Descripción general

La estrategia es un sistema de negociación integral que combina varios indicadores técnicos y la emoción del mercado. En el núcleo de la estrategia se usan señales cruzadas de medias móviles a corto y largo plazo (SMA) y se combina con el indicador MACD para confirmar la dirección de la tendencia. Además, la estrategia integra el indicador de emoción del mercado RSI, así como un sistema de identificación de formas gráficas, que incluye la identificación de formas de doble cima/doble fondo y cima y hombro.

Principio de estrategia

La estrategia se basa en los siguientes componentes centrales:

- Sistema de medias móviles multi-periódicas: para juzgar tendencias con SMA de 10 y 30 períodos

- Indicador MACD: configuración con parámetros estándar para la confirmación de tendencias

- Monitoreo de la emoción del mercado: el indicador RSI para el juicio de sobrecompra

- Reconocimiento de formas de gráficos: sistema de reconocimiento automático que incluye formas de doble cima / doble fondo y copa de cabeza y hombros

- Filtración por tiempo: oportunidades de negociación enfocadas en un período de tiempo específico

- Identificación del punto de resistencia: utiliza 20 ciclos de retroceso para determinar el punto de resistencia principal

Las condiciones de compra deben cumplirse: estar en el momento de la negociación objetivo, usar el SMA largo en el SMA corto, y el indicador MACD mostrar una señal múltiple. Las condiciones de venta deben cumplirse: el precio alcanza el punto de resistencia principal y el indicador MACD muestra una señal de cabeza hueca.

Ventajas estratégicas

- Confirmación de señales multidimensionales: combinación de indicadores técnicos y formas gráficas para mejorar la fiabilidad de las señales de transacción

- Mejor gestión de riesgos: incluye un mecanismo de salida anticipada basado en el RSI

- Integración del sentimiento del mercado: juzgue el sentimiento del mercado a través del indicador RSI y evite perseguir demasiado las caídas

- Identificación automática de formas: reducir las diferencias de juicio subjetivo

- Filtrado por tiempo: enfoque en los momentos de mayor actividad del mercado para mejorar la eficiencia de las operaciones

Riesgo estratégico

- Sensibilidad de parámetros: la configuración de parámetros de varios indicadores técnicos puede afectar el rendimiento de la estrategia

- Riesgo de atraso: las medias móviles y el MACD tienen un cierto atraso

- Precisión de reconocimiento de formas: los sistemas de reconocimiento automático pueden equivocarse

- Dependencia del entorno del mercado: puede generar falsas señales frecuentes en mercados convulsionados

- Limitación temporal: las oportunidades que se pueden perder en otros períodos de tiempo solo se pueden negociar en ciertos períodos

Dirección de optimización de la estrategia

- Adaptación de parámetros: introducción de un mecanismo de ajuste de parámetros de adaptación para ajustar automáticamente los parámetros del indicador en función de la volatilidad del mercado

- Sistema de peso de la señal: establecer un sistema de peso de las señales de los indicadores para mejorar la precisión de la decisión

- Optimización de la detención de pérdidas: aumento de los mecanismos de detención de pérdidas dinámicas y mejora de la capacidad de control de riesgos

- Mejoras en el reconocimiento de formas: la introducción de algoritmos de aprendizaje automático mejora la precisión del reconocimiento de formas en gráficos

- Extensión del ciclo de retroalimentación: realice retroalimentación en diferentes ciclos de mercado para verificar la estabilidad de la estrategia

Resumir

Se trata de una estrategia de negociación integrada, que a través de la combinación de varios indicadores técnicos y la emoción del mercado, se establece un sistema de negociación relativamente completo. La ventaja de la estrategia reside en la detección de señales multidimensional y en un mecanismo de gestión de riesgos perfeccionado, pero también hay problemas como la sensibilidad de los parámetros y la precisión de la identificación de formas.

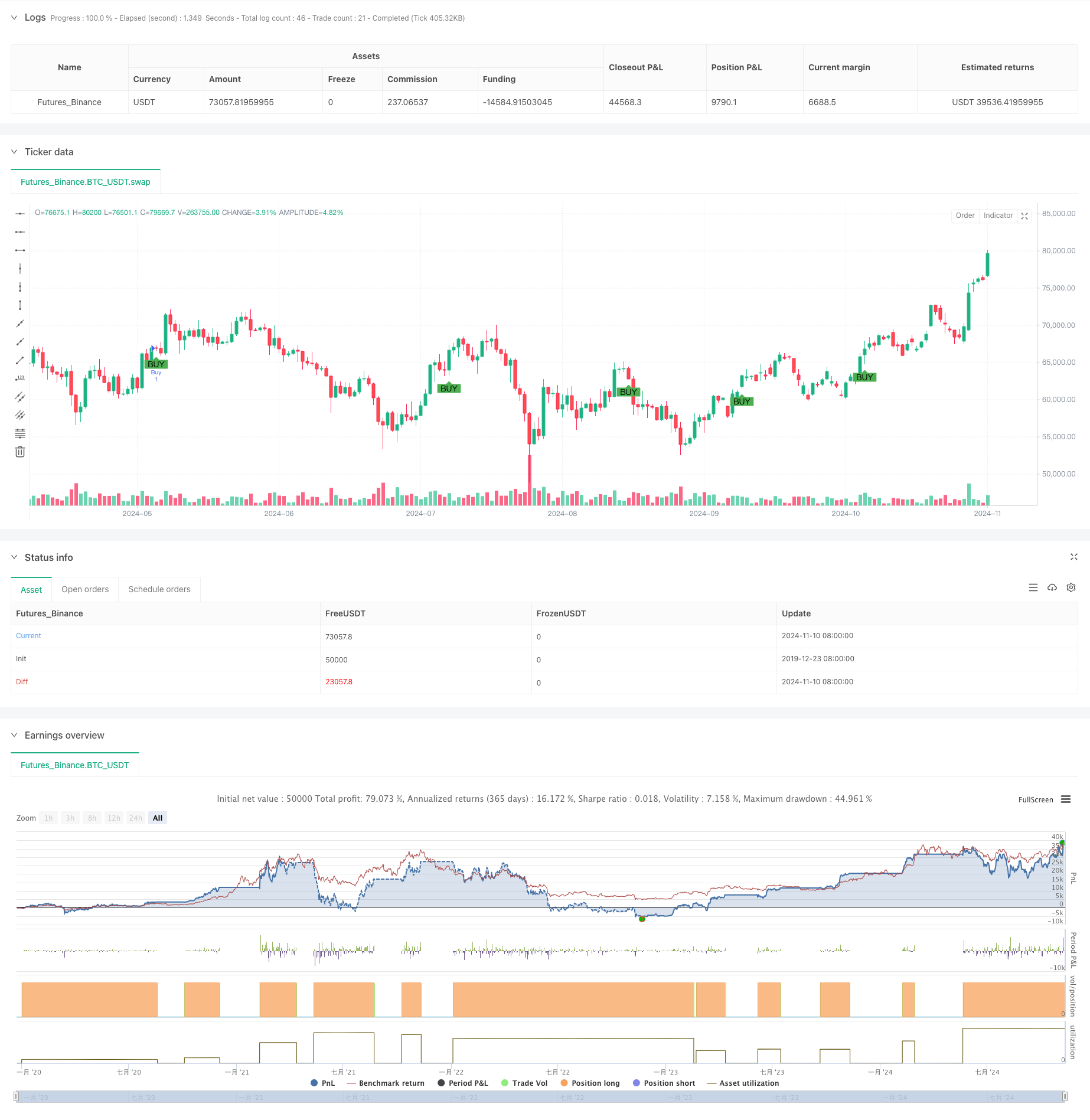

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XAUUSD SMA with MACD & Market Sentiment + Chart Patterns", overlay=true)

// Input parameters for moving averages

shortSMA_length = input.int(10, title="Short SMA Length", minval=1)

longSMA_length = input.int(30, title="Long SMA Length", minval=1)

// MACD settings

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Lookback period for identifying major resistance (swing highs)

resistance_lookback = input.int(20, title="Resistance Lookback Period", tooltip="Lookback period for identifying major resistance")

// Calculate significant resistance (local swing highs over the lookback period)

major_resistance = ta.highest(close, resistance_lookback)

// Calculate SMAs

shortSMA = ta.sma(close, shortSMA_length)

longSMA = ta.sma(close, longSMA_length)

// RSI for market sentiment

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=0, maxval=50)

rsi = ta.rsi(close, rsiLength)

// Time filtering: only trade during New York session (12:00 PM - 9:00 PM UTC)

isNewYorkSession = true

// Define buy condition based on SMA, MACD, and New York session

buyCondition = isNewYorkSession and ta.crossover(shortSMA, longSMA) and macdLine > signalLine

// Define sell condition: only sell if price is at or above the identified major resistance during New York session

sellCondition = isNewYorkSession and close >= major_resistance and macdLine < signalLine

// Define sentiment-based exit conditions

closeEarlyCondition = strategy.position_size < 0 and rsi > rsiOverbought // Close losing trade early if RSI is overbought

holdWinningCondition = strategy.position_size > 0 and rsi < rsiOversold // Hold winning trade if RSI is oversold

// ------ Chart Patterns ------ //

// Double Top/Bottom Pattern Detection

doubleTop = ta.highest(close, 50) == close[25] and ta.highest(close, 50) == close[0] // Approximate double top: two peaks

doubleBottom = ta.lowest(close, 50) == close[25] and ta.lowest(close, 50) == close[0] // Approximate double bottom: two troughs

// Head and Shoulders Pattern Detection

shoulder1 = ta.highest(close, 20)[40]

head = ta.highest(close, 20)[20]

shoulder2 = ta.highest(close, 20)[0]

isHeadAndShoulders = shoulder1 < head and shoulder2 < head and shoulder1 == shoulder2

// Pattern-based signals

patternBuyCondition = isNewYorkSession and doubleBottom and rsi < rsiOversold // Buy at double bottom in oversold conditions

patternSellCondition = isNewYorkSession and (doubleTop or isHeadAndShoulders) and rsi > rsiOverbought // Sell at double top or head & shoulders in overbought conditions

// Execute strategy: Enter long position when buy conditions are met

if (buyCondition or patternBuyCondition)

strategy.entry("Buy", strategy.long)

// Close the position when the sell condition is met (price at resistance or pattern sell)

if (sellCondition or patternSellCondition and not holdWinningCondition)

strategy.close("Buy")

// Close losing trades early if sentiment is against us

if (closeEarlyCondition)

strategy.close("Buy")

// Visual cues for buy and sell signals

plotshape(series=buyCondition or patternBuyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition or patternSellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// ------ Alerts for Patterns ------ //

// Add alert for pattern-based buy condition

alertcondition(patternBuyCondition, title="Pattern Buy Signal Activated", message="Double Bottom or Pattern Buy signal activated: Conditions met.")

// Add alert for pattern-based sell condition

alertcondition(patternSellCondition, title="Pattern Sell Signal Activated", message="Double Top or Head & Shoulders detected. Sell signal triggered.")

// Existing alerts for SMA/MACD-based conditions

alertcondition(buyCondition, title="Buy Signal Activated", message="Buy signal activated: Short SMA has crossed above Long SMA and MACD is bullish.")

alertcondition(sellCondition, title="Sell at Major Resistance", message="Sell triggered at major resistance level.")

alertcondition(closeEarlyCondition, title="Close Losing Trade Early", message="Sentiment is against your position, close trade.")

alertcondition(holdWinningCondition, title="Hold Winning Trade", message="RSI indicates oversold conditions, holding winning trade.")