Descripción general

Una estrategia de trading de equilibrio múltiple es un sistema de trading complejo que combina varios indicadores técnicos y niveles de precios. Utiliza indicadores como el MACD, el RSI, el EMA y las bandas de Brin, combinados con los niveles de retroceso de Fibonacci, para adoptar diferentes estrategias de trading en diferentes rangos de precios para lograr un equilibrio de comercio en varios niveles. La idea central de la estrategia es aumentar la precisión de las operaciones mediante la confirmación múltiple, al mismo tiempo que se optimiza la gestión de capital mediante el aumento gradual de la posición.

Principio de estrategia

Los principios centrales de la estrategia incluyen:

- Utiliza los indicadores MACD, RSI y EMA para determinar las tendencias y el dinamismo del mercado.

- Utiliza las bandas de Brin y los niveles de retroceso de Fibonacci para identificar los puntos clave de soporte y resistencia.

- Establecer múltiples puntos de entrada a diferentes niveles de precios para la construcción gradual de las posiciones.

- Gestionar el riesgo estableciendo diferentes niveles de stop y stop loss.

- El gráfico de Haykanush se utiliza para proporcionar información adicional sobre la estructura del mercado.

La estrategia es analizar estos factores en conjunto y tomar acciones de negociación correspondientes en diferentes condiciones de mercado para lograr ganancias estables.

Ventajas estratégicas

- Confirmación múltiple: mejora la fiabilidad de las señales de negociación mediante la combinación de varios indicadores técnicos.

- Gestión flexible de los fondos: El aumento gradual de los fondos permite un mejor control de los riesgos y la optimización de la utilización de los fondos.

- Adaptabilidad: La estrategia puede ajustar el comportamiento de las operaciones a diferentes condiciones del mercado.

- Gestión integral del riesgo: hay varios niveles de mecanismos de suspensión y detención para controlar el riesgo de manera efectiva.

- Alto grado de automatización: La ejecución de las estrategias puede ser completamente automatizada, reduciendo la intervención humana.

Riesgo estratégico

- Exceso de transacciones: debido a que la estrategia establece varios niveles de transacciones, puede ocasionar transacciones frecuentes y aumentar los costos de las transacciones.

- Sensibilidad a parámetros: La estrategia utiliza varios indicadores y parámetros, que requieren un ajuste cuidadoso para adaptarse a diferentes entornos de mercado.

- Riesgo de retirada: En un mercado con mucha volatilidad, puede haber un mayor riesgo de retirada.

- Dependencia tecnológica: La estrategia depende en gran medida de los indicadores técnicos y puede fallar en ciertas condiciones de mercado.

- Riesgo de gestión de fondos: La forma gradual de acumular posiciones puede conducir a una exposición excesiva en algunos casos.

Dirección de optimización de la estrategia

- Ajuste de parámetros dinámicos: Introducción de algoritmos de aprendizaje automático para ajustar los parámetros de la estrategia según las condiciones del mercado.

- Análisis del sentimiento del mercado: integración de indicadores de sentimiento del mercado, como el índice VIX, para mejorar la adaptabilidad de la estrategia.

- Análisis de múltiples marcos de tiempo: Introducción de análisis de múltiples marcos de tiempo para mejorar la fiabilidad de las señales de negociación.

- Ajuste de la volatilidad: ajuste del volumen de operaciones y los niveles de stop loss en función de la volatilidad del mercado.

- Optimización de costos de transacción: Introducción de modelos de costos de transacción para optimizar la frecuencia y el tamaño de las transacciones.

Resumir

La estrategia de comercio de equilibrio múltiple es un sistema de comercio integrado, fuerte y adaptable. Al combinar varios indicadores técnicos y niveles de precios, la estrategia puede mantener la estabilidad en diferentes entornos de mercado. Si bien existen algunos riesgos, estos pueden ser controlados de manera efectiva mediante la optimización y el ajuste continuos.

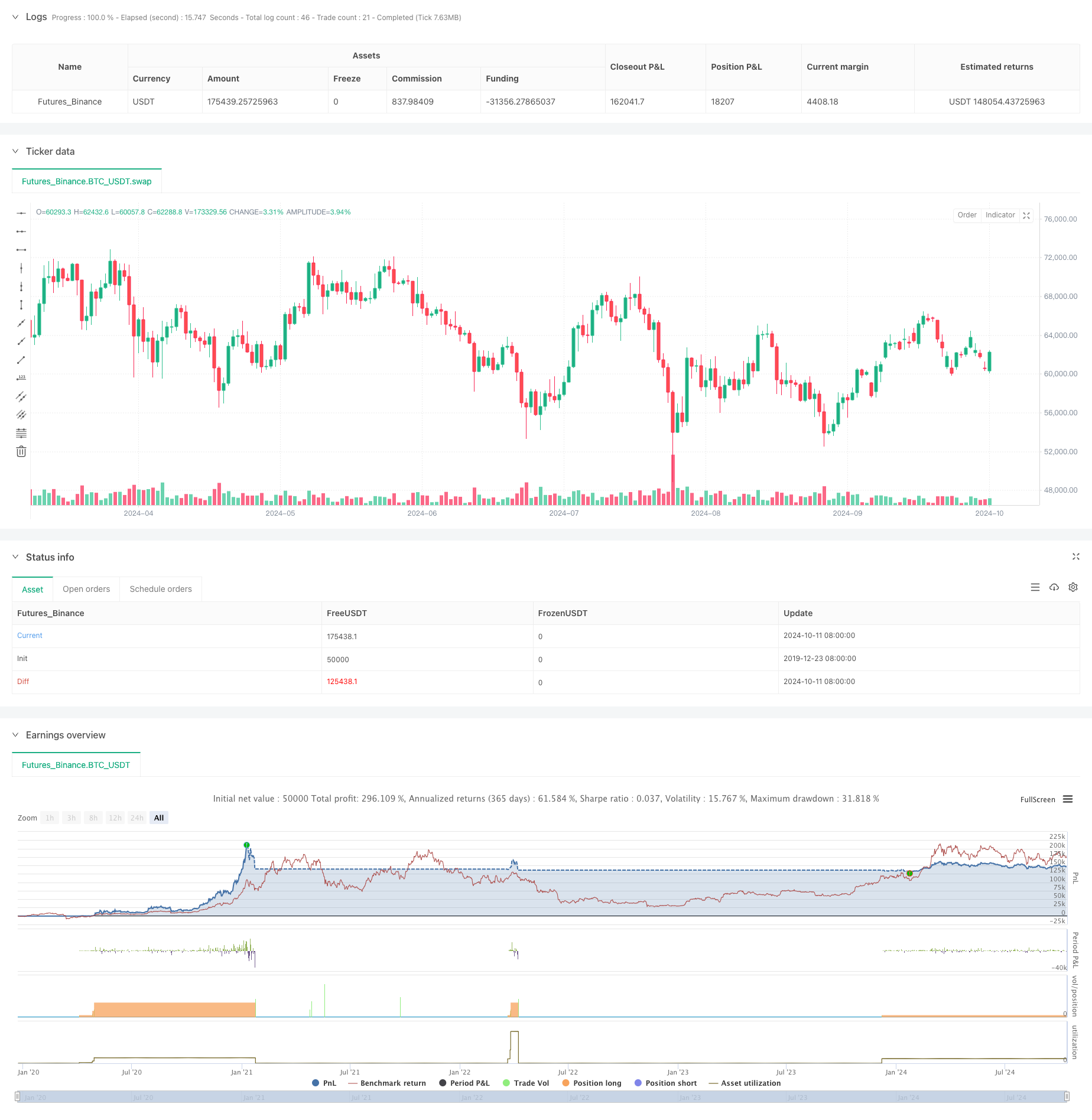

/*backtest

start: 2019-12-23 08:00:00

end: 2024-10-12 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Incremental Order size +', shorttitle='TradingPost', overlay=true, default_qty_value=1, pyramiding=10)

//Heiken Ashi

isHA = input(false, 'HA Candles')

//MACD

fastLength = 12

slowlength = 26

MACDLength = 9

MACD = ta.ema(close, fastLength) - ta.ema(close, slowlength)

aMACD = ta.ema(MACD, MACDLength)

delta = MACD - aMACD

//Bollinger Bands Exponential

src = open

len = 18

e = ta.ema(src, len)

evar = (src - e) * (src - e)

evar2 = math.sum(evar, len) / len

std = math.sqrt(evar2)

Multiplier = input.float(3, minval=0.01, title='# of STDEV\'s')

upband = e + Multiplier * std

dnband = e - Multiplier * std

//EMA

ema3 = ta.ema(close, 3)

//RSIplot

length = 45

overSold = 90

overBought = 10

price = close

vrsi = ta.rsi(price, length)

notna = not na(vrsi)

macdlong = ta.crossover(delta, 0)

macdshort = ta.crossunder(delta, 0)

rsilong = notna and ta.crossover(vrsi, overSold)

rsishort = notna and ta.crossunder(vrsi, overBought)

lentt = input(14, 'Pivot Length')

//The length defines how many periods a high or low must hold to be a "relevant pivot"

h = ta.highest(lentt)

//The highest high over the length

h1 = ta.dev(h, lentt) ? na : h

//h1 is a pivot of h if it holds for the full length

hpivot = fixnan(h1)

//creates a series which is equal to the last pivot

l = ta.lowest(lentt)

l1 = ta.dev(l, lentt) ? na : l

lpivot = fixnan(l1)

//repeated for lows

last_hpivot = 0.0

last_lpivot = 0.0

last_hpivot := h1 ? time : nz(last_hpivot[1])

last_lpivot := l1 ? time : nz(last_lpivot[1])

long_time = last_hpivot > last_lpivot ? 0 : 1

//FIBS

z = input(100, 'Z-Index')

p_offset = 2

transp = 60

a = (ta.lowest(z) + ta.highest(z)) / 2

b = ta.lowest(z)

c = ta.highest(z)

fibonacci = input(0, 'Fibonacci') / 100

//Fib Calls

fib0 = (hpivot - lpivot) * fibonacci + lpivot

fib1 = (hpivot - lpivot) * .21 + lpivot

fib2 = (hpivot - lpivot) * .3 + lpivot

fib3 = (hpivot - lpivot) * .5 + lpivot

fib4 = (hpivot - lpivot) * .62 + lpivot

fib5 = (hpivot - lpivot) * .7 + lpivot

fib6 = (hpivot - lpivot) * 1.00 + lpivot

fib7 = (hpivot - lpivot) * 1.27 + lpivot

fib8 = (hpivot - lpivot) * 2 + lpivot

fib9 = (hpivot - lpivot) * -.27 + lpivot

fib10 = (hpivot - lpivot) * -1 + lpivot

//Heiken Ashi Candles

heikenashi_1 = ticker.heikinashi(syminfo.tickerid)

data2 = isHA ? heikenashi_1 : syminfo.tickerid

res5 = input.timeframe('5', 'Resolution')

//HT Fibs

hfib0 = request.security(data2, res5, fib0[1])

hfib1 = request.security(data2, res5, fib1[1])

hfib2 = request.security(data2, res5, fib2[1])

hfib3 = request.security(data2, res5, fib3[1])

hfib4 = request.security(data2, res5, fib4[1])

hfib5 = request.security(data2, res5, fib5[1])

hfib6 = request.security(data2, res5, fib6[1])

hfib7 = request.security(data2, res5, fib7[1])

hfib8 = request.security(data2, res5, fib8[1])

hfib9 = request.security(data2, res5, fib9[1])

hfib10 = request.security(data2, res5, fib10[1])

vrsiup = vrsi > vrsi[1] and vrsi[1] > vrsi[2]

vrsidown = vrsi < vrsi[1] and vrsi[1] < vrsi[2]

long = ta.cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

short = ta.cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long2 = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short2 = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

reverseOpens = input(false, 'Reverse Orders')

if reverseOpens

tmplong = long

long := short

short := tmplong

short

//Strategy

ts = input(99999, 'TS')

tp = input(30, 'TP')

sl = input(15, 'SL')

last_long = 0.0

last_short = 0.0

last_long := long ? time : nz(last_long)

last_short := short ? time : nz(last_short)

in_long = last_long > last_short

in_short = last_short > last_long

long_signal = ta.crossover(last_long, last_short)

short_signal = ta.crossover(last_short, last_long)

last_open_long = 0.0

last_open_short = 0.0

last_open_long := long ? open : nz(last_open_long[1])

last_open_short := short ? open : nz(last_open_short[1])

last_open_long_signal = 0.0

last_open_short_signal = 0.0

last_open_long_signal := long_signal ? open : nz(last_open_long_signal[1])

last_open_short_signal := short_signal ? open : nz(last_open_short_signal[1])

last_high = 0.0

last_low = 0.0

last_high := not in_long ? na : in_long and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low := not in_short ? na : in_short and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

long_ts = not na(last_high) and high <= last_high - ts and high >= last_open_long_signal

short_ts = not na(last_low) and low >= last_low + ts and low <= last_open_short_signal

long_tp = high >= last_open_long + tp and long[1] == 0

short_tp = low <= last_open_short - tp and short[1] == 0

long_sl = low <= last_open_long - sl and long[1] == 0

short_sl = high >= last_open_short + sl and short[1] == 0

last_hfib_long = 0.0

last_hfib_short = 0.0

last_hfib_long := long_signal ? fib1 : nz(last_hfib_long[1])

last_hfib_short := short_signal ? fib5 : nz(last_hfib_short[1])

last_fib7 = 0.0

last_fib10 = 0.0

last_fib7 := long ? fib7 : nz(last_fib7[1])

last_fib10 := long ? fib10 : nz(last_fib10[1])

last_fib8 = 0.0

last_fib9 = 0.0

last_fib8 := short ? fib8 : nz(last_fib8[1])

last_fib9 := short ? fib9 : nz(last_fib9[1])

last_long_signal = 0.0

last_short_signal = 0.0

last_long_signal := long_signal ? time : nz(last_long_signal[1])

last_short_signal := short_signal ? time : nz(last_short_signal[1])

last_long_tp = 0.0

last_short_tp = 0.0

last_long_tp := long_tp ? time : nz(last_long_tp[1])

last_short_tp := short_tp ? time : nz(last_short_tp[1])

last_long_ts = 0.0

last_short_ts = 0.0

last_long_ts := long_ts ? time : nz(last_long_ts[1])

last_short_ts := short_ts ? time : nz(last_short_ts[1])

long_ts_signal = ta.crossover(last_long_ts, last_long_signal)

short_ts_signal = ta.crossover(last_short_ts, last_short_signal)

last_long_sl = 0.0

last_short_sl = 0.0

last_long_sl := long_sl ? time : nz(last_long_sl[1])

last_short_sl := short_sl ? time : nz(last_short_sl[1])

long_tp_signal = ta.crossover(last_long_tp, last_long)

short_tp_signal = ta.crossover(last_short_tp, last_short)

long_sl_signal = ta.crossover(last_long_sl, last_long)

short_sl_signal = ta.crossover(last_short_sl, last_short)

last_long_tp_signal = 0.0

last_short_tp_signal = 0.0

last_long_tp_signal := long_tp_signal ? time : nz(last_long_tp_signal[1])

last_short_tp_signal := short_tp_signal ? time : nz(last_short_tp_signal[1])

last_long_sl_signal = 0.0

last_short_sl_signal = 0.0

last_long_sl_signal := long_sl_signal ? time : nz(last_long_sl_signal[1])

last_short_sl_signal := short_sl_signal ? time : nz(last_short_sl_signal[1])

last_long_ts_signal = 0.0

last_short_ts_signal = 0.0

last_long_ts_signal := long_ts_signal ? time : nz(last_long_ts_signal[1])

last_short_ts_signal := short_ts_signal ? time : nz(last_short_ts_signal[1])

true_long_signal = long_signal and last_long_sl_signal > last_long_signal[1] or long_signal and last_long_tp_signal > last_long_signal[1] or long_signal and last_long_ts_signal > last_long_signal[1]

true_short_signal = short_signal and last_short_sl_signal > last_short_signal[1] or short_signal and last_short_tp_signal > last_short_signal[1] or short_signal and last_short_ts_signal > last_short_signal[1]

// strategy.entry("BLUE", strategy.long, when=long)

// strategy.entry("RED", strategy.short, when=short)

g = delta > 0 and vrsi < overSold and vrsiup

r = delta < 0 and vrsi > overBought and vrsidown

long1 = ta.cross(close, fib1) and g and last_long_signal[1] > last_short_signal // and last_long_signal > long

short1 = ta.cross(close, fib5) and r and last_short_signal[1] > last_long_signal // and last_short_signal > short

last_long1 = 0.0

last_short1 = 0.0

last_long1 := long1 ? time : nz(last_long1[1])

last_short1 := short1 ? time : nz(last_short1[1])

last_open_long1 = 0.0

last_open_short1 = 0.0

last_open_long1 := long1 ? open : nz(last_open_long1[1])

last_open_short1 := short1 ? open : nz(last_open_short1[1])

long1_signal = ta.crossover(last_long1, last_long_signal)

short1_signal = ta.crossover(last_short1, last_short_signal)

last_long1_signal = 0.0

last_short1_signal = 0.0

last_long1_signal := long1_signal ? time : nz(last_long1_signal[1])

last_short1_signal := short1_signal ? time : nz(last_short1_signal[1])

long2 = ta.cross(close, fib2) and g and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short2 = ta.cross(close, fib4) and r and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long2 = 0.0

last_short2 = 0.0

last_long2 := long2 ? time : nz(last_long2[1])

last_short2 := short2 ? time : nz(last_short2[1])

last_open_short2 = 0.0

last_open_short2 := short2 ? open : nz(last_open_short2[1])

long2_signal = ta.crossover(last_long2, last_long1_signal) and long1_signal == 0

short2_signal = ta.crossover(last_short2, last_short1_signal) and short1_signal == 0

last_long2_signal = 0.0

last_short2_signal = 0.0

last_long2_signal := long2_signal ? time : nz(last_long2_signal[1])

last_short2_signal := short2_signal ? time : nz(last_short2_signal[1])

//Trade 4

long3 = ta.cross(close, fib3) and g and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short3 = ta.cross(close, fib3) and r and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long3 = 0.0

last_short3 = 0.0

last_long3 := long3 ? time : nz(last_long3[1])

last_short3 := short3 ? time : nz(last_short3[1])

last_open_short3 = 0.0

last_open_short3 := short3 ? open : nz(last_open_short3[1])

long3_signal = ta.crossover(last_long3, last_long2_signal) and long2_signal == 0

short3_signal = ta.crossover(last_short3, last_short2_signal) and short2_signal == 0

last_long3_signal = 0.0

last_short3_signal = 0.0

last_long3_signal := long3_signal ? time : nz(last_long3_signal[1])

last_short3_signal := short3_signal ? time : nz(last_short3_signal[1])

//Trade 5

long4 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short4 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long4 = 0.0

last_short4 = 0.0

last_long4 := long4 ? time : nz(last_long4[1])

last_short4 := short4 ? time : nz(last_short4[1])

long4_signal = ta.crossover(last_long4, last_long3_signal) and long2_signal == 0 and long3_signal == 0

short4_signal = ta.crossover(last_short4, last_short3_signal) and short2_signal == 0 and short3_signal == 0

last_long4_signal = 0.0

last_short4_signal = 0.0

last_long4_signal := long4_signal ? time : nz(last_long4_signal[1])

last_short4_signal := short4_signal ? time : nz(last_short4_signal[1])

//Trade 6

long5 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short5 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long5 = 0.0

last_short5 = 0.0

last_long5 := long5 ? time : nz(last_long5[1])

last_short5 := short5 ? time : nz(last_short5[1])

long5_signal = ta.crossover(last_long5, last_long4_signal) and long3_signal == 0 and long4_signal == 0

short5_signal = ta.crossover(last_short5, last_short4_signal) and short3_signal == 0 and short4_signal == 0

last_long5_signal = 0.0

last_short5_signal = 0.0

last_long5_signal := long5_signal ? time : nz(last_long5_signal[1])

last_short5_signal := short5_signal ? time : nz(last_short5_signal[1])

//Trade 7

long6 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short6 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long6 = 0.0

last_short6 = 0.0

last_long6 := long6 ? time : nz(last_long6[1])

last_short6 := short6 ? time : nz(last_short6[1])

long6_signal = ta.crossover(last_long6, last_long5_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0

short6_signal = ta.crossover(last_short6, last_short5_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0

last_long6_signal = 0.0

last_short6_signal = 0.0

last_long6_signal := long6_signal ? time : nz(last_long6_signal[1])

last_short6_signal := short6_signal ? time : nz(last_short6_signal[1])

//Trade 8

long7 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short7 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long7 = 0.0

last_short7 = 0.0

last_long7 := long7 ? time : nz(last_long7[1])

last_short7 := short7 ? time : nz(last_short7[1])

long7_signal = ta.crossover(last_long7, last_long6_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0

short7_signal = ta.crossover(last_short7, last_short6_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0

last_long7_signal = 0.0

last_short7_signal = 0.0

last_long7_signal := long7_signal ? time : nz(last_long7_signal[1])

last_short7_signal := short7_signal ? time : nz(last_short7_signal[1])

//Trade 9

long8 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short8 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long8 = 0.0

last_short8 = 0.0

last_long8 := long8 ? time : nz(last_long8[1])

last_short8 := short8 ? time : nz(last_short8[1])

long8_signal = ta.crossover(last_long8, last_long7_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0 and long7_signal == 0

short8_signal = ta.crossover(last_short8, last_short7_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0 and short7_signal == 0

last_long8_signal = 0.0

last_short8_signal = 0.0

last_long8_signal := long8_signal ? time : nz(last_long8_signal[1])

last_short8_signal := short8_signal ? time : nz(last_short8_signal[1])

//Trade 10

long9 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short9 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long9 = 0.0

last_short9 = 0.0

last_long9 := long9 ? time : nz(last_long9[1])

last_short9 := short9 ? time : nz(last_short9[1])

long9_signal = ta.crossover(last_long9, last_long8_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0 and long7_signal == 0 and long8_signal == 0

short9_signal = ta.crossover(last_short9, last_short8_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0 and short7_signal == 0 and short8_signal == 0

last_long9_signal = 0.0

last_short9_signal = 0.0

last_long9_signal := long9_signal ? time : nz(last_long9_signal[1])

last_short9_signal := short9_signal ? time : nz(last_short9_signal[1])

strategy.entry('Long', strategy.long, qty=1, when=long_signal)

strategy.entry('Short', strategy.short, qty=1, when=short_signal)

strategy.entry('Long', strategy.long, qty=2, when=long1_signal)

strategy.entry('Short1', strategy.short, qty=2, when=short1_signal)

strategy.entry('Long', strategy.long, qty=4, when=long2_signal)

strategy.entry('Short2', strategy.short, qty=4, when=short2_signal)

strategy.entry('Long', strategy.long, qty=8, when=long3_signal)

strategy.entry('Short3', strategy.short, qty=8, when=short3_signal)

strategy.entry('Long', strategy.long, qty=5, when=long4_signal)

strategy.entry('Short', strategy.short, qty=5, when=short4_signal)

strategy.entry('Long', strategy.long, qty=6, when=long5_signal)

strategy.entry('Short', strategy.short, qty=6, when=short5_signal)

strategy.entry('Long', strategy.long, qty=7, when=long6_signal)

strategy.entry('Short', strategy.short, qty=7, when=short6_signal)

strategy.entry('Long', strategy.long, qty=8, when=long7_signal)

strategy.entry('Short', strategy.short, qty=8, when=short7_signal)

strategy.entry('Long', strategy.long, qty=9, when=long8_signal)

strategy.entry('Short', strategy.short, qty=9, when=short8_signal)

strategy.entry('Long', strategy.long, qty=10, when=long9_signal)

strategy.entry('Short', strategy.short, qty=10, when=short9_signal)

short1_tp = low <= last_open_short1 - tp and short1[1] == 0

short2_tp = low <= last_open_short2 - tp and short2[1] == 0

short3_tp = low <= last_open_short3 - tp and short3[1] == 0

short1_sl = high >= last_open_short1 + sl and short1[1] == 0

short2_sl = high >= last_open_short2 + sl and short2[1] == 0

short3_sl = high >= last_open_short3 + sl and short3[1] == 0

close_long = ta.cross(close, fib6)

close_short = ta.cross(close, fib0)

// strategy.close("Long", when=close_long)

// strategy.close("Long", when=long_tp)

// strategy.close("Long", when=long_sl)

// strategy.close("Short", when=long_signal)

// strategy.close("Short1", when=long_signal)

// strategy.close("Short2", when=long_signal)

// strategy.close("Short3", when=long_signal)

strategy.close('Short', when=short_tp)

strategy.close('Short1', when=short1_tp)

strategy.close('Short2', when=short2_tp)

strategy.close('Short3', when=short3_tp)

strategy.close('Short', when=short_sl)

strategy.close('Short1', when=short1_sl)

strategy.close('Short2', when=short2_sl)

strategy.close('Short3', when=short3_sl)