La estrategia es un sistema de negociación inteligente que combina volumen de transacciones, movimiento de precios y múltiples paradas y pérdidas. Identifica oportunidades de negociación potenciales mediante la monitorización de fluctuaciones anormales en el volumen de transacciones, alzas de precios y una combinación de indicadores de movimiento, y utiliza una gestión de paradas y pérdidas por niveles para optimizar el riesgo-beneficio.

Principio de estrategia

La estrategia se basa en tres señales de negociación centrales: 1) ruptura de la transacción - la transacción actual es más de 2 veces la transacción promedio de los últimos 20 ciclos; 2) aumento de los precios - el aumento de los precios recientes supera el umbral establecido; 3) confirmación de la dinámica - el RSI es mayor que 55 y el precio está por encima de la media de 50 ciclos. Cuando se cumplen estas tres condiciones al mismo tiempo, el sistema emite más.

Ventajas estratégicas

- La confirmación de múltiples señales mejora la precisión de las transacciones

- Los planes de stop-loss estratificados bloquean las ganancias y controlan el riesgo

- Los parámetros son muy ajustables para adaptarse a diferentes entornos de mercado

- La combinación de indicadores técnicos y análisis de tráfico hace que la señal sea más confiable

- Función de alerta en tiempo real para aprovechar las oportunidades

Riesgo estratégico

- La configuración incorrecta de los parámetros puede conducir a un exceso de comercio

- El riesgo de que se produzcan pérdidas frecuentes cuando los mercados se muevan con fuerza

- Las pérdidas de tiempo de parada pueden ser difíciles en mercados con poca liquidez.

- No tener en cuenta los factores fundamentales puede hacer que se pierda un impacto importante

- La excesiva dependencia de los indicadores tecnológicos puede fallar en el mercado horizontal

Dirección de optimización de la estrategia

- Introducción de un juicio de mercado, usando diferentes parámetros en diferentes situaciones

- Aumentar el análisis de la calidad de la transacción, filtrando las señales de emisión falsas

- Adición de indicadores de intensidad de tendencias para mejorar la capacidad de seguimiento de tendencias

- Optimización del intervalo de paradas y pérdidas para adaptarlo mejor a las características de fluctuación del mercado

- Considere la inclusión de controles de retiro para mejorar la estabilidad de la curva de fondos

Resumir

Se trata de una estrategia de negociación madura que integra varios elementos de análisis técnico. A través de una estricta selección de señales y una gestión flexible de posiciones, los riesgos están muy bien controlados al tiempo que se aprovechan las oportunidades de tendencia. Aunque todavía hay espacio para la optimización, el diseño general es razonable y vale la pena verificarlo y usarlo en el mundo real.

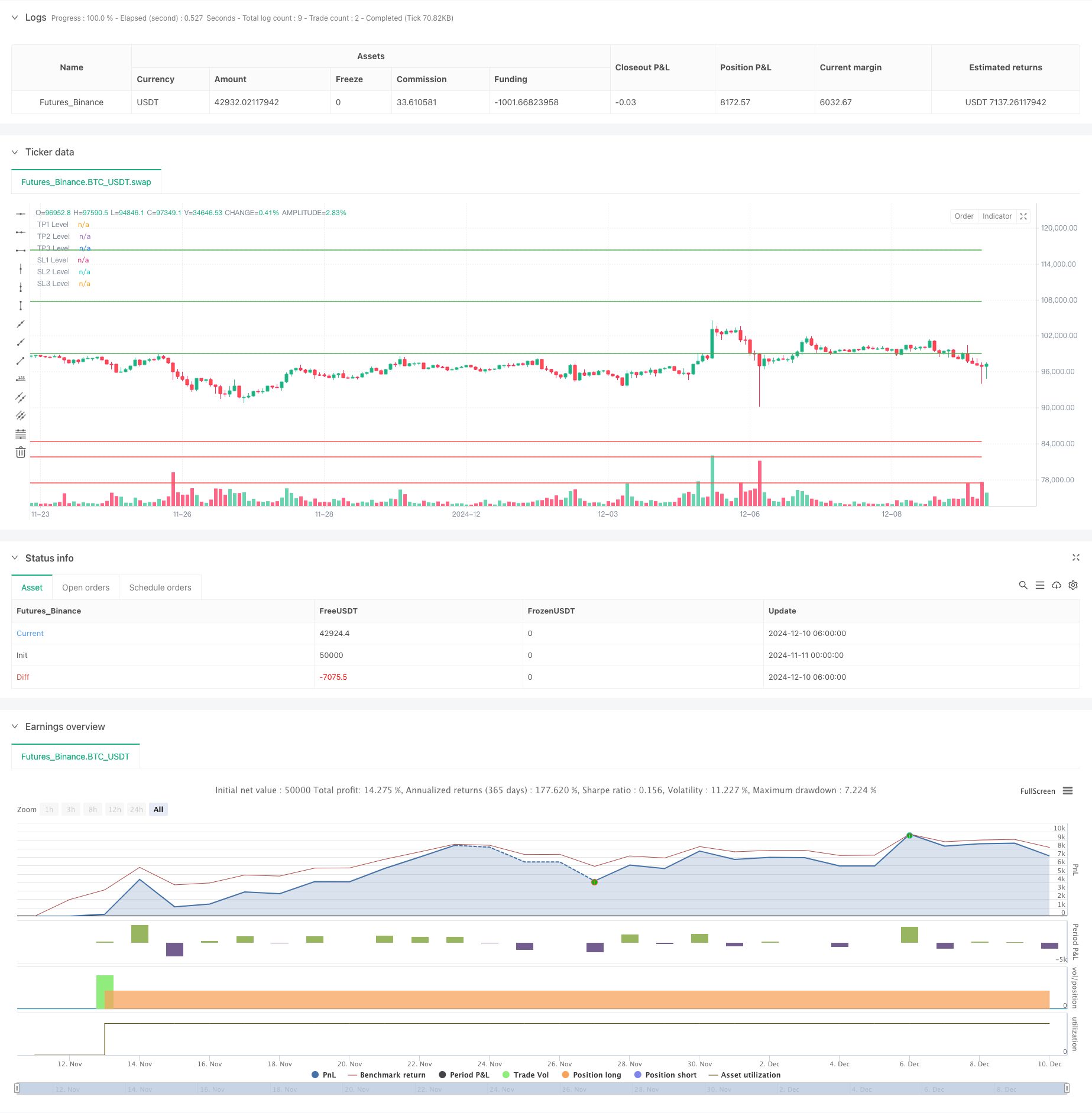

/*backtest

start: 2024-11-11 00:00:00

end: 2024-12-10 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Volume Spike & Momentum Strategy with Alerts", overlay=true)

// Inputs for customization

priceGainPercent = input.float(5, title="Minimum Price Gain (%)", minval=1)

volumeLookback = input.int(20, title="Volume Lookback Period (Bars)", minval=1)

momentumSmaLength = input.int(50, title="SMA Length for Momentum (Bars)", minval=1)

rsiThreshold = input.float(55, title="RSI Threshold for Momentum", minval=1)

// Take Profit percentages

tp1Percent = input.float(15, title="Take Profit 1 (%)", minval=1)

tp2Percent = input.float(25, title="Take Profit 2 (%)", minval=1)

tp3Percent = input.float(35, title="Take Profit 3 (%)", minval=1)

// Percentage of position to close at each take-profit

tp1ClosePercent = input.float(30, title="Close % at TP1", minval=1, maxval=100)

tp2ClosePercent = input.float(40, title="Close % at TP2", minval=1, maxval=100)

tp3ClosePercent = input.float(30, title="Close % at TP3", minval=1, maxval=100)

// Stop-loss percentages

sl1Percent = input.float(2, title="Stop Loss 1 (%)", minval=0.1)

sl2Percent = input.float(5, title="Stop Loss 2 (%)", minval=0.1)

sl3Percent = input.float(10, title="Stop Loss 3 (%)", minval=0.1)

// Percentage of position to close at each stop-loss

sl1ClosePercent = input.float(30, title="Close % at SL1", minval=1, maxval=100)

sl2ClosePercent = input.float(40, title="Close % at SL2", minval=1, maxval=100)

sl3ClosePercent = input.float(30, title="Close % at SL3", minval=1, maxval=100)

// Detect volume spikes

avgVolume = ta.sma(volume, volumeLookback) // Average volume over the last X bars (customizable)

volumeSpike = volume > avgVolume * 2 // Spike in volume if current volume is 2x the average

// Detect price gain over the recent period (e.g., 5-10% gain over the last X bars)

priceChangePercent = (close - ta.lowest(close, 5)) / ta.lowest(close, 5) * 100

priceGainCondition = priceChangePercent >= priceGainPercent

// Check for overall momentum using an SMA and RSI

longTermSma = ta.sma(close, momentumSmaLength)

rsi = ta.rsi(close, 14)

momentumCondition = close > longTermSma and rsi >= rsiThreshold

// Store the entry price on a new trade

var float entryPrice = na

if (strategy.opentrades == 0 and (volumeSpike and priceGainCondition and momentumCondition))

entryPrice := close // Capture the entry price on a new trade

// Calculate take-profit levels based on the entry price

tp1Price = entryPrice * (1 + tp1Percent / 100)

tp2Price = entryPrice * (1 + tp2Percent / 100)

tp3Price = entryPrice * (1 + tp3Percent / 100)

// Calculate stop-loss levels based on the entry price

sl1Price = entryPrice * (1 - sl1Percent / 100)

sl2Price = entryPrice * (1 - sl2Percent / 100)

sl3Price = entryPrice * (1 - sl3Percent / 100)

// Exit conditions for multiple take-profits

tp1Condition = high >= tp1Price // Exit partial if price hits take-profit 1

tp2Condition = high >= tp2Price // Exit partial if price hits take-profit 2

tp3Condition = high >= tp3Price // Exit full if price hits take-profit 3

// Exit conditions for multiple stop-losses

sl1Condition = low <= sl1Price // Exit partial if price hits stop-loss 1

sl2Condition = low <= sl2Price // Exit partial if price hits stop-loss 2

sl3Condition = low <= sl3Price // Exit full if price hits stop-loss 3

// Buy Condition: When volume spike, price gain, and momentum conditions are met

if (volumeSpike and priceGainCondition and momentumCondition)

strategy.entry("Buy", strategy.long)

// Alerts for conditions

alertcondition(volumeSpike and priceGainCondition and momentumCondition, title="Entry Alert", message="Entry conditions met: Volume spike, price gain, and momentum detected!")

alertcondition(tp1Condition, title="Take Profit 1", message="Take Profit 1 hit!")

alertcondition(tp2Condition, title="Take Profit 2", message="Take Profit 2 hit!")

alertcondition(tp3Condition, title="Take Profit 3", message="Take Profit 3 hit!")

alertcondition(sl1Condition, title="Stop Loss 1", message="Stop Loss 1 hit!")

alertcondition(sl2Condition, title="Stop Loss 2", message="Stop Loss 2 hit!")

alertcondition(sl3Condition, title="Stop Loss 3", message="Stop Loss 3 hit!")

// Exit conditions: Multiple take-profits and stop-losses

if (tp1Condition)

strategy.exit("Take Profit 1", "Buy", limit=tp1Price, qty_percent=tp1ClosePercent)

if (tp2Condition)

strategy.exit("Take Profit 2", "Buy", limit=tp2Price, qty_percent=tp2ClosePercent)

if (tp3Condition)

strategy.exit("Take Profit 3", "Buy", limit=tp3Price, qty_percent=tp3ClosePercent)

// Stop-loss exits

if (sl1Condition)

strategy.exit("Stop Loss 1", "Buy", stop=sl1Price, qty_percent=sl1ClosePercent)

if (sl2Condition)

strategy.exit("Stop Loss 2", "Buy", stop=sl2Price, qty_percent=sl2ClosePercent)

if (sl3Condition)

strategy.exit("Stop Loss 3", "Buy", stop=sl3Price, qty_percent=sl3ClosePercent)

// Plotting take-profit and stop-loss levels on the chart

plot(tp1Price, color=color.green, style=plot.style_linebr, title="TP1 Level")

plot(tp2Price, color=color.green, style=plot.style_linebr, title="TP2 Level")

plot(tp3Price, color=color.green, style=plot.style_linebr, title="TP3 Level")

plot(sl1Price, color=color.red, style=plot.style_linebr, title="SL1 Level")

plot(sl2Price, color=color.red, style=plot.style_linebr, title="SL2 Level")

plot(sl3Price, color=color.red, style=plot.style_linebr, title="SL3 Level")