Descripción general

Esta estrategia es un sistema de negociación integral que combina líneas de señal dinámica (DSL), volatilidad y indicadores de dinámica. La estrategia identifica efectivamente las tendencias del mercado a través de valores mínimos dinámicos y bandas de oscilación que se adaptan a sí mismas, y utiliza los indicadores de dinámica para filtrar las señales y capturar el momento preciso de la negociación. El sistema diseña un mecanismo completo de gestión de riesgos, que incluye el establecimiento de objetivos de pérdidas y ganancias dinámicas basadas en el riesgo y el beneficio.

Principio de estrategia

La lógica central de la estrategia se basa en tres componentes principales:

En primer lugar, el sistema de líneas de señal dinámica, mediante el cálculo de las líneas de subida y bajada dinámicas basadas en promedios móviles. Estas líneas de subida y bajada se ajustan automáticamente en función de los altos y bajos recientes del mercado, lo que permite el seguimiento de la adaptación a la tendencia. El sistema también combina con el indicador ATR para construir bandas de ondas dinámicas para confirmar la intensidad de la tendencia y establecer la posición de parada.

El segundo es el sistema de análisis dinámico, que utiliza el indicador RSI optimizado para el promedio móvil de índice de retardo cero (ZLEMA). Al aplicar el concepto de línea de señal dinámica al RSI, el sistema puede identificar con mayor precisión las zonas de sobreventa y sobreventa y generar señales de ruptura dinámica.

La tercera es el mecanismo de integración de señales. La señal de negociación debe satisfacer simultáneamente la confirmación de la tendencia y la ruptura de la dinámica dos condiciones para ser activada. La entrada múltiple requiere que el precio se eleve y se mantenga por encima de la órbita, mientras que el RSI rompa la línea de señal dinámica por debajo.

Ventajas estratégicas

- Adaptabilidad: Las líneas de señal dinámicas y las bandas de oscilación se ajustan automáticamente según las condiciones del mercado, lo que permite que las estrategias se adapten a diferentes entornos del mercado.

- Filtración de señales falsas: reduce significativamente la probabilidad de señales falsas al requerir una doble confirmación de tendencias y dinámicas.

- Gestión de riesgos perfeccionada: Integración de los objetivos de pérdidas dinámicas basadas en el ATR y la fijación de ganancias basadas en la relación de ganancias de riesgo, logrando un control de riesgos sistematizado.

- Flexible y personalizable: los parámetros de la estrategia se pueden ajustar de manera óptima en función de diferentes mercados y períodos de tiempo.

Riesgo estratégico

- Riesgo de reversión de tendencia: en una fuerte reversión del mercado, el ajuste de la línea de señal dinámica puede no ser lo suficientemente oportuno, lo que lleva a una mayor retirada.

- Riesgo de mercado oscilante: en mercados con fluctuaciones intermitentes, las rupturas frecuentes pueden provocar múltiples paros.

- Sensibilidad a los parámetros: el rendimiento de la política es sensible a la configuración de parámetros, los parámetros incorrectos pueden afectar el efecto de la política.

Dirección de optimización de la estrategia

- Identificación de entornos de mercado: Se puede agregar un mecanismo de clasificación de entornos de mercado para usar diferentes configuraciones de parámetros en diferentes estados de mercado.

- Optimización de parámetros dinámicos: Introducción de un mecanismo de ajuste de parámetros adaptativos para optimizar automáticamente la línea de señal y los parámetros de la banda de onda según la volatilidad del mercado.

- Análisis de varios períodos de tiempo: integración de señales de varios períodos de tiempo para mejorar la fiabilidad de las decisiones comerciales.

- Adaptación a la volatilidad: ajuste de los parámetros de pérdidas y ganancias por riesgo durante la alta volatilidad y mejora de los beneficios por ajuste de riesgo de la estrategia.

Resumir

La estrategia capta eficazmente las tendencias del mercado a través de una combinación innovadora de líneas de señal dinámicas y indicadores de dinámica. Un mecanismo de gestión de riesgos y un sistema de filtración de señales perfectos lo hacen con un fuerte valor de aplicación en el campo.

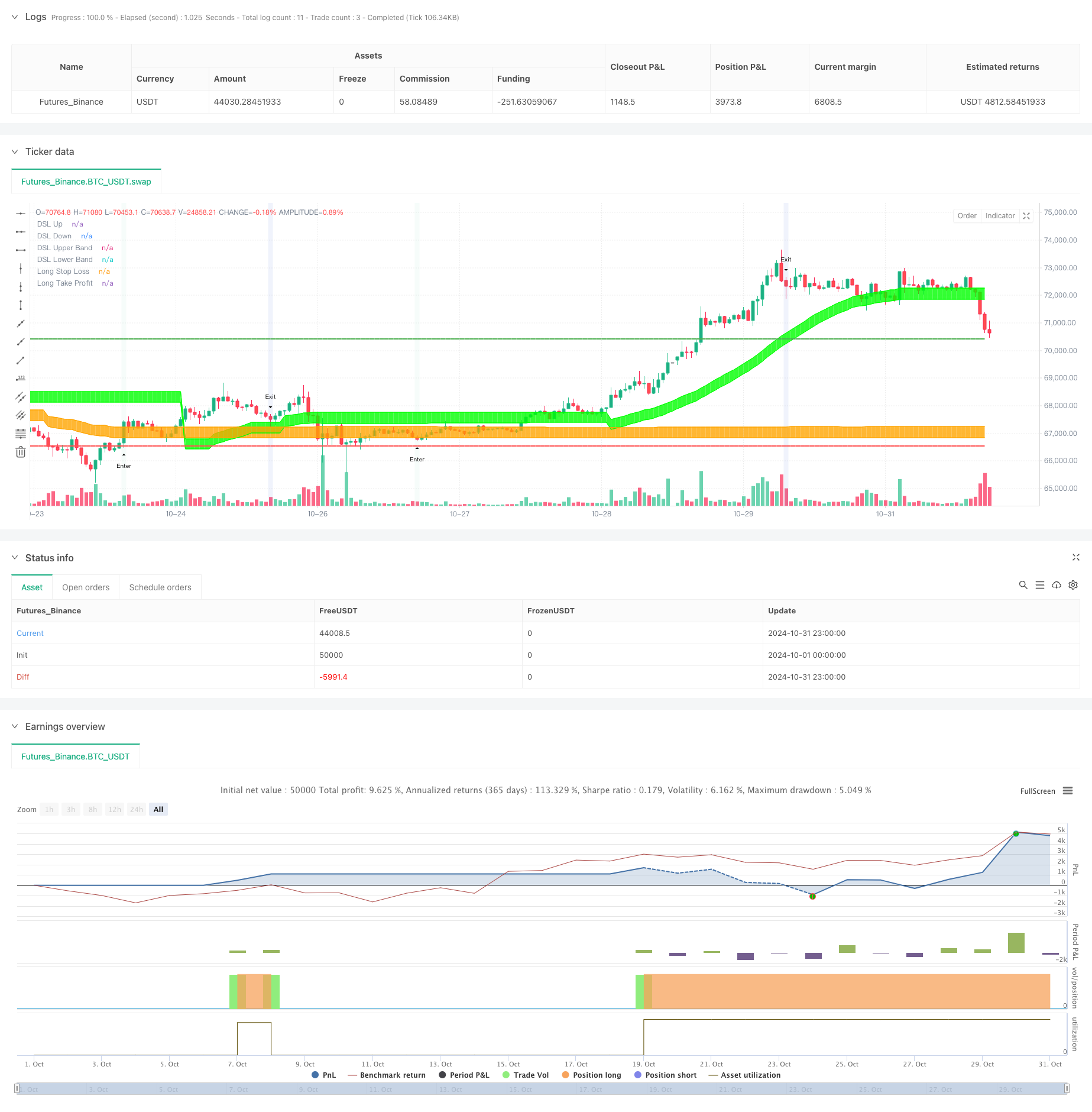

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DailyPanda

//@version=5

strategy("DSL Strategy [DailyPanda]",

initial_capital = 2000,

commission_value=0.00,

slippage=3,

overlay = true)

//--------------------------------------------------------------------------------------------------------------------

// USER INPUTS

//--------------------------------------------------------------------------------------------------------------------

// DSL Indicator Inputs CP

int len = input.int(34, "Length", group="CP") // Length for calculating DSL

int offset = input.int(30, "Offset", group="CP") // Offset for threshold levels

float width = input.float(1, "Bands Width", step = 0.1, maxval = 2, minval = 0.5, group="CP") // Width for ATR-based bands

float risk_reward = input.float(1.5, "Risk Reward", group="Risk Mgmt") // Risk Reward ratio

// Colors for upper and lower trends

color upper_col = input.color(color.lime, "+", inline = "col")

color lower_col = input.color(color.orange, "-", inline = "col")

// DSL-BELUGA

len_beluga = input.int(10, "Beluga Length", group="BELUGA")

dsl_mode_inp = input.string("Fast", "DSL Lines Mode", options=["Fast", "Slow"], group="BELUGA")

dsl_mode = dsl_mode_inp == "Fast" ? 2 : 1

// Colors for DSL-BELUGA

color color_up = #8BD8BD

color color_dn = #436cd3

i_lossPct = input.int(defval=100, title="% max day DD", minval=1, maxval=100, step=1, group="Risk Management")

i_goal = input.bool(title="Enable Daily Goal", defval=false, group="Risk Management")

i_goalPct = input.int(defval=4, title="% Daily Goal", minval=1, step=1, group="Risk Management")

//############################## RISK MANAGEMENT ##############################

// Set maximum intraday loss to our lossPct input

// strategy.risk.max_intraday_loss(i_lossPct, strategy.percent_of_equity)

//strategy.risk.max_intraday_loss(value=1200, type=strategy.cash)

// Store equity value from the beginning of the day

eqFromDayStart = ta.valuewhen(ta.change(dayofweek) > 0, strategy.equity, 0)

// Calculate change of the current equity from the beginning of the current day

eqChgPct = 100 * ((strategy.equity - eqFromDayStart - strategy.openprofit) / (strategy.equity-strategy.openprofit))

f_stopGain = eqChgPct >= i_goalPct and i_goal ? true : false

//--------------------------------------------------------------------------------------------------------------------

// INDICATOR CALCULATIONS

//--------------------------------------------------------------------------------------------------------------------

// Function to calculate DSL lines based on price

dsl_price(float price, int len) =>

// Initialize DSL lines

float dsl_up = na

float dsl_dn = na

float sma = ta.sma(price, len)

// Dynamic upper and lower thresholds calculated with offset

float threshold_up = ta.highest(len)[offset]

float threshold_dn = ta.lowest(len)[offset]

// Calculate the DSL upper and lower lines based on price compared to the thresholds

dsl_up := price > threshold_up ? sma : nz(dsl_up[1])

dsl_dn := price < threshold_dn ? sma : nz(dsl_dn[1])

// Return both DSL lines

[dsl_up, dsl_dn]

// Function to calculate DSL bands based on ATR and width multiplier

dsl_bands(float dsl_up, float dsl_dn) =>

float atr = ta.atr(200) * width // ATR-based calculation for bands

float upper = dsl_up - atr // Upper DSL band

float lower = dsl_dn + atr // Lower DSL band

[upper, lower]

// Get DSL values based on the closing price

[dsl_up, dsl_dn] = dsl_price(close, len)

// Calculate the bands around the DSL lines

[dsl_up1, dsl_dn1] = dsl_bands(dsl_up, dsl_dn)

//--------------------------------------------------------------------------------------------------------------------

// DSL-BELUGA INDICATOR CALCULATIONS

//--------------------------------------------------------------------------------------------------------------------

// Calculate RSI with a period of 10

float RSI = ta.rsi(close, 10)

// Zero-Lag Exponential Moving Average function

zlema(src, length) =>

int lag = math.floor((length - 1) / 2)

float ema_data = 2 * src - src[lag]

float ema2 = ta.ema(ema_data, length)

ema2

// Discontinued Signal Lines function

dsl_lines(src, length)=>

float up = 0.

float dn = 0.

up := (src > ta.sma(src, length)) ? nz(up[1]) + dsl_mode / length * (src - nz(up[1])) : nz(up[1])

dn := (src < ta.sma(src, length)) ? nz(dn[1]) + dsl_mode / length * (src - nz(dn[1])) : nz(dn[1])

[up, dn]

// Calculate DSL lines for RSI

[lvlu, lvld] = dsl_lines(RSI, len_beluga)

// Calculate DSL oscillator using ZLEMA of the average of upper and lower DSL Lines

float dsl_osc = zlema((lvlu + lvld) / 2, 10)

// Calculate DSL Lines for the oscillator

[level_up, level_dn] = dsl_lines(dsl_osc, 10)

// Detect crossovers for signal generation

bool up_signal = ta.crossover(dsl_osc, level_dn) and dsl_osc < 55

bool dn_signal = ta.crossunder(dsl_osc, level_up) and dsl_osc > 50

//--------------------------------------------------------------------------------------------------------------------

// VISUALIZATION

//--------------------------------------------------------------------------------------------------------------------

// Plot the DSL lines on the chart

plot_dsl_up = plot(dsl_up, color=color.new(upper_col, 80), linewidth=1, title="DSL Up")

plot_dsl_dn = plot(dsl_dn, color=color.new(lower_col, 80), linewidth=1, title="DSL Down")

// Plot the DSL bands

plot_dsl_up1 = plot(dsl_up1, color=color.new(upper_col, 80), linewidth=1, title="DSL Upper Band")

plot_dsl_dn1 = plot(dsl_dn1, color=color.new(lower_col, 80), linewidth=1, title="DSL Lower Band")

// Fill the space between the DSL lines and bands with color

fill(plot_dsl_up, plot_dsl_up1, color=color.new(upper_col, 80))

fill(plot_dsl_dn, plot_dsl_dn1, color=color.new(lower_col, 80))

// Plot signals on the chart

plotshape(up_signal, title="Buy Signal", style=shape.triangleup, location=location.belowbar, size=size.tiny, text="Enter")

plotshape(dn_signal, title="Sell Signal", style=shape.triangledown, location=location.abovebar, size=size.tiny, text="Exit")

// Color the background on signal occurrences

bgcolor(up_signal ? color.new(color_up, 90) : na, title="Up Signal Background", editable = false)

bgcolor(dn_signal ? color.new(color_dn, 90) : na, title="Down Signal Background", editable = false)

//--------------------------------------------------------------------------------------------------------------------

// STRATEGY CONDITIONS AND EXECUTION

//--------------------------------------------------------------------------------------------------------------------

// Variables to hold stop loss and take profit prices

var float long_stop_loss_price = na

var float long_take_profit_price = na

var float short_stop_loss_price = na

var float short_take_profit_price = na

float pos_size = math.abs(strategy.position_size)

// Long Entry Conditions

bool long_condition1 = not na(dsl_up1) and not na(dsl_dn) and dsl_up1 > dsl_dn

bool long_condition2 = open > dsl_up and close > dsl_up and open[1] > dsl_up and close[1] > dsl_up and open[2] > dsl_up and close[2] > dsl_up

bool long_condition3 = up_signal and pos_size == 0

bool long_condition = long_condition1 and long_condition2 and long_condition3 and (not f_stopGain)

// Short Entry Conditions

bool short_condition1 = not na(dsl_dn1) and not na(dsl_up) and dsl_dn < dsl_up1

bool short_condition2 = open < dsl_dn1 and close < dsl_dn1 and open[1] < dsl_dn1 and close[1] < dsl_dn1 and open[2] < dsl_dn1 and close[2] < dsl_dn1

bool short_condition3 = dn_signal and pos_size == 0

bool short_condition = short_condition1 and short_condition2 and short_condition3 and (not f_stopGain)

// Long Trade Execution

if (long_condition and not na(dsl_up1))

long_stop_loss_price := dsl_up1

float risk = close - long_stop_loss_price

if (risk > 0)

long_take_profit_price := close + risk * risk_reward

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", from_entry="Long", stop=long_stop_loss_price, limit=long_take_profit_price)

else if (strategy.position_size <= 0)

// Reset when not in a long position

long_stop_loss_price := na

long_take_profit_price := na

// Short Trade Execution

if (short_condition and not na(dsl_dn1))

short_stop_loss_price := dsl_dn1

float risk = short_stop_loss_price - close

if (risk > 0)

short_take_profit_price := close - risk * risk_reward

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", from_entry="Short", stop=short_stop_loss_price, limit=short_take_profit_price)

else if (strategy.position_size >= 0)

// Reset when not in a short position

short_stop_loss_price := na

short_take_profit_price := na

//--------------------------------------------------------------------------------------------------------------------

// PLOTTING STOP LOSS AND TAKE PROFIT LEVELS

//--------------------------------------------------------------------------------------------------------------------

// Plot the stop loss and take profit levels only when in a position

float plot_long_stop_loss = strategy.position_size > 0 ? long_stop_loss_price : na

float plot_long_take_profit = strategy.position_size > 0 ? long_take_profit_price : na

float plot_short_stop_loss = strategy.position_size < 0 ? short_stop_loss_price : na

float plot_short_take_profit = strategy.position_size < 0 ? short_take_profit_price : na

plot(plot_long_stop_loss, title="Long Stop Loss", color=color.red, linewidth=2, style=plot.style_linebr, editable=false)

plot(plot_long_take_profit, title="Long Take Profit", color=color.green, linewidth=2, style=plot.style_linebr, editable=false)

plot(plot_short_stop_loss, title="Short Stop Loss", color=color.red, linewidth=2, style=plot.style_linebr, editable=false)

plot(plot_short_take_profit, title="Short Take Profit", color=color.green, linewidth=2, style=plot.style_linebr, editable=false)