Descripción general

La estrategia es un sistema de negociación multicapa basado en el dinamismo y el seguimiento de tendencias. Identifica oportunidades de negociación de alta probabilidad mediante la combinación del indicador Williams Shark, el indicador Williams Split, el indicador Magic Shock (AO) y el índice Moving Average (EMA). La estrategia utiliza un mecanismo de inversión escalonada de fondos, que aumenta gradualmente la posición a medida que la tendencia aumenta.

Principio de estrategia

La estrategia utiliza un mecanismo de filtración múltiple para asegurar la precisión de la dirección de la operación. En primer lugar, se hace un juicio de tendencia a largo plazo a través de EMA, buscando oportunidades para hacer más solo cuando el precio está por encima de EMA. En segundo lugar, se hace un juicio de tendencia a corto plazo a través de la combinación de la Williams Shark Indicator y el Fractional, confirmando la tendencia alcista cuando la ruptura de la fracción superior ocurre por encima de la línea de los dientes del tiburón. Finalmente, después de la confirmación de la tendencia, la estrategia busca la señal de entrada múltiple “bowl” del indicador AO como el momento específico.

Ventajas estratégicas

- El mecanismo de filtración de múltiples capas reduce eficazmente la interferencia de señales falsas

- La ciencia de la gestión de fondos, con un enfoque progresivo de la acumulación de capital

- La característica de seguimiento de tendencias le permite capturar las grandes tendencias.

- No hay un punto de parada fijo, sino que los indicadores técnicos determinan la dinámica de la tendencia al final

- El sistema tiene una buena configurabilidad para ajustar los parámetros según las diferentes condiciones del mercado

- Los resultados de la encuesta muestran un buen factor de rentabilidad y un buen rendimiento promedio.

Riesgo estratégico

- Las señales falsas en un mercado convulso pueden ser continuas

- Puede ocurrir un retroceso mayor cuando la tendencia se invierte.

- Las condiciones de filtración múltiple pueden llevar a perder oportunidades de negocio

- En cuanto a la gestión de fondos, el aumento continuo de posiciones puede conllevar riesgos en momentos de gran volatilidad.

- La elección de los parámetros de la EMA tiene un gran impacto en el rendimiento de la estrategia

Para reducir estos riesgos, se recomienda:

- Optimización de los parámetros en diferentes entornos de mercado

- Considerar el aumento de los filtros de fluctuación

- Las condiciones para la adquisición de una posición más estricta

- Establecer el límite máximo de retirada

Dirección de optimización de la estrategia

- Introducción de filtros de fluctuación para el indicador ATR

- Agregue análisis del volumen de operaciones para mejorar la confiabilidad de la señal

- Desarrollo de mecanismos de adaptación de parámetros dinámicos

- Mejora de los mecanismos de frenado para obtener ganancias a tiempo cuando la tendencia disminuye

- Aumentar el módulo de reconocimiento de estado de mercado para usar diferentes parámetros en diferentes entornos de mercado

Resumir

Se trata de una estrategia de seguimiento de tendencias de diseño razonable, que logra un buen rendimiento de ganancias a través del uso de múltiples indicadores técnicos, al tiempo que garantiza la seguridad. La innovación de la estrategia radica en el mecanismo de confirmación de tendencias en varios niveles y el método de gestión progresiva de fondos.

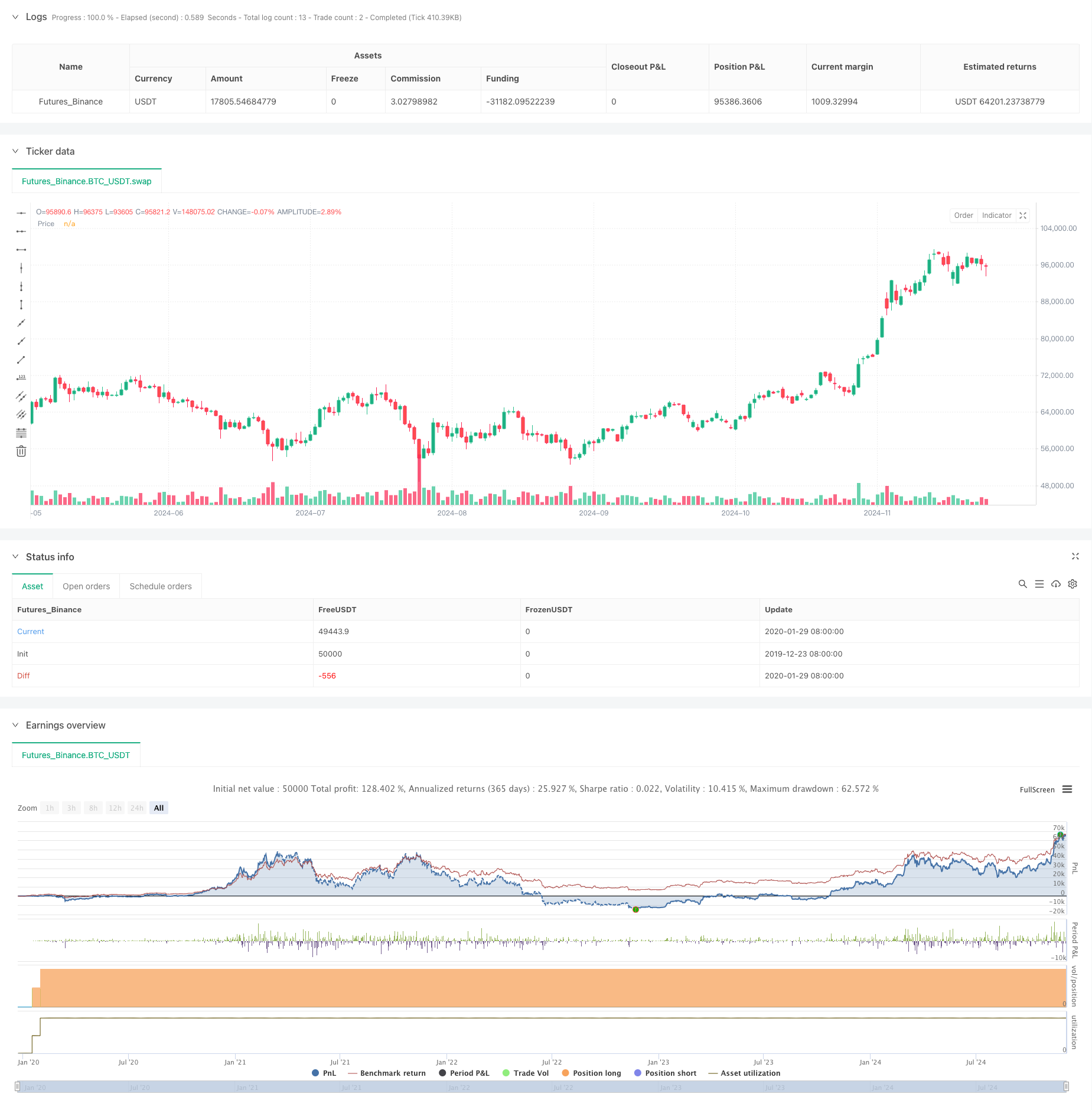

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-04 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Skyrexio

//@version=6

//_______ <licence>

strategy(title = "MultiLayer Awesome Oscillator Saucer Strategy [Skyrexio]",

shorttitle = "AO Saucer",

overlay = true,

format = format.inherit,

pyramiding = 5,

calc_on_order_fills = false,

calc_on_every_tick = false,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 10,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0.1,

slippage = 5,

use_bar_magnifier = true)

//_______ <constant_declarations>

var const color skyrexGreen = color.new(#2ECD99, 0)

var const color skyrexGray = color.new(#F2F2F2, 0)

var const color skyrexWhite = color.new(#FFFFFF, 0)

//________<variables declarations>

var int trend = 0

var float upFractalLevel = na

var float upFractalActivationLevel = na

var float downFractalLevel = na

var float downFractalActivationLevel = na

var float saucerActivationLevel = na

bool highCrossesUpfractalLevel = ta.crossover(high, upFractalActivationLevel)

bool lowCrossesDownFractalLevel = ta.crossunder(low, downFractalActivationLevel)

var int signalsQtyInRow = 0

//_______ <inputs>

// Trading bot settings

sourceUuid = input.string(title = "sourceUuid:", defval = "yourBotSourceUuid", group = "🤖Trading Bot Settings🤖")

secretToken = input.string(title = "secretToken:", defval = "yourBotSecretToken", group = "🤖Trading Bot Settings🤖")

// Trading period settings

lookBackPeriodStart = input(title = "Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

lookBackPeriodStop = input(title = "Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

// Strategy settings

EMaLength = input.int(100, minval = 10, step = 10, title = "EMA Length", group = "📈Strategy settings📈")

//_______ <function_declarations>

//@function Used to calculate Simple moving average for Alligator

//@param src Sourse for smma Calculations

//@param length Number of bars to calculate smma

//@returns The calculated smma value

smma(src, length) =>

var float smma = na

sma_value = ta.sma(src, length)

smma := na(smma) ? sma_value : (smma * (length - 1) + src) / length

smma

//_______ <calculations>

//Upfractal calculation

upFractalPrice = ta.pivothigh(2, 2)

upFractal = not na(upFractalPrice)

//Downfractal calculation

downFractalPrice = ta.pivotlow(2, 2)

downFractal = not na(downFractalPrice)

//Calculating Alligator's teeth

teeth = smma(hl2, 8)[5]

//Calculating upfractal and downfractal levels

if upFractal

upFractalLevel := upFractalPrice

else

upFractalLevel := upFractalLevel[1]

if downFractal

downFractalLevel := downFractalPrice

else

downFractalLevel := downFractalLevel[1]

//Calculating upfractal activation level, downfractal activation level to approximate the trend and this current trend

if upFractalLevel > teeth

upFractalActivationLevel := upFractalLevel

if highCrossesUpfractalLevel

trend := 1

upFractalActivationLevel := na

downFractalActivationLevel := downFractalLevel

if downFractalLevel < teeth

downFractalActivationLevel := downFractalLevel

if lowCrossesDownFractalLevel

trend := -1

downFractalActivationLevel := na

upFractalActivationLevel := upFractalLevel

if trend == 1

upFractalActivationLevel := na

if trend == -1

downFractalActivationLevel := na

//Calculating filter EMA

filterEMA = ta.ema(close, EMaLength)

//Сalculating AO saucer signal

ao = ta.sma(hl2,5) - ta.sma(hl2,34)

diff = ao - ao[1]

saucerSignal = ao > ao[1] and ao[1] < ao[2] and ao > 0 and ao[1] > 0 and ao[2] > 0 and trend == 1 and close > filterEMA

//Calculating sauser activation level

if saucerSignal

saucerActivationLevel := high

else

saucerActivationLevel := saucerActivationLevel[1]

if not na(saucerActivationLevel[1]) and high < saucerActivationLevel[1] and diff > 0

saucerActivationLevel := high

saucerSignal := true

if (high > saucerActivationLevel[1] and not na(saucerActivationLevel)) or diff < 0

saucerActivationLevel := na

//Calculating number of valid saucer signal in current trading cycle

if saucerSignal and not saucerSignal[1]

signalsQtyInRow := signalsQtyInRow + 1

if not na(saucerActivationLevel[1]) and diff < 0 and na(saucerActivationLevel) and not (strategy.opentrades[1] <= strategy.opentrades - 1)

signalsQtyInRow := signalsQtyInRow - 1

if trend == -1 and trend[1] == 1

signalsQtyInRow := 0

//_______ <strategy_calls>

//Defining trade close condition

closeCondition = trend[1] == 1 and trend == -1

//Cancel stop buy order if current Awesome oscillator column lower, than prevoius

if diff < 0

strategy.cancel_all()

//Strategy entry

if (signalsQtyInRow == 1 and not na(saucerActivationLevel))

strategy.entry(id = "entry1", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry1",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 2 and not na(saucerActivationLevel))

strategy.entry(id = "entry2", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry2",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 3 and not na(saucerActivationLevel))

strategy.entry(id = "entry3", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry3",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 4 and not na(saucerActivationLevel))

strategy.entry(id = "entry4", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry4",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 5 and not na(saucerActivationLevel))

strategy.entry(id = "entry5", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry5",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//Strategy exit

if (closeCondition)

strategy.close_all(alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "close",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//_______ <visuals>

//Plotting shapes for adding to current long trades

gradPercent = if strategy.opentrades == 2

90

else if strategy.opentrades == 3

80

else if strategy.opentrades == 4

70

else if strategy.opentrades == 5

60

pricePlot = plot(close, title="Price", color=color.new(color.blue, 100))

teethPlot = plot(strategy.opentrades > 1 ? teeth : na, title="Teeth", color= skyrexGreen, style=plot.style_linebr, linewidth = 2)

fill(pricePlot, teethPlot, color = color.new(skyrexGreen, gradPercent))

if strategy.opentrades != 1 and strategy.opentrades[1] == strategy.opentrades - 1

label.new(bar_index, teeth, style = label.style_label_up, color = color.lime, size = size.tiny, text="Buy More", textcolor = color.black, text_formatting = text.format_bold)

//_______ <alerts>