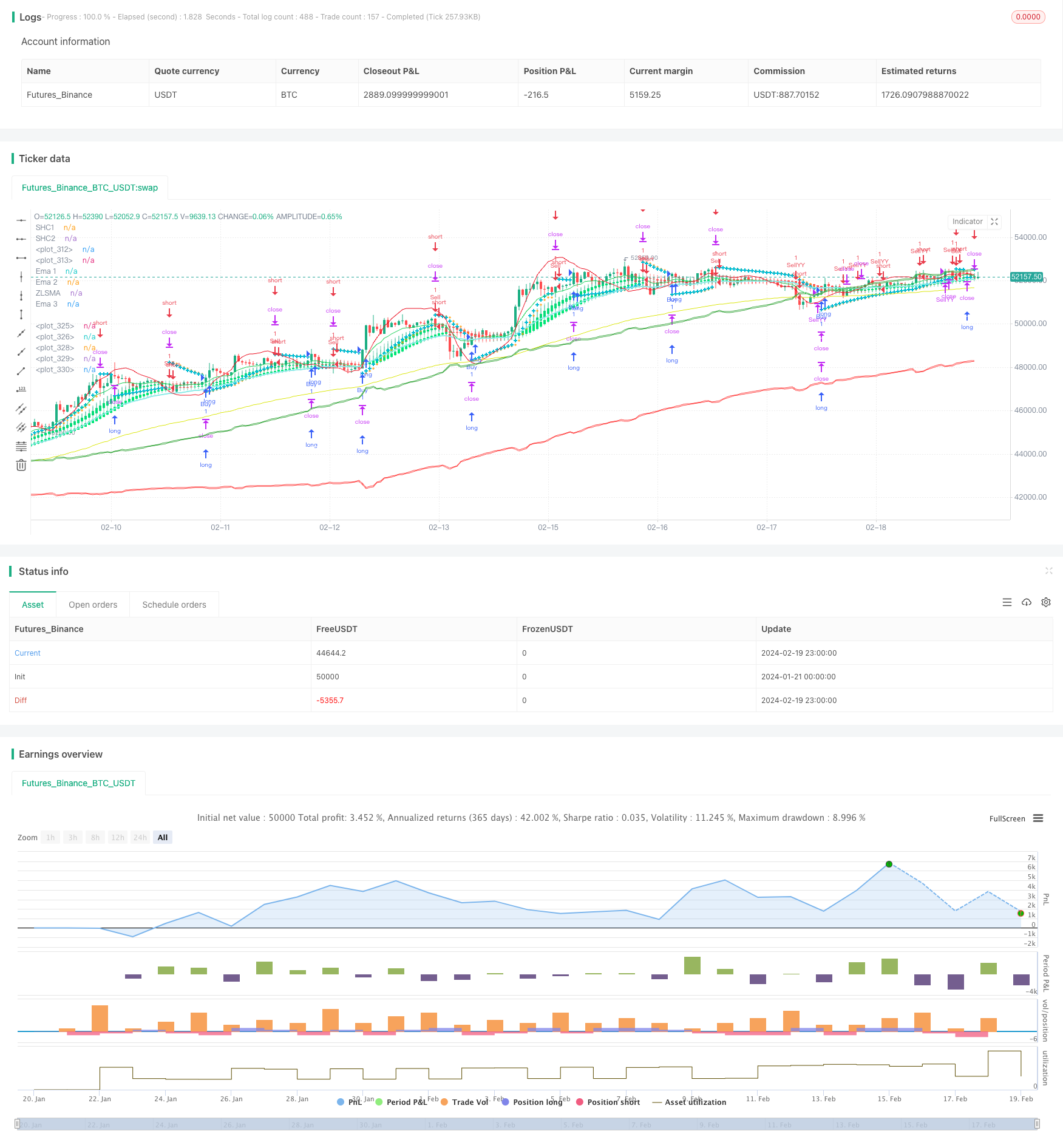

Estrategia técnica de trading cuantitativo con múltiples indicadores

Descripción general

La estrategia utiliza un conjunto de indicadores técnicos, incluyendo el sistema de giro de parallaxes, las exportaciones de opinión, las medias móviles simples con cero retraso, las medias móviles de índices y las medias corrientes, para identificar posibles puntos de compra y venta en los gráficos.

Principio de estrategia

Indicadores principales

- Sistemas de giro de líneas paralelas: para determinar puntos de parada y puntos de entrada potenciales

- Estrategias de exportación de opinión: para determinar la dirección de las tendencias

- Promedio móvil simple con cero retraso: proporciona promedios móviles con bajo retraso

- Medias móviles indexadas: seguimiento de tendencias y fluctuaciones de precios

- Línea media suave: genera una línea media más suave

Señales de comercio

- Hacer más cuando el sistema de giro de la paralela muestra una tendencia alcista y el precio es superior a la media móvil del índice 99. Hacer más cuando muestra una tendencia descendente y el precio es inferior a la media móvil del índice 99.

- Las señales de la estrategia de exportación de la opinión pública confirman la dirección de la tendencia

- La línea plana y uniforme se combina con la señal de la línea paralela para evitar falsas rupturas

Gestión de riesgos

- Establecimiento de stop loss y stop loss

- Considere la posibilidad de reubicar las condiciones de compra y ajuste flexible de la posición

Análisis de las ventajas

La mayor ventaja de esta estrategia reside en que la combinación de indicadores es completa y permite identificar de manera efectiva la dirección de la tendencia. El sistema de líneas paralizadas determina los puntos de inflexión potenciales; la estrategia de exportación de opinión determina las principales tendencias; las medias móviles filtran las falsas señales.

Además, la estrategia incluye mecanismos de parada y parada para controlar el riesgo. La línea de equilibrio suave también se utiliza para evitar la interferencia de los ruidos a corto plazo.

Análisis de riesgos

Debido a la dependencia de más indicadores de juicio, la estrategia se enfrenta a ciertas dificultades cuando estos indicadores emiten señales de conflicto. Además, la configuración incorrecta de los parámetros también puede tener un efecto adverso en el comercio.

Además, la negociación técnica en sí misma conlleva ciertos riesgos y no puede evitar completamente las pérdidas. Se debe actuar con cautela y no seguir a ciegas.

Dirección de optimización

- Prueba y optimización de los parámetros del indicador para encontrar la combinación óptima

- La incorporación de algoritmos de aprendizaje automático para mejorar aún más la precisión de las señales mediante modelos de entrenamiento en Big Data

- En combinación con los indicadores de sentimiento, información de noticias, etc., para determinar la situación del mercado, ajustar dinámicamente las posiciones y las líneas de parada

- Optimización de la lógica de reajuste de condiciones de compra para que la detección de señales sea más flexible y coherente

Resumir

La estrategia integra varios indicadores técnicos para identificar las señales de negociación a través de una combinación de indicadores. La ventaja es que la señal es alta en precisión y estabilidad. Al mismo tiempo, las medidas de control de riesgo están en su lugar. En general, es un programa de negociación que vale la pena considerar.

/*backtest

start: 2024-01-21 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("CE-ZLSMA-EMA-SAR-SHC", overlay=true)

// Parabolic SAR Strategy

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

var bool longSar = false

var bool shortSar = false

//input smoothed HAC 1

len=input.int(title="Length SHC1", defval = 10)

o=ta.ema(open,len)

c=ta.ema(close,len)

h=ta.ema(high,len)

l=ta.ema(low,len)

haclose = (o+h+l+c)/4

var haopen = 0.0

if na(haopen[1])

haopen := (o + c) / 2

else

haopen := (haopen[1] + haclose[1]) / 2

hahigh = math.max (h, math.max(haopen,haclose))

halow = math.min (l, math.min(haopen,haclose))

len2=input(10)

o2=ta.ema(haopen, len2)

c2=ta.ema(haclose, len2)

h2=ta.ema(hahigh, len2)

l2=ta.ema(halow, len2)

col=o2>c2 ? color.red : color.lime

bool shc1Green = o2 > c2

bool shc1Lime = o2 < c2

//input smoothed HAC 1

lenSHC2=input.int(title="Length SHC2 ", defval = 20)

oShc2=ta.ema(open,lenSHC2)

cShc2=ta.ema(close,lenSHC2)

hShc2=ta.ema(high,lenSHC2)

lShc2=ta.ema(low,lenSHC2)

hacloseShc2 = (oShc2+hShc2+lShc2+cShc2)/4

var haopenShc2 = 0.0

if na(haopenShc2[1])

haopenShc2 := (oShc2 + cShc2) / 2

else

haopenShc2 := (haopenShc2[1] + hacloseShc2[1]) / 2

hahighShc2 = math.max (hShc2, math.max(haopenShc2,hacloseShc2))

halowShc2 = math.min (lShc2, math.min(haopenShc2,hacloseShc2))

len2Shc2=input(10)

o2Shc2=ta.ema(haopenShc2, len2Shc2)

c2Shc2=ta.ema(hacloseShc2, len2Shc2)

h2Shc2=ta.ema(hahighShc2, len2Shc2)

l2Shc2=ta.ema(halowShc2, len2Shc2)

colShc2=o2Shc2>c2Shc2 ? color.red : color.lime

bool shc2Green = o2Shc2 > c2Shc2

bool shc2Lime = o2Shc2 < c2Shc2

//end smooth

bool shcGree = shc1Green and shc2Green

bool shcLime = shc1Lime and shc2Lime

//zlsma

lengthZlsma = input.int(title="Length", defval=32)

offset = input.int(title="Offset", defval=0)

src = input(close, title="Source")

lsma = ta.linreg(src, lengthZlsma, offset)

lsma2 = ta.linreg(lsma, lengthZlsma, offset)

eq= lsma-lsma2

zlsma = lsma+eq

// ema 10

len4 = input.int(10, minval=1, title="Length")

src4 = input.source(close, title="Source")

out4 = ta.ema(src4, len4)

//End of format

// ema 34

len5 = input.int(34, minval=1, title="Length")

src5 = input.source(close, title="Source")

out5 = ta.ema(src5, len5)

//end ema 34

// ema 99

len6 = input.int(99, minval=1, title="Length")

src6 = input.source(close, title="Source")

out6 = ta.ema(src6, len6)

// end ema 99

//kiem tra dieu kien gia dong cua lon hon ema99 thi moi me lenh long

bool onEma99 = close > out6

bool downEma99 = open < out6

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := math.max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := math.min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := math.min(AF + increment, maximum)

else

if low < EP

EP := low

AF := math.min(AF + increment, maximum)

if uptrend

SAR := math.min(SAR, low[1])

if bar_index > 1

SAR := math.min(SAR, low[2])

else

SAR := math.max(SAR, high[1])

if bar_index > 1

SAR := math.max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

if barstate.isconfirmed

if uptrend

// log.info("true")

strategy.entry("ParSE", strategy.short, stop=nextBarSAR, comment="ParSE")

strategy.cancel("ParLE")

shortSar := false

longSar := true

else

// log.info("false")

strategy.entry("ParLE", strategy.long, stop=nextBarSAR, comment="ParLE")

strategy.cancel("ParSE")

longSar := false

shortSar := true

// Chandelier Exit Strategy

length = input.int(title="ATR Period", defval=1)

mult = input.float(title="ATR Multiplier", step=0.1, defval=1.1)

showLabels = input.bool(title="Show Buy/Sell Labels ?", defval=true)

useClose = input.bool(title="Use Close Price for Extremums ?", defval=true)

highlightState = input.bool(title="Highlight State ?", defval=true)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

var bool longOpened = false

var bool shortOpended = false

// Entry and exit logic

if (dir == 1)

if longSar

if not longOpened

strategy.close("Sell", disable_alert = true)

strategy.order("Buy", strategy.long)

longOpened := true

shortOpended := false

if (dir == -1)

if shortSar

if not shortOpended

strategy.close("Buy", disable_alert = true)

strategy.order("Sell", strategy.short)

shortOpended := true

longOpened := false

//strategy YY

// ~~~~~~~~~~~ INPUTS ~~~~~~~~~~~ //

lenYY = input.int(80, "Trend Length:", tooltip="How far back should we span this indicator?\nThis length effects all lengths of the indicator")

purchaseSrc = input.source(close, "Purchase Source (Long and Short):", tooltip="What source needs to exit the purchase zone for a purchase to happen?")

exitSrc = input.source(close, "Exit Source (Long and Short):", tooltip="What source needs to hit a exit condition to stop the trade (Take profit, Stop Loss or hitting the other sides Purchase Zone)?")

useTakeProfit = input.bool(true, "Use Take Profit", tooltip="Should we take profit IF we cross the basis line and then cross it AGAIN?")

useStopLoss = input.bool(true, "Use Stop Loss", tooltip="Stop loss will ensure you don't lose too much if its a bad call")

stopLossMult = input.float(0.1, "Stoploss Multiplier %:", tooltip="How far from the purchase lines should the stop loss be")

resetCondition = input.string("Entry", "Reset Purchase Availability After:", options=["Entry", "Stop Loss", "None"],

tooltip="If we reset after a condition is hit, this means we can purchase again when the purchase condition is met. \n" +

"Otherwise, we will only purchase after an opposite signal has appeared.\n" +

"Entry: means when the close enters the purchase zone (buy or sell).\n" +

"Stop Loss: means when the close hits the stop loss location (even when were out of a trade)\n" +

"This allows us to get more trades and also if our stop loss initally was hit but it WAS a good time to purchase, we don't lose that chance.")

// ~~~~~~~~~~~ VARIABLES ~~~~~~~~~~~ //

var bool longStart = na

var bool longAvailable = na

var bool longTakeProfitAvailable = na

var bool longStopLoss = na

var bool shortStart = na

var bool shortAvailable = na

var bool shortTakeProfitAvailable = na

var bool shortStopLoss = na

resetAfterStopLoss = resetCondition == "Stop Loss"

resetAfterEntry = resetCondition == "Entry"

// ~~~~~~~~~~~ CALCULATIONS ~~~~~~~~~~~ //

// Mid Line

midHigh = ta.vwma(ta.highest(high, lenYY), lenYY)

midLow = ta.vwma(ta.lowest(low, lenYY), lenYY)

mid = math.avg(midHigh, midLow)

midSmoothed = ta.ema(mid, lenYY)

//Volume Filtered

avgVol = ta.vwma(volume, lenYY)

volDiff = volume / avgVol

midVolSmoothed = ta.vwma(midSmoothed * volDiff, 3)

//RSI Filtered

midDifference = ta.sma(midHigh - midLow, lenYY)

midRSI = ta.rsi(midVolSmoothed, lenYY) * 0.01

midAdd = midRSI * midDifference

//Calculate Zones

purchaseZoneHigh = midSmoothed + midAdd

purchaseZoneLow = midSmoothed - midAdd

purchaseZoneBasis = math.avg(purchaseZoneHigh, purchaseZoneLow)

//Create Stop Loss Locations

stopLossHigh = purchaseZoneHigh * (1 + (stopLossMult * 0.01))

stopLossLow = purchaseZoneLow * (1 - (stopLossMult * 0.01))

// ~~~~~~~~~~~ PURCHASE CALCULATIONS ~~~~~~~~~~~ //

//Long

longEntry = ta.crossunder(purchaseSrc, purchaseZoneLow)

longStart := ta.crossover(purchaseSrc, purchaseZoneLow) and longAvailable

longAvailable := ta.crossunder(purchaseSrc, purchaseZoneHigh) or (resetAfterStopLoss and longStopLoss) or (resetAfterEntry and longEntry) ? true : longStart ? false : longAvailable[1]

longEnd = ta.crossover(exitSrc, purchaseZoneHigh)

longStopLoss := ta.crossunder(exitSrc, stopLossLow)

longTakeProfitAvailable := ta.crossover(exitSrc, purchaseZoneBasis) ? true : longEnd ? false : longTakeProfitAvailable[1]

longTakeProfit = ta.crossunder(exitSrc, purchaseZoneBasis) and longTakeProfitAvailable

//Short

shortEntry = ta.crossover(purchaseSrc, purchaseZoneHigh)

shortStart := ta.crossunder(purchaseSrc, purchaseZoneHigh) and shortAvailable

shortAvailable := ta.crossover(purchaseSrc, purchaseZoneLow) or (resetAfterStopLoss and shortStopLoss) or (resetAfterEntry and shortEntry)? true : shortStart ? false : shortAvailable[1]

shortEnd = ta.crossunder(exitSrc, purchaseZoneLow)

shortStopLoss := ta.crossover(exitSrc, stopLossHigh)

shortTakeProfitAvailable := ta.crossunder(exitSrc, purchaseZoneBasis) ? true : shortEnd ? false : shortTakeProfitAvailable[1]

shortTakeProfit = ta.crossover(exitSrc, purchaseZoneBasis) and shortTakeProfitAvailable

// ~~~~~~~~~~~ STRATEGY ~~~~~~~~~~~ //

var bool openLongYY = false

var bool openShortYY = false

if (longStart)

strategy.order("BuyYY", strategy.long)

strategy.close("SellYY", disable_alert = true)

openLongYY := true

openShortYY := false

else if (longEnd or (useStopLoss and longStopLoss) or (useTakeProfit and longTakeProfit))

strategy.close("BuyYY", disable_alert = true)

if (shortStart)

strategy.close("BuyYY", disable_alert = true)

strategy.order("SellYY", strategy.short)

openShortYY := true

openLongYY := false

else if (shortEnd or (useStopLoss and shortStopLoss) or (useTakeProfit and shortTakeProfit))

strategy.close("SellYY", disable_alert = true)

// ~~~~~~~~~~~ ALERTS ~~~~~~~~~~~ //

// if longStart or (longEnd or (useStopLoss and longStopLoss) or (useTakeProfit and longTakeProfit)) or shortStart or (shortEnd or (useStopLoss and shortStopLoss) or (useTakeProfit and shortTakeProfit))

// alert("{{strategy.order.action}} | {{ticker}} | {{close}}", alert.freq_once_per_bar)

// Plotting

plot(SAR, style=plot.style_cross, linewidth=1, color=color.orange)

plot(nextBarSAR, style=plot.style_cross, linewidth=3, color=color.aqua)

plot(zlsma, color=color.rgb(235, 15, 33), linewidth=1, title = "ZLSMA")

plot(out4, color=color.rgb(24, 209, 85), title="Ema 1")

plot(out5, color=color.rgb(139, 234, 231), linewidth = 2, title="Ema 2")

plot(out6, color=color.rgb(219, 230, 18), title="Ema 3")

plotcandle(o2, h2, l2, c2, title="SHC1", color=col)

plotcandle(o2Shc2, hShc2, l2Shc2, c2Shc2, title="SHC2", color=col)

// ~~~~~~~~~~~ PLOTS YY ~~~~~~~~~~~ //

shortLine = plot(purchaseZoneHigh, color=color.green)

shortStopLossLine = plot(stopLossHigh, color=color.green) //color=color.rgb(0, 97, 3)

fill(shortLine, shortStopLossLine, color = color.new(color.green, 90))

plot(purchaseZoneBasis, color=color.white)

longLine = plot(purchaseZoneLow, color=color.red)

longStopLossLine = plot(stopLossLow, color=color.red) //color=color.rgb(105, 0, 0)

fill(longLine, longStopLossLine, color=color.new(color.red, 90))