Descripción general

La estrategia es un sistema de trading avanzado y cuantitativo que combina las bandas de Brin, el indicador RSI y el filtro de tendencia de 200 ciclos EMA. La estrategia capta oportunidades de ruptura de alta probabilidad en la dirección de la tendencia a través de la combinación de múltiples indicadores técnicos, mientras que filtra eficazmente las falsas señales en los mercados convulsivos.

Principio de estrategia

La lógica central de la estrategia se basa en los siguientes tres niveles:

- La señal de ruptura de la banda de Brin: utiliza la banda de Brin para subir y bajar como un canal de fluctuación. La ruptura de la banda de Brin se considera una señal de ruptura y la ruptura de la banda de Brin es una señal de ruptura.

- Confirmación de la dinámica RSI: Confirmación de la dinámica RSI por encima de 50 y confirmación de la dinámica de la contracción por debajo de 50 para evitar el comercio en ausencia de tendencia.

- Filtración de tendencias de EMA: utiliza la EMA de 200 ciclos para determinar la tendencia principal y abre posiciones solo en la dirección de la tendencia. El precio hace más por encima de la EMA y hace menos por debajo.

La confirmación de la transacción requiere:

- Dos líneas K consecutivas mantienen la brecha

- Cantidad de transacciones por encima del promedio de 20 ciclos

- Detención dinámica basada en el ATR

- Objetivo de ganancias basado en un riesgo y un beneficio por riesgo de 1,5 veces

Ventajas estratégicas

- Filtración sincronizada de múltiples indicadores técnicos, mejora significativa de la calidad de la señal

- Un mecanismo dinámico de gestión de posiciones que se adapta a la volatilidad del mercado

- Un mecanismo de confirmación de transacciones estricto y eficaz para reducir las señales falsas

- Sistema completo de control de riesgos, incluido el stop loss dinámico y el riesgo-beneficio fijo

- Espacio de optimización de parámetros flexible para adaptarse a diferentes entornos de mercado

Riesgo estratégico

- La optimización excesiva de parámetros puede provocar un sobreajuste

- Las fuertes fluctuaciones en el mercado podrían provocar pérdidas frecuentes

- Las turbulencias en los mercados podrían generar pérdidas continuas

- La señal de retraso en el punto de cambio de tendencia

- Las señales contradictorias entre los indicadores técnicos

Sugerencias para el control de riesgos:

- Se impone una estricta disciplina para evitar daños.

- Controlar el riesgo de una sola transacción

- Regular retestado para verificar la validez de los parámetros

- Combinado con análisis básico

- Evite el exceso de comercio

Dirección de optimización de la estrategia

- Introducir más indicadores técnicos para la verificación mutua

- Desarrollo de mecanismos de optimización de parámetros de adaptación

- Se agregó un indicador de sentimiento del mercado

- Mecanismos de confirmación de operaciones optimizados

- Desarrollo de un sistema de gestión de posiciones más flexible

Las principales ideas de optimización:

- Parámetros de ajuste según las diferentes dinámicas del ciclo del mercado

- Aumentar las condiciones de filtración de transacciones

- Optimización de la configuración de riesgo-beneficio

- Mejora en el mecanismo de suspensión de pérdidas

- Desarrollo de sistemas de reconocimiento de señales más inteligentes

Resumir

La estrategia utiliza una combinación orgánica de indicadores técnicos como el Brin Belt, el RSI y el EMA para construir un sistema de negociación completo. El sistema muestra un fuerte valor de aplicación en la práctica a través de un estricto control de riesgos y un espacio de optimización de parámetros flexible, al tiempo que garantiza la calidad de las operaciones.

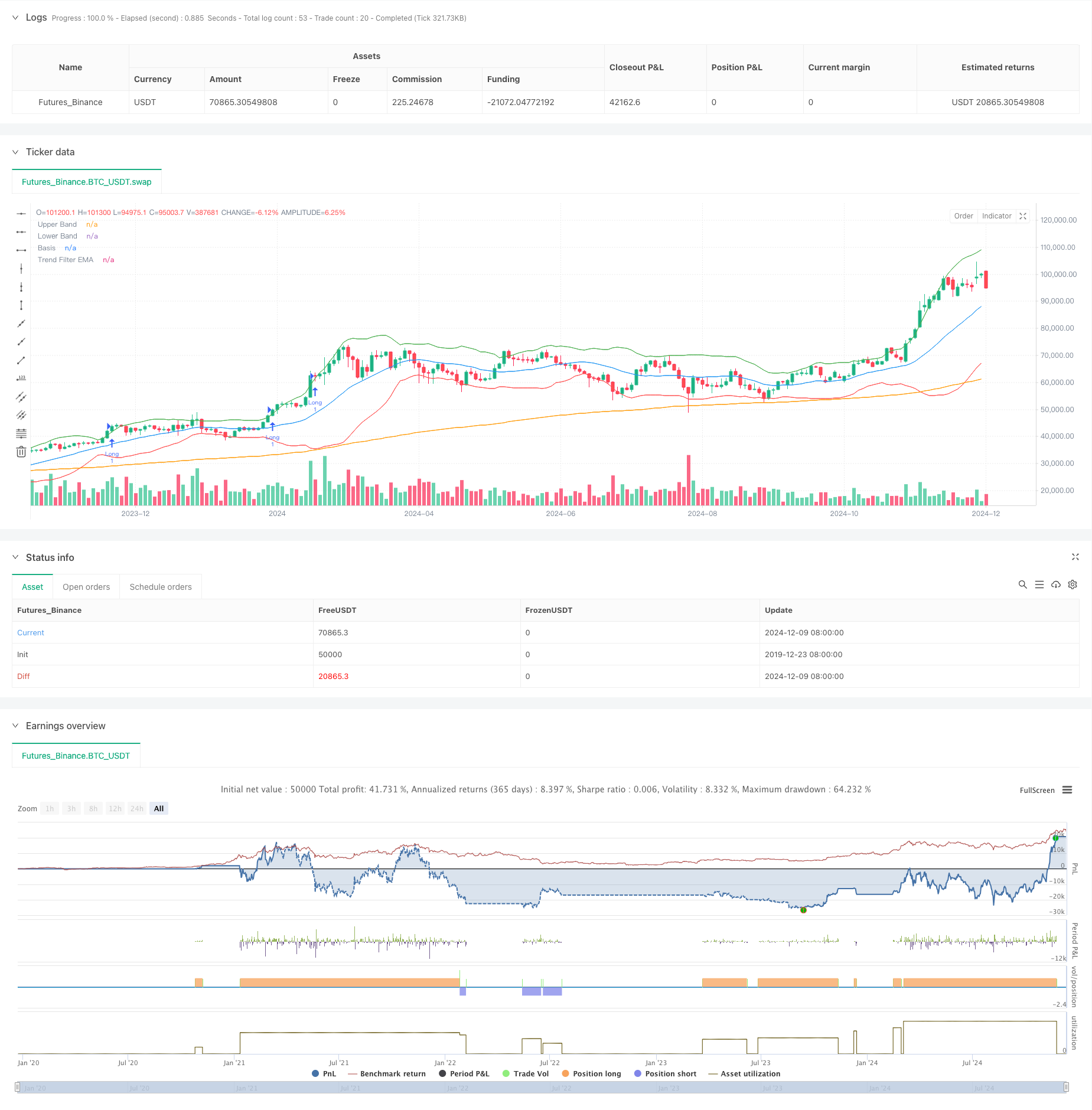

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved Bollinger Breakout with Trend Filtering", overlay=true)

// === Inputs ===

length = input(20, title="Bollinger Bands Length", tooltip="The number of candles used to calculate the Bollinger Bands. Higher values smooth the bands, lower values make them more reactive.")

mult = input(2.0, title="Bollinger Bands Multiplier", tooltip="Controls the width of the Bollinger Bands. Higher values widen the bands, capturing more price movement.")

rsi_length = input(14, title="RSI Length", tooltip="The number of candles used to calculate the RSI. Shorter lengths make it more sensitive to recent price movements.")

rsi_midline = input(50, title="RSI Midline", tooltip="Defines the midline for RSI to confirm momentum. Higher values make it stricter for bullish conditions.")

risk_reward_ratio = input(1.5, title="Risk/Reward Ratio", tooltip="Determines the take-profit level relative to the stop-loss.")

atr_multiplier = input(1.5, title="ATR Multiplier for Stop-Loss", tooltip="Defines the distance of the stop-loss based on ATR. Higher values set wider stop-losses.")

volume_filter = input(true, title="Enable Volume Filter", tooltip="If enabled, trades will only execute when volume exceeds the 20-period average.")

trend_filter_length = input(200, title="Trend Filter EMA Length", tooltip="The EMA length used to filter trades based on the market trend.")

trade_direction = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"], tooltip="Choose whether to trade only Long, only Short, or Both directions.")

confirm_candles = input(2, title="Number of Confirming Candles", tooltip="The number of consecutive candles that must meet the conditions before entering a trade.")

// === Indicator Calculations ===

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper_band = basis + dev

lower_band = basis - dev

rsi_val = ta.rsi(close, rsi_length)

atr_val = ta.atr(14)

vol_filter = volume > ta.sma(volume, 20)

ema_trend = ta.ema(close, trend_filter_length)

// === Helper Function for Confirmation ===

confirm_condition(cond, lookback) =>

count = 0

for i = 0 to lookback - 1

count += cond[i] ? 1 : 0

count == lookback

// === Trend Filter ===

trend_is_bullish = close > ema_trend

trend_is_bearish = close < ema_trend

// === Long and Short Conditions with Confirmation ===

long_raw_condition = close > upper_band * 1.01 and rsi_val > rsi_midline and (not volume_filter or vol_filter) and trend_is_bullish

short_raw_condition = close < lower_band * 0.99 and rsi_val < rsi_midline and (not volume_filter or vol_filter) and trend_is_bearish

long_condition = confirm_condition(long_raw_condition, confirm_candles)

short_condition = confirm_condition(short_raw_condition, confirm_candles)

// === Trade Entry and Exit Logic ===

if long_condition and (trade_direction == "Long" or trade_direction == "Both")

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=close - (atr_multiplier * atr_val), limit=close + (atr_multiplier * risk_reward_ratio * atr_val))

if short_condition and (trade_direction == "Short" or trade_direction == "Both")

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", stop=close + (atr_multiplier * atr_val), limit=close - (atr_multiplier * risk_reward_ratio * atr_val))

// === Plotting ===

plot(upper_band, color=color.green, title="Upper Band")

plot(lower_band, color=color.red, title="Lower Band")

plot(basis, color=color.blue, title="Basis")

plot(ema_trend, color=color.orange, title="Trend Filter EMA")