1== false and dec4==false and dec5==false

if checker_5 or checker_51

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up,textcolor= color.white, size=size.small, text="CORAL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec4

if dec4 == true and dec2==false and dec3== false and dec1==false and dec5==false

if checker_7 or checker_71

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec5

if dec5 == true and dec1==false and dec2== false and dec3==false and dec4==false

if checker_9 or checker_91

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//=======================================================================2 SEÇENEK=======================================================================//

//dec1-dec2

if dec1 == true and dec2==true and dec3== false and dec4== false and dec5== false

if (checker_1== true or checker_11==true) and (checker_3 == true or checker_31 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec3

if dec1 == true and dec2==false and dec3== true and dec4== false and dec5== false

if (checker_1 == true or checker_11==true) and (checker_5 == true or checker_51 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n CORAL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec4

if dec1 == true and dec2==false and dec3== false and dec4== true and dec5== false

if (checker_1 == true or checker_11==true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec5

if dec1 == true and dec2==false and dec3== false and dec4== false and dec5== true

if (checker_1 == true or checker_11==true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec2 dec3

if dec1 == false and dec2==true and dec3== true and dec4== false and dec5== false

if (checker_3 == true or checker_31==true) and (checker_5 == true or checker_51 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n CORAL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec2 dec4

if dec1 == false and dec2==true and dec3== false and dec4== true and dec5== false

if (checker_3 == true or checker_31==true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec2 dec5

if dec1 == false and dec2==true and dec3== false and dec4== false and dec5== true

if (checker_3 == true or checker_31==true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec3 dec4

if dec1 == false and dec2==false and dec3== true and dec4== true and dec5== false

if (checker_5 == true or checker_51==true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="CORAL\n MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec3 dec5

if dec1 == false and dec2==false and dec3== true and dec4== false and dec5== true

if (checker_5 == true or checker_51==true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="CORAL\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec4 dec5

if dec1 == false and dec2==false and dec3== false and dec4== true and dec5== true

if (checker_7 == true or checker_71==true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="MACD\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//=======================================================================3 SEÇENEK=======================================================================//

// dec 1 dec2 dec3

if dec1 == true and dec2==true and dec3 == true and dec4 ==false and dec5== false

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_5 == true or checker_51 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL\n\n CORAL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec1 dec2 dec4

if dec1 == true and dec2==true and dec3 == false and dec4 ==true and dec5== false

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL\n\n MACD ")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec1 dec2 dec5

if dec1 == true and dec2==true and dec3 == false and dec4 ==false and dec5== true

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL\n\n WAVE ")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec1 dec3 dec4

if dec1 == true and dec2==false and dec3 == true and dec4 ==true and dec5== false

if (checker_1 == true or checker_11==true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n CORAL\n\n MACD ")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec1 dec3 dec5

if dec1 == true and dec2==false and dec3 == true and dec4 ==false and dec5== true

if (checker_1 == true or checker_11==true) and (checker_5 == true or checker_51 == true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n CORAL\n\n WAVE ")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec1 dec4 dec5

if dec1 == true and dec2==false and dec3 == false and dec4 ==true and dec5== true

if (checker_1 == true or checker_11==true) and (checker_7 == true or checker_71 == true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n MACD\n\n WAVE ")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec2 dec3 dec4

if dec1 == false and dec2==true and dec3 == true and dec4==true and dec5== false

if (checker_3 == true or checker_31==true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n CORAL\n\n MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec2 dec3 dec5

if dec1 == false and dec2==true and dec3== true and dec4== false and dec5== true

if (checker_3 == true or checker_31==true) and (checker_5 == true or checker_51 == true) and (checker_9 == true or checker_91==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n CORAL\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec2 dec4 dec5

if dec1 == false and dec2==true and dec3== false and dec4== true and dec5== true

if (checker_3 == true or checker_31==true) and (checker_7 == true or checker_71 == true) and (checker_9 == true or checker_91==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n MACD\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec3 dec4 dec5

if dec1 == false and dec2==false and dec3 == true and dec4 ==true and dec5== true

if (checker_5 == true or checker_51==true) and (checker_7 == true or checker_71 == true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="CORAL\n MACD\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//=======================================================================4 SEÇENEK=======================================================================//

//dec1 dec2 dec3 dec4

if dec1 == true and dec2==true and dec3 == true and dec4==true and dec5== false

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 ==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n CORAL\n\n CORAL\n\n\n MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec3 dec4 dec5

if dec1 == true and dec2==false and dec3 == true and dec4==true and dec5== true

if (checker_1 == true or checker_11==true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 == true) and (checker_9 == true or checker_91 ==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n CORAL\n\n MACD\n\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec2 dec4 dec5

if dec1 == true and dec2==true and dec3 == false and dec4==true and dec5== true

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_7 == true or checker_71 == true) and (checker_9 == true or checker_91 ==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL\n\n MACD\n\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec2 dec3 dec5

if dec1 == true and dec2==true and dec3 == true and dec4==false and dec5== true

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_5 == true or checker_51 == true) and (checker_9 == true or checker_91 ==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL\n\n CORAL\n\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec2 dec3 dec4 dec5

if dec1 == false and dec2==true and dec3 == true and dec4==true and dec5== true

if (checker_3 == true or checker_31 == true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 ==true) and (checker_9 == true or checker_91==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n CORAL\n\n MACD\n\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//=======================================================================5 SEÇENEK=======================================================================//

//dec1 dec2 dec3 dec4 dec5

if dec1 == true and dec2==true and dec3 == true and dec4==true and dec5== true

if (checker_1 == true or checker_11) and (checker_3 == true or checker_31 == true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 ==true) and (checker_9 == true or checker_91==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SUPER BUY")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//=======================================================================SELL=======================================================================//

//=======================================================================TEK SEÇENEK=======================================================================//

if buy == true and sell==false

//dec1

if dec1 == true and dec2==false and dec3== false and dec4==false and dec5==false

if checker_2 or checker_21

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec2

if dec2 == true and dec1==false and dec3== false and dec4==false and dec5==false

if checker_4 or checker_41

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec3

if dec3 == true and dec2==false and dec1== false and dec4==false and dec5==false

if checker_6 or checker_61

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="CORAL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec4

if dec4 == true and dec2==false and dec3== false and dec1==false and dec5==false

if checker_8 or checker_81

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec5

if dec5 == true and dec1==false and dec2== false and dec3==false and dec4==false

if checker_10 or checker_101

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//=======================================================================2 SEÇENEK=======================================================================//

//dec1-dec2

if dec1 == true and dec2==true and dec3== false and dec4== false and dec5== false

if (checker_2==true or checker_21==true) and (checker_4 or checker_41 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec3

if dec1 == true and dec2==false and dec3== true and dec4== false and dec5== false

if (checker_2 == true or checker_21==true) and (checker_6 == true or checker_61 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n CORAL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec4

if dec1 == true and dec2==false and dec3== false and dec4== true and dec5== false

if (checker_2 == true or checker_21==true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec5

if dec1 == true and dec2==false and dec3== false and dec4== false and dec5== true

if (checker_2 == true or checker_21==true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec2 dec3

if dec1 == false and dec2==true and dec3== true and dec4== false and dec5== false

if (checker_4 == true or checker_41==true) and (checker_6 == true or checker_61 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n CORAL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec2 dec4

if dec1 == false and dec2==true and dec3== false and dec4== true and dec5== false

if (checker_4 == true or checker_41==true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec2 dec5

if dec1 == false and dec2==true and dec3== false and dec4== false and dec5== true

if (checker_4 == true or checker_41==true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec3 dec4

if dec1 == false and dec2==false and dec3== true and dec4== true and dec5== false

if (checker_6 == true or checker_61==true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="CORAL\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec3 dec5

if dec1 == false and dec2==false and dec3== true and dec4== false and dec5== true

if (checker_6 == true or checker_61==true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="CORAL\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec4 dec5

if dec1 == false and dec2==false and dec3== false and dec4== true and dec5== true

if (checker_8 == true or checker_81==true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="MACD\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//=======================================================================3 SEÇENEK=======================================================================//

// dec1 dec2 dec3

if dec1 == true and dec2==true and dec3 == true and dec4 ==false and dec5== false

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_6 == true or checker_61 == true)

label.new(bar_index, high+ta.tr/2, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n CORAL")

strategy.entry("short", strategy.short)

sell:= true

buy := false

// dec1 dec2 dec4

if dec1 == true and dec2==true and dec3 == false and dec4 ==true and dec5== false

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr/2, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy := false

// dec1 dec2 dec5

if dec1 == true and dec2==true and dec3 == false and dec4 ==false and dec5== true

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr/2, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n MACD ")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec1 dec3 dec4

if dec1 == true and dec2==false and dec3 == true and dec4 ==true and dec5== false

if (checker_2 == true or checker_21==true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n CORAL\n\n MACD ")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec1 dec3 dec5

if dec1 == true and dec2==false and dec3 == true and dec4 ==false and dec5== true

if (checker_2 == true or checker_21==true) and (checker_6 == true or checker_61 == true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n MACD ")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec1 dec4 dec5

if dec1 == true and dec2==false and dec3 == false and dec4 ==true and dec5== true

if (checker_2 == true or checker_21==true) and (checker_8 == true or checker_81 == true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n MACD\n\n WAVE ")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec2 dec3 dec4

if dec1 == false and dec2==true and dec3 == true and dec4==true and dec5== false

if (checker_4 == true or checker_41==true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n CORAL\n\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec2 dec3 dec5

if dec1 == false and dec2==true and dec3== true and dec4== false and dec5== true

if (checker_4 == true or checker_41==true) and (checker_6 == true or checker_61 == true) and (checker_10 == true or checker_101==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n CORAL\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec2 dec4 dec5

if dec1 == false and dec2==true and dec3== false and dec4== true and dec5== true

if (checker_4 == true or checker_41==true) and (checker_8 == true or checker_81 == true) and (checker_10 == true or checker_101==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n CORAL\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec3 dec4 dec5

if dec1 == false and dec2==false and dec3 == true and dec4 ==true and dec5== true

if (checker_6 == true or checker_61==true) and (checker_8 == true or checker_81 == true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="CORAL\n MACD\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//=======================================================================4 SEÇENEK=======================================================================//

//dec1 dec2 dec3 dec4

if dec1 == true and dec2==true and dec3 == true and dec4==true and dec5== false

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 ==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n CORAL\n\n\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec3 dec4 dec5

if dec1 == true and dec2==false and dec3 == true and dec4==true and dec5== true

if (checker_2 == true or checker_21==true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 == true) and (checker_10 == true or checker_101 ==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n CORAL\n\n MACD\n\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec2 dec4 dec5

if dec1 == true and dec2==true and dec3 == false and dec4==true and dec5== true

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_8 == true or checker_81 == true) and (checker_10 == true or checker_101 ==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n MACD\n\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec2 dec3 dec5

if dec1 == true and dec2==true and dec3 == true and dec4==false and dec5== true

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 ==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n CORAL\n\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec2 dec3 dec4 dec5

if dec1 == false and dec2==true and dec3 == true and dec4==true and dec5== true

if (checker_4 == true or checker_41 == true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 ==true) and (checker_10 == true or checker_101==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n CORAL\n\n MACD\n\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//=======================================================================5 SEÇENEK=======================================================================//

//dec1 dec2 dec3 dec4 dec5

if dec1 == true and dec2==true and dec3 == true and dec4==true and dec5== true

if (checker_2 == true or checker_21) and (checker_4 == true or checker_41 == true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 ==true) and (checker_10 == true or checker_101==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SUPER SELL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false