Estrategia cuantitativa basada en el pivote de Kamachira y las bandas de Bollinger

Fecha de creación:

2024-02-05 14:23:59

Última modificación:

2024-02-05 14:23:59

Copiar:

0

Número de Visitas:

1065

1

Seguir

1664

Seguidores

Descripción general

La estrategia primero calcula los puntos cardinales de Camachira en función de los máximos, mínimos y cierre de la fecha de negociación anterior. Luego se filtra el precio en combinación con el indicador de la banda de Brin, generando una señal de negociación cuando el precio rompe los puntos cardinales.

Principio de estrategia

- Calcular el precio máximo, mínimo y el precio de cierre del día anterior

- Calcula el eje de Camachilla con la fórmula H4, H3, H2, H1 y los subtramos L1, L2, L3 y L4

- Calculando el día 20 de la subida y bajada del tren de Bryn.

- Hacer más cuando el precio sube y baja, y hacer menos cuando baja

- El punto de parada está situado cerca de la banda de Brin en la vía ascendente o descendente

Análisis de las ventajas

- El eje de Camachilla contiene varios puntos de resistencia de soporte clave para aumentar la fiabilidad de la señal de negociación

- En combinación con el indicador de la banda de Bryn, se puede filtrar eficazmente las brechas falsas

- La combinación de varios conjuntos de parámetros, la flexibilidad de negociación

Análisis de riesgos

- La configuración incorrecta de los parámetros del indicador de la banda de Bryn puede causar errores en las señales de negociación

- Los puntos clave del eje de Camachira se calculan en función de los precios del día de negociación anterior, que pueden verse afectados por el salto nocturno

- Las operaciones con múltiples cabezas en blanco tienen riesgos de pérdidas

Dirección de optimización

- Optimización de los parámetros de la banda de Bryn para encontrar la combinación óptima de parámetros

- Combinación de otros indicadores para filtrar falsas señales de ruptura

- Aumentar las estrategias de detener las pérdidas y reducir las pérdidas individuales

Resumir

La estrategia utiliza el eje de Camachilla y el indicador de las bandas de Brin para generar señales de negociación cuando el precio supera los puntos de resistencia de soporte clave. Se puede optimizar los parámetros y filtrar las señales para aumentar la rentabilidad y la estabilidad de la estrategia. En general, la estrategia de negociación es clara, operable y digna de ser verificada en el terreno.

Código Fuente de la Estrategia

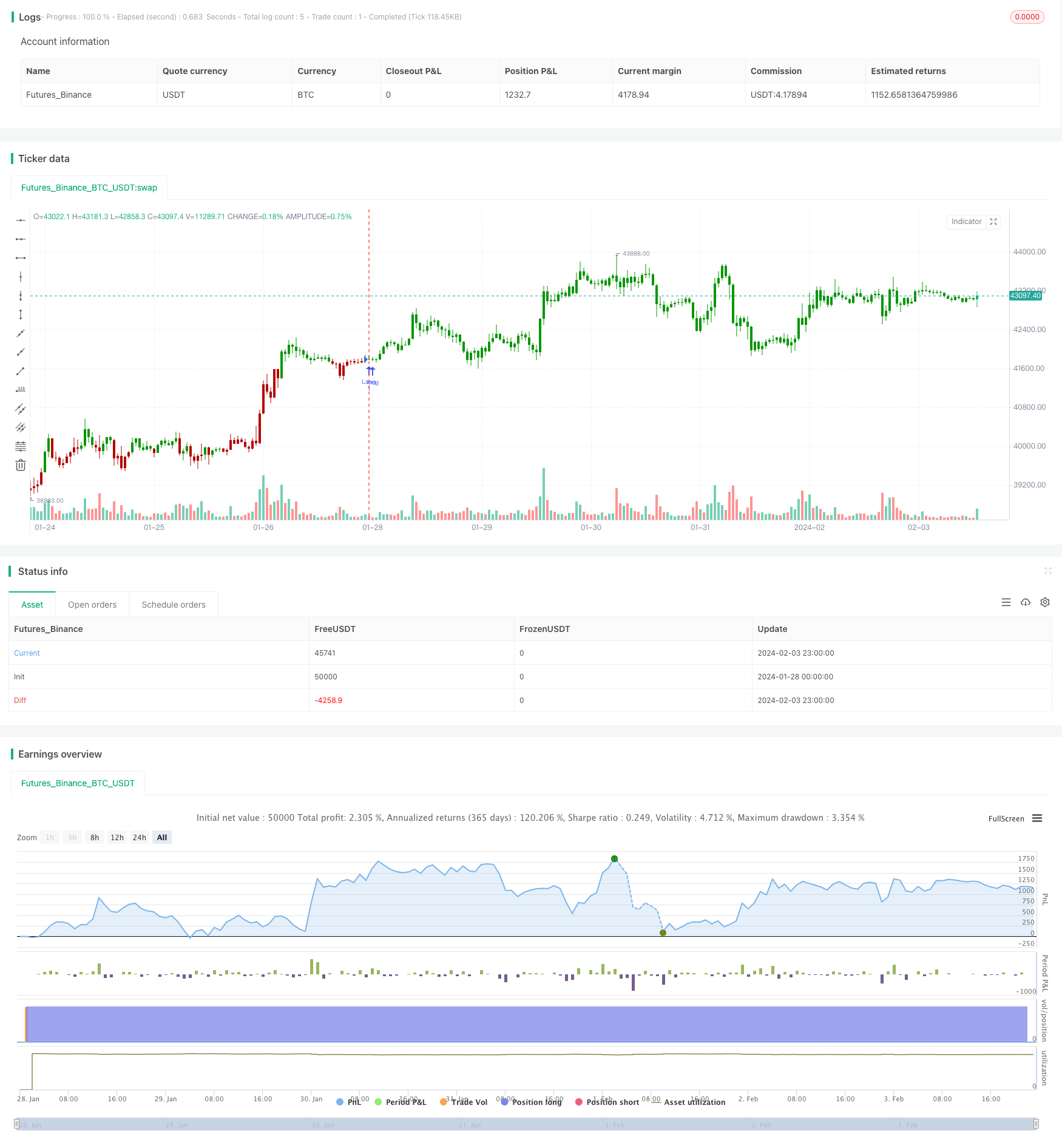

/*backtest

start: 2024-01-28 00:00:00

end: 2024-02-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 12/05/2020

// Camarilla pivot point formula is the refined form of existing classic pivot point formula.

// The Camarilla method was developed by Nick Stott who was a very successful bond trader.

// What makes it better is the use of Fibonacci numbers in calculation of levels.

//

// Camarilla equations are used to calculate intraday support and resistance levels using

// the previous days volatility spread. Camarilla equations take previous day’s high, low and

// close as input and generates 8 levels of intraday support and resistance based on pivot points.

// There are 4 levels above pivot point and 4 levels below pivot points. The most important levels

// are L3 L4 and H3 H4. H3 and L3 are the levels to go against the trend with stop loss around H4 or L4 .

// While L4 and H4 are considered as breakout levels when these levels are breached its time to

// trade with the trend.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Camarilla Pivot Points V2 Backtest", shorttitle="CPP V2", overlay = true)

res = input(title="Resolution", type=input.resolution, defval="D")

width = input(1, minval=1)

SellFrom = input(title="Sell from ", defval="R1", options=["R1", "R2", "R3", "R4"])

BuyFrom = input(title="Buu from ", defval="S1", options=["S1", "S2", "S3", "S4"])

reverse = input(false, title="Trade reverse")

xHigh = security(syminfo.tickerid,res, high)

xLow = security(syminfo.tickerid,res, low)

xClose = security(syminfo.tickerid,res, close)

H4 = (0.55*(xHigh-xLow)) + xClose

H3 = (0.275*(xHigh-xLow)) + xClose

H2 = (0.183*(xHigh-xLow)) + xClose

H1 = (0.0916*(xHigh-xLow)) + xClose

L1 = xClose - (0.0916*(xHigh-xLow))

L2 = xClose - (0.183*(xHigh-xLow))

L3 = xClose - (0.275*(xHigh-xLow))

L4 = xClose - (0.55*(xHigh-xLow))

pos = 0

S = iff(BuyFrom == "S1", H1,

iff(BuyFrom == "S2", H2,

iff(BuyFrom == "S3", H3,

iff(BuyFrom == "S4", H4,0))))

B = iff(SellFrom == "R1", L1,

iff(SellFrom == "R2", L2,

iff(SellFrom == "R3", L3,

iff(SellFrom == "R4", L4,0))))

pos := iff(close > B, 1,

iff(close < S, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )