Estrategia cuantitativa de ruptura de precios con patrón E9 Shark 32

Descripción general

La estrategia es un sistema de negociación cuantitativa basado en la identificación de formas de precios, cuyo núcleo es la identificación y explotación de las formas especiales de la línea K, como el “alligator 32”. La estrategia analiza los cambios en la continuidad de los puntos altos y bajos, establece niveles de precios clave después de la confirmación de la forma y negocia cuando se rompen estos niveles. La estrategia combina varios elementos de análisis técnico, como la identificación de formas, el seguimiento de tendencias y las rupturas de precios, para crear un sistema de negociación completo.

Principio de estrategia

El núcleo de la estrategia consiste en identificar la forma “alfinero 32”, que requiere que se cumplan las siguientes condiciones: los mínimos de las dos líneas K anteriores bajan continuamente, mientras que los máximos suben continuamente. Cuando se confirma la forma, la estrategia bloquea los máximos y mínimos de la línea K inicial de la forma como niveles de precios clave.

Ventajas estratégicas

- La identificación de formas es precisa: las formas se identifican mediante una definición matemática estricta, evitando juicios subjetivos.

- La gestión de riesgos es perfecta: incluye una clara configuración de objetivos de stop loss y profit

- Comentarios visuales claros: líneas y fondos de diferentes colores para marcar formas y señales de transacción

- Filtración de señales repetitivas: solo se permite una transacción por cada modalidad para evitar el exceso de transacciones

- Establecimiento de objetivos razonables: establecimiento de objetivos de ganancias basados en la amplitud de las fluctuaciones morfológicas, con una buena relación riesgo-beneficio

Riesgo estratégico

- Riesgo de mercado en movimiento: Falsa brecha frecuente en mercados en movimiento horizontal

- Riesgo de deslizamiento: Es posible que se produzca un deslizamiento mayor en el trayecto rápido

- Dependencia de un solo formato: la dependencia excesiva de un solo formato puede perder otras oportunidades de negociación

- Sensibilidad a los parámetros: los parámetros de los objetivos de stop loss y profit tienen un mayor impacto en el rendimiento de la estrategia

Dirección de optimización de la estrategia

- Adición de confirmación de transacción: se puede combinar el cambio de transacción para confirmar la validez de la ruptura

- Introducción de filtros de entornos de mercado: aumento de indicadores de intensidad de tendencia para filtrar entornos de mercado desfavorables

- Optimización de los métodos de pérdidas: se puede considerar el uso de pérdidas dinámicas para mejorar la adaptabilidad de la estrategia

- Añadir filtro de tiempo: añadir filtro de período de negociación para evitar fluctuaciones en un período específico

- Mejorar la gestión de fondos: agregar módulos de gestión de posiciones para optimizar la eficiencia de la utilización de fondos

Resumir

La estrategia de ruptura de precios de forma cuantitativa de E9 es un sistema de negociación estructurado y lógicamente claro. Construye una estrategia de negociación de ejecución cuantitativa a través de una definición de forma estricta y reglas de negociación claras.

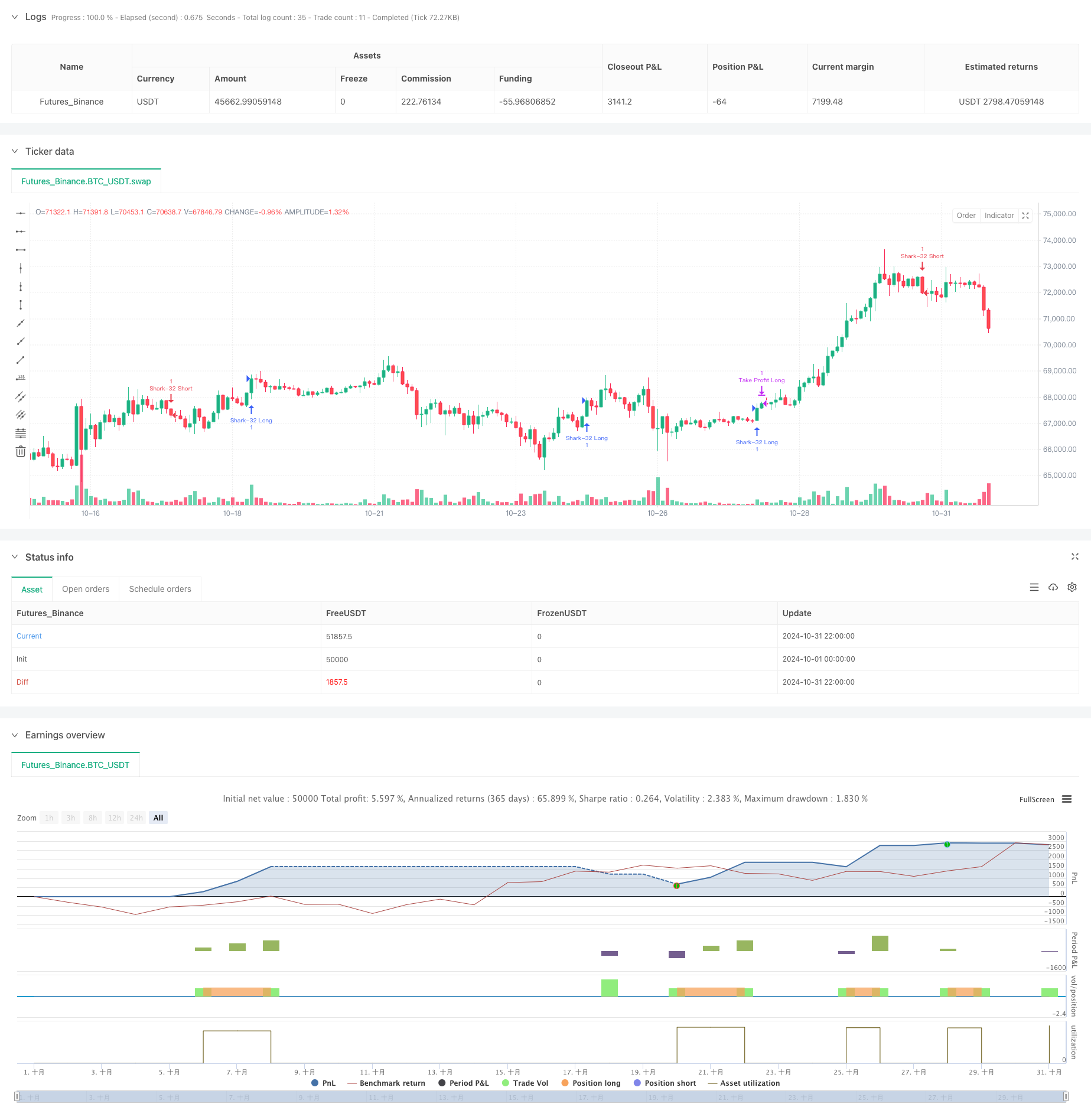

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//╔═════════════════════════════════════════════════════════════════════════════════════════════════════════════╗

//║ ║

//║ ░▒▓████████▓▒░▒▓███████▓▒░ ░▒▓██████▓▒░░▒▓███████▓▒░░▒▓████████▓▒░▒▓███████▓▒░ ░▒▓████████▓▒░▒▓██████▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓███████▓▒░░▒▓████████▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓██████▓▒░ ░▒▓███████▓▒░. ░▒▓██████▓▒░ ░▒▓███████▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓███████▓▒░░▒▓████████▓▒░▒▓█▓▒░░▒▓█▓▒. ░▒▓████████▓▒░▒▓██████▓▒░ ║

//║ ║

//╚═════════════════════════════════════════════════════════════════════════════════════════════════════════════╝

//@version=5

strategy("E9 Shark-32 Pattern Strategy with Target Lines", shorttitle="E9 Shark-32 Strategy", overlay=true)

// Inputs for background color settings

bgcolorEnabled = input(true, title="Enable Background Color")

bgcolorColor = input.color(color.new(color.blue, 90), title="Background Color")

// Inputs for bar color settings

barcolorEnabled = input(true, title="Enable Bar Color")

barcolorColor = input.color(color.rgb(240, 241, 154), title="Bar Color")

// Inputs for target lines settings

targetLinesEnabled = input(true, title="Enable Target Lines")

targetLineColor = input.color(color.white, title="Target Line Color")

targetLineThickness = input.int(1, title="Target Line Thickness", minval=1, maxval=5)

// Define Shark-32 Pattern

shark32 = low[2] < low[1] and low[1] < low and high[2] > high[1] and high[1] > high

// Initialize color variables for bars

var color barColorCurrent = na

var color barColor1 = na

var color barColor2 = na

// Update color variables based on Shark-32 pattern

barColorCurrent := barcolorEnabled and (shark32 or shark32[1] or shark32[2]) ? barcolorColor : na

barColor1 := barcolorEnabled and (shark32[1] or shark32[2]) ? barcolorColor : na

barColor2 := barcolorEnabled and shark32[2] ? barcolorColor : na

// Apply the bar colors to the chart

barcolor(barColorCurrent, offset=-2, title="Shark-32 Confirmed Current")

barcolor(barColor1, offset=-3, title="Shark-32 Confirmed Previous Bar 1")

barcolor(barColor2, offset=-4, title="Shark-32 Confirmed Previous Bar 2")

// Variables for locking the high and low of confirmed Shark-32

var float patternHigh = na

var float patternLow = na

var float upperTarget = na

var float lowerTarget = na

// Once Shark-32 pattern is confirmed, lock the patternHigh, patternLow, and target lines

if shark32

patternHigh := high[2] // The high of the first bar in Shark-32 pattern

patternLow := low[2] // The low of the first bar in Shark-32 pattern

// Calculate the upper and lower white target lines

upperTarget := patternHigh + (patternHigh - patternLow) // Dotted white line above

lowerTarget := patternLow - (patternHigh - patternLow) // Dotted white line below

// Initialize variables for the lines

var line greenLine = na

var line redLine = na

var line upperTargetLine = na

var line lowerTargetLine = na

// Draw the lines based on the locked patternHigh, patternLow, and target lines

// if shark32

// future_bar_index_lines = bar_index + 10

// // Draw lines based on locked patternHigh and patternLow

// greenLine := line.new(x1=bar_index[2], y1=patternHigh, x2=future_bar_index_lines, y2=patternHigh, color=color.green, width=2, extend=extend.none)

// redLine := line.new(x1=bar_index[2], y1=patternLow, x2=future_bar_index_lines, y2=patternLow, color=color.red, width=2, extend=extend.none)

// // Draw dotted white lines if targetLinesEnabled is true

// if targetLinesEnabled

// upperTargetLine := line.new(x1=bar_index[2], y1=upperTarget, x2=future_bar_index_lines, y2=upperTarget, color=targetLineColor, width=targetLineThickness, style=line.style_dotted, extend=extend.none)

// lowerTargetLine := line.new(x1=bar_index[2], y1=lowerTarget, x2=future_bar_index_lines, y2=lowerTarget, color=targetLineColor, width=targetLineThickness, style=line.style_dotted, extend=extend.none)

// // Create a box to fill the background between the red and green lines

// if bgcolorEnabled

// box.new(left=bar_index[2], top=patternHigh, right=future_bar_index_lines, bottom=patternLow, bgcolor=bgcolorColor)

// -------------------------------------------------------------------------

// Strategy Entry and Exit Parameters

// -------------------------------------------------------------------------

// Input parameters for stop loss

longStopLoss = input.float(1.0, title="Long Stop Loss (%)", minval=0.1) // Percentage-based stop loss for long

shortStopLoss = input.float(1.0, title="Short Stop Loss (%)", minval=0.1) // Percentage-based stop loss for short

// Variable to track if a trade has been taken

var bool tradeTaken = false

// Reset the flag when a new Shark-32 pattern is confirmed

if shark32

tradeTaken := false

// Entry conditions only trigger after the Shark-32 is confirmed

longCondition = ta.crossover(close, patternHigh) and not tradeTaken // Long entry when close crosses above locked patternHigh

shortCondition = ta.crossunder(close, patternLow) and not tradeTaken // Short entry when close crosses below locked patternLow

// Trigger long and short trades based on the crossover conditions

if (longCondition)

label.new(bar_index, high, "Long Trigger", style=label.style_label_down, color=color.green, textcolor=color.white, size=size.small)

strategy.entry("Shark-32 Long", strategy.long)

tradeTaken := true // Set the flag to true after a trade is taken

if (shortCondition)

label.new(bar_index, low, "Short Trigger", style=label.style_label_up, color=color.red, textcolor=color.white, size=size.small)

strategy.entry("Shark-32 Short", strategy.short)

tradeTaken := true // Set the flag to true after a trade is taken

// Exit long trade based on the upper target line (upper white dotted line) as take profit

if strategy.position_size > 0

strategy.exit("Take Profit Long", "Shark-32 Long", limit=upperTarget, stop=close * (1 - longStopLoss / 100))

// Exit short trade based on the lower target line (lower white dotted line) as take profit

if strategy.position_size < 0

strategy.exit("Take Profit Short", "Shark-32 Short", limit=lowerTarget, stop=close * (1 + shortStopLoss / 100))