Estrategia de seguimiento de tendencias de ruptura de combinación de indicadores

Descripción general

Esta estrategia se llama estrategia de seguimiento de tendencias de ruptura de la combinación de indicadores de silicio. La estrategia utiliza una combinación de varios indicadores para identificar la dirección de la tendencia del mercado y realizar operaciones de seguimiento de tendencias.

- Utiliza el indicador de tendencias de ondas para determinar las principales tendencias del mercado

- La combinación del RSI y el índice de flujo de capital filtra algunas señales falsas

- Indicadores de la EMA para determinar la dirección de las acciones concretas

- El ingreso se realiza a través de un método de seguimiento innovador para asegurar que se sigue la tendencia

Principio de estrategia

La estrategia se basa en determinar la dirección y la intensidad de las grandes tendencias, y se establece un comercio bidireccional de múltiples espacios. Los principios de funcionamiento específicos son los siguientes:

La señal de entrada de múltiples cabezas:

- El precio está por encima de la EMA de 200 días, lo que indica que se encuentra en un mercado de más de uno

- El precio retrocede a un soporte cerca de la EMA de los 50 días

- Los indicadores de ondas se invierten en una tendencia alcista y aparecen señales de compra

- El RSI y las MFI muestran sobrecompra

- Tres líneas K consecutivas superan el EMA de 50 días, lo que indica un alza

Señales de entrada sin cabeza: Contrario a las señales de entrada múltiples

La forma de detener la pérdida: Se ofrecen dos opciones: precio mínimo / precio máximo de cierre, ATR de cierre

Análisis de las ventajas estratégicas

La estrategia tiene las siguientes ventajas:

- El análisis de las tendencias a través de varios indicadores para evitar falsas rupturas

- EMA para determinar la dirección de las operaciones y seguir las tendencias

- Métodos de seguimiento de pérdidas para obtener ganancias sostenibles

- Se puede hacer más de un shorting al mismo tiempo, siguiendo la dirección arbitraria del mercado

Análisis de riesgos estratégicos

La estrategia también tiene sus riesgos:

- Probabilidad de que el indicador emita una señal falsa

- El punto de parada está demasiado pequeño, lo que aumenta el riesgo de parada

- El número de transacciones y los costos son una pérdida oculta

Para reducir los riesgos mencionados anteriormente, se puede optimizar en los siguientes aspectos:

- Ajuste de los parámetros del indicador para filtrar las señales de error

- La relajación adecuada de los puntos de parada

- Optimización de los parámetros del indicador para reducir el número de transacciones

Dirección de optimización de la estrategia

A nivel de código, las principales direcciones de optimización de la estrategia incluyen:

- Ajustar los parámetros de los indicadores de ondas, RSI y MFI para seleccionar la mejor combinación de parámetros

- Pruebas de rendimiento para diferentes parámetros de ciclo EMA

- Ajuste el factor de riesgo de ganancias de la parada de pérdidas para obtener la configuración óptima

A través de ajustes y pruebas de parámetros, las estrategias pueden maximizar los beneficios y reducir los riesgos y retrasos.

Resumir

Esta estrategia utiliza una combinación de varios indicadores para determinar la dirección de la tendencia general, utiliza el indicador EMA como señal de operación concreta y utiliza el método de seguimiento de stop loss para bloquear las ganancias. A través de la optimización de los parámetros, se pueden obtener mejores ganancias estables.

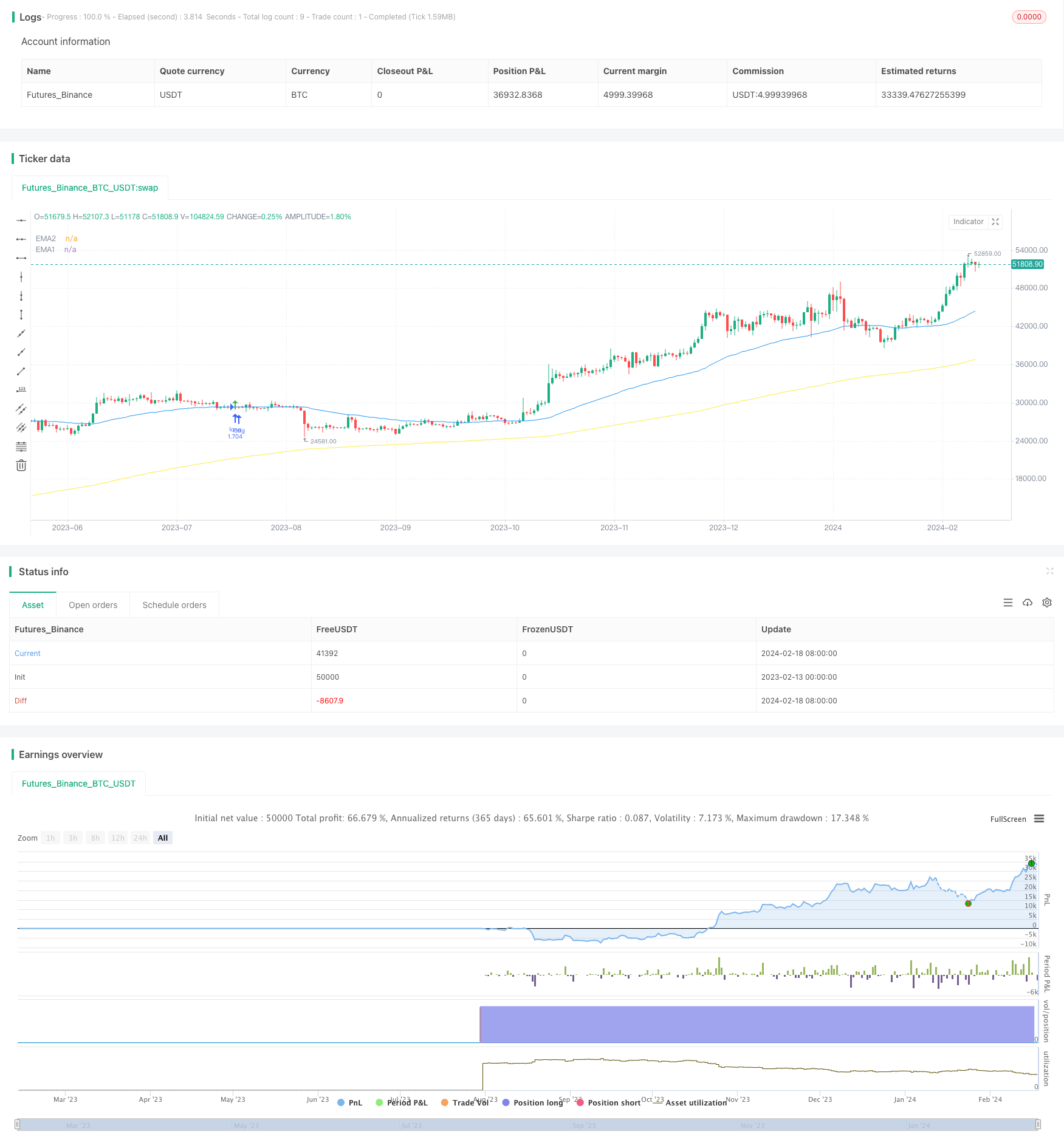

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Lowest Low/ Highest High & ATR Stop Loss/ Take Profit

//Optimized for the 30 minutes chart

strategy(title="TradePro's Trading Idea Cipher B+ Divergence EMA Pullback Strategy", shorttitle="WT MFI RSI EMA PB STRAT", overlay = true, pyramiding = 0, max_bars_back=5000, calc_on_order_fills = false, commission_type = strategy.commission.percent, commission_value = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=5000, currency=currency.USD)

// { Time Range

FromMonth=input(defval=1,title="FromMonth",minval=1,maxval=12)

FromDay=input(defval=1,title="FromDay",minval=1,maxval=31)

FromYear=input(defval=2020,title="FromYear",minval=2016)

ToMonth=input(defval=1,title="ToMonth",minval=1,maxval=12)

ToDay=input(defval=1,title="ToDay",minval=1,maxval=31)

ToYear=input(defval=9999,title="ToYear",minval=2017)

start=timestamp(FromYear,FromMonth,FromDay,00,00)

finish=timestamp(ToYear,ToMonth,ToDay,23,59)

window()=>true

// See if this bar's time happened on/after start date

afterStartDate = time >= start and time<=finish?true:false

zeroline = 0

// } Time Range

// { Wavetrend, RSI, MFI

// WaveTrend

cl = input(12, "Channel Length")

al = input(12, "Average Length")

overbought = input(53, title = 'WT Overbought Level 1', type = input.integer)

oversold = input(-53, title = 'WT Oversold Level 1', type = input.integer)

ap = hlc3

esa = ema(ap, cl)

d = ema(abs(ap - esa), cl)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, al)

wt1 = tci

wt2 = sma(wt1,4)

wtOs = wt2 <= oversold

wtOb = wt2 >= overbought

wtX = cross(wt1, wt2)

wtUp = wt2 - wt1 <= 0

wtDown = wt2 - wt1 >= 0

buySignal = wtX and wtOs and wtUp

sellSignal = wtX and wtOb and wtDown

// RSI & MFI

rsiMFIPosY = input(2, title = 'MFI Area Y Pos', type = input.float)

rsiMFIperiod = input(80,title = 'MFI Period', type = input.integer)

rsiMFIMultiplier = input(200, title = 'MFI Area multiplier', type = input.float)

f_rsimfi(_period, _multiplier, _tf) => security(syminfo.tickerid, _tf, sma(((close - open) / (high - low)) * _multiplier, _period) - rsiMFIPosY)

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

// } Wavetrend, RSI, MFI

// { EMA

emasrc = close

res = input(title="EMA Timeframe", type=input.resolution, defval="30")

len1 = input(title="EMA1 Length", type=input.integer, defval=200)

col1 = color.yellow

len2 = input(title="EMA2 Length", type=input.integer, defval=50)

col2 = color.blue

// Calculate EMA

ema1 = ema(emasrc, len1)

emaSmooth1 = security(syminfo.tickerid, res, ema1, barmerge.gaps_off, barmerge.lookahead_off)

ema2 = ema(emasrc, len2)

emaSmooth2 = security(syminfo.tickerid, res, ema2, barmerge.gaps_off, barmerge.lookahead_off)

// Draw EMA

plot(emaSmooth1, title="EMA1", linewidth=1, color=col1)

plot(emaSmooth2, title="EMA2", linewidth=1, color=col2)

// } EMA

// { Long Entry

enablelong = input(true, title="Enable long?")

//Long Signal

upcondition = close > emaSmooth1

wavetrendlong = wt1 and wt2 < zeroline

mfilong = rsiMFI > 0

emapblong1 = (close > emaSmooth2) and (close[1] < emaSmooth2[1])

emapblong2 = ((close[2] > emaSmooth2[2]) and (close[3] > emaSmooth2[3]) and (close[4] > emaSmooth2[4])) or ((close[5] > emaSmooth2[5]) and (close[6] > emaSmooth2[6]) and (close[7] > emaSmooth2[7])) or ((close[8] > emaSmooth2[8]) and (close[9] > emaSmooth2[9]) and (close[10] > emaSmooth2[10]))

longcondition = upcondition and wavetrendlong and buySignal and mfilong and emapblong1 and emapblong2

//strategy buy long

if (longcondition) and (afterStartDate) and strategy.opentrades < 1 and (enablelong == true)

strategy.entry("long", strategy.long)

plotshape(longcondition, style=shape.arrowup,

location=location.abovebar, color=color.green)

// } Long Entry

// { Short Entry

enableshort = input(true, title="Enable short?")

//Short Signal

downcondition = close < emaSmooth1

wavetrendshort = wt1 and wt2 > zeroline

mfishort = rsiMFI < 0

emapbshort1 = (close < emaSmooth2) and (close[1] > emaSmooth2[1])

emapbshort2 = ((close[2] < emaSmooth2[2]) and (close[3] < emaSmooth2[3]) and (close[4] < emaSmooth2[4])) or ((close[5] < emaSmooth2[5]) and (close[6] < emaSmooth2[6]) and (close[7] < emaSmooth2[7])) or ((close[8] < emaSmooth2[8]) and (close[9] < emaSmooth2[9]) and (close[10] < emaSmooth2[10]))

shortcondition = downcondition and wavetrendshort and sellSignal and mfishort and emapbshort1 and emapbshort2

//strategy buy short

if (shortcondition) and (afterStartDate) and strategy.opentrades < 1 and (enableshort == true)

strategy.entry("short", strategy.short)

plotshape(shortcondition, style=shape.arrowdown,

location=location.belowbar, color=color.red)

// } Short Entry

// { Exit Conditions

bought = strategy.position_size[1] < strategy.position_size

sold = strategy.position_size[1] > strategy.position_size

barsbought = barssince(bought)

barssold = barssince(sold)

slbuffer = input(title="SL Buffer", type=input.float, step=0.1, defval=0)

// } Exit Conditions

// { Lowest Low/ Highes High Exit Condition

enablelowhigh = input(false, title="Enable lowest low/ highest high exit?")

//Lowest Low LONG

profitfactorlong = input(title="ProfitfactorLong", type=input.float, step=0.1, defval=2)

loLen = input(title="Lowest Low Lookback", type=input.integer,

defval=50, minval=2)

stop_level_long = lowest(low, loLen)[1]

if enablelowhigh == true and strategy.position_size>0

profit_level_long = strategy.position_avg_price + ((strategy.position_avg_price - stop_level_long[barsbought])*profitfactorlong) + slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_long[barsbought] - slbuffer, limit=profit_level_long)

//Lowest Low SHORT

profitfactorshort = input(title="ProfitfactorShort", type=input.float, step=0.1, defval=2)

highLen = input(title="highest high lookback", type=input.integer,

defval=50, minval=2)

stop_level_short = highest(high, highLen)[1]

if enablelowhigh == true and strategy.position_size<0

profit_level_short = strategy.position_avg_price - ((stop_level_short[barssold] - strategy.position_avg_price)*profitfactorshort) - slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_short[barssold] + slbuffer, limit=profit_level_short)

// } Lowest Low/ Highes High Exit Condition

// { ATR Take Profit/ Stop Loss

enableatr = input(true, title="Enable ATR exit?")

atrprofitfactorlong = input(title="ATR Profitfactor Long", type=input.float, step=0.1, defval=6)

atrstopfactorlong = input(title="ATR Stopfactor Long", type=input.float, step=0.1, defval=5)

atrprofitfactorshort = input(title="ATR Profitfactor Short", type=input.float, step=0.1, defval=3)

atrstopfactorshort = input(title="ATR Stopfactor Short", type=input.float, step=0.1, defval=5)

//ATR

lengthATR = input(title="ATR Length", defval=11, minval=1)

atr = atr(lengthATR)

//LONG EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barsbought1 = barssince(bought)

profit_level = strategy.position_avg_price + (atr*atrprofitfactorlong)

stop_level = strategy.position_avg_price - (atr*atrstopfactorlong)

strategy.exit("Take Profit/ Stop Loss", "long", stop=stop_level[barsbought1], limit=profit_level[barsbought1])

//SHORT EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barssold1 = barssince(sold)

profit_level = strategy.position_avg_price - (atr*atrprofitfactorshort)

stop_level = strategy.position_avg_price + (atr*atrstopfactorshort)

strategy.exit("Take Profit/ Stop Loss", "short", stop=stop_level[barssold1], limit=profit_level[barssold1])

// } ATR Take Profit/ Stop Loss