Estrategia teórica de la media móvil doble

Descripción general

La estrategia de opinión de doble línea media es una estrategia de seguimiento de tendencias. Construye un grupo de líneas rápidas y un grupo de líneas lentas mediante el cálculo de dos conjuntos de medias móviles, y combina la relación entre el precio y la línea media para determinar la dirección de la tendencia.

La estrategia combina la dirección de la línea media rápida y lenta, la cantidad de velas que rompen el precio y otros factores para determinar el momento de entrada y salida.

Principio de estrategia

La estrategia de opinión de doble igualdad utiliza dos conjuntos de medias móviles para representar las tendencias a corto y largo plazo. En concreto, la estrategia define:

- Grupo de medias rápidas, que incluye medias rápidas descendentes y medias rápidas ascendentes, que representan tendencias a corto plazo;

- El grupo de líneas medias lentas, que contiene líneas medias lentas descendentes y líneas medias lentas ascendentes, representa tendencias a largo plazo.

La estrategia determina la racionalidad de las tendencias a corto y largo plazo, así como los momentos específicos de entrada y salida, a través de la relación de precios de los grupos de línea media rápida y de línea media lenta.

Condiciones de ingresoAsí es:

- La línea de subida rápida es una entrada múltiple cuando la línea de subida lenta se rompe 2 líneas K o más.

- La línea de baja velocidad se incluye en el juego cuando la línea de baja velocidad se rompe 2 líneas K o más hacia abajo.

Condiciones de salidaAsí es:

- Durante la posesión múltiple, la línea promedio rápida es atravesada por la línea promedio lenta cuando la partida múltiple es disputada.

- Durante la posesión de la cabeza vacía, la línea media rápida se usa como cabeza vacía cuando se usa la línea media lenta.

Además, la estrategia también tiene funciones como stop loss, stop loss y stop loss tracking para controlar el riesgo.

Análisis de las ventajas

Las principales ventajas de una estrategia de doble línea de opinión son:

- El análisis de las dos líneas de equilibrio permite filtrar el ruido del mercado y fijar la dirección de la tendencia.

- La combinación de la línea media rápida y la relación de precios determina una mayor fiabilidad de la señal.

- Las reglas de la estrategia son sencillas, claras, fáciles de entender, adecuadas para la implementación de transacciones cuantitativas.

- Los mecanismos de control de riesgos incorporados, como el stop loss, el stop loss y el stop loss tracking, pueden controlar el riesgo de las operaciones de manera efectiva.

Análisis de riesgos

La estrategia de doble línea de opinión también tiene ciertos riesgos, que se reflejan principalmente en:

- En situaciones de crisis, se pueden generar señales falsas que pueden provocar transacciones innecesarias.

- El sistema de línea media reacciona lentamente a los eventos inesperados (por ejemplo, la publicación de ganancias / ganancias importantes) y puede generar grandes pérdidas.

- El trazado del stop loss puede ser roto en ciertas circunstancias, ampliando las pérdidas.

Para controlar los riesgos mencionados anteriormente, se pueden mejorar métodos como la optimización de los parámetros de la media móvil o la filtración en combinación con otros indicadores.

Dirección de optimización

Las estrategias de doble línea de opinión se pueden optimizar en las siguientes dimensiones:

- Optimización de los parámetros de las medias móviles y ajuste de la media de los ciclos para adaptarse a las diferentes situaciones de ciclo.

- Añadir otros indicadores Filter, formar una estrategia de combinación de indicadores múltiples, mejorar la precisión de la señal.

- Optimización de las configuraciones de stop loss y stop-loss, configuración de los límites de retiro y control de la máxima pérdida.

- Introducción de modelos de aprendizaje automático para la predicción de tendencias y el ajuste de la sincronización.

Resumir

La estrategia de opinión de doble línea es una estrategia de seguimiento de tendencias muy práctica en general. Las reglas de juicio son simples, la lógica es clara, el riesgo se controla a través del sistema de doble línea, y la base teórica es sólida. El siguiente paso es la optimización de los parámetros, el control del riesgo, etc.

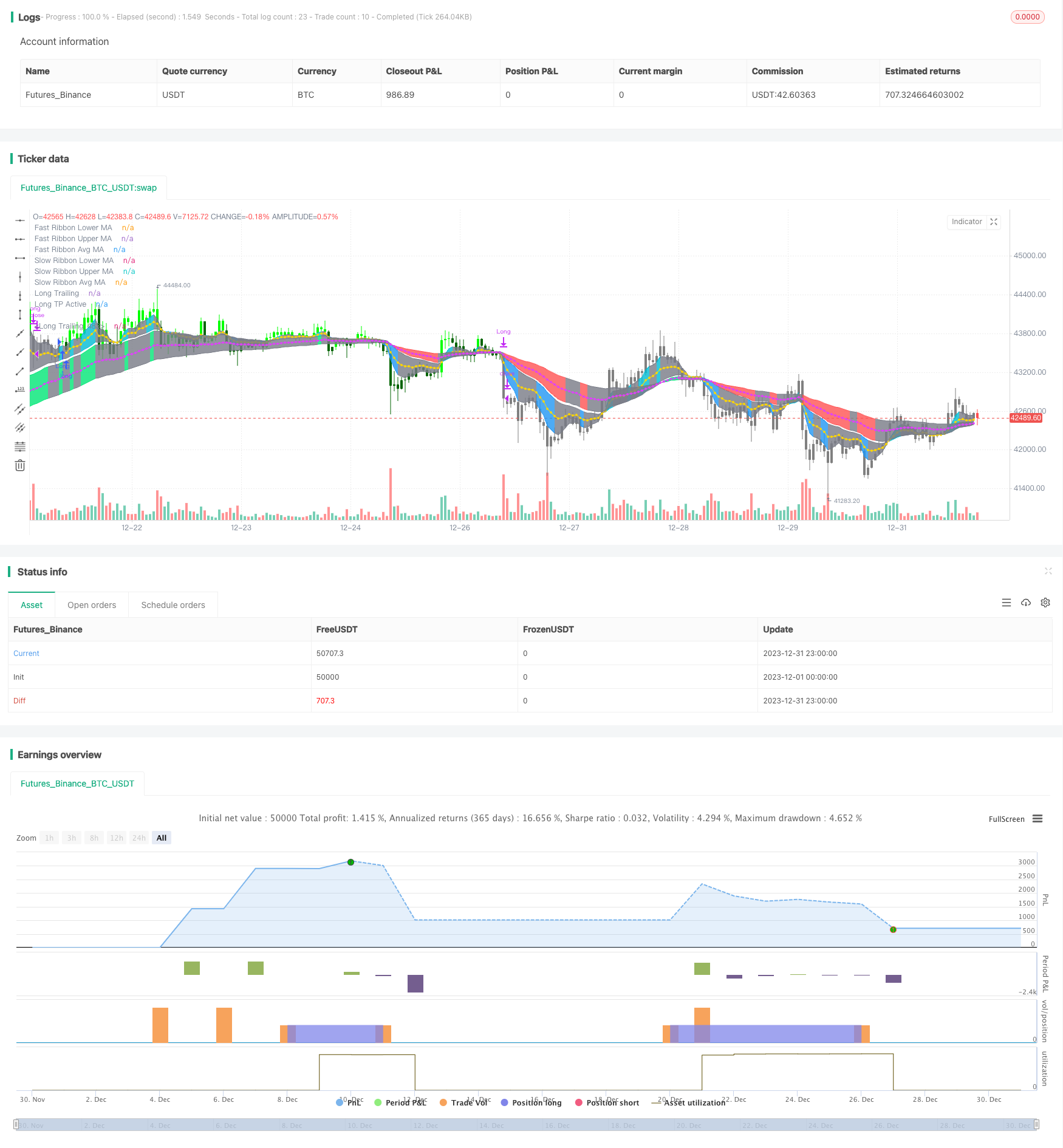

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="[Autoview][BackTest]Dual MA Ribbons R0.12 by JustUncleL", shorttitle="[BT]DualRibbons R0.12", overlay=true )

//study(title="[Autoview][Alerts]Dual MA Ribbons R0.12 by JustUncleL", shorttitle="[AL]DualRibbons R0.12", overlay=true)

//

// Author: JustUncleL

// Revision: R0.12 Beta

// Date: 30-Apr-2018

//

// Description:

// ============

// This is an implementaion of a strategy based on two MA Ribbonn, a Fast Ribbon

// and a Slow Ribbon.

// The strategy revolves around a pair of scripts: One to generate alerts signals for

// Autoview and one for Backtesting, to tune your settings.

// The risk management options are performed within the script to set SL(StopLoss),

// TP(TargetProfit), TSL(Trailing Stop Loss) and TTP (Trailing Target Profit).

// The only requirement for Autoview is to Buy and Sell as directed by this script,

// no complicated syntax is required.

//

// The Dual Ribbons are designed to capture the inferred behaviour of traders and

// investors by using two groups of averages:

// > Traders MA Ribbon:

// Lower MA and Upper MA (Aqua=Uptrend, Blue=downtrend, Gray=Neutral), with

// centre line Avg MA (Orange dotted line).

// > Investors MAs Ribbon:

// Lower MA and Upper MA (Green=Uptrend, Red=downtrend, Gray=Neutral), with

// centre line Avg MA (Fuchsia dotted line).

// > Anchor time frame (0=current). This is the time frame that the MAs are

// calculated for. This way 60m MA Ribbons can be viewed on a 15 min chart to establish

// tighter Stop Loss conditions.

//

// Trade Management options:

// -------------------------

// - Option to specify Backtest start and end time.

// - Trailing Stop, with Activate Level (as % of price) and Trailing Stop (as % of price)

// - Target Profit Level, (as % of price)

// - Stop Loss Level, (as % of price)

// - BUY green triandles and SELL dark red triangles

// - Trade Order closed colour coded Label:

// > Dark Red = Stop Loss Hit

// > Green = Target Profit Hit

// > Purple = Trailing Stop Hit

// > Orange = Opposite (Sell) Order Close

//

// Trade Management Indication:

// ----------------------------

// - Trailing Stop Activate Price = Blue dotted line

// - Trailing Stop Price = Fuschia solid stepping line

// - Target Profit Price = Lime '+' line

// - Stop Loss Price = Red '+' line

//

// Dealing With Renko Charts:

// --------------------------

// - If you choose to use Renko charts, make sure you have enabled the "IS This a RENKO Chart"

// option, (I have not so far found a way to Detect the type of chart that is running).

// - If you want non-repainting Renko charts you MUST use TRADITIONAL Renko Bricks. This

// type of brick is fixed and will not change size.

// - Also use Renko bricks with WICKS DISABLED. Wicks are not part of Renko, the whole

// idea of using Renko bricks is not to see the wick noise.

// - Set you chart Time Frame to the lowest possible one that will build enough bricks

// to give a reasonable history, start at 1min TimeFrame. Renko bricks are not dependent

// on time, they represent a movement in price. But the chart candlestick data is used

// to create the bricks, so lower TF gives more accurate Brick creation.

// - You want to size your bricks to 2/1000 of the pair price, so for ETHBTC the price is say 0.0805

// then your Renko Brick size should be about 2*0.0805/1000 = 0.0002 (round up).

// - You may find there is some slippage in value, but this can be accounted for in the Backtes

// by setting your commission a bit higher, for Binance for example I use 0.2

//

// References:

// ===========

// - MA Ribbon R#.# by JustUncleL

// - "How to automate this strategy for free using a chrome extension" by CryptoRox

//

// Revisions:

// ==========

// R0.12 - Beta 2 Version

//

//

//

// -----------------------------------------------------------------------------

// Copyright 2018 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

//

// Use Alternate Anchor TF for MAs

uRenko = input(true, title="IS This a RENKO Chart")

//

anchor = input(0,minval=0,maxval=1440,title="Alternate TimeFrame Multiplier (0=none)")

//

src = close //input(close, title="EMA Source")

showRibbons = input(true,title="Show Coloured MA Ribbons")

showAvgs = input(true,title="Show Ribbon Median MA Lines")

//

// Fast Ribbon MAs

// Lower MA - type, length

typeF1 = input(defval="EMA", title="FAST MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF1 = input(defval=5, title="FAST Ribbon Lower MA Length", minval=1)

gammaF1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeF11 = typeF1 //input(defval="WMA", title="FAST Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF11 = input(defval=25, title="FAST Ribbon Upper Length", minval=2)

gammaF11 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// Slow Ribbon MAs

// Lower MA - type, length

typeS1 = input(defval="EMA", title="SLOW MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS1 = input(defval=28, title="SLOW Ribbon Lower MA Length", minval=1)

gammaS1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeS16 = typeS1 //input(defval="WMA", title="SLOW Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS16 = input(defval=72, title="SLOW Ribbon Upper Length", minval=2)

gammaS16 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// - Constants

gold = #FFD700

// - FUNCTIONS

// - variant(type, src, len, gamma)

// Returns MA input selection variant, default to SMA if blank or typo.

// SuperSmoother filter

// © 2013 John F. Ehlers

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier.

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := isdwm? 1 : mult // Only available Daily or less

mult = anchor>0 ? anchor : 1

//

high_ = uRenko? max(close,open) : high

low_ = uRenko? min(close,open) : low

//adjust MA lengths with Anchor Multiplier

//Fast MA Ribbon

emaF1 = variant(typeF1, src, lenF1*mult, gammaF1)

emaF11 = variant(typeF11, src, lenF11*mult,gammaF11)

emafast = (emaF1+emaF11)/2 // Average of Upper and Lower MAs

//

//Slow MA Ribbon

emaS1 = variant(typeS1,src, lenS1*mult,gammaS1)

emaS16 = variant(typeS16, src, lenS16*mult, gammaS16)

emaslow = (emaS1+emaS16)/2 // Average of Upper and Lower MAs

//

// Count crossover candles

xup = 0

xdn = 0

fup = 0

fdn = 0

sup = 0

sdn = 0

//

xup := (emafast-emaslow)>0 and (emafast-emaslow)>(emafast[1]-emaslow[1]) ? nz(xup[1])+1 : 0

xdn := (emafast-emaslow)<0 and (emafast-emaslow)<(emafast[1]-emaslow[1]) ? nz(xdn[1])+1 : 0

fup := (emaF1-emaF11)>0 and (emaF1-emaF11)>(emaF1[1]-emaF11[1]) ? nz(fup[1])+1 : 0

fdn := (emaF1-emaF11)<0 and (emaF1-emaF11)<(emaF1[1]-emaF11[1]) ? nz(fdn[1])+1 : 0

sup := (emaS1-emaS16)>0 and (emaS1-emaS16)>(emaS1[1]-emaS16[1]) ? nz(sup[1])+1 : 0

sdn := (emaS1-emaS16)<0 and (emaS1-emaS16)<(emaS1[1]-emaS16[1]) ? nz(sdn[1])+1 : 0

//Fast EMA Final Color Rules

colFinal = fup>=2 ? aqua : fdn>=2 ? blue : gray

//Slow EMA Final Color Rules

colFinal2 = sup>=2 ? lime : sdn>=2 ? red : gray

//Fast EMA Plots

p1=plot(showRibbons?emaF1:na, title="Fast Ribbon Lower MA", style=line, linewidth=1, color=colFinal,transp=10)

p2=plot(showRibbons?emaF11:na, title="Fast Ribbon Upper MA", style=line, linewidth=1, color=colFinal,transp=10)

plot(showAvgs?emafast:na, title="Fast Ribbon Avg MA", style=circles,join=true, linewidth=1, color=gold,transp=10)

//

fill(p1,p2,color=colFinal, transp=90)

//Slow EMA Plots

p3=plot(showRibbons?emaS1:na, title="Slow Ribbon Lower MA", style=line, linewidth=1, color=colFinal2,transp=10)

p4=plot(showRibbons?emaS16:na, title="Slow Ribbon Upper MA", style=line, linewidth=1, color=colFinal2,transp=10)

plot(showAvgs?emaslow:na, title="Slow Ribbon Avg MA", style=circles,join=true, linewidth=1, color=fuchsia,transp=10)

//

fill(p3,p4, color=colFinal2, transp=90)

// Generate Buy Sell signals,

buy = 0

sell=0

//

buy := xup>=2 and sup>=2 and fup>=2 ? nz(buy[1])>0?buy[1]+1:1 : 0

sell := xdn>=2 and sdn>=2 and fdn>=2 ? nz(sell[1])>0?sell[1]+1 :1 : 0

//

//////////////////////////////////////////////////

//* Put Entry and special Exit conditions here *//

//////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////////////////////

//*** This Trade Management Section of code is a modified version of that found in ***//

//*** "How to automate this strategy for free using a chrome extension" by CryptoRox ***//

//*** Modifications made by JustUncleL. ***//

//////////////////////////////////////////////////////////////////////////////////////////

//

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made by JustUncleL*//

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

///////////////////////////////////////////////

//* Place Entry and Special Exit Logic here *//

///////////////////////////////////////////////

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

// Keep current state until opposite signal detected.

bsState = 0, bsState := nz(bsState[1])

bsState := buy==1 and bsState<=0? 1 :

sell==1 and bsState>=0? -1 :

bsState

//Entry Conditions, when state changes direction.

longLogic = change(bsState) and bsState==1 and (barstate.isconfirmed or barstate.ishistory)

shortLogic = change(bsState) and bsState==-1 and (barstate.isconfirmed or barstate.ishistory)

// Exit on Sell signal

longExitC = 0

shortExitC = 0

longExitC := (emafast<emaslow and close<emaslow)

and (barstate.isconfirmed or barstate.ishistory) ? nz(longExitC[1])+1 : 0

shortExitC := (emafast>emaslow and close>emaslow)

and (barstate.isconfirmed or barstate.ishistory) ? nz(shortExitC[1])+1 : 0

// Exit condition for no SL.

longExit = change(longExitC) and longExitC==1

shortExit = change(shortExitC) and shortExitC==1

//////////////////////////

//* Strategy Component *//

//////////////////////////

fastExit = input(false,title="Use Opposite Trade as a Close Signal")

clrBars = input(true,title="Colour Candles to Trade Order state")

orderType = input("LongsOnly",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly","Flip"])

//

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

//

long = longLogic

short = shortLogic

if orderType=="Flip"

long := shortLogic

short := longLogic

////////////////////////////////

//======[ Signal Count ]======//

////////////////////////////////

sectionLongs = 0

sectionLongs := nz(sectionLongs[1])

sectionShorts = 0

sectionShorts := nz(sectionShorts[1])

if long and isLong

sectionLongs := sectionLongs + 1

sectionShorts := 0

if short and isShort

sectionLongs := 0

sectionShorts := sectionShorts + 1

longCondition = (long and isLong)

shortCondition = (short and isShort)

////////////////////////////////

//======[ Entry Prices ]======//

////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

///////////////////////////////////////////////

//======[ Position Check (long/short) ]======//

///////////////////////////////////////////////

last_longCondition = na

last_shortCondition = na

last_longCondition := longCondition ? time : nz(last_longCondition[1])

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1])

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

/////////////////////////////////

//======[ Trailing Stop ]======//

/////////////////////////////////

isTS = input(true, "Trailing Stop")

ts = input(3.0, "Trailing Stop (%)", minval=0,step=0.1, type=float) /100

last_high = na

last_low = na

last_high_short = na

last_low_long = na

last_high := not in_longCondition ? na : in_longCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_high_short := not in_shortCondition ? na : in_shortCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_low := not in_shortCondition ? na : in_shortCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

last_low_long := not in_longCondition ? na : in_longCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

long_ts = isTS and not na(last_high) and (low_ <= last_high - last_high * ts) //and (last_high >= last_open_longCondition + last_open_longCondition * tsi)

short_ts = isTS and not na(last_low) and (high_ >= last_low + last_low * ts) //and (last_low <= last_open_shortCondition - last_open_shortCondition * tsi)

///////////////////////////////

//======[ Take Profit ]======//

///////////////////////////////

isTP = input(true, "Take Profit")

tp = input(3.0, "Take Profit (%)",minval=0,step=0.1,type=float) / 100

ttp = input(1.0, "Trailing Profit (%)",minval=0,step=0.1,type=float) / 100

ttp := ttp>tp ? tp : ttp

long_tp = isTP and (last_high >= last_open_longCondition + last_open_longCondition * tp) and (low_ <= last_high - last_high * ttp)

short_tp = isTP and (last_low <= last_open_shortCondition - last_open_shortCondition * tp) and (high_ >= last_low + last_low * ttp)

/////////////////////////////

//======[ Stop Loss ]======//

/////////////////////////////

isSL = input(false, "Stop Loss")

sl = input(3.0, "Stop Loss (%)", minval=0,step=0.1, type=float) / 100

long_sl = isSL and (low_ <= last_open_longCondition - last_open_longCondition * sl)

short_sl = isSL and (high_ >= last_open_shortCondition + last_open_shortCondition * sl)

////////////////////////////////////

//======[ Stop on Opposite ]======//

////////////////////////////////////

//NOTE Short exit signal is non-repainting, no need to force it, if Pyramiding keep going

long_sos = (fastExit or (not isTS and not isSL)) and longExit

short_sos = (fastExit or (not isTS and not isSL)) and shortExit

/////////////////////////////////

//======[ Close Signals ]======//

/////////////////////////////////

// Create a single close for all the different closing conditions, all conditions here are non-repainting

longClose = isLong and (long_tp or long_sl or long_ts or long_sos) and not longCondition

shortClose = isShort and (short_tp or short_sl or short_ts or short_sos) and not shortCondition

in_closeLong = longClose

in_closeLong := not isLong? false : longClose ? true : longCondition? false : in_closeLong[1]

in_closeShort = shortClose

in_closeShort := not isShort? false : shortClose ? true : shortCondition? false : in_closeShort[1]

///////////////////////////////

//======[ Plot Colors ]======//

///////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? green : long_sl ? maroon : long_ts ? purple : long_sos ? orange :longCloseCol[1]

shortCloseCol := short_tp ? green : short_sl ? maroon : short_ts ? purple : short_sos ? orange : shortCloseCol[1]

//

tpColor = isTP and in_longCondition ? lime : isTP and in_shortCondition ? lime : na

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : na

//////////////////////////////////

//======[ Strategy Plots ]======//

//////////////////////////////////

plot(isTS and in_longCondition and isLong and not in_closeLong?

last_high - last_high * ts : na, "Long Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_longCondition and isLong and not in_closeLong and last_high < last_open_longCondition + last_open_longCondition * tp ?

last_open_longCondition + last_open_longCondition * tp : na, "Long TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_longCondition and isLong and not in_closeLong and last_high >= last_open_longCondition + last_open_longCondition * tp ?

last_high - last_high * ttp : na, "Long Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_longCondition and isLong and not in_closeLong and last_low_long > last_open_longCondition - last_open_longCondition * sl ?

last_open_longCondition - last_open_longCondition * sl : na, "Long SL", slColor, style=3,join=false, linewidth=2,offset=1)

//

plot(isTS and in_shortCondition and isShort and not in_closeShort?

last_low + last_low * ts : na, "Short Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_shortCondition and isShort and not in_closeShort and last_low > last_open_shortCondition - last_open_shortCondition * tp ?

last_open_shortCondition - last_open_shortCondition * tp : na, "Short TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_shortCondition and isShort and not in_closeShort and last_low <= last_open_shortCondition - last_open_shortCondition * tp ?

last_low + last_low * ttp : na, "Short Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_shortCondition and isShort and not in_closeShort and last_high_short < last_open_shortCondition + last_open_shortCondition * sl ?

last_open_shortCondition + last_open_shortCondition * sl : na, "Short SL", slColor, style=3,join=false, linewidth=2,offset=1)

//

bclr = not clrBars ? na : in_closeLong and in_closeShort ? GRAY :

in_longCondition and not in_closeLong and isLong ? close<last_open_longCondition? DARKGREEN : LIME :

in_shortCondition and not in_closeShort and isShort ? close>last_open_shortCondition? DARKRED : RED : GRAY

barcolor(bclr,title="Trade State Bar Colouring")

///////////////////////////////

//======[ Alert Plots ]======//

///////////////////////////////

//plotshape(longCondition?close:na, title="Long", color=green, textcolor=green, transp=0,

// style=shape.triangleup, location=location.belowbar, size=size.small,text="LONG",offset=0)

//plotshape(longClose and not in_closeLong[1]?close:na, title="Long Close", color=longCloseCol, textcolor=white, transp=0,

// style=shape.labeldown, location=location.abovebar, size=size.small,text="Long\nClose",offset=0)

//plotshape(shortCondition?close:na, title="Short", color=red, textcolor=red, transp=0,

// style=shape.triangledown, location=location.abovebar, size=size.small,text="SHORT",offset=0)

//plotshape(shortClose and not in_closeShort[1]?close:na, title="Short Close", color=shortCloseCol, textcolor=white, transp=0,

// style=shape.labelup, location=location.belowbar, size=size.small,text="Short\nClose",offset=0)

// Autoview alert syntax - This assumes you are trading coins BUY and SELL on Binance Exchange

// WARNING*** Only use Autoview to automate a strategy after you've sufficiently backtested and forward tested the strategy.

// You can learn more about the syntax here:

// http://autoview.with.pink/#syntax and you can watch this video here: https://www.youtube.com/watch?v=epN5Tjinuxw

// For the opens you will want to trigger BUY orders on LONGS (eg ETHBTC) with alert option "Once Per Bar Close"

// and SELL orders on SHORTS (eg BTCUSDT)

// b=buy q=0.001 e=binance s=ethbtc t=market ( LONG )

// or b=sell q=0.001 e=binance s=btcusdt t=market ( SHORT )

//alertcondition(longCondition, "Open Long", "LONG")

//alertcondition(shortCondition, "Open Short", "SHORT")

// For the closes you will want to trigger these alerts on condition with alert option "Once Per Bar"

// (NOTE: with Renko you can only use "Once Per Bar Close" option)

// b=sell q=99% e=binance s=ethbtc t=market ( CLOSE LONGS )

// or b=buy q=99% e=binance s=btcusdt t=market ( CLOSE SHORTS )

// This gets it as it happens and typically results in a better exit live than in the backtest.

// It works really well for counteracting some market slippage

//alertcondition(longClose and not in_closeLong[1], "Close Longs", "CLOSE LONGS")

//alertcondition(shortClose and not in_closeShort[1], "Close Shorts", "CLOSE SHORTS")

////////////////////////////////////////////

//======[ Strategy Entry and Exits ]======//

////////////////////////////////////////////

if testPeriod() and isLong

strategy.entry("Long", 1, when=longCondition)

strategy.close("Long", when=longClose and not in_closeLong[1])

if testPeriod() and isShort

strategy.entry("Short", 0, when=shortCondition)

strategy.close("Short", when=shortClose and not in_closeShort[1])

// --- Debugs

//plotchar(longExit,location=location.bottom)

//plotchar(longCondition,location=location.bottom)

//plotchar(in_longCondition,location=location.bottom)

//plotchar(longClose,location=location.bottom)

//plotchar(in_closeLong,location=location.bottom)

// --- /Debugs

///////////////////////////////////

//======[ Reset Variables ]======//

///////////////////////////////////

if longClose or not in_longCondition or not isLong

last_high := na

last_high_short := na

sectionLongs := 0

if longClose and isLong and not in_closeLong[1] and bsState==1

bsState := 0

if shortClose or not in_shortCondition or not isShort

last_low := na

last_low_long := na

sectionShorts := 0

if shortClose and isShort and not in_closeShort[1] and bsState==-1

bsState := 0

//plotchar(bsState,location=location.bottom)

// EOF